|

Did you know...

📈 Inflation remains high at 3.3% y/y, and the Fed's slow response is not helping. 📊 The latest jobs report shows a shift to part-time work and declining labor force participation, with real wages declining. 🏡 The Texas GOP's priorities miss key issues like spending restraint and property tax elimination, which are crucial for economic growth. Listen, like, share, and subscribe. Check out my newsletter for show notes and more at www.vanceginn.substack.com.

0 Comments

Originally published at Inside Sources.

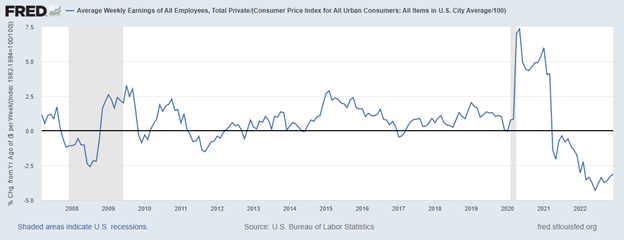

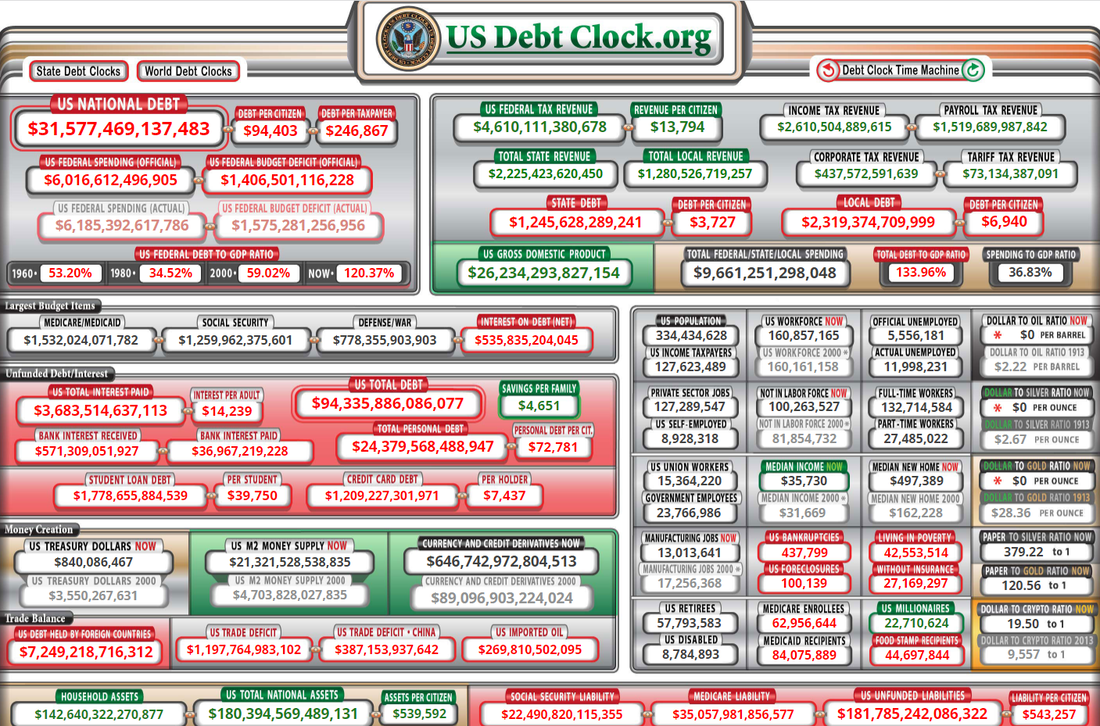

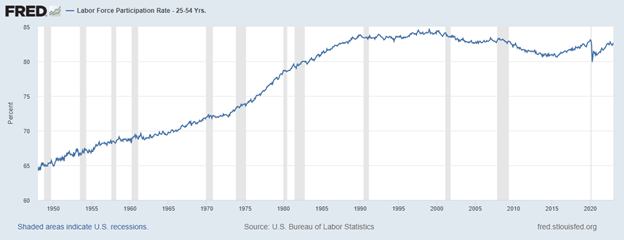

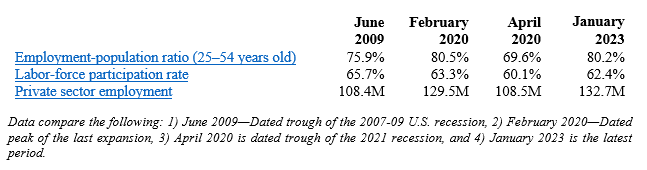

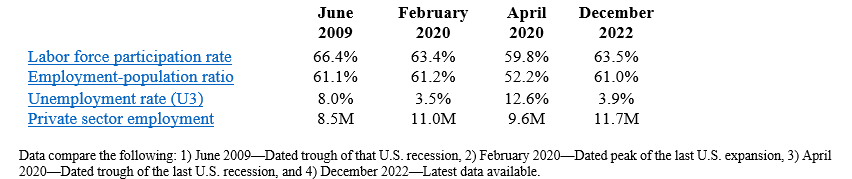

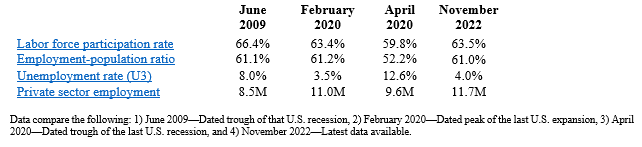

The final jobs report for 2023 was recently reported. The headlines look good but don’t tell the full story. This has been a common theme with many economic indicators, from the labor market to economic output. With this being an election year, politicians are trying to milk every apparent “win” or “loss” for voter approval. With all the noise, we need an honest assessment of the economic ups and downs to help guide voters in November. First, the payroll survey shows that were 216,000 net non-farm jobs added in December, which historically is rather robust. However, that’s not even half the story. To examine how many productive private-sector jobs were added in December, we need to make some corrections. This includes subtracting 52,000 unproductive government jobs added in December as they are a burden on private-sector workers. Also, we need to subtract the 71,000 jobs that were revised down for October and November. Doing so leaves just 95,000 productive non-farm jobs added in December, which is historically weak. Couple these findings with even weaker results from the household survey showing 683,000 fewer people were employed compared with November 2023, and this report is even weaker. While the unemployment rate was unchanged from the previous report at 3.7 percent, the labor force dropped by nearly 700,000 last month, meaning fewer people had work or were looking for work. The labor force participation rate dropped to 62.5 percent, the lowest since February 2023. Contributing factors to the declining labor force participation are myriad and complex, not always correlated to the economy. But they are typically connected with expanded roles of government and other factors. For example, the Economic Policy Innovation Center recently released a report highlighting how millions of people have dropped out of the labor force. The author notes “if the employment-to-population ratio were the same today as it was before the COVID-19 pandemic in February 2020, 2.6 million more people would be employed today.” The report finds that the largest share of people leaving have been retirees since the pandemic. The next largest group is 20 to 24 years old, who have been living off the handouts since the pandemic or with their parents. Interestingly, even with skyrocketing daycare costs, those without kids are a large share of those leaving the workforce. This makes some sense as maybe they are young and don’t have kids and have other means to survive, but this also is a conundrum because they’re reducing their long-term earnings potential. But with recent minimum wage hikes by 22 states that no doubt will displace many low-skilled workers and the rise in dependency on government safety nets over the last few years, there’s likely to be more people out of the labor force for longer. Speaking of distortion, average weekly earnings have been improving, but after adjusting for inflation, they are up just 0.4 percent over the last year. While it’s promising to see real wages go up after years when it wasn’t, workers would feel much more relief if inflation were further slowed. But mischief in Congress and the Federal Reserve keeps that from happening. Inflation soared due to the federal government’s deficit spending, mostly monetized by the Federal Reserve. This created a situation of too much money chasing too few goods that resulted in persistent inflation. As purchasing power remains a problem for many Americans, workers become disenchanted with jobs, especially when the monetary benefit of government handouts exceeds wages. Reducing government spending is imperative. Doing so will help the Fed tame inflation, reignite labor force participation, and spur job creation. Celebrating wins is important, especially during the recovery after the Donald Trump lockdowns, but our leaders must not turn a blind eye to underlying problems. As we await jobs reports, we must consider the underlying issues that affect Americans directly rather than just the headlines. What we uncover might shape whether our elected leader champions free-market flourishing or leans toward the big-government ideologies our forefathers warned against. Recent polling data from CNN reveals a grim reality: 84 percent of Americans are concerned about the national economy. Despite President Biden’s efforts to highlight seemingly positive metrics as indicators of the success of his progressive policies, a closer look at the data reveals why most Americans remain dissatisfied.

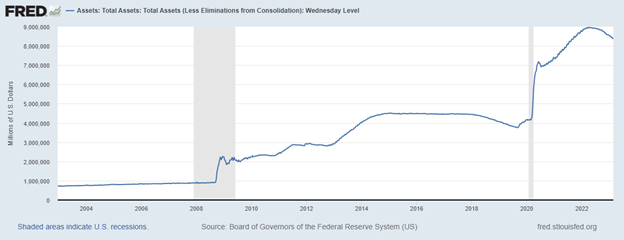

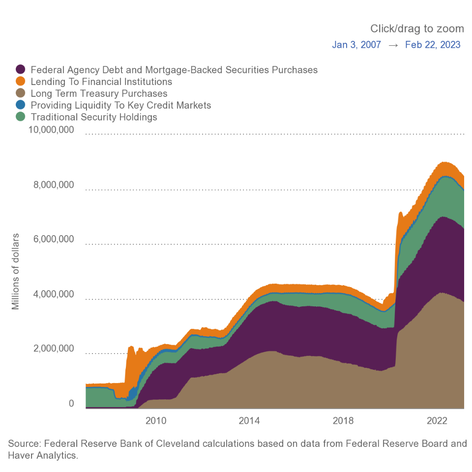

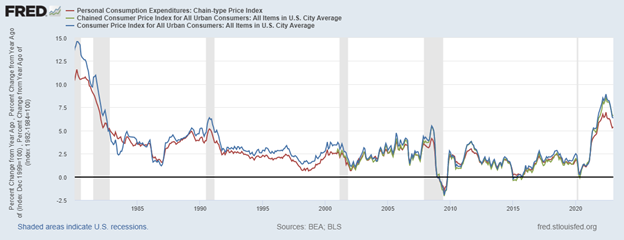

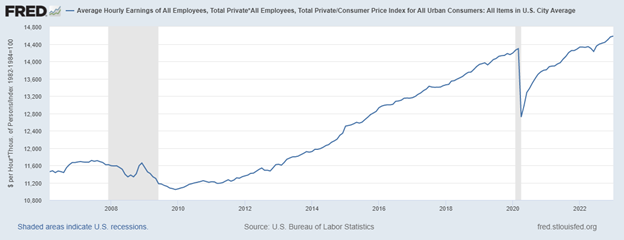

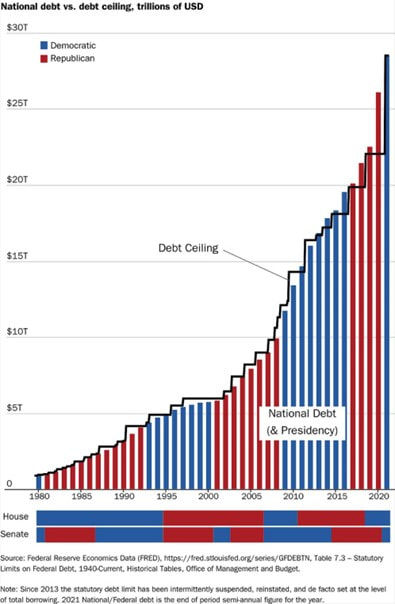

Biden’s claim of adding 14 million jobs since taking office would be impressive if it were true. The reality is that, since he took office in Jan. 2021, 13 million private sector jobs have been added. This appropriately excludes the unproductive addition of one million government jobs that will soon set a record under his watch. But the bigger point negating his rosy scenario is that the vast majority of this touted “job growth” stems from restoring job losses from the pandemic lockdowns. When we accurately tally the new jobs added since the shutdowns began in Feb. 2020, the count stands at 4.5 million private sector jobs added in three years. While this is a positive, it’s an average of 1.5 million jobs yearly, far from qualifying as record-breaking job creation. The latest U.S. jobs report for November provides additional data, reaffirming the mixed nature of the labor market. The payroll report indicates a feeble performance. There was a headline number of 199,000 jobs added. But there were revisions in October of 35,000 fewer jobs added. So, net additions stand at 164,000 jobs. When government jobs are correctly subtracted, the count is just 115,000 new productive private jobs last month. On a more positive note, the household report shows a substantial increase of 532,000 in the labor force, resulting in a 62.8 percent participation rate. Employment experienced robust growth of 747,000, contributing to a decline in the unemployment rate to 3.7 percent. But the broader unemployment rate that includes underemployed and discouraged workers is nearly twice as high at seven percent. However, it’s crucial to note that the average weekly earnings show a 3.7 percent increase over the last year, though this has been overshadowed by the elevated inflation. Fresh data on inflation as measured by the chained consumer price index (chained-CPI), which accounts for the substitution effect of changes in individual prices not accounted for by the headline CPI, reveals signs of moderation. The latest core chained-CPI inflation rate, which excludes food and energy and is watched by the Federal Reserves, for Nov. 2023 was up 3.7 percent year-over-year. Not only is this 85 percent higher than the Fed’s average inflation rate target of two percent, it also nearly matches the increase in earnings, negating any increase in purchasing power. In fact, real average weekly earnings have declined for 24 straight months. No wonder people are concerned about the economy. The ongoing reduction of the Fed’s balance sheet contributes to this inflation moderation, but further cuts to its bloated balance sheet are necessary to stabilize prices across the economy. Their balance sheet currently hovers around $8 trillion, nearly double its pre-pandemic figure, having increased tenfold in fifteen years from $800 billion in 2007. While some blame the national debt crisis on not having enough tax revenue from slower-than-optimal GDP growth, the truth is excessive government spending. Inflation is not your fault, as The Atlantic recently claimed. It’s the fault of excessive government spending by Congress that led to rising national debt which the Fed purchased and printed money. Too much money chasing too few goods is the classic definition of inflation, and it fits this time, too. A better way to solve this would be to slash government spending and taxes like President Calvin Coolidge did a century ago. During the Roaring 20s, the national debt declined, and the economy supported more opportunities for people to flourish. In light of the evidence, the question arises: Is Bidenomics working? The answer, drawn from the data, suggests it is not. To guide the economy back on course, recalibration is imperative. This includes prioritizing fiscal responsibility, pruning the Fed’s ballooning balance sheet, and reining in excessive government spending. Only through such pro-growth measures can we hope to unlock genuine economic recovery and chart a course toward lasting prosperity. Thank you for listening to the 29th episode of "This Week's Economy," where I briefly recap and share my insights on key economic and policy news. Today, I cover:

1) National: No government shut down as Congress passes a continuing resolution budget, House Speaker Kevin McCarthy kicked out with a new speaker to be voted in next Wednesday, presidential candidate Nikki Haley bashes excessive government spending and signs Taxpayer Protection Pledge as all candidates should, and latest jobs report reveals overall weakness; 2) States: Americans for Tax Reform released its Sustainable Budget Project for states that I helped author and Texas will have another special legislative session this Monday to discuss passing Universal School Choice; and 3) Other: My latest op-eds, including one published by The Wall Street Journal with Grover Norquist on the national and state spending problems, and another published by The Daily Caller on why the FTC suing Amazon over antitrust concerns is a waste of time and taxpayer dollars. Please subscribe to my work on your favorite platform, follow me on social media, share my work, and like or leave a 5-star rating to help me spread this message to the masses! This commentary was originally published at EconLib here.

Americans say the economy is the most important problem facing the country. But major headlines covering the latest jobs report for August do their best to downplay this concern. The New York Times’ headline covering the news was, “August Jobs Report: U.S. Jobs Growth Forges On,” but the economic reality is far less cheerful. Sure, the jobs report beat the consensus estimate by economists. But that high-level look at the data fails to address underlying issues keenly felt by many Americans that are apparent with more scrutiny. And these problems won’t be over unless policies out of D.C. substantially and quickly improve. Last month, 187,000 jobs were added, according to the payroll survey, compared with the anticipated 170,000. But the jobs added in the prior two months were revised lower by a cumulative 110,000 jobs, bringing the net jobs added in August to just 77,000. This extends an ongoing trend of downward revisions over the last several months. According to the household survey, the unemployment rate, a weak indicator of the labor market’s strength, jumped substantially from 3.5% to 3.8%. Coupled with news of slow wage growth of just 0.2% last month, there is growing concern among Americans trying to make ends meet. We know the higher unemployment rate isn’t from too few jobs available. The number of job openings has been nearly double that of those unemployed for a long time, though decreasing quickly. Instead, the higher rate suggests a sluggish economy in which there are more unemployed or ghost job openings from companies that do not intend to hire but want to gauge interest and competition. There is some good news. The labor force increased by 736,000, which raised the participation rate to 62.8% in August. This is the highest rate since February 2020, just before the shutdowns in response to the COVID-19 pandemic. More people entering the labor force and higher participation rates appear promising. However, the increase in the labor force was a combination of 222,000 more people employed, with the other 514,000 people becoming unemployed. And diving deeper, 4.2 million more adults remain not in the labor force compared with February 2020. Many of these individuals have been unemployed for years, so obtaining employment could be difficult due to a lack of productivity signals in their resume on top of employers dealing with a stagnant economy. The rise in the unemployment rate, lackluster wage growth, and the possibility of unfilled job openings all point to a weak labor market. Add in ongoing stagflation, as too-high inflation continues, and Americans are rightly concerned about the future. Some blame the Federal Reserve for this weakness because of its fight to bring down inflation after creating it. However, Milton Friedman debunked this tradeoff between lower inflation and a higher unemployment rate decades ago. Specifically, there’s no long-run tradeoff between the two, so the Fed must focus on the single mandate of price stability instead. The Fed has been working to combat inflation by hiking its interest rate target to a multi-decade high of 5.5% and slowly reducing its bloated balance sheet. This is why you’ve seen car loan and mortgage rates soar to multi-decade highs. These higher rates significantly disrupt the new car and housing markets. But this is the resulting bust after the artificial post-pandemic “boom” as new money moves throughout the economy and manipulated interest rates create malinvestments. We felt the higher inflation rate last year from the Fed’s actions of close to 9%, and now it’s about one-third of that rate, but this remains about 50% higher than its 2% flexible average inflation target. The Fed has stated that it may raise interest rates further. And I believe that it will be forced to raise its target rate to about 6% before this hiking cycle is over. But just raising this rate won’t be enough to curb inflation for long if Congress’ deficit spending remains unchecked. This will force the Fed to monetize it to avoid putting more pressure on Congress to get their irresponsible fiscal house in order. President Biden and Democrats in Congress made this situation worse with the passage of the misnamed Inflation Reduction Act, which is likely to cost about four times the initial $300 billion estimate over a decade. Their wasteful spending, along with Republicans’ excessive spending before them, has led to a fiscal crisis, the most significant national threat. Congress will unlikely make the needed reforms to the primary drivers of the deficit of mandatory spending programs like Social Security and Medicare because of rent-seeking in politics. This will likely result in the Fed not sufficiently cutting its balance sheet to stop inflation. Rather, the Fed will probably choose to increase its balance sheet, putting more inflationary pressure on the economy when that’s the last thing it needs. A vital measure of the economy known as real gross domestic output, the real average of gross domestic product and gross domestic income, has declined in three of the last six quarters. While I don’t want there to be a hard landing, this is the situation that central planners by Congress spending and taxing too much, President Biden regulating too much, and the Fed printing too much have left us. There will be efforts by the government to correct these government failures, but we shouldn’t double down on past mistakes. Let’s learn from these failures and remember the most recent lesson in the 1980s: President Reagan cutting regulations, Congress passing tax cuts (but spending too much), and Fed Chairman Paul Volcker cutting the balance sheet. Initially, the cuts to the Fed’s balance sheet contributed to soaring double-digit interest rates, and the economy suffered a double-dip recession. However, afterward, the economy was able to heal from the prior hindrances of past presidents, congressional members, and the Fed, resulting in a long period of economic prosperity, which is often called the Great Moderation. What we have today is an economy where the government is growing, and markets aren’t as much. This must be reversed. When workers, entrepreneurs, and employers are free to engage in voluntary transactions, competition thrives, innovation flourishes, and resources are allocated efficiently. Moreover, free markets promote consumer choice and personal freedom. When government interventions, such as wasteful spending, excessive regulations, and high taxes, are removed, markets can function more efficiently and respond dynamically to changing economic conditions. Striking the right balance between constitutionally limited government functions and preserving the freedom of markets is crucial for achieving a vibrant and prosperous economy. Rising unemployment, stagnant wages, and the specter of inflation require a multifaceted approach. Raising interest rates hasn’t been enough. The government must focus on responsible fiscal and monetary policies, including reducing government spending, addressing burdensome regulations and taxes, and substantially cutting the Fed’s balance sheet. Americans are still suffering, and there is no time to waste in aggressively assessing these measures that cause economic strain so that people can get back to flourishing instead of merely “making it.” Today, I cover: 1) National:

3) Other: My thoughts on the DOJ lawsuit against Google for violating antitrust laws and why I believe it's an attack on consumers and capitalism. You can watch this TWE episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Americans say the economy is the most important problem facing the country. But major headlines covering the latest jobs report for August do their best to downplay this concern. The New York Times’ headline covering the news was, “August Jobs Report: U.S. Jobs Growth Forges On,” but the economic reality is far less cheerful.

Sure, the jobs report beat the consensus estimate by economists. But that high-level look at the data fails to address underlying issues keenly felt by many Americans that are apparent with more scrutiny. And these problems won’t be over unless policies out of D.C. substantially and quickly improve. Last month, 187,000 jobs were added, according to the payroll survey, compared with the anticipated 170,000. But the jobs added in the prior two months were revised lower by a cumulative 110,000 jobs, bringing the net jobs added in August to just 77,000. This extends an ongoing trend of downward revisions over the last several months. According to the household survey, the unemployment rate, a weak indicator of the labor market’s strength, jumped substantially from 3.5% to 3.8%. Coupled with news of slow wage growth of just 0.2% last month, there is growing concern among Americans trying to make ends meet. We know the higher unemployment rate isn’t from too few jobs available. The number of job openings has been nearly double that of those unemployed for a long time, though decreasing quickly. Instead, the higher rate suggests a sluggish economy in which there are more unemployed or ghost job openings from companies that do not intend to hire but want to gauge interest and competition. There is some good news. The labor force increased by 736,000, which raised the participation rate to 62.8% in August. This is the highest rate since February 2020, just before the shutdowns in response to the COVID-19 pandemic. More people entering the labor force and higher participation rates appear promising. However, the increase in the labor force was a combination of 222,000 more people employed, with the other 514,000 people becoming unemployed. And diving deeper, 4.2 million more adults remain not in the labor force compared with February 2020. Many of these individuals have been unemployed for years, so obtaining employment could be difficult due to a lack of productivity signals in their resume on top of employers dealing with a stagnant economy. The rise in the unemployment rate, lackluster wage growth, and the possibility of unfilled job openings all point to a weak labor market. Add in ongoing stagflation, as too-high inflation continues, and Americans are rightly concerned about the future. Some blame the Federal Reserve for this weakness because of its fight to bring down inflation after creating it. However, Milton Friedman debunked this tradeoff between lower inflation and a higher unemployment rate decades ago. Specifically, there’s no long-run tradeoff between the two, so the Fed must focus on the single mandate of price stability instead. The Fed has been working to combat inflation by hiking its interest rate target to a multi-decade high of 5.5% and slowly reducing its bloated balance sheet. This is why you’ve seen car loan and mortgage rates soar to multi-decade highs. These higher rates significantly disrupt the new car and housing markets. But this is the resulting bust after the artificial post-pandemic “boom” as new money moves throughout the economy and manipulated interest rates create malinvestments. We felt the higher inflation rate last year from the Fed’s actions of close to 9%, and now it’s about one-third of that rate, but this remains about 50% higher than its 2% flexible average inflation target. The Fed has stated that it may raise interest rates further. And I believe that it will be forced to raise its target rate to about 6% before this hiking cycle is over. But just raising this rate won’t be enough to curb inflation for long if Congress’ deficit spending remains unchecked. This will force the Fed to monetize it to avoid putting more pressure on Congress to get their irresponsible fiscal house in order. President Biden and Democrats in Congress made this situation worse with the passage of the misnamed Inflation Reduction Act, which is likely to cost about four times the initial $300 billion estimate over a decade. Their wasteful spending, along with Republicans’ excessive spending before them, has led to a fiscal crisis, the most significant national threat. Congress will unlikely make the needed reforms to the primary drivers of the deficit of mandatory spending programs like Social Security and Medicare because of rent-seeking in politics. This will likely result in the Fed not sufficiently cutting its balance sheet to stop inflation. Rather, the Fed will probably choose to increase its balance sheet, putting more inflationary pressure on the economy when that’s the last thing it needs. A vital measure of the economy known as real gross domestic output, the real average of gross domestic product and gross domestic income, has declined in three of the last six quarters. While I don’t want there to be a hard landing, this is the situation that central planners by Congress spending and taxing too much, President Biden regulating too much, and the Fed printing too much have left us. There will be efforts by the government to correct these government failures, but we shouldn’t double down on past mistakes. Let’s learn from these failures and remember the most recent lesson in the 1980s: President Reagan cutting regulations, Congress passing tax cuts (but spending too much), and Fed Chairman Paul Volcker cutting the balance sheet. Initially, the cuts to the Fed’s balance sheet contributed to soaring double-digit interest rates, and the economy suffered a double-dip recession. However, afterward, the economy was able to heal from the prior hindrances of past presidents, congressional members, and the Fed, resulting in a long period of economic prosperity, which is often called the Great Moderation. What we have today is an economy where the government is growing, and markets aren’t as much. This must be reversed. When workers, entrepreneurs, and employers are free to engage in voluntary transactions, competition thrives, innovation flourishes, and resources are allocated efficiently. Moreover, free markets promote consumer choice and personal freedom. When government interventions, such as wasteful spending, excessive regulations, and high taxes, are removed, markets can function more efficiently and respond dynamically to changing economic conditions. Striking the right balance between constitutionally limited government functions and preserving the freedom of markets is crucial for achieving a vibrant and prosperous economy. Rising unemployment, stagnant wages, and the specter of inflation require a multifaceted approach. Raising interest rates hasn’t been enough. The government must focus on responsible fiscal and monetary policies, including reducing government spending, addressing burdensome regulations and taxes, and substantially cutting the Fed’s balance sheet. Americans are still suffering, and there is no time to waste in aggressively assessing these measures that cause economic strain so that people can get back to flourishing instead of merely “making it.” Originally published at Econlib. As the U.S. commemorates Labor Day, we should consider how many Americans aren’t actively participating in the workforce and what to do about it.

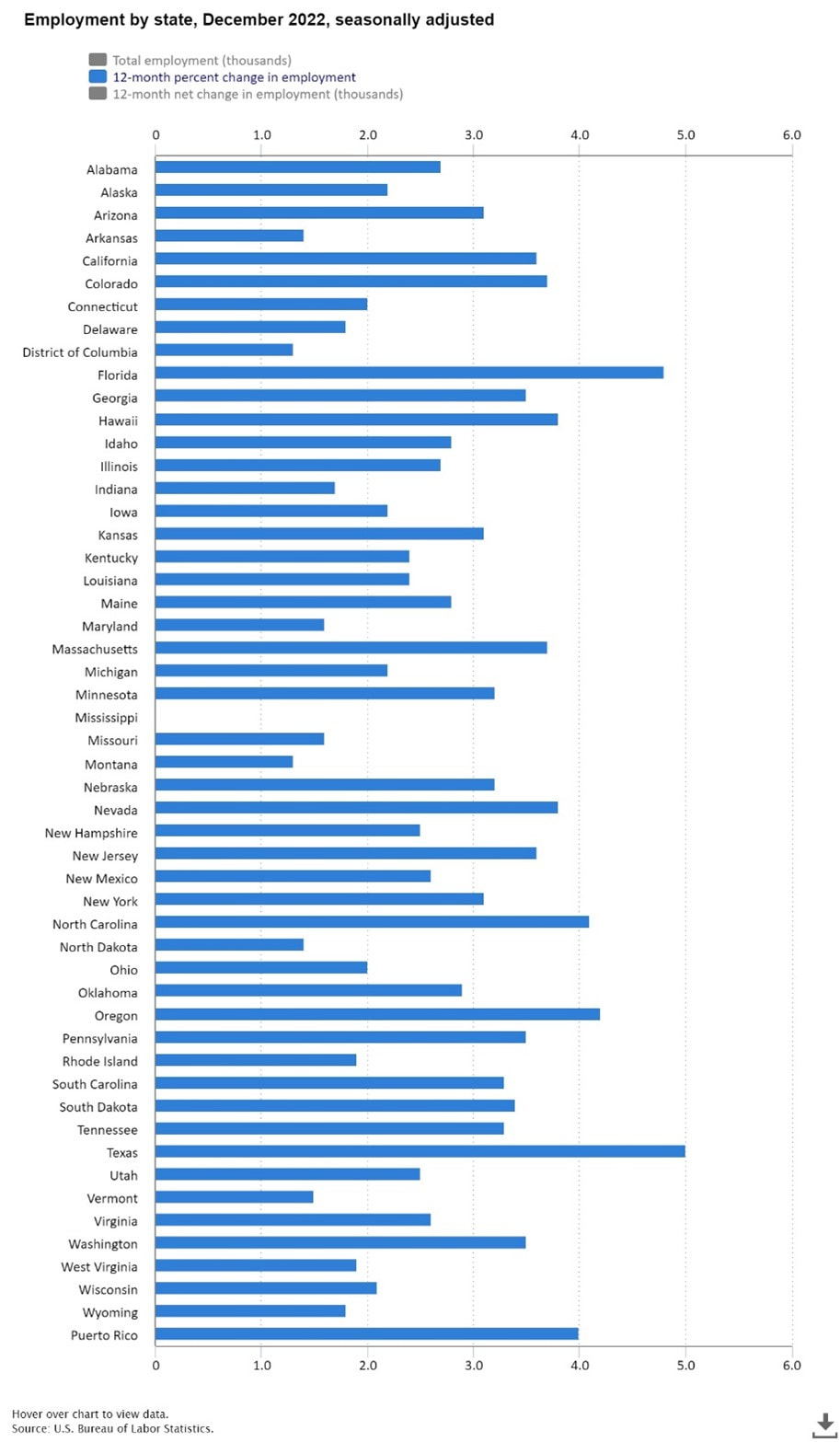

The labor force participation rate was 66% in 2007, declining to 63.3% in February 2020. Today, it’s even lower at 62.8%. Although there are many reasons for this trend, including Baby Boomers retiring, one glaring cause that will continue to exacerbate it with time is the flawed safety-net system. Labor Day was created to commemorate the many contributions of American workers, and rightly so. There’s an inspiring symbiotic relationship between the dignity individuals derive from working and the flourishing that the country experiences as a result. This is why it’s so concerning that the current structure of the many safety-net programs can disincentivize work-capable individuals from seeking, finding and keeping employment. Too often, these recipients become trapped in a cycle of government dependence. Programs like Temporary Assistance for Needy Families (TANF) and Supplemental Nutrition Assistance Program (SNAP) have minimal work requirements. This can discourage users from seeking better-paying employment opportunities, especially if the increase in income reduces the payments from these programs, which is called a benefits cliff. With purchasing power decreased from ongoing inflation, dependence on these programs is growing. There’s a high cost of these programs on recipients and taxpayers funding it, with little to show for it. Anti-poverty efforts have cost taxpayers about $25 trillion (adjusted for inflation) since 1965 and more than $1 trillion annually. While the official poverty rate in America has barely changed since 1970, only six years after President Lyndon B. Johnson declared the “war on poverty,” other measures show substantial improvements in people’s livelihoods. But much of that is because of safety-net programs that boost people’s income at the expense of other taxpayers. Ideally, a flourishing civil society with strong families, communities, nonprofits, churches and other institutions in civil society would render government assistance irrelevant. But we’re a long way from that vision being attainable. Until then, these programs need key reforms, and implementing empowerment accounts (EAs) would help. EAs are designed to consolidate state-administered safety-net programs into a single account accessible through a debit card. While they initially focus on streamlining existing programs, their potential lies in gradually replacing most, if not all, other safety-net programs over time. EAs incorporate a work requirement for work-capable adults, complemented by skills training and education. Recipients would also have access to financial literacy education, community-based case management and opportunities to build savings while enrolled in the program, helping reduce the benefits cliff. An essential aspect of EAs is their adaptability. The account’s government contribution would depend on current income, assets and dependents. Unlike current safety-net programs with income thresholds that create benefit cliffs, empowerment accounts would use a time limit while offering more flexible income limits for up to a year. This approach ensures recipients are motivated to achieve self-sufficiency within a defined period. Community-based case management, provided by established non-profit organizations, would connect recipients with crucial resources and foster connections within local communities. EA’s structure of requiring participation from safety-net recipients would go beyond merely providing financial assistance to equipping them to sustain fiscal and employment stability. The result would not only mean taxpayer funds are more efficiently spent, but struggling individuals are equipped for independence, leading to a decreased poverty rate, higher labor force participation rate and a flourishing economy. Too often, the government promotes mediocrity by quickly “rescuing” people from their situation without showing them how to maintain stability. But all individuals deserve to experience the irreplaceable satisfaction that comes from earned self-sufficiency. While celebrating Labor Day, Americans should emphasize not lack of work but meaningful work that aligns with individual callings. By empowering individuals to regain their financial independence through encouraging labor force participation, we pave the way for holistic human flourishing. Implementing empowerment accounts would mark a pivotal step towards promoting prosperity and reducing dependency on government safety nets. Originally published by The Daily Caller. Texas is a leader in job creation over the last year and since February 2020. But Texas faces major headwinds as the recently ended 88th Legislature looked more like California than what is expected from the free-market bastion of hope and prosperity in Texas.

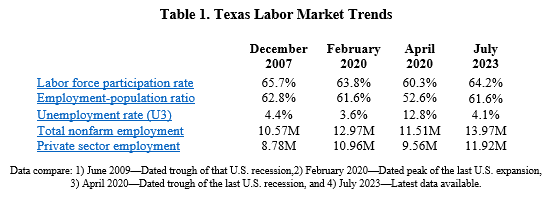

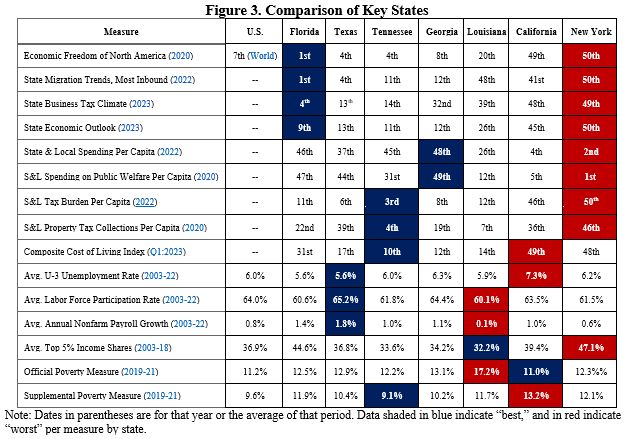

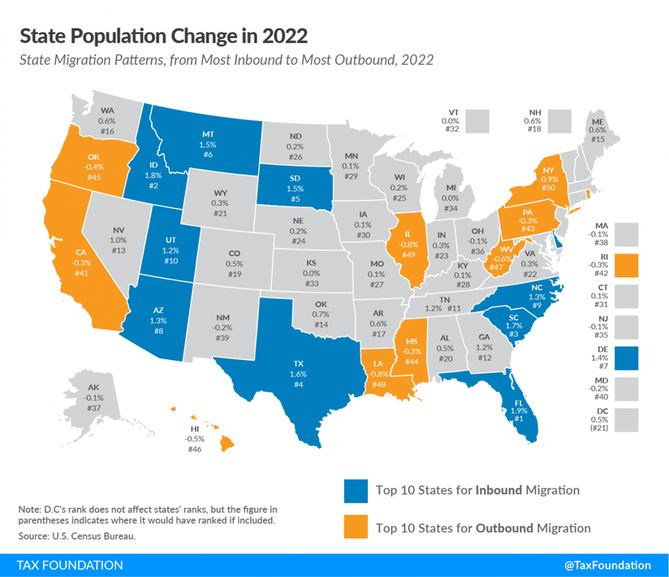

The best path to let people prosper is free-market capitalism as it is the best economic institution that supports jobs and entrepreneurship for more people to earn a living, gain skills, and build social capital. Table 1 shows Texas’ labor market for July 2023 from the U.S. Bureau of Labor Statistics. The labor market continues to improve in Texas even as there are some weaknesses remaining.

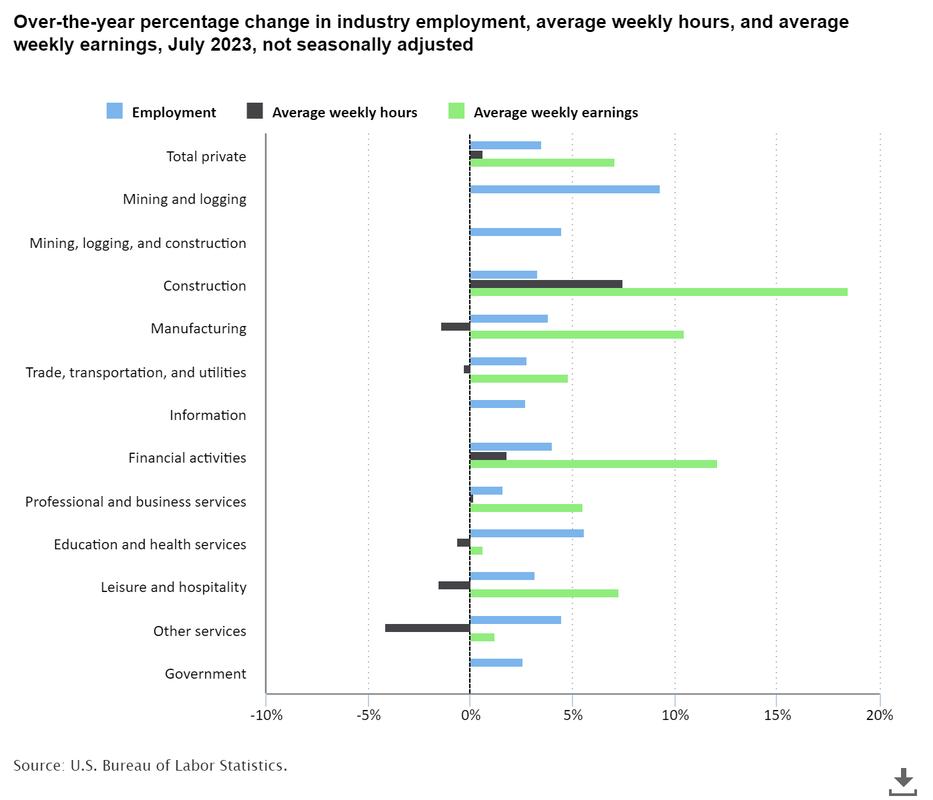

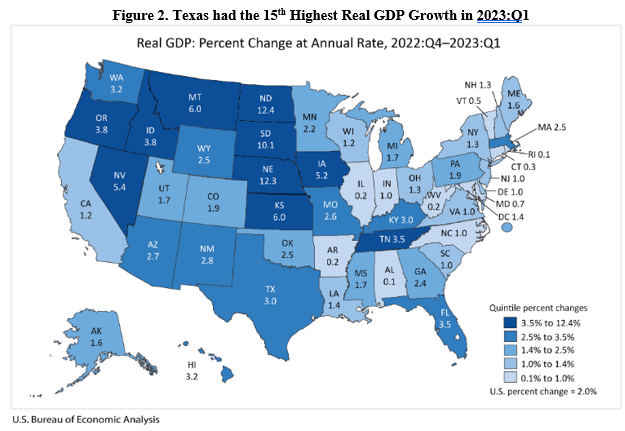

The economy continues to expand in Texas though there are headwinds.

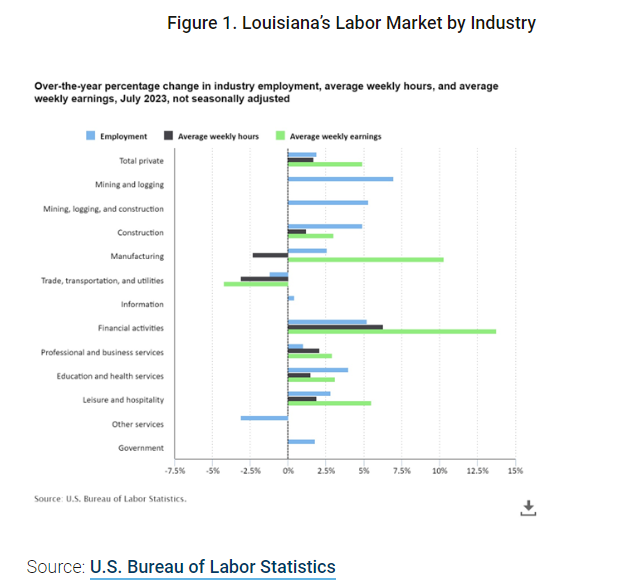

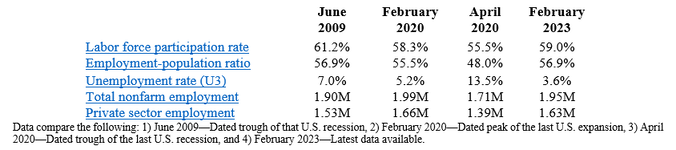

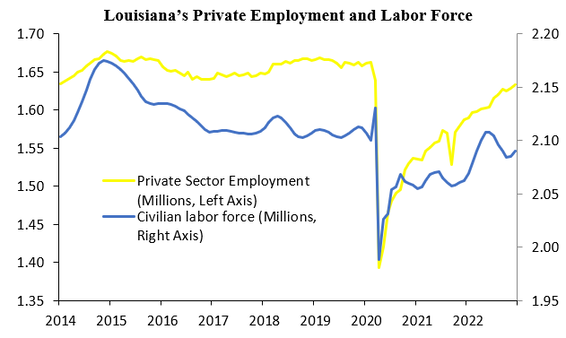

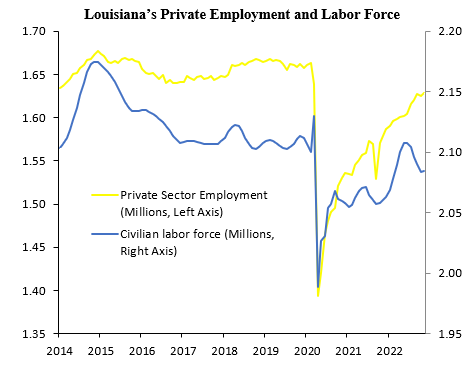

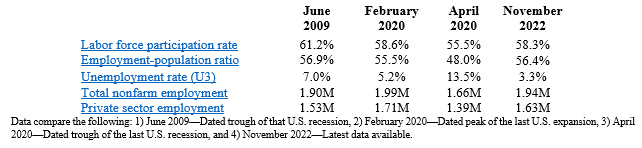

Strengthening the Texas Model will help Texans better resist D.C.’s overreach and flourish more for generations to come. Louisiana has many fantastic resources with educated people, eccentric culture, robust ports, abundant oil and gas production, and much more yet poor public policies stifle this potential, highlighted by job losses in July 2023. The Pelican Institute’s “Comeback Agenda” shows the path forward to let people prosper. Table 1 provides Louisiana’s key labor market information over time, including the latest data for July 2023 that was recently released by the U.S. Bureau of Labor Statistics. These data indicate some strength on the surface, but we must look deeper to see how Louisianans are really doing in this economy. Louisiana’s unemployment rate is lower but for the wrong reasons as people continue to leave the labor force.

Overview of the labor market in industries in Louisiana.

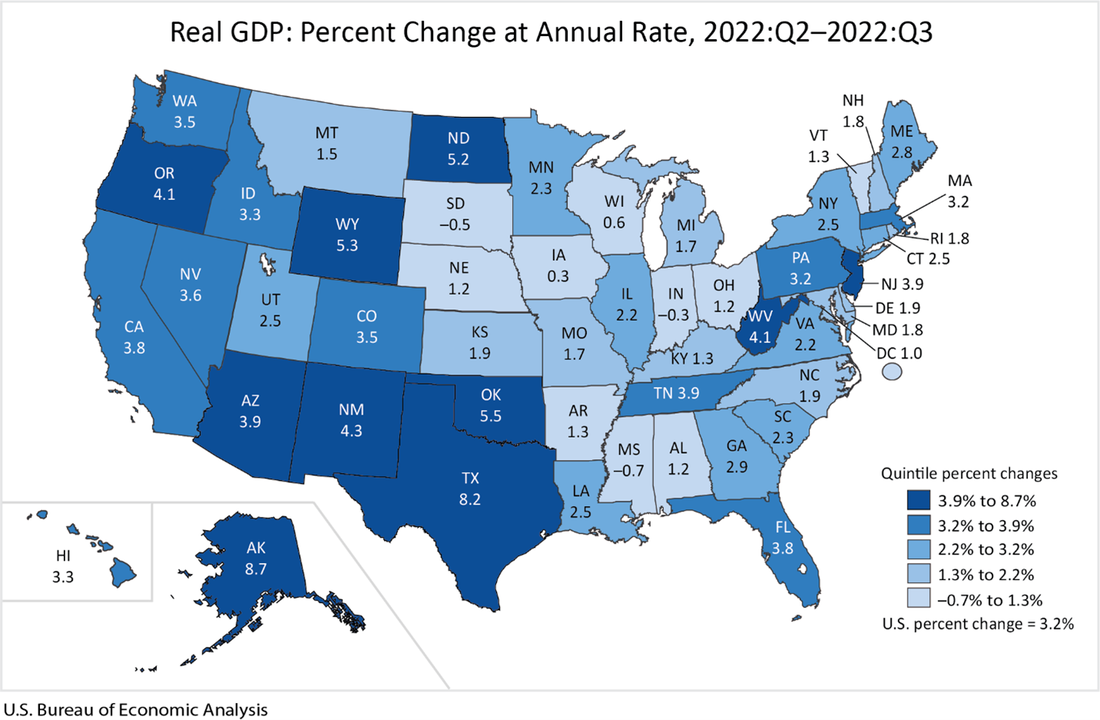

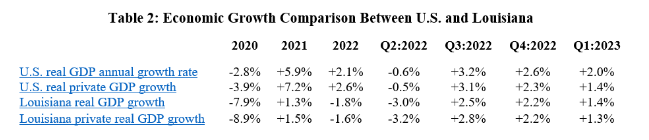

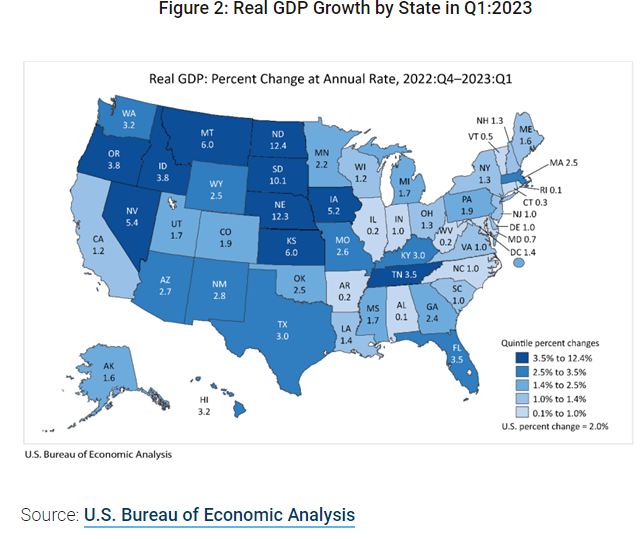

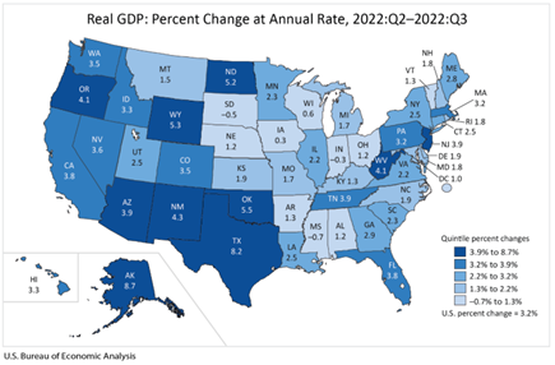

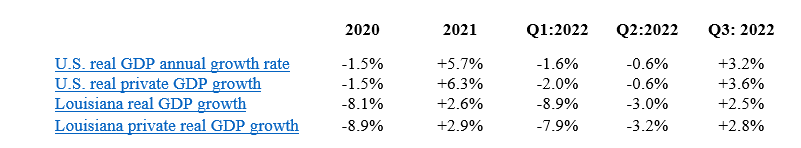

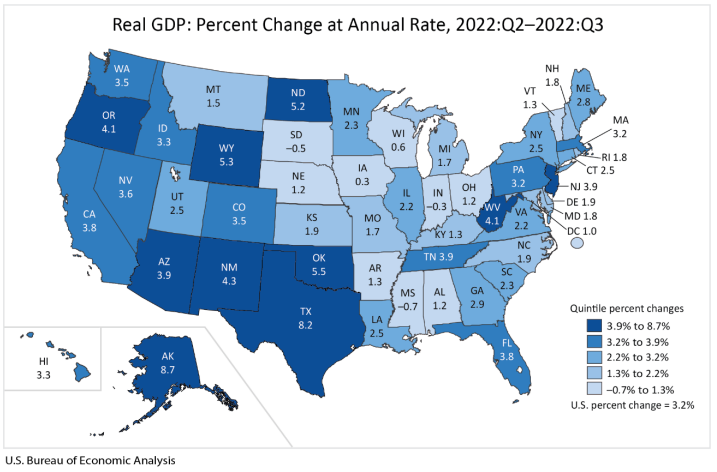

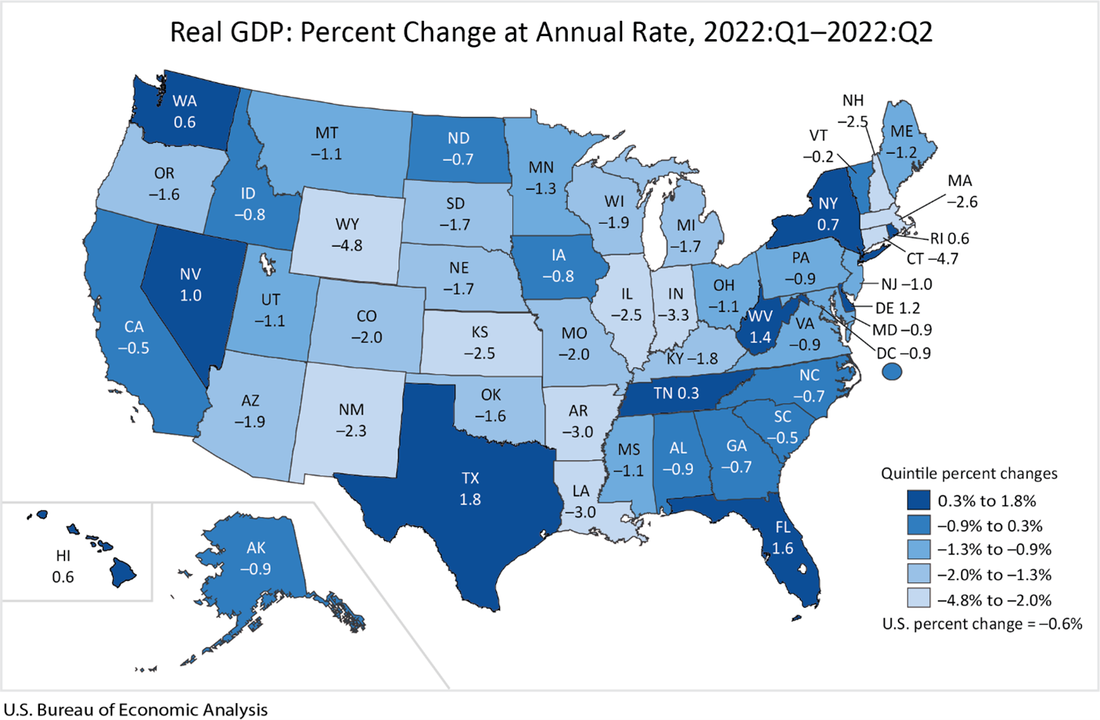

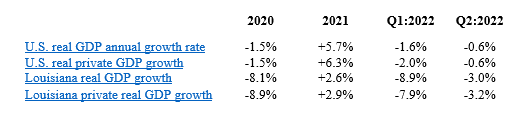

Compared with neighboring states based on several measures there continue to be major concerns with the labor market and other areas in Louisiana. Another one of those is economic growth. Table 2 shows how the U.S. and Louisiana economies performed since 2020, as reported by the U.S. Bureau of Economic Analysis.

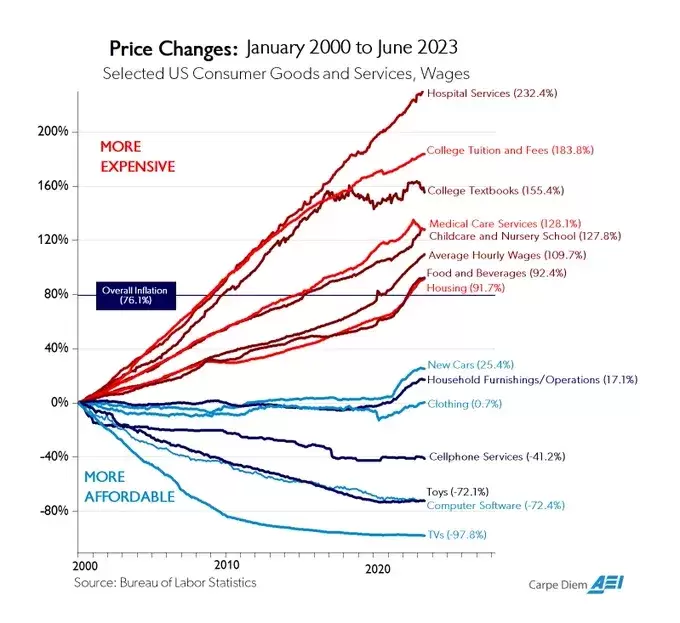

This Week's Economy Ep. 20 | Fitch Downgrades U.S. Credit Score, New Weaker Jobs Report & More8/4/2023 Today, I cover: 1) National: Findings from the latest (weaker) Jobs Report, household survey, average weekly earnings, and my thoughts on Fitch downgrading the U.S. credit score; 2) States: Why state and local tax revenues are down and what it means; and 3) Other: My recent interviews on Fox Business, NTD News, and KTRH Houston discussing the Fitch downgrade and how Bidenomics rewards the wealthy. Check out the latest Chart of the Century put out by AEI. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

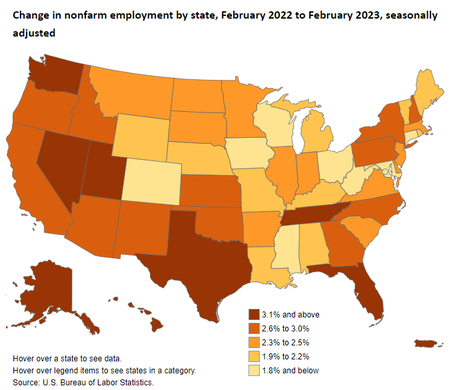

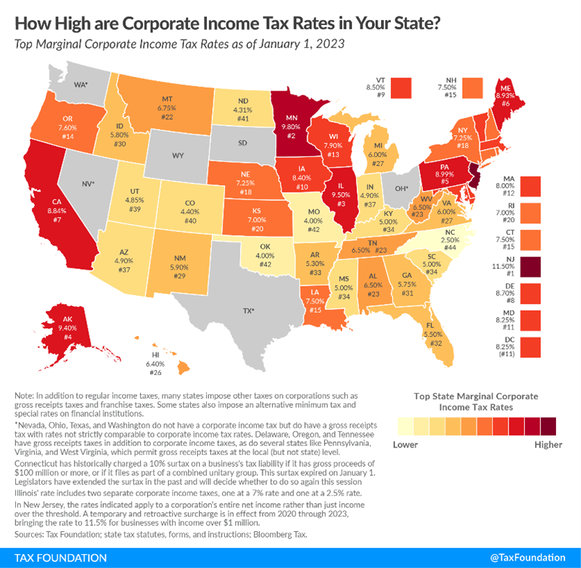

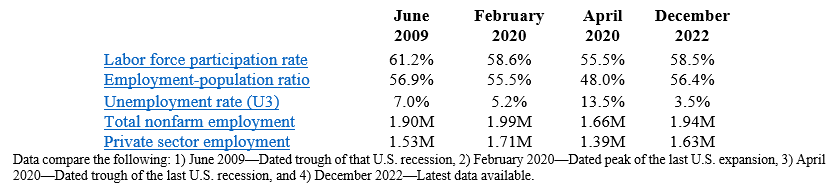

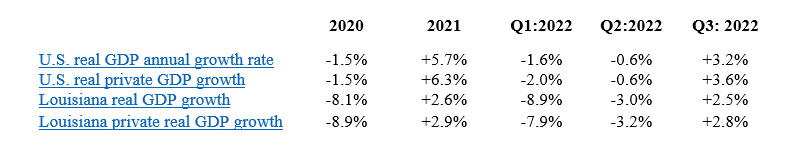

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Our new jobs report highlights Louisiana’s economic situation based on the most recent data. The report is based on several key factors that indicate how the economy, labor market, and public policy influence the lives of everyday Louisianans. While some of these data indicate a relatively strong labor market–such as the historically low unemployment rate–there are underlying factors showing Louisiana’s economic struggle. Louisiana’s comeback story will happen through reforms that remove government barriers, bring jobs and opportunity back to Louisiana, and let people prosper. We must decide: Will we continue to hold on to the status quo (which hasn’t done us any favors), or will we embrace the significant reforms necessary to bring jobs and opportunity to Louisiana? We need the latter. Read the full two-pager originally posted by Pelican Institute. Key Point: Louisiana’s labor market looks okay on the surface, but weaknesses remain because of poor policies which hinder economic opportunity across the state. There’s need for a comeback agenda. Louisiana’s Labor Market: The table below shows Louisiana’s labor market over time until the latest data for February 2023 from the U.S. Bureau of Labor Statistics. The establishment survey shows that net total nonfarm jobs in the state increased by 2,400 jobs last month (+0.1%), bringing total jobs to 46,600 jobs below the pre-shutdown level in February 2020. Private sector employment was up by 2,500 jobs (+0.2%) and government employment declined by 100 jobs (-0.1%) last month. Compared with a year ago, total employment was up by 35,500 jobs (+1.9%), which was the 7th lowest rate in the country, with the private sector adding 31,700 jobs (+2.0%) and the government adding 3,800 jobs (+1.2%). The household survey finds that the working-age population declined by 1,181 people (-0.03%) last month, down 12,944 people (-0.4%) over the last year, and down 31,247 people (-0.9%) since February 2020. But the civilian labor force rose by 8,240 people (+0.4%) last month, 4,312 people (+0.2%) over last year, and 9,465 people (+0.5%) since February 2020. These figures result in a labor force participation rate of 59.0% which is up from 58.3% since pre-shutdown but well below the 61.2% rate in June 2009 at the trough of the Great Recession. While the unemployment rate of 3.6% is substantially lower than the 5.2% rate in February 2020, a broader look at Louisiana’s labor market shows that Louisianans still face challenges, especially compared with neighboring states based on several measures. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real (inflation-adjusted) gross domestic product (GDP) in Q3:2022 for Louisiana and other states. The following table shows how U.S. and Louisiana economies performed since 2020. The steep declines were during the shutdowns in 2020 in response to the COVID-19 pandemic, which was when the labor market suffered most. The decline in real GDP annualized growth of -3% in Q2:2022 was the 5th worst and increase of +2.5% in Q3:2022 ranked 23rd in the country. The BEA also reported that personal income in Louisiana grew at an annualized pace of +5.8% (ranked 19th) in Q2:2022 (tied +5.8% U.S. average) and of +2.5% (ranked 47th) in Q3:2022 (below +5.3% U.S. average). Bottom Line: Louisianans gained jobs in February but continue to feel the costs of restrictive policies that reduce opportunities for them to find well-paid jobs. Institutions matter to human flourishing but they are too weak in Louisiana according to the Fraser Institute’s ranking of 20th for economic freedom. And the Tax Foundation recently ranked the Pelican State as having the 12th worst business tax climate and 15th highest corporate income tax rate. The state has improved its tax code recently and lower taxes may happen soon, but excessive government spending, highly complicated personal income tax code, and poor business tax climate contribute to a net outmigration of Louisianans and a 19.6% poverty rate that ranks highest in the country. State and local policymakers should work to reverse this trend by passing pro-growth policies. Comeback Agenda: The Pelican Institute for Public Policy recently released “Louisiana’s Comeback Agenda” to turn things around in the Pelican State by doing the following:

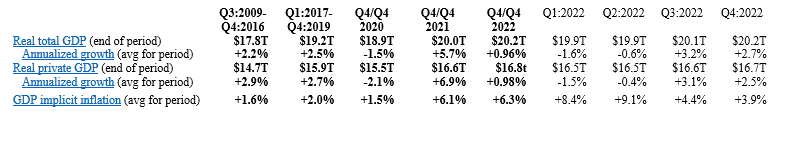

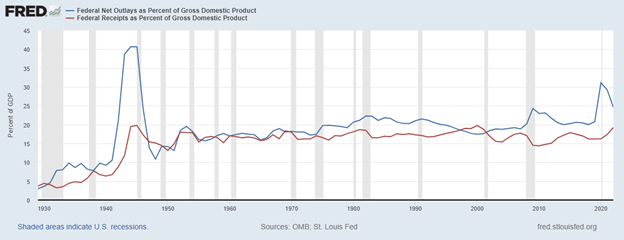

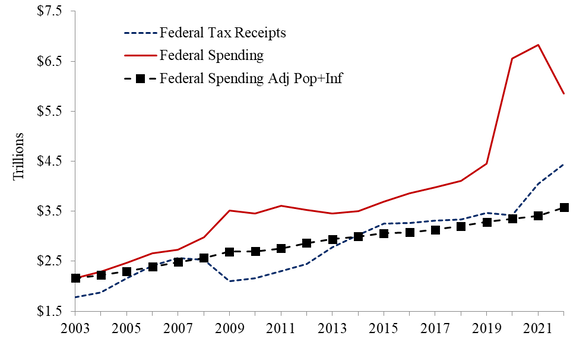

Key Point: The U.S. economy in 2022 had the slowest Q4-over-Q4 growth during a recovery since at least 2009 and average weekly earnings are now down for 22 straight months as inflation keeps roaring. But there’s hope if we just give free-market capitalism a chance to let people prosper. Overview: Although President Biden recently tried to claim that the state of the union is strong, facts tell a different story. The government failures that drove the “shutdown recession,” high inflation, and weak economic growth over the last three years continue to plague Americans. This includes excessive federal spending leading to massive deficit spending adding up to $7 trillion since January 2020 to reach nearly $31.5 trillion in national debt—about $250,000 owed per taxpayer. This has created a fight between the Biden administration and House Republicans over the debt ceiling, as raising it must come with spending restraint to avoid some of the fiscal insanity that will lead to insolvency if nothing is changed. And more inflation could be on the horizon if the Federal Reserve chooses to monetize more more of the new debt, which past excess has already contributed to 40-year-high inflation rates. These government failures with little relief from pro-growth policies in sight mean that things will get worse before they get better. Labor Market: The Bureau of Labor Statistic recently released its U.S. jobs report for January 2022. This report came with substantial revisions to seasonal adjustments and population estimates which could bias the data for a while given that the revised estimates include the much of the last three years of data that are highly volatile. And recall the recent report by the Philadelphia Fed finds that if you add up the jobs added in states in Q2:2022 there were just 10,500 net new jobs rather than more than 1 million reported. The establishment survey shows there were +517,000 (+3.3%) net nonfarm jobs added in January to 155.1 million employees, with +443,000 (+3.6%) added in the private sector and +74,000 (+1.4%) jobs added in the government sector. Most of the private sector jobs were added in the sectors of leisure and hospitality (+128,000), private education and health services (+105,000), and professional and business services (+82,000), which these three sectors led over the last 12 months as well; information (-5,000) and utilities (-700) were the only net job declines over the last month and no sector had net job losses over the last year. Average hourly earnings for all employees was up by 10 cents last month to $33.03, or up by +4.4% over the last year. And average weekly earnings in the private sector increased by $13.35 last month to $1,146, or up by +4.7% over the 12 months. The household survey had another large increase of +894,000 jobs added to 160.1 million employed There have been declines in net jobs in four of the last 10 months for a total increase of +1.8 million since March 2022, which is about half of the +3.6 million of the net jobs added per the establishment survey. The official U3 unemployment rate declined slightly to 3.4% which is the lowest since 1969. But challenges remains as inflation-adjusted average weekly earnings were down -1.5% over the last year for the 22nd straight month, weighing on Americans budgets to make ends meet. And since February 2020 before the shutdown recession, the prime age (25-54 years old) employment-population ratio was 0.3-percentage point lower, prime-age labor force participation rate was 0.3-percentage point lower, and the total labor-force participation rate was 0.9-percentage-point lower with millions of people out of the labor force thereby holding the U3 unemployment rate much lower than otherwise. Economic Growth: The U.S. Bureau of Economic Analysis’ recently released the 2nd estimate for economic output for Q4:2022. The following table provides data over time for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. And most of the estimates for Q4:2022 and growth in 2022 were revised lower, providing more evidence that 2022 was a very weak year if not a recession. The shutdown recession in 2020 had GDP contract at historic annualized rates because of individual responses and government-imposed shutdowns related to the COVID-19 pandemic. Economic activity has had booms and busts thereafter because of inappropriately imposed government COVID-related restrictions in response to the pandemic and poor fiscal policies that severely hurt people’s ability to exchange and work. Since 2021, the growth in nominal total GDP, measured in current dollars, was dominated by inflation, which distorts economic activity. The GDP implicit price deflator was +6.1% for Q4-over-Q4 2021, representing half of the +12.2% increase in nominal total GDP. This inflation measure was +9.1% in Q2:2022—the highest since Q1:1981—for a +8.5% increase in nominal total GDP that quarter. This made two consecutive declines in real total (and private) GDP, providing a criterion to date recessions every time since at least 1950. In Q3:2022, nominal total GDP was +7.6% and GDP inflation was +4.4% for the +3.2% increase in real total GDP. But if inflation had been as high as it was in the prior two quarters or had the contribution of net exports of goods and services (driven by natural gas exports to Europe) not been 2.9%, real total GDP would have either declined or been essentially flat for a third straight quarter. In Q4:2022, there was a similar story of weakness as nominal total GDP was +6.6% and GDP inflation was +3.9% for the +2.7% increase in real total GDP. But if you consider the +2.7% real total GDP growth was driven by contributions of volatile inventories (+1.5pp), government spending (+0.6pp), and next exports (+0.5pp) which total +2.6pp, the actual growth is quite tepid like it was in Q3:2022. For all of 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.9%, which was the slowest Q4-over-Q4 growth for a year since 2009 (last part of Great Recession). The Atlanta Fed’s early GDPNow projection on February 24, 2023 for real total GDP growth in Q1:2023 was +2.7% based on the latest data available. The table above also shows the last expansion from June 2009 to February 2020. A reason for slower real private GDP growth in the latter period is due to higher deficit-spending, contributing to crowding-out of the productive private sector. Congress’ excessive spending thereafter led to a massive increase in the national debt by more than +$7 trillion that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in the following figure with federal spending and tax receipts as a share of GDP no matter if there are higher or lower tax rates. But the Fed monetized much of the new debt to keep rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 6.5% since the record high in April 2022. The Fed will need to cut its balance sheet (see first figure below with total assets over time) more aggressively if it is to stop manipulating so many markets (see second figure with types of assets on its balance sheet) and persistently tame inflation, which there’s likely a need for deflation for a while given the rampant inflation over the last two years. The resulting inflation measured by the consumer price index (CPI) has cooled some from the peak of +9.1% in June 2022 but remains hot at +6.4% in January 2023 over the last year, which remains at a 40-year high (highest since July 1982) along with other key measures of inflation (see figure below). After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only +2.2% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, deficits and taxes are always and everywhere a spending problem. The figure below (h/t David Boaz at Cato Institute) shows how this problem is from both Republicans and Democrats. As the federal debt far exceeds U.S. GDP, and President Biden proposed an irresponsible FY23 budget and Congress never passed one until the ridiculous $1.7 trillion omnibus in December, America needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on population growth plus inflation. If Congress had followed this approach from 2003 to 2022, the figure below shows tax receipts, spending, and spending adjusted for only population growth plus chained-CPI inflation. Instead of an (updated) $19.0 trillion national debt increase, there could have been only a $500 billion debt increase for a $18.5 trillion swing in a positive direction that would have substantially reduced the cost of this debt to Americans. Of course, part of this includes the Great Recession and the Shutdown Recession, so these periods would have likely been good reason to exceed the limit, but regardless we would be in a much better fiscal and economic situation with this fiscal rule. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And to top this off, the Federal Reserve should follow a monetary rule so that the costly discretion stops creating booms and busts. Bottom Line: While there appears to be a strengthening labor market in January, let’s see if this continues as my guess is that these were biased from the data adjustments, and we will see a weaker labor market in the months to come. My expectation is that stagflation will continue along with the a deeper recession this year given the “zombie economy” with “zombie labor” of many workers sitting on the sidelines and others are “quiet quitting” along with the failures of many “zombie firms” that live on debt. Ultimately, Americans are struggling from bad policies out of D.C.. Instead of passing massive spending bills, the path forward should include pro-growth policies. These policies ought to be similar to those that supported historic prosperity from 2017 to 2019 that get government out of the way rather than the progressive policies of more spending, regulating, and taxing. The time is now for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty.

Recommendations:

Our new jobs report highlights Louisiana’s economic situation based on the most recent data. The report is based on several key factors that indicate how the economy, labor market, and public policy influence the lives of everyday Louisianans. While some of these data indicate a relatively strong labor market–such as the historically low unemployment rate–there are underlying factors showing Louisiana’s economic struggle. Moreover, the data show that Louisiana lost 36,857 residents from 2021-2022, ranking third worst in the nation. Louisiana’s comeback story will happen through reforms that remove government barriers, bring jobs and opportunity back to Louisiana, and let people prosper. We must decide: Will we continue to hold on to the status quo (which hasn’t done us any favors), or will we embrace the significant reforms necessary to bring jobs and opportunity to Louisiana? We need the latter. Read the full two-pager: Originally published at Pelican Institute. Key Point: Louisiana’s labor market looks okay even as the unemployment rate increased by 0.2-percentage point to 3.5% unemployment rate. But the labor force has 10,622 (-0.5%) fewer people in it than pre-shutdown in February 2020 and private sector employment is 30,000 (-1.8%) below then, indicating a much weaker labor market and economy overall. Labor Market: A job is the best path to prosperity as work brings dignity, hope, and purpose to people through life-long benefits of earning a living, gaining skills, and building social capital. The table below shows Louisiana’s labor market over time until the latest data for December 2022 by the U.S. Bureau of Labor Statistics. The establishment survey shows that net total nonfarm jobs in the state increased by 4,800 jobs last month (+0.2%), bringing this to 50,700 jobs below the pre-shutdown level in February 2020. Private sector employment was up by 4,400 jobs (+0.3%) and government employment rose by 400 jobs (+0.1%) last month. Compared with a year ago, total employment was up by 46,200 jobs (+2.4%) with the private sector adding 45,600 jobs (+2.9%) and the government adding 600 jobs (+0.2%). The household survey finds that the civilian labor force rose by 5,028 people last month and is down 10,622 people since February 2020, which results in the labor force participation rate of 58.5% being 0.1-percentage point lower than it was in February 2020 but well below the 61.2% rate in June 2009 at the trough of the Great Recession. The employment-population ratio is 0.9-percentage point above where it was in February 2020 and nearly back to where it was in June 2009. While the unemployment rate of 3.5% is substantially lower than the 5.2% rate in February 2020, a broader look at Louisiana’s labor market rather than this weak indicator shows that Louisianans still face challenges, especially compared with neighboring states based on several measures. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real (inflation-adjusted) gross domestic product (GDP) in Q3:2022 for Louisiana and other states. The following table shows how U.S. and Louisiana economies performed since 2020. The steep declines were during the shutdowns in 2020 in response to the COVID-19 pandemic, which was when the labor market suffered most. The decline in real GDP annualized growth of -3% in Q2:2022 was the 5th worst and increase of +2.5% in Q3:2022 ranked 23rd in the country. The BEA also reported that personal income in Louisiana grew at an annualized pace of +5.8% (ranked 19th) in Q2:2022 (tied +5.8% U.S. average) and of +2.5% (ranked 47th) in Q3:2022 (below +5.3% U.S. average). Bottom Line: Louisianans gained jobs in December but continue to feel the costs of the shutdowns in 2020 and other restrictive policies that reduce opportunities for them to find well-paid jobs. Institutions matter to human flourishing in countries and states, which is floundering in Louisiana compared with many other states. The Fraser Institute recently ranked Louisiana 20th for economic freedom based on 2020 data for government spending, taxes, and labor market regulation. And the Tax Foundation recently ranked the Pelican State as having the 12th worst business tax climate and 15th highest corporate income tax rate. While the state has improved its tax code recently and lower taxes may happen soon from an expected budget surplus, this lack of economic freedom and poor business tax climate are contributing to a net outmigration of Louisianans to other states, which is a drain on the state’s economic potential now and in the future. State and local policymakers should work to reverse this trend by passing pro-growth policies. Free-Market Solutions: In 2023, the Louisiana Legislature should provide the state’s comeback story by:

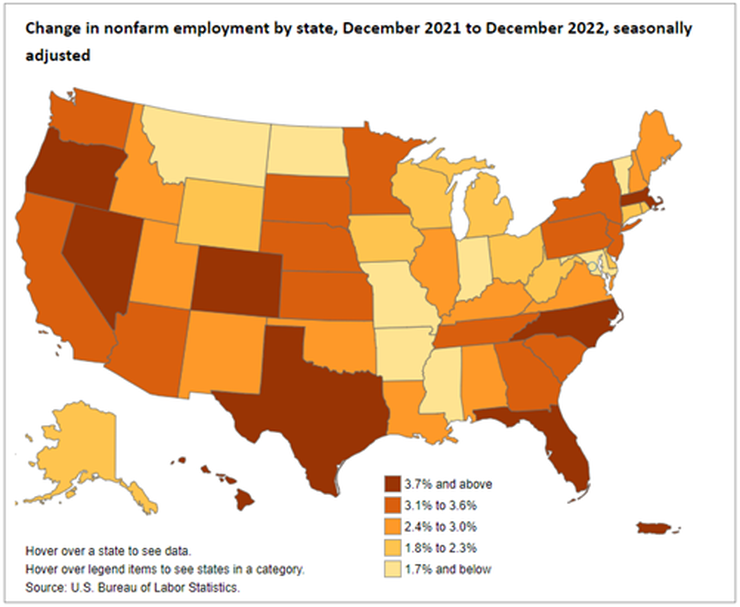

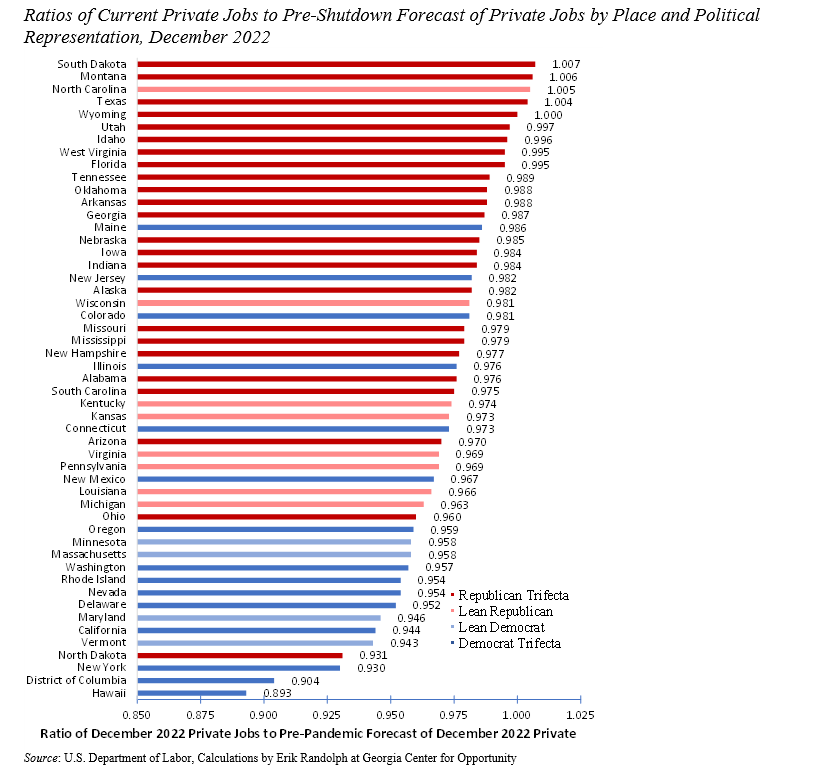

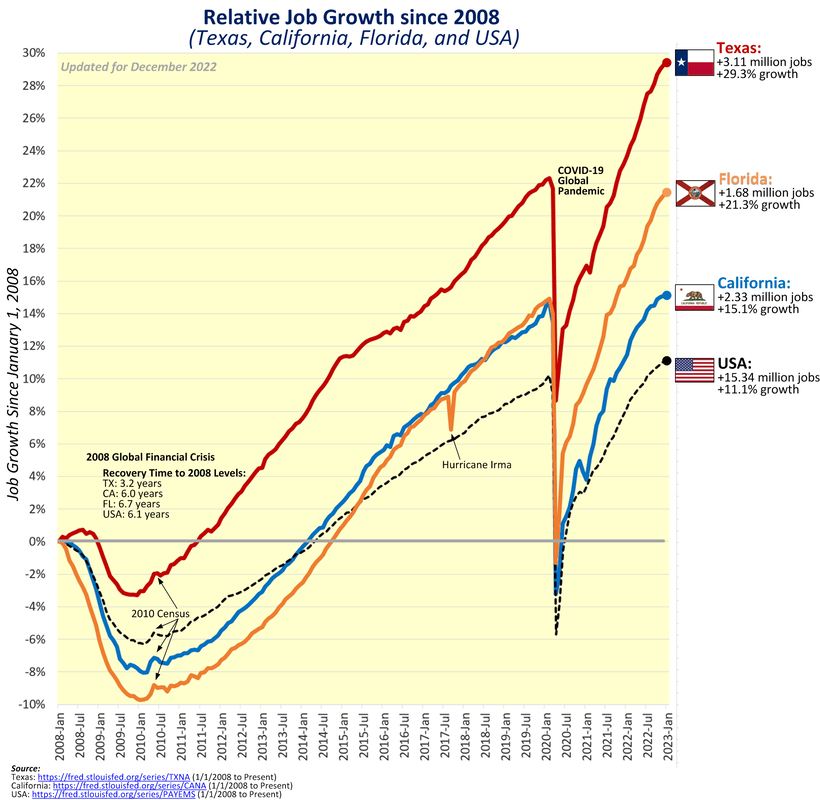

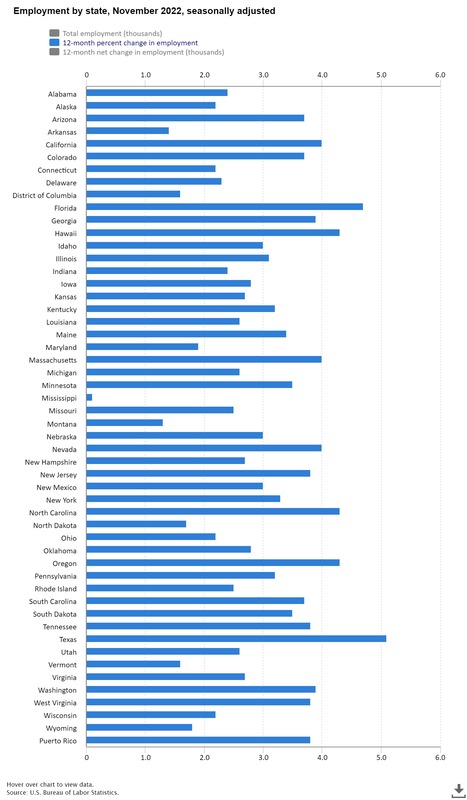

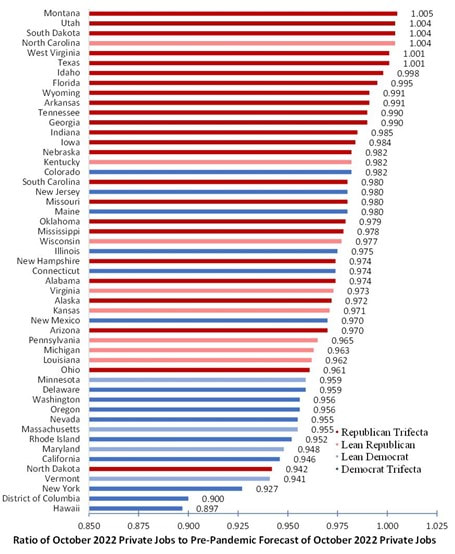

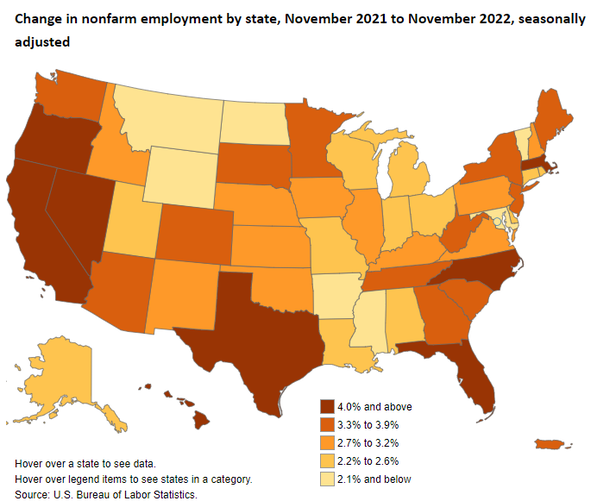

Key Point: Texas continues to lead the way in job creation over the last year (see first figure) and second in economic growth in the third quarter of 2023 (see last figure), but there’s more to do to help struggling Texans deal with the state’s affordability crisis, especially spending, regulating, and taxing less. Overview: Texas has been a national leader in the economic recovery since the inappropriate shutdown recession in Spring 2020. This includes reaching a new record high in total nonfarm employment for the 14th straight month, leading exports of technology products for 20 consecutive years, and being home to more than 50 of the world’s Fortune 500 companies. While the 87th Texas Legislature in 2021 supported the recovery by passing many pro-growth policies like the nation’s strongest state spending limit, there’s more to do in the ongoing 2023 session to remove barriers placed by state and local governments. Labor Market: The best path to prosperity is a job, as it helps bring financial self-sufficiency, dignity, hope, and purpose to people so they can earn a living, gain skills, and build social capital. The table below shows the state’s labor market for December 2022. The establishment survey shows that net nonfarm jobs in Texas increased by 29,500 last month, resulting in increases for 31 of the last 32 months, to bring record-high employment to 13.7 million. Compared with a year ago, total employment was up by 650,100 (+5.0%)—fastest growth rate in the country—with the private sector adding 628,800 jobs (+5.7) and the government adding 21,300 jobs (+1.1%). The household survey shows that the labor force participation rate is slightly higher than in February 2020 but well below June 2009 at the trough of the Great Recession. The employment-population ratio fell was unchanged in November and nearly where it was in February 2020, and the private sector now employs 700,000 more people than then. Texans still face challenges with a worse unemployment rate, though historically low, and nonfarm private jobs just recently above its pre-shutdown trend (Figure 1). The figure below compares the ratio of current private employment to pre-shutdown forecast levels in red states and blue states if both chambers of the legislature and the governor are Republican (dark red), Democrat (dark blue), or some combination (lighter colors). The results show a clear distinction between red states and blue states, with the stringency of restrictions by governments during the pandemic along with pro-growth policies before and after the shutdowns playing key roles. Specifically, 21 of the 25 states with the best (highest) ratios are in red-ish states while 13 of the 15 states and D.C. with the worst (lowest) ratios are in blue-ish places as of December 2022. The following figure from Soquel Creek on Twitter tells the story even more directly: those states with more economic freedom prosper more than those with less economic freedom (see rankings in Fraser Institute's Economic Freedom of North America report: FL ranks #1, Texas ranks #4, California ranks #49, and New York ranks #50). Overall, multiple indicators should be considered in this nuanced labor market, such as the fact that the unemployment rate is a weak indicator as many have dropped out of the labor force. While the labor force participation rate in Texas slightly exceeds where it was before the shutdowns, and the 3.9% unemployment rate could be considered full employment, the employment-population ratio is 0.2-percentage point below the pre-shutdown ratio. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real gross domestic product (GDP) by state for Q3:2022. The Figure below Texas had the second fastest GDP growth (first is Alaska) of +8.2% on an annualized basis to $1.89 trillion (above the U.S. average of +3.2% to $20.05 trillion). In the prior quarter, Texas had the fastest growth with +1.8% growth as the U.S. average declined by -0.6% that quarter. Of course, these followed Texas’ GDP contractions of -7.0% in Q1:2020 and -28.5% in Q2 during the depths of the shutdown recession. Fortunately, GDP rebounded in Q3 and Q4, yet declined overall in 2020 by -2.9% (less than -3.4% decline of U.S. average) but increased by +3.9% in 2021 (below the +5.9% U.S. average). The BEA also reported that personal income in Texas grew at an annualized pace of +6.9% in Q3:2022 (ranked 6th highest and faster than the U.S. average of +5.3%) but slower than the robust +8.4% in Q2:2022 (ranked 6th best and above the U.S. average of +4.9%) as job creation and inflated income measures found their way across the economy.  Bottom Line: As Texas recovers from the shutdown recession and faces an uncertain future with the U.S. economy having stagflation and a likely recession, Texans need substantial relief to help make ends meet. Other states are cutting, flattening, and phasing out taxes, so Texas must make bold reforms to support more opportunities to let people prosper, mitigate the affordability crisis, and withstand destructive policies out of D.C.

Free-Market Solutions: In 2023, the Texas Legislature should improve the Texas Model by:

A Big Mac attack can now be satisfied with nearly no human contact, all from the comfort of the car.

The largest fast food chain in the country, McDonald’s, is testing a highly automated location with no indoor seating just outside Fort Worth. It is the only location like this in the country. “The features – inside and outside – are geared toward customers who are planning to dine at home or on the go,” a McDonald’s press statement explained of the design. The restaurant at 8540 West Freeway in White Settlement has multiple modes for ordering and receiving the fare. A dedicated drive-through lane allows for ordering ahead and picking up burgers and drinks from a conveyor belt. An employee takes the order number and is available to answer questions throughout the process, a company spokesperson said. Order kiosks inside the location accept cash or credit, parking is available for curbside pick-up, and food couriers like GrubHub drivers have a dedicated area to streamline their interaction as well. According to the spokesperson for McDonald’s, customers appreciate the new technology and ease of ordering associated with the “Order Ahead Lane.” He also claimed delivery drivers appreciate the simplicity of an area just for them to pick up customers’ orders. Franchisee Keith Vanecek and Manager Rosemin Jussab are two of the people behind the operation of the new test restaurant. Jussab, who has worked for McDonald’s for 20 years since her college days, enjoys the challenge and the technology that comes along with it. “The focus on technology within this restaurant is amazing and shows the emphasis we put on innovation; it’s exciting to be a part of,” she said in a press release. For those concerned that an automated restaurant like this one will eliminate entry-level jobs, McDonald’s says it anticipates this restaurant format will require a comparable number of team members to a traditional store. Employees are required for interaction between customers and the restaurant team when picking up orders, assisting with using the self-order kiosks, and delivering curbside orders. The recent coronavirus pandemic likely contributed to the speed of automation we are seeing in industries like fast food restaurants today, economist Vance Ginn told The Texan. Ginn said the pandemic has led to difficulty finding workers, inflation has raised the wages demanded by entry-level workers, and high turnover rates have increased costs for training. Combined, these factors have contributed to an acceleration in the implementation of technology like the new test location of McDonald’s. “Businesses have to make a profit or they don’t stay in business,” Ginn noted. “Short-term [the automation] may have some costs, but other jobs will come around,” Ginn said. He suggested a shift to other jobs will take place as has always happened when technology advances and crowds out another industry. “When the Model T was created, people cried about the end of horses and buggies, but we wouldn’t want to go back,” he added. Additionally, entry level workers may be incentivized to get training in higher technical skills to participate in the workforce. McDonald’s is aiming to serve its customers more satisfactorily and seamlessly through the use of automation at its new test location. The chain has struggled with customer satisfaction, falling at the bottom of the list 15 points behind Chick-Fil-A, a perennial leader with employees declaring their “pleasure” in serving customers. Whether the newest test location will help McDonald’s move up in the satisfaction rankings, and whether it is adopted elsewhere, remains to be seen. “That’s the beauty of the free market,” Ginn commented. “Businesses can try new things and see if they are profitable. It allows for experimentation.” Originally published at The Texan. Key Point: Texas leads the way in job creation over the last year and in economic growth in the latest reported quarter but there’s more to do to help struggling Texans deal with the state’s affordability crisis, especially spending less and moving further to sales taxes. Overview: Texas has been a national leader in the economic recovery since the inappropriate shutdown recession in Spring 2020. This includes reaching a new record high in total nonfarm employment for the 13th straight month, leading exports of technology products for 20 consecutive years, and being home to 54 of the Fortune 500 companies. While the 87th Texas Legislature in 2021 supported the recovery by passing many pro-growth policies like the nation’s strongest state spending limit, there’s more to do in the session in 2023 to remove barriers placed by state and local governments. Solutions include governments passing responsible budgets and returning surplus tax dollars collected to taxpayers by reducing property taxes until they’re eliminated. Other states are cutting, flattening, and phasing out taxes, so Texas must make bold reforms to support more opportunities to let people prosper, mitigate the affordability crisis, and withstand destructive policies out of D.C. Labor Market: The best path to prosperity is a job, as it helps bring financial self-sufficiency, dignity, hope, and purpose to people so they can earn a living, gain skills, and build social capital. The table below shows the state’s labor market for November 2022. The establishment survey shows that net nonfarm jobs in Texas increased by 33,600 last month, resulting in increases for 30 of the last 31 months, to bring record-high employment to 13.7 million. Compared with a year ago, total employment was up by 657,600 (+5.1%), which was the fastest growth rate in the nation, with the private sector adding 635,100 jobs (+5.8) and the government adding 22,500 jobs (+1.1%). The household survey shows that the labor force participation rate is slightly higher than in February 2020 but well below June 2009 at the trough of the Great Recession. The employment-population ratio fell by 0.1% in November moving it further away from where it was in February 2020, and the private sector now employs 700,000 more people. Texans still face challenges with a worse unemployment rate, though historically low, and nonfarm private jobs just recently above its pre-shutdown trend (Figure 1). Figure 1 compares the ratio of current private employment to pre-shutdown forecast levels in red states and blue states if both chambers of the legislature and the governor are Republican (dark red), Democrat (dark blue), or some combination (lighter colors). The results show a clear distinction between red states and blue states, with the stringency of restrictions by governments during the pandemic along with pro-growth policies before and after the shutdowns playing key roles. Specifically, 22 of the 25 states with the best (highest) ratios are in red-ish states while 13 of the 15 states and D.C. with the worst (lowest) ratios are in blue-ish places as of October 2022. Figure 1 Ratios of Current Private Jobs to Pre-Shutdown Forecast of Private Jobs by Place and Political Representation, October 2022 Overall, multiple indicators should be considered as the unemployment rate is a rather weak signal of the labor market. While the labor force participation rate in Texas exceeds where it was before the shutdowns, and the 4.0% unemployment rate could be full employment, the employment-population ratio is 0.2-percentage point above the pre-shutdown ratio. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) provided the real gross domestic product (GDP) by state for Q2:2022. Texas had the fastest GDP growth of +1.8%—to $1.85 trillion—on an annualized basis (above the -2.6% U.S. average). These followed Texas’ GDP growth declines of -7.0% in Q1:2020 and -28.5% in Q2 during the depths of the recession. GDP rebounded in Q3 and Q4, yet declined overall in 2020 by -2.9% (less than -3.4% decline of U.S. average) but increased by +3.9% in 2021 (below the +5.9% U.S. average). The BEA also reported that personal income in Texas grew at an annualized pace of +9.3% in Q2:2022 (ranked 3rd best and above the +5.8% U.S. average) as job creation and inflated income measures found their way across the economy. Bottom Line: As Texas recovers from the shutdown recession and faces an uncertain future with the U.S. economy having stagflation and a likely recession, Texans need substantial relief to help make ends meet. While the Texas Model was strengthened by the 87th Legislature last year from less government spending, taxing, and regulating, more is needed for limiting government at the state and local levels.

Recommendations: In 2023, the Texas Legislature should improve upon its past efforts by:

Key Point: Louisiana’s labor market looks okay with a 3.3% unemployment rate but the labor force has 15,617 (-0.7%) fewer people in it than pre-shutdown in February 2020 and private sector employment is 34,400 (-2.1%) below then, indicating a much weaker labor market and economy. Labor Market: A job is the best path to prosperity as work brings dignity, hope, and purpose to people through life-long benefits of earning a living, gaining skills, and building social capital. The table below shows Louisiana’s labor market over time until the latest data for October 2022 by the U.S. Bureau of Labor Statistics. The establishment survey shows that net total nonfarm jobs in the state increased by 3,800 jobs last month, bringing this to 55,900 jobs below the pre-shutdown level in February 2020. Private sector employment was up by 3,700 jobs and government employment rose by 100 jobs last month. Compared with a year ago, total employment was up by 49,200 (+2.6%) with the private sector adding 49,700 jobs (+3.1%) and the government cutting 500 jobs (-0.2%). The household survey finds that the civilian labor force rose by 840 people last month and is down 1058 people since February 2020, which results in the labor force participation rate of 58.3% being 0.3-percentage point lower than it was in February 2020 but well below June 2009 at the trough of the Great Recession. The employment-population ratio is 0.9-percentage point above where it was in February 2020. While the unemployment rate of 3.3% is substantially lower than the 5.2% rate in February 2020, a broader look at Louisiana’s labor market rather than this weak indicator shows that Louisianans still face challenges, especially compared with neighboring states based on several measures. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real (inflation-adjusted) gross domestic product (GDP) for Louisiana and others states. The following table shows how U.S. and Louisiana economies performed since 2020. The steep declines were during the shutdowns in 2020 in response to the COVID-19 pandemic, which was when the labor market suffered most. The decline in real GDP annualized growth in Q2:2022 of 3% was the 5th worst in the nation. The BEA also reported that personal income in Louisiana grew at an annualized pace of 5.8% (19th best) in Q2:2022 (tied +5.8% U.S. average). Bottom Line: Louisianans gained jobs in November but continue to feel the costs of the shutdowns in 2020 and other restrictive policies that reduce opportunities for them to find well-paid jobs. Institutions matter to human flourishing in countries and states, which is floundering in Louisiana compared with many other states. The Fraser Institute recently ranked Louisiana 20th for economic freedom based on 2020 data for government spending, taxes, and labor market regulation. And the Tax Foundation recently ranked the Pelican State as having the 12th worst business tax climate. While the state has improved its tax code recently and lower taxes may happen soon from an expected budget surplus, this lack of economic freedom and poor business tax climate are contributing to a net outmigration of Louisianans to other states, which is a drain on the state’s economic potential now and in the future. State and local policymakers should work to reverse this trend by passing pro-growth policies.

Recommendations: In 2023, the Louisiana Legislature should provide the state’s comeback story by:

Louisiana Economic Situation October 2022

Key Point: Louisiana’s labor market looks okay on the surface but the working-age population is 12,366 (-0.35%) below pre-shutdowns in February 2020 and private sector employment remains 35,900 (-2.2%) below then. Moreover, the decline in real GDP annualized growth in Q2:2022 of 3% was the 5th worst in the nation. Labor Market: The best path to prosperity is a job, as work brings dignity, hope, and purpose to people by allowing them to earn a living, gain skills, and build social capital that endures. The table below shows Louisiana’s labor market over time according to the U.S. business cycle until the latest data for September 2022. Net total nonfarm jobs in the state increased by 5,000 last month, resulting in increases for 11 of the last 12 months but remains 56,900 jobs below the pre-shutdown level in February 2020 while the working-age population is down 12,366 since then. Compared with a year ago, total employment was up by 95,600 (+5.2%) with the private sector adding 98,100 jobs (+6.4%) and the government cutting 2,500 jobs (-0.8%). The labor force participation rate of 58.5% is 0.1-percentage point lower than it was in February 2020 but well below June 2009 at the trough of the Great Recession. The employment-population ratio is 1-percentage point below where it was in February 2020, and the private sector employs 35,900 (-2.2%) fewer people than then. Louisianans still face challenges given these latest figures for the labor market and remain well below the pre-shutdown trend. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real gross domestic product (GDP) for Louisiana and others states. The following tells the story of the U.S. and Louisiana economies over the last two and a half years. The steep decline was during the shutdowns in 2020 in response to the COVID-19 pandemic, which was when the labor market suffered. The decline in real GDP annualized growth in Q2:2022 of 3% was the 5th worst in the nation. The BEA also reported that personal income in Louisiana grew at an annualized pace of 5.8% (19th best) in Q2:2022 (tied +5.8% U.S. average). Bottom Line: Louisianans continue to feel the effects of the shutdowns in 2020 and policies that are too restrictive in allowing more economic growth and prosperity with well-paid jobs. This has influenced a net outmigration of Louisianans to other states over time, which is a drain on the state’s economic potential now and in the future. State and local policymakers should work to reverse this trend by passing pro-growth policies following the Pelican Institute’s roadmap for a comeback story. Recommendations: In 2023, the Louisiana Legislature should provide the state’s comeback story by:

Originally posted at Pelican Institute Top Stat: Average hourly earnings (inflation-adjusted) down about 3.0% year-over-year