|

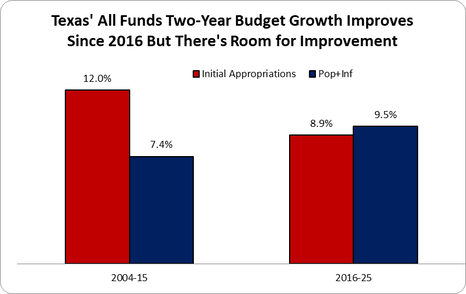

Government Spending Is The Problem The late, great economist Milton Friedman said, "The real problem is government spending." This is true as spending comes before taxes or regulations. In fact, if people didn't form a government or politicians didn’t create new programs, then there would be no need for government spending and no need for taxes. And if there was no government spending nor taxes to fund spending then there would be no one to create or enforce regulations. While this might sound like a utopian paradise, which I agree, there are essential limited roles for governments outlined in constitutions and laws. Of course, most governments are doing much more than providing limited roles that preserve life, liberty, and property. This is why I have long been working diligently for more than a decade to get a strong fiscal rule of a spending limit enacted by federal, state, and local governments promptly under my calling to "let people prosper," as effectively limiting government supports more liberty and therefore more opportunities to flourish. Fortunately, there have been multiple state think tanks that have championed this sound budgeting approach through what they've called either the Responsible, Conservative, or Sustainable State Budget. I recently worked with Americans for Tax Reform to publish the Sustainable Budget Project, which provides spending comparisons and other valuable information for every state. This groundbreaking approach was outlined recently in my co-authored op-ed with Grover Norquest of ATR in the Wall Street Journal. When Did This Budget Approach Begin? I started this approach in 2013 with my former colleagues at the Texas Public Policy Foundation with work on the Conservative Texas Budget. The approach is a fiscal rule based on an appropriations limit that covers as much of the budget as possible, ideally the entire budget, with a maximum amount based on the rate of population growth plus inflation and a supermajority (two-thirds) vote to exceed it. A version of this approach was started in Colorado in 1992 with their taxpayer's bill of rights (TABOR), which was championed by key folks like Dr. Barry Poulson and others. (picture below is from a road sign in Texas) Why Population Growth Plus Inflation? While there are many measures to use for a spending growth limit, the rate of population growth plus inflation provides the best reasonable measure of the average taxpayer's ability to pay for government spending without excessively crowding out their productive activities. It is important to look at this from the taxpayer’s perspective rather than the appropriator’s view given taxpayers fund every dollar that appropriators redistribute from the private sector. Population growth plus inflation is also a stable metric reducing uncertainty for taxpayers (and appropriators) and essentially freezes inflation-adjusted per capita government spending over time. The research in this space is clear that the best fiscal rule is a spending limit using the rate of population growth plus inflation, not gross state product, personal income, or other growth rates. In fact, population growth plus inflation typically grows slower than these other rates so that more money stays in the productive private sector where it belongs. To get technical for a moment, personal income growth and gross state product growth are essentially population growth plus inflation plus productivity growth. There's no reasonable consideration that government is more productive over time, so that term would be zero leaving population growth plus inflation. And if you consider the productivity growth in the private sector, then more money should be in that sector at the margin for the greatest rate of return, leaving just population growth plus inflation. Population growth plus inflation becomes the best measure to use no matter how you look at it. Given the high inflation rate more recently, it is wise to use the average growth rate of population growth plus inflation over a number of years to smooth out the increased volatility (ATR's Sustainable Budget Project uses the average rate over the three years prior to a session year). And this rate of population growth plus inflation should be a ceiling and not a target as governments should be appropriating less than this limit. Ideally, governments should freeze or cut government spending at all levels of government to provide more room for tax relief, less regulation, and more money in taxpayers' pockets. Overview of Conservative Texas Budget Approach Figure 1 shows how the growth in Texas’ biennial budget was cut by one-fourth after the creation of the Conservative Texas Budget in 2014 that first influenced the 2015 Legislature when crafting the 2016-17 budget along with changes in the state’s governor (Gov. Greg Abbott), lieutenant governor (Lt. Gov. Dan Patrick), and some legislators. The 8.9% average growth rate of appropriations since then was below the 9.5% biennial average rate of population growth plus inflation since then, which this was drive substantially higher after the latest 2024-25 budget that is well above this key metric (before this biennial budget the growth rate was 5.2% compared with 9.4% in the rate of population growth plus inflation). This approach was mostly put into state law in Texas in 2021 with Senate Bill 1336, as the state already has a spending limit in the constitution. The bill improved the limit to cover all general revenue ("consolidated general revenue") or 55% of the total budget rather than just 45% previously, base the growth limit on the rate of population growth times inflation instead of personal income growth, and raise the vote from a simple majority to three-fifths of both chambers to exceed it instead of a simple majority. There are improvements that should be made to this recent statutory spending limit change in Texas, such as adding it to the constitution and improving the growth rate to population growth plus inflation instead of population growth times inflation calculated by (1+pop)*(1+inf). But this limit is now one of the strongest in the nation as historically the gold standard for a spending limit of the Colorado's Taxpayer Bill of Rights (TABOR) has been watered down over the years by their courts and legislators, as it currently covers just 43% of the budget instead of the original 67%. My Work On The Federal Budget In The White House From June 2019 to May 2020, I took a hiatus from state policy work to serve Americans as the associate director for economic policy ("chief economist") at the White House's Office of Management and Budget. There I learned much about the federal budget, the appropriations process, and the economic assumptions which are used to provide the upcoming 10-year budget projections. In the President's FY 2021 budget, we found $4.6 trillion in fiscal savings and I was able to include the need for a fiscal rule which rarely happens (pic of President Trump's last budget). Sustainable Budget Work With Other States and ATR When I returned to the Texas Public Policy Foundation in May 2020, as I wanted to get back to a place with some sense of freedom during the COVID-19 pandemic and to be closer to family, I started an effort to work on this sound budgeting approach with other state think tanks. This contributed to me working with many fantastic people who are trying to restrain government spending in their states and the federal levels. Here are the latest data on the federal and state budgets as part of ATR's Sustainable Budget Project. From 2014 to 2023, the following happened: Federal spending increased by 81.7%, nearly four times faster than the 23.1% increase in the rate of population growth plus inflation.

Result: American taxpayers could have been spared more than $2.5 trillion in taxes and debt just in 2023 if federal and state governments had grown no faster than the rate of population growth plus inflation during the previous decade. And this would be even more if we considered the cumulative savings over the period. My hope is that if we can get enough state think tanks to promote this budgeting approach, get this approach put into constitutions and statutes, and use it to limit local government spending as well, there will be plenty of momentum to provide sustainable, substantial tax relief and eventually impose a fiscal rule of a spending limit on the federal budget. This is an uphill battle but I believe it is necessary to preserve liberty and provide more opportunities to let people prosper. Sustainable State Budget Revolution Across The Country Below are the states and think tanks which I'm working with and this revolution is going, which you can find an overview of this budgeting approach in Louisiana and should be applied elsewhere. I update these periodically, successful versus not successful budgeting attempts being 20-7 so far.

If you're interested in doing this in your state, please reach out to me. For more details, check out these write-ups on this issue by Grover Norquist and I at WSJ, Dan Mitchell at International Liberty, and The Economist.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed