|

0 Comments

Did you know...

📈 Inflation remains high at 3.3% y/y, and the Fed's slow response is not helping. 📊 The latest jobs report shows a shift to part-time work and declining labor force participation, with real wages declining. 🏡 The Texas GOP's priorities miss key issues like spending restraint and property tax elimination, which are crucial for economic growth. Listen, like, share, and subscribe. Check out my newsletter for show notes and more at www.vanceginn.substack.com. Join my conversation with Ryan Bourne, chair of economics understanding at Cato Institute and editor of the book The War on Prices, on the latest Let People Prosper Show podcast. Like, subscribe, and share the Let People Prosper Show, and visit vanceginn.substack.com and vanceginn.com for more insightful content.

Originally published at Marketplace.

Inflation numbers came in better than expected this week, and they’re the latest in several months of data showing that price growth has slowed down. Another way to look at inflation came out from the Congressional Budget Office this week, looking at the issue from the lens of purchasing power. The CBO found that if you look at the same basket of goods from pre-pandemic to 2023, on average, Americans need less of their income to buy the same set of stuff. But if that just feels a bit off to you, I get it. According to the Congressional Budget Office, purchasing power went up across all income groups because incomes grew faster than prices between 2019 and 2023. “That kind of goes against the common perception of what’s going on is that people are losing purchasing power over the last few years,” said Vance Ginn who is president of Ginn Economic Consulting and was a White House chief economist during the Trump administration. The CBO found, percentage-wise, folks in the highest income bracket spent less of their income on common expenses — down 6.3%, thank you stock market. Folks in the lower income brackets weren’t so lucky. They saw only a two percent drop in how much they spent on basics, thanks to higher wages. But for people in the middle, it was even less noticeable. “And that’s why I think they’ve been, kind of, not being able to be as prosperous as some of the others during this period,” said Ginn. Plus these numbers reflect averages, not people’s individual experiences. And that’s where narratives really come into play, especially in an election year. “We did go through a period of about 18 months of very elevated inflation. But it’s also true that prices today are rising roughly in line with previous historical experience,” said Michael Linden, a Senior Policy Fellow at the Washington Center for Equitable Growth. And in campaign ads and in stump speeches we’ll probably end up hearing versions of both inflation stories, amplified in whichever direction benefits the candidate talking. “And I think that the American people are going to have to decide when they hear about inflation, which of those two things is more important to them,” said Linden. And whose narrative about the economy you choose to believe. Don’t miss the latest economic news in 9 minutes:

💸New CPI inflation report shows a 3.4% increase over the last year, while real average weekly earnings have dropped 4.4% since Biden took office. The Fed must act faster to cut its balance sheet, as I discussed on Fox Business with Cavuto. #Bidenomics #Inflation 📈Biden's tariff practices are a tax hike on those earning less than $400K, despite promises. Join me on the Sean Hannity Show, Lars Larson Show, and NTD News where I discussed the high costs and the failure of Bidenomics. #Tariffs 📚Government schools in Texas are fully funded, NOT UNDERFUNDED like some are saying! Despite declining enrollment and failing test scores, progressives still push for more funding. It's time for universal ESAs to empower parents and lower property taxes. #SchoolChoice 💬 Like, subscribe, and share my take on key economic issues every week. For more info, subscribe to my newsletter at vanceginn.substack.com and check out vanceginn.com. In “This Week’s Economy” episode 55, I discuss the following and more in 11 minutes:

Originally published at AIER.

ohn Cochrane’s The Fiscal Theory of the Price Level examines the relationship between fiscal policy and inflation, which many consider to be the increase in the price level of a basket of goods and services. An influential and accomplished economist at the Hoover Institution, Cochrane is one of the most forward-thinking economists today. His approach challenges conventional wisdom and presents a compelling case for reevaluating our understanding of the economy. I learned much from reading the book and while interviewing him about it on my Let People Prosper Show podcast. I highly recommend reading this extensive book, though I have reservations about fiscal policy trumping monetary policy when considering the influence on inflation. Cochrane begins by laying out the foundational principles of his theory. He emphasizes the roles of government debt, taxes, and inflation expectations on prices. He argues that traditional economic models, which focus primarily on the role of central banks in controlling inflation through monetary policy, such as those by Milton Friedman, overlook the substantial effect of fiscal variables on prices. By uniquely integrating fiscal considerations and the public’s expectations about those factors into economic analysis, Cochrane aims to provide a more robust framework for understanding and predicting inflationary trends. He delves into various theoretical and empirical aspects of fiscal theory, drawing on a wide range of literature and evidence to support his arguments. He explores the implications of government budget constraints, the role of Ricardian equivalence that assumes a balanced budget over time, and the potential limitations of conventional monetary tools in controlling inflationary pressures. His thorough examination of these issues provides readers with a comprehensive understanding of the complexities of studying the relationship between fiscal policy and inflation. Cochrane’s arguments are persuasive and well-supported, but some aspects of his analysis warrant scrutiny. One area of contention is Cochrane’s emphasis on the primacy of fiscal policy in driving inflationary dynamics, particularly his assertion that the Federal Reserve plays a secondary role compared to Congress in shaping inflation outcomes. While Cochrane makes a compelling case for the importance of fiscal variables, the penultimate creator of inflation is the Fed when it creates more money than the goods and services produced. Milton Friedman, who extensively studied the role of the Fed in economic activity and inflation, said: “Inflation is always and everywhere a monetary phenomenon. It is a result of a greater increase in the quantity of money than in the output of goods and services which is available for spending.” The Fed controls what’s called “high-powered money” of various assets on its balance sheet. These assets include mostly Treasury securities from the tens of trillions of dollars in debt issued by the federal government. It also includes mortgage-backed securities, lending to financial institutions, federal agency debt, and other lending facilities. I agree with Cochrane that federal deficits give ammunition to the Fed when it purchases Treasury debt, grows high-powered money, contributes to more money chasing too few goods and services, and results in inflation. But other assets on the Fed’s balance sheet also matter, especially since the Great Financial Crisis in 2008 when the Fed started quantitative easing. Cochrane’s framework overlooks the significant role of monetary policy in influencing inflation expectations and shaping the broader economic environment. While fiscal policy can play a role in determining long-term inflation trends, as the debt distorts interest rates in the market, the Fed’s control of the money supply to target the federal funds rate and influence other rates along the yield curve remains a potent tool for managing expectations. While we should challenge Congress to adopt a fiscal rule for sustainable budgets to relieve excessive spending that drives up the national debt, this does not undermine the source of inflation: the Fed. But if Congress could balance its budget, which hasn’t happened since 2001, it would remove a bullet the Fed could shoot at the economy. In other words, a sustainable fiscal policy, wherein Congress passes balanced budgets by limiting government spending — the ultimate burden of government and the source of budget deficits — would help control inflation. While this could mitigate the assets available for the Fed to add to high-powered money, it would not solve the inflation problem because of many other available assets. Another issue that arises from considering fiscal policy the prime mover of inflation is how it works in practice. Fiscal policy is not directly expansionary or contractionary, as it is just taking funds from some people to give to others, with many of the takers being politicians and bureaucrats in government. These actions move money around in the economy without increasing productive activity that creates goods and services. There are roles for the federal, state, and local governments, but those should be limited to those outlined in constitutions. If Congress would abide by the Constitution, whereby it funded only limited government instead of the bloated federal government today, then fiscal policy would not be so burdensome. Fiscal policy would also not fall into the Keynesian trap of trying to “stabilize economic activity,” as the only thing that governments typically stimulate is more government because of the created failures due to the limited knowledge and rent seeking by politicians and bureaucrats. The underlying problem is usually government failures that cannot be resolved by more government. When Congress returns to its limited, constitutional roles, the federal budget will be drastically cut, resulting in lower taxes and opportunities to pay down and retire the national debt. This would also help reduce the massive distortions throughout the economy from government spending, taxes, and regulations. It would also decrease the Fed’s influence on the economy, but not entirely because of the other assets available for its disposal. The Fed also distorts economic activity through its ability to influence each stage of the production process with the assets on its balance sheet and its effect on interest rates. When the Fed purchases Treasury debt and increases high-powered money, the new money does not go to everyone simultaneously. Instead, the money trickles down from the financial sector to other sectors based on credit availability and other factors, in what is called the Cantillon effect. The manipulation of different markets throughout the production process of goods by the new money and the influence the purchase of assets by the Fed has on interest rates create boom and bust cycles. There is ample evidence about these economic steps, especially from the Austrian business cycle theory. Fiscal policy influences many steps in the production process through subsidies, tax breaks, and regulations, which hinder the voluntary production of individual goods and services through a well-functioning price system. But Congress cannot increase the money supply, which only the Fed can do, nor influence the general price level nor the resulting inflation. All things considered, Cochrane’s comprehensive exploration of fiscal theory and extensive analysis of its implications for the price level riveted me. His methodical dissection of economic concepts and pragmatic approach to examining fiscal policy offered a fresh perspective on economic dynamics. In conclusion, the Fiscal Theory of the Price Level offers a valuable contribution to the ongoing debate surrounding the determinants of inflation and the role of fiscal policy in the economy. While I’m sympathetic to Cochrane’s arguments, it is essential to recognize the importance of a central bank’s monetary policy in causing inflation through its balance sheet. Additionally, we should acknowledge the distortions caused by government policy, whether fiscal or monetary, and recognize the secondary role of fiscal policy compared to monetary policy in addressing inflationary pressures. To ensure sound economic outcomes, it is imperative to establish strong fiscal and monetary rules that provide an institutional framework limiting the burdens of government actions on our lives and livelihoods. Despite my dissent on the emphasis placed on fiscal policy’s role in inflation, the book’s productive discourse on the delicate dynamics of key economic elements make this an important contribution to inflation studies. Originally published at American Institute for Economic Research.

The Economist recently compared Joe Biden’s and Donald Trump’s economic records, concluding Biden wins so far. While the article raises valid points, it excludes key details that make the findings questionable. Ten months from now, there’s a high likelihood Biden and Trump could go head-to-head again for the presidency, especially after the results from the Iowa caucus. But voters should be informed about the effects of their policies on key issues like immigration, inflation, and wages. Starting with a divisive bang, let’s look at each leader’s track record concerning immigration. The Economist correctly noted that apprehensions along the southern border were much lower under Trump. They increased by the most in 12 years during the economic expansion of 2019, decreased early in the COVID-19 pandemic when people could be turned away for public health concerns, and rose again during the lockdowns. While some may see apprehensions rising between Trump and Biden as a loss for Biden, I see it as a loss for both. This metric is somewhat unreliable, given one person can be caught and counted multiple times, and those caught are a subset of total migrants. The truth is immigration is good for the economy, but government failures create unnecessarily complex barriers against legal immigration, contributing to the humanitarian crisis along the Mexico border today. Neither President has pushed for what’s needed (market-based immigration reforms) both lose. Inflation is another hot topic, especially for Biden. The Economist hands the win to Trump, as inflation was far lower during his presidency. But can we give him the credit? Remember, Trump pressured the Federal Reserve to reduce its interest rate target and expand its balance sheet, which was inflationary. His deficit spending skyrocketed during the lockdowns and was mostly monetized by the Federal Reserve, contributing to what was always going to be persistent inflation. Biden made this deficit spending and resulting inflation much worse. Add in the Fed’s many questionable decisions, such as doubling its assets, cutting and maintaining a zero interest rate target for too long, and focusing too much on woke nonsense, and we can see how this was always going to be persistent inflation. But even the Fed’s latest projections indicate it won’t hit its average inflation target of two percent until at least 2026. Likely, it will cut the current federal funds rate target range of 5.25 percent to 5.5 percent three times this year, keep a bloated balance sheet to finance massive budget deficits, and run record losses. If so, this inflation projection is too rosy. Some of Trump’s policies helped stabilize prices, including his tax and regulation reductions. But he still allowed egregious spending. Biden has doubled down on red ink that has contributed to the recent 40-year-high inflation rate. While inflation has been moderating recently under Biden, Trump gets the win. Of course, neither Presidents nor Congress control inflation, as that job is the Fed’s, but its fiscal policies influence it. When it comes to inflation-adjusted wages, The Economist grants a tie. Let’s consider real average weekly earnings that include hourly earnings and hours worked per week, adjusted for the chained consumer price index, which adjusts for the substitution bias and has been used for indexing federal tax brackets since the Tax Cuts and Jobs Act of 2017. Trump’s era witnessed a robust upward trajectory of real earnings, with considerable gains by lower-income earners, thereby reducing income inequality. We must acknowledge a real wage spike in 2020 during Trump’s lockdowns, marked by the loss of 22 million jobs and various challenges. To maintain a fair analysis, I disregard this spike. A year later, real wages demonstrated a decline under Biden. Extending the timeframe to two years later, real wages remain relatively flat to slightly increased. To provide a contextual understanding, when we consider the trend under Trump, excluding the 2020 spike, real wages for all private workers or production and nonsupervisory workers fall below those observed during Biden. It’s worth noting, however, that these wages have been higher since 2019, albeit nearly stagnant for all private workers. Given real earnings, I agree with The Economist that Trump and Biden are tied. While much more can be said for each President’s policies, continuing to add context when making assessments is crucial. I give Trump a nuanced “win” overall because his policies supported more flourishing during his first three years until the terrible mistake of the COVID lockdowns, with its huge, long-term costs. I should note that I made a strong case inside the White House for no shutdowns and less government spending but, alas, my efforts, and those by others, lost to Fauci, Birx, and Trump. Given the improved purchasing power during his presidency, Trump receives better poll ratings than Biden after three years of their presidencies. But this win doesn’t mean that Trump’s record is best regarding these issues, protectionism, and more. Let’s hope free-market capitalism, the best path to let people prosper, is on display this November, no matter who is on the ballot. Economic Reality Check: What Do Falling Mortgage Rates & Jobs+Inflation Signal for the 2024 Economy?12/15/2023 Thank you for tuning into the 39th episode of “This Week’s Economy.”

Much information is packed into today’s newsletter, including my new podcast episode revealing the economic news you need to know in less than 14 minutes! Today, I cover: 1) National: -Why the new U.S. jobs report (my latest commentary) is not as strong as some say -Inflation rates have moderated but still remain well above the Fed’s 2% rate target -Federal Reserve paused again with its federal funds rate target in the range of 5.25-5.5%, supporting a boost in the stock market and likely lower mortgage rates 2) States: -Sustainable Colorado Budget was released that I authored with Ben Murrey at Independence Institute, which provides a path forward for the Centennial state to return to its TABOR roots and buy down the income tax -School choice challenges face Texas as many state leaders are against it, and they keep spending too much -California’s deficit reaches crazy highs, proving why spending is the ultimate government burden 3) Other: -Don't miss my latest LPP episode with Jennifer Huddleston discussing problems with regulating technology, including AI -One of my latest op-eds argues why China is not our biggest threat…what is? -Argentina's new president makes significant strides that could set an example for the U.S. Today, I cover the following:

Check out the short from the episode below if you want a quick recap before watching the full episode. While the latest “strong” US jobs report and “cooling” CPI inflation have been touted as promising, a closer look reveals more complexity, and many American families continue to bear the brunt of DC’s failures over the last three-plus years.

The payroll survey’s net gain of 336,000 non-farm jobs is a popular headline, as the figure nearly doubled expectations. But the household survey, a second crucial report by the US Bureau of Labor Statistics, shows that only 84,000 jobs were added in September. Meanwhile, the unemployment rate stayed at 3.8 percent, which would be much higher if more people were looking for work. Let’s consider the labor force participation rate of 62.8 percent to double-check the headlines. If this rate were 63.3 percent, as it was in February 2020, there would be 1.4 million more people in the labor force. If they are all unemployed, today’s unemployment rate would be nearly 5 percent, which is substantially higher than the touted 3.8 percent rate. There have also been substantial revisions to the non-farm jobs report in recent months because of volatile data used for seasonal adjustments since the shutdowns, which makes much of it “garbage in, garbage out.” There were, for example, an additional 119,000 jobs added over just July and August than what was initially reported, giving us reason for pause with all of these reports. In short, this volatility in the job market data makes it challenging to discern actual trends, especially when Americans continue to be concerned about the economy. On top of a fickle job market, the latest consumer price index (CPI) sits at 3.7 percent over the past year, while the core inflation, which excludes food and energy, is 4.1 percent. This core inflation rate is double the Federal Reserve’s average inflation rate target and doesn’t show any signs of reverting to 2 percent any time soon. This problem was created by the Fed’s bloated balance sheet, which results from its willingness to help finance the federal budget deficits caused by excessive government spending. Until Congress reins in government spending and money printing, inflation will strain household budgets. Also, real (inflation-adjusted) average weekly earnings dropped by 0.2 percent over the past year, and the average family’s real income has suffered a significant blow, with a decline of more than $7,000 since the start of 2021. These financial setbacks are not coincidental. They are the direct result of the progressive policies of the Biden Administration, the Federal Reserve’s bloated balance sheet, and Congress’s habit of excessive spending. If we want to understand the true state of our economy, we should pay more attention to the Fed’s balance sheet, which remains a crucial indicator of inflationary pressures. This is why I was never on team “transitory inflation.” Even a relatively superficial understanding of the work of Milton Friedman, Friedrich Hayek, and John Taylor has indicated from the start that we would face persistent inflation. Sure, supply-side factors contributed to higher prices in some markets, as did supply chain bottlenecks. But those are short-term fluctuations that don’t tell the entire story of reduced purchasing power for everyone over a longer period, which is a story of failed public policy on top of the failed shutdowns during the pandemic. The explanation is pretty straightforward. There was a sudden halt in the economy due to pandemic shutdowns that distorted many exchanges throughout the marketplace. The federal government then sent out redistributed money to individuals and employers so they wouldn’t have to fret too much during a stressful time. This propped up many Americans, creating any number of zombie firms, zombie workers, and a debt-fueled zombie economy. But this alone wouldn’t explain the inflation, as increased government spending doesn’t stimulate anything other than more government and some specific markets. Next, the Fed more than doubled its balance sheet, increasing its assets from $4 trillion to $9 trillion. This doesn’t lead to long-term economic growth, but it does contribute to many market distortions and inflation across the economy. Much of this money stays in the hands of the banks, mortgage companies, and others at the upper part of the income spectrum. Only then does some of it spread further, in a process known as the Cantillon effect. The problem is not only a propped-up economy with multiple asset bubbles, but reduced purchasing power that punishes lower-income families the most. Few, if any, of the positives from more money in circulation goes to these families. Instead, they have seen whatever savings they had dwindle. To achieve a more stable and prosperous economic future, we must strike a balance between sound fiscal and monetary policies and curb excessive government spending and money printing. This will only begin to happen when we have rules that control discretionary policies by the administration, Congress, and the Fed. While headline jobs and inflation data might suggest a strong economic recovery, digging just a little deeper into the data shows a weak economy with major challenges. It’s time for policymakers to take a hard look at the factors contributing to these economic woes and adopt prudent policies that address the root causes of stagflation. Originally published by AIER. Check out the highlights from my recent segment on Fox Business. Former Office of Management and Budget chief economist Vance Ginn and Slatestone Wealth chief market strategist Kenny Polcari analyze how the Middle East conflict and House speaker standstill impact markets.

Full segment on Fox Business here. Please subscribe to my newsletter if you haven’t already, and subscribe to my podcast wherever you get yours. You can find direct links to follow my work at the buttons at the end of this post. I would appreciate it if you would also rate and review my podcast! Today, I cover:

Inflation might be cooling some, but recent reports suggest many Americans aren’t economically optimistic. Despite President Biden continuing to celebrate the success of his “Bidenomics” approach, the reality is that purchasing power is still down, and job market weaknesses remain. So, why is the current administration so proud? It seems deficit spending is the reason.

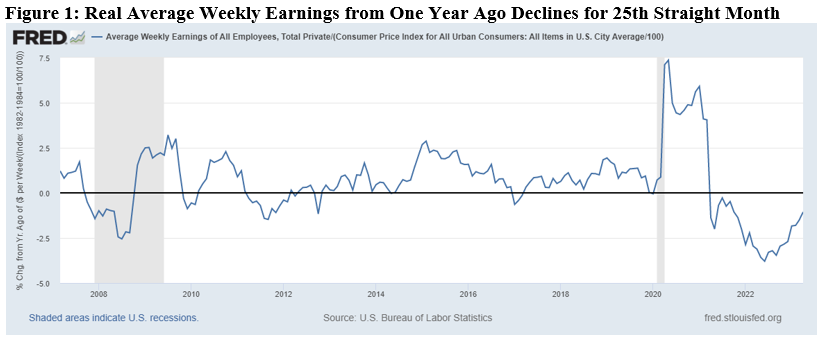

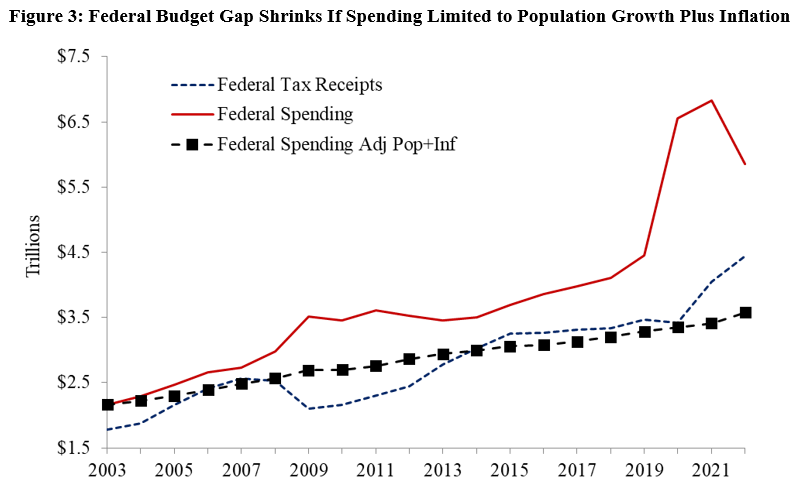

A poll from Monmouth University found that only one in four Americans believe the country is headed in the right direction, and a significant 62% disapprove of how Biden is handling inflation. And it’s no wonder, considering that real wages have failed to keep up with inflation for a staggering 26 consecutive months. Understandably, people are becoming weary. The latest CPI report shows a moderate decline in headline inflation to 3% in June 2023 from the previous month’s 4%. However, core inflation, which excludes food and energy prices, remains stubbornly high at 4.8% year over year. This improvement shows some relief, but to get the economy back on track, we must address the underlying inflationary pressures caused by deficit-spending of more than $6 trillion funded by a bloated Federal Reserve balance sheet, which is declining too slowly. Turning to the latest jobs report for June, the figures are disappointing, falling well below expectations. Only 99,000 net jobs were added after accounting for downward revisions in the two prior months. Moreover, many of these jobs were government jobs, straining the productive private sector that pays for those jobs. According to the household survey, employment has remained nearly stagnant since March, indicating a lack of substantial job creation. To make matters worse, the labor force participation rate has yet to return to its pre-pandemic rate, indicating millions of Americans are uncertain about their job prospects. Even for employed people, their purchasing power is down, and renters and individuals from low socio-economic backgrounds are struggling. If this is the outcome of “Bidenomics,” it’s clear that a different approach is necessary to restore the American economy. The government must rein in spending, and the Federal Reserve should be more aggressive in cutting its balance sheet. Despite the lackluster evidence that his initiatives are helping, President Biden continues to approve increased deficit spending through initiatives like the Inflation Reduction Act, which is estimated to cost over $1 trillion. The national debt has surpassed $32 trillion, translating to roughly $95,000 owed per American or almost $250,000 per taxpayer, far exceeding the country’s economic output. This continuous increase in spending, coupled with kicking the problem down the road for future generations to tackle, as seen in the latest debt ceiling deal, won’t effectively lower inflation or provide the economic relief Americans desperately need. A different direction is essential, involving responsible budgeting to curb excessive spending and align expenditures with means. Congress should consider passing a strict spending limit with a growth rate that better matches the average taxpayer’s ability to fund government spending, calculated based on the maximum rate of population growth plus inflation. If Congress had adhered to this maximum spending growth rate from 2003 to 2022, there could have been a cumulative $500 billion debt increase instead of the actual $19 trillion increase, resulting in $18 trillion in static savings for taxpayers. In essence, restraining spending now is pro-growth and will foster greater economic prosperity. The latest inflation and jobs reports suggest that the touted “Bidenomics” approach leaves much to be desired. To secure a brighter economic future, current economic strategies need serious reevaluation that focus on fiscal responsibility and sustainable growth. Originally published at The Daily Caller. The Federal Reserve decided at its recent meeting to pause hiking its target interest rate at 5.25% after raising it at 10 consecutive meetings from 0%. But don’t expect the relief to last long as the Fed will likely raise this rate in July and future meetings up to 6% by the end of the year.

The Fed’s current pause has been met with a flurry of hikes in interest rates in other countries, which could mean trouble for Americans. The European Central Bank increased its main rate to 4%; Bank of England hiked its rate to 5%, Turkey raised its rate to 15%, and Argentina hiked its rate to a staggering 97%. Now that higher returns are available in other countries with rising or higher interest rates than in the U.S., the value of the U.S. dollar will fall having a domino effect that would further burden struggling Americans. The Fed will soon have to raise its target interest rate again and likely further than what could have been the case had it not paused. This is because the resulting decline in the value of the dollar will lead to more expensive imports contributing to higher inflation, economic hindrances, and the need for further tightening by the Fed. And financial conditions remain loose as there’s much money sloshing around in the markets, which is why the Fed should be more aggressively cutting its balance sheet instead of focusing so much on its target interest rate. Investors will be drawn to the higher returns available in these high-interest rate countries, which will increase demand for their currencies relative to the U.S. dollar thereby appreciating the foreign currency and depreciating the dollar. This will raise the cost of imports from those countries, leading to more domestic inflation or fewer purchases to satisfy one’s desires. The last thing Americans need is for their purchasing power to be further reduced because we’ve paused our interest rate hikes while so much of the world is doing the opposite. Recent reports reveal that Americans are still struggling because of inflation, which remains hot at about 4% over the last year. Food prices increased in May at home and away from home, and shelter and new vehicle prices are up. While wages are rising slightly, they still aren’t keeping pace with inflation year-over-year for 26 straight months. Times are tough, which is why the Fed needs to cut the one policy tool it can control which is its balance sheet. And by a lot. While the money supply known as M2 and the Fed’s monetary base are declining year-over-year at some of the fastest paces on record because of recent Fed actions, these declines follow the most rapid increases on record, which left their levels extraordinarily high. These extreme increases resulted in persistent inflation and massive distortions across the marketplace. Just as the markets were hurt by the Fed increasing its monetary base, so can the markets improve with fewer distortions by the Fed decreasing its balance sheet. By relying less on government intervention and artificial liquidity, markets can get closer to being free markets. Specifically, the Fed should start cutting its balance sheet by at least 12% year-over-year instead of the current 6% annual rate and removing its injections in mortgage-backed securities and long-term Treasury securities. The result will be a harder economic landing but one that’s necessary given how the government failures over the last couple of years have propped up many areas of the economy with malinvestments that can’t last when cheap credit and loose financial conditions collapse. The resulting recession will be tough, though it was avoidable without these government interventions. But if the government lets markets work, the economy would stabilize more quickly. The long-term result would be that wages keep pace or grow faster than inflation again, cooking at home would be cheaper than eating out, and debts would decrease. Unfortunately, fiscal policy by Congress continues to run amok with massive deficits that must be partially financed by the Fed or risk soaring interest rates, massive net interest payments on the debt, unsustainable budgets, and further soaring inflation and interest rates. This isn’t a pretty scenario but it’s one that officials in D.C. put us in and we must face the difficult choices to get out of it. When the balance sheet is cut and interest rates go up in the U.S., money will flow back into the U.S. helping to appreciate the dollar and reduce the cost of imports. There’s nothing particularly important about trade deficits or surpluses as those are equal to capital account surpluses or deficits, respectively, but the hit to the purchasing power of the dollar for Americans is highly important. Now more than ever, the Fed needs to take drastic measures to improve our economy before it’s choked out by international currencies strengthening. Will it act before it’s too late? Originally published at Daily Caller. Recent reports show that annual inflation rose 4% in May, down from 4.9% in April. In response to this and recent bank failures, the Federal Reserve announced that it’s pausing raising its target interest rate in June after approving 10 consecutive rate hikes, raising its target from nearly zero to a high of 5.25%.

But prices remain elevated and inflation is double the average 2% rate that the Fed prefers, which is making it challenging for Americans to get by. Food prices increased in May at home and away from home faster than 5% year-over-year, and shelter and new vehicle prices are up well above 4%. While wages are rising slightly, they still aren’t keeping pace with inflation year-over-year for 26 straight months. Simply put, times are tough. This is why the Fed needs to use the one policy tool in its box that it directly controls and has the most significant influence on inflation: cutting its balance sheet. Measures of the money supply are declining. The broader money supply known as M2 is down about 5% over the last year, which is the fastest pace since the Great Depression. And the Fed’s monetary base has declined by about 6% over the last year, which is the fastest pace since 2019. But these are after some of the most rapid increases in these measures on record, which leaves their amounts extraordinarily high and manipulative in the marketplace. These extreme increases in measures of the money supply resulted in artificial market distortion as more money was created out of thin air while available goods and services remained stifled by shutdowns, government spending, taxes, and regulations. As this made it more difficult to discern the true value of goods and services, price signals were thwarted. None of these ramifications will be abetted by declining interest rates or pausing rate hikes. Just as the markets were hurt by the Fed increasing its monetary base, so can the markets improve with fewer distortions by the Fed decreasing its balance sheet. By relying less on government intervention and artificial liquidity, markets can get closer to being free markets and clear based on market fundamentals rather than government failures. The Fed should at least double its rate of current cuts to achieve market sanity, meaning at least 12% year-over-year, until it gets to less than 10% of gross domestic product rather than the nearly 50% today. This would be aggressive and result in a harder economic landing but is necessary given the severe market distortions after many markets have been propped up on false strength for years. In the event of a hard landing, spending, employment, and investment would likely be affected as economic activity would be forced to slow down. But if the government lets markets work, the economy would stabilize more quickly. The long-term result would be that wages keep pace or grow faster than inflation again, cooking at home would be cheaper than eating out, and debts would decrease. Unfortunately, since overspending is a bi-partisan problem, political pushback would likely ensue if the Fed goes this route as it will mean a higher cost of funding the massive national debt. Although cutting the balance sheet is the solution, a cultural shift among politicians that favors less spending must preclude it because the Fed is implicitly and explicitly helping the federal government from blowing up the budget more with even higher net interest payments. Ultimately, the path toward a stronger and more prosperous economy lies in the Fed's willingness to take bold actions and the political will to embrace responsible spending and balance sheet practices. A brighter economic future can be achieved by prioritizing market stability over short-term political considerations. Originally published at The Center Square. This Week's Economy Ep. 14 | Inflation is Americans’ Top Concern, State Jobs Report, & Minimum Wage6/23/2023 Thank you for reading the Let People Prosper newsletter, which today includes the 12th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover: 1) National: New Pew Research poll reveals that inflation is the top concern for Americans on both sides of the political aisle, Fed needs to do more, and financial markets remain loose; 2) States: New state-level jobs report and which states are leading and breakdown of the largest spending increase in Texas history and why it's not good for keeping the Texas Model strong; and 3) Other: The importance of educating young audiences on capitalism and socialism and my experience teaching with a "minimum wage" game to a group of high school students. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. According to a recent CNBC survey, pessimism regarding the American economy is at an all-time high, with 69% of the public having a negative view. The leading reason is inflation in a weak economy. The latest report this week shows that inflation remains persistently high at near 5%, eroding slower-growing average weekly earnings year-over-year for 25 straight months.

The Federal Reserve recently raised its federal funds rate target for the 10th meeting in a row to 5.25%–the highest since August 2007. While these rate hikes were anticipated in light of ongoing inflation, they could have been avoided. But excessive government spending and money printing during the “boom” led to this government-failure bust, the effects of which we’ll feel for months and even years to come. The sluggish economic growth has been rough on Americans, but inflation has been a killer. The survey also noted, “Just 5% say their household income is growing faster than inflation, 26% say it’s keeping pace, and 67% report they are falling behind.” This is devastating lower-income households’ standard of living. The trend of declining real wages is particularly harmful to low-income Americans. But even the wealthy feel the effects, as more than half of higher-income Americans surveyed report spending less on eating out and entertainment. This has contributed to the anemic annualized economic growth of just 1.1% in the first quarter of 2023 after rising by only 0.9% from the fourth quarter of 2021 to the fourth quarter of 2022. As prices increase, businesses spend more on production, making it more difficult to raise workers’ wages while remaining profitable. Employees who can’t be paid enough to fund costly goods like childcare and groceries, which have risen by 7.1% over the last year, spend less on other things or fall behind on their bills. Businesses earning less revenue will invest less, and so goes the vicious downward cycle. Another hit on Americans has been the cost of shelter, which was up 8.1% over the last year even as there are signs that housing prices are cooling across the country. Still, housing prices have been “eclipsing the inflation rate by 150% since 1970.” This means many Americans can’t afford to own a home, and that’s getting further out of reach as mortgage rates have soared. What’s to be done about inflation threatening Americans’ livelihoods? Legendary economist Milton Friedman had some advice about addressing sky-rocketing inflation that is valuable today. There is one and only one basic cause of inflation: too high a rate of growth in the quantity of money—too much money chasing the available supply of goods and services,” he argues. “These days, that cause is produced in Washington, proximately, by the Federal Reserve System, which determines what happens to the quantity of money; ultimately, by the political and other pressures impinging on the System, of which the most important are the pressures to create money in order to pay for exploding Federal spending and in order to promote the goal of ‘full employment.’ Despite raising its target interest rate to fight inflation, the Fed has a bloated balance sheet of nearly $9 trillion, which is too high for disinflation to its target of an average 2% rate. When the Fed engages in excessive money printing compared with the supply of goods and services, inflation is the result, as Friedman described. While it was appropriate for the Fed to raise its target rate, the ongoing increase to its balance sheet is just continuing to distort productive economic activity. And Congress must restrain spending. The national debt is nearly $31.5 trillion, with net interest payments on the debt set to exceed $1 trillion soon. The government must borrow to finance the deficit when it spends more than it makes, driving up interest rates. Higher interest rates increase the cost of borrowing for businesses, leading to lower investment, which reduces the supply of goods and services. Add in the Fed buying the debt that increases the money supply with less supply of goods and services, resulting in more inflation. House Republicans passed a debt ceiling bill that would return spending to 2022 levels and limit spending to just 1% growth over the next decade while eliminating other bad policies. Negotiations between the two parties continue, while a June 1 deadline looms. If they don’t reach agreement, it will make the debt issue an ongoing concern as defaulting on the debt nears, further raising interest rates that weaken the economy. This means we can expect a deeper, longer recession. The Fed and Congress have a duty to stop flawed policies of excessive printing and spending, respectively. High inflation harms Americans, and the Fed and Congress must address this. If they don’t take action soon to address these government failures, the erosion of the American dream will continue. The future of America depends on sound, pro-growth, pro-liberty policies instead that will let people prosper. Originally published at Econlib. TRUTH On Inflation, Housing Market, Interest Rates, & Incentives w. Dr. Chuck Beauchamp | Ep. 445/16/2023 In today's new episode of the "Let People Prosper" podcast, I'm thankful to be joined by Dr. Chuck Beauchamp for a thought-provoking discussion on new inflation numbers and the current economy. We discuss: 1) The newest inflation numbers and how the rate is impacting various markets including food, housing, and energy; 2) Interest rates' impact on the housing market and the crisis of affordability; and 3) Why the U.S. dollar's status could continue to wane and more. You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating). Chuck’s bio:

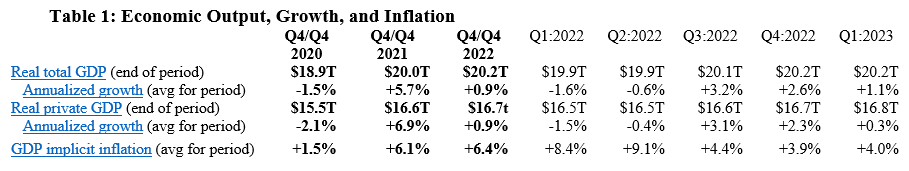

Find show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more here at my website (https://www.vanceginn.com/) or Substack newsletter (https://vanceginn.substack.com). Please subscribe to the newsletter, share it with your friends and family, and leave me a comment. The U.S. dollar will likely soon lose its status as the global reserve currency. The dollar’s global reserve dominance has declined in recent years. As a result, international trade partners are hedging new connections. This will restructure the global economic order and create challenges ahead, especially for middle-class Americans.

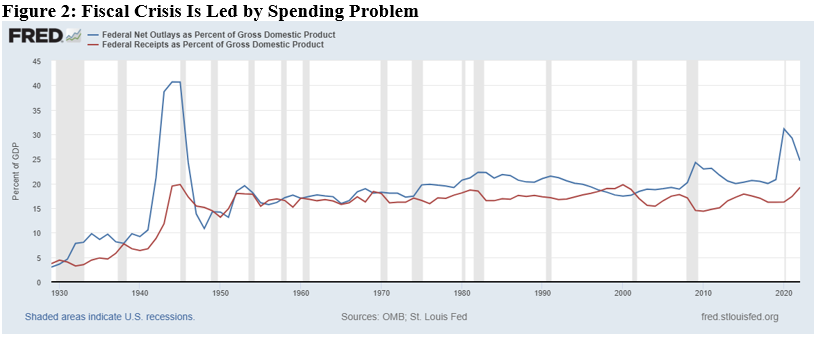

Americans should know what’s happening and how they can prepare for this possibility. But first, what does it mean to be the world’s global reserve currency, and why does it matter? The U.S. Dollar is the dominant global reserve currency. It’s widely accepted and is the preferred medium of exchange for international transactions. The dollar has enjoyed this status for the past 80 years due to its strong reputation acquired across a long history of America’s rising military prowess, fulfilling its financial obligations, and maintaining a strong economy. These institutional foundations of the dollar created high demand among foreign entities. One of the most important transactions utilizing the dollar is the purchase of oil. Oil is currently priced in dollars globally and other dollar-denominated assets. Losing or weakening the dollar’s position and value results in higher oil prices. The dollar’s elevated demand has helped keep its value high relative to other currencies. This prompted many countries to tie their currency directly to our dollar. The U.S. benefited by leveraging foreign demand for dollars into loans to the U.S. federal government. Foreign investors lend the U.S. high volumes of money because of the debt’s dollar denomination. The higher demand for U.S. Treasury securities pushes down domestic interest rates. This influences lower rates on mortgages and business loans, which help provide increased investment and economic growth. Losing or weakening the dollar’s reserve position will result in increased interest rates, decreased investment, and weak to negative economic growth. The dollar’s reserve status has also meant an increased volume of international trade. Ultimately, international trade helps keep interest rates and inflation moderately low. Losing or weakening the dollar’s reserve position will result in increased inflation. Trouble for the dollar is on the horizon. The once-givens about the dollar have come into question recently due prominently to excessive deficit spending. Foreign investors are reducing their demand for dollars as they diversify their portfolios. This combination contributed to the ballooning of the debt, depreciated the dollar, led to higher inflation and falling year-over-year real average weekly earnings for 25 straight months, and drove up interest rates, thereby slowing economic activity. Of course, this will have tradeoffs and many of them won’t be good. As mentioned, the major tradeoffs will be higher inflation and interest rates. The latter will trigger a move by the Federal Reserve to attempt to lower interest rates. But if its target rate is held below what markets dictate, the Fed will monetize the debt, increase the money supply, and drive inflation higher. The long-term result will be even higher interest rates to tame inflation. Unfortunately, the consequences of higher interest rates and inflation would be severe. People should expect higher mortgage rates than the already rising average rate of 6.4%. This is the highest in 15 years. Ultimately, higher interest rates would result in a steeper contraction in the housing market, exacerbate economic weakness, increase job losses, and worsen poverty. But maybe more importantly, it would likely crush middle-class Americans and the lifestyle that they’ve been accustomed to having for decades. The higher cost of shelter, food, gasoline, and energy as the dollar loses its reserve currency status would wreck havoc on their budgets and force major decisions about what’s best for their families. This could mean having to put off saving for college, going on vacations, and living in much smaller homes. All because our government couldn’t spend our money wisely. Therefore, the government should take serious steps to restore confidence in the dollar before a bad situation for Americans becomes worse or irreconcilable. To start, the federal government should reduce deficit spending. The long-term goal should be a balanced budget and an eventual start to paying down the debt. This will be pro-growth as the government stops redistributing taxpayer money from productive to unproductive activities. It will also strengthen the fiscal and economic situation of the U.S. The result will be an improvement in foreigners’ outlook on the dollar that would help preserve the dollar’s status. Dollar-focused policies should be tied to reducing the money in circulation. This should occur as the Federal Reserve reduces its balance sheet. Doing so tames inflationary pressures and could even result in some disinflation. This would allow the hard-earned dollars of Americans to go further than they do today. These policy improvements should be put into law with fiscal and monetary policy rules. The rules should remove the discretion of big-government spenders and printers. This would enable people’s livelihoods to get back on track and improve for generations. The potential loss of the dollar’s reserve currency status could have significant economic consequences, and there are even more than highlighted here. There is, however, reason for optimism: The U.S. economy is resilient and adapts well to challenges. But will those in D.C. allow for that to happen in the dynamic marketplace? Time will tell. But let’s hope so before it’s too late for middle-class Americans and everyone else to have the opportunity to fulfill their hopes and dreams. Originally published at The Daily Caller with Chuck Beauchamp, Ph.D. Key Point: The best way to let people prosper is free-market capitalism. Unfortunately, government has created a situation where inflation-adjusted average weekly earnings are down year-over-year for 25 straight months and economic growth is anemic. Overview: Government failures drove the “shutdown recession” and stagflationary period over the last three years that has plagued Americans, with more banking problems to come. This is fueled by the debt ceiling fight and elevated inflation that has also rocked the U.S. dollar. The answer are pro-growth policies of less spending by Congress, less regulation by the Biden administration, and less money printing by the Fed. Labor Market: The Bureau of Labor Statistic recently released its U.S. jobs report for April 2023, which was another mixed report with some strengths but many weaknesses. The establishment survey is the most reported shows there were +253,000 (+2.6%) net nonfarm jobs added in April to 155.7 million employees, which has increased by +4.0 million over the last year but just +3.3 million since February 2020. However, there were cumulative revisions in the prior two months of 149,000, so on net for that reduced the net increase to just +104,000 jobs indicating a weakening labor market. Over the last month, there were +230,000 jobs (+2.7%) added in the private sector and +23,000 jobs (+2.1%) added in the government sector. Most of the private sector jobs were added in the sectors of private education and health services (+77,000), professional and business services (+43,000), and leisure and hospitality (+31,000), which these three also led over the last 12 months. But wholesale trade lost -2,200 jobs last month while no industry had job losses over the last year. The household survey increased by +139,000 jobs to 161.0 million employed in April. There have been declines in net employment in four of the last 13 months for a total increase of +3 million since April 2022 and +2.3 million since February 2020, which both are 1 million below the jobs reported in the establishment survey. This could be because of reporting issues or the number of jobs each person has in the market. The official U3 unemployment rate ticked down to 3.4% and the broader U6 underutilization rate fell to 6.6%, which both are near or at historic lows. Since February 2020, the prime-age (25-54 years old) employment-population ratio is up by 0.3pp to 80.8%, prime-age labor force participation rate was 0.3-percentage point higher at 83.3%, and the total labor-force participation rate was 0.7-percentage-point lower at 62.6% with millions of people out of the labor force holding the U3 rate artificially low. Given some improvements, challenges remain for Americans as inflation-adjusted average weekly earnings were down (-1.1%) over the last year for the 25th straight month. Economic Growth: The U.S. Bureau of Economic Analysis’ recently released the 1st estimate for economic output for Q1:2023. Table 1 provides data over time for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. Most of the estimates for Q4:2022 and growth in 2022 have been revised lower, providing more evidence that 2022 was a very weak economy if not a recession. Economic activity has had booms and busts since the government-imposed COVID-related restrictions in response to the pandemic and poor fiscal and monetary policies that severely hurt people’s ability to exchange and work. In 2022, the first two quarters had declines in real total (and private) GDP, providing a reason to date recessions every time since at least 1950. While the second half of 2022 looked better, those two quarters were influenced by net exports and inventories that would have made the economy much weaker. For 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.9%, which was the slowest Q4-over-Q4 growth during a recover on record. Then the anemic growth of just +1.1% in Q1:2023 provides more reason that this is an extended recession or at least stagflation. The Atlanta Fed’s early GDPNow projection on May 8, 2023 for real total GDP growth in Q2:2023 was +2.7% based on the latest data available, but this rate has been lowered in recent quarters. Considering the last expansion from June 2009 to February 2020, there was slower real private GDP growth in the latter part of that period due to higher deficit-spending, contributing to crowding-out of the productive private sector. Congress’ excessive spending since February 2020 led to a massive increase in the national debt by nearly +$7.6 trillion that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in Figure 2 with federal spending and tax receipts as a share of GDP no matter if there are higher or lower tax rates. But the Fed monetized much of the new debt to keep interest rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 5.2% to $8.5 trillion since the record high in April 2022 after rising nearly $400 billion in March 2023 then down $200 billion since then. The Fed will need to cut its balance sheet (total assets over time) more aggressively if it is to stop manipulating markets (see this for types of assets on its balance sheet) and persistently tame inflation, as we may need deflation which hasn’t happened since 2009 given the rampant inflation over the last two years. The current annual inflation rate of the consumer price index (CPI) has been cooling since a peak of +9.1% in June 2022 but remains elevated at +4.9% in April 2023, which remains the highest since 2008 as do other key measures of inflation. After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only +2.6% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, deficits and taxes are always and everywhere a spending problem. David Boaz at Cato Institute notes how this problem is from both Republicans and Democrats. In order to get control of this fiscal crisis which is contributing to a monetary crisis, the U.S. needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on the rate of population growth plus inflation. If Congress had followed this approach from 2003 to 2022, the figure below shows tax receipts, spending, and spending adjusted for only population growth plus chained-CPI inflation. Instead of an (updated) $19.0 trillion national debt increase, there could have been only a $500 billion debt increase for a $18.5 trillion swing in a positive direction that would have substantially reduced the cost of this debt to Americans. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And to top this off, the Federal Reserve should follow a monetary rule so that the costly discretion stops creating booms and busts. Bottom Line: Stagflation will continue with the a deeper recession this year given the “zombie economy” and the unraveling of the banking sector which will hit main street hard. Instead of passing massive spending bills, the path forward should include pro-growth policies that shrink government rather than big-government, progressive policies. It’s time for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty. There is some optimism with the House Republicans debt ceiling bill package, but it’s got an uphill battle to become law with Democrats in the Senate and White House so more must be done.

Recommendations:

David is joined by former Trump-era OMB economist, Dr. Vance Ginn, to discuss the history of economic thought; the strengths and weaknesses of the classical, Chicago, and Austrian schools of thought; whether or not we need a Fed; and what to do about excess debt and economic growth. Yes, it is a busy hour, but one you will not want to miss!

Despite the on-going, sky high, Biden-flation, American's are spending like crazy. And it's a little bit puzzling. But then again, it really isn't, because we want what we want when we want it, and we want it now!

"But that is gonna start to come to a halt very quickly, as inflation continues to take a bite out of their consumption habits" said Dr. Vance Ginn, president of Ginn economic consulting, "And part of the spending numbers that we see are really just from inflation. If you adjust a lot of these for inflation, we're actually seeing declining retail sales." The other reality is, too many Americans are charging up their credit cards, and living beyond their means. "A lot of people are also racking up a lot on their credit cards" Dr. Ginn told KTRH, "Credit card debt is up to a record high of over a trillion dollars across the economy, and we've seen that soar just over the last year." And looking ahead to this year, the clock will eventually strike midnight, and the U.S. will officially be in another recession. Originally posted at KTRH News. Both Republicans and Democrats at the national level have put us down a path of slow growth, massive deficits, and high inflation. With a new Republican majority in the U.S. House and the daunting debt ceiling fight over the bloated $31.4 trillion national debt almost exclusively due to excessive spending, there’s a proven pro-growth, pro-liberty path.

In 2022, the U.S. had real GDP growth of just 0.9 percent (Q4-over-Q4), the highest inflation in 40 years, the highest mortgage rates in 20 years, and the worst stock market in 14 years. Average real weekly earnings have now declined year-over-year for 22 straight months. Fortunately, history is a good guide for how to overcome this mess. The two of us have served as chief economists at the Office of Management and Budget (OMB), though 50 years apart. One of us (Arthur Laffer, originator of the “Laffer Curve”) was the first chief economist of the OMB in the Nixon White House. The other (Vance Ginn) was the last associate director for economic policy at the OMB in the Trump White House. While much has changed since the OMB was formed in 1970, the problems are basically the same today. There remains a lot of unjustifiable government spending, prosperity-killing taxes, unwarranted regulations, excessive liquidity, and harmful interference in international trade. But just because counterproductive economic policies have been around for a long time doesn’t mean we shouldn’t try for a better world. Each of the above areas is the subject of intense debate. In politics, these debates have their short-term winners and losers as judged by elections. But the principles of economics aren’t determined by votes. The remedy for economic malaise has been and is less government, not more. Free-market, pro-growth policies are the cure. The legacy of the 1970s is now called the era of stagflation, and the 2020s are shaping up to be known for the same, or worse. Even with 50 years of experience, many people still haven’t learned a lesson. During the Nixon and Ford administrations, the economy was stifled at every turn. The dollar was taken off gold and devalued, resulting in higher inflation. Then there was the imposition of wage and price controls, which did nothing to stop inflation but instead ravaged the economy. Government spending was out of control. Taxes were raised, and tariffs imposed, including a 10 percent import tax surcharge; such was the wisdom of the D.C. crowd. The consequences were rising inflation, stock market collapse, impeachment, and a weak economy. Then, President Jimmy Carter tried to do more of the same with the same consequences. There followed a true renaissance, led by President Ronald Reagan’s tax and regulatory cuts and Federal Reserve Chairman Paul Volcker’s sound monetary policy. Inflation crashed, the stock market soared, new jobs surged, and Reagan won re-election in a landslide, winning 49 states. And then there was the sad interlude of George H.W. Bush, who broke his promise by raising taxes, leading to a one-term presidency. President Bill Clinton, partnering as he did with House Speaker Newt Gingrich, cut government spending by 3 percentage points of GDP, cut capital gains tax rates while exempting owner-occupied homes from this tax altogether, and finally, he and the Republicans pushed the North American Free Trade Agreement (NAFTA) through Congress. On the bad side, he raised the top two tax rates. But the spending restraint contributed to a budget surplus for four straight years. President George W. Bush, with a penchant for spending more and for temporary tax cuts, was followed by President Barack Obama, with a desire on steroids to spend even more, plus he nationalized health care. Stagnation took hold, and prosperity faded. In his first two years, President Trump reversed some of the prior 16 years of bad policy with substantial tax cuts, historic deregulation, and other measures that helped get government out of the way, contributing to the lowest poverty rate and the highest real median household income on record. But with the onset of the pandemic, prosperity was cut short by the ill-advised massive spending increases and lockdowns. Today, we’re once again mired in a sea of bad policies and bad consequences despite President Joe Biden’s self-serving narrative. With tax hikes, massive spending, oppressive energy regulations, soaring debt levels, trade protectionism, and a bloated Fed balance sheet, stagflation was given a brand-new lease on life. We should follow the proven, pro-growth path (not currently taken) of sound money, minimal regulations, free trade, flat taxes, and most of all, spending restraint for the sake of the economy and human flourishing. It’s also great politics. With this elixir in hand, it would be springtime again in America. And that is something Americans can believe in. Vance Ginn, Ph.D., is an economist and senior fellow at Young Americans for Liberty and previously served as the associate director for economic policy of the White House’s Office of Management and Budget from 2019 to 2020. Arthur Laffer, Ph.D., is an economist from Nashville, Tennessee, and was the first chief economist of the White House’s Office of Management and Budget. Originally published at The Federalist. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed