|

Texans appreciate living in a state that values liberty, sensible business policy, and, perhaps most importantly, a strong dislike for taxes, which inevitably infringe on the first two values.

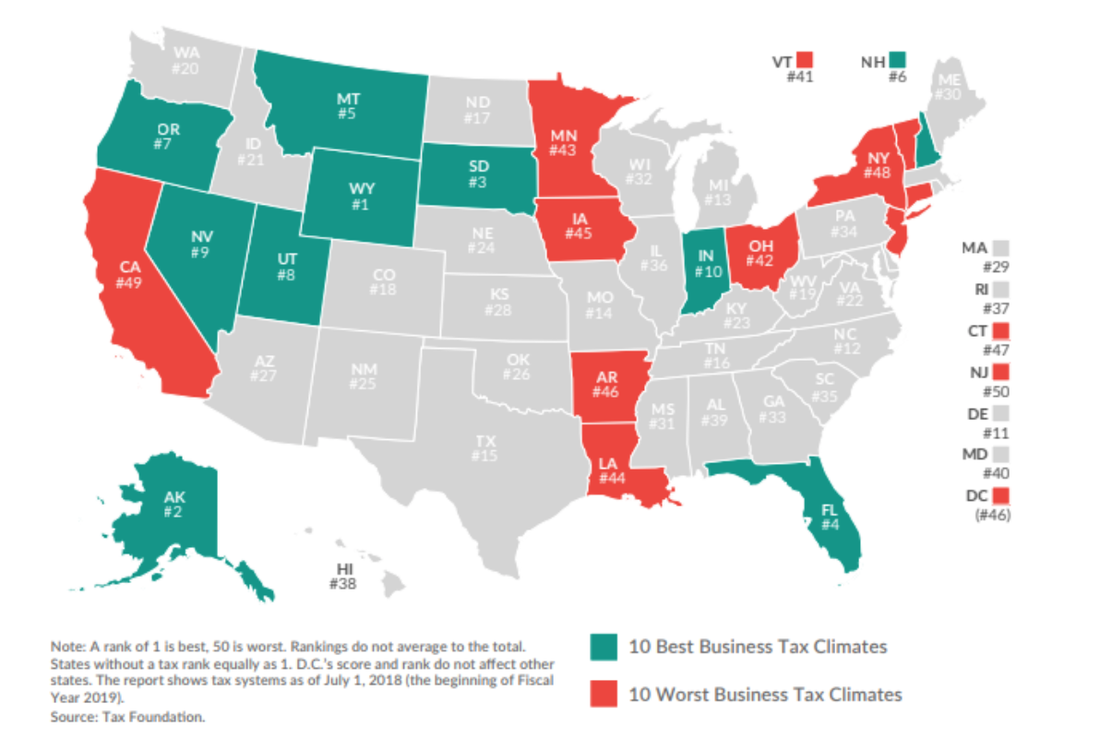

But, in comparison with other states, Texas is beginning to lose its competitive edge in business climate as noted in the Tax Foundation’s recently released 2019 State Business Tax Climate Index. The report ranks all fifty states based on the burdens of each state’s corporate income tax, individual income tax, sales tax, unemployment insurance, and property tax. Figure 1 presents the ranking of each state whereby the top-ranked states include either states without at least one major tax, such as the individual income tax, or states that have all major taxes with low rates and broad bases. Meanwhile, poorly ranked states share similar shortcomings such as complex non-neutral taxes and comparatively high tax rates, such as in the three worst ranked states: California (48th), New York (49th), and New Jersey (50th). In this year’s report, Texas’ overall rank took a hit, sliding from 13th best nationwide in 2018 to 15th best for 2019. Yet, the drop is not due to new policy as the state’s individual category scores remained unchanged and actually improved by 8 ranks for Unemployment Insurance. Rather, the new lower overall rank highlights Texas’ stagnation in decreasing its tax burden as other states jump on the opportunity to increase their prosperity from lower burdens. While Texas excels in the category of individual income tax because as it doesn’t have one, the state is consistently held back by its corporate income tax portion of the index, which remains unchanged at 49th, or second worst! This is because Texas’ business tax is a gross receipts-style tax that is costly to comply with and pay. If Texas eliminated this onerous tax, the Tax Foundation has found the state’s business tax climate overall rank could improve to 3rd best. And the Texas Public Policy Foundation and the Legislative Budget Board (LBB) have estimated large economic gains. Texans have been hurt by burdensome local property taxes for too long, with that ranking in the report being 14th worst in the last three years. We know all too well about complexity, high rates, and lack of voter oversight of Texas’ local property tax system. To overcome this over-burdensome system, the Foundation has recently released a report detailing a strategy to slow the growth of state and local government spending in order to use surplus state funds to permanently reduce the school maintenance and operations (M&O) property tax until its eliminated. This would end nearly half of the property tax burden in Texas within about a decade while increasing funding for school districts over time with state taxes that would eventually fund 100 percent of schools M&O. Moving forward, Texas’ elected officials should consider these rankings by the Tax Foundation and other reports when looking for ways to improve the state’s business tax climate so Texans have the best chance to start a new business or gain employment. The Texas model of limited government has contributed to human flourishing, where 24 percent of new civilian jobs created nationwide have been since December 2007, but there’s always room for improvement. https://www.texaspolicy.com/blog/detail/texas-business-tax-climate-needs-improving

0 Comments

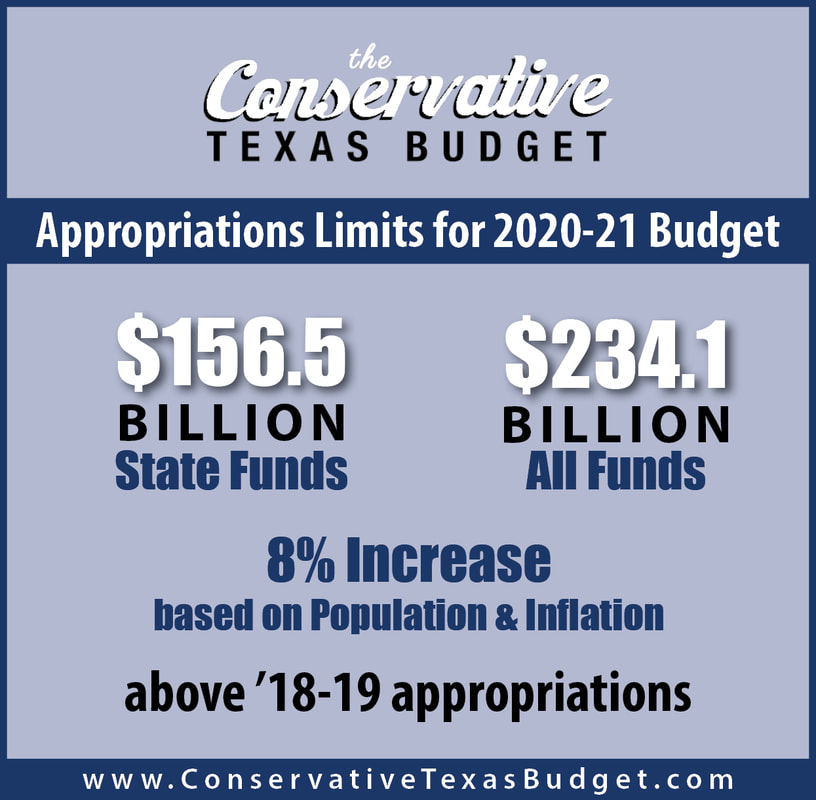

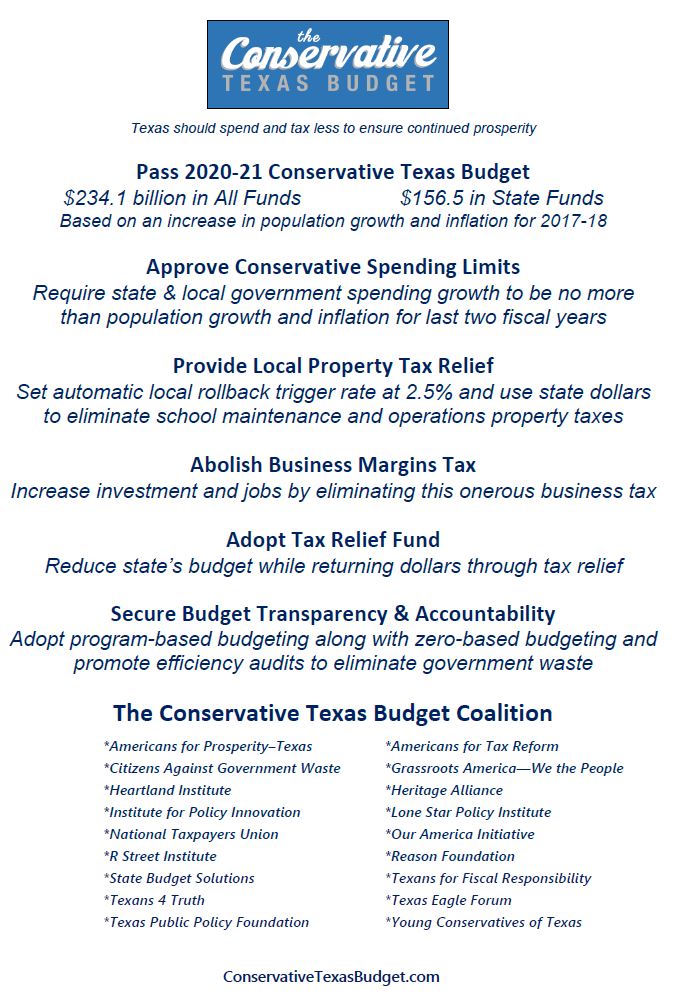

In this Let People Prosper episode, I provide today's press conference of the 18-member Conservative Texas Budget Coalition, with special thanks to Senator Donna Campbell for standing with us on these key legislative priorities, along with my explanation of the details of each of these priorities and how they work together to let people prosper. The Coalition outlined its legislative priorities for Texas' upcoming 2019 session. This includes the Conservative Texas Budget that sets limits for the 2020-21 budget of $156.5 billion in state (non-federal) funds and $234.1 billion in all funds to effectively limit spending so tax relief can be realized by all Texans. Read today's press release with quotes by each of the members of the Coalition. This is important because spending trends since 2004 outlined in the Real Texas Budget show that Texas families of four are paying $1,000 more, on average, in state taxes than if the budget had just matched population growth and inflation. Moreover, if the Texas Legislature can hold spending within a 4 percent growth limit this session and thereafter, Texas can eliminate the school maintenance and operations property tax--nearly half of the property tax burden statewide--within about 11 years. Read this for details of this simple property tax relief plan. As noted on the Coalition's website, other legislative priorities includes strengthening government spending limits, eliminating the business margins tax, creating a tax relief fund, and increasing budget transparency to let people prosper.

Texas’ property tax system has turned property holders into renters, where government is their landlord and Texans who struggle to pay annual tax bills face confiscation of their properties. Additionally, the growth of government is harming taxpayers and the economy through higher taxes and more regulation.

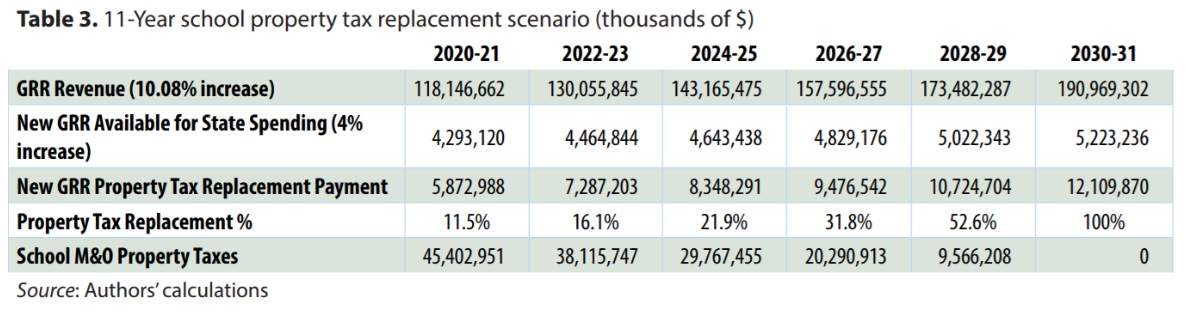

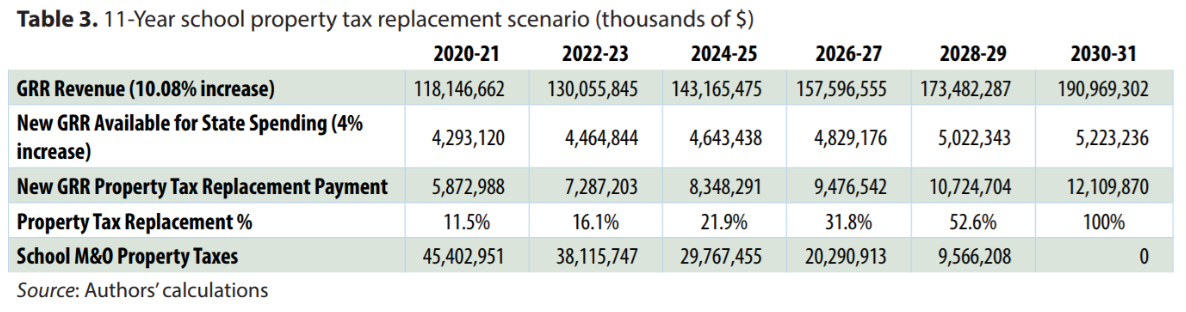

For example, Eddie Wilson owns the landmark Austin restaurant Threadgill’sbut recently announced he must close a location soon noting that he is “Flummoxed and bludgeoned by property tax increases, the grim truth is that we can’t afford it on the slim margins you make on meatloaf and chicken-fried steak.” Substantial, permanent property tax relief is needed. The Foundation’s recent report provides a plan of limiting government spending to eventually abolish property taxes in Texas by starting with eliminating the school maintenance and operations (M&O) property tax—nearly half of the property tax burden in Texas. The school M&O property tax is a good place to start because the level of student funding is determined by state funding formulas that are first funded by local property taxes and then by state dollars. Although there’s a lot of noise about whether local governments or the state legislature is at fault for a skyrocketing local property tax burden, the truth is excessive spending is the problem and taxpayers foot the bill regardless (see figure below). The relative ease of this process is lost with other local tax jurisdictions. Our plan is simple: State and local governments would limit spending such that state revenue permanently replaces the school M&O property tax within about 11 years. In other words, every dollar not spent by the state or school districts will produce a 90-cent property tax cut for Texans until half of the property tax in Texas is eliminated. Here are the plan’s details:

Table 3 shows how the plan could work mathematically given the above criteria: Under this plan, Texans will experience substantially lower property tax bills immediately and slower growth in them over time along with the broader economic benefits of slower government spending and a lower tax burden. Other options, such as sufficiently broadening the sales tax base, that begin with spending restraint to replace the school M&O property tax may be considered to deal with this problem. Limiting government spending and using state dollars to replace nearly half of the property tax burden that funds education would shift Texas toward a more efficient sales tax system to let people prosper. https://www.texaspolicy.com/blog/detail/property-tax-relief-in-texas-plan-to-eliminate-school-mo-property-tax In this Let People Prosper episode, I discuss my latest published research on how institutions matter for prosperity in Texas and beyond. I compare multiple measures of economic freedom and economic results between the largest four states in terms of population and economic output of California, Texas, New York, and Florida along with U.S. averages. These data indicate that Texas has greater economic freedom and prosperity, which should be emulated by other states and D.C., but there's more to do to improve the Texas Model.

VIDEO of event "#NAFTA and #FreeTrade: Gain or Loss to Texans?" hosted by @TPPF & @Heritage here: https://t.co/U5cwxTjrXV. Panelists include @Glenn_Hegar, @dwkreutzer, and me, with @DrewWhiteTX moderating. I hope you'll watch and share it with others.

Here are other publications of mine on NAFTA and international trade: 1) Texans Support, Prosper from Free Trade 2) Renegotiating NAFTA Without Favoritism Supports Prosperity 3) NAFTA Contributes to Texas Model's Success (Overview of my academic research) 4) Trade Deficits Can Be a Good Sign 5) Fast Track to Free Trade Prosperity This presentation provides information about Texas’ economy, labor market, and fiscal situation and key public policies that would strengthen the Texas model to foster more individual liberty and economic prosperity. Watch my explanation of this state-level labor report and other videos at my YouTube channel: Vance Ginn Economics. https://www.texaspolicy.com/blog/detail/texas-economic-labor-market-and-fiscal-situation

In this Let People Prosper episode, I review my latest piece at the Institute for Family Studies on how the Texas Model supports prosperous families. There's plenty of data to review in the piece, but let's discuss how institutions matter, especially the institution that's one of the most fundamental to our flourishing: the family.

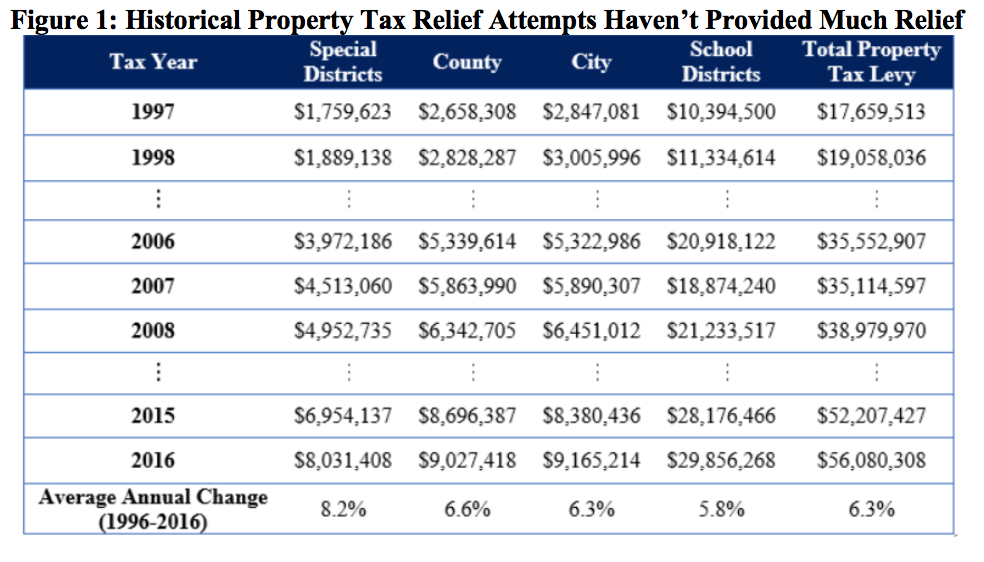

Check out this thread on Twitter where I break down the piece in more detail. #LetPeopleProsper We previously discussed the problems with Texas’ skyrocketing property tax burden. Let’s now consider past failed property tax relief attempts signaling a need for options that will provide permanent relief.

Since Texas’ modern property tax system took shape in 1979 with the passage of the “Peveto bill,” there have been three major attempts by the Texas Legislature to provide relief for taxpayers. Unfortunately, none of the attempted solutions created lasting reductions in property taxes as the attempts failed to address increased spending—the cause of increasing taxes—and instead simply shifted around the burden. 1997 Reform Attempt: Homestead Exemption Increase by $10,000 The 75th Texas Legislature attempted to reduce the rising property tax in 1997 by increasing the homestead exemption for school district property taxes by $10,000. Instead of allowing only $5,000 to be deducted from the taxable value of an individual’s property, the taxpayer could now deduct up to $15,000. The increased exemption was accompanied with homeowners who were 65 and over receiving a freeze on their school district property taxes. The total tax relief package was estimated at $1 billion. However, it resulted in little to no effect as school district property taxes increased by nearly $1 billion and total property taxes increased $1.4 billion the year after implementation and continued rising thereafter. 2006 Reform Attempt: Property Tax-Franchise Tax Swap After the Texas Supreme Court determined the school finance system was unconstitutional in 2005 from an essentially statewide property tax, the Legislature in a 2006 special session aimed to bring property tax relief. The solution was a reformed business franchise tax to what’s known as the margins tax today and increase the motor vehicle sales tax and tobacco tax while also changing the school finance formulas. While the outcome was an initial reduction in school district and total property taxes, the declines were marginal the first year with taxes being substantially higher than 2006 in 2008. As a result, instead of sustained property tax reduction, Texans experienced an increase in both local property taxes and state taxes. Moreover, the swap exchanged an already poor property tax system with an arguably worse margins tax that should be eliminated. 2015 Reform Attempt: Homestead Exemption Increase by $10,000 Similar to the 1997 reform, the 84th Texas Legislature looked to raise the homestead exemption for school districts property taxes another $10,000 to $25,000. Again, lower local property tax collections were replaced with state funds so as to not decrease school district budgets. Yet, much like 1997, there was no improvement in the tax burden as school property taxes increased by $1.7 billion and all property taxes increased by almost $4 billion the next year. Conclusion With past property tax relief failures of increasing the homestead exemption and the franchise tax swap, the time has come for a strategy that employs reducing the growth of government spending at the state and local levels while using state dollars to eliminate property taxes. Despite the economic success of the Texas Model of relatively fiscally conservative governance, a skyrocketing local property tax burden remains one of the state’s most pressing policy challenges.

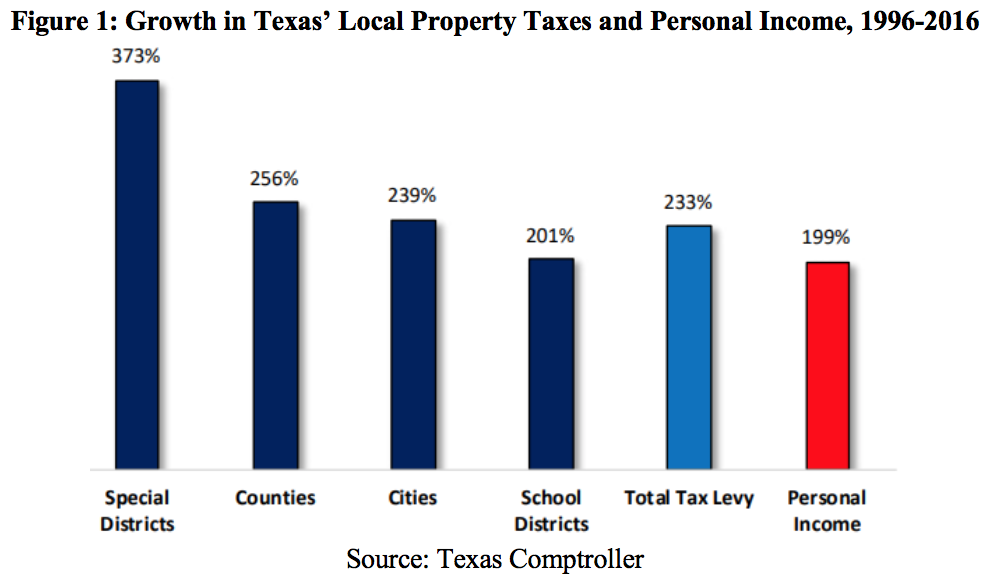

While Texans have the luxury of not paying a state personal income tax, which should be constitutionally banned, they’re currently weighed down by more than 5,100 local taxing jurisdictions that boast the sixth highestproperty tax rate nationwide. These locally-determined tax rates along with often subjectively appraised property values combine to give the total property tax levy statewide of $56 billion in 2016—contributing to an average property tax burden of more than $8,000 per year for families of four. Although many Texans live in uncertainty year-to-year on what their property tax bill will be, much of the damage of such ominous tax burdens are not so uncertain: discouraged economic growth, distorted investment decisions, depressed job creation, and ultimately renting property from the government forever. While the pain is felt statewide, it’s particularly felt among housing-rich but income-poor individuals, such as the elderly, who often must move as increasing tax liabilities extend beyond their means. In fact, some Texans who have paid off their mortgage now pay more for their property tax liability than prior mortgage payments, forcing them out of their home. The high property tax burden also keeps some people from ever having the means with which to purchase property. Both of these issues limit the liberty and economic prosperity of Texans from property taxes at often no fault of their own. This is particularly harmful because people aren’t able to ever own their home but rather pay rent to the government forever. And even those who do not have property are burdened as renters can reasonably expect property managers to pass the tax along to them and consumers pay more goods and services as business owners do the same. The culmination of these increases by local tax jurisdictions contribute to the total property tax levy statewide increasing by 233 percent to $56 billion in property taxes collected in 2016—the single largest tax imposed in the Lone Star State. For comparison, there may be a need for increasing spending and therefore taxes to fund increases in population and inflation. However, in this period, the state’s population growth increased by 47 percent and price inflation increased by 53 percent—collectively well below the increase in property taxes. On an average annual basis, the total property tax levy increased by 6.3 percent during that period; however, population growth increased by 1.9 percent and price inflation increased by 2.2 percent. Again, these growth rates indicate the mounting burden on Texans compared with a potentially reasonable argument for spending and taxing more. With many local tax jurisdictions raising property taxes at rates that are outpacing key measures of Texans’ ability to pay, the Texas Legislature has attempted to limit the growth of property taxes but to little avail. The steady increase in the property tax burden despite these unsuccessful attempts signal the real issue: Texas’ local governments don’t have a revenue problem, they have a spending problem. By first identifying this spending problem, we can begin to discuss real property tax relief. In this episode, I explore the following questions: What are claimed market failures? Do they exist? Can government intervention correct them? Is there such thing as government failure? It's important to ask these questions to determine whether or not market failure or government failure are the bigger problem in society. Much of this has do with the differences between Mainline Economics (my preference) and Mainstream Economics.

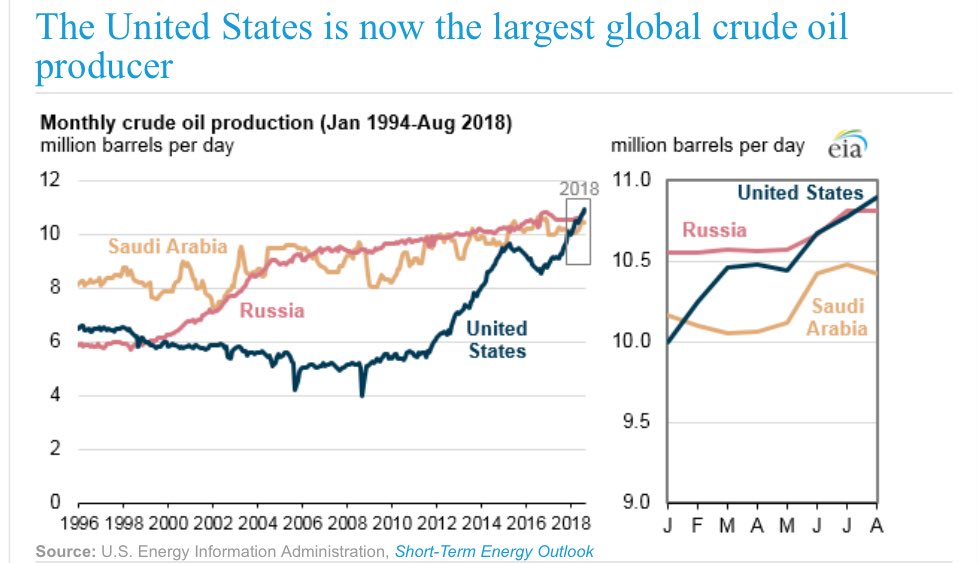

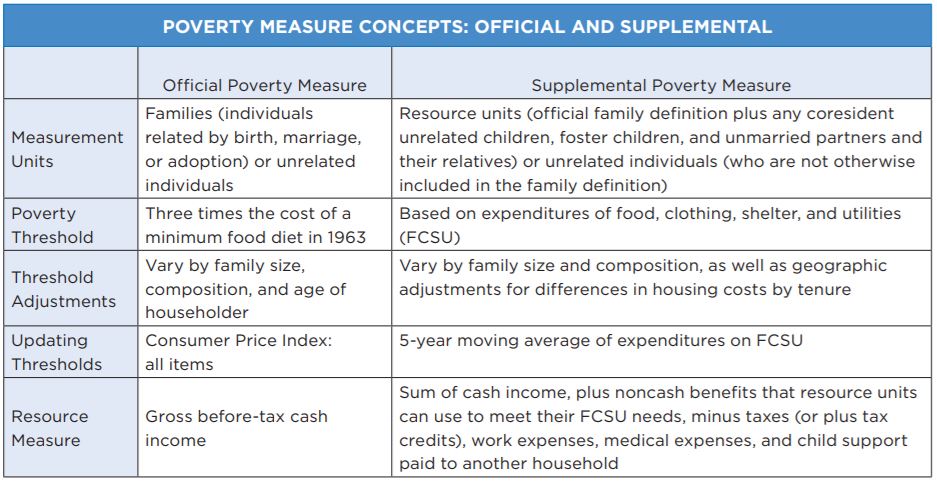

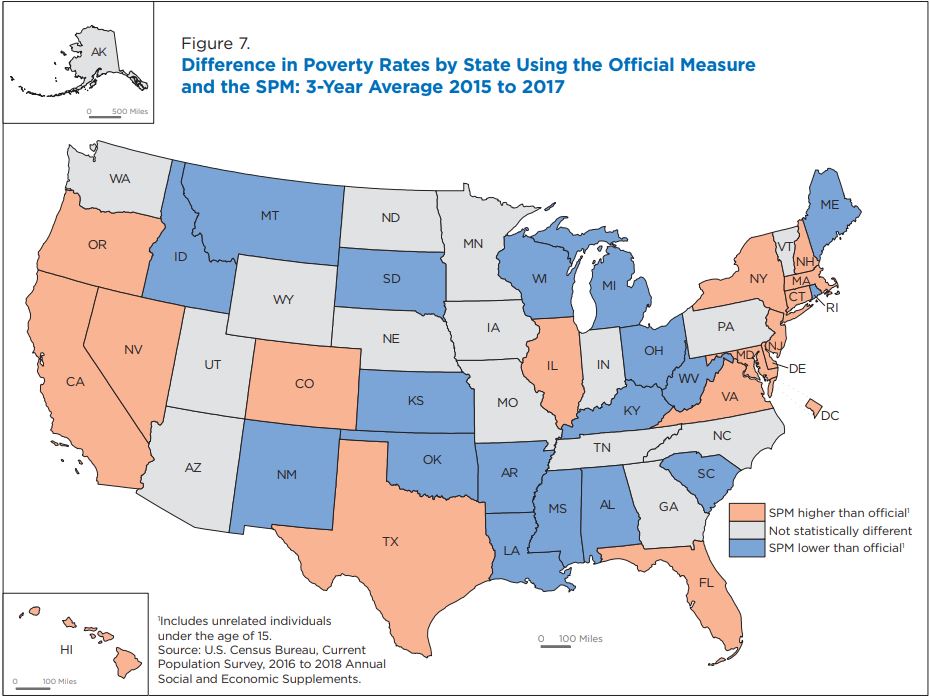

This enters controversial territory in economics and politics by discussing the myths of "market failure." Supposed market failures usually include problems with markets because of asymmetric information (occupational licensing and healthcare), monopolies (utilities and EpiPen), and externalities (pollutants) that can theoretically be corrected by government intervention. However, I make the case that these issues in markets are generated by government intervention, not unhampered markets, and the introduction of government intrusion to attempt to correct these potential issues only expand government and make the problem worse. Moreover, there are no free-market government solutions, which is why toxic pollutants should be dealt with by letting markets sufficiently price them or alternatively, though not recommended, by regulation. Policy solutions such as a carbon tax indirectly price externalities and the price will always be wrong because of the "knowledge problem" taught by economist Friedrich Hayek and the poor modeling that's done by so-called experts (see William Easterly's book The Tyranny of Experts). In general, the institutional structure of an economy should be supported by the government through upholding contracts, protecting people, and providing very few public goods. Instead of resorting to government intervention to solve supposed market failures, we should first understand that the government is likely the problem and Let People Prosper by promoting institutions with strong private property rights and fewer barriers to entry and exit markets. #LetPeopleProsper In this let people prosper episode, I discuss two key reports released today. The first is that the Energy Information Administration reported that the U.S. oil production exceeded Russia and Saudi Arabia to become the top oil producer in the world in August 2018. The second is the Census Bureau released the latest income and poverty-related data that shows less poverty nationwide with little change in Texas' supplemental poverty measure (SPM) while California still has the highest SPM in the nation. Regarding the EIA's data, the following figure shows this historic moment in U.S. history. Here's the EIA's projection through 2019: "Although EIA does not publish crude oil production forecasts for Russia and Saudi Arabia in STEO, EIA expects that U.S. crude oil production will continue to exceed Russian and Saudi Arabian crude oil production for the remaining months of 2018 and through 2019." Much of this expansion in oil production has been in Texas. In fact, Texas is producing a record amount of oil at 4.4 million barrels per day as of June 2018 (latest data available), which is about 40% of total U.S. production that month. The increase in oil production in the last couple of years has contributed to faster economic growth and job creation, thereby helping to reduce the poverty rate. Of course, this is a relatively small direct relationship, but the indirect relationship of more production capacity in the private sector is quite remarkable. Moreover, the regulatory cuts last year and the general increased economic activity and job creation in recent years has helped get people out of poverty. This is noted by poverty measures improving some in the latest report for the average of the 2015-17 period (see page 26-27 of this report). The Official Poverty Measure (OPM) looks at one poverty level across the entire nation with the federal poverty level of $12,752 for an individual and a family of four (two adults and two kids) of $24,858. The OPM declined to 12.9%, or 41.2 million, nationally for the average of 2015-17. However, the OPM is a poor measure of poverty because there are different housing costs in each state along with different levels of government benefits. Several years ago the Census Bureau created the Supplemental Poverty Measure (SPM) that accounts for after-tax income, differences in regional costs of housing and other expenditures, and government transfers (see figure below). The SPM declined to 14.1 percent, or 45.3 million, nationally. These measures for the 2015-17 period are also available by state. Let's consider the two largest states: California and Texas. California's OPM is 13.4%, which is near the national average, with 5.3 million people in poverty, and SPM is 19%, which is the highest nationally, with 7.5 million in poverty. Texas' OPM is 14%, more than a percentage point higher than the national average, with 3.9 million people in poverty, and SPM is 14.7%, which is near the U.S. average, with 4.1 million in poverty.

These data make sense because Texas is a relatively cheaper place to live that in California so Texans' dollars go a lot further than Californians' even as California has a more liberal welfare state and spends much more per capita. In this Let People Prosper episode, I'm honored with the "Champion of Freedom" award from Grassroots America--We The People's Executive Director JoAnn Fleming for advancing economic freedom and prosperity in Texas and beyond. I'm thankful for receiving this stellar award! Here's Part 1 with JoAnn Fleming announcing my award and providing some very kind remarks. Here's Part 2 where I give my acceptance speech. Short and to the point. I thank God, wife, family, colleagues at TPPF, and all of the freedom fighters working hard to assure liberty is rising! Now let's get to work to assure to expand opportunities to #LetPeopleProsper.

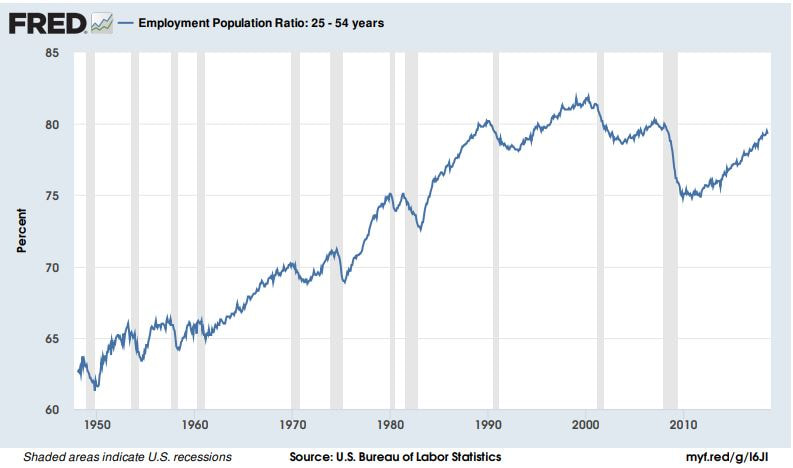

In this #LetPeopleProsper episode, I discuss the good, bad, and my take on the August jobs report by the U.S. Bureau of Labor Statistics. Overall, a good report but weaknesses remain.

Here are the key points of the report:

In general, the increased strength of the labor market has been a product of the regulatory and tax relief last year. A good sign as the Trump administration has started to follow more of hte prosperous Texas model. Let's hope that continues to #LetPeopleProsper. In this Let People Prosper episode, I'm interviewed by Josiah Neeley of R Street Institute and Doug McCullough of Lone Star Policy Institute on the Urbane Cowboys podcast about trade, NAFTA, Texas Model, and much more ("Ginn as in Gig").

You can listen to the podcast on Apple iTunes or wherever you get your podcasts. #LetPeopleProsper In this Let People Prosper episode, I discuss the issue of occupational licensing how burdensome it is for many workers while many of the licenses provide little consumer protection from health, safety, and welfare concerns. This issue was in TPPF's daily newsletter "The Cannon," which I recommend that you subscribe.

In fact, licenses often result in being a barrier to entry for many people wanting to join a licensed occupation, creating a situation where there are costs to consumers, workers, and society at large. This makes licenses the most burdensome labor market regulation in spite of the reasoning for them being from a market failure of asymmetric information. Often, market failures aren't failures at all but rather the resulting costs are from government failures, which another case for this is with occupational licensing. The case of Bastiat's teh seen versus the unssen. Instead, more information to consumers and lower barriers to entry for workers would provide an efficient market that doesn't misallocate workers and cost consumers and society in the process. I discuss recommended solutions that I mentioned in my recent testimony before the Texas Senate Business and Commerce Committee (watch my testimony here starting at 37:45 and read my written testimony here). There was a great discussion among the panelists and legislators about occupational licensing and what you should be done about them. #LetPeopleProsper |

Vance Ginn, Ph.D.

|

||||||||||||

RSS Feed

RSS Feed