|

Thank you for tuning into the FINAL Let People Prosper podcast episode 76 of 2023! Today, I have a brief but informative podcast for you, recapping the highlights of the economy and my business, Ginn Economic Consulting, LLC.

As a Christmas gift, I am giving away a complimentary subscription to the paid version of my newsletter and a copy of Lexi Hudson’s fantastic book, “The Soul of Civility: Timeless Principles to Heal Society and Ourselves.” To enter this giveaway, simply fill out the information at the link and rate my podcast on either Apple Podcasts or Spotify. Is there anyone whom you would like for me to interview in 2024? Leave them in the comments. Today, I cover:

0 Comments

The Fraser Institute recently released its annual “Economic Freedom of the World” report. While the US inched up one spot from its previous ranking to fifth-best, this ranking remains below its peak of third-best in 2000.

A first-time finding not seen in any of 27 prior years: Hong Kong fell from first place. Singapore nudged out Hong Kong for the top spot by 0.01 points. While that rating may seem minuscule, the implications of how both countries got here are not. The report, which shows comprehensive data from 2021, assesses economic freedom among nations across five major areas: size of government, legal system and property rights, sound money, freedom to trade internationally, and regulations. According to the Fraser Institute’s Matt Mitchell, “The most important component of economic freedom…is the rule of law section…you need to be able to trust that the contracts you form and the property you acquire will be protected. We found that regulatory barriers and the rule of law matter more than taxes [for economic freedom].” Given these guidelines, Hong Kong’s fall isn’t surprising. China’s special administrative region allowed to manage most of its own affairs under the “one country, two systems” precedent since 1997, Hong Kong’s independence has been seriously threatened since 2020 with the passage of China’s new security law. Today, as a result, Hong Kong has one of the fastest-growing political prisoner populations worldwide. Although the protection of Hong Kong’s independence under the system was set to last until 2047, it seems unlikely that China will keep its promise. Over the past two years, Hong Kong’s economic freedom ranking dropped by a substantial 0.40 points, a total decline of 0.64 points since its highest rating of 9.19 in 2010. This is much steeper than the average economic freedom drop worldwide following the pandemic, which is the lowest average score since 2009, pointing to China’s harsh policies as a primary factor. China’s recent security law inhibits free speech and impartial justice, integral to the rule of law which is the foundation upon which individuals can construct their economic aspirations, with trust as the indispensable glue. But trust isn’t just a legal concept. It’s deeply interwoven with a nation’s cultural fabric. Trust is the bedrock upon which economic prosperity thrives, allowing individuals and businesses to engage in voluntary exchanges with confidence. Recent developments, including China imposing significant trade barriers, limits to foreign labor employment, increased business costs, and new attempts to restrict media, tarnished Hong Kong’s overall score. The lesson from the report rings loud and clear: A small government footprint in fiscal matters alone won’t guarantee economic freedom. What’s needed is a symphony of elements: the rule of law, property rights, stable currency, open trade, and sensible regulation. High-income industrial economies like now top-ranking Singapore shine in areas related to legal systems, property rights, sound currency, and international trade while keeping their government size compact. The report is a valuable tool for deciphering economic freedom’s complexities, and the factors underlying the success story of Singapore and Hong Kong’s decline drive home the point that tax rates don’t solely determine economic prosperity. It hinges on the quality of institutions, the rule of law, and the cultural values that champion trust and voluntary exchange. As the US strives to enhance its economic freedom, the country would be wise to heed the lessons offered by Singapore’s rise and Hong Kong’s fall. In particular, this should include removing government barriers so that there are more ways for free people to prosper. Originally published at American Institute for Economic Research. The Biden Administration’s Justice Department took Google to a civil trial on Tuesday, beginning the department’s first major monopoly lawsuit since it took on Microsoft in 1998. What’s the allegation? Google supposedly violated U.S. antitrust laws. But it seems the main “violations” are that Google is good at what they do, consumers love their product and Microsoft is mad.

Jonathan Kantor at the Justice Department (and Lina Khan at the Federal Trade Commission) have pushed an endlessly fruitless crusade against “Big Tech.” Now, it has taken issue with Google’s methods of becoming the default browser on popular devices, which they’ve done through legal means that more savvy people might just call “marketing.” Products like iPhones and MacBooks make it easy for consumers to change their default browser to whatever they prefer. Most of them favor Google because they believe it’s a better search engine. Herein lies the real crux of the lawsuit. Antitrust laws were created to preserve competition. The original laws were rightly deemed too broad and vague, so a new guiding principle of the consumer welfare standard for enforcing these laws was implemented to consider whether consumers are better or worse off from the actions of businesses. In economics, consumer welfare is defined as the “value consumers get from a product less the price they paid.” That value varies from person to person, which is what makes free markets work. Consumers have the ability and the sovereignty to decide which product or service is best for them. To violate the consumer welfare standard would mean moving toward a monopoly. This is when a business has a large market share, or even the market share, such that they can raise prices of their goods or services regardless of quality. The outcome would reduce consumer welfare and, therefore, contribute to potential antitrust law violations. Found guilty, a business could be broken up into smaller parts, forced to sell off part of it or face penalties. In other words, it’s another hindrance to productive activities as targeted employers are forced to beef up on lawyers to deal with federal pushback instead of allocating those resources toward productive means that would help their employees and customers prosper. Despite what the DOJ claims, antitrust laws are rarely enforced to protect consumer welfare, and this case is no exception. Google is not only Americans’ preferred browser, but the company is consistently rated one of the best places to work. So, it seems most of its consumers find value in the product. If they don’t, they can use Bing, Firefox, DuckDuckGo or any other search engine that competes with Google and is readily accessible. So, if this case isn’t centered around consumer welfare or targeting monopolies, what is it really about? If the DOJ wins, which is highly unlikely, American competition and innovation will be stifled. This rent-seeking behavior may win votes with folks on the Left concerned with restricted competition and those on the right concerned about censoring on popular platforms like Google and Meta, but at what cost? Inhibiting free markets with increased regulations is far more likely to drive up prices and decrease consumer welfare than any part of “Big Tech.” This pursuit wastes taxpayers’ dollars that would be better spent elsewhere or, better yet, for the federal government to spend less so people have more money in their pockets to improve their own welfare. At a time when inflation remains too high, the labor market is cooling and Americans are suffering from a bleak economy, this lawsuit is a frustrating misuse of government resources. Moreover, government attempts like this to manipulate markets will always fail due to what economist Friedrich Hayek identified as the knowledge problem. He argued that information (knowledge) is decentralized, dispersed across society and not contained within departments of power. Central planners, in this case the DOJ (and FTC), do not have all the knowledge necessary to designate market competition, and they never will. Free market capitalism cannot be manipulated but must be allowed to work through spontaneous order. This lawsuit attacks free markets and, thereby, free people. Not monopolies or consumer welfare violations, and it’s abundantly clear that neither of those are real problems regarding Google. It’s time for the DOJ to accept defeat and focus on things that actually matter. Ganging up on Google amid all the problems Americans face today, while understanding legitimate concerns with some of Google’s actions, is out-of-touch, to say the least. Originally published at Daily Caller. Today, I cover: 1) National:

3) Other: My thoughts on the DOJ lawsuit against Google for violating antitrust laws and why I believe it's an attack on consumers and capitalism. You can watch this TWE episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. We discuss: 1) How antitrust laws harm capitalism, why free markets work better with less government interference, and how people misunderstand antitrust laws; 2) What people, especially younger generations, misunderstand about capitalism, what it is and isn't, and how most of us on either side of the political aisle have more in common than not; and 3) How Hannah believes the country could change for the better, and her fascinating background from being a singer/songwriter and interning for Taylor Swift's team to becoming a liberty warrior. Hannah’s bio:

You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. In this episode, we discuss: 1) The importance of economic freedom, how it is measured, the rule of law, and the importance of protecting private property; 2) Myths about which European countries are socialist and the history of different economic institutions in Poland, including his latest work “The Road to Socialism and Back: An Economic History of Poland, 1939–2019”; and 3) A history of socialism and communism, what Marx failed to see in countries with capitalism or socialism, and reasons to be optimistic about economic freedom and prosperity worldwide. Matt’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Oren Cass, founder of the think tank American Compass, presents a vision of the “new right” in his recently released book, Rebuilding American Capitalism. In it, he advocates for a top-down approach to governance in response to what he perceives as free-market failures.

He tends to believe that certain politicians can and should shape markets to achieve desired outcomes rather than letting free markets, which are free people, work. This attempt to rebrand not only the right but capitalism itself is flawed, as history and sound economics prove. Cass pinpoints growing concerns in the economy to help bolster his arguments, like poor inflation-adjusted wage growth and lack of strong social and family units. These are problems making it harder for people to prosper, but they are not, as he suggests, evidence that free-market capitalism has failed. But these problems–if they are problems, as Scott Winship and Jeremy Horpedahl recently found that people are thriving–aren’t the results of free markets but are driven instead by government failures. These failures include bloated government spending, restrictive regulations, high tax burdens, excessive safety net programs, costly tariffs, and other barriers to entry in the marketplace. They are imposed by politicians and government bureaucrats, hindering competition, disrupting entrepreneurial endeavors, impeding wage growth, and destroying human flourishing. Cass contends that capitalism only works under the right conditions, which must be facilitated by the government to keep the labor market and the economy strong. Rather than what he calls the “Old Right’s market fundamentalism” of fewer regulations and less government intervention being best, he welcomes more government with certain politicians in power. He proudly makes markets the scapegoat and, with it, globalization and financialization. In the book’s foreword, Cass writes: "Globalization must be replaced with a bounded market that restores the mutual dependence of American capital and labor and invites the trade and immigration that benefit American workers. Financialization must be reversed so that both talent and capital in pursuit of profit find their best opportunities in productive investment rather than extraction and speculation." Believing that more opportunities in the form of globalization inhibit rather than help Americans is the same faulty basis with which people discourage immigration and trade, which are central to thriving economies. But the crux of Cass’s theory is that he believes markets must be molded, even referring to work by the father of modern economics Adam Smith. Conveniently, he fails to cite the economist Frederick Hayek, who built on Smith’s ideas, to identify spontaneous order, the basis of free-market capitalism that argues economic growth and prosperity arise from voluntary transactions by free people, not government guidance and control. This “new right” idea was debunked long before Cass came along by Hayek (and others), who also highlighted the “knowledge problem” associated with central planning. He argued that no central authority can possess the information necessary to make efficient decisions for an entire economy. The complexity of economic interactions and the constant flux of information require decentralized decision-making and market mechanisms to aggregate and incorporate local knowledge effectively. Hayek’s insights emphasize the limitations of top-down control and the importance of allowing market forces and individual actors to shape economic outcomes based on their localized knowledge and preferences from the bottom-up. But Cass would have it that government is heralded as the keeper of knowledge and the arbiter of good decisions rather than encouraging freedom and liberty in individuals, i.e., the essence of capitalism. Capitalism allows individuals to pursue their economic aspirations and make decisions based on their knowledge and preferences through voluntary exchange within rules of the game set by limited government. Through this freedom, innovation, entrepreneurship, and competition thrive, leading to greater prosperity for all. History is full of successful economic transformations driven by leaders who championed limited government and free markets. Former President Calvin Coolidge cut government spending, cut taxes, and reduced the national debt, providing more paths for human flourishing. Likewise, former President Ronald Reagan cut taxes, tried to rein in government spending, and reduced regulations, unleashing economic growth and job creation. Both of them understood that cutting spending, reducing taxes, and removing excessive regulations create an environment where businesses thrive and workers can benefit. Their approaches embraced the power of individual freedom and self-determination, not top-down control that breeds the opposite. Oren Cass’s theory of the “new right” and its embrace of government fundamentalism misunderstands the principles of capitalism and human behavior. Top-down approaches, rooted in centralized control and regulation, do not lead to economic prosperity or personal freedom no matter who is in charge but do distort the efficient allocation of resources, undermine the adaptability of markets, and reduce opportunities to let people prosper. To achieve a thriving and prosperous economy, we must adhere to and strengthen the principles of free-market capitalism, which too much of our economy today is deprived of when considering healthcare, education, transportation, manufacturing, and the labor market. This should include embracing limited government, voluntary exchange, and individual freedom as the pillars of strong families, productive workers, and profitable employers. Economist Milton Friedman noted what this debate is about decades ago. “The problem of social organization is how to set up an arrangement under which greed will do the least harm; capitalism is that kind of a system.” And while “history suggests that capitalism is a necessary condition for political freedom,” it’s clearly “not a sufficient condition.” But capitalism is the best system yet that has supported economic prosperity and political freedom. The problem is that we have had too little free-market capitalism for people to thrive because of too much government. There’s no need for a “new right” of big-government progressive policies offered by Cass and others when free-market capitalism of the “old right” is too often missing in our lives. Originally published at Econlib. On today's episode of the "Let People Prosper" show, which was recorded on March 6, 2023, I'm honored to be joined by Dr. Arthur Laffer, legendary economist and 2019 recipient of the Presidential Medal of Freedom. We discuss:

Dr. Arthur Laffer’s bio and other info (here):

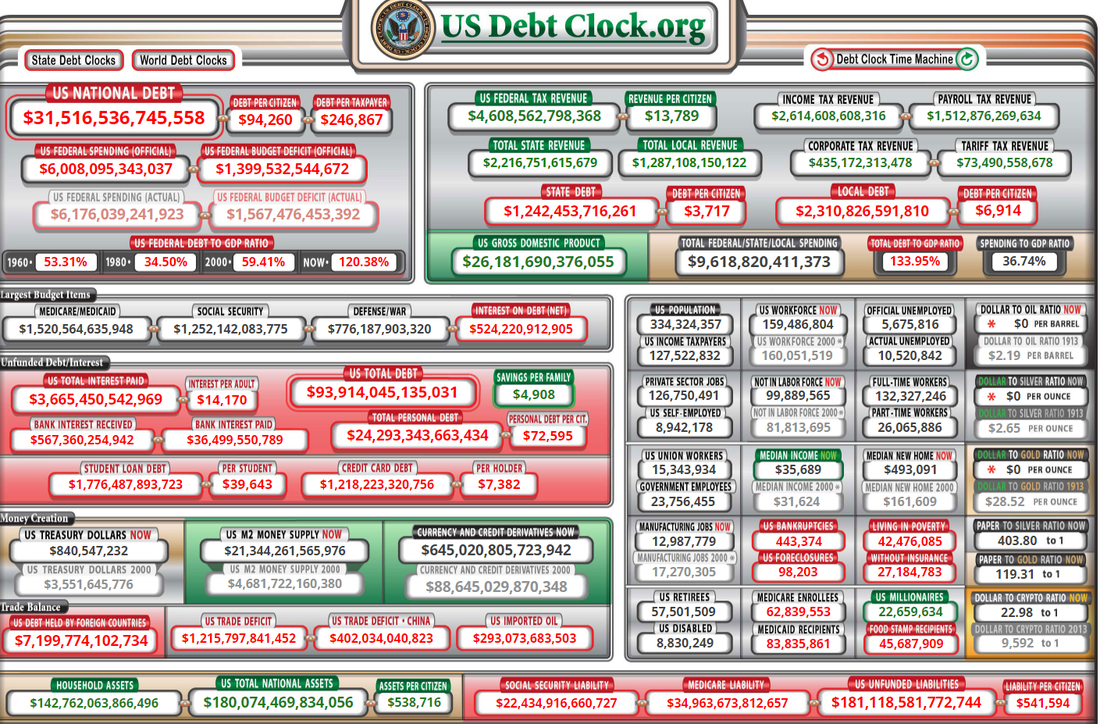

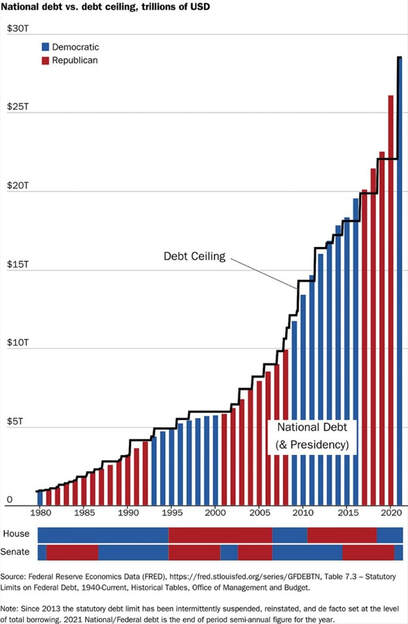

Both Republicans and Democrats at the national level have put us down a path of slow growth, massive deficits, and high inflation. With a new Republican majority in the U.S. House and the daunting debt ceiling fight over the bloated $31.4 trillion national debt almost exclusively due to excessive spending, there’s a proven pro-growth, pro-liberty path.

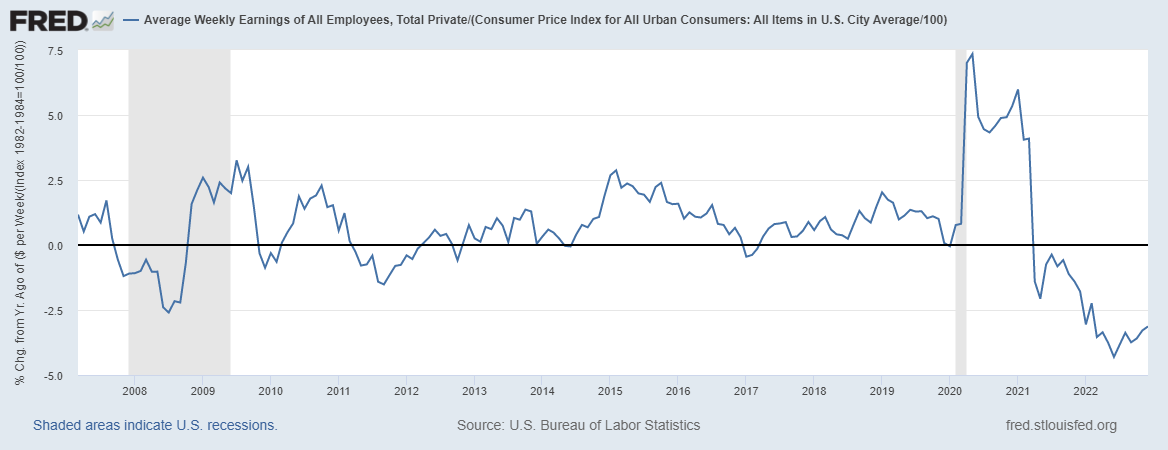

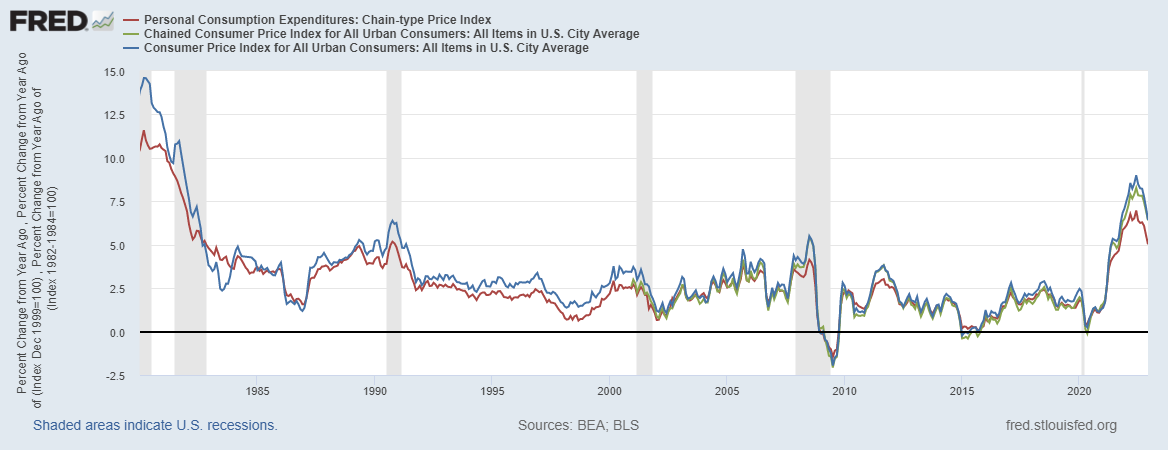

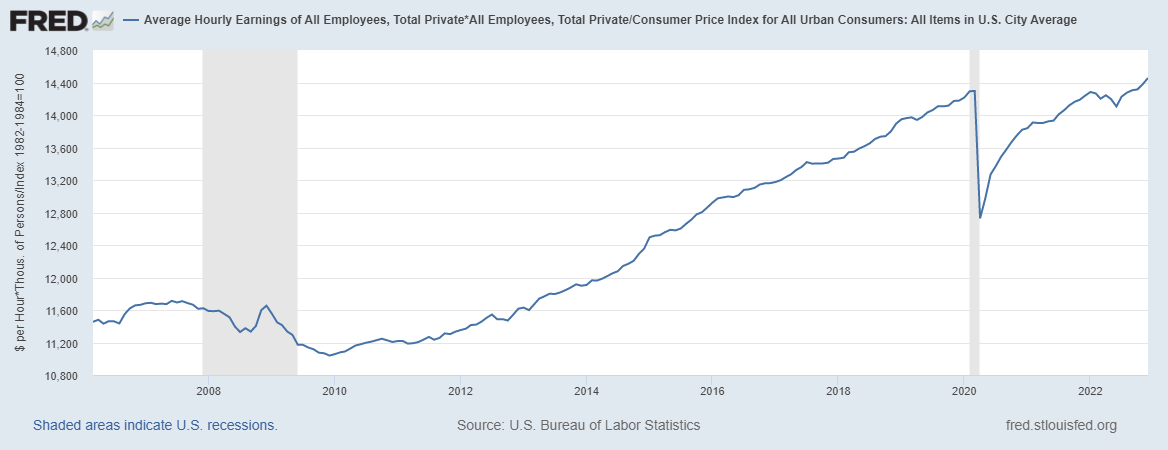

In 2022, the U.S. had real GDP growth of just 0.9 percent (Q4-over-Q4), the highest inflation in 40 years, the highest mortgage rates in 20 years, and the worst stock market in 14 years. Average real weekly earnings have now declined year-over-year for 22 straight months. Fortunately, history is a good guide for how to overcome this mess. The two of us have served as chief economists at the Office of Management and Budget (OMB), though 50 years apart. One of us (Arthur Laffer, originator of the “Laffer Curve”) was the first chief economist of the OMB in the Nixon White House. The other (Vance Ginn) was the last associate director for economic policy at the OMB in the Trump White House. While much has changed since the OMB was formed in 1970, the problems are basically the same today. There remains a lot of unjustifiable government spending, prosperity-killing taxes, unwarranted regulations, excessive liquidity, and harmful interference in international trade. But just because counterproductive economic policies have been around for a long time doesn’t mean we shouldn’t try for a better world. Each of the above areas is the subject of intense debate. In politics, these debates have their short-term winners and losers as judged by elections. But the principles of economics aren’t determined by votes. The remedy for economic malaise has been and is less government, not more. Free-market, pro-growth policies are the cure. The legacy of the 1970s is now called the era of stagflation, and the 2020s are shaping up to be known for the same, or worse. Even with 50 years of experience, many people still haven’t learned a lesson. During the Nixon and Ford administrations, the economy was stifled at every turn. The dollar was taken off gold and devalued, resulting in higher inflation. Then there was the imposition of wage and price controls, which did nothing to stop inflation but instead ravaged the economy. Government spending was out of control. Taxes were raised, and tariffs imposed, including a 10 percent import tax surcharge; such was the wisdom of the D.C. crowd. The consequences were rising inflation, stock market collapse, impeachment, and a weak economy. Then, President Jimmy Carter tried to do more of the same with the same consequences. There followed a true renaissance, led by President Ronald Reagan’s tax and regulatory cuts and Federal Reserve Chairman Paul Volcker’s sound monetary policy. Inflation crashed, the stock market soared, new jobs surged, and Reagan won re-election in a landslide, winning 49 states. And then there was the sad interlude of George H.W. Bush, who broke his promise by raising taxes, leading to a one-term presidency. President Bill Clinton, partnering as he did with House Speaker Newt Gingrich, cut government spending by 3 percentage points of GDP, cut capital gains tax rates while exempting owner-occupied homes from this tax altogether, and finally, he and the Republicans pushed the North American Free Trade Agreement (NAFTA) through Congress. On the bad side, he raised the top two tax rates. But the spending restraint contributed to a budget surplus for four straight years. President George W. Bush, with a penchant for spending more and for temporary tax cuts, was followed by President Barack Obama, with a desire on steroids to spend even more, plus he nationalized health care. Stagnation took hold, and prosperity faded. In his first two years, President Trump reversed some of the prior 16 years of bad policy with substantial tax cuts, historic deregulation, and other measures that helped get government out of the way, contributing to the lowest poverty rate and the highest real median household income on record. But with the onset of the pandemic, prosperity was cut short by the ill-advised massive spending increases and lockdowns. Today, we’re once again mired in a sea of bad policies and bad consequences despite President Joe Biden’s self-serving narrative. With tax hikes, massive spending, oppressive energy regulations, soaring debt levels, trade protectionism, and a bloated Fed balance sheet, stagflation was given a brand-new lease on life. We should follow the proven, pro-growth path (not currently taken) of sound money, minimal regulations, free trade, flat taxes, and most of all, spending restraint for the sake of the economy and human flourishing. It’s also great politics. With this elixir in hand, it would be springtime again in America. And that is something Americans can believe in. Vance Ginn, Ph.D., is an economist and senior fellow at Young Americans for Liberty and previously served as the associate director for economic policy of the White House’s Office of Management and Budget from 2019 to 2020. Arthur Laffer, Ph.D., is an economist from Nashville, Tennessee, and was the first chief economist of the White House’s Office of Management and Budget. Originally published at The Federalist. California Gov. Gavin Newsom boldly — and a wee bit desperately — ran ads last summer encouraging Florida residents to relocate to California . Housing affordability is one reason it probably won't work.

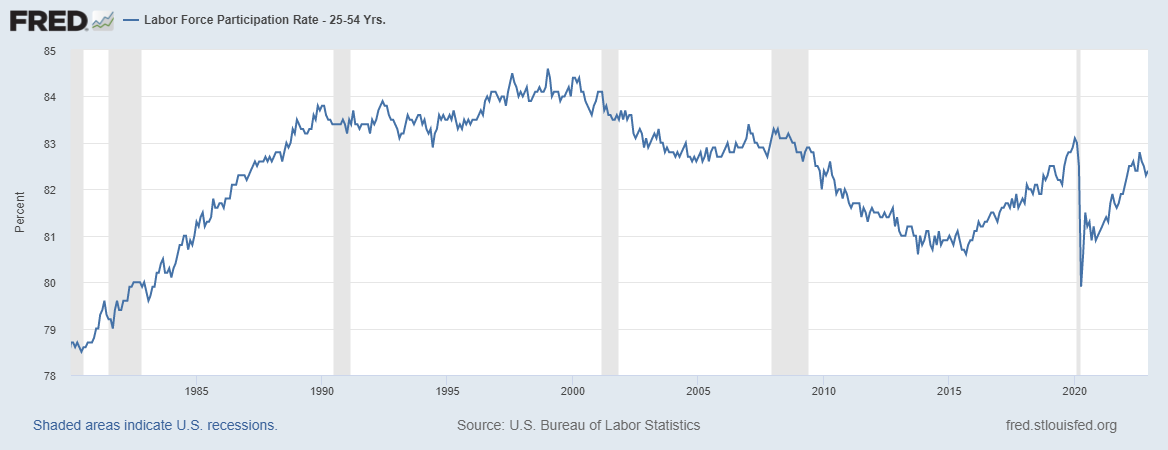

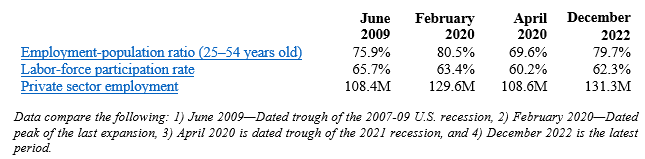

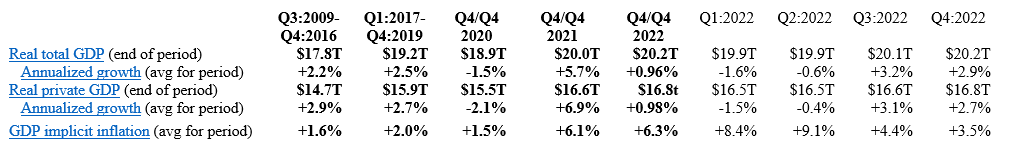

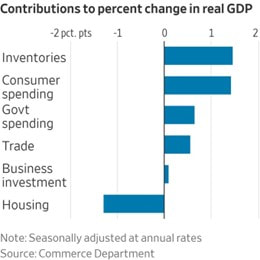

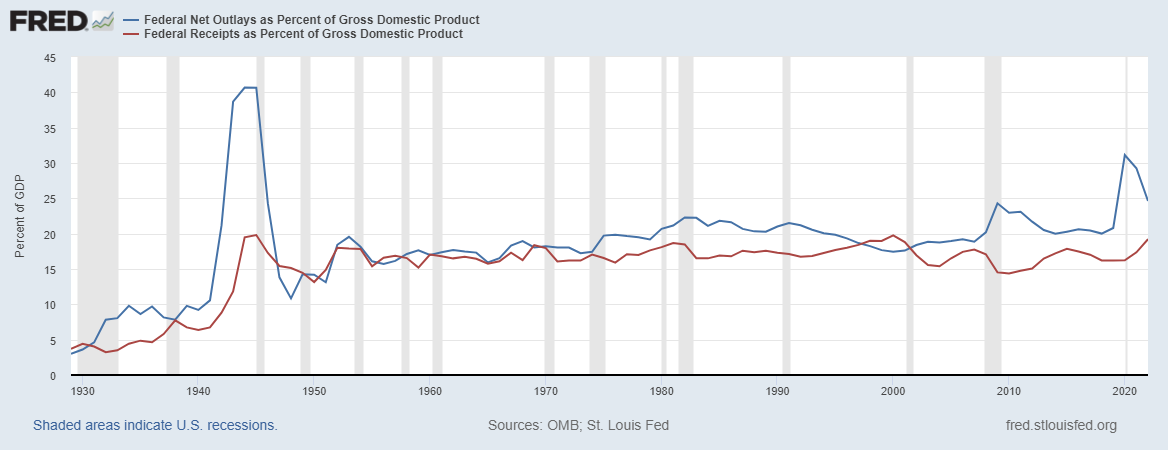

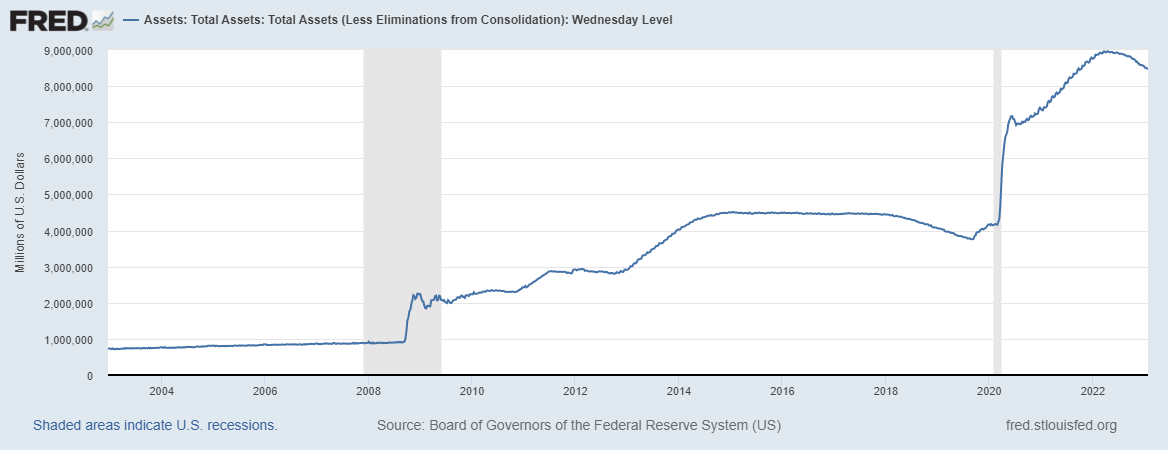

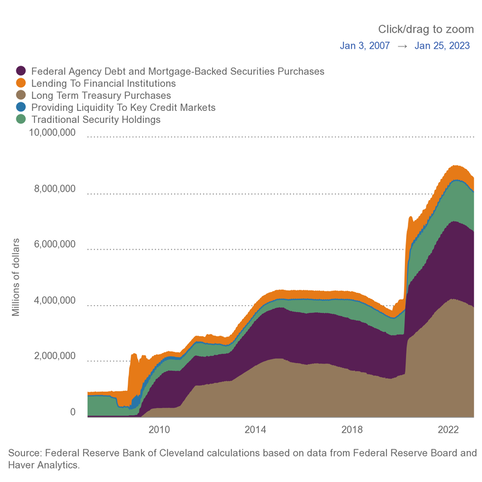

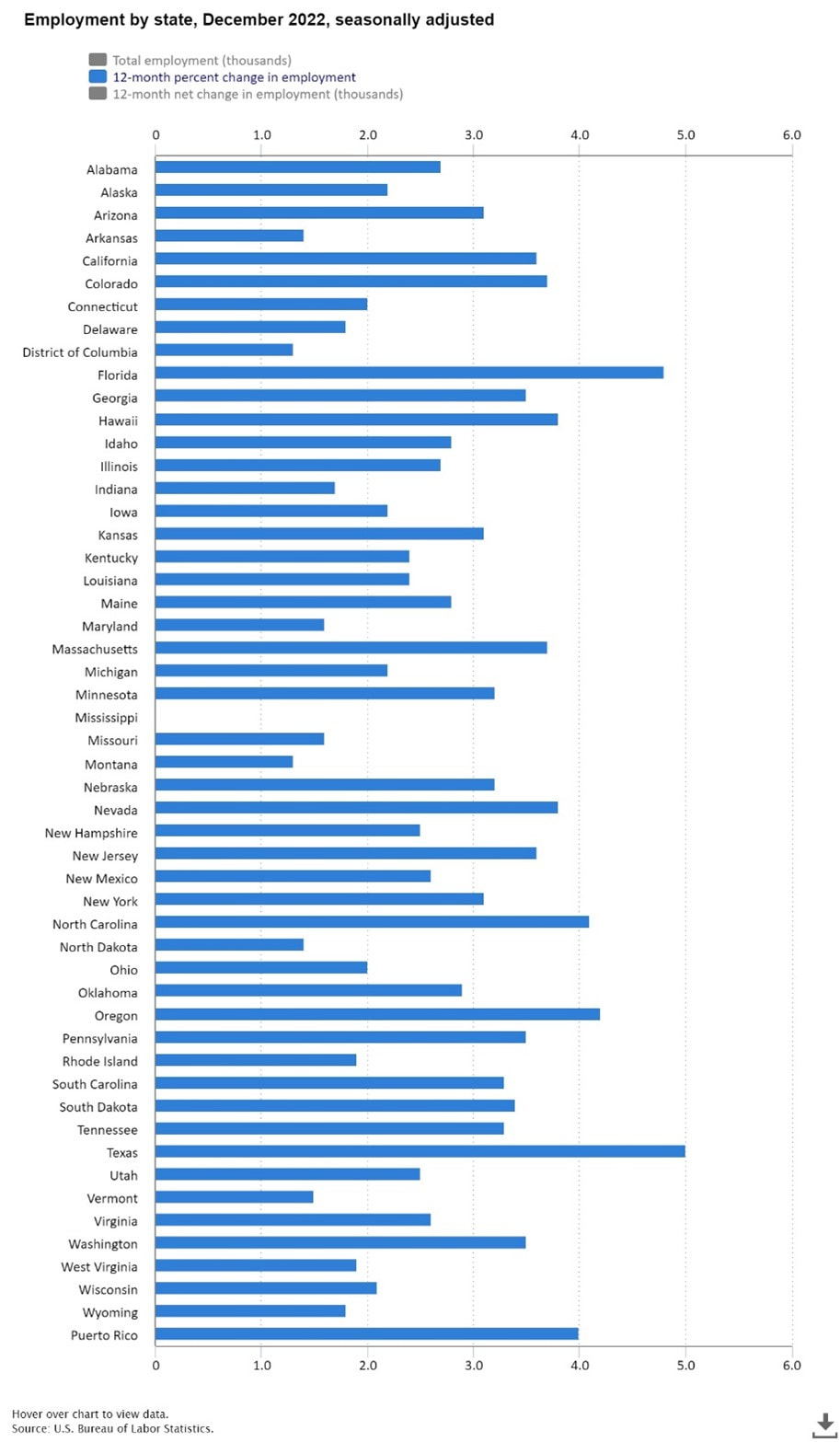

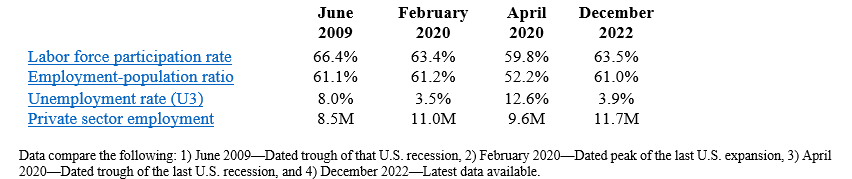

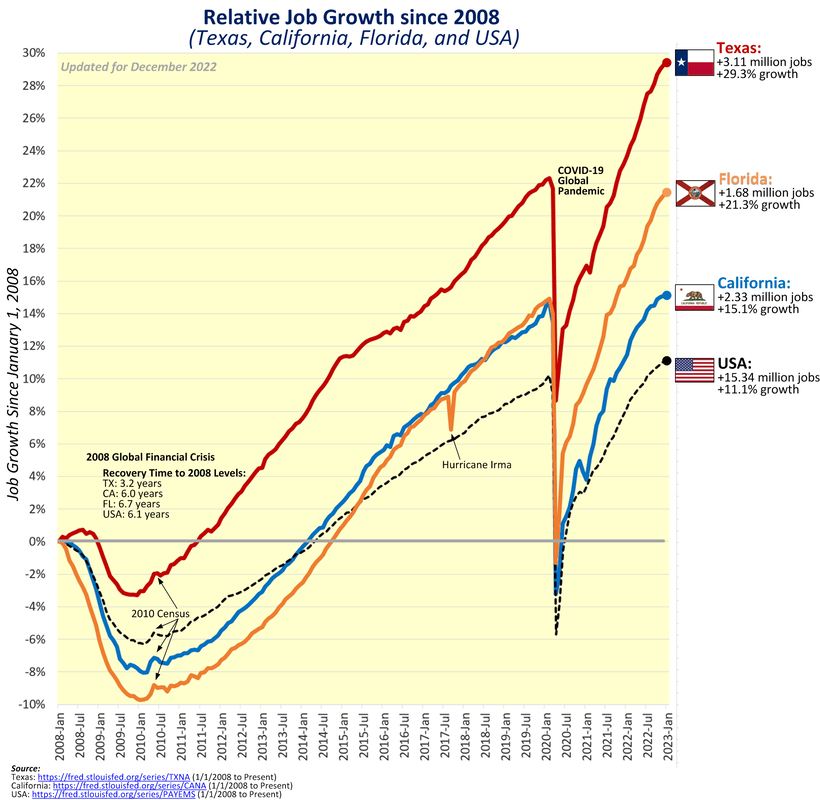

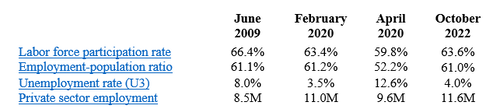

Housing affordability has been a major factor driving Californians to states such as Texas and Florida, where they can realistically afford the American dream of owning a home. Cost of living — which is mainly a housing problem — and taxes round out the top motivations for fleeing the once-growing states such as California. The states that win on housing affordability from free-market-oriented policy win overall. Twenty years ago, few would have bet on a mass exodus of residents from the popular albeit highly regulated housing market in California. Issues related to land use, zoning, and bureaucratic chaos led to substantially higher housing costs. The five most expensive housing markets nationwide are all within California. Further, a recent Hoover Institution report found that one of the top reasons companies leave California is “... high living costs, particularly the cost of housing affordability.” In the same vein, C2ER finds that California’s housing costs are about 1.7 times greater than Florida’s and 2.2 times higher than Texas’s. This contributes to California suffering losses of big businesses (11 Fortune 1,000 companies) between 2018 to 2021, along with small, quickly growing companies. Texas and Florida have figured out the secret to housing affordably through free-market policies that help entrepreneurs address challenges to build more homes in a safe, less costly manner. The recent census report shows how Florida drew the most net new domestic residents (318,855), with Texas coming in second (230,961). Many people packed up and moved to states with “lower taxes, more affordable housing and a higher standard of living.” What’s more, Texas came in first in overall population growth (470,708), with Florida second (416,754). These states are the ones that tend to let builders build more freely than the others. The Wharton Residential Land Use Regulation Index , one of the most respected analyses of the effect of regulation on price, shows a strong, positive correlation between house prices and over-regulation. Take, for example, San Francisco, where it takes 861 days to get a permit for one residential home. In Houston, it takes just 15 days . That’s huge savings for homebuilders and, therefore, homeowners. For Texas to remain competitive, it must guard against bureaucratic bottlenecks like those developing in Austin, where simply getting residential site plans approved now takes one to two years . To remain prosperous, Texas must keep and improve on free-market principles, especially in housing. Otherwise, the resulting higher costs of living will force people and businesses elsewhere. Florida has done a good job winning the war against excessive regulation to make way for more home construction. In 2019, the Sunshine State passed a law allowing third parties to help streamline the permitting process, alleviating wait times for home construction. In 2021, it passed a shot-clock law that effectively limited permit responses by cities to no more than 30 days. It’s not complicated: The states and cities that will prosper in the coming decade will be those that allow a less regulated housing market so the quantity of housing supplied can efficiently meet the quantity demanded. For states that plan to attract business while retaining residents, they must improve the regulatory environment for builders by getting out of the way. This should include streamlining building regulations to make it easier to build new housing, reforming land use policies to encourage development, and sorting out the bureaucratic bottleneck that complicates the building process. Like musical chairs, if you have fewer chairs than people, some people have to find a new home … or a state. Vance Ginn, former associate director for economic policy in the White House Office of Management and Budget, is president of Ginn Economic Consulting, LLC , chief economist at Pelican Institute for Public Policy, and senior fellow at Young Americans for Liberty. Nicole Nabulsi Nosek is the founder and chair of Texans for Reasonable Solutions. Originally published at Washington Examiner. Key Point: Americans are suffering under big-government policies as average weekly earnings adjusted for inflation are down for 21 straight months. It's time for pro-growth policies to unleash economic potential to let people prosper. Overview: The irresponsible “shutdown recession” and subsequent government failures have led to a longer, deeper recession with high inflation that are having persistent consequences for many Americans’ livelihoods. This includes excessive federal spending redistributing scarce private sector resources with deficit spending of more than $7 trillion since January 2020 to reach the new high of $31.4 trillion in national debt—about $95,000 owed per American or $250,000 owed per taxpayer. This new debt has hit its limit and needs to be addressed with spending restraint as the Federal Reserve monetized most of the new debt, leading to a 40-year-high inflation rates. The failed policies of the Biden administration, Congress, and the Fed must be replaced with a liberty-preserving, free-market, pro-growth approach by the new majority by House Republicans so there are more opportunities to let people prosper. Labor Market: The U.S. Bureau of Labor Statistics recently released the U.S. jobs report for December 2022. The BLS’s establishment report shows there were 223,000 net nonfarm jobs added last month, with 220,000 added in the private sector. Interestingly, while there have appeared to be a relatively robust number of jobs created, a recent report by the Philadelphia Fed find that if you add up the jobs added in states in Q2:2022 there were just 10,500 net new jobs rather than more than 1 million initially estimated. This further indicates that the recession started in (likely) March 2022 (more on this below). That expected revision to the establishment report supports the weak data in the BLS’s household survey, which employment increased by 717,000 jobs last month but had declined in four of the last nine months for a total increase of 916,000 jobs since March 2022. This number of net jobs added since then is much lower than the report 2.9 million payroll jobs in the establishment. The official U3 unemployment rate declined slightly to 3.5%, but challenges remain, including: 3.1% decline in average weekly earnings (inflation-adjusted) over the last year, 0.4-percentage point lower prime-age (25–54 years old) employment-population ratio than in February 2020, 0.6-percentage point below prime-age labor force participation rate, and 1.0-percentage-point lower total labor-force participation rate with millions of people out of the labor force. These data support my warnings for months of stagflation, recession, and a “zombie economy.” This includes “zombie labor” as many workers are sitting on the sidelines and others are “quiet quitting” while there’s a declining number of unfilled jobs than unemployed people to 4.5 million And that demand for labor is likely inflated from many “zombie firms,” which run on debt and could make up at least 20% of the stock market and will likely lay off workers with rising debt costs. Economic Growth: The U.S. Bureau of Economic Analysis’ released economic output data for Q4:2022. The following provides data for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. The shutdown recession in 2020 had GDP contract at historic annualized rates because of individual responses and government-imposed shutdowns related to the COVID-19 pandemic. Economic activity has had booms and busts thereafter because of inappropriately imposed government COVID-related restrictions in response to the pandemic and poor fiscal policies that severely hurt people’s ability to exchange and work. Since 2021, the growth in nominal total GDP, measured in current dollars, was dominated by inflation, which distorts economic activity. The GDP implicit price deflator was +6.1% for Q4-over-Q4 2021, representing half of the +12.2% increase in nominal total GDP. This inflation measure was +9.1% in Q2:2022—the highest since Q1:1981—for a +8.5% increase in nominal total GDP that quarter. This made two consecutive declines in real total (and private) GDP, providing a criterion to date recessions every time since at least 1950. In Q3:2022, nominal total GDP was +7.6% and GDP inflation was +4.4% for the +3.2% increase in real total GDP. But if inflation had been as high as it was in the prior two quarters or had the contribution of net exports of goods and services (driven by natural gas exports to Europe) not been 2.9%, real total GDP would have either declined or been essentially flat for a third straight quarter. In Q4:2022, there was a similar story of weaknesses as nominal total GDP was +6.4% and GDP inflation was +3.5% for the +2.9% increase in real total GDP. But if you consider the +2.9% real total GDP growth was driven by contributions of volatile inventories (+1.5pp), government spending (+0.6pp), and next exports (+0.6pp) which total +2.7pp, the actual growth is quite tepid. For all of 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.96%, which was the slowest Q4-over-Q4 growth for a year since 2009 (last part of Great Recession). The Atlanta Fed’s early GDPNow projection on January 27, 2023 for real total GDP growth in Q1:2023 was +0.7% based on the latest data available. The table above also shows the last expansion from June 2009 to February 2020. The earlier part of the expansion had slower real total GDP growth but had faster real private GDP growth. A reason for this difference is higher deficit-spending in the latter period, contributing to crowding-out of the productive private sector. Congress’ excessive spending thereafter led to a massive increase in the national debt that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in the following figure with federal spending and tax receipts as a share of GDP. But the Fed monetized much of it to keep rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 6% since the record high in April 2022. The Fed will need to cut its balance sheet (see first figure below with total assets over time) more aggressively if it is to stop manipulating so many markets (see second figure with types of assets on its balance sheet) and persistently tame inflation. The resulting inflation measured by the consumer price index (CPI) has cooled some from the peak of 9.1% in June 2022 but remains hot at 6.5% in December 2022 over the last year, which remains at a 40-year high (highest since June 1982) along with other key measures of inflation (see figure below). After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only 1.1% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, high deficits and taxes are always and everywhere a spending problem. The figure below (h/t David Boaz at Cato Institute) shows how this problem is from both Republicans and Democrats. As the federal debt far exceeds U.S. GDP, and President Biden proposed an irresponsible FY23 budget and Congress never passed one until the ridiculous $1.7 trillion omnibus in December, America needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on population growth plus inflation. If Congress had followed this approach from 2002 to 2021, the (updated) $17.7 trillion national debt increase would instead have been a $1.1 trillion decrease (i.e., surplus) for a $18.8 trillion swing to the positive that would have reduced the cost to Americans. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And the Federal Reserve should follow a monetary rule.

Bottom Line: Americans are struggling from bad policies out of D.C., which have resulted in a recession with high inflation. Instead of passing massive spending bills, like passage of the “Inflation Reduction Act” that will result in higher taxes, more inflation, and deeper recession, the path forward should include pro-growth policies. These policies ought to be similar to those that supported historic prosperity from 2017 to 2019 that get government out of the way rather than the progressive policies of more spending, regulating, and taxing. The time is now for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty. Recommendations:

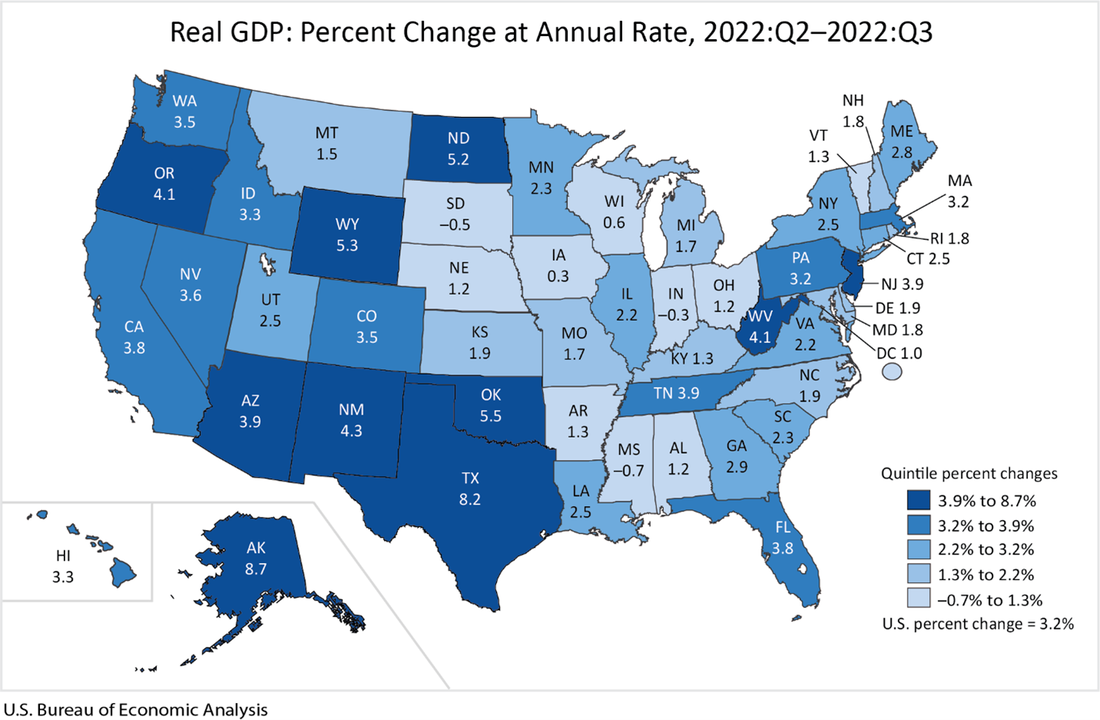

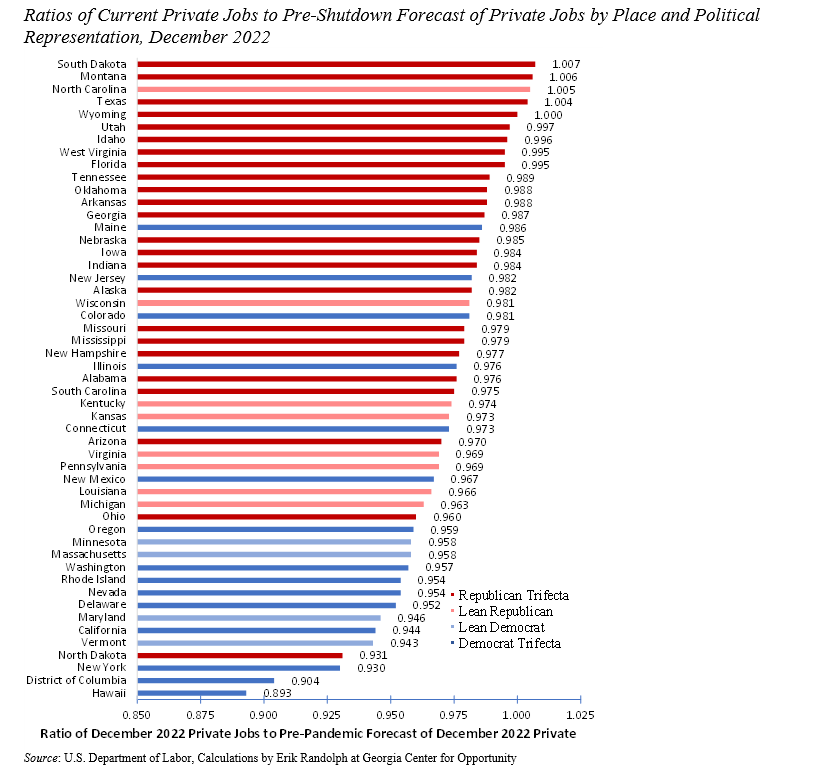

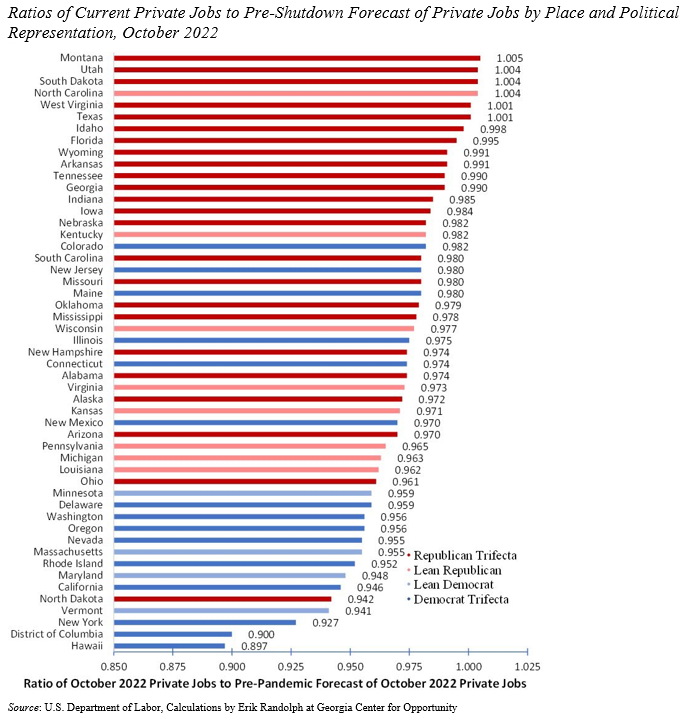

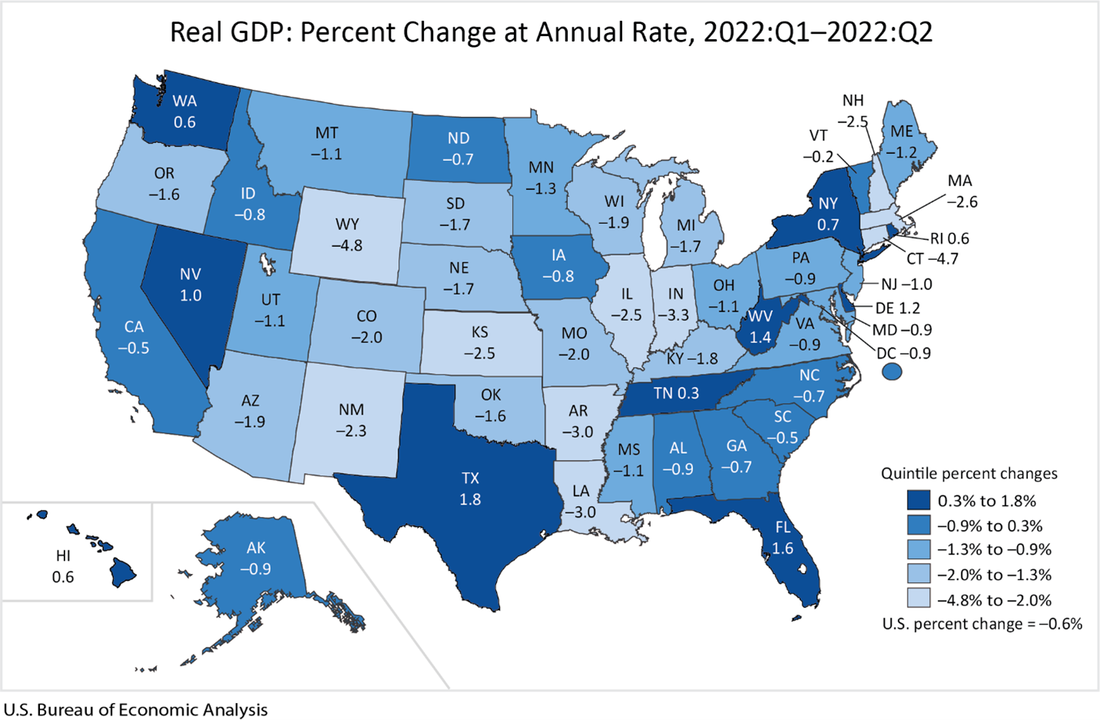

Key Point: Texas continues to lead the way in job creation over the last year (see first figure) and second in economic growth in the third quarter of 2023 (see last figure), but there’s more to do to help struggling Texans deal with the state’s affordability crisis, especially spending, regulating, and taxing less. Overview: Texas has been a national leader in the economic recovery since the inappropriate shutdown recession in Spring 2020. This includes reaching a new record high in total nonfarm employment for the 14th straight month, leading exports of technology products for 20 consecutive years, and being home to more than 50 of the world’s Fortune 500 companies. While the 87th Texas Legislature in 2021 supported the recovery by passing many pro-growth policies like the nation’s strongest state spending limit, there’s more to do in the ongoing 2023 session to remove barriers placed by state and local governments. Labor Market: The best path to prosperity is a job, as it helps bring financial self-sufficiency, dignity, hope, and purpose to people so they can earn a living, gain skills, and build social capital. The table below shows the state’s labor market for December 2022. The establishment survey shows that net nonfarm jobs in Texas increased by 29,500 last month, resulting in increases for 31 of the last 32 months, to bring record-high employment to 13.7 million. Compared with a year ago, total employment was up by 650,100 (+5.0%)—fastest growth rate in the country—with the private sector adding 628,800 jobs (+5.7) and the government adding 21,300 jobs (+1.1%). The household survey shows that the labor force participation rate is slightly higher than in February 2020 but well below June 2009 at the trough of the Great Recession. The employment-population ratio fell was unchanged in November and nearly where it was in February 2020, and the private sector now employs 700,000 more people than then. Texans still face challenges with a worse unemployment rate, though historically low, and nonfarm private jobs just recently above its pre-shutdown trend (Figure 1). The figure below compares the ratio of current private employment to pre-shutdown forecast levels in red states and blue states if both chambers of the legislature and the governor are Republican (dark red), Democrat (dark blue), or some combination (lighter colors). The results show a clear distinction between red states and blue states, with the stringency of restrictions by governments during the pandemic along with pro-growth policies before and after the shutdowns playing key roles. Specifically, 21 of the 25 states with the best (highest) ratios are in red-ish states while 13 of the 15 states and D.C. with the worst (lowest) ratios are in blue-ish places as of December 2022. The following figure from Soquel Creek on Twitter tells the story even more directly: those states with more economic freedom prosper more than those with less economic freedom (see rankings in Fraser Institute's Economic Freedom of North America report: FL ranks #1, Texas ranks #4, California ranks #49, and New York ranks #50). Overall, multiple indicators should be considered in this nuanced labor market, such as the fact that the unemployment rate is a weak indicator as many have dropped out of the labor force. While the labor force participation rate in Texas slightly exceeds where it was before the shutdowns, and the 3.9% unemployment rate could be considered full employment, the employment-population ratio is 0.2-percentage point below the pre-shutdown ratio. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real gross domestic product (GDP) by state for Q3:2022. The Figure below Texas had the second fastest GDP growth (first is Alaska) of +8.2% on an annualized basis to $1.89 trillion (above the U.S. average of +3.2% to $20.05 trillion). In the prior quarter, Texas had the fastest growth with +1.8% growth as the U.S. average declined by -0.6% that quarter. Of course, these followed Texas’ GDP contractions of -7.0% in Q1:2020 and -28.5% in Q2 during the depths of the shutdown recession. Fortunately, GDP rebounded in Q3 and Q4, yet declined overall in 2020 by -2.9% (less than -3.4% decline of U.S. average) but increased by +3.9% in 2021 (below the +5.9% U.S. average). The BEA also reported that personal income in Texas grew at an annualized pace of +6.9% in Q3:2022 (ranked 6th highest and faster than the U.S. average of +5.3%) but slower than the robust +8.4% in Q2:2022 (ranked 6th best and above the U.S. average of +4.9%) as job creation and inflated income measures found their way across the economy.  Bottom Line: As Texas recovers from the shutdown recession and faces an uncertain future with the U.S. economy having stagflation and a likely recession, Texans need substantial relief to help make ends meet. Other states are cutting, flattening, and phasing out taxes, so Texas must make bold reforms to support more opportunities to let people prosper, mitigate the affordability crisis, and withstand destructive policies out of D.C.

Free-Market Solutions: In 2023, the Texas Legislature should improve the Texas Model by:

Our country’s economic journey throughout 2022 is one for the books. We had the highest inflation in 40 years , the highest mortgage rates in 20 years , and the worst stock market declines in 14 years . People are still struggling to pay bills, reduce debt, and save money, with average weekly earnings adjusted for inflation down 3% year over year .

The dismal state of the economy blindsided many people last year, but we don’t have to be caught so unaware in 2023. Knowledge is power, and knowing what could happen this year might make a difference in your finances. I believe that the burden of the inflationary recession will intensify this year. Expect to see the economy continue to correct from the consequences of Congress’s excessive deficit-spending that simply moved our money around, Biden’s overregulation that stifled energy production and other markets, and the Federal Reserve’s monetary mischief that manipulated markets through its bloated balance sheet. Currently, the Fed’s balance sheet remains well over $8.5 trillion , not falling nearly fast enough after it peaked at $8.9 trillion in April 2022. Much of this stems from when the Fed’s balance sheet more than doubled due to pandemic-related shutdowns to help Congress afford massive spending that ballooned the national debt by more than $7 trillion over the last three years. Now, the debt sits at about $31.5 trillion . Adding to the perfect storm is a regulation-happy president, Joe Biden, who hinders the ability of the free market to flourish, particularly in the areas of oil and gas, with his flawed green-energy agenda. The vital ingredients for a suffering economy with continually high inflation and high interest rates are present. The popular misery index (a measurement of economic distress on the everyday person), which uses the unemployment rate plus inflation, was above 10% in December — the highest rate since before the shutdowns in 2012. Given the projection of the economy in 2023, we can expect rising unemployment and elevated inflation as employers cut costs or raise prices to stay afloat. We’ve already seen employment take hits in the household survey, which has shown net employment declined in four of the last nine months for a total increase of just 916,000 jobs added since March 2022. In short, we’re looking at a continued inflationary recession with higher interest rates in 2023. It won’t be pretty, but there’s a reason for hope: a divided Congress. Republicans now have control of the House, and Democrats have control of the Senate and the White House. That division can create roadblocks to poor policies being pushed out of the Biden administration and the Democrat-controlled Senate, which has destroyed economic opportunities over the last two years. But the other possibility is more costly executive orders from Biden as he seeks to push more green energy policies, such as the ESG investing scam or stopping permits for oil and gas, and other flawed initiatives. This would mean more blockades to free-market flourishing. If the economy is prohibited from growing due to excessive regulation, taxation, and spending, we can anticipate that things will get worse before they get better. We’re in this mess because of 2020’s “shutdown recession” and subsequent government failures. The way out is the proven recipe of pro-growth, liberty-enhancing policies of less spending, taxation, and regulation while the Fed aggressively cuts its balance sheet. This would unleash the economic potential of the productive private sector and get people working well-paid jobs while substantially reducing inflation. In the meantime, hardworking people should minimize expenses, save for the storms ahead, and stay connected to family and the community for the smoothest possible sailing throughout what is sure to be a bumpy ride in 2023. Originally published at Washington Examiner. A 2022 Pew Research Center survey found that an alarming number of people still believe that socialism “gives all people an equal opportunity to be successful,” with 52% agreeing this statement is at least somewhat true for socialism.

Fortunately, 64% agreed that statement is at least somewhat true for capitalism. Still, it is evident that most people who favor socialism don’t understand it or its negative consequences. Apologists for socialism need to understand what the late economist Friedrich Hayek said: “There is all the difference in the world between treating people equally and attempting to make them equal. While the first is the condition of a free society, the second means, as de Tocqueville describes it, a new form of servitude.” Socialist economies surrender class distinction by giving up freedom to politicians in the marketplace, including work, education, healthcare, and more. This is the exact opposite of “free.” Nothing scarce is free because there are trade-offs that come with every decision. Nations with socialized labor, schooling, and medicine must fund them at the expense of taxpayers, from the lost productivity that results from less economic growth, and from the lost opportunities with each of those taken dollars. People in socialist economies work under a glass ceiling that they can never break. They surrender so much of their resources to the government that it contributes to a forced mediocrity. But in capitalist economies, the ceiling is much higher. People have more potential to prosper because the means of capital and labor are owned by them personally, not by politicians. Greater economic freedom under capitalism tends to yield higher life expectancies, higher incomes, greater per capita GDP, and less poverty when considering countries or states . But when the government is empowered instead of its citizens, people are left with few options for innovative solutions in the private sector. This destroys organic competition, where the best solution can be the most successful. This bears out the experience of socialist economies, that the government institutions dominating the provision of services typically have low quality at high cost. Some socialists claim that their preferred system of pooling resources for everyone is a superior way of helping people than philanthropy or the work of employers, churches, or charities. But this assumes that a one-size-fits-all approach will work for everyone. In reality, each person is different with unique needs, which is why making ways for entrepreneurs to create new solutions is critical. A system run by politicians can never fully satisfy the needs of its people. It makes winners of the politically connected and losers of everyone else. One reason that people, especially young adults, may find socialism appealing is because it appears compassionate on its surface. A paradise where everyone is clothed, fed, and happy sounds like something to desire. But that’s never the outcome when liberties are surrendered to leaders. The lack of belief in free markets is really the lack of belief in free people. Too many on the Left and the Right fail to understand this fact with their big-government solutions. The world is witnessing this reality unfold in real time in the once-thriving nation of Cuba . Cubans embraced socialism 60 years ago with high hopes and are now impoverished and starving, waiting in line for hours with hopes of getting some bread , while politicians spend their money on sports teams and hotels to impress outsiders. By its nature, socialism disempowers people and forces them down the road to serfdom. Capitalism, with a free market economy of voluntary exchange and limited government, allows spontaneous order with a well-functioning price system to best allocate resources to those who value it most. This results in a compassionate system for people rather than for politicians. Socialism hasn’t worked, other than to impoverish many people across the globe. Stop its expansion and instead return to the antidote: free market capitalism. Originally published at Washington Examiner. America is in the midst of an identity crisis, and it’s probably not the kind you’d think. Our nation is wrecked by an abysmal economy and unhappy people losing confidence in their country. In such unhappiness, people on both sides of the political aisle too often propose “solutions” that grant the government more control of our lives, even though that control is usually the source of the problem.

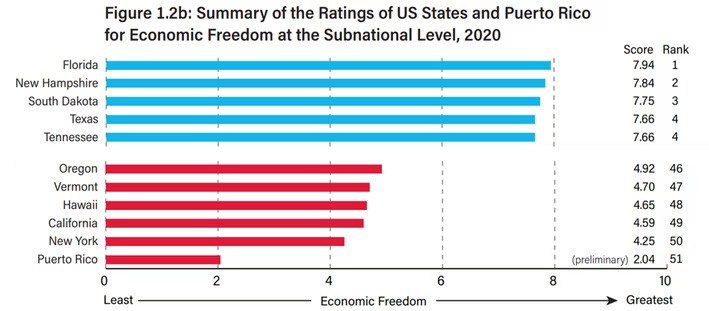

The American experiment has paved the way for millions to escape poverty and build a better life via a free-market system with a constitutional republic that encourages innovation and results in more human flourishing than ever before. We need to get back to those roots. I had the opportunity to discuss this phenomenon with Dr. Samuel Gregg, author of the book The Next American Economy and distinguished fellow at the American Institute for Economic Research, who said this country’s founding values are based on “liberty and personal responsibility.” What set America apart was a vision for commoners to determine their own future, and we continue to rank as the most entrepreneurial country in the world. American’s earliest ideals demanded liberty and responsibility, rejecting directives from a distant King. As a result, the roles of the federal and state governments were carefully managed by a system of federalism, with checks and balances to restrain overreach and protect liberty. According to Gregg, this ongoing experiment is why immigrants are continually inspired to leave their homes and venture to the United States. These core tenets of America have become less defined over the past century. America has increasingly chosen big government over individual liberties, thereby reducing the benefits of free-market capitalism. The major expansions of government started in the progressive era, with Presidents Teddy Roosevelt, Woodrow Wilson, and Herbert Hoover. Those historic expansions were put on steroids by President Franklin D. Roosevelt’s “New Deal,” which prolonged and deepened the Great Depression. Likewise, President Lyndon B. Johnson’s “Great Society” program ballooned government through the creation Medicare and Medicaid, among others. The results have been massive government spending with increased dependency on government programs. President George W. Bush’s expansion of Medicare with Part D provided some prescription drug coverage for seniors, with questionable results, at a massive cost. President Barack Obama’s Obamacare expanded government control, contributing to the high cost and declining quality of US healthcare. President Trump’s attempt to punish China with tariffs actually punished low-income Americans most. Most recently, President Biden’s 2022 “Inflation Reduction Act” further grows government, without reducing inflation and at a huge cost to taxpayers. Inflating the role of government in an attempt to solve underlying issues created by big government created a vicious cycle that continues today. Government meddling distorts the economy by blocking and confusing free people’s choices. This results from a cultural shift, where Americans increasingly seem to believe government can solve problems better than markets or individuals. This belief is contradicted by the evidence. The lack of belief in free markets is really the lack of believe in free people, as the market is nothing but people. Big government is usually the cause of economic and social problems, so trying to solve them with more government just exacerbates the issues. A severe deficit in the knowledge of history, both of culture and economics, helps explain why post-modern socialist solutions increasingly entrance younger generations. Unlike older countries, America’s identity comes from the “texts, documents, and debates” that created our founding, says Gregg. Surveys show that only 1 in 3 Americans can pass a citizenship test, because most of them aren’t familiar with the foundational ideas outlined in our texts and documents. A national identity crisis is near-inevitable, when we forget our core values of liberty and personal responsibility The further we stray from the principles that made our nation great (including free-market capitalism, a constitutional republic, and personal responsibility) the more swiftly we head down what economist Friedrich Hayek called “the road to serfdom.” Only by learning our unique history, and grasping the principles of free-market economics free from burdensome interference, can Americans embark on the next American economy. Originally published at AIER.  People point to tax burdens and over-regulation as the reasons for economic decline. But the reality is that high government spending is the precursor to heavy taxes and regulation. Look no further than the Fraser Institute’s latest report to see how states rank for economic freedom based on government spending, taxes, and labor market regulation. The five lowest-ranking states for economic freedom are Oregon (46th), Vermont (47th), Hawaii (48th), California (49th), and New York (50th). The most economically free states are Florida (1st), New Hampshire (2nd), South Dakota (3rd), Texas (4th), and Tennessee (4th). I recently interviewed Dr. Dean Stansel, contributing author of the report, about his findings. He said, “anytime the government takes from you, that’s an infringement on your freedom.” And he’s right; if the government doesn’t spend, it doesn’t need to tax and it wouldn’t fund bureaucrats to regulate.

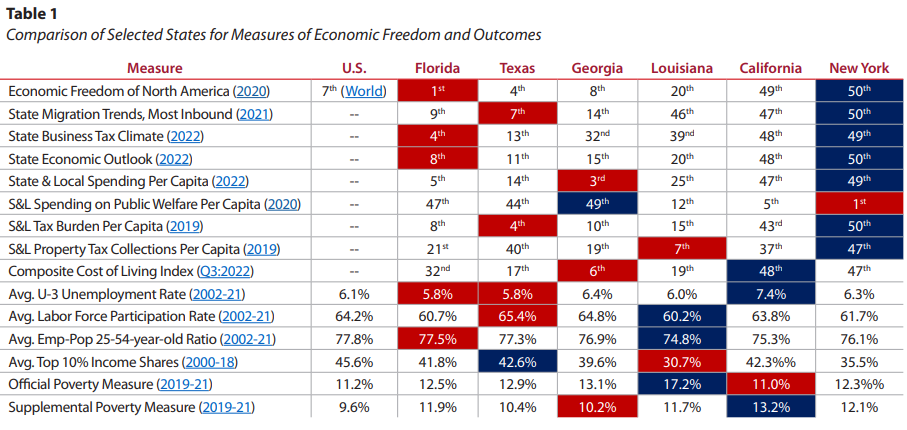

The data in the report are two years behind, so these findings reflect 2020, which include only a few months of the pandemic-related shutdowns and excessive policy restrictions. Given the continued excess of spending since then, there is good reason to believe that the scores will look worse in the following reports, even if the relative rankings don’t change much. The lowest-ranking states for economic freedom spend excessively and raise taxes to fund self-imposed expenses instead of limiting spending to what the average taxpayer can afford. Given this, there’s no surprise that New York is 50th. The state’s extreme spending has led it to what’s been estimated as a $10 billion deficit. It also ranks last in individual income taxes and second to last in property taxes, according to the Tax Foundation’s latest rankings of state business tax climate, which ranks the state 49th. Florida, on the other hand, ranks first in economic freedom with no personal income taxes, and ranks fourth among states in business tax climate. The trend is similar among the more and less economically free states: those with lower spending, taxes, and regulations boast better economic freedom rankings, while states like New York and California with egregious tax burdens and regulations are the least economically free. According to Stansel, the top states remained at the top even after pandemic-related shutdowns slowed state economies because they more successfully kept spending, taxes, and labor market regulations under control. But the real question is: why should we care about economic freedom? Economic freedom is the measure of how much people can decide for themselves on how to meet their needs, given that we live in a world where resources, especially time, are scarce. In free-market capitalism, people own and direct the means of capital and labor. But with socialism, politicians own and direct the means of capital and labor. Government interference, whether in the form of excessive government spending that distorts economic activity, or heavy taxation and barriers to work and capital growth through regulation, reduces means and opportunities for voluntary exchange that supports greater human flourishing. The more regulations state governments impose, the less incentive people have to work and be entrepreneurial. The more the state taxes, the less money people have to contribute to the savings, investment, and capital growth that provides for the wealth of nations’ investment. People are fleeing less economically free states toward the freer. There is greater potential for personal flourishing where there are fewer barriers to individual decisions that support economic growth. While tax and regulation reforms are reasonable steps for states seeking more economic freedom, it won’t help much if state spending remains unrestrained. According to the late economist and originator of the ideas for the EFNA report, Milton Friedman, the ultimate burden of government is not how much it taxes, but how much it spends. Balancing the budget is one thing, but that’s a short-term fix for an ideological problem too many states seem to have made, about the expanded role of government. Taxpayers must fund government programs when instead, the government should be limited to its constitutional roles so more money stays in the pockets of taxpayers and the productive private sector. Until states decide to impose a strict spending limit based on a maximum rate of population growth plus inflation, cut and eliminate burdensome taxes, and scrap burdensome regulations, economic freedom will continue to collapse. And, more importantly, people will suffer. States must not let that happen. Instead, state governments should get out of the way so that economic freedom can empower people to prosper. Originally published at AIER. Those states that practice more free-market capitalism with limited government tend to have better economic performance, providing an economy and civil society with opportunities to help the neediest among us achieve long-lasting prosperity. Key points – Comparing institutional frameworks in states and their outcomes provides key factors that encourage thriving states, families, and entrepreneurs. – Measures of economic freedom and government burden are useful indicators of which states have growing economies and more jobs over time. – The results for these states demonstrate how institutions that encourage individual liberty, free enterprise, and civil society support prosperous outcomes, particularly in relieving poverty. – States ought to pursue policies that advance more of these lessons to provide a robust economy and flourishing civil society that will best help the neediest among us. Original post at TPPF. Is the flat income tax revolution underway across the states enough? No, but it must be advanced.

This extraordinary feat includes four states passing a flat personal income tax in 2022 after only four did over the last century. Now 14 states have or will soon have flat income taxes. But if you consider how the nine states without personal income taxes outperform, on average, the nine states with flat income taxes in economic growth, domestic migration, and nonfarm payroll employment over the last decade, more is necessary. While flattening income taxes is important, eliminating them is best. And this should be tied to spending restraint to avoid the infamous Kansas problem of excess spending while cutting taxes. The five states always with a flat income tax were Massachusetts (1917), Indiana (1965), Michigan (1967), Illinois (1969), and Pennsylvania (1971). The next four states initially with progressive income taxes before improving to a flat income tax were Colorado (1987), Utah (2007), North Carolina (2014), and Kentucky (2019). The four states that passed a flat income tax in 2022 were Idaho (starts in 2023), Mississippi (2023), Georgia (2024), and Iowa (2026). After a recent court decision, Arizona will also have a flat income tax in 2023 at the lowest rate in the nation at 2.5%. This will support greater economic growth as progressive personal income taxes disincentivize people to work and live in those states. This is happening in California, where even its wealthy citizens are fed up with sky-high personal income taxes that will worsen when the top marginal tax rate rises to 14.4% in 2024. According to the American Legislative Exchange Council’s 15th edition of the Rich States, Poor States report that compares the economic performance of the 50 states, the nine states already with a flat income tax rank mostly in the middle of the pack from 2010 to 2020. This includes an average overall ranking for those nine states of 24th based upon three key economic variables with average rankings of 23rd in state gross domestic product (GDP), 29th in absolute domestic migration, and 22nd in nonfarm payroll. The highest overall rankings for these states are Utah (2nd) and Colorado (6th), lowest are Illinois (43rd) and Pennsylvania (45th). States should seek better outcomes that ultimately help people flourish. The nine states without a personal income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. These states have average rankings in ALEC’s report of 19th overall, 22nd in GDP, 14th in migration, and 21st in jobs. The highest overall rankings are Florida (3rd) and Washington (5th), with Texas (8th) and Tennessee (10th) also in the top 10, and lowest are Wyoming (41st) and Alaska (49th). Historically, the nine states with the highest personal income tax rates, including California (ranks 19th) and New York (36th), have underperformed in these economic measures and have dire outlooks ranking 48th and 50th, respectively, in ALEC’s report. Progressive, high-income tax structures produce undesirable outcomes, and states should work toward eliminating personal income taxes. Other taxes and policies matter. The Tax Foundation’s latest report on state business tax climates shows how other taxes influence business activity, and thus economic performance. States without a personal income tax or lower tax burdens overall rank the highest in business tax climate with Wyoming (1st), South Dakota (2nd), Alaska (3rd), and Florida (4th) leading the way. And those states with the highest personal income rates perform worst with California (48th), New York (49th), and New Jersey (50th) being last. What many of these states without personal income taxes tend to use to fund their spending are consumption-based taxes. The least burdensome form of taxation tends to be a flat final sales tax with the broadest base and lowest rate possible. Whatever you tax, you get less of it. Taxing consumption results in less consumption but more savings, which can support greater capital accumulation and economic growth while taxing the underground economy, such as drug dealers and undocumented workers. But the ultimate burden of government is not how much it taxes but how much it spends. Jonathan Williams, who is a co-author of the ALEC report, correctly noted, “There are nine states with no income taxes, and they spend substantially less per capita than states with an income tax.” When there’s already heavy headwinds imposed by policymakers in Washington and across many states, it’s time to build on the flat tax revolution by cutting or even freezing state budgets, strengthening state spending limits, and eliminating personal income taxes. Original post at EconLib. Key Point: Texas recently leads the way in job creation and economic growth but there’s more to do to help struggling Texans deal with the state’s affordability crisis, especially freezing government spending and moving further to sales taxes. Overview: Texas has been a national leader in the economic recovery since the inappropriate social and economic shutdowns that caused a severe recession in Spring 2020. This includes reaching a new record high in total nonfarm employment for the 12th straight month, leading exports of technology products for 20 consecutive years, and being home to 54 of the Fortune 500 companies. While the 87th Texas Legislature in 2021 supported the recovery by passing many pro-growth policies like the nation’s strongest state spending limit, there’s more to do in 2023 to remove barriers placed by state and local governments. Solutions include governments passing responsible budgets and returning surplus tax dollars collected to taxpayers by reducing property taxes until they’re eliminated. Other states are cutting, flattening, and phasing out taxes, so Texas must make bold reforms to support more opportunities to let people prosper, mitigate the affordability crisis, and withstand destructive policies out of D.C. Labor Market: The best path to prosperity is a job, as it helps bring financial self-sufficiency, dignity, hope, and purpose to people so they can earn a living, gain skills, and build social capital. The table below shows the state’s labor market for October 2022. The payroll survey shows that net nonfarm jobs in Texas increased by 49,500 last month, resulting in increases for 29 of the last 30 months bring record-high employment to 13.6 million. Compared with a year ago, total employment was up by 694,200 (+5.4%), which was the fastest growth rate in the nation, with the private sector adding 670,200 jobs (+6.1%) and the government adding 24,000 jobs (+1.2%). The household survey shows that the labor force participation rate is slightly higher than it was in February 2020 but below June 2009 at the trough of the Great Recession. The employment-population ratio is nearly back to where it was in February 2020, and the private sector now employs 600,000 more people. Texans still face challenges with a worse unemployment rate, though historically low, and nonfarm private jobs just recently above its pre-shutdown trend (Figure 1). Figure 1 compares the ratio of current private employment to pre-shutdown forecast levels in red states and blue states if both chambers of the legislature and the governor are Republican (dark red), Democrat (dark blue), or some combination (lighter colors). The results show a clear distinction between red states and blue states, with the stringency of restrictions by governments during the pandemic along with pro-growth policies before and after the shutdowns playing key roles. Specifically, 22 of the 25 states with the best (highest) ratios are in red-ish states while 13 of the 15 states and D.C. with the worst (lowest) ratios are in blue-ish places. Figure 1 Figure 1 is informative because only Republican governors, with the exception of Louisiana, ended the supplemental unemployment payments that contributed to some people receiving more than while working before the payments expired. These data indicate a strong relationship between sound policy and more job creation. Overall, multiple indicators should be considered as the unemployment rate is a rather weak signal of the labor market. While the labor force participation rate in Texas exceeds where it was before the shutdowns, and the 4.0% unemployment rate could be full employment, the employment-population ratio is 0.2-percentage point above the pre-shutdown ratio. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) provided the real gross domestic product (GDP) by state for Q2:2022. Texas had the fastest GDP growth of +1.8%—to $1.85 trillion—on an annualized basis (above the -2.6% U.S. average). These followed Texas’ GDP growth declines of -7.0% in Q1:2020 and -28.5% in Q2 during the depths of the recession. GDP rebounded in Q3 and Q4, yet declined overall in 2020 by -2.9% (less than -3.4% decline of U.S. average) but increased by +3.9% in 2021 (below the +5.9% U.S. average). The BEA also reported that personal income in Texas grew at an annualized pace of +9.3% in Q2:2022 (ranked 3rd best and above the +5.8% U.S. average) as job creation and inflated income measures found their way across the economy.

Bottom Line: As Texas recovers from the shutdown recession and faces an uncertain future with the U.S. economy having stagflation and a likely recession, Texans need substantial relief to help make ends meet. While the Texas Model was strengthened by the 87th Legislature last year from less government spending, taxing, and regulating, more is needed for limiting government at the state and local levels. Recommendations: In 2023, the Texas Legislature should improve upon its past efforts by:

The latest U.S. Jobs Report for September 2022 may look good, but a peek under the hood shows major weakness in a fragile economy. Things will get worse before they get better. And those most affected by the worsening economy are everyday Americans, small business owners, and entrepreneurs, without whom capitalism’s prosperity crumbles.

Of course, Democrats fearing upcoming election loss are hiding behind the record-low 3.5 percent unemployment rate to ignore the reality that inflation-adjusted average hourly earnings fell by 3 percent over the last year, the 18th consecutive monthly decline. These earnings have risen slower than inflation, essentially after the $1.9 trillion, March 2021 American Rescue Plan that was supposed to “stimulate” the economy. Unfortunately, trillions more taxpayer dollars have been appropriated since then, further fueling the fire of money-printing by the Federal Reserve, which is a major cause of 40-year high inflation that won’t soon moderate without a more aggressive tightening policy. The trickle-down effects of high inflation from money-printing funding excessive deficit-spending are keenly felt by American families, who have experienced an estimated loss in real income per capita of $4,200 since January 2021. And 40 percent more say they may not be able to pay their bills, compared to a year ago. Americans are forced to make tradeoffs they should never face. But with prices for food at home up 13.5 percent, shoppers must choose between eating healthy or paying the bills. Many are choosing less-healthy eating habits, creating health concerns in an already fragile healthcare system dominated by failures from government intervention. Reduced purchasing power has forced other tradeoffs, such as 93 percent of working Americans having a side hustle. The dismal state of the nation is squashing people’s potential to prosper. In addition to the average working American, businesses are hit hard. GAP, Peloton, Tesla, Microsoft, J.P. Morgan, and countless others have laid off hundreds to thousands of workers as they grapple with the effects of this recession. More importantly, 75 percent of small business owners say inflation is hitting their profit margin and 56 percent don’t see inflation abating until at least summer 2023, forcing them to raise prices, cut overhead costs, and minimize labor hours. Unable to compete with big corporations that can keep costs lower, small businesses and entrepreneurs are seriously threatened. If the Fed doesn’t act more aggressively to substantially reduce its bloated $8.8 trillion balance sheet, lowering the high inflation it largely created, Americans will continue to suffer. This economy especially hurts the poor, who are stripped of their dignity without a well-paid job and the ability to afford necessities for their family. There must be a liberty-friendly, pro-growth approach moving forward, removing government barriers that have crippled the success of capitalism. This should include cutting government spending, taxes, and regulations to help quickly balance the budget, to stop fueling the Fed’s destructive policies. Congress should pass rules-based policies of a spending limit with a maximum growth rate of population growth plus inflation to cut bloated government spending, and a monetary policy rule, short of eliminating the Fed. At the very least, Republicans should help undo the damage from a reckless government that has added nearly $7 trillion in deficit spending over the last couple of years. Of course, this violates the Statutory Pay-As-You-Go Act of 2010. Last year, the Biden administration waived PAYGO, like the Trump administration inappropriately did in prior years, in pursuance of the American Rescue Plan Act. But with a now evenly divided Senate, Republicans have the power to oppose similar proposals that would drive the nation into deeper debt. To pull America away from the grips of a recession and the shackles of inflation, the government must get out of the way of the productive private sector. So long as the government continues egregious progressive policies, the hardworking Americans fueling the economy will be unable to do so, making for a government-dependent and economically unfree status that capitalism, with limited government, once helped them escape. Originally posted by AIER |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed