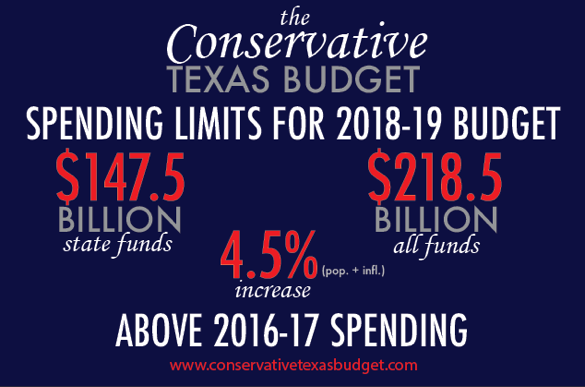

Last session, the Texas Legislature passed a generally conservative budget, defined as a budget that increases above previous appropriations by no more than the rate of state population growth plus inflation. This key spending metric accounts for changes in government spending from changes in the state’s population and the general cost of providing goods and services. Past legislatures have also passed conservative budgets; however, favorable budgets have consistently been followed by unfavorable ones with massive spending hikes. To prevent such costly cycles, the Texas Public Policy Foundation has joined with the Conservative Texas Budget Coalition to propose the 2018-19 Conservative Texas Budget (see Figure 1) as a guideline for the 85th Texas Legislature and government agencies (watch the recent press conference here and read the paper here). Figure 1: Spending Limits for a Conservative 2018-19 Texas Budget The Conservative Texas Budget sets a spending growth limit of 4.5 percent for the upcoming 2018-19 budget, ensuring that total appropriations will not exceed the estimated increase in population growth plus inflation over the two previous fiscal years (FY 2015 and FY 2016). Specifically, the Conservative Texas Budget sets spending limits that:

State government spending in Texas has increased 68.5 percent since 2004, or 11.8 percent faster than increases in compounded population growth plus inflation. Given this, the Legislature should control state spending by consistently passing a conservative budget. The Texas economy once benefited from high oil prices and a steady global economy; however, lower oil prices, a stronger U.S. dollar, and global economic weakness are detriments to economic growth. Therefore, it’s essential to pass a conservative budget that funds basic government-provided goods and services while reducing the tax burden on Texans. The Conservative Texas Budget will best equip Texas as it moves into a future that is forcibly less dependent on oil and gas. By using the past two fiscal years as a base rather than arbitrary predictions of the future, this budget is superior in both predictability and stability. Ultimately, holding government spending growth below population growth plus inflation will get spending back on track to funding basic goods and services so the excessive tax burden can be cut. By passing the second consecutive conservative budget, the 85th Texas Legislature will provide Texans the freedom needed to reach their full potential while upholding the Texas model of growth and prosperity as one for the nation to follow. www.texaspolicy.com/blog/detail/the-conservative-texas-budget-ending-an-unfavorable-budget-cycle

0 Comments

This commentary originally appeared on TribTalk on June 29, 2016

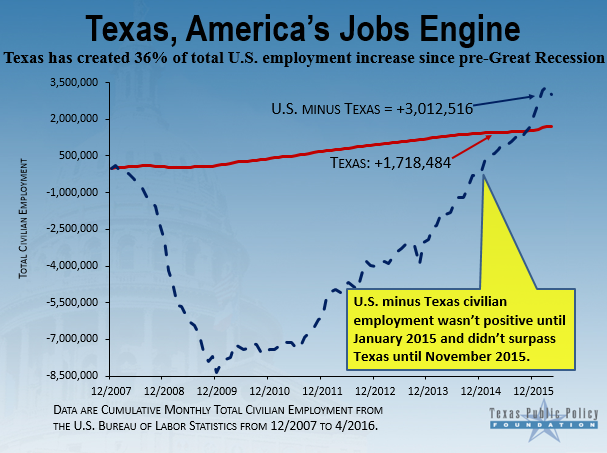

For Texas families to continue flourishing under a responsible model of no personal income tax and relatively low taxes overall, government spending must be restrained. The Texas Legislature can do this next session by passing a conservative spending limit. Research shows that a job is the best path to prosperity, and the Texas economy is a testament to that fact. Texas has created 36 percent of all civilian jobs in America since the latest national recession began in December 2007 and has had an unemployment rate at or below the U.S. average for 112 straight months. According to a recent report by the Texas Public Policy Foundation titled The Real Texas Budget, the current state budget of $209.1 billion is up 11.8 percent since 2004 after adjusting for the key metric of population growth plus inflation. This translates into $22 billion more spending (read higher taxes) in the current budget cycle, or roughly $1,600 for the average family of four this year. This excessive spending growth shows that more needs to be done to limit the excessive burden of government. A major impediment to slowing government spending is the weak constitutional spending limit. The state's current spending limit has three major problems:

To correct these problems, the Foundation and the 12 other members of the Conservative Texas Budget Coalition advocate for a conservative spending limit. This proposal would cover the entire state budget; would base its increase on the lowest growth rate of population growth plus inflation, personal income, or gross state product; and would use the two fiscal years immediately preceding a regular legislative session to calculate the growth rate. Reforming the spending limit in this way eliminates opportunities for legislators to use gimmicks to avoid the cap and abolishes projecting data that could be used for political purposes. Since historically population growth plus inflation has often been the lowest increase of the three metrics, it’s the one that should get the most attention. It certainly did at a recent Texas Senate Finance Committee hearing, where critics argued that using the population growth plus inflation limit would be inflexible and unnecessary. As the argument went, personal income is a better metric because it adds productivity to the population growth plus inflation metric. However, this assumes that the growth of productivity requires a corresponding increase in government spending, which is not necessarily the case. If the private sector is more productive, it makes more sense to leave tax dollars there so they’ll have greater economic benefit. Therefore, if there’s no reason to include productivity in the spending limit, then what’s left is population growth plus inflation. Research finds that simply moving to this metric could lead to tax relief and accelerated economic growth. In 2015, the 84th Texas Legislature proved that this limit could work by holding the increase in appropriations over previous spending to 2.9 percent — well below the 6.5 percent mark for a conservative budget based on our proposed limit. Overall, legislators were good stewards of tax dollars by setting budget priorities to meet the needs of the state while providing $4 billion in tax and fee relief. Although last session’s passage of a conservative budget is encouraging, there’s no constitutional guarantee that this fiscal responsibility will continue in future legislative sessions. Legislators should pass a conservative spending limit next session to keep more money in the pockets of hard-working Texans and promote prosperity for years to come. www.texaspolicy.com/blog/detail/texas-needs-a-conservative-spending-limit The Conservative Texas Budget sets spending limits on the growth of state funds and all funds for Texas’ 2018-19 budget.

www.texaspolicy.com/content/detail/the-2018-19-conservative-texas-budget AUSTIN – The Texas Public Policy Foundation along with the 12 additional member organizations of the Conservative Texas Budget Coalition today released The Conservative Texas Budget. The report’s authors, Talmadge Heflin, Director of the Center for Fiscal Policy at TPPF, and Economist Dr. Vance Ginn use a calculated state spending growth limit based on population growth plus inflation of 4.5 percent over the previous two fiscal years (FY 2015 & 2016) to set spending limits of $147.5 billion in state funds and $218.5 billion in all funds.

“The evidence is clear: low tax, low spend states perform better than high tax, high spend states. To cut the tax burden on Texans from previous spending excesses, the Texas Legislature should build on the momentum of last session by passing a historic second consecutive conservative budget,” said Heflin. “Doing so will provide the state with at most a spending increase of $9.4 billion to cover basic public necessities while prioritizing spending and cutting the tax burden on Texas taxpayers so that they can reach their full potential.” Dr. Ginn added, “The 2016-17 appropriations total is up $22 billion, or 11.8 percent, compared with if the Legislature had followed population growth plus inflation since the 2003 Legislative Session. This excess in budget growth above funding the increased cost in basic public goods and services burdens average Texas families of four with $1,600 more to fund state government this year. To cut this excessive tax burden, the 85th Texas Legislature should pass a conservative budget that increases by no more than population growth plus inflation of 4.5 percent while returning additional taxpayer dollars to hard-working Texans.” Americans for Tax Reform President Grover Norquist said, “By keeping growth in state spending below the rate of population and inflation when crafting a new budget in 2017, Texas lawmakers will ensure that state government lives within its means. Such spending restraint will also help legislators to get rid of the margin tax, which will ensure Texas remains the economic envy of the nation in the future.” Americans for Prosperity Foundation Texas State Director Jerome Greener added, “Americans for Prosperity-TX stands firmly for responsible spending and economical budgeting practices in Texas. To compensate for any spending increase, Texan families will be asked to shoulder a significantly heavier tax burden than they otherwise would. It is our hope that the Legislature will recognize the importance of balancing our budget and capping any budget increase to population and inflation to keep our economy strong.” Liberty Action Texas Executive Director Brendan Steinhauser said, "Texas needs a conservative budget in order to remain a beacon of liberty and opportunity for all Texans. Legislators should follow limited government principles and fight for a budget that limits spending to population growth plus inflation. Texas voters want to see conservative leadership in the capitol, and this is a chance for legislators to deliver just that." “Texas has proven to be an economic powerhouse over the last decade,” said Clark Packard, National Taxpayers Union’s (NTU) Counsel and Government Affairs Manager. “However, it is vital that Texas adopts a fiscally responsible rate of growth for their budget, which does not exceed inflation and population growth. A budget that exceeds this growth rate will prove detrimental to private sector growth and expand the reach of the state government." Texas Eagle Forum President Trayce Bradford said, “Today, the Texas Eagle Forum stands united with the Conservative Texas Budget Coalition to support the recommended spending limits for the 2018-19 budget outlined in The Conservative Texas Budget. While many factors contribute to Texas being an ideal state, Texas’ efforts to keep taxes low plays a key role. Unless intentional steps are taken to limit the growth of state spending next session, Texans will eventually find themselves burdened with higher taxes and a less conducive environment to pursue their dreams.” Our America Initiative Texas Director Gil Robinson said, "Our America Initiative is a grass roots organization that promotes liberty and personal choice through local action. The Texas government has a better record than many states in keeping spending within sustainable limits, but the framework to continue this record can be improved. We encourage the upcoming legislature to adopt a spending limit based on population growth plus inflation to better support the Texas miracle of a growing economy and affordable quality of life for its residents." "The key to developing good habits is consistency,” said R Street Texas Director Josiah Neeley. “The Texas legislature needs to continue the fiscal discipline it showed over the last two years during the upcoming session." Pamela Villarreal, senior fellow and manager, Tax Analysis Center, National Center for Policy Analysis, added, “A TEL based on population growth and inflation will benefit the state of Texas in two ways: limiting spending could potentially lead to lowering taxes, which would result in increased investment and personal income in the state. Or, the excess revenue could be put in a rainy day fund, which would cushion Texas in times of economic downturns.” “The Conservative Texas Budget provides prudent guidelines for how the Texas Legislature can control spending,” said Bob Williams, president of State Budget Solutions. “It demonstrates the clear need for holding down spending growth in the Texas budget so Texans have the best chance to prosper. Legislators can achieve this by passing a budget that holds the increase in appropriations of all funds and all state funds over the current budget to less than the increase in population growth plus inflation." The Conservative Texas Budget report also highlights how the nine states without an income tax, including Texas, perform better economically than the nine states with the nation’s highest income tax rates. This comparison provides evidence that limiting total state spending is necessary to keep taxes low and to allow Texans the freedom to prosper. To read the full report, please visit: http://txpo.li/2018-19-conservative-texas-budget www.texaspolicy.com/press_release/detail/coalition-releases-the-conservative-texas-budget This presentation provides information about Texas’ economy, labor market, and fiscal situation and key public policies for the 2017 Legislative Session that would increase individual liberty and economic prosperity.

www.texaspolicy.com/blog/detail/texas-economic-labor-market-and-fiscal-situation  By Dr. Vance Ginn and Melissa Schlosberg The 2015 Texas Legislative Session was historic as legislators passed a conservative budget that increased by less than the key economic metric of population growth plus inflation and $4 billion in tax and fee relief. The Conservative Texas Budget Coalition congratulated the Legislature for these results since it helped to reduce the growth of government giving Texans a better opportunity to reach their full potential. Although this was a favorable outcome, there’s work for the Legislature to do in 2017 to correct spending excesses since fiscal year (FY) 2004. After examining Texas budget data since then, the Foundation published The Real Texas Budget: Why Texas Needs to Ratchet Down Spending Growth that highlights findings in a corresponding spreadsheet which include:

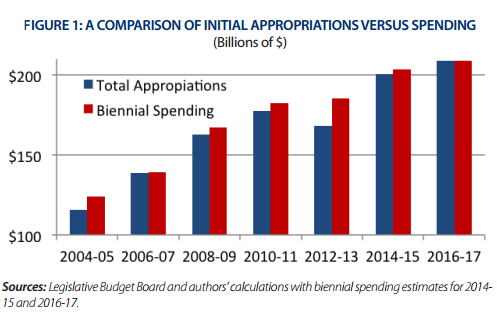

Since the 2004-05 budget, Texas has spent $39 billion more dollars than initially appropriated. Figure 1 illustrates the backfilling over this period, which is especially apparent in the 2012-13 budget cycle when the 2013 Legislature covered the underfunded amounts to Medicaid and K-12 Schools by the 2011 Legislature. In The Real Texas Budget, the Foundation provides Texans with the ability to understand how their tax dollars are spent. We also highlight the need for increasing budget transparency by the following legislative recommendations:

www.texaspolicy.com/blog/detail/the-real-texas-budget-taxpayers-deserve-transparency On Tuesday, the U.S. Department of Commerce’s Bureau of Economic Analysis (BEA) released the real gross domestic product (GDP) growth numbers for all 50 states in the fourth quarter of 2015. Along with revised figures for the previous three quarters, the BEA also released updated GDP growth for all of 2015.

One conclusion is remarkably evident from these data: the Texas miracle is still alive and well. Despite the massive drop in oil prices (the average price of oil dropped from $105.78 in June 2014 to $37.34 in December 2015), the Texas economy has continued to grow rapidly, outpacing the national trend and most of its economic contemporaries. In the face of lower commodity prices, diversified industries, a fiscally responsible government, and a lessened dependence on production in the oil and gas sector have enabled the state to prosper. Table 1 illustrates that the nationwide economic trend was generally positive, with some negative outliers. United States GDP grew 2.4 percent in 2015, a slight uptick from 2.2 percent in 2014. Regionally, the Far West states grew the most (3.8 percent) and the Plains and New England economies barely advanced (1.3 percent). California, Oregon, and Texas had the greatest growth while Alaska, North Dakota, and West Virginia had the least. At first glance, Texas growth in the most recent quarter looks unimpressive; the state GDP only grew 1.4 percent in the fourth quarter of 2015, which ranked as only the 29th highest of 50 states. However, robust growth of 7 percent in the first quarter compensated for weak performances of -2.3 percent and 1.3 percent in the 2nd and 3rd quarters, respectively. Accordingly, the growth rate for the entire year of 2015 was much better; Texas GDP grew a strong 3.8 percent, which ranked 3rd in the nation, only behind Oregon and California. This growth is remarkable considering that the state also grew 3.8 percent in 2014, when oil prices began to collapse. Texas also outperformed many of its economic competitors in 2015. Among states that have a significant amount of oil and gas production, Texas grew the fastest (3.8 percent), outperforming Oklahoma (1.3 percent), Alaska (-0.5 percent), and North Dakota (-2.2 percent). Among states with largest four economies, Texas surpassed both New York (1.4 percent) and Florida (3.1 percent) and was only slightly below California (4.1 percent). Texas has grown more than any other state since 2013, except Colorado (the two states are virtually tied at increases around 7.7 percent). The tales of the state’s demise are greatly exaggerated; Texas is not a petrostate solely dependent on the sale of fossil fuels. Rather, economic diversification and limited government have empowered the Texas economy to continue prospering, irrespective of oil prices. www.texaspolicy.com/blog/detail/the-texas-miracle-is-alive-and-well The Texas economy has performed relatively well during much of the pastfifteen years regarding economic output and job creation under a fiscally responsible system of low taxes and smart regulation. However, this Texas model can be strengthened to support greater prosperity by reforming the state’s weak constitutional spending limit.

The current limit caps the growth of non-constitutionally dedicated general revenue—about 45 percent of the state’s total budget—to an estimated growth rate in the state’s economy. Statutorily, the state’s economy is measured by a 33-month projection of personal income, which is “the sum of net earnings by place of residence, property income, and personal current transfer receipts.” Meanwhile, Table 1 provides budget information from the Foundation’s The Real Texas Budget report that shows growth in the state budget has increased 68.5 percent since the 2004-2005 biennium under this limit. After adjusting the budget for the key metric of population growth plus inflation, it’s up 11.8 percent. This translates into Texans paying $22 billion more in taxes during the current 2016-17 budget cycle than if the Legislature had increased the budget each period by this key metric. Clearly, budget growth must be brought under control so that the rising burden of taxation doesn’t continue to keep Texans from reaching their full potential. To accomplish this, the Foundation advocates for the Legislature to adopt a conservative spending limit that makes three key reforms. First, the Legislature should apply the spending limit to the entire budget. The current limit leaves more than half of government spending uncapped. This provides legislators with incentive to constitutionally dedicate funds to move them outside of the cap so they can spend more under the cap thereby growing the entire budget. Limiting the entire budget would end this practice while increasing the limit’s effectiveness and improving budget transparency. Second, the cap should be based on the lowest growth rate among state population growth plus inflation, total state personal income, and total gross state product instead of the current limit of just personal income. Third, the budget cap should be calculated using the growth rate from the two fiscal years immediately preceding a regular legislative session instead of making arbitrary predictions about future economic growth. This would reduce budget volatility and help absorb unexpected economic events that could influence the budget like the steep drop in oil prices since 2014. Historically, population growth plus inflation is usually the lowest metric and relatively more stable over time than the other metrics. However, we are mindful of the Great Inflation during the 1970s and don’t think it’s appropriate to grow government spending at double-digit rates of inflation, which is why we suggest the lowest of the three metrics. Research finds that simply moving the spending limit to population growth plus inflation will lead to tax relief and accelerated economic growth. Figure 1 shows that the adopted growth rate in personal income is typically higher than our lowest metric each period. To summarize our reform proposal of a conservative spending limit more succinctly:

Figure 2 shows that if the Foundation’s conservative spending limit had been in place since FY 2004, the average Texas family could have saved roughly $2,000 in taxes per year. This doesn’t mean that we are calling for $28 billion in spending cuts, but rather making the case that government spending could have increased at a much slower pace and met the needs of Texans since the 2004-05 budget. Critics claim that a spending limit based on population growth plus inflation is inflexible and sclerotic. At a recent Texas Senate Finance Committee hearing on reforming the spending limit, the argument was made that the current measure of personal income is simply a version of the equation: population growth plus inflation plus productivity. If this equation is correct, a limit based on population growth plus inflation fails to account for the importance of productivity. Regardless, an increase in private sector productivity doesn’t necessarily require a corresponding increase in government spending. Moreover, a more productive private sector signals that the marginal return per dollar would be greater in the private sector, meaning that more dollars should stay there instead of being taxed to pay for higher government spending. If government productivity is what’s considered in this calculation, it would be practically impossible to measure and would likely be zero over time. Therefore, if this personal income equation is appropriate, productivity would either make the spending limit growth rate less than or equal to population growth plus inflation, which is what the Foundation calls for in the Conservative Texas Budget. If legislators deem that spending should grow by more than this, they have the flexibility to argue their case to voters and vote to bust the cap. The current spending limit has contributed to excessive spending. Texas needs to adopt a conservative spending limit to better control the budget and remain a model for other states to follow. www.texaspolicy.com/blog/detail/real-texas-budget-shows-the-need-for-a-conservative-spending-limit The Real Texas Budget demonstrates the need for increased transparency in the Texas budget to help taxpayers control the growth of state spending.

Read the full report here: http://www.texaspolicy.com/content/detail/the-real-texas-budget-why-texas-needs-to-ratchet-down-spending-growth.  This commentary originally appeared in The Federalist on June 9, 2016 “So what you need to know is that the Texas miracle is a myth, and more broadly that Texan experience offers no useful lessons on how to restore national full employment. It’s true that Texas entered recession a bit later than the rest of America, mainly because the state’s still energy-heavy economy was buoyed by high oil prices.” — Paul Krugman, New York Times, August 14, 2011. Oil price: $87 per barrel Recent oil price peak on June 20, 2014: $108 per barrel “But everything is bigger in Texas, including inflated expectations, so the slowdown has come as something of a shock. Now, there’s no mystery about what is happening: It’s all about the hydrocarbons.” — Paul Krugman, New York Times, June 5, 2015. Oil price: $60 per barrel Oil price on May 25, 2016: $50 per barrel The Texas miracle has included robust economic growth and job creation during at least the last decade. Liberal economist Paul Krugman and others have argued the Texas miracle would end after the steep drop in oil prices. However, the still-growing Texas economy shows us they were wrong. Since the Texas economy didn’t fall off a cliff, other states and DC can learn a lot from Texas’ free-market governing approach. Krugman wrote last year, and has repeatedly made this case about Texas, that “there’s no mystery about what is happening: It’s all about the hydrocarbons.” So what about oil? Krugman’s argument is that the Texas miracle was only about oil prices and not the Texas model of low taxes overall, no personal income tax, relatively restrained government spending, and predictable regulations. Again, given that oil prices remain less than half of what they were at their peak, Krugman and all those arguing that the Texas model will fail are just wrong. Texas: A Jobs Powerhouse First, let’s identify the Texas miracle. Since the last national recession started in December 2007, Texas has created 36 percent of all civilian jobs added nationwide in a state with less than 10 percent of the country’s population. Employment in the rest of the United States didn’t turn positive until January 2015 and didn’t surpass Texas’ job creation until November 2015. The best way out of poverty is a job, so this miraculous job creation has been a boon for Texas families and families that have arrived from other states. Sure, economic growth and job creation in Texas have slowed compared with growth rates before the oil price crash. Economic growth in the second and third quarters of 2015 was less than 1 percent, and the annual nonfarm job creation rate is less than half of what it was at the recent peak of oil prices. Although places more dependent on oil and gas activity have slowed substantially, Houston’s unemployment rate remains relatively low at 4.9 percent and Midland’s even lower at 4.3 percent.But the drop in oil prices was not an isolated economic event that contributed to slower growth in Texas. Other challenges since 2014 include a slower global economy and a stronger U.S. dollar. Really, the oil market is dependent on these global factors, so by definition the oil price can’t be the sole cause of slower growth. Free-Market Economies Are Resilient Moreover, things are much different in Texas than they were back in the 1980s. This is what Krugman and others really get wrong about the Texas miracle. The state had its last major recession from 1986 to 1987, after oil prices collapsed and the real estate and financial sectors crashed. Back then, the mining sector, dominated by oil and gas activity, was directly related to about 21 percent of the real private economy and roughly 5 percent of the labor force. Today, mining is 15 percent of the real private economy and less than half of the labor force share. As a result, the combination of more economic diversification and pro-growth policies has produced a much more resilient economy. Texas in 2016 looks a lot different than Texas in 1987. Economic diversification also means Texas is more dependent on the rest of the U.S. and international trade. The current U.S. economic expansion of only 2.1 percent average annual growth is set to be the weakest recovery since World War II, with no relief in sight. With the Federal Reserve having held interest rates too low for too long and rightly beginning to tighten credit last December, slower economic growth and lower oil prices are likely to continue as highly distorted markets correct.Suffocating regulations by the Obama administration, including Dodd-Frank and ObamaCare, also factor into the equation. Overregulation has pushed the American dream further out of reach for too many Americans. Without growth in exports and the oil and gas sector, which fueled much of the U.S. economic expansion since 2009, the national economy stands on a shaky foundation that may have a costlier effect on Texas than low oil prices. Behold the Strength of the Texan Economy But no matter what’s slowing Texas’ economy, the sky isn’t falling, as critics love to argue when grasping for an economic narrative that repudiates free markets and fiscal conservatism. Such a narrative can’t withstand scrutiny. The latest state-level jobs report by the Bureau of Labor Statistics shows that Texas added to its payrolls in a remarkable 65 of the last 67 months. This job creation has led to an unemployment rate of 4.4 percent that’s been at or below the national average for 112 straight months. States that are not as well diversified haven’t fared as well. During the last 12 months, nonfarm job creation declined by 17,600 (-3.8 percent) in North Dakota, 10,800 (-3.7 percent) in Wyoming, 3,500 (-1 percent) in Alaska, 12,300 (-0.6 percent) in Louisiana, and 2,100 (-0.1 percent) in Oklahoma. Texas, on the other hand, created a positive 189,600 jobs (1.6 percent) with 154,200 new private-sector jobs in all but the mining and manufacturing sectors, which were hardest hit by the economic headwinds. These haven’t all been low-wage jobs, either. The Federal Reserve Bank of Dallas findsthat job creation in Texas from 2005 to 2014 has increased by about 25 percent in both the upper-middle and highest income quartiles while the lowest income quartile has increased by slightly more than 30 percent. Job creation in the rest of the United States has increased by less than 5 percent in the upper two quartiles and by 25 percent in the lowest quartile. Clearly, Texas has been the place where both high- and low-wage jobs have been created, which is necessary to meet the skills of a diversified workforce so everyone has an opportunity to succeed. Texas faces real, and potentially major, economic challenges. However, state lawmakers could strengthen the Texas model’s proven recipe of a diversified economy and limited government philosophy. The sooner other states adopt and adapt that model, the better they will be able to meet economic challenges and propel America towards greater prosperity. By continuing to reduce the size and scope of government, families will prosper and refute the false claims by Krugman and others. The truth is, it’s not all about oil in Texas. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed