|

In this episode, I discuss the following with John Mozena: 1) How politicians, even on the right, incorporate components of "sidewalk socialism" and why this is a dangerous game; 2) How corporate welfare is disrupting the natural flow of spontaneous order in society, destroying states, and corrupting universities; and 3) Why decreased spending and regulations are the best paths forward to human flourishing and more. John’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment.

0 Comments

dEverything old is new again, and that’s turning out to be true in the case of a growing drumbeat to use antitrust tools to rein in big technology companies like Apple, Amazon, Meta, and Google. But as a new policy report from the Pelican Institute points out, expanding the enforcement powers of antitrust agencies will do more harm than good—and an existing approach to protect consumers and producers, while encouraging innovation, is the better path forward. In their report “Antitrust & Enforcement: Letting Markets Work without Empowering Government,” Ted Bolema, Ph.D., J.D., Antitrust and Competition Fellow at the Innovators Network Foundation, and Vance Ginn, Ph.D., Chief Economist at the Pelican Institute, write that while the current frustrations with the size of large tech companies and censorship practices may be warranted, giving government enforcers and bureaucrats more power is not the answer. Instead, existing antitrust laws and the consumer welfare standard are still the best tools for protecting competition and consumers. “For the last 50 years or so, scholars and courts have operated with a consensus about the goal of antitrust enforcement: the consumer welfare standard, which asks, ‘does the conduct in question make consumers better or worse off?’” Bolema and Ginn write. “Antitrust enforcement based on the consumer welfare standard protects one of the most important outcomes of the competitive market process and is worth preserving.” Bolema and Ginn also note that calls to create new antitrust tools in response to conduct by “Big Tech” are misguided and will do far more to empower politicians and government bureaucrats than to prevent abusive conduct by technology companies. “Expanding the enforcement powers of antitrust agencies — as many on the left and some on the right now wish to do — harkens back to an older ‘big is bad’ approach,” they write. “Rather than promoting competition, such a retrograde approach undercuts the competitive market process which provides more innovation, cheaper prices, and better-quality goods and services necessary for continued human flourishing.” Bolema and Ginn say that the consumer welfare standard—and putting power in the hands of consumers and producers— is the tried and true path to ensuring their best interests. “As history has proven, empowering people in the marketplace rather than bureaucrats in government results in more efficient and effective outcomes and better supports liberty and prosperity,” Bolema and Ginn conclude. You can read the full report, “Antitrust & Enforcement: Letting Markets Work without Empowering Government,” here. Originally published by Pelican Institute. In this episode, I discuss the following with Dr. Judy Shelton: 1) Why money is important, how it gets its value, what it really is and is not; 2) What the Fed did wrong during the pandemic, how it continues to mishandle interest rates, and why this approach will ultimately not abet inflation; and 3) Skyrocketing interest rates around the world, how central banks manipulate currencies, and much more. Check out one of her recent op-eds in The Wall Street Journal “The Fed’s Monetary Policy Tool Kit Needs an Overhaul.” Dr. Shelton’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Inflation might be cooling some, but recent reports suggest many Americans aren’t economically optimistic. Despite President Biden continuing to celebrate the success of his “Bidenomics” approach, the reality is that purchasing power is still down, and job market weaknesses remain. So, why is the current administration so proud? It seems deficit spending is the reason.

A poll from Monmouth University found that only one in four Americans believe the country is headed in the right direction, and a significant 62% disapprove of how Biden is handling inflation. And it’s no wonder, considering that real wages have failed to keep up with inflation for a staggering 26 consecutive months. Understandably, people are becoming weary. The latest CPI report shows a moderate decline in headline inflation to 3% in June 2023 from the previous month’s 4%. However, core inflation, which excludes food and energy prices, remains stubbornly high at 4.8% year over year. This improvement shows some relief, but to get the economy back on track, we must address the underlying inflationary pressures caused by deficit-spending of more than $6 trillion funded by a bloated Federal Reserve balance sheet, which is declining too slowly. Turning to the latest jobs report for June, the figures are disappointing, falling well below expectations. Only 99,000 net jobs were added after accounting for downward revisions in the two prior months. Moreover, many of these jobs were government jobs, straining the productive private sector that pays for those jobs. According to the household survey, employment has remained nearly stagnant since March, indicating a lack of substantial job creation. To make matters worse, the labor force participation rate has yet to return to its pre-pandemic rate, indicating millions of Americans are uncertain about their job prospects. Even for employed people, their purchasing power is down, and renters and individuals from low socio-economic backgrounds are struggling. If this is the outcome of “Bidenomics,” it’s clear that a different approach is necessary to restore the American economy. The government must rein in spending, and the Federal Reserve should be more aggressive in cutting its balance sheet. Despite the lackluster evidence that his initiatives are helping, President Biden continues to approve increased deficit spending through initiatives like the Inflation Reduction Act, which is estimated to cost over $1 trillion. The national debt has surpassed $32 trillion, translating to roughly $95,000 owed per American or almost $250,000 per taxpayer, far exceeding the country’s economic output. This continuous increase in spending, coupled with kicking the problem down the road for future generations to tackle, as seen in the latest debt ceiling deal, won’t effectively lower inflation or provide the economic relief Americans desperately need. A different direction is essential, involving responsible budgeting to curb excessive spending and align expenditures with means. Congress should consider passing a strict spending limit with a growth rate that better matches the average taxpayer’s ability to fund government spending, calculated based on the maximum rate of population growth plus inflation. If Congress had adhered to this maximum spending growth rate from 2003 to 2022, there could have been a cumulative $500 billion debt increase instead of the actual $19 trillion increase, resulting in $18 trillion in static savings for taxpayers. In essence, restraining spending now is pro-growth and will foster greater economic prosperity. The latest inflation and jobs reports suggest that the touted “Bidenomics” approach leaves much to be desired. To secure a brighter economic future, current economic strategies need serious reevaluation that focus on fiscal responsibility and sustainable growth. Originally published at The Daily Caller. This Week's Economy Ep. 18 | Which States Show MOST Job Growth? Why Antitrust Laws Are HUGE Barriers7/21/2023 Today, I cover: 1) National: Findings from the latest Jobs Report, including which states are leading the way in job creation; 2) States: Why the latest Texas property tax relief is significant, but could be better, and a new conservative state budget plan for Tennessee that could propel the state to greater prosperity; and 3) Other: My new antitrust paper at Pelican Institute and more. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

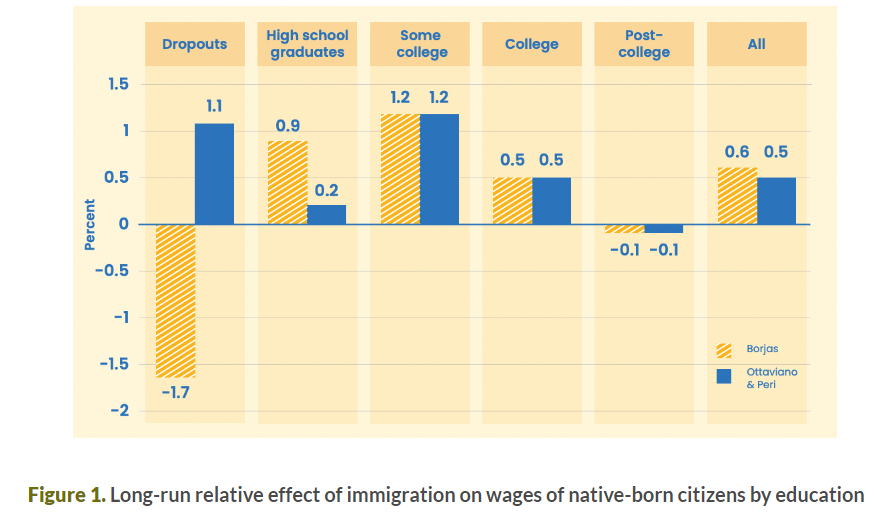

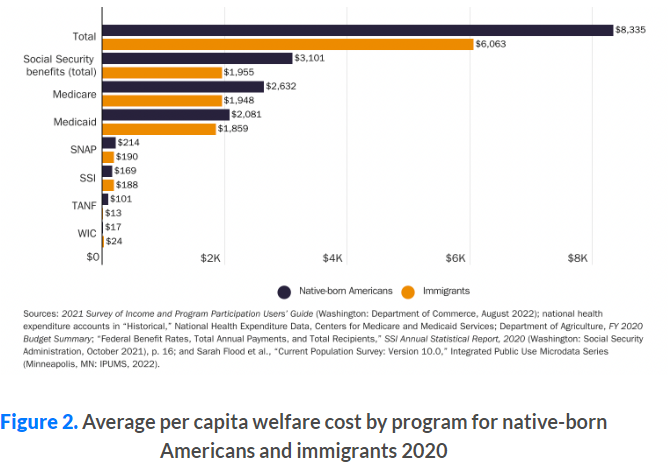

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Immigrants founded America, yet the path for immigrants to become U.S. citizens is harder than ever, and getting worse. Florida’s new law aimed to identify undocumented immigrants and prosecute any who have helped them enter the country will strain the state’s businesses, hospitals, and law enforcement. Meanwhile, the U.S. citizenship test, one of the final steps to becoming an official American, is undergoing changes that could make it more difficult for non-native English speakers to pass. These types of barriers to legal immigration, including border walls and complicated visa applications, hinder economic prosperity for immigrants and the native-born population. But America keeps discouraging immigration with more red tape because people fail to understand the economic impacts of immigration due to fear-mongering and false messaging. Thankfully, facts and data tell the true story that the country is overall helped by immigrants. Perhaps you’ve heard the common concern that immigrants “steal jobs” and “lower wages.” On the surface, it seems intuitive that immigrants increasing the supply of workers would yield these effects. But that’s incomplete as there is no one labor market but many labor markets depending on skills, experiences, and other criteria. Alex Nowrasteh, vice president for economic and social policy studies with the Cato Institute and author of Wretched Refuse?, states, “To substitute natives, immigrants would have to be similar. But the competition is not even, so that doesn’t apply. Immigrants tend to have either high or low levels of education, while Americans are in the middle. There are also language differences. For immigrants who do not yet know English, they will not be selected for jobs that require verbal communication with the public.” Immigrants are more likely to find themselves competing for jobs against other immigrants instead of native-born workers for this reason. When immigrants move to the United States, the wages of native-born workers actually tend to increase. This is because immigrants contribute to increased demand by purchasing goods and services. As a result, businesses expand, leading to higher labor demand and wage growth for native workers. Studies have shown that immigrants are twice as likely as native-born Americans to start businesses, ranging from small enterprises to large-scale ventures. This entrepreneurial spirit increases labor demand for immigrants and contributes to greater opportunities for everyone else. As Nowrasteh puts it, “Every argument against immigration could be an argument against native-born Americans having babies.” When a child is born, that’s a new future worker who will grow up, enter the labor market, and could “steal” someone’s wages. Thankfully, it doesn’t work like that, and most people recognize that having children is adding to the labor market in the long term and not posing a threat to someone else’s job or wages. Another fear often promoted to discourage easier immigration is that immigrants cost us more tax dollars. Again, it sounds believable, but studies show differently. Not only are new immigrants barred from using safety-net programs in most instances, but also, the average immigrant consumes 27% less welfare than the average native-born American. Making immigrants the scapegoat when assessing the cost of government programs distracts from the much more prominent concern of how many U.S. citizens depend on these programs, noting the need for safety net reforms for everyone. Regarding taxes, immigrants pay more on average and generate more federal tax revenue. Due to the varying state tax codes, immigrants may or may not pay more taxes than citizens depending on which state they live. Moreover, most immigrants enter the country in their early twenties and immediately join the workforce, making them fiscally positive contributors who don’t rely on education subsidies.

Recognizing how immigration is often misunderstood as a threat when it is actually a huge benefit is critical if Americans hope to cultivate a prosperous economy where native-born and legal migrant workers can thrive. Restricting immigration limits the ability to work with individuals who possess the skills and talents that could enhance productivity and innovation in the long run, and the whole country suffers as a result. State and federal resources that discourage immigration would be better invested by reforming the path to immigration so that individuals who want to contribute to American society can do so with relative ease. While reasonable exclusions for national security threats may be necessary, beyond that, discouraging immigration harms the American economy. Physical barriers like the Texas-Mexico border wall are costly to build, maintain, and patrol, are ineffective at deterring people from entering the country, and represent the illogical fear of immigration leading to worse outcomes. Instead, reforming the visa system with a market-based approach to expand legal immigration opportunities would alleviate border chaos, reduce the black market, and enhance economic growth. New anti-immigration laws like the one in Florida will move America backward. Originally published by Econlib. Mark Zuckerberg’s new social media platform, Threads, designed by Meta to compete against Twitter, has been the most rapidly downloaded app ever. Receiving more than 30 million downloads in less than 24 hours with more than 150 million downloads to date, Threads is a resounding testament to how innovation and growth are fostered by competition in free markets.

Twitter has seen its ups and downs over the past decade, but things have become more volatile since Elon Musk bought the company last year. By imposing fees for blue check mark verification, a formerly cost-free symbol of authority reserved for authenticated public figures (rightly or wrongly, and I pay for the verification to receive the included benefits), Twitter became more pay-to-play, alienating some of its user base in the process. Then, recently, Musk implemented another paywall limiting tweet visibility, sparking widespread outrage. Combined with the app's roller coaster of breaks and bugs, these changes revealed ample opportunity for more competition. Following a mass exodus of Twitter users, the app’s former users have a new platform to use, and they’re eagerly taking advantage. Recognizing the desire for a less-restricted social media platform, Zuckerburg created Threads. Twitter’s decline parallels regulations that hinder voluntary exchange, frustrate consumers, and stifle economic growth. Sure, this result was self-imposed by Twitter, so it’s not as bad as government-imposed regulations, but similar privately-determined restrictions yield costly results. Entrepreneurs struggle to thrive when the natural flow of the market is restricted by bureaucratic red tape. Just as Twitter’s users were compelled to leave and the app suffered from feature problems, so are consumers and entrepreneurs in the free market discouraged to contribute when there are more hoops to jump through. When markets are allowed freedom to function, competition is encouraged, innovation is rewarded, and economic prosperity is propelled. Striking the balance between necessary oversight and a flourishing free market is essential. But on the whole, regulations give more power to the government and less to the people. This results in less opportunity for innovation and human flourishing. Is Thread’s early success due to Zuckerberg’s reputation and credibility? Possibly. But without the U.S. free market system of capitalism that makes it easier for entrepreneurs to start new ventures compared with anywhere else in the world, Threads’ popularity would not be possible. Capitalism rewards ingenuity, empowers individuals, and enables transformative innovations. As we witness the unfolding journey of Threads, it is an opportune moment to show gratitude for our free market system and recognize the importance of preserving that liberty. When we champion these values and discourage their inhibitors, including regulations and barriers to innovation, we’re keeping America’s entrepreneurial spirit alive. Threads is the current hot topic among inventions, but in the free market system of the U.S., who knows what could be next? Competition should be encouraged to improve customer satisfaction and provide more job opportunities. Originally published by Real Clear Policy. Thank you for listening to the Let People Prosper Show podcast and for reading the newsletter for show notes and key economic insights. We discuss: 1) What’s been called the "old right" vs. the "new right", where Oren Cass of the “new right” gets some things correct, and the flaws in this view’s solutions to perceived market failures; 2) The Austrian Business Cycle Theory and what the Austrian School of economics tells us about current issues with inflation and interest rates; and 3) Learning from past errors in misdiagnosing economic events, theories about how the current economy will bust, and more. Check out his podcast, The Bob Murphy Show: https://www.bobmurphyshow.com/

Dr. Murphy’s bio:

You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. For at least a decade before the pandemic, Tennessee leaders have practiced conservative budgeting, keeping increases in state spending below population growth plus inflation. This saved Tennessee taxpayers billions of dollars, allowing for further pro-growth tax cuts. As the state is finally spending the last of its federal relief funds, it is more important than ever that Tennessee leaders practice conservative budgeting and fiscal restraint, correct for those excesses, and return to pre-pandemic spending trends. The Conservative Tennessee Budget ensures that the burden on Tennessee families to fund the state government will not increase beyond their ability to pay for it. For the upcoming FY 2025 budget, that maximum threshold would be $59.45 billion. By appropriating below that amount, Tennessee policymakers will continue to give taxpayers the best opportunity to prosper and live their version of the American dream. Finally, Tennessee should make this CTB approach the law of the land by improving the state’s current spending limit with this stronger limit to best let people prosper. Originally published at Beacon Center. Overview

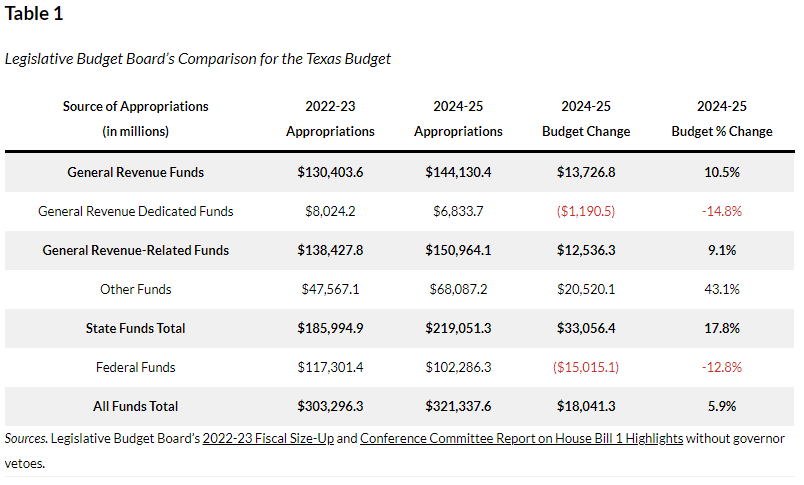

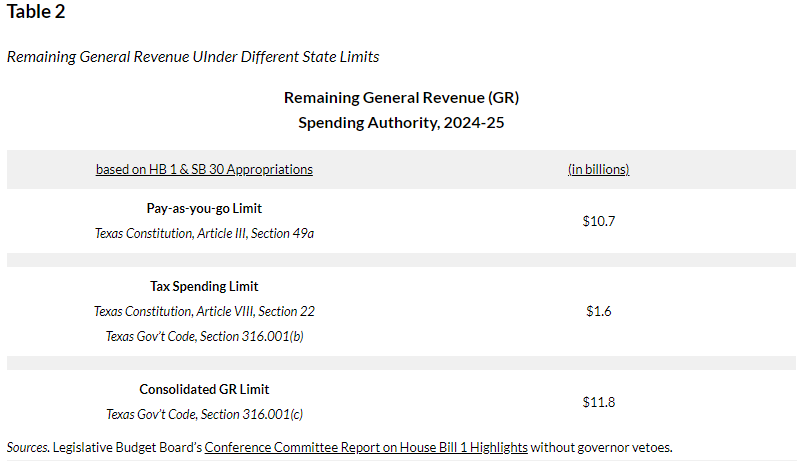

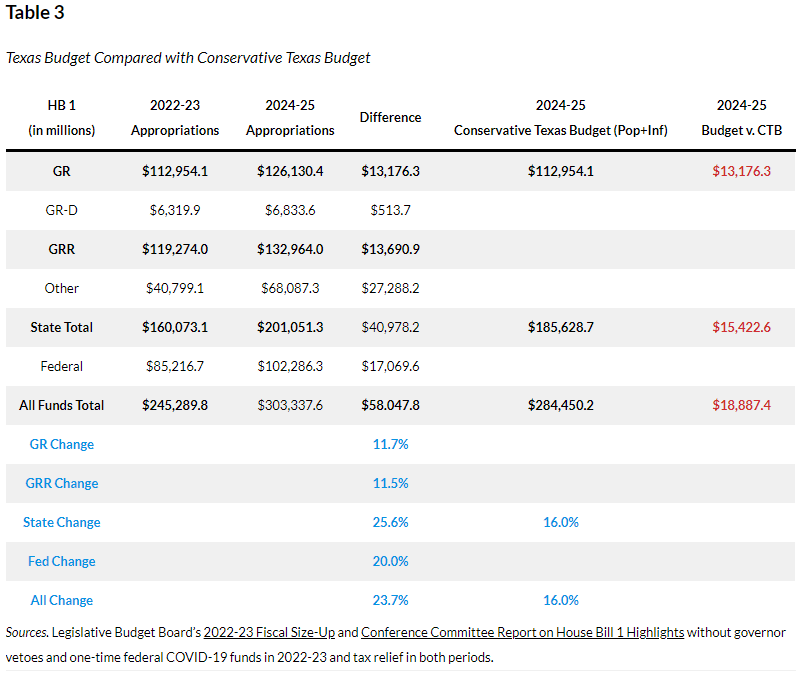

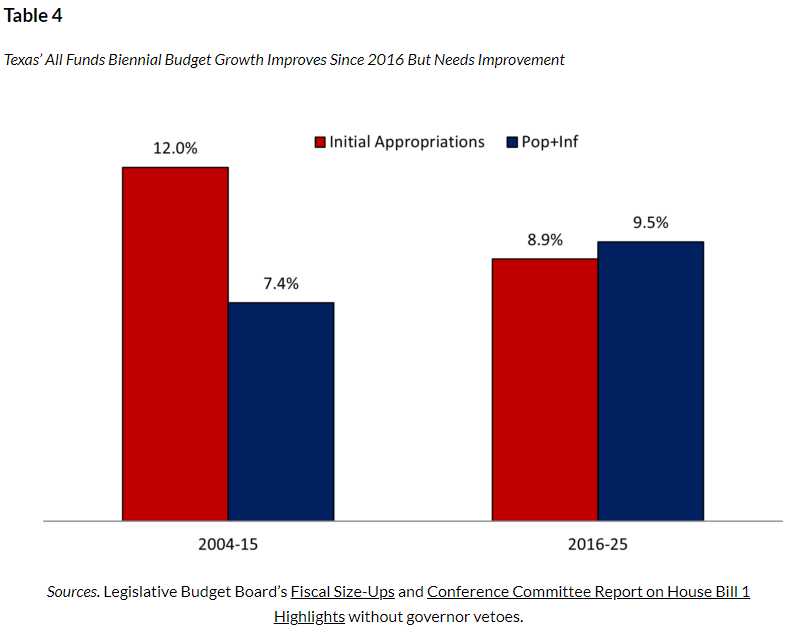

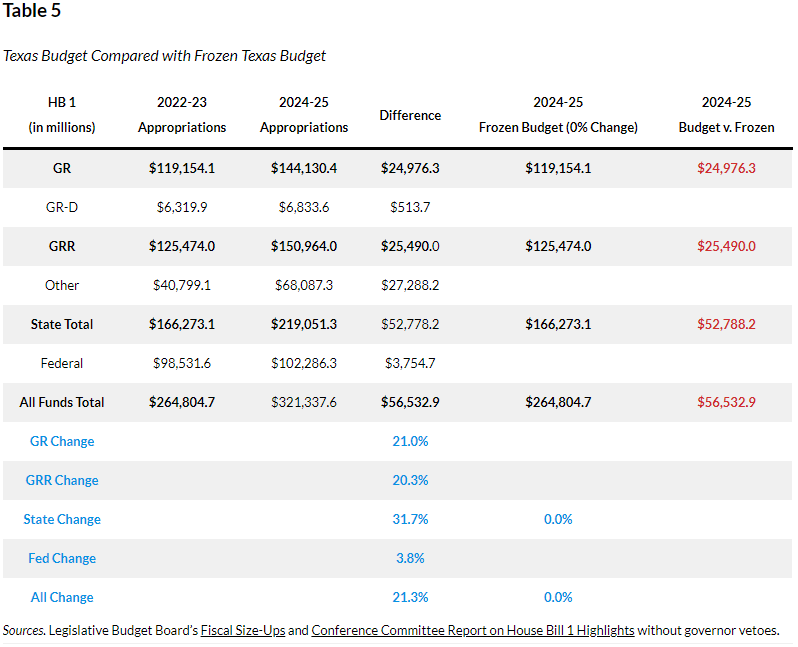

Texas Passes Largest Budget Increase in Texas History Texas Governor Greg Abbott (R) recently signed the Texas budget (HB 1) passed by the 88th Texas Legislature with the largest spending increases, the largest corporate welfare increases, and the largest social safety net increases—without the largest property tax cuts—in Texas history. State officials can claim that the budget increases by less than the rate population growth and inflation using the data in Table 1 by the Legislative Budget Board. But those calculations use fuzzy math, as they’re based on inflating the 2022-23 base budget of general revenue not dedicated by the Constitution and consolidated general revenue with more spending, then increasing it by the rate of population growth times inflation of 12.33% (determined by the average of population growth times inflation over the last two years and the upcoming two years). Compare this with 2024-25 appropriations, which will be higher later when the supplemental bill passes. These calculations are then spending-to-appropriations, which is like comparing apples with oranges. Even with these calculations, the Legislative Budget Board shows in Table 2 that there is $10.7 billion in tax revenue remaining, $1.6 billion available under the constitutional spending limit using general revenue not dedicated by the Constitution, and $11.8 billion available under the 2021 spending limit with consolidate general revenue using general revenue and dedicated general revenue. While the data in Table 1 provides an apples-to-apples budget comparison, the charts below are more accurate ways to evaluate the budget growth from an appropriations-to-appropriations approach. Better Comparisons for Budget Growth Understanding that any growth in the budget means an expansion of government, there are two strong arguments for limiting government spending: 1) Table 3 shows data for freezing the budget in inflation-adjusted per capita terms using the rate of population growth plus inflation (i.e., Conservative Texas Budget and responsible budget approach in other states), which was 16% over the last two fiscal years. This approach is appropriate as it grows slower than the economy over time. It also excludes $13.3 billion in COVID-related funding in the first biennium as well as new and old tax relief amounts of $6.2 billion ($100 million in new relief) in the first period and $18 billion (i.e., amounts passed in HB 1 of $5.2 billion for old relief and the latest of $12.7 billion in new relief during the second special session). Excluding these helps to not include one-time federal funding and amounts that don’t grow government. Using the CTB approach above, Table 4 highlights how the budget has improved since implementation of the CTB started with the 2016-17 budget. This looked much better before the current 2024-25 budget, but the massive growth of the current budget raised the growth of initial appropriations even as the rate of population growth plus inflation rose slightly during the latter five-budget period. If the growth of the budget is not controlled, it will soon surpass the rate of population growth plus inflation like it did during the prior six budget periods. 2) Table 5 shows freezing the budget with zero growth as the budget is already too big (i.e., Frozen Budget), including COVID-related funds in the first period and new and old property tax relief amounts in both periods. Conclusion

Both approaches show that while the general revenue related (GRR) funds amount is below the rate of population growth and inflation (either plus or times) for the CTB approach, the broader measures of state funds and all funds that better represent the burden of government spending on taxpayers are well above either metric. And when using the frozen Texas budget approach, the only budget amount below either rate of population growth and inflation is federal funds. In other words, the Legislature is using fuzzy math when it comes to the budget and property tax relief. This looks much more like what would be done in California rather than Texas. This is not what Texans want or expect from their elected officials. If this continues, Texas will be California soon. While this is the largest spending increase in Texas history, there was also at least $10 billion in new corporate welfare—the largest in state history. Texas must not sit back on its laurels while ending this populist trend. Texas must do what’s in the best interest for everyone, which is limiting or cutting government spending, taxes, and regulations so there’s more freedom for people to prosper. A better path would have been to spend less and put Texas on a path to eliminate property taxes so Texans can have the right to own their property instead of perpetually renting from the government. By following the Texans for Fiscal Responsibility’s three-step process of passing a frozen state budget, using 90% of surplus dollars to compress school district M&O property tax rates until they are zero, and having local governments eliminate the rest of their property taxes with surplus dollars above a new local spending limit, Texas can eliminate property taxes soon. There’s a chance to do so during a special session during the interim or next session. Originally published with links at Texans for Fiscal Responsibility. (The Center Square) – The property tax relief package passed by the state Legislature is the second largest in Texas history, economist Vance Ginn, president of Austin-based Ginn Economic Consulting, says.

While at the Texas Public Policy Foundation, Ginn helped devise a plan to eliminate one of multiple property taxes homeowners pay: the school maintenance and operations (M&O) tax. Eliminating this tax over time was part of Gov. Greg Abbott’s call for the first and second special legislative sessions. Ginn, who sat down with The Center Square to explain differing property tax relief approaches, was also integral to implementing federal tax reform efforts when he worked at the White House’s Office of Management and Budget under the Trump administration. After the legislature passed an $18 billion property tax relief package Thursday, House Speaker Dade Phelan said it was “the largest cut in Texas history.” Lt. Gov. Dan Patrick said it was “the largest property tax relief package in Texas history, and likely the world.” Abbott, when running for reelection for his third term, vowed to return half of the state’s record $33 billion surplus to taxpayers. On Wednesday, he said the package allocated “at least $13.5 billion from our historic budget surplus to provide substantial relief to property taxpayers across Texas.” With additional money from the budget, he said they were delivering “over $18 billion in property tax cuts.” According to Ginn’s analysis, the package includes $12.7 billion in new relief and $5.3 billion from the earlier-approved state budget. Neither $13.5 billion nor $12.7 billion is half of the surplus, he points out. The combined $18 billion in property tax cuts, Ginn also points out, isn’t the largest property tax cut in state history. That occurred under Gov. Rick Perry in the 2008-2009 legislative session when the legislature passed $14.2 billion in property tax relief, he said. In order to surpass that, adjusting for inflation, “for us to have the same purchasing power of those dollars back then it would need to be about $21 billion,” he said. “This isn't the largest tax cut in history. It's substantial, it's historic, probably the second most ever.” But more problematic, he says, is the Republican-led legislature spent more money than ever before. “This session was the largest spending increase in Texas history of more than 20%,” he said. “If you look at all funds, and more than 30% if you look at state funds, the state's portion is up by a massive 30%. More than $50 billion being spent; that’s more than ever before. “If you spend too much, you can't provide as much in tax relief. That's just dollars coming from the taxpayers.” The $33 billion surplus means the state over collected taxes, he added. “That should be returned to the taxpayer. And the best way to do that,” through property tax reduction, “is through compression.” “The research that I've done on this in the past is that's the only way you can get to zero. If we really want to eliminate property taxes, which is what Governor Greg Abbott said he wants to do, you can't do it by raising the homestead exemption. You could raise the homestead exemption to $1 million, $2 million, $3 million but you're always going to have property values that are above that. So that can't get you to zero.” “Appraisal caps don't do that either,” he said, because they just slow growth, referring to the House plan, which was included in the bill. “Appraisal caps don't reduce property taxes. The only way to get to $0 per a $100 valuation, meaning a 0% tax rate, is by compression, lowering property tax rates until they get to zero. If you want to talk about limiting the growth of property taxes or a small relief, then you can talk about appraisal caps or homestead exemptions. But if you want elimination, and actually reduce them over time, the only way, the gold standard, is compression.” Ginn explained how compression works. "Rght now, when people pay property taxes to the school districts, the districts are funded at a set amount. The amount [that taxpayers overpay] that goes over the set amount, known as recapture, spills over and goes to Austin. When we talk about compression, what we're saying is we're wanting to reduce the recapture amount by the state funding a reduction in school M&O property tax rates. “You do this by using state dollars collected from taxpayers, mostly sales taxes, but also franchise taxes. The school districts still receive the same amount of money because state law requires them to be fully funded. The difference is how much [recapture money] goes to Austin or not.” Compression going to zero would eliminate recapture altogether, he explains. Recapture is one reason why “the school property tax is essentially a statewide property tax,” he said. While the M&O tax is “determined by the school finance formulas that are set by the Texas legislature, “It's local in name only. That's why the focus has been to eliminate it at the state level. Use record levels of sales taxes and surplus dollars to reduce, compress the school district property tax until it goes all the way to zero.” Original post at Washington Examiner from The Center Square. This Week's Economy Ep. 17 | Are New CPI Inflation & Jobs Reports Good News? Reality of "Bidenomics"7/14/2023 Thank you for reading the Let People Prosper newsletter, which today includes the 16th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover: 1) National: Findings from the latest Jobs Report and CPI inflation data, including employment still not recovered fully since shutdowns and inflation not fully cooled; 2) States: Updates on Texas' second special session, why the proposed property tax relief is a letdown, and new reports revealing that red states have better economies; and 3) Other: My thoughts on "Bidenomics" and the Fed's balance sheet. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

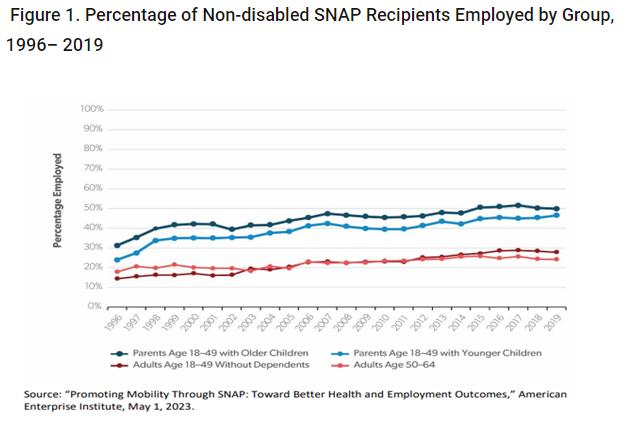

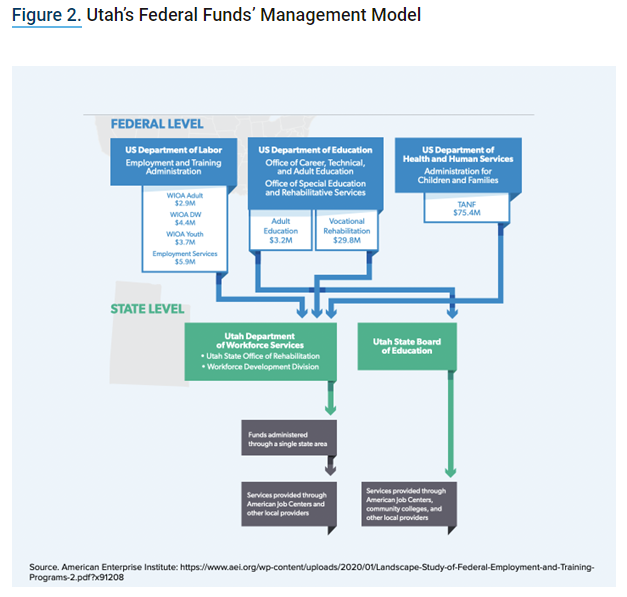

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Louisiana has one of the highest poverty rates out of all the states, but why? That’s a complicated question for which there are several right answers, some of which are more difficult to solve than others. But one contributing factor isn’t so complicated, and it’s something legislators can and should address soon: safety-net program dependance. Research reveals that safety-net programs often trap people in poverty rather than lift them out, and a high percentage of Pelican State residents depend on these programs. Therefore, to promote long-lasting self-sufficiency, and thereby a more prosperous economy, Louisiana must reform its safety-net programs. Louisiana had 17,670 safety-net programs users per 100,000 in 2019, making it the second-most safety-net dependent state in the country behind only New Mexico. Meanwhile, 18% of Louisianans rely on SNAP (food stamps) or approximately 1 in 6 residents compared with 1 in 8 individuals participating in SNAP nationally. While SNAP helps families in the short-term experiencing hardship, the reality is that many participants show that the program doesn’t help them reach long-term independence, but can in fact keep them from it. SNAP contains work disincentives, which explains why its participants have low employment rates. Angela Rachidi, senior fellow and Rowe scholar in poverty studies at American Enterprise Institute, recently reported “that the employment-to-population ratio among work-capable SNAP participants without dependents has hovered between 15 and 30 percent over time. A 2018 report by the Council of Economic Advisors analyzed household survey data and found that a slightly higher share of SNAP participants worked while receiving SNAP, but even their analysis suggested that 50 percent or fewer worked” (see Figure 1). Safety-net programs like SNAP are often referred to as “anti-poverty” programs, since that’s the supposed end goal. But when up to a third of work-capable SNAP recipients remain unemployed over time, the path out of poverty for these participants is not readily apparent. Without incentives and supports that encourage employment and self-sufficiency, users are enabled to stay dependent, and therefore, stuck in poverty. This cycle harms the individual, communities, and thereby, Louisiana. As if the challenges for Louisiana contained within SNAP weren’t bad enough, other safety-net programs compound the problem. The Temporary Assistance for Needy Families (TANF), which provides grants to states to purportedly help people get out of poverty, lacks efficacy. A performance audit in Louisiana found that the state does “not collect sufficient outcome information to determine the overall effectiveness of TANF-funded programs and initiatives. The current performance measures that DCFS uses to monitor and evaluate TANF programs are mostly output and process measures which are not useful in determining whether programs are effective at meeting TANF goals.” One of TANF’s official goals is to “end the dependance of needy parents on government benefits through work, job preparation, and marriage.” Considering that Louisianans on TANF have the rate for those participating in the labor force in the nation, at just 3.5% in the fiscal year 2020, it hardly seems that TANF is accomplishing its goal. Work is integral to human dignity and staying out of poverty; addressing the work participation rate will lead to more productive and happy people and, thereby, a better state economy as residents are equipped and eager to contribute to society. This starts with better-managing safety net programs like SNAP and TANF while connecting participants with work. Louisiana can draw valuable lessons from Utah’s effective implementation of a “no wrong door” strategy for streamlining government programs. In the 1990s, Utah successfully integrated various safety-net programs, such as employment services, vocational rehabilitation, and TANF, resulting in simplified eligibility requirements, a unified application process, and the assignment of dedicated case managers to guide individuals through the system. Utah improved the quality of services and enhanced administrative efficiencies, and achieved cost savings through this approach. These reforms equipped individuals to get their needed help and become self-sufficient. Louisiana must strive to empower its work-capable population, enabling them to pursue opportunities for growth and flourishing within the state. With a streamlined and effective system like Utah’s, Louisiana can transition from safety-net programs to employment, reducing poverty and fostering prosperity.

That’s part of the Pelican Institute’s “Comeback Agenda” for Louisiana. The time is now. Originally published at Pelican Institute. An Overview

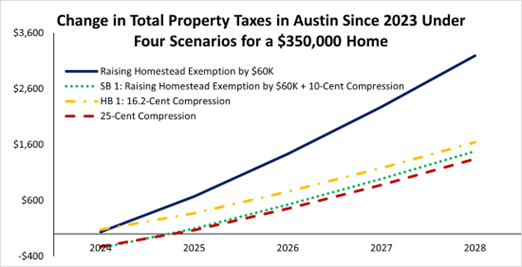

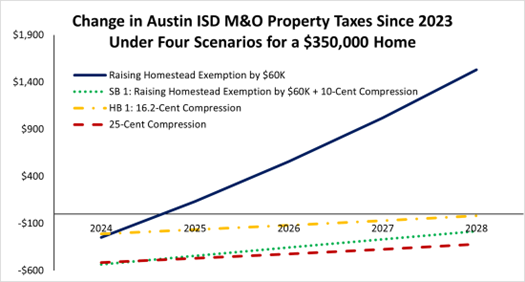

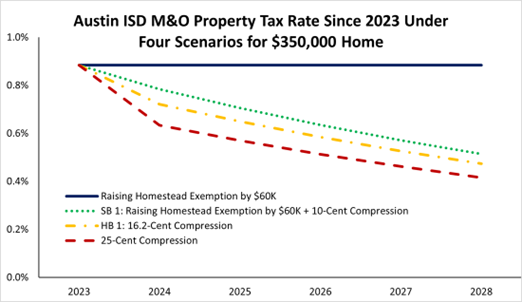

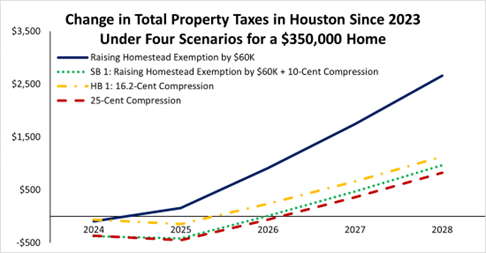

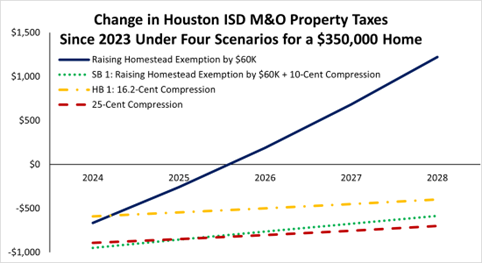

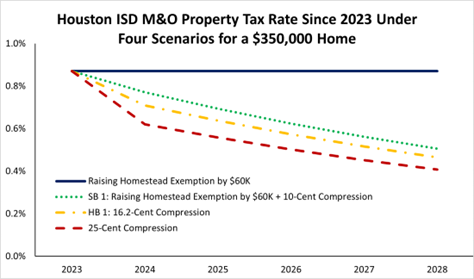

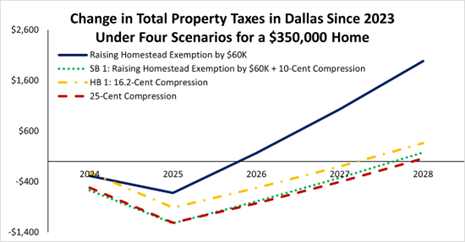

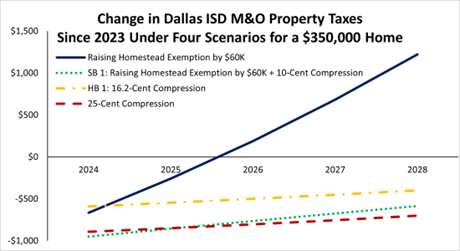

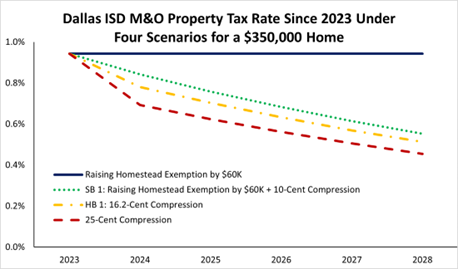

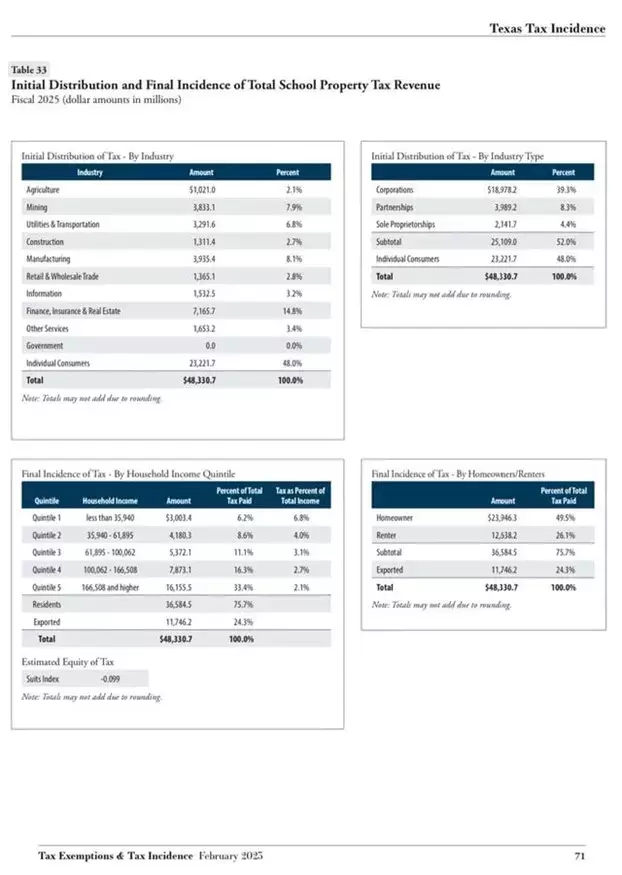

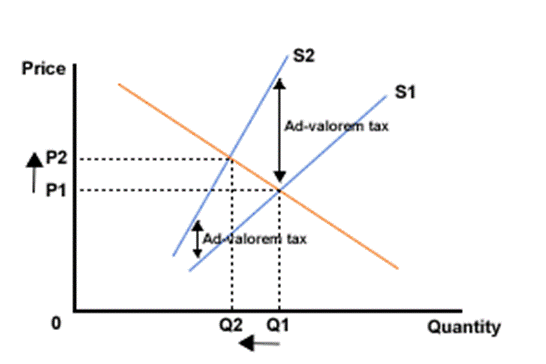

The good news is that state officials in Texas have been debating how to provide one of the largest tax cuts in the state’s history and were even talking about eliminating school maintenance and operations (M&O) property taxes. But that good news withered away in the second special session of the 88th Texas Legislature, as the amount looks to be only about $12.7 billion in new relief (an additional $5.3 billion to maintain past relief was passed in HB 1 budget) of the at least $33 billion surplus. And given that the largest property tax cut was $14.2 billion for 2008-09, the state would need to provide $21 billion in new relief this time for it to be the largest tax cut in Texas history, so Texans could have the same purchasing power of relief as they had then. While there has been a lot of debate on how the state should provide property tax relief of school district maintenance and operations (M&O) property taxes, which comprise more than 40% of total property taxes collected by local governments across the state, the best way to provide the most relief to everyone is through compression. This is simply using state dollars—mostly through sales taxes—to buy down school district M&O property tax rates that the state mostly controls with its school finance formulas. Instead, the compromise between the House and Senate, which Governor Abbott looks poised to sign, is a watered-down approach that provides too little in relief—just $12.7 billion in new relief in SB 2 (88(2))—because they chose to spend too much. And there is too little in compression with just $7 billion for 10.7 cents per $100 valuation in reduction for school M&O property taxes. The rest is a combination of raising the homestead exemption for school districts by $60,000 to $100,000, limiting non-homestead appraisal growth to 20% for three years, and requiring three directors on appraisal district boards to be elected with counties that have a population of 75,000 or more. The next part of the package is SB 3 (88(2)), raising the franchise tax exemption for gross revenue to $2.45 million from $1 million. The final piece is HJR 2 (88(2)), which puts this package (except the compression) on the November 7, 2023, ballot for voters to consider approving. While it is good that there is so much going to tax relief, this package will make the tax system more complicated, make it more difficult to eliminate school M&O property taxes, contribute to higher school M&O property tax rates, and shift the burden around as homesteads and small businesses are chosen as the winners while renters and other employers are losers. The government should not be in the business of socially engineering people’s lives through the tax code by picking winners and losers, and this is exactly what this package does. Paths to Eliminating Property Taxes I have long researched and published on eliminating property taxes in Texas. There are different ways to do it, but the one discussed most recently by Texans for Fiscal Responsibility and Governor Abbott was the buy-down of school M&O property taxes until they’re eliminated, something I supported in a paper I co-authored in 2018. The plan has been through multiple iterations. My July 2021 co-authored paper looked at this buy-down approach of using 90% of state surplus dollars above a stricter spending limit of population growth plus inflation to compress school M&O property tax rates until they are zero within about a decade; the other approach explored in this paper was of tax reform that would broaden the sales tax base to eliminate those taxes immediately, without raising the rate, based on a dynamic economic model. Both of these were built on a strong spending limit, given spending is the ultimate burden of government on taxpayers. The latest was a December 2022 co-authored paper where we address the affordability crisis in Texas and how the buy-down plan would help with this while providing more economic growth. I also wrote a 2023 paper updating this based on how quickly this could be done if a frozen budget with zero growth was used to provide more surplus funding to eliminate these property taxes. I also wrote another 2023 paper noting how there is no need to be fearful about a recession or reduced revenue as there would be the need for spending restraint or cuts, plenty of money in the rainy day fund, or excess reserves held by school districts to address any shortfall to maintain the relief and fund public education. Adding to this research were two professors at Rice University who, in 2018, also studied different reforms of the buy-down approach and the sales tax expansion approach to eliminate school M&O property taxes. They found that these approaches would provide substantial benefits to the state in terms of increased economic growth and job creation. After reviewing different options for the buy-down approach, compression is best because everyone benefits, including from the dynamic effects of more growth, more jobs, and lower prices. It’s also the only way that’s being discussed today to get the school M&O property tax rate to 0%. Another approach to provide property tax relief was pushed by the Senate this year and looks to be included in the bill passed in the second special session: raising the homestead exemption from $40,000 to $100,000. But this approach will never eliminate those taxes and will push the burden of funding spending to everyone else, making the system less equitable while quickly evaporating any relief from appraisal growth and making the path to elimination harder because rates will rise from it when school spending increases. Given the different approaches discussed this year by the House and governor and then the Senate and lieutenant governor, I did an analysis of the median valued home in Texas of $350,000 in Austin, Houston, and Dallas. I used the tax rates for each of these locations and had the home increase in value by 10% per year, which is the maximum growth for a homestead under current law. I didn’t change anything else to provide an apples-to-apples comparison of a tax reform in 2023 to estimate what would happen over the next five years given a 1) $60,000 increase in the homestead exemption, 2) SB 1 (88(1)) with $60,000 increase in the homestead exemption and 10-cent compression (similar to tax relief package in second special session), 3) HB 1 (88(1)) with 16.2-cent compression, and 4) what would be largest tax cut in Texas history of $21 billion with a 25-cent compression. I should note that this modeling is just on a homestead, so it doesn’t account for the much more broad-based effects of the compression scenarios. Austin The following three charts are for Austin, including Austin ISD, to see what these four scenarios would look like given the assumptions above in each year. The first chart shows what would happen for total property taxes (i.e. ISD, city, county, and special purpose district property taxes) under these scenarios compared with the total tax paid of $5,945 for a $350,000 home in Austin. The results show that SB 1 and the 25-cent compression are similar; however, both of them would have only one year of lower total property taxes until 2025, when the amount paid would exceed that of 2023. The second chart shows similar results as SB 1 and the 25-cent compression have the greatest effects on the 2023 ISD M&O property taxes of $3,089. However, HB1 also provides relief until 2028, when the amount paid would exceed that of 2023. But, more importantly, given these are only homesteads and don’t account for families who pay rent or own a business, the third chart’s example shows that HB 1 with 16.2-cent compression and the 25-cent compression cut the tax rate the most over time, as this compression in just 2024 continues to buy down the rate as values increase by 10%. Houston The following charts are for Houston, with similar results for each of the scenarios. Dallas The following charts are for Dallas, with similar results. In my conversations with CBS News Texas, ABC 13 Houston, and The Texan, I recently explained how compression is the gold standard to eliminate school M&O property taxes. I also recently wrote[VG1] how the Texas Legislature had the largest spending increase in Texas history this session, thereby not providing enough in property tax relief. I argued that Governor Abbott should veto the budget or at least $8 billion of budget items and use it for compression so that Texans get record relief. But that did not happen. It should be noted that compression will help renters. The Texas comptroller’s report (see Table 33 below) finds that 26% of school property taxes is passed along to renters. Businesses submit 52% of those taxes, but people pay for them through higher prices, lower wages, fewer jobs, and higher rent. Simple supply and demand shows that the property taxes would rotate the private market supply of housing leftward, thereby raising rents and lowering the quantity supplied compared with the free market. In other words, the market does set the rents, but that market is distorted by property taxes, so removing those school taxes would help push down rents through competition. When the landlord has a vacancy and is paying lower property taxes, then she will lower the rent given lower cost to attract tenants. It may not happen overnight, but it will as that’s how competition works, and those businesses that don’t will be forced out of the market through losses. This wouldn’t just be a shift in supply of housing that would reduce rents; that would happen some when this tax is cut and certainly when it’s eventually eliminated, but that’s not the only way. The following chart shows that there’s movement down the demand curve as the supply curve corrects to the private supply curve (S1) rather than the distorted supply curve (S2) with the ad-valorem property tax, which will lower prices and increase the quantity supplied. This is through competition that will happen as consumers will have more negotiating power and landlords will want to rent out every unit but won’t if they don’t lower their rents, as their competition will because their costs have been reduced. From the fact that property taxes are going down, there’s a reduction in cost by the landlords, so they have the ability to get more renters at a lower rent. As renters know, if property taxes don’t go down, they will go to another location—hence more consumer power. The consumer has much power in every market if they choose to wield it, especially when government gets out of the way. Again, it wouldn’t change rents overnight, as many are in leases, but it would over time. One of the issues contributing to the affordability crisis in Texas, especially for lower-income folks, is skyrocketing property taxes. Any relief would be most appreciated by 100% of property holders through compression. Lowering school M&O property tax rates through compression is the best path for everyone to benefit from lower taxes, more economic growth, and tax rates that would go to zero. Many groups shown in the page below have already stated their support for the buy-down plan, which was supported by the governor; the House passed much of it, though that was mostly thrown out in the final package. And they needed to add HB 16 (88(2)) by State Rep. Briscoe Cain, which would put in statute the buy-down plan to zero, along with his HB 17, which would impose spending limits on local governments. Conclusion

At the end of the day, I’m glad Texans are talking about property tax relief. Other states have been cutting taxes, so Texas can’t sit back and be competitive with other states without spending less and cutting taxes, as corporate welfare makes the problems worse. The Legislature unfortunately passed a revamp of the expired Chapter 313 in HB 5 during the regular session. This new version, called Chapter 403, provides property tax abatements issued by school districts to mostly big businesses. Fortunately, when school district M&O property taxes are eliminated, this corporate welfare will be eliminated, too. There are so many reasons to eliminate property taxes. Texas will be an economic juggernaut! And what’s maybe the most important is that Texans will have more of their right to own property preserved instead of renting from the government forever with this immoral wealth tax known as property taxes. Raising the homestead exemption might be a part of the final deal, but we should remember that it picks winners and losers, is not sound tax policy, and has been tried three times (1997, 2015, and 2021) without substantial reductions in those taxes paid. I’m okay with broadening the sales tax base and eliminating school M&O property taxes immediately and using surplus dollars above a stricter spending limit to buy down sales taxes over time. This would also broaden the sales tax base for local governments, which should use those funds to buy down their own property taxes and limit their spending with a restrictive limit like the state’s based on population growth and inflation to use surplus dollars to buy down the rest until they are zero. But there isn’t the political will yet to take this approach, so the best way right now is the buy-down path for school property taxes by the state and local government buying down their own could happen over the next decade for the eventual elimination of all property taxes in Texas. The way to do this is by sufficiently reining in government spending, which the Legislature did not do this session—thereby wasting an unprecedented opportunity to do something big. Eliminate school property taxes first, then find a way to eliminate the rest. My preference is to limit all local government spending to the state’s spending limit based on population growth and inflation, and use 90% of their surpluses to buy down their own property taxes until they are zero. This is a path to giving Texans their God-given right to own property. Get tax relief done for Texans! Stop renting, start owning! Originally published by Texans for Fiscal Responsibility. On September 11, 1960, a group of young conservatives gathered in the home of William F. Buckley, Jr., in Sharon, Connecticut. For decades, the timeless ideals embodied in the document they produced animated the American conservative movement.

Today’s public policy challenges are different than the ones faced by the Sharon Statement signatories in 1960. Authoritarianism is on the rise both at home and abroad. More and more people on the left and right reject the distinctive creed that made America great: that individual liberty is essential to the moral and physical strength of the nation. In order to ensure that America’s best days are ahead, we affirm the following principles:

See full list of signatories and the original post at Freedom Conservatism. Today, I'm honored to be joined by Dr. Michael Munger, director of the interdisciplinary politics, philosophy, and economics program at Duke University and professor of political science. We discuss: 1) How transaction costs, including regulations and political corruption, prolong poverty and prevent prosperity and the role of economic freedom in human flourishing; 2) Whether capitalism can work within America’s republic and the ways in which it's currently failing because of too much government; and 3) Why cutting taxes without cutting spending is futile and the need for de-regulation, especially in regards to housing. Dr. Munger’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. This Week's Economy Ep. 16 | Why Final Sales Tax Is Least Burdensome with Less Government Spending7/7/2023 Thank you for watching the Let People Prosper Show, which today includes the 16th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover: 1) National: Why America is headed down a road of less freedom and liberty due to ongoing excessive government spending and why a spending limit based on a maximum of the rate of population growth plus inflation would put us back on track to prosper; and 2) Sound Fiscal Policy: Why I believe that the only tax the governments should have in a 21st-century economy to fund limited government is a final sales tax, and the benefits of eliminating property, income, and corporate taxes and the problems with carbon taxes. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Thank you for listening to the Let People Prosper podcast and for reading the newsletter for show notes and key economic insights. We discuss: 1) Fascinating findings and research from his new book "The Spirit of 1776: Libertarianism and American Renewal," including how the current U.S. system of government has strayed from the Constitution and what we can learn from the founding fathers about compromise; 2) The true definition of the “common good” and why we can only achieve a free society through liberty and humanitarian virtues; and 3) Dr. Salter's opinion on the current economy, whether or not the U.S. is in a recession, and why he believes the dollar is seriously threatened. Dr. Salter’s bio:

The Federal Reserve decided at its recent meeting to pause hiking its target interest rate at 5.25% after raising it at 10 consecutive meetings from 0%. But don’t expect the relief to last long as the Fed will likely raise this rate in July and future meetings up to 6% by the end of the year.

The Fed’s current pause has been met with a flurry of hikes in interest rates in other countries, which could mean trouble for Americans. The European Central Bank increased its main rate to 4%; Bank of England hiked its rate to 5%, Turkey raised its rate to 15%, and Argentina hiked its rate to a staggering 97%. Now that higher returns are available in other countries with rising or higher interest rates than in the U.S., the value of the U.S. dollar will fall having a domino effect that would further burden struggling Americans. The Fed will soon have to raise its target interest rate again and likely further than what could have been the case had it not paused. This is because the resulting decline in the value of the dollar will lead to more expensive imports contributing to higher inflation, economic hindrances, and the need for further tightening by the Fed. And financial conditions remain loose as there’s much money sloshing around in the markets, which is why the Fed should be more aggressively cutting its balance sheet instead of focusing so much on its target interest rate. Investors will be drawn to the higher returns available in these high-interest rate countries, which will increase demand for their currencies relative to the U.S. dollar thereby appreciating the foreign currency and depreciating the dollar. This will raise the cost of imports from those countries, leading to more domestic inflation or fewer purchases to satisfy one’s desires. The last thing Americans need is for their purchasing power to be further reduced because we’ve paused our interest rate hikes while so much of the world is doing the opposite. Recent reports reveal that Americans are still struggling because of inflation, which remains hot at about 4% over the last year. Food prices increased in May at home and away from home, and shelter and new vehicle prices are up. While wages are rising slightly, they still aren’t keeping pace with inflation year-over-year for 26 straight months. Times are tough, which is why the Fed needs to cut the one policy tool it can control which is its balance sheet. And by a lot. While the money supply known as M2 and the Fed’s monetary base are declining year-over-year at some of the fastest paces on record because of recent Fed actions, these declines follow the most rapid increases on record, which left their levels extraordinarily high. These extreme increases resulted in persistent inflation and massive distortions across the marketplace. Just as the markets were hurt by the Fed increasing its monetary base, so can the markets improve with fewer distortions by the Fed decreasing its balance sheet. By relying less on government intervention and artificial liquidity, markets can get closer to being free markets. Specifically, the Fed should start cutting its balance sheet by at least 12% year-over-year instead of the current 6% annual rate and removing its injections in mortgage-backed securities and long-term Treasury securities. The result will be a harder economic landing but one that’s necessary given how the government failures over the last couple of years have propped up many areas of the economy with malinvestments that can’t last when cheap credit and loose financial conditions collapse. The resulting recession will be tough, though it was avoidable without these government interventions. But if the government lets markets work, the economy would stabilize more quickly. The long-term result would be that wages keep pace or grow faster than inflation again, cooking at home would be cheaper than eating out, and debts would decrease. Unfortunately, fiscal policy by Congress continues to run amok with massive deficits that must be partially financed by the Fed or risk soaring interest rates, massive net interest payments on the debt, unsustainable budgets, and further soaring inflation and interest rates. This isn’t a pretty scenario but it’s one that officials in D.C. put us in and we must face the difficult choices to get out of it. When the balance sheet is cut and interest rates go up in the U.S., money will flow back into the U.S. helping to appreciate the dollar and reduce the cost of imports. There’s nothing particularly important about trade deficits or surpluses as those are equal to capital account surpluses or deficits, respectively, but the hit to the purchasing power of the dollar for Americans is highly important. Now more than ever, the Fed needs to take drastic measures to improve our economy before it’s choked out by international currencies strengthening. Will it act before it’s too late? Originally published at Daily Caller. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed