This Week's Economy Ep. 15 | Home Prices Decline, Ford Layoffs from Green Energy, Updates in LA & TX6/30/2023 Thank you for watching the Let People Prosper Show, which today is the 15th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover:

1) National: Latest reports from the markets and how the U.S. dollar is being devalued due to interest rates rising in other countries; 2) States: What's lacking in Louisiana's new irresponsible state budget and why more spending and tax reform is required to keep the state competitive, and why the Texas job market is thriving while Louisiana flounders; and 3) Other: Significant layoffs at Ford and why this is likely impacted by green energy agendas subsidizing electric vehicles and why subsidies and tax incentives are flawed approaches to reducing carbon emissions. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment.

0 Comments

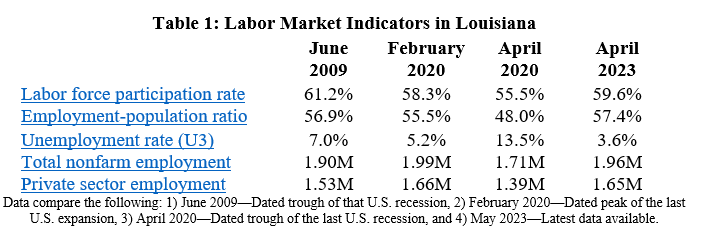

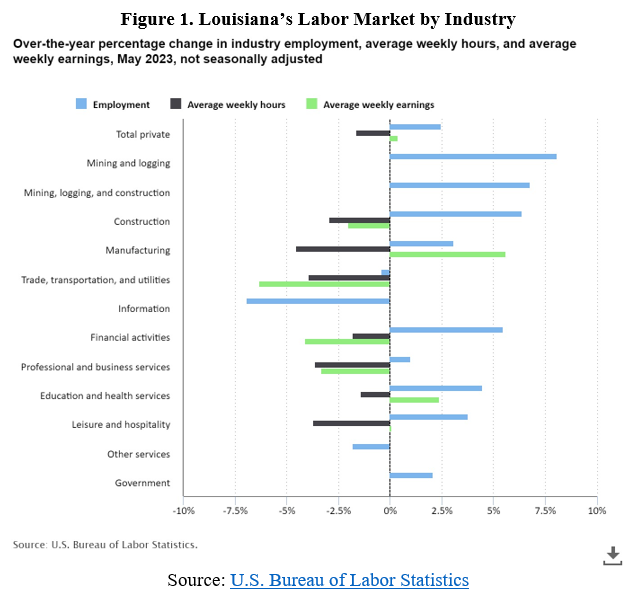

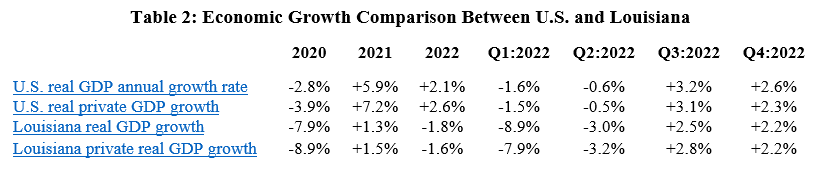

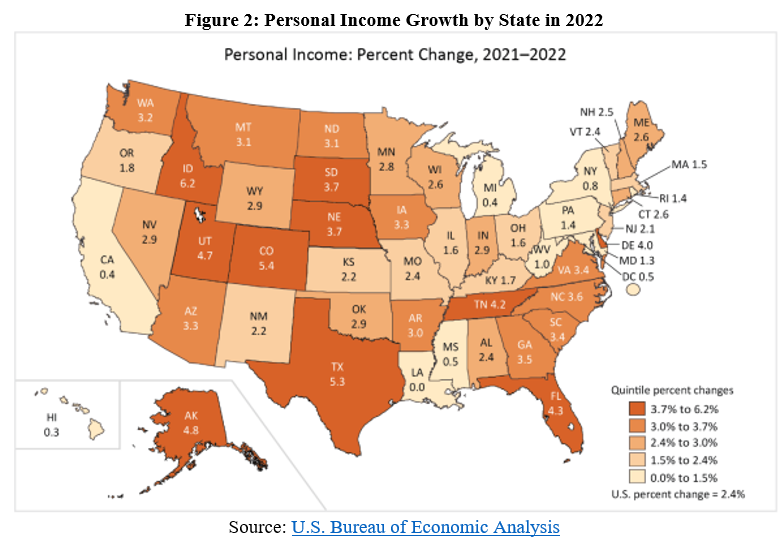

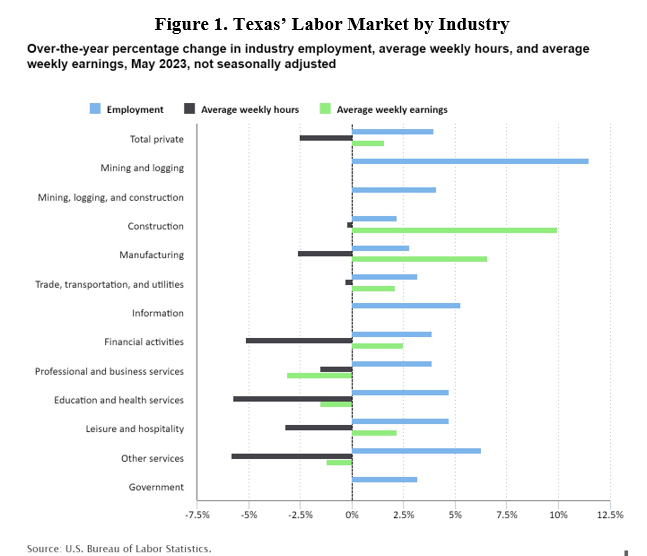

Key Point: Louisiana’s labor market shows improvement on the surface but there are underlying problems because of poor public policies which can be overcome with the Pelican Institute’s “Comeback Agenda.” Louisiana’s Labor Market: Table 1 shows Louisiana’s labor market information over time until the latest data for May 2023 which was released this month by the U.S. Bureau of Labor Statistics. The BLS report has two surveys which provide different information about the labor market. The payroll survey provides information on nonfarm employment based on responses by established employers for at least two years. The household survey provides responses from households for those who have a job and their demographics, which determines measures like the labor force participation rate and unemployment rate. The payroll report shows that Louisiana’s net total nonfarm jobs increased by 4,600 jobs last month (+0.2%) to 1.96 million employed, which is 29,700 jobs below the pre-shutdown level in February 2020. Private sector employment was up by 4,400 jobs (+0.3%) to 1.65 million and government employment increased by 200 jobs (+0.1%) to 317,100 last month. Compared with a year ago, total employment was up by 48,400 jobs (+2.5%), with the private sector adding 41,700 jobs (+2.6%) and the government adding 6,700 jobs (+2.2%). This results in about 85% of all nonfarm jobs being in the productive private sector while 15% is in the government sector, which is the same as the share for the entire U.S. Figure 1 shows the percent changes in changes in employment, average weekly hours, and average weekly earnings by industry over the last year. The industries leading the way in increases in employment are mining and logging, construction, and financial activities while information and other services have the largest declines. Average weekly hours have declined or been flat in all industries with manufacturing, trade, and professional and business services declining the most. Average weekly earnings increased the most in manufacturing and education and health services but declined in most industries with trade and financial activities declining the most. These data show the dichotomy between those in the labor market as there are industries gaining employment but average weekly earnings are falling in most cases and are falling even further when adjusted for inflation, hurting many chances for Louisianans to make ends meet. The household survey finds that the working-age population, defined as 16 to 64 years old, declined by another 894 people last month to 3.6 million, down 10,623 people over the last year, and down 34,106 people since February 2020. But the civilian labor force, defined as those who are working or looking for work, rose by 3,377 people to 2.1 million last month, 22,506 people over last year, and 27,910 people since February 2020. These figures result in a labor force participation rate of 59.6%, which is up from 58.8% from last year and up from 58.3% since pre-shutdown but well below the 61.2% rate in June 2009. But the number of employed has been increasing as it was up 2,363 over the last year, contributing to the slightly higher unemployment rate over the last year from 3.5% to 3.5%; but this rate remains lower than the 5.2% rate in February 2020. And a broader look at Louisiana’s labor market shows that Louisianans still face challenges with the continued decline in the working-age population which weighs on the labor-market shortage and long-term economic growth. And comparisons with neighboring states based on several labor market measures indicate concerns. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real (inflation-adjusted) gross domestic product (GDP) and personal income for Louisiana and other states. Table 2 shows how the U.S. and Louisiana economies performed since 2020. The steep declines were during the shutdowns in 2020 in response to the COVID-19 pandemic, which was when the labor market suffered most. The increase in real GDP of +2.2% in Q4:2022 ranked 26th in the country, resulting in an annual decline in economic output by -1.8% in 2022 which was the second worst in the country. The BEA also reported that personal income in Louisiana grew at an annualized pace of +6.0% (ranked 32nd) in Q4:2022 (below +7.4% U.S. average). This resulted in personal income growth of 0.0% in 2022, ranking 50th of the states (see Figure 2). The growth rate for 2022 was driven by the negative $10 billion (-4.0-percentage points) in transfer payments from a decline in safety net payments as the expanded child tax credit expired and more people found jobs but increases in net earnings by $8.4 billion (+3.4-percentage points) and other income by $1.6 billion (+0.6-percentage point). Personal income per person in Louisiana increased by 0.08% to $54,622 last year, which ranked 42nd in the country but the increase was far below inflation.

Bottom Line: More Louisianans gained jobs in April, but their pay hasn’t been keeping up with inflation in a stagnant economy. While the state improved its tax code in 2021, there was an irresponsible budget passed in 2023 which excessively grew spending, busted spending caps in FY23 and FY 24 and didn’t provide tax relief even with billions in excess tax revenue. Given these results, there is little reason to believe that there will be improvements in the state’s poor business tax climate, net outmigration of Louisianans, or the 19.6% poverty rate which ranks second highest in the country. Which pro-growth policies should be pursued instead? Refer to the Pelican Institute’s “Comeback Agenda” for policy recommendations that would turn the tide and provide opportunities for people to prosper. Originally published at Pelican Institute. Recent reports show that annual inflation rose 4% in May, down from 4.9% in April. In response to this and recent bank failures, the Federal Reserve announced that it’s pausing raising its target interest rate in June after approving 10 consecutive rate hikes, raising its target from nearly zero to a high of 5.25%.

But prices remain elevated and inflation is double the average 2% rate that the Fed prefers, which is making it challenging for Americans to get by. Food prices increased in May at home and away from home faster than 5% year-over-year, and shelter and new vehicle prices are up well above 4%. While wages are rising slightly, they still aren’t keeping pace with inflation year-over-year for 26 straight months. Simply put, times are tough. This is why the Fed needs to use the one policy tool in its box that it directly controls and has the most significant influence on inflation: cutting its balance sheet. Measures of the money supply are declining. The broader money supply known as M2 is down about 5% over the last year, which is the fastest pace since the Great Depression. And the Fed’s monetary base has declined by about 6% over the last year, which is the fastest pace since 2019. But these are after some of the most rapid increases in these measures on record, which leaves their amounts extraordinarily high and manipulative in the marketplace. These extreme increases in measures of the money supply resulted in artificial market distortion as more money was created out of thin air while available goods and services remained stifled by shutdowns, government spending, taxes, and regulations. As this made it more difficult to discern the true value of goods and services, price signals were thwarted. None of these ramifications will be abetted by declining interest rates or pausing rate hikes. Just as the markets were hurt by the Fed increasing its monetary base, so can the markets improve with fewer distortions by the Fed decreasing its balance sheet. By relying less on government intervention and artificial liquidity, markets can get closer to being free markets and clear based on market fundamentals rather than government failures. The Fed should at least double its rate of current cuts to achieve market sanity, meaning at least 12% year-over-year, until it gets to less than 10% of gross domestic product rather than the nearly 50% today. This would be aggressive and result in a harder economic landing but is necessary given the severe market distortions after many markets have been propped up on false strength for years. In the event of a hard landing, spending, employment, and investment would likely be affected as economic activity would be forced to slow down. But if the government lets markets work, the economy would stabilize more quickly. The long-term result would be that wages keep pace or grow faster than inflation again, cooking at home would be cheaper than eating out, and debts would decrease. Unfortunately, since overspending is a bi-partisan problem, political pushback would likely ensue if the Fed goes this route as it will mean a higher cost of funding the massive national debt. Although cutting the balance sheet is the solution, a cultural shift among politicians that favors less spending must preclude it because the Fed is implicitly and explicitly helping the federal government from blowing up the budget more with even higher net interest payments. Ultimately, the path toward a stronger and more prosperous economy lies in the Fed's willingness to take bold actions and the political will to embrace responsible spending and balance sheet practices. A brighter economic future can be achieved by prioritizing market stability over short-term political considerations. Originally published at The Center Square. Oren Cass, founder of the think tank American Compass, presents a vision of the “new right” in his recently released book, Rebuilding American Capitalism. In it, he advocates for a top-down approach to governance in response to what he perceives as free-market failures.

He tends to believe that certain politicians can and should shape markets to achieve desired outcomes rather than letting free markets, which are free people, work. This attempt to rebrand not only the right but capitalism itself is flawed, as history and sound economics prove. Cass pinpoints growing concerns in the economy to help bolster his arguments, like poor inflation-adjusted wage growth and lack of strong social and family units. These are problems making it harder for people to prosper, but they are not, as he suggests, evidence that free-market capitalism has failed. But these problems–if they are problems, as Scott Winship and Jeremy Horpedahl recently found that people are thriving–aren’t the results of free markets but are driven instead by government failures. These failures include bloated government spending, restrictive regulations, high tax burdens, excessive safety net programs, costly tariffs, and other barriers to entry in the marketplace. They are imposed by politicians and government bureaucrats, hindering competition, disrupting entrepreneurial endeavors, impeding wage growth, and destroying human flourishing. Cass contends that capitalism only works under the right conditions, which must be facilitated by the government to keep the labor market and the economy strong. Rather than what he calls the “Old Right’s market fundamentalism” of fewer regulations and less government intervention being best, he welcomes more government with certain politicians in power. He proudly makes markets the scapegoat and, with it, globalization and financialization. In the book’s foreword, Cass writes: "Globalization must be replaced with a bounded market that restores the mutual dependence of American capital and labor and invites the trade and immigration that benefit American workers. Financialization must be reversed so that both talent and capital in pursuit of profit find their best opportunities in productive investment rather than extraction and speculation." Believing that more opportunities in the form of globalization inhibit rather than help Americans is the same faulty basis with which people discourage immigration and trade, which are central to thriving economies. But the crux of Cass’s theory is that he believes markets must be molded, even referring to work by the father of modern economics Adam Smith. Conveniently, he fails to cite the economist Frederick Hayek, who built on Smith’s ideas, to identify spontaneous order, the basis of free-market capitalism that argues economic growth and prosperity arise from voluntary transactions by free people, not government guidance and control. This “new right” idea was debunked long before Cass came along by Hayek (and others), who also highlighted the “knowledge problem” associated with central planning. He argued that no central authority can possess the information necessary to make efficient decisions for an entire economy. The complexity of economic interactions and the constant flux of information require decentralized decision-making and market mechanisms to aggregate and incorporate local knowledge effectively. Hayek’s insights emphasize the limitations of top-down control and the importance of allowing market forces and individual actors to shape economic outcomes based on their localized knowledge and preferences from the bottom-up. But Cass would have it that government is heralded as the keeper of knowledge and the arbiter of good decisions rather than encouraging freedom and liberty in individuals, i.e., the essence of capitalism. Capitalism allows individuals to pursue their economic aspirations and make decisions based on their knowledge and preferences through voluntary exchange within rules of the game set by limited government. Through this freedom, innovation, entrepreneurship, and competition thrive, leading to greater prosperity for all. History is full of successful economic transformations driven by leaders who championed limited government and free markets. Former President Calvin Coolidge cut government spending, cut taxes, and reduced the national debt, providing more paths for human flourishing. Likewise, former President Ronald Reagan cut taxes, tried to rein in government spending, and reduced regulations, unleashing economic growth and job creation. Both of them understood that cutting spending, reducing taxes, and removing excessive regulations create an environment where businesses thrive and workers can benefit. Their approaches embraced the power of individual freedom and self-determination, not top-down control that breeds the opposite. Oren Cass’s theory of the “new right” and its embrace of government fundamentalism misunderstands the principles of capitalism and human behavior. Top-down approaches, rooted in centralized control and regulation, do not lead to economic prosperity or personal freedom no matter who is in charge but do distort the efficient allocation of resources, undermine the adaptability of markets, and reduce opportunities to let people prosper. To achieve a thriving and prosperous economy, we must adhere to and strengthen the principles of free-market capitalism, which too much of our economy today is deprived of when considering healthcare, education, transportation, manufacturing, and the labor market. This should include embracing limited government, voluntary exchange, and individual freedom as the pillars of strong families, productive workers, and profitable employers. Economist Milton Friedman noted what this debate is about decades ago. “The problem of social organization is how to set up an arrangement under which greed will do the least harm; capitalism is that kind of a system.” And while “history suggests that capitalism is a necessary condition for political freedom,” it’s clearly “not a sufficient condition.” But capitalism is the best system yet that has supported economic prosperity and political freedom. The problem is that we have had too little free-market capitalism for people to thrive because of too much government. There’s no need for a “new right” of big-government progressive policies offered by Cass and others when free-market capitalism of the “old right” is too often missing in our lives. Originally published at Econlib. Today, I'm honored to be joined by Dr. Jay Bhattacharya, Professor of Health Policy at Stanford University and a research associate at the National Bureau of Economics Research. We discuss: 1) How the U.S. policy response to the COVID-19 pandemic harmed the poor, working class, and children and the subsequent side effects those groups continue to grapple with (see his Twitter thread here for more details); 2) Why shutting down the economy and enforcing social distancing is not effective from a health and medicine perspective and a better alternative; and 3) Why Dr. Bhattacharya fears the U.S. would have the same response in the event of another pandemic and his suggestions for how to handle one. Dr. Bhattacharya’s bio:

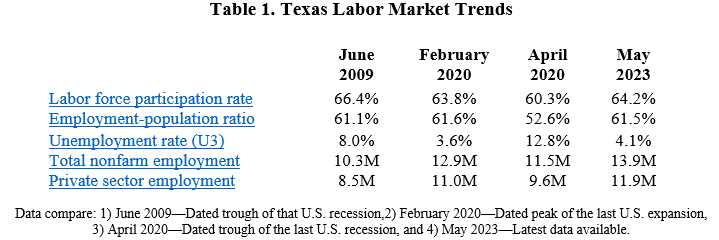

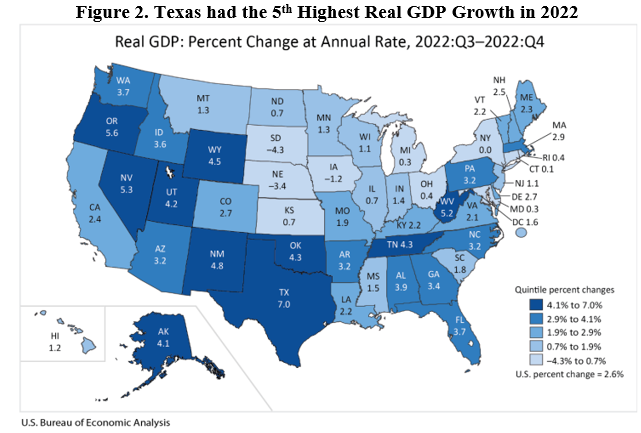

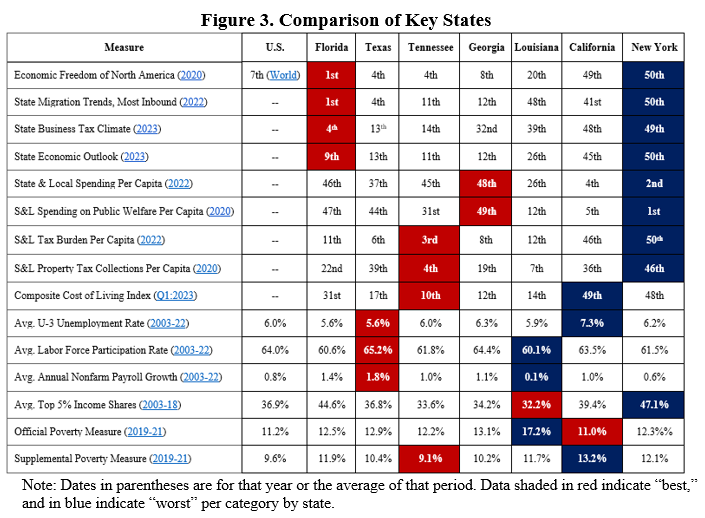

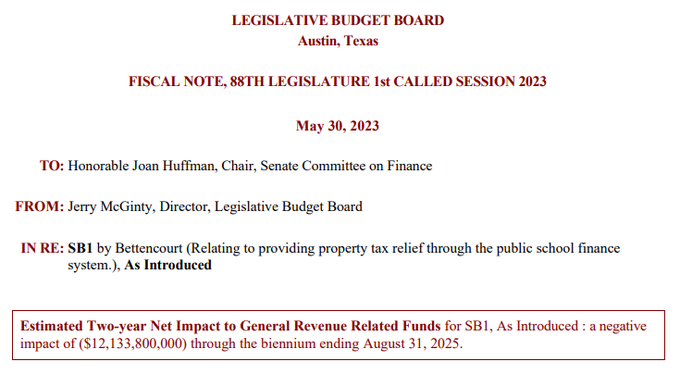

Key Point: Texas is a leader in job creation over the last year and since February 2020. But Texas faces major headwinds as the recently ended 88th Legislature looked more like California than what is expected from the free-market bastion of hope and prosperity in Texas, which could change during special sessions but nothing certain yet. The path forward must be one of free-market capitalism instead of expanding the size and scope of government to let people prosper. Overview: Texas has reached a new record high in total nonfarm employment for the 20 straight months. The 88th Legislature ended on May 29 and went straight into a special session to provide property tax relief but that hasn’t happened yet, and the second special session ends on June 27. Instead, the Legislature passed the largest spending increase in the state’s history, the most money for corporate welfare, one of the largest expansions of safety nets, and no school choice. This was a huge, missed opportunity for Texas that will set up a fiscal cliff with so much spending, less competition with fiscally conservative states, and less opportunity for flourishing which combined will stop the Lone Star State from being a leader in the country. Labor Market: The best path to let people prosper is free-market capitalism as it is the best system that supports jobs and entrepreneurship for more people to earn a living, gain skills, and build social capital. Table 1 shows Texas’ labor market for May 2023. The payroll survey shows net nonfarm jobs in Texas increased by 51,000 last month, resulting in increases for 36 of the last 37 months, to bring record-high employment to 13.9 million. Compared with a year ago, total employment was up by 529,800 (+4.0%)--fastest growth rate in the country—with the private sector adding 472,000 jobs (+4.1%) to 11.9 million and the government adding 57,800 jobs (+2.9%) to 2.0 million. But there continued declining inflation-adjusted average weekly earnings in most industries in Texas (see Figure 1). The household survey shows that the labor force participation rate is higher and employment-population rate is slightly lower than in February 2020, but the former is well below June 2009 at the trough of the Great Recession. The state’s unemployment rate of 4.1% is higher than the U.S. rate of 3.7% but this is weak indicator as it’s highly volatile based on changes in the labor force. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) reported the real gross domestic product (GDP) by state for 2022. Figure 2 shows Texas had the fifth fastest real GDP growth of +3.4% to $1.9 trillion (above the U.S. average of +2.1% to $20.0 trillion). The BEA also reported that personal income in Texas grew by 5.3% to $1.9 trillion in 2022 which was the third highest in the country. This is behind Idaho (+6.2%) and Colorado (+5.4%) but well above the U.S. growth rate of 2.4% (to $21.8 trillion). Bottom Line: As Texans face an affordability crisis from high inflation and high property taxes and an uncertain future with the U.S. economy likely in a deepening recession, they need substantial relief to help make ends meet. Other states are cutting, flattening, and phasing out taxes, passing responsible budgets, and passing school choice, so Texas should have made bold reforms to support more opportunities to let people prosper, mitigate the affordability crisis, and withstand destructive policies out of D.C. Figure 3 provides a comparison of the size of government, economic freedom, and economic outcomes among the four largest states, Tennessee, Georgia, and Louisiana. While Texas does relatively well, there is much more to do for more liberty and prosperity. Unfortunately, the Texas Legislature failed to achieve these needed policy objectives in the regular session of 2023 so Governor Greg Abbott (R) called them back to provide property tax relief which hasn’t yet so will have to call them back again for this along with passing school choice and should bring them back to eliminate corporate welfare and expansion of safety net programs.

Free-Market Solutions: The Texas Legislature should improve the Texas Model by:

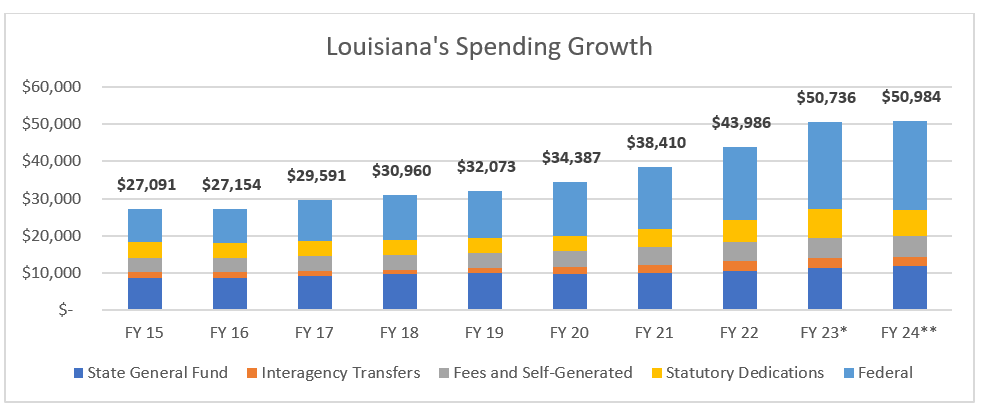

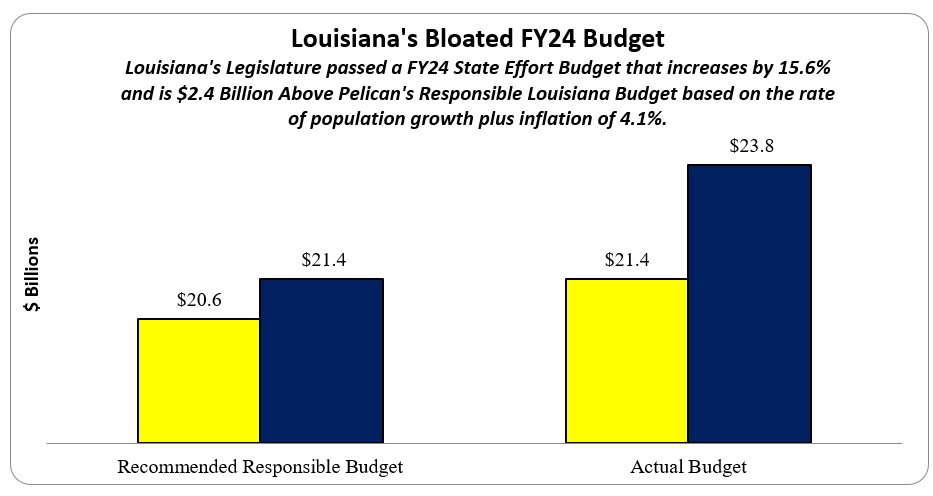

Louisiana’s 2023 Regular Legislative Session ended on June 8th with a bang. Amid much arguing and a lot of untransparent, last-minute maneuvering, the Legislature passed a big-spending budget that busted through its own limits on spending extra taxpayer dollars (also known as the “spending cap” or the “expenditure limit”). When the dust settled, the legislature spent approximately $2.2 billion in extra revenue this year and nearly $1 billion more than was originally expected in fiscal year 2024 (FY 24). In doing so, they missed a critical opportunity to save for the future, pay down debt, and put Louisiana on a path toward a comeback. Louisiana’s Weak Expenditure Limit Is A Problem When the government takes in more tax dollars, politicians tend to spend it. Unfortunately, as budgets grow year after year, that spending keeps getting higher and higher. That might seem OK in good times, when more money is coming in. But when bad times come, revenue drops, and taxpayers are stuck paying for an unsustainable budget. That’s why a spending cap is important. Think of it this way. If you get a raise at work and have more money to spend, you might decide to go on a spending spree and buy a new car or a bigger house. But if you lose your job (and don’t have money saved up), you’re going to struggle to pay your bills. That’s what’s happening with Louisiana’s budget. Over the last few years, tax increases, personal income growth, and massive infusions of federal dollars led to an influx of cash. In other words, these are “good times” from a fiscal perspective, and more money has been coming into the state’s coffers. Unfortunately, Louisiana’s spending cap is weak, ineffective, arbitrary, and inconsistent—and it allows legislators to keep busting through its limits. This year, the legislature decided to irresponsibly raise the limit by $1.4 billion to $17.9 billion—12.7% higher than the original limit in FY 23—so they could go on a spending spree. Where Did the Extra Money Come From? In FY 23, there was an additional $2.2 billion more than was originally appropriated to fund the state government. This included $726 million remaining from FY 22 (called a surplus) and an additional $1.5 billion in revenue and budget savings in FY 23 (called an excess). Fiscal conservatives in the legislature presented an option to spend this money wisely, without busting the spending cap, by saving for a rainy day, triggering tax relief for all taxpayers, paying down costly debt, and improving dilapidated infrastructure. However, as the carrot was waved in front of many legislators to “bring home the bacon,” many caved to the pressure and voted to raise the spending cap and spend all the available money. The FY 24 budget as passed by the Legislature totals a record-breaking $51 billion and added roughly $800 million in new, recurring spending (spending that must continue year after year). This budget is nearly double what was spent just ten years ago. This budget growth is unsustainable and beyond the ability of the average Louisiana taxpayer to pay. *FY 23 budget as of 12/1/2022 ** FY 24 appropriations as passed by the Legislature Where was the money spent? With the influx of more than $2.2 billion in tax revenue above and beyond what was needed to run an already bloated state government budget, plus an additional $1 billion for the following year, lawmakers used a series of budget bills to appropriate these funds that exceeded the expenditure limit in both years and grew the budget irresponsibly for future years when revenues are predicted to decline.

A mere $60 million more deposited into the Rainy Day Fund–instead of some of the above favored member projects–would have triggered tax relief for millions of Louisiana taxpayers. It would have been modest, to be sure, but it was promised by the legislature in 2021 that if revenues exceeded a certain growth rate, taxes would be lowered by that amount. And revenues did exceed a very generous growth rate, but because not enough money was placed in the savings account, the trigger wasn’t met. In other words, lawmakers actively chose to spend a modest portion of the $2.2 billion total that was intended for tax relief on other favored projects. While there was much debate and discussion, very little was given to paying down debt. The $473 million to LASERS debt is just half of what was originally planned in the House passed version of the budget bills, which would have freed up over 8% of employee benefit costs for the state. In the end, only $50 million, which was the required payment, went to TRSL, the teacher’s retirement system. That’s a drop in the bucket compared to the $600 million proposed by the House for teachers and $800 million for state workers. The total owed on public employee retirement debt totals more than $19 billion and total debt owed by the state is more than $29 billion, this payment represents pocket change. The $525 million in debt payments that made it through the entire process is helpful, to be sure, but frees up very little and does not improve the outlook much in the long-run. To add insult to injury, no forethought was given to the types and locations of infrastructure projects in the state, primarily taking shape in the form of pork barrel projects to local governments for local parks, roads, water systems, and the like, rather than a comprehensive, thoughtful plan put forth that maintained current state roads and built new capacity to move Louisiana forward in the future. Better Budgeting for the Future There should be a better guardrail placed on budget growth which sets a maximum that can be appropriated each year. This will provide an easy, transparent way to see if responsible budgeting occurs throughout the session. Of course, a spending limit should ultimately be based on spending, but using appropriations gives taxpayers a better way to see how their money is being used throughout the legislative process. And there is a better metric to use that represents the average taxpayer’s ability to pay for government spending in the rate of population growth plus inflation. This is why the Pelican Institute released the proposed Responsible Louisiana Budget (RLB) earlier this year which limits state funds to less than the average rate of population growth plus inflation over the last three years. The method is being recommended in more than 10 other states to help rein in out of control spending with mixed results. For the FY 24 RLB, the growth rate was 4.1% over FY 23 appropriations for a maximum of state funds appropriations of $21.4 billion. This amount is different from the state’s current expenditure limit as there are different amounts covered and the amount should be the largest part of the budget possible, which is why we started with state funds, but more would be preferable. The following chart shows the recommended RLB and what the actual budget looks like, which is $2.4 billion higher than the RLB. Therefore, this is an irresponsible budget and is unsustainable given the ongoing expenditures throughout the budget. There was some good use of funds to pay down debt, but otherwise this growth in the budget will mean greater spending restraint or higher taxes will be necessary to keep these services, activities, and projects funded in the future. And this is not the time to do this given that more people are leaving Louisiana than moving in and there are economic headwinds on the horizon. We need a comeback story now. This budget is a tremendous, missed opportunity and actually hurts that effort. Our state’s leaders must do better going forward.

This year, lawmakers had a unique and significant opportunity to make a real difference for the future of Louisiana. But that opportunity was squandered by Louisiana politics at its finest. The state had a historic opportunity to pay down debt and save for the future, setting Louisiana on a path to fiscal responsibility and sustainability. Lawmakers also had an opportunity to provide much needed tax relief amid record-breaking inflationary times to help families across the state, and they had the opportunity to address the astronomical backlog of infrastructure needs in a responsible and organized fashion. Instead, lawmakers followed the path of least resistance, to “bring home the bacon” and continue to increase local government dependence on the state, while also continuing to grow state government in an unsustainable way. It is very likely lawmakers in the new term will be faced with similar decisions in the 2024 Legislative Session. Will Louisiana voters continue to elect leaders who will continue down the path of unsustainability, or will they elect leaders who will make the responsible decisions to put Louisiana on a path to a Comeback Story? Originally posted at Pelican Institute with co-author Jamie Tairov. This Week's Economy Ep. 14 | Inflation is Americans’ Top Concern, State Jobs Report, & Minimum Wage6/23/2023 Thank you for reading the Let People Prosper newsletter, which today includes the 12th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover: 1) National: New Pew Research poll reveals that inflation is the top concern for Americans on both sides of the political aisle, Fed needs to do more, and financial markets remain loose; 2) States: New state-level jobs report and which states are leading and breakdown of the largest spending increase in Texas history and why it's not good for keeping the Texas Model strong; and 3) Other: The importance of educating young audiences on capitalism and socialism and my experience teaching with a "minimum wage" game to a group of high school students. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Today, I'm honored to be joined by Patrick Gleason, Vice President of State Affairs at Americans for Tax Reform. We discuss: 1) How the state flat tax revolution has swept across the country over the last two years, which states have joined, and why it is a beneficial change for more flourishing; 2) Misconceptions about flat taxes, Kansas as an example of how to make tax relief fail, and the need for responsible state budgets; and 3) Patrick's current work on tax and school choice reform across states. Gleason’s bio:

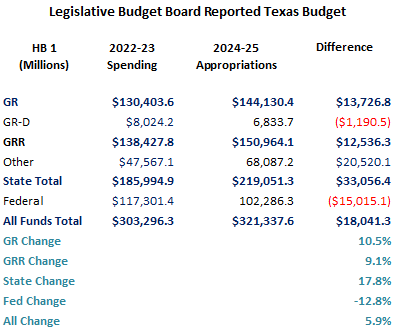

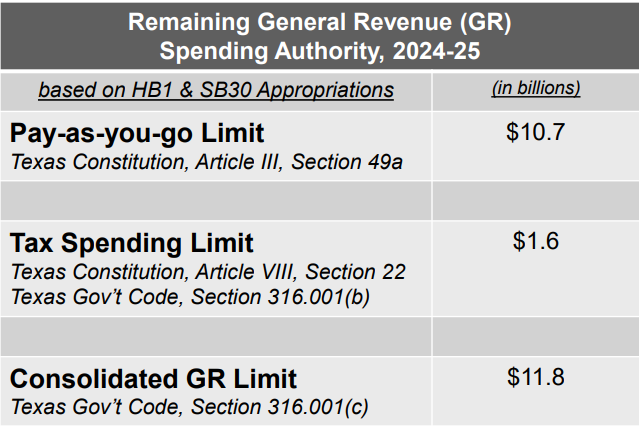

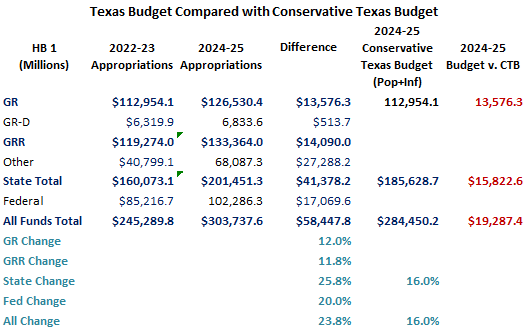

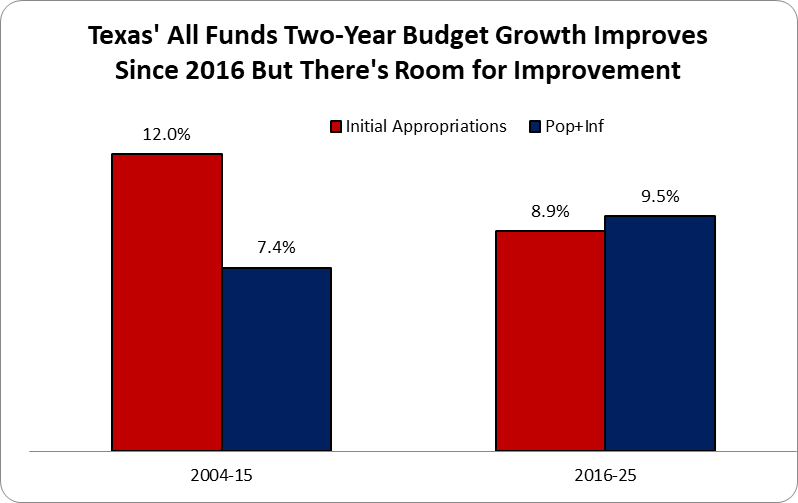

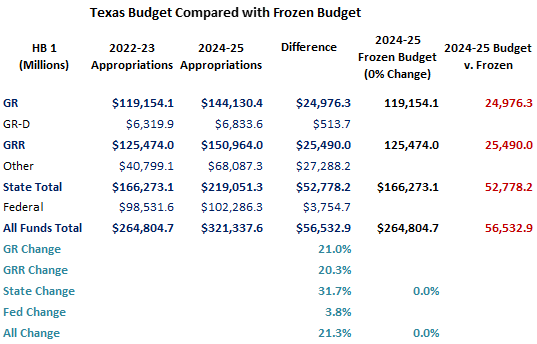

You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share on social media, subscribe to your favorite platform and my newsletter, like it, and leave a 5-star rating. Find show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more at my website and my Substack newsletter. Unfortunately, Texas Governor Greg Abbott (R) signed the Texas budget passed by the 88th Texas Legislature with largest spending increases, largest corporate welfare increases, and largest social safety net increases without the largest property tax cuts in Texas history. State officials can claim that the budget increases by less than the rate population growth and inflation using the data in the table below by the Legislative Budget Board. But those calculations use fuzzy math as they're based on inflating the 2022-23 base budget of general revenue not dedicated by the constitution and consolidated general revenue with more spending then increasing it by the rate of population growth times inflation of 12.33% (determined by the average of population growth times inflation over the last two years and the upcoming two years) compared with 2024-25 appropriations which will be higher later when the supplemental bill passes. These calculations are then spending-to-appropriations which are like comparing apples with oranges, not appropriate accounting. Even with these calculations, the Legislative Budget Board shows that there is $10.7 billion in tax revenue remaining, $1.6 billion available under the constitutional spending limit using general revenue not dedicated by the constitution, and $11.8 billion available under the 2021 spending limit using consolidate general revenue using general revenue and dedicated general revenue. The charts below are more accurate ways to evaluate the budget growth from an appropriations-to-appropriations approach for an apples-to-apples comparison. Understanding that any growth in the budget means an expansion of government, there are two strong arguments: 1) Freezing the budget in inflation-adjusted per capita terms using the rate of population growth plus inflation (i.e., Conservative Texas Budget and responsible budget approach in other states), which was 16% over the last two fiscal years, is appropriate as it grows slower than the economy over time. This approach excludes $13.3 billion in COVID-related funding in the first biennium and excluding new and old property tax relief amounts of $6.2 billion ($100 million in new relief) in the first period and $17.6 billion ($12.3 billion in new relief and $5.3 billion in old relief) in the second period to not include one-time federal funding and amounts that don't grow government. Using the CTB approach above, here's how the budget has improved since implementation of the CTB started with the 2016-17 budget. This looked much better before the current 2024-25 budget, but the massive growth of the current budget raised the growth of initial appropriations even as the rate of population growth plus inflation rose slightly during the latter five budget period. If the growth of the budget is not controlled, it will soon surpass the rate of population growth plus inflation like it did during the prior six budget periods. 2) Freezing the budget with zero growth as the budget is already too big (i.e., Frozen Budget), including COVID-related funds in the first period and new and old property tax relief amounts in both periods. Both of these approaches show that while the general revenue-related (GRR) funds amount is below the rate of population growth and inflation (either plus or times) for the CTB approach, the broader measures of state funds and all funds that better represent the burden of government spending on taxpayers are well above either metric. And when using the Frozen Budget approach, the only budget amount below either rate of population growth and inflation is federal funds.

In other words, they are using fuzzy math when it comes to the budget and property tax relief. This looks much more like what would be done in California rather than Texas. This is not what Texans want or expect from their elected officials. If this continues, Texas will be California soon. There’s time to turn some of this around with at least passing more for property tax relief that does it correctly (here's why) for everyone through compression of school M&O property taxes on their path to zero. It would be great if they could get to $21B in new relief, which is the $14.2 billion in property tax relief provided in 2008-09 adjusted for inflation, instead of the $12.3B currently discussed but that looks unlikely now so it won’t be the largest property tax relief in Texas history. The red state of Texas must not sit back on its laurels. The populist trend must not continue. Do what's in the best interest for everyone which is limiting or cutting government spending, taxes, and regulations so that there's more freedom for people to do what's in their best interest and let people prosper. Thank you for reading the Let People Prosper newsletter, which today includes the 12th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover:

1) National: Why the new inflation rate is not exactly good news in light of prices still being too high in many sectors and why the Fed should more aggressively cut its balance sheet; 2) States: Updates on the Texas special session and the ongoing fight for property tax relief and why I believe eliminating M&O property taxes with compression is the best path forward; Louisiana's latest session and why its budget is irresponsible; and 3) Other: Discussion of "the new right" and why it's anti-capitalism and anti-freedom. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter, share this post, and leave a comment. The debt ceiling fiasco is over, and with it, the costly Inflation Reduction Act, or as I like to call it, the Inflation Recession Act, was unfortunately left mostly intact. Congress’s lackluster attempt to curb spending will matter even less considering this, as new calculations show. The time is ripe for a reassessment and elimination of at least the ill-advised tax credits contained within the IRA before irreversible damage is inflicted on our already suffering economy.

Last year, the Congressional Budget Office (CBO) estimated that the IRA would cost $391 billion from 2022 to 2031. But with updated data and Treasury rules, new cost estimates show it to be three times higher at $1.2 trillion. During my recent testimony before the U.S. House Ways and Means Committee, I noted the need for a re-estimate of the IRA’s cost for tax credits that subsidize manufactured battery cells and modules for electric vehicles (EV). The CBO’s estimate of these tax credits was $30.6 billion, but new calculations have it at nearly $200 billion–or nearly seven times higher. Battery cells can receive a $35 tax credit for every kWh of energy the battery produces, while battery modules can receive $10 per kWh, or “$45 for a battery module that does not use battery cells.” The CBO’s assessment was conducted prior to the Treasury’s release of draft guidance in March that relaxes mineral sourcing standards to produce EV batteries. And since the IRA passed, there’s more evidence that incentives matter as EV manufacturers substantially increase production to get the tax credits well above CBO’s estimates. Look no further than Tesla for a real-time example of how these tax credits will cost us. Maker of the most-sold EVs in America, Tesla moved its battery production from Germany to Texas after the tax credits were announced. And its Model Y emerged as the best-selling EV in the U.S. last year, with a total of 234,834 units sold. Its battery starts at 75-kWh, so for those sales, Tesla could have received more than $616 million in tax credits had the tax credits been in place. For 2023, Tesla expects to manufacture 2 million EVs, resulting in possibly $5 billion in annual tax credits for batteries. Meanwhile, Ford, which had the second-highest EV sales last year, plans to triple production for its F-150 Lightning, targeting 150,000 units by the end of 2023. The battery size for this model starts at 98-kWh, and assuming Ford meets its goal, that would cost taxpayers $514 million in tax credits. If Tesla and Ford can collectively receive at least $1 billion in tax credits in 2023, it’s easy to see how the CBO’s estimate over the next decade for all EV batteries is too low. This difference between the estimates and the growth of the EV market is concerning in this post-pandemic economy, verging on a recession where more than 60% of Americans are estimated to be living paycheck to paycheck. More government spending, like what’s allotted in the IRA, and more debt, like what’s allowed under the debt ceiling deal, is the last thing America needs. As government spending increases, so do taxes, leading to less work, lower productivity and growth, and, subsequently, less tax revenue. These measures contribute to even higher budget deficits that stifle economic growth, increase poverty, and exacerbate multi-decade high inflation. While the IRA’s green energy initiatives, massive tax hikes, and excessive spending should have been enough reason to reject it initially, Democrats forced it through based on CBO’s massive underestimates of tax credits and other initiatives. Now, taxpayers will suffer the aftermath of this expensive legislation, which is why these costs should be reevaluated and ultimately eliminated before this weak economy is made worse for struggling Americans. For a better path forward, we need more pro-growth policies and less government spending, not bad debt deals and corporate welfare to large businesses on the backs of taxpayers. Originally published at Econlib. Today, I'm honored to be joined by Leslie Ford, adjunct fellow at the American Enterprise Institute’s Center on Opportunity and Social Mobility and a senior fellow with the Alliance for Opportunity. We discuss: 1) The history of the war on poverty, how safety net programs have evolved, and where the war on poverty stands today; 2) How safety net programs can discourage upward mobility and keep people trapped in poverty through penalties such as those on marriage; and 3) Data on what requirements help safety net recipients achieve long-lasting self-sufficiency and prosperity, and more. You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share on social media, subscribe to your favorite platform and my newsletter, like it, and leave a 5-star rating.

Find show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more at my website and here in my Substack newsletter. Please subscribe to this newsletter, share it with your friends and family, and leave me a comment. Thank you for joining me for the Let People Prosper podcast, which today includes the 12th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover:

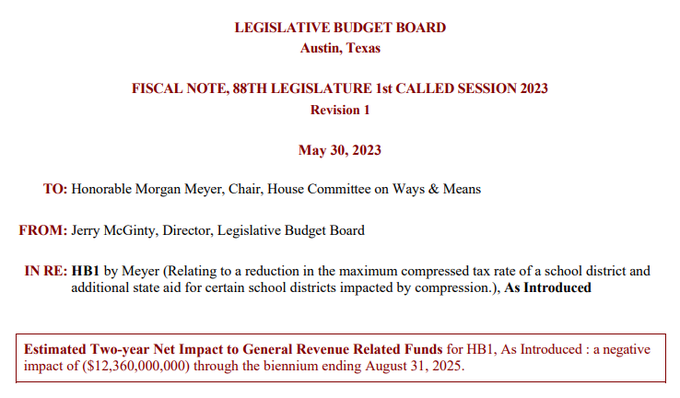

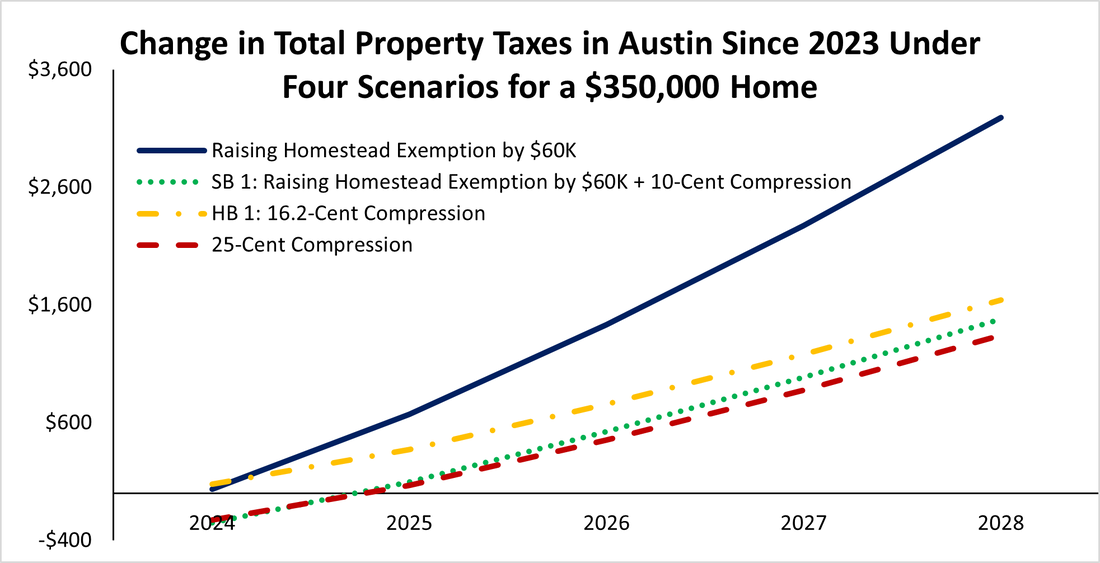

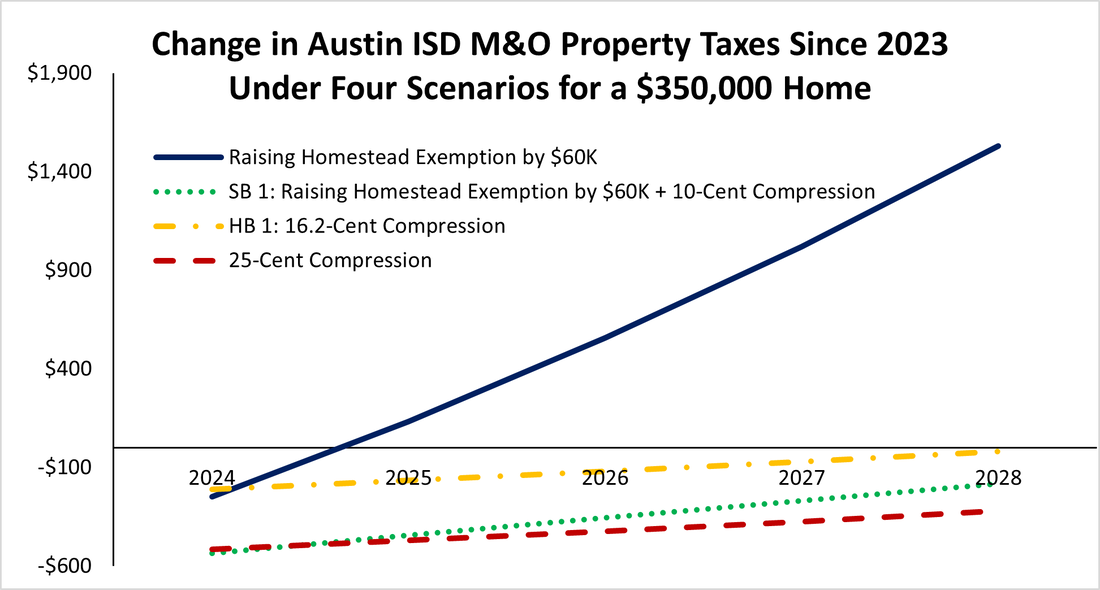

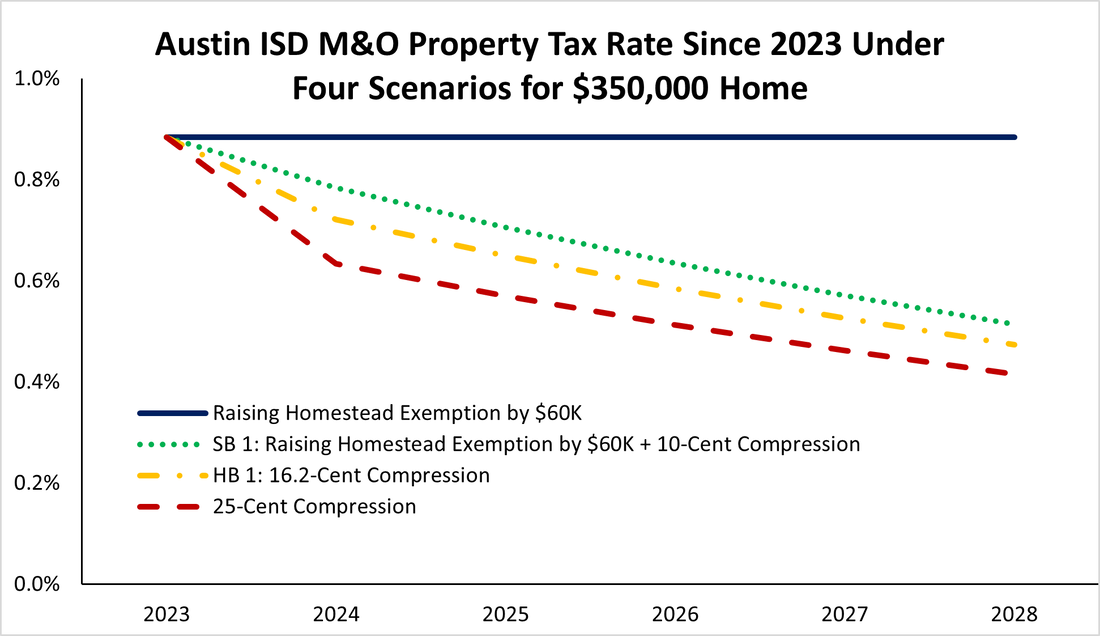

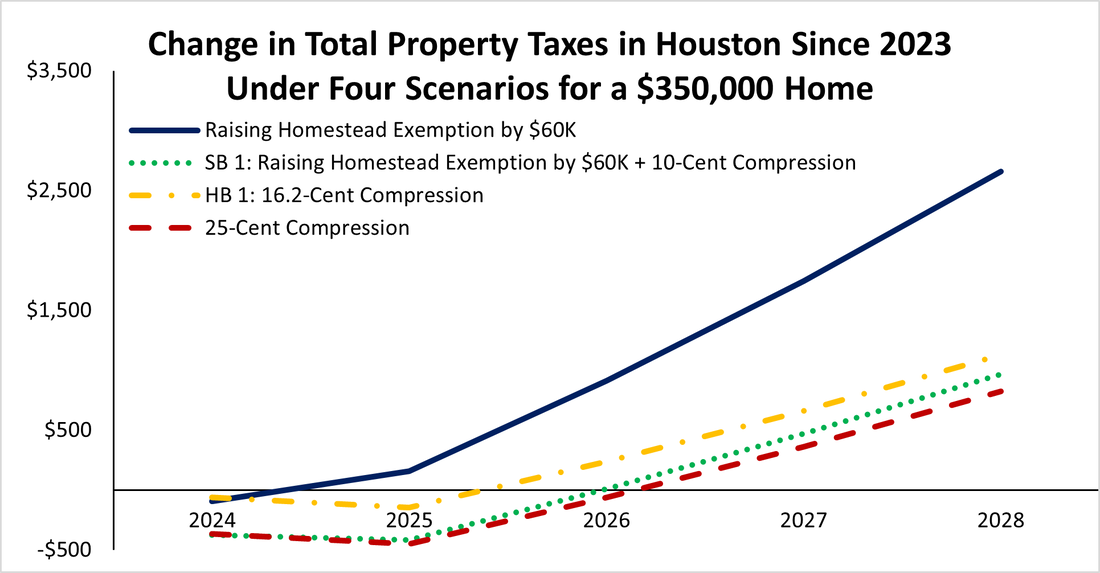

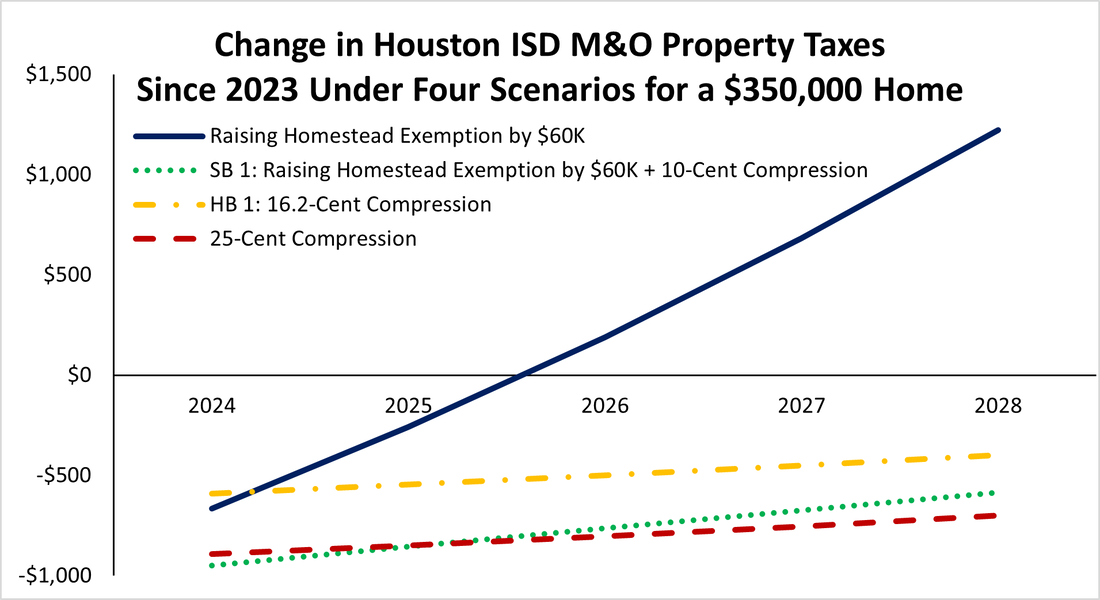

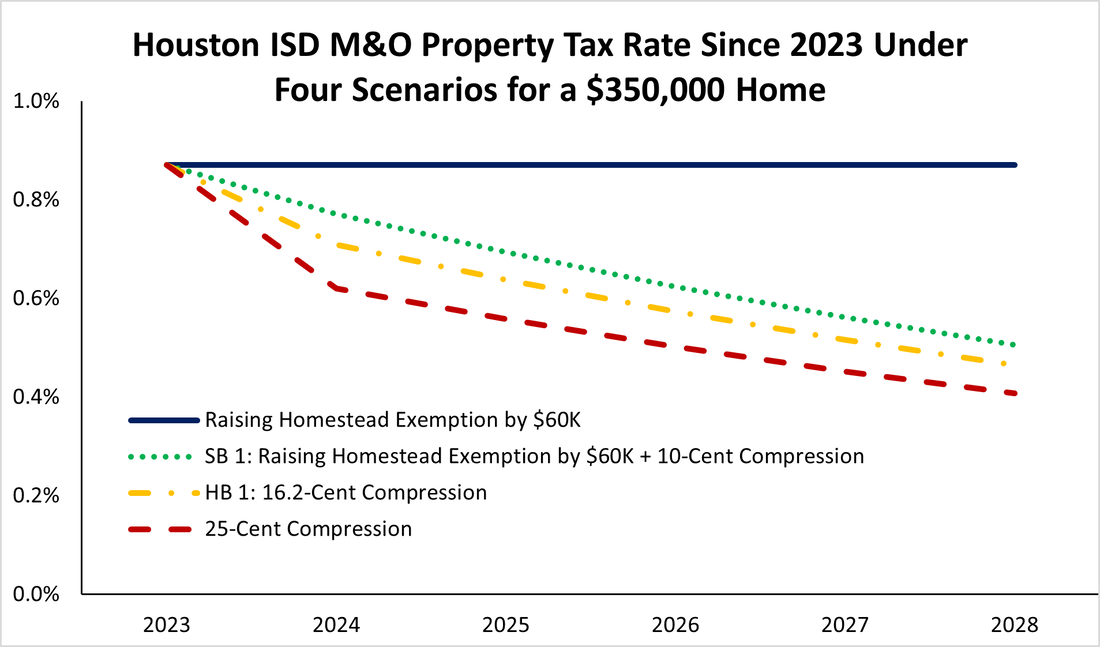

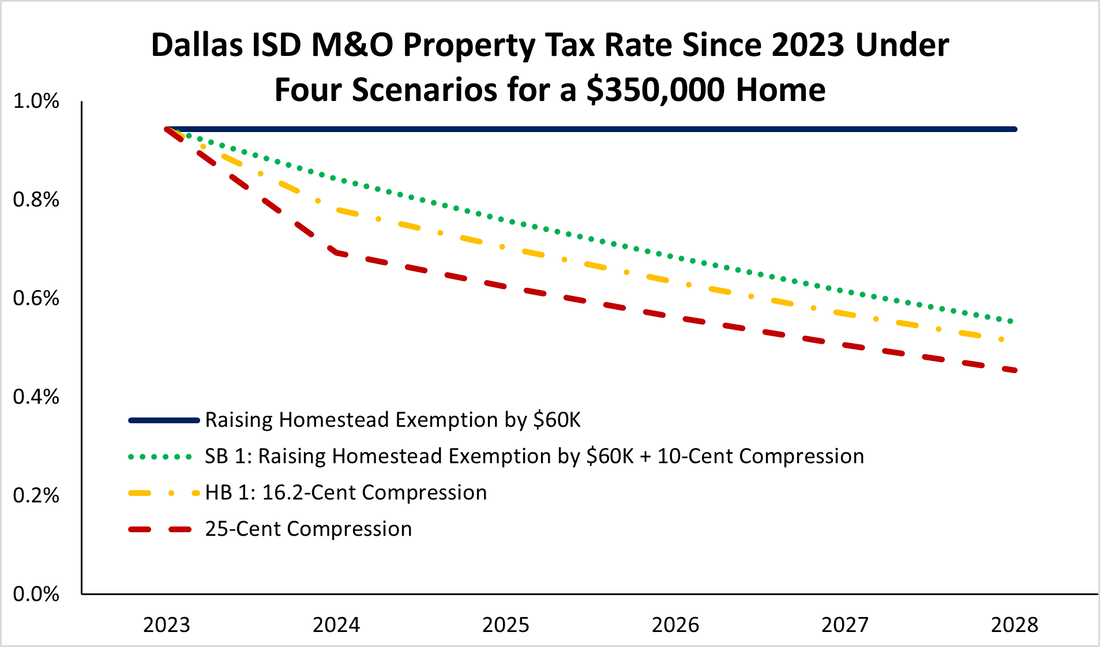

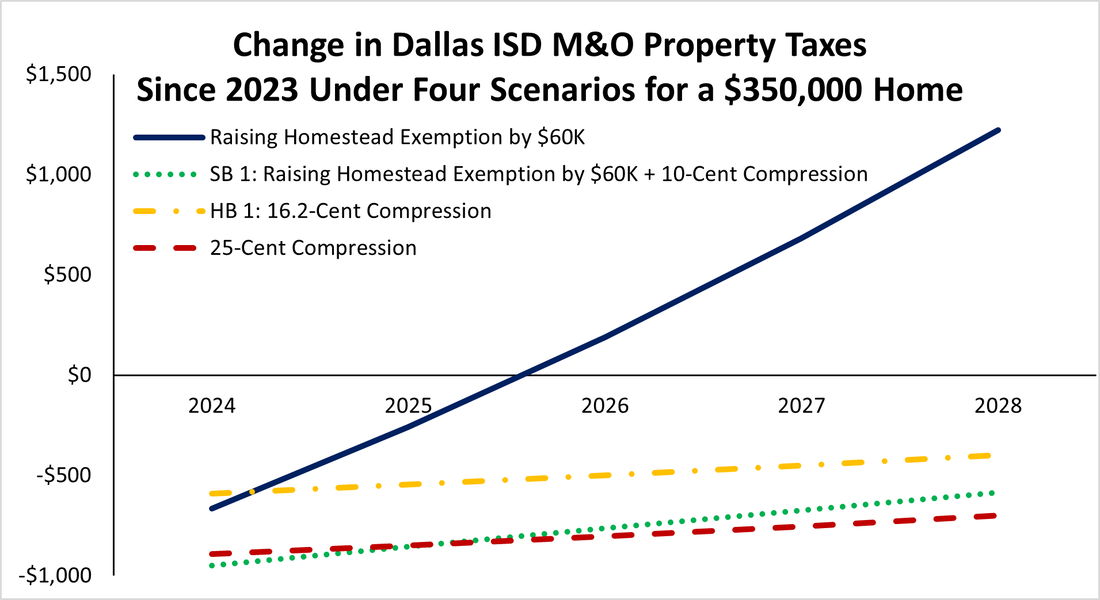

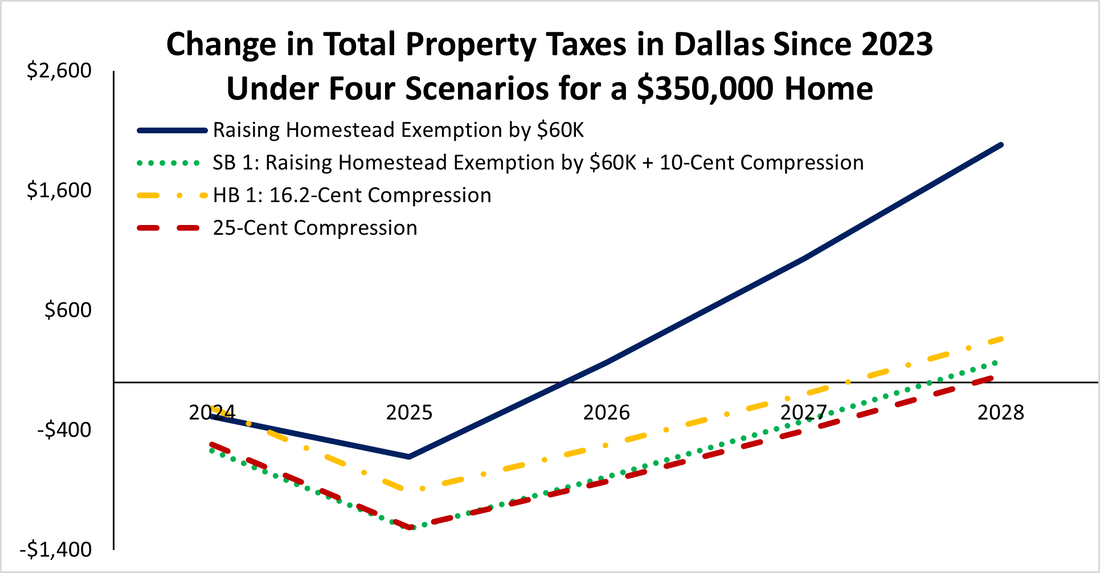

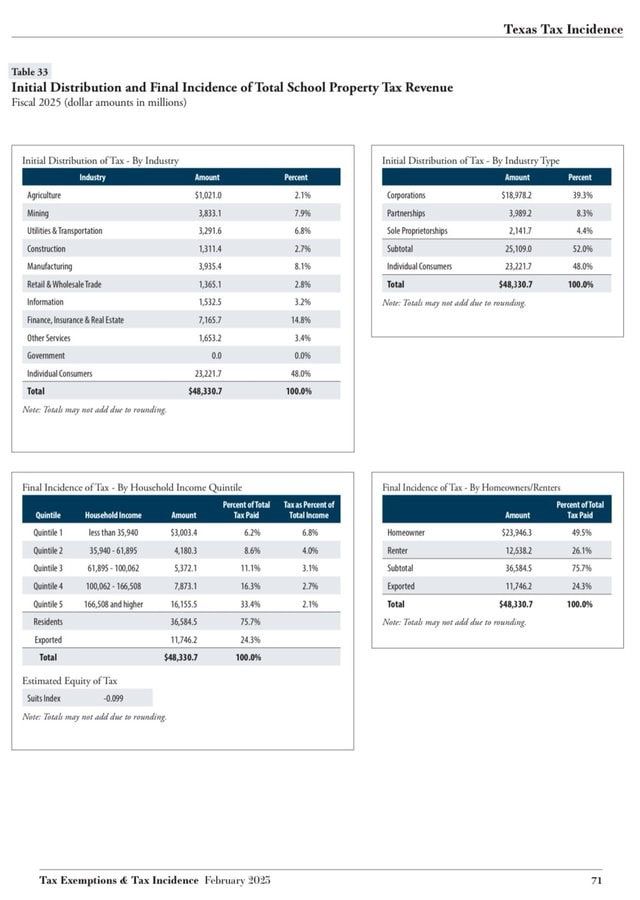

1) National: What the new market data and latest jobs report indicate about the current economy, insights from the Establishment and Household Surveys, and my thoughts on the recently passed debt ceiling deal; 2) Texas: Discussion on the latest efforts in Texas to eliminate property taxes with a buy-down of school M&O property taxes using state surplus funds for what’s called compression (details here), and why this is the best path forward for Texas to prosper; 3) Other: Sneak peek of next week's exciting podcast episode with Leslie Ford discussing safety net reforms. Please like this video and subscribe to the channel if you enjoyed this podcast! And don’t miss my latest Daily Caller article on the debt ceiling deal: You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (https://www.vanceginn.com/) often for updates and subscribe to my newsletter to receive these episodes and more in your inbox. It's great to see that state officials in Texas are debating how to provide one of the largest tax cuts in the state's history. Unfortunately, that amount is only about $12.3 billion in new relief (an additional $5.3 billion to maintain past relief) of the at least $33 billion surplus. And given that the largest property tax cut was $14.2 billion for 2008-09, the state would need to provide $21 billion in new relief this time for it to be the largest tax cut in Texas history so that Texans can have the same purchasing power of relief as in 2008. While there's a lot of debate of how the state should provide property tax relief of school district maintenance and operations (M&O) property taxes, the best way to provide the most relief to everyone is through compression, which is using state dollars mostly through sales taxes to buy down school district M&O property taxes that the state mostly controls with its school finance formulas, and it is the best way being discussed to get those taxes to zero. The Texas House already passed HB1 in the first special session that provides $12.4 billion for a 16.2-cent (per $100 valuation of property) compression of ISD M&O property taxes. Meanwhile, the Texas Senate already passed SB1 that provides $12.1 billion for 10-cent compression and a $60K increase in homestead exemption to $100K for ISD M&O property taxes. Texas Governor Greg Abbott then tweeted that his plan is the plan outlined by the Texas Public Policy Foundation which uses state surplus dollars for compression of ISD M&O property taxes each session until they are zero. I’m very familiar with this plan as I co-authored the original version with my former colleagues at TPPF in 2018. The plan has been through multiple iterations. My July 2021 co-authored paper looked at this buy-down approach of using 90% of state surplus dollars above a stricter spending limit of population growth plus inflation to compress school M&O property taxes until they are zero within about a decade or a tax reform that would broaden the sales tax base to eliminate those taxes immediately without raising the rate based on a dynamic economic model. And the latest was a December 2022 co-authored paper where we address the affordability crisis in Texas and how the buy down plan would help with this while providing more economic growth. I also wrote a 2023 paper updating this based on how quickly this could be done if a frozen budget with zero growth was used to provide more surplus funding to eliminate these property taxes. And I also wrote another 2023 paper noting how there is no need to fear about a recession or reduced revenue as there would be the need for spending restraint or cuts, plenty of money in the rainy day fund, or excess reserves held by school districts to address any shortfall to maintain the relief and fund public education. Two professors at Rice University also studied different reforms in 2018 of the buy down approach and the sales tax expansion approach to eliminate school M&O property taxes and they found that these would provide substantial benefits to the state. Compression is best because everyone benefits, including from the dynamic effects of more growth, more jobs, and lower prices, and it's the only way that's being discussed today to get the school M&O property tax rate to 0%. The other path by the Senate is to raise the homestead exemption from $40,000 to $100,000 but that will never eliminate those taxes and will push the burden of funding spending to everyone else making the system less equitable while evaporating any relief quickly from appraisal growth and making the path to elimination harder .because rates will rise from it. Given the different approaches being discussed by the House/Governor and Senate/Lt. Governor, I did an analysis of the median valued home in Texas of $350,000 in Austin, Houston, and Dallas. I used the tax rates for each of these locations and had the home increase in value by 10% per year, which is the maximum growth for a homestead under current law. I didn't change anything else to provide an apples-to-apples comparison of a tax reform in 2023 to estimate what would happen over the next five years given a 1) $60,000 increase in the homestead exemption, 2) SB 1 with $60,000 increase in the homestead exemption and 10-cent compression, 3) HB 1 with 16.2-cent compression, and 4) what would be largest tax cut in Texas history with a 25-cent compression. I should note that this modeling is just on a homestead so doesn’t account for the much more broad-based effects of the compression scenarios. Austin The following three charts are for Austin, including Austin ISD, to see what these four scenarios would look like given the assumptions above in each year. The first chart shows what would happen for total property taxes (i.e. ISD, city, county, and special purpose district property taxes) under these scenarios compared with the total tax paid of $5,945 for a $350,000 home in Austin, which the results show that SB 1 and the 25-cent compression are similar but both of them would have only one year of lower total property taxes until 2025 when the amount paid would exceed that of 2023. The second chart shows similar results as SB 1 and the 25-cent compression have the greatest effects on the 2023 ISD M&O property taxes of $3,089 but HB1 also provides relief until 2028 when the amount paid would exceed that of 2023. But, more importantly, given these are only homesteads and don't account for families who pay rent or own a business, the third chart shows that HB 1 with 16.2-cent compression and the 25-cent compression cut the tax rate the most over time as this compression in just 2024 continues to buy down the rate as values increase by 10% in this example. Houston The following charts are for Houston with similar results for each of the scenarios. Dallas The following charts are for Dallas with similar results. I recently explained how this would work and how compression is the gold standard with the only meaningful way to eliminate school M&O property taxes that are being discussed now in my conversation on CBS News Texas. I also recently wrote how the Texas Legislature had the largest spending increase in Texas history this session thereby not providing enough in property tax relief. I argued that Gov. Abbott should veto the budget or at least $8 billion of budget items and use it for compression so that Texans get record relief. It should be noted that compression will help renters. The Texas Comptroller's report (see figure below) finds that 26% of school property taxes are passed along to renters, and businesses submit 52% of those taxes but people pay for them through higher prices, lower wages, fewer jobs, and higher rent. Simple supply and demand shows that the property taxes would rotate the private market supply of housing leftward thereby raising rents and lowering the quantity supplied compared with the free market. In other words, the market does set the rents but that market is distorted by property taxes so removing those school taxes would help push down rents through competition. When the landlord has a vacancy and is paying lower property taxes, then she will lower the rent given lower cost to attract tenants. It may not happen overnight but it will as that’s how competition works, and those biz that don’t will by forced out of the market through losses. This wouldn't just be a shift in supply of housing that would reduce rents, which would happen some when this tax is cut and certainly when it’s eventually eliminated, but that’s not the only way. There’s also movement down the demand curve as the supply curve corrects to the private supply curve (S1) rather than the distorted supply curve (S2) with the ad-valorem property tax which will lower prices and increase the quantity supplied. This is through competition which will happen as consumers will have more negotiating power and landlords will want to rent out every unit but won’t if they don’t lower their rents as their competition will because their costs have been reduced. From the fact that property taxes are going down there’s a reduction in cost by the landlords so they have the ability to get more renters at a lower rent. And renters would know this as property taxes go down or they will go to another location. Hence, more consumer power, which the consumer has much power in every market if they choose to wield it, especially jelly when govt gets out of the way. It wouldn’t change rents overnight as many are in leases, but it would over time. One of the issues contributing to the affordability crisis in #Texas especially for lower-income folks is skyrocketing property taxes. Any relief would be most appreciated by 100% of property holders through compression. Lowering school M&O property tax rates through compression is the best path for everyone to benefit, not only from lower taxes but also more economic growth, and for those taxes to go to zero. Many groups have already stated their support for the buy down plan, which is also supported by the Governor and the House has passed much of it though they need to add HB 5 by Rep. Briscoe Cain which would put in statute the buy down plan to zero. At the end of the day, I'm glad Texans are talking about property tax relief as other states have been cutting taxes so Texas can't sit back and be competitive with other states without spending less and cutting taxes, as corporate welfare makes the problems worse. The Legislature unfortunately passed a revamp of the expired Chapter 313 in HB 5 during the regular session that is now called Chapter 403, which provides property tax abatements issued by school districts to mostly big businesses. Fortunately, when school district M&O property taxes are eliminated, this corporate welfare will be eliminated, too.

There are so many reasons to eliminate this tax. Texas will be an economic juggernaut! And what's maybe the most important is that Texans will have more of their right to own property preserved instead of renting from the government forever from this immoral wealth tax known as property taxes. Raising the homestead d emotion might be a part of the final deal, but we should remember that the homestead exemption picks winners and losers, is not sound tax policy, and has been tried three times (1997, 2015, and 2021) without substantial reductions in those taxes paid. 'm okay with broadening the sales tax base and eliminating school M&O property taxes immediately and using surplus dollars to buy down sales taxes over time. This would also broaden the sales tax base for local governments which should use those funds to buy down their own property taxes and limit their spending with a restrictive limit like the state's based on population growth and inflation to use surplus dollars to buy down the rest until they are zero. But there isn’t the political will yet do this approach so the best way right now is the buy down path for school property taxes by the state and local government buying down their own could happen over the next decade for the eventual elimination of all property taxes in Texas. The time to start doing this is now. Get tax relief done for Texans! Today, I'm honored to be joined by Alex Nowrasteh, Director of Immigration Studies at Cato Institute's Center for Global Liberty and Prosperity. We discuss: 1) Immigration myths, including "immigrants steal jobs," and why that isn't true; 2) What data reveal about where today's immigrants are coming from, how their life improves upon moving to America, and how America is improved by immigrants, and 3) Need for immigration reform, why one day we'll tear down the Texas border wall, and more. You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share on social media, subscribe to your favorite platform and my newsletter, like it and leave a 5-star rating.

Thank you for checking out the latest podcast episode, which today includes the 11th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover: 1) National: Why the debt ceiling deal that just passed through the House would be disastrous for the nation and a better path forward is to spend less to relieve the economic suffering of Americans; 2) States: A recap of the 88th Legislative Session and what Gov. Abbott should push for in the recently-called special session to alleviate Texans of burdensome property taxes, excessive state spending, and massive corporate welfare. 3) Other: Exciting Let People Prosper updates including a new episode with NYT bestseller Amity Shlaes, and an insightful new podcast next week with Alex Nowrasteh on immigration. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating!).

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, keep coming back to my website or subscribe to my newsletter, share this post, and leave a comment. Texas’ 88th regular legislative session, sine die as of Memorial Day, will be remembered as the one that got Texas closer to looking like California and less like the leading pro-market and limited government Lone Star State.

Instead of the desired “largest property tax cut in Texas history,” school choice, and spending restraint that would best let people prosper, legislators passed the largest increases in spending, corporate welfare, and safety nets in state history. Texas taxpayers can only hope that Gov. Greg Abbott’s (R) just-called special session will help with property tax relief but there will need to be more special sessions for universal school choice and other pro-prosperity priorities. The newly passed total budget for the upcoming two-year period amounts to $321 billion, which is a 21.3% increase from what was initially appropriated in the prior period. Excluding federal funds, state funds increased by 31.7% to $219.1 billion. These are the largest increases in recent history and likely ever. And both are substantially above the rate of population growth plus inflation of 16% over the last two fiscal years. In short, legislators passed massive budget increases which aren’t conservative or responsible and will make it difficult to sustain these expenditures over time. Making matters worse, the Legislature provides over $10 billion in new corporate welfare, the largest amount in state history. This includes renewal of property tax abatements by school districts, HB 5, that had died in December 2022, money for the governor’s Texas Enterprise Fund, and subsidies for natural gas projects, movie production, broadband projects, water projects, state parks, and more. And much of this will be on the ballot this November to create new funds to spend on these efforts, which voters should reject. Instead, these expenditures should be done in the normal budget process as constitutionally dedicating these taxpayer dollars will remove them from under the constitutional spending limit, allowing the state to spend even more. Texans were quick to celebrate the movement toward new property tax relief efforts, which is a major burden for property owners across the state. And with a surplus of $33 billion, there was the opportunity to do so by rightfully returning these over collected taxes. But those cuts never materialized in the wake of less effective solutions of appraisal caps and homestead exemptions taking precedence over the previously promised historical property tax cut. The gold standard for relief of school district maintenance and operations property taxes is through compression, which means that the state uses mostly sales taxes to buy down those property tax rates and thus tax collections by the most possible. And the amount should be about $21 billion, or 25-cent compression, in inflation-adjusted dollars to have the same purchasing power today as what was the largest property tax cut of $14.2 billion in 2008. This is a critical path to eliminating nearly half of the property tax burden in Texas so people can truly own their property instead of renting from the government forever. Still, any relief provided is made much less effective with the passage of HB5, which is just Chapter 313 revamped. HB5 gives more corporate welfare to big businesses by allowing school districts to give tax breaks to companies for new buildings, thereby choosing winners and losers among school districts affected. As school districts lose property tax funds at the hands of HB5, state funds must compensate for the loss on the backs of taxpayers across the state. These big spending, big corporate welfare, and no tax relief represent a potential turning point in the wrong direction that harms a robust economy. In the first called special session this week, there has already been a bill passed by the Texas House that would provide that opportunity by compressing school district M&O property taxes by 16.2 cents per $100 valuation with $12.4 billion. The Texas Senate has a proposal that would compress those taxes by 10 cents per $100 valuation and raise the homestead exemption by $60,000 to $100,0000 with $12.1 billion. So far, Gov. Abbott has said that the call was only for compression but Lt. Gov. Dan Patrick (R) has been pushing back. At the end of the day, compression is best as it helps everyone, is long-lasting as a share of taxable value, and, more importantly, is the only way to eliminate these taxes. But what’s still a problem is that these amounts are only about one-third of the $33 billion surplus, meaning the Legislature wants to spend more money than return to taxpayers. This is not the path to prosperity as at least $21 billion in new tax cuts is needed for this to be the largest property tax relief in Texas history. Lawmakers should prioritize responsible relief measures that encourage job growth and support initiatives that promote long-term economic prosperity by reducing spending, cutting taxes, and supporting prosperity. Originally published by The Center Square. Larry and Glenda Legler think the state should be using much of its nearly $33 billion surplus to give Texans a break on their property taxes.

Larry Legler said, "The state's got an ungodly amount of money that they need to do something with." But after months of promises to do that, Republican leaders still can't agree on the way to provide relief. "That's what's getting frustrating." Governor Greg Abbott prefers ending the school maintenance and operations or "M&O" portion of your property taxes over ten years. That portion alone is about 42% of your property tax bill. To make that happen, the state would shift sales tax, other state revenues, and surplus money to pay for public schools. That would allow the state to gradually reduce the rate for M&O property taxes until they're eliminated altogether. Vance Ginn, a conservative economist and president of Ginn Economic Consulting, has pushed this idea for years. "It's the only way that you can get to $0 school district property taxes is by buying down those rates because that rate can go to zero which zero out of a hundred-dollar valuation for a home is $0. And so that is still $0, and you've eliminated that tax." But Lt. Gov. Dan Patrick and the Texas Senate have a different plan. While it uses more state revenues and less property taxes to pay for schools, it would also increase homestead exemptions for most homeowners from $40,000 to $100,000. And for homeowners over 65, it would raise homestead exemptions from $70,000 to $110,000. Patrick said it would provide nearly double the savings for homeowners than the Governor's plan. CBS News Texas asked Patrick earlier this week if he doesn't support eliminating the school property tax. He said, "You can't get there. You only have sales tax to prop up a state of 30 to 35 to 40 million people the next decade. What happens when we have a decline and sales taxes go down? You'll have no money to pay your bills. You can't be a one-legged horse." Ginn disagreed. "The Comptroller said we're going to have about $27 billion in the rainy-day Fund. The rainy-day fund is there to cover unforeseen revenue shortfalls which would be exactly this sort of situation." Abbott said 30 business and other groups support his plan. The Leglers said because they're seniors, they prefer the plan from Patrick and the Senate. "Everything's gone sky high and when people can't get the medications they need, which is not our case, but many people we know, or they can't afford groceries, a loaf of bread at the grocery store, we got a problem." Both the House and Senate have approved different legislation, and until they pass the same bill, the Governor cannot sign it into law. Abbott will speak Friday about this, and other issues related to the regular and special legislative sessions. Originally published by CBS Texas. On Wednesday night, the House passed what could be one of the worst debt ceiling deals in U.S. history, as it doesn’t provide the fiscal responsibility needed for suffering Americans.

In fact, this deal perpetuates most of the same reckless policies that have contributed to stagflation, leaving Americans struggling financially. Despite what appears to be a relatively strong labor market, wages have failed to keep pace with inflation on an annual basis for more than two years. Homeownership has become unattainable for many, and higher prices have forced over half of the adult population to reduce their savings. You would think that such widespread suffering would motivate Congress to reform its fiscal insanity, but apparently, that’s not the case. While 49 out of 50 states have a balanced budget amendment and most have a spending limit, there are no such rules at the federal level. The debt ceiling is the only mechanism, other than elections, that we have to keep Congress’ spending in check. By suspending the debt ceiling, we’re inviting more reckless spending, which is why our national debt has skyrocketed to a ridiculous amount of more than $31 trillion. The net interest on the debt alone will soon surpass $1 trillion. The new debt ceiling bill allows politicians to kick the can further down the road of payment for the debt to our children and grandchildren to deal with later. By raising the debt ceiling for another two years and only imposing a one percent annual spending limit next year, there’s ample room for the debt and spending to continue to grow at an already bloated budget. A more reasonable timeframe for suspending the limit would have been two months, giving Republicans and Democrats the opportunity to pursue essential spending restraint. Irresponsible spending is a bipartisan problem, but Republicans, with their majority in the House and a platform of fiscal conservatism, bear even greater responsibility to address this issue. Two years is an extensive period considering the adverse effects of the current national debt on inflation, interest rates, the U.S. dollar’s status, and the result of exacerbating the daily struggle of Americans to make ends meet, let alone pursue the largely destroyed American Dream. Some argue that Congress should budget like a family. However, they should budget even more conservatively as Congress is entrusted with the hard-earned tax dollars of the public, not their own. Unleashing spending on out-of-control war efforts with the lack of major reforms and cuts where needed in the budget when our country teeters on the brink of financial crisis doesn’t promote individual liberty or economic growth. In the meantime, fiscal conservatives in Congress should continue advocating for a spending limit rule such as seen in the states to put an end to this crisis. A responsible budget that grows, if it grows at all, by less than the rate of population growth plus inflation, which represents the average taxpayer’s ability to afford spending, would be a great goal. Without substantial spending restraint, Americans can expect more suffering. As economist Milton Friedman once said, the ultimate burden of government is not how much it taxes but how much it spends. This debt ceiling bill was an opportunity to help reduce this burden, and we lost that. Originally published by the Daily Caller. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed