Pros and Cons of Using a Home Equity Line of Credit to Pay Off Your Mortgage: Interview on NTD News5/22/2024 With house prices surging recently, the average American homeowner now has around $300,000 of equity in their home. With the cost of living also soaring, many homeowners are considering taking out a home equity loan, or HELOC, to pay off their mortgage. But how exactly do such lines of credit work, and are they a good idea?

NTD’s Evelyn Li spoke with Vance Ginn, the former chief economist at the White House’s Office of Management and Budget and the president of Ginn Economic Consulting, to find out more. Interview on NTD News on May 22, 2024: https://www.ntd.com/pros-and-cons-of-using-a-home-equity-line-of-credit-to-pay-off-your-mortgage-economic-consultant_994520.html

0 Comments

Originally published at AIER.

Recently, the Biden administration handed $1.5 billion to the nation’s largest domestic semiconductor manufacturer, GlobalFoundries, the biggest payout from the CHIPS and Science Act of 2022 so far. The argument for this corporate welfare is America is too dependent on chips from China and Taiwan so more should be made domestically. Instead of seeing how America should reduce the cost of doing business for all semiconductor businesses here, some businesses will be picked as winners and others as losers. The cost of this form of socialism gives capitalism a bad rap and should be rejected. This move echoes a broader trend of governments worldwide intervening in their economies through industrial policy. A cocktail of targeted subsidies, tax breaks, and regulatory tinkering, industrial policy aims to sculpt economic outcomes by favoring specific industries or firms, all for the supposed benefit of the national economy. Industrial policy puts business “investment” decisions in the hands of government bureaucrats. What could go wrong? While its champions tout its potential to boost competitiveness and spur innovation, the reality often tells a different story, especially in light of massive deficit spending. In practice, industrial policy tends to fan the flames of higher prices and sow the seeds of economic destruction. Politicians too often meddle with voluntary market dynamics by artificially bolstering favored sectors through subsidies and tax perks, resulting in the misallocation of resources and distorted prices. Moreover, the infusion of government funds to bankroll these initiatives with borrowed money can contribute to the Federal Reserve helping finance the debt, increasing the money supply, and stoking inflation. The nexus between deficit spending and prices looms large over industrial policy. When politicians resort to deficit spending to bankroll industrial ventures, they put upward pressure on interest rates by issuing more debt and competing with scarce private funds. Elevated interest rates disturb private investment, ushering in a likely economic slowdown. Suppose deficit financing leans heavily on monetary expansion, whereby the central bank snaps up government debt. In that case, it fuels inflation by flooding the market with money that chases fewer goods and services. The national debt is above $34 trillion, and the Federal Reserve has already monetized much of the increase in recent years. Racking up even more deficits is insane: repeating the same mistakes and expecting a different result. Excessive spending and money printing have landed us with above-target inflation for over three years running. The repercussions of industrial policy ripple beyond inflation to encompass the broader economic landscape. Excessive government meddling in specific industries crowds out private investment and entrepreneurship. When particular firms enjoy subsidies and preferential treatment, it distorts the competitive landscape and deters innovation. This stifles economic vibrancy and impedes the rise of new industries or technologies crucial for sustained growth. For a cautionary tale of how Biden’s recent move could play out, look no further than Europe. Nations like Sweden, heralded by the West as a utopian example of big government yielding big benefits, spent the last year grappling with economic strife driven by dwindling private consumption and housing construction. Europe’s penchant for industrial policy, marked by subsidies, high taxes, and regulatory hoops, has contributed to its economic stagnation. To sidestep the dilemma of industrial policy missteps, policymakers should stop propping up their favorite sector or industry and instead unleash people to flourish by getting the government out of the way. Politicians should foster an environment conducive to entrepreneurship, innovation, and competition. This entails cutting government spending, reducing taxes, trimming red tape, and championing trade by removing barriers to private sector flourishing. By allowing market forces to determine resource allocation and rewarding entrepreneurship and risk-taking, people here and elsewhere can unleash their full potential and adapt to changing circumstances more effectively than under industrial policy frameworks. Biden’s billion-dollar amount to one company may seem like a lot, but that’s just a drop in the bucket of what’s to come from the CHIPS Act. Instead, these funds should be eliminated, preventing Congress from taking us further down the road to serfdom. Originally published at Law & Liberty.

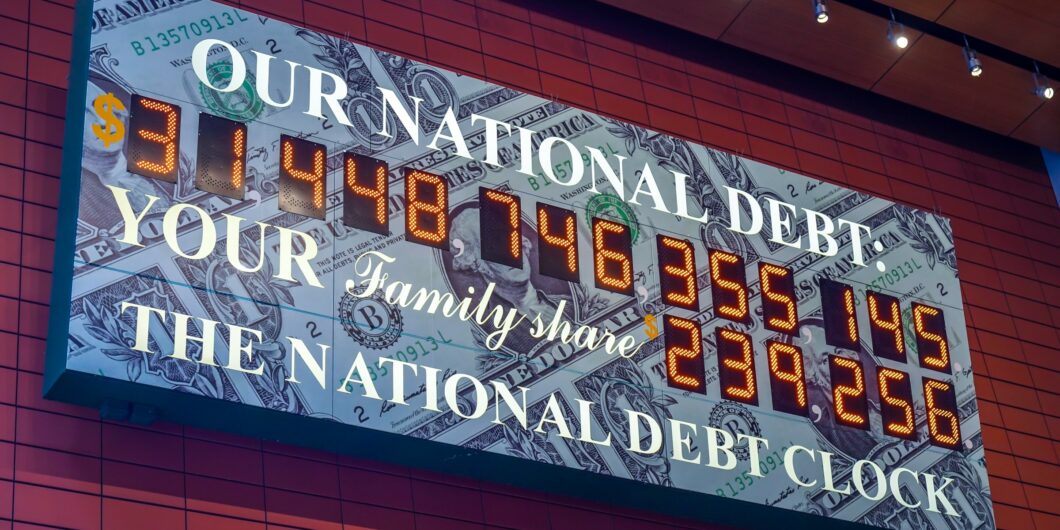

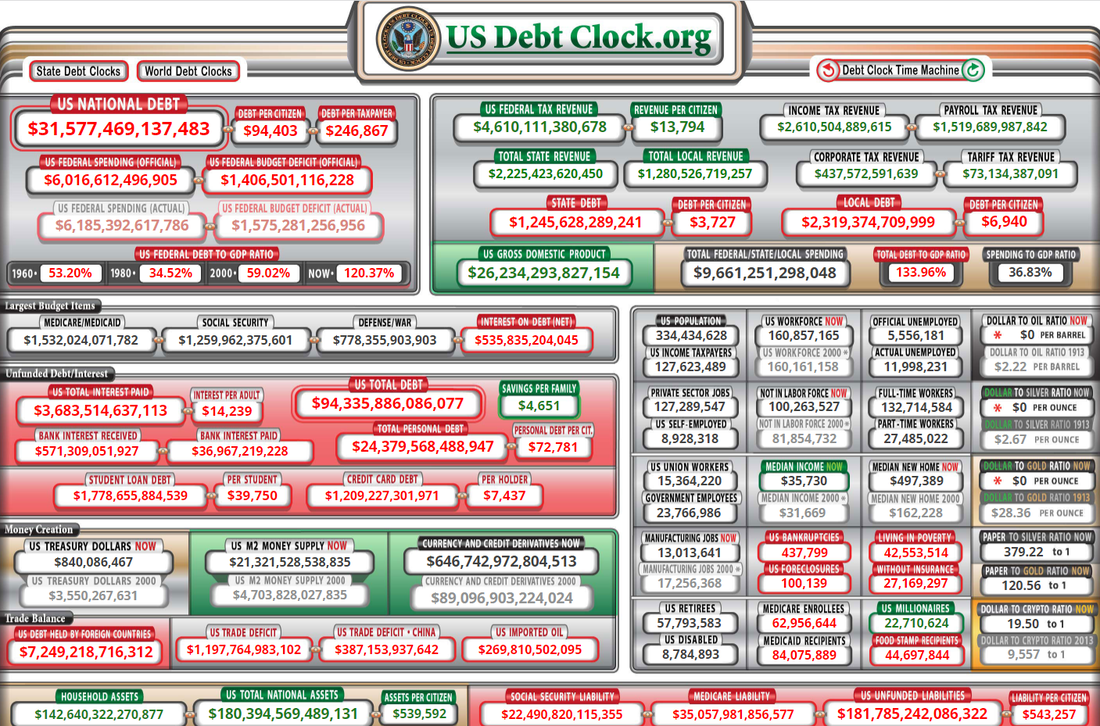

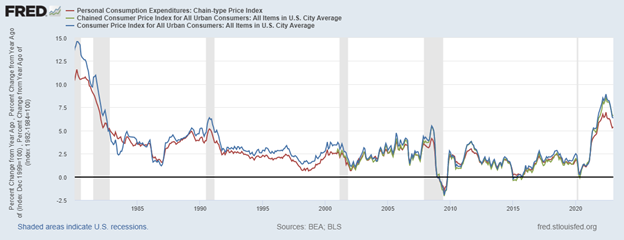

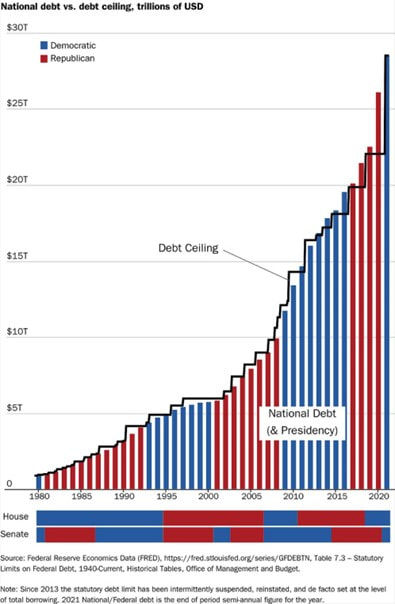

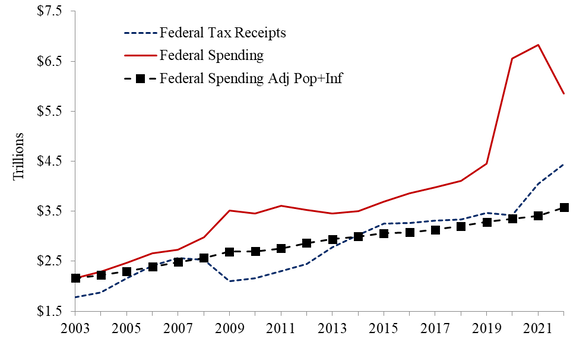

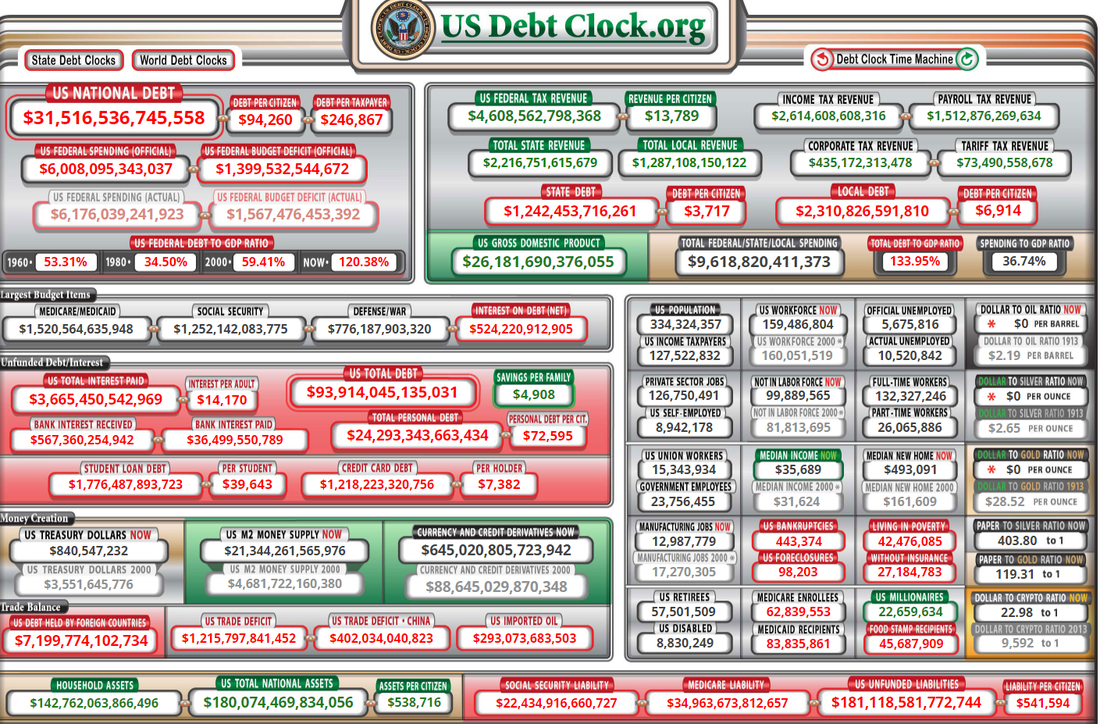

The Congressional Budget Office (CBO) just released the February 2024 Budget and Economic Outlook, and projections look grim. This year, net interest cost—the federal government’s interest payments on debt held by the public minus interest income—stands at a staggering $659 billion in 2023 and has recently soared to about $1 trillion. Unless politicians face these facts and restrain spending, Americans can expect rising inflation and painful tax hikes without improvement in public services. Some politicians quickly blamed a lack of tax revenue, calling for repealing the 2017 Trump tax cuts. But how much more money can they take? New IRS data shows that 98% of all income taxes are paid by the top 50% of income earners, those making at least $46,637. Moreover, 35% of Americans feel worse off than 12 months ago and inflation remains the primary concern for those across the income spectrum. So perhaps, rather than taking more money, the government should own up to its mistakes. The massive net interest costs result from bad spending habits, not a lack of revenue. This requires the federal government to adopt strict fiscal and monetary rules to rein in wasteful deficit spending and money printing that fuel higher interest rates and inflation. Net interest cost is the second largest taxpayer expenditure after Social Security and is higher than spending on Medicaid, federal programs for children, income security programs, or veterans’ programs. And it’s expected to grow. The CBO projects net interest to surpass Medicare spending this year and balloon to $1.6 trillion in 2034 as a result of higher debt and higher interest rates. Interest rates on Treasury debt are at the highest since 2007, paying between 4% and 5.5%, and the rates are expected to rise further. As the stockpile of gross federal debt is expected to grow by about $20 trillion to $54 trillion over the next decade, politicians will face an increasing temptation to rely on the Federal Reserve to pay for it by printing money. If the Fed does, the dollar’s value will decline, and Americans will continue to struggle financially. In an ideal world, politicians will organize the budget process to focus on funding a limited government and ensuring Americans keep their hard-earned money. They would also have plans to cut spending during times of economic downturn to reduce tax burdens on families and businesses and avoid the Keynesian fallacies of deficit spending to fill gaps in economic growth. However, America isn’t Shangri-La. As Thomas Sowell poignantly notes, a politician’s first goal is to get elected, the second goal is to get reelected, and the third goal is far behind the first two. So long as there are investors happy to purchase Treasury debt, there will be politicians who are happy to sway voters with generous spending programs financed by public debt. This must end. Instead, Washington should require strong institutional constraints with a spending limit. The limit should cover the entire budget and hold any budget growth to a maximum rate of population growth plus inflation. This growth limit represents the average taxpayer’s ability to pay for spending. Following this limit from 2004 to 2023 would have resulted in a $700 billion debt increase instead of the actual increase of $20 trillion. Such a policy has been in effect in Colorado since 1992. It is the Taxpayer’s Bill of Rights (TABOR) amendment to the Colorado Constitution. TABOR has revenue and expenditure limitations that apply to state and local governments. The revenue limitation applies to all tax revenue, prevents new taxes and fees, and must be overridden by popular vote. Expenditures are limited to revenue from the previous year plus the rate of population growth plus inflation. Any revenue above this limitation must be refunded with interest to Colorado citizens. A spending cap like TABOR is necessary but not sufficient to solve the problem because politicians in Washington can still pressure the Federal Reserve to pay for the increased debt by printing money. Therefore, it must be combined with a monetary rule to force fiscal sustainability while requiring sound money with fewer distortions in the economy. Monetary rules can come in many forms. While no rule is perfect, research shows that a rule-based monetary policy can result in greater stability and predictability in money growth than the current policy of “Constrained Discretion” whereby the Fed follows rules during “normal times” and has discretion during “extraordinary times.” Whether we are in ordinary or extraordinary times is up to policymakers, who typically don’t want to “let a good crisis go to waste,” as they say. Milton Friedman advocated for a money growth rate rule, the “k-percent rule.” This rule states that the central bank should print money at a constant rate (k-percent) every year. A variation of this rule was used by Fed Chair Paul Volcker in the late 1970s and early 1980s to tackle the Great Inflation with much success. Unfortunately, the Fed had already done too much damage with excessive money growth before then, so the cuts to the Fed’s balance sheet contributed to soaring interest rates that forced destructive corrections in the economy, resulting in a double-dip recession in the early 1980s. This led to the Fed abandoning money growth targeting in October 1982. It is important to note, though, that this “monetarist experiment” was not bound to any law, constitutional or statutory. During that time, the Fed still operated under discretion, which is why it was able to abandon the monetary growth rule just a few years after it had begun, unfortunately. There are other rules that could be applied. John Taylor proposed what’s been coined the Taylor Rule, which estimates what the federal funds rate target, which is the lending rate between banks, should be based on the natural rate of interest, economic output from its potential, and inflation from target inflation. Scott Sumner most recently popularized nominal GDP targeting, which uses the equation of exchange to allow the money supply times the velocity of money to equal nominal GDP. It has different variations, but the key is that velocity changes over time, so the money supply should change based on money demand to achieve a nominal GDP level or growth rate over time. By focusing on a rules-based approach to spending and monetary policy, Americans do not have to worry about electing the perfect candidate every election. Proper constraints will nudge even the worst politicians to make fiscally responsible choices and reduce net interest costs. Furthermore, America will be better positioned to respond to crises at home and abroad. If Congress wants to see who is to blame for the grim CBO projections, they should look in the mirror. Stop looking to take hard-earned money away from Americans and focus on sound budget and monetary reforms now. Don’t miss episode 72 of the Let People Prosper show with guest Avik Roy, president of the Foundation for Research on Equal Opportunity (FREOPP).

We discuss America’s biggest economic problems and how to solve them. Avik and I discuss the following and more:

Check out the full show notes at my Substack newsletter and subscribe to get my posts directly in your inbox. Americans say the economy is the most important problem facing the country. But major headlines covering the latest jobs report for August do their best to downplay this concern. The New York Times’ headline covering the news was, “August Jobs Report: U.S. Jobs Growth Forges On,” but the economic reality is far less cheerful.

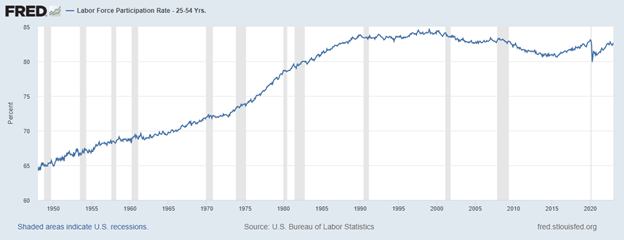

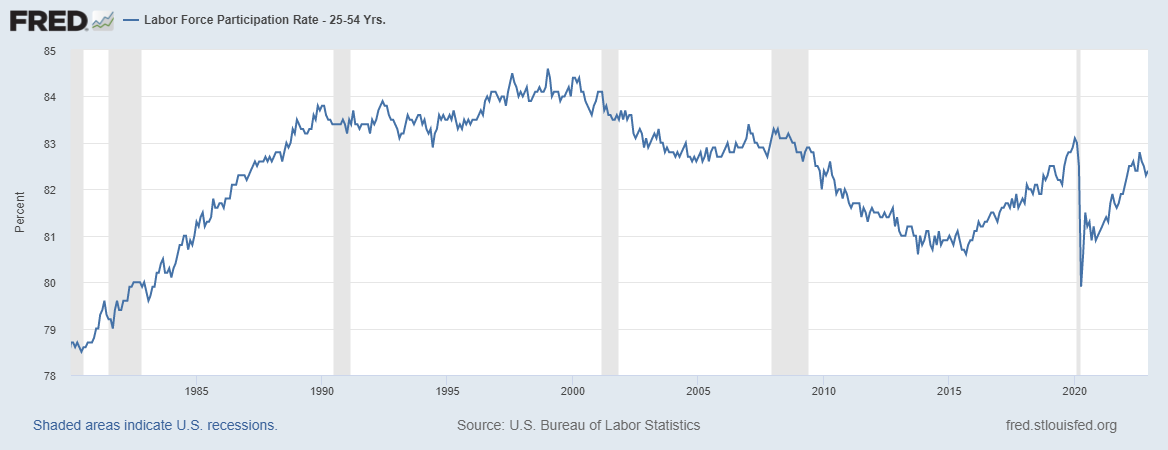

Sure, the jobs report beat the consensus estimate by economists. But that high-level look at the data fails to address underlying issues keenly felt by many Americans that are apparent with more scrutiny. And these problems won’t be over unless policies out of D.C. substantially and quickly improve. Last month, 187,000 jobs were added, according to the payroll survey, compared with the anticipated 170,000. But the jobs added in the prior two months were revised lower by a cumulative 110,000 jobs, bringing the net jobs added in August to just 77,000. This extends an ongoing trend of downward revisions over the last several months. According to the household survey, the unemployment rate, a weak indicator of the labor market’s strength, jumped substantially from 3.5% to 3.8%. Coupled with news of slow wage growth of just 0.2% last month, there is growing concern among Americans trying to make ends meet. We know the higher unemployment rate isn’t from too few jobs available. The number of job openings has been nearly double that of those unemployed for a long time, though decreasing quickly. Instead, the higher rate suggests a sluggish economy in which there are more unemployed or ghost job openings from companies that do not intend to hire but want to gauge interest and competition. There is some good news. The labor force increased by 736,000, which raised the participation rate to 62.8% in August. This is the highest rate since February 2020, just before the shutdowns in response to the COVID-19 pandemic. More people entering the labor force and higher participation rates appear promising. However, the increase in the labor force was a combination of 222,000 more people employed, with the other 514,000 people becoming unemployed. And diving deeper, 4.2 million more adults remain not in the labor force compared with February 2020. Many of these individuals have been unemployed for years, so obtaining employment could be difficult due to a lack of productivity signals in their resume on top of employers dealing with a stagnant economy. The rise in the unemployment rate, lackluster wage growth, and the possibility of unfilled job openings all point to a weak labor market. Add in ongoing stagflation, as too-high inflation continues, and Americans are rightly concerned about the future. Some blame the Federal Reserve for this weakness because of its fight to bring down inflation after creating it. However, Milton Friedman debunked this tradeoff between lower inflation and a higher unemployment rate decades ago. Specifically, there’s no long-run tradeoff between the two, so the Fed must focus on the single mandate of price stability instead. The Fed has been working to combat inflation by hiking its interest rate target to a multi-decade high of 5.5% and slowly reducing its bloated balance sheet. This is why you’ve seen car loan and mortgage rates soar to multi-decade highs. These higher rates significantly disrupt the new car and housing markets. But this is the resulting bust after the artificial post-pandemic “boom” as new money moves throughout the economy and manipulated interest rates create malinvestments. We felt the higher inflation rate last year from the Fed’s actions of close to 9%, and now it’s about one-third of that rate, but this remains about 50% higher than its 2% flexible average inflation target. The Fed has stated that it may raise interest rates further. And I believe that it will be forced to raise its target rate to about 6% before this hiking cycle is over. But just raising this rate won’t be enough to curb inflation for long if Congress’ deficit spending remains unchecked. This will force the Fed to monetize it to avoid putting more pressure on Congress to get their irresponsible fiscal house in order. President Biden and Democrats in Congress made this situation worse with the passage of the misnamed Inflation Reduction Act, which is likely to cost about four times the initial $300 billion estimate over a decade. Their wasteful spending, along with Republicans’ excessive spending before them, has led to a fiscal crisis, the most significant national threat. Congress will unlikely make the needed reforms to the primary drivers of the deficit of mandatory spending programs like Social Security and Medicare because of rent-seeking in politics. This will likely result in the Fed not sufficiently cutting its balance sheet to stop inflation. Rather, the Fed will probably choose to increase its balance sheet, putting more inflationary pressure on the economy when that’s the last thing it needs. A vital measure of the economy known as real gross domestic output, the real average of gross domestic product and gross domestic income, has declined in three of the last six quarters. While I don’t want there to be a hard landing, this is the situation that central planners by Congress spending and taxing too much, President Biden regulating too much, and the Fed printing too much have left us. There will be efforts by the government to correct these government failures, but we shouldn’t double down on past mistakes. Let’s learn from these failures and remember the most recent lesson in the 1980s: President Reagan cutting regulations, Congress passing tax cuts (but spending too much), and Fed Chairman Paul Volcker cutting the balance sheet. Initially, the cuts to the Fed’s balance sheet contributed to soaring double-digit interest rates, and the economy suffered a double-dip recession. However, afterward, the economy was able to heal from the prior hindrances of past presidents, congressional members, and the Fed, resulting in a long period of economic prosperity, which is often called the Great Moderation. What we have today is an economy where the government is growing, and markets aren’t as much. This must be reversed. When workers, entrepreneurs, and employers are free to engage in voluntary transactions, competition thrives, innovation flourishes, and resources are allocated efficiently. Moreover, free markets promote consumer choice and personal freedom. When government interventions, such as wasteful spending, excessive regulations, and high taxes, are removed, markets can function more efficiently and respond dynamically to changing economic conditions. Striking the right balance between constitutionally limited government functions and preserving the freedom of markets is crucial for achieving a vibrant and prosperous economy. Rising unemployment, stagnant wages, and the specter of inflation require a multifaceted approach. Raising interest rates hasn’t been enough. The government must focus on responsible fiscal and monetary policies, including reducing government spending, addressing burdensome regulations and taxes, and substantially cutting the Fed’s balance sheet. Americans are still suffering, and there is no time to waste in aggressively assessing these measures that cause economic strain so that people can get back to flourishing instead of merely “making it.” Originally published at Econlib. Fitch Ratings downgraded the US credit rating from AAA to AA+ because they expect fiscal deterioration over the next few years. While the diagnosis seems delayed, they’re right. Irresponsible bipartisan spending for decades is the culprit. With the national debt approaching $33 trillion, the American economy appears unlikely to recover its AAA status any time soon.

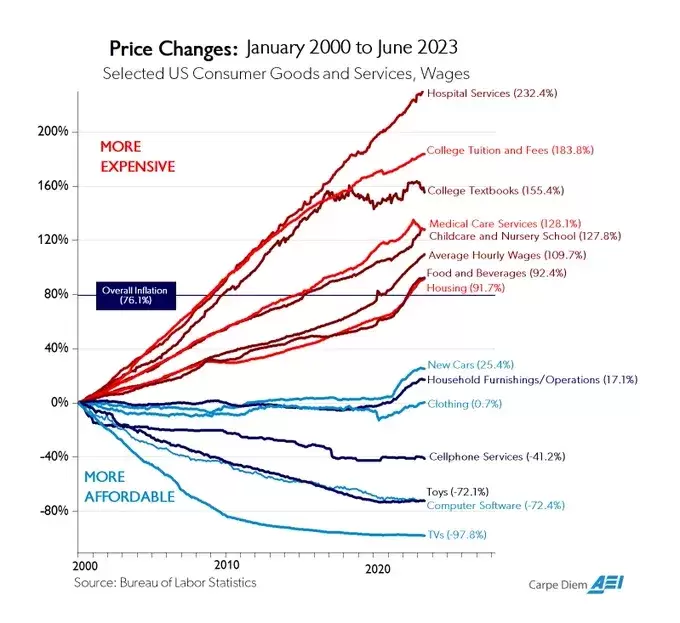

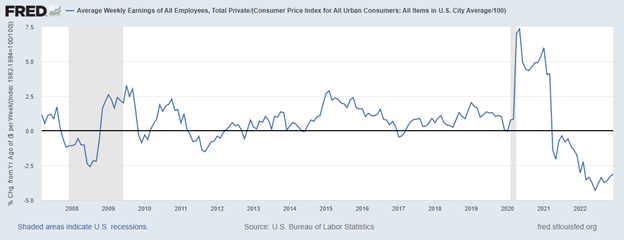

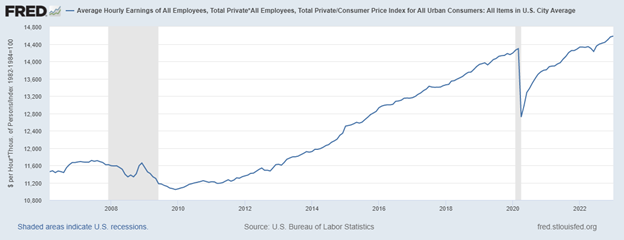

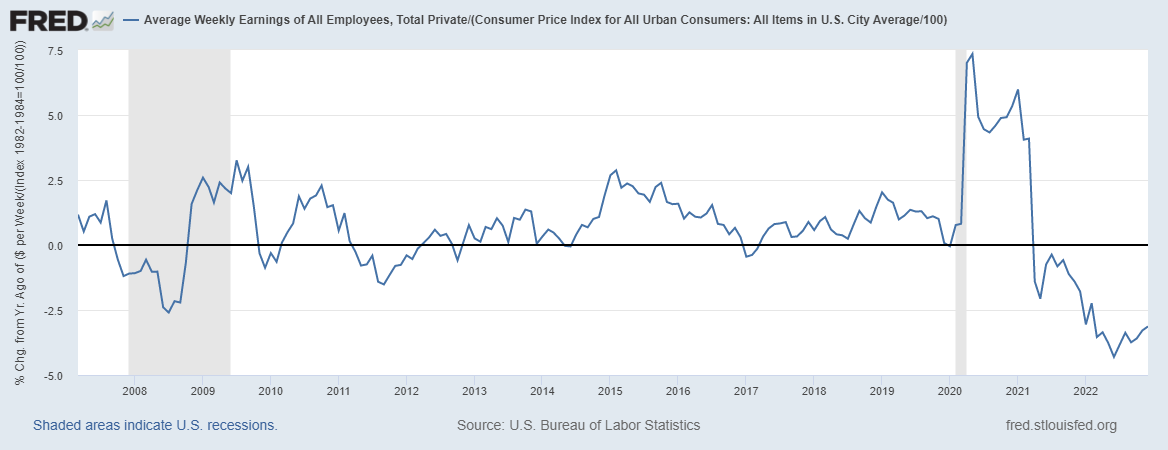

Republicans and Democrats have consistently increased spending more than tax revenues, leading to massive debt and unsustainable deficits. Increased spending under President Biden made a dire situation even worse. For instance, in just five weeks since suspending the debt ceiling, the deficit rose by $1 trillion. Inflation soared once the current administration took office, and still hasn’t leveled off. Real wages are just now catching up with inflation after falling behind for more than two consecutive years. The US dollar’s value has waned. America is not a safe investment, thus the downgrade. Fitch Ratings predicts slower economic growth in the coming years due to high regulations, increased taxes, and demographic changes affecting productivity and population. This slower growth means less tax revenue for the federal government. Also, mandatory spending on Social Security and Medicare, which make up the bulk of federal spending, is projected to grow rapidly, contributing to rising deficits that will soon have just net interest payments exceed spending on national defense. Americans can expect their wallets to be tangibly affected soon. The downgrade will contribute to even higher interest rates than otherwise, which will have a domino effect on various aspects of the economy, including the stock market. Unless severe corrective measures are taken, the situation will likely deteriorate further, impacting people’s prosperity and perpetuating a debt and stagflationary situation. The government should focus on fiscal responsibility and better budget management to avoid a deepening spending crisis, exacerbating Americans’ existing economic burden. First, an approach of zero-based, performance-based budgeting should be implemented throughout the government to identify and eliminate ineffective programs. Second, independent audits by private entities of government spending for programs would provide transparency and guide decision-making regarding which programs to retain, modify, or cut. Third, but likely most important, implementing a fiscal rule that has worked at the state level, such as population growth plus inflation for a maximum budget growth rate, could cap the government’s debt accumulation and support more economic growth. Had such a rule been adopted over the last two decades, the national debt increase would have been significantly lower, by just $500 billion instead of the actual $19 trillion, allowing for better debt management. The US credit downgrade should be a sobering wake-up call that urges Congress and the administration to prioritize fiscal responsibility. As the nation faces economic challenges and increasing debt burdens, it is crucial to adopt prudent measures to put America back on a path to prosperity. Only through concerted efforts to control spending, implement effective budgeting practices, and consider the long-term economic impact of policy decisions can America chart a sustainable and prosperous course for the future. Otherwise, buckle up. It’s going to be a bumpy ride. Originally published at AIER. This Week's Economy Ep. 20 | Fitch Downgrades U.S. Credit Score, New Weaker Jobs Report & More8/4/2023 Today, I cover: 1) National: Findings from the latest (weaker) Jobs Report, household survey, average weekly earnings, and my thoughts on Fitch downgrading the U.S. credit score; 2) States: Why state and local tax revenues are down and what it means; and 3) Other: My recent interviews on Fox Business, NTD News, and KTRH Houston discussing the Fitch downgrade and how Bidenomics rewards the wealthy. Check out the latest Chart of the Century put out by AEI. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. The debt ceiling fiasco is over, and with it, the costly Inflation Reduction Act, or as I like to call it, the Inflation Recession Act, was unfortunately left mostly intact. Congress’s lackluster attempt to curb spending will matter even less considering this, as new calculations show. The time is ripe for a reassessment and elimination of at least the ill-advised tax credits contained within the IRA before irreversible damage is inflicted on our already suffering economy.

Last year, the Congressional Budget Office (CBO) estimated that the IRA would cost $391 billion from 2022 to 2031. But with updated data and Treasury rules, new cost estimates show it to be three times higher at $1.2 trillion. During my recent testimony before the U.S. House Ways and Means Committee, I noted the need for a re-estimate of the IRA’s cost for tax credits that subsidize manufactured battery cells and modules for electric vehicles (EV). The CBO’s estimate of these tax credits was $30.6 billion, but new calculations have it at nearly $200 billion–or nearly seven times higher. Battery cells can receive a $35 tax credit for every kWh of energy the battery produces, while battery modules can receive $10 per kWh, or “$45 for a battery module that does not use battery cells.” The CBO’s assessment was conducted prior to the Treasury’s release of draft guidance in March that relaxes mineral sourcing standards to produce EV batteries. And since the IRA passed, there’s more evidence that incentives matter as EV manufacturers substantially increase production to get the tax credits well above CBO’s estimates. Look no further than Tesla for a real-time example of how these tax credits will cost us. Maker of the most-sold EVs in America, Tesla moved its battery production from Germany to Texas after the tax credits were announced. And its Model Y emerged as the best-selling EV in the U.S. last year, with a total of 234,834 units sold. Its battery starts at 75-kWh, so for those sales, Tesla could have received more than $616 million in tax credits had the tax credits been in place. For 2023, Tesla expects to manufacture 2 million EVs, resulting in possibly $5 billion in annual tax credits for batteries. Meanwhile, Ford, which had the second-highest EV sales last year, plans to triple production for its F-150 Lightning, targeting 150,000 units by the end of 2023. The battery size for this model starts at 98-kWh, and assuming Ford meets its goal, that would cost taxpayers $514 million in tax credits. If Tesla and Ford can collectively receive at least $1 billion in tax credits in 2023, it’s easy to see how the CBO’s estimate over the next decade for all EV batteries is too low. This difference between the estimates and the growth of the EV market is concerning in this post-pandemic economy, verging on a recession where more than 60% of Americans are estimated to be living paycheck to paycheck. More government spending, like what’s allotted in the IRA, and more debt, like what’s allowed under the debt ceiling deal, is the last thing America needs. As government spending increases, so do taxes, leading to less work, lower productivity and growth, and, subsequently, less tax revenue. These measures contribute to even higher budget deficits that stifle economic growth, increase poverty, and exacerbate multi-decade high inflation. While the IRA’s green energy initiatives, massive tax hikes, and excessive spending should have been enough reason to reject it initially, Democrats forced it through based on CBO’s massive underestimates of tax credits and other initiatives. Now, taxpayers will suffer the aftermath of this expensive legislation, which is why these costs should be reevaluated and ultimately eliminated before this weak economy is made worse for struggling Americans. For a better path forward, we need more pro-growth policies and less government spending, not bad debt deals and corporate welfare to large businesses on the backs of taxpayers. Originally published at Econlib. Thank you for joining me for the Let People Prosper podcast, which today includes the 12th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today, I cover:

1) National: What the new market data and latest jobs report indicate about the current economy, insights from the Establishment and Household Surveys, and my thoughts on the recently passed debt ceiling deal; 2) Texas: Discussion on the latest efforts in Texas to eliminate property taxes with a buy-down of school M&O property taxes using state surplus funds for what’s called compression (details here), and why this is the best path forward for Texas to prosper; 3) Other: Sneak peek of next week's exciting podcast episode with Leslie Ford discussing safety net reforms. Please like this video and subscribe to the channel if you enjoyed this podcast! And don’t miss my latest Daily Caller article on the debt ceiling deal: You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (https://www.vanceginn.com/) often for updates and subscribe to my newsletter to receive these episodes and more in your inbox. On Wednesday night, the House passed what could be one of the worst debt ceiling deals in U.S. history, as it doesn’t provide the fiscal responsibility needed for suffering Americans.

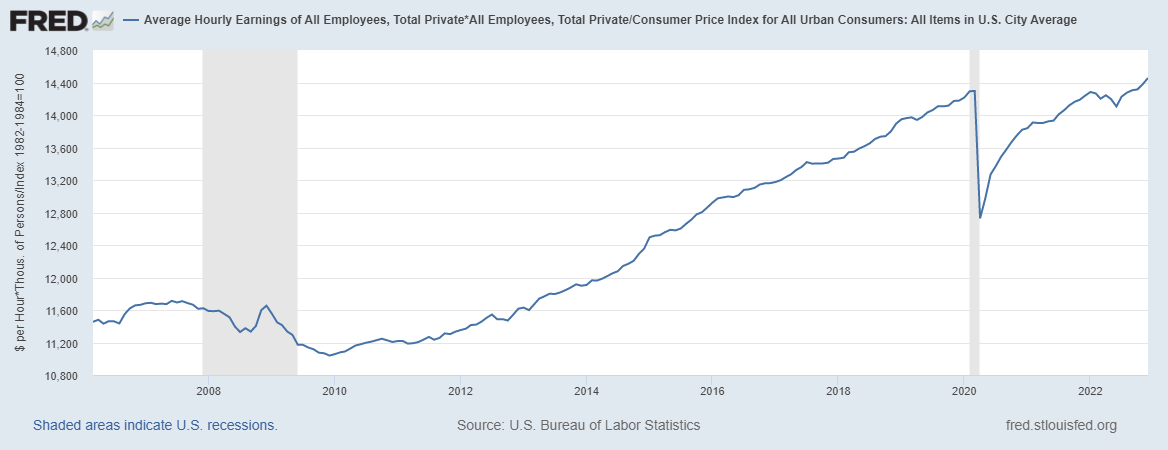

In fact, this deal perpetuates most of the same reckless policies that have contributed to stagflation, leaving Americans struggling financially. Despite what appears to be a relatively strong labor market, wages have failed to keep pace with inflation on an annual basis for more than two years. Homeownership has become unattainable for many, and higher prices have forced over half of the adult population to reduce their savings. You would think that such widespread suffering would motivate Congress to reform its fiscal insanity, but apparently, that’s not the case. While 49 out of 50 states have a balanced budget amendment and most have a spending limit, there are no such rules at the federal level. The debt ceiling is the only mechanism, other than elections, that we have to keep Congress’ spending in check. By suspending the debt ceiling, we’re inviting more reckless spending, which is why our national debt has skyrocketed to a ridiculous amount of more than $31 trillion. The net interest on the debt alone will soon surpass $1 trillion. The new debt ceiling bill allows politicians to kick the can further down the road of payment for the debt to our children and grandchildren to deal with later. By raising the debt ceiling for another two years and only imposing a one percent annual spending limit next year, there’s ample room for the debt and spending to continue to grow at an already bloated budget. A more reasonable timeframe for suspending the limit would have been two months, giving Republicans and Democrats the opportunity to pursue essential spending restraint. Irresponsible spending is a bipartisan problem, but Republicans, with their majority in the House and a platform of fiscal conservatism, bear even greater responsibility to address this issue. Two years is an extensive period considering the adverse effects of the current national debt on inflation, interest rates, the U.S. dollar’s status, and the result of exacerbating the daily struggle of Americans to make ends meet, let alone pursue the largely destroyed American Dream. Some argue that Congress should budget like a family. However, they should budget even more conservatively as Congress is entrusted with the hard-earned tax dollars of the public, not their own. Unleashing spending on out-of-control war efforts with the lack of major reforms and cuts where needed in the budget when our country teeters on the brink of financial crisis doesn’t promote individual liberty or economic growth. In the meantime, fiscal conservatives in Congress should continue advocating for a spending limit rule such as seen in the states to put an end to this crisis. A responsible budget that grows, if it grows at all, by less than the rate of population growth plus inflation, which represents the average taxpayer’s ability to afford spending, would be a great goal. Without substantial spending restraint, Americans can expect more suffering. As economist Milton Friedman once said, the ultimate burden of government is not how much it taxes but how much it spends. This debt ceiling bill was an opportunity to help reduce this burden, and we lost that. Originally published by the Daily Caller. The U.S. dollar will likely soon lose its status as the global reserve currency. The dollar’s global reserve dominance has declined in recent years. As a result, international trade partners are hedging new connections. This will restructure the global economic order and create challenges ahead, especially for middle-class Americans.

Americans should know what’s happening and how they can prepare for this possibility. But first, what does it mean to be the world’s global reserve currency, and why does it matter? The U.S. Dollar is the dominant global reserve currency. It’s widely accepted and is the preferred medium of exchange for international transactions. The dollar has enjoyed this status for the past 80 years due to its strong reputation acquired across a long history of America’s rising military prowess, fulfilling its financial obligations, and maintaining a strong economy. These institutional foundations of the dollar created high demand among foreign entities. One of the most important transactions utilizing the dollar is the purchase of oil. Oil is currently priced in dollars globally and other dollar-denominated assets. Losing or weakening the dollar’s position and value results in higher oil prices. The dollar’s elevated demand has helped keep its value high relative to other currencies. This prompted many countries to tie their currency directly to our dollar. The U.S. benefited by leveraging foreign demand for dollars into loans to the U.S. federal government. Foreign investors lend the U.S. high volumes of money because of the debt’s dollar denomination. The higher demand for U.S. Treasury securities pushes down domestic interest rates. This influences lower rates on mortgages and business loans, which help provide increased investment and economic growth. Losing or weakening the dollar’s reserve position will result in increased interest rates, decreased investment, and weak to negative economic growth. The dollar’s reserve status has also meant an increased volume of international trade. Ultimately, international trade helps keep interest rates and inflation moderately low. Losing or weakening the dollar’s reserve position will result in increased inflation. Trouble for the dollar is on the horizon. The once-givens about the dollar have come into question recently due prominently to excessive deficit spending. Foreign investors are reducing their demand for dollars as they diversify their portfolios. This combination contributed to the ballooning of the debt, depreciated the dollar, led to higher inflation and falling year-over-year real average weekly earnings for 25 straight months, and drove up interest rates, thereby slowing economic activity. Of course, this will have tradeoffs and many of them won’t be good. As mentioned, the major tradeoffs will be higher inflation and interest rates. The latter will trigger a move by the Federal Reserve to attempt to lower interest rates. But if its target rate is held below what markets dictate, the Fed will monetize the debt, increase the money supply, and drive inflation higher. The long-term result will be even higher interest rates to tame inflation. Unfortunately, the consequences of higher interest rates and inflation would be severe. People should expect higher mortgage rates than the already rising average rate of 6.4%. This is the highest in 15 years. Ultimately, higher interest rates would result in a steeper contraction in the housing market, exacerbate economic weakness, increase job losses, and worsen poverty. But maybe more importantly, it would likely crush middle-class Americans and the lifestyle that they’ve been accustomed to having for decades. The higher cost of shelter, food, gasoline, and energy as the dollar loses its reserve currency status would wreck havoc on their budgets and force major decisions about what’s best for their families. This could mean having to put off saving for college, going on vacations, and living in much smaller homes. All because our government couldn’t spend our money wisely. Therefore, the government should take serious steps to restore confidence in the dollar before a bad situation for Americans becomes worse or irreconcilable. To start, the federal government should reduce deficit spending. The long-term goal should be a balanced budget and an eventual start to paying down the debt. This will be pro-growth as the government stops redistributing taxpayer money from productive to unproductive activities. It will also strengthen the fiscal and economic situation of the U.S. The result will be an improvement in foreigners’ outlook on the dollar that would help preserve the dollar’s status. Dollar-focused policies should be tied to reducing the money in circulation. This should occur as the Federal Reserve reduces its balance sheet. Doing so tames inflationary pressures and could even result in some disinflation. This would allow the hard-earned dollars of Americans to go further than they do today. These policy improvements should be put into law with fiscal and monetary policy rules. The rules should remove the discretion of big-government spenders and printers. This would enable people’s livelihoods to get back on track and improve for generations. The potential loss of the dollar’s reserve currency status could have significant economic consequences, and there are even more than highlighted here. There is, however, reason for optimism: The U.S. economy is resilient and adapts well to challenges. But will those in D.C. allow for that to happen in the dynamic marketplace? Time will tell. But let’s hope so before it’s too late for middle-class Americans and everyone else to have the opportunity to fulfill their hopes and dreams. Originally published at The Daily Caller with Chuck Beauchamp, Ph.D. House Republicans have proposed a bill that would increase the debt ceiling but cut government spending. Biden has refused to negotiate the terms of the bill because of these cuts. Now U.S. Treasury Secretary Janet Yellen says the 14th Amendment could be invoked to declare the debt ceiling unconstitutional. This would enable the United States to avoid default but would lead to what Yellen calls a “constitutional crisis.” NTD spoke with Vance Ginn, senior fellow at Americans for Tax Reform, to learn more about the issue.

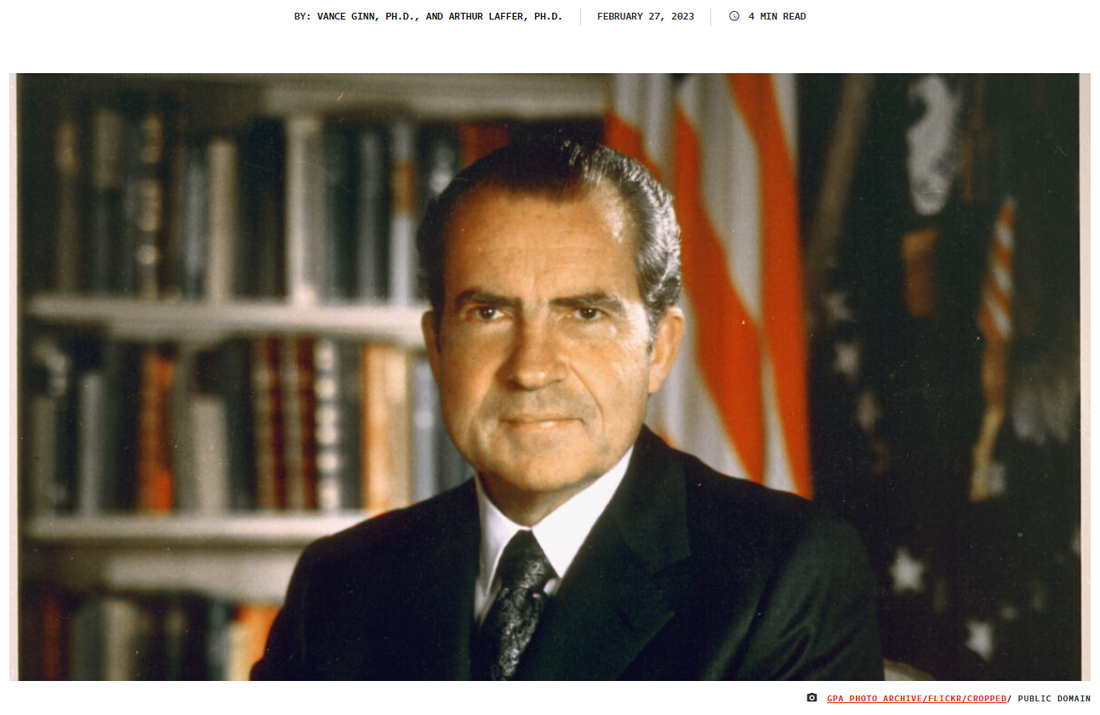

Watch interview with NTD News here. Both Republicans and Democrats at the national level have put us down a path of slow growth, massive deficits, and high inflation. With a new Republican majority in the U.S. House and the daunting debt ceiling fight over the bloated $31.4 trillion national debt almost exclusively due to excessive spending, there’s a proven pro-growth, pro-liberty path.

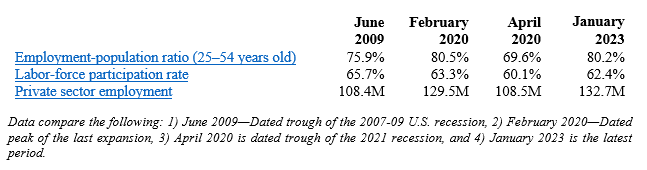

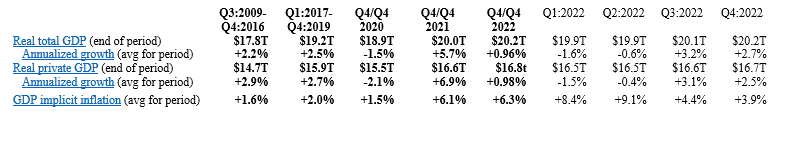

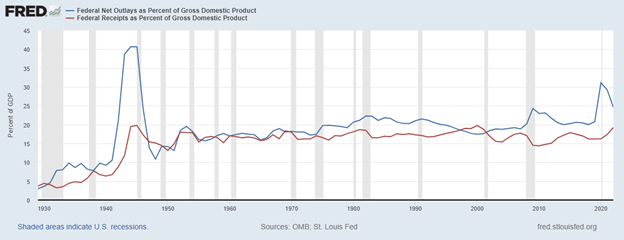

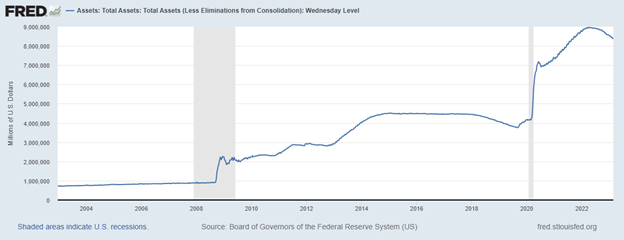

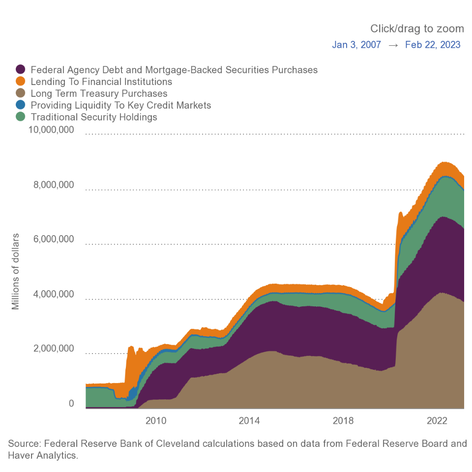

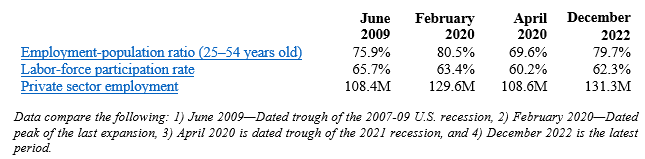

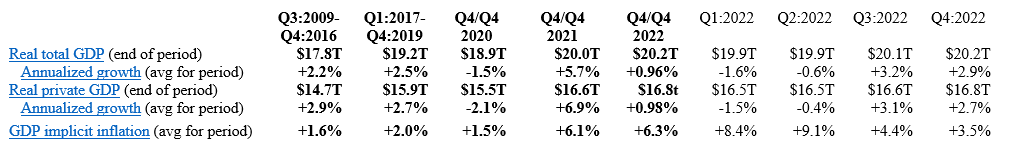

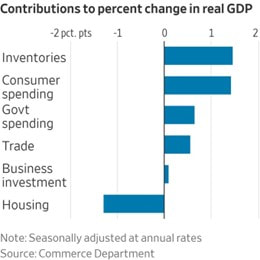

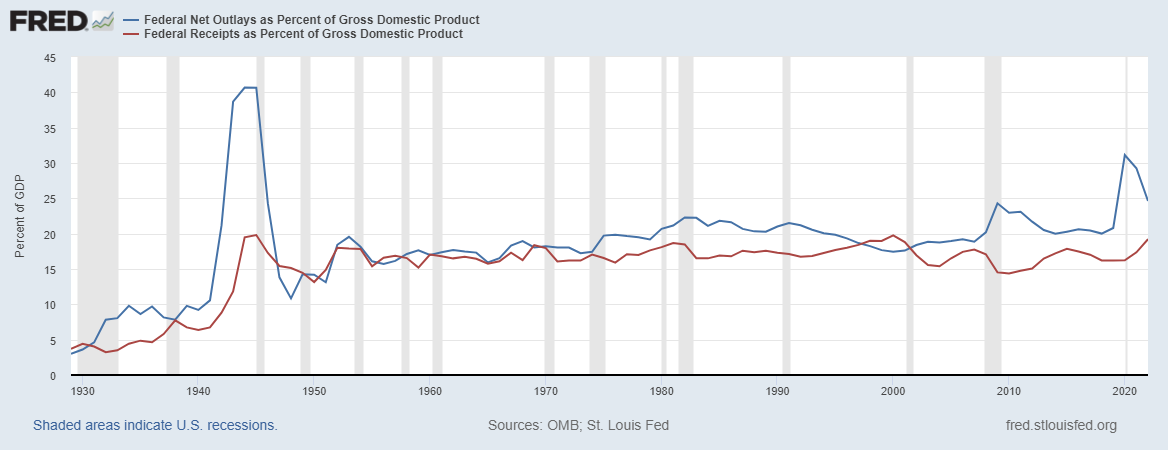

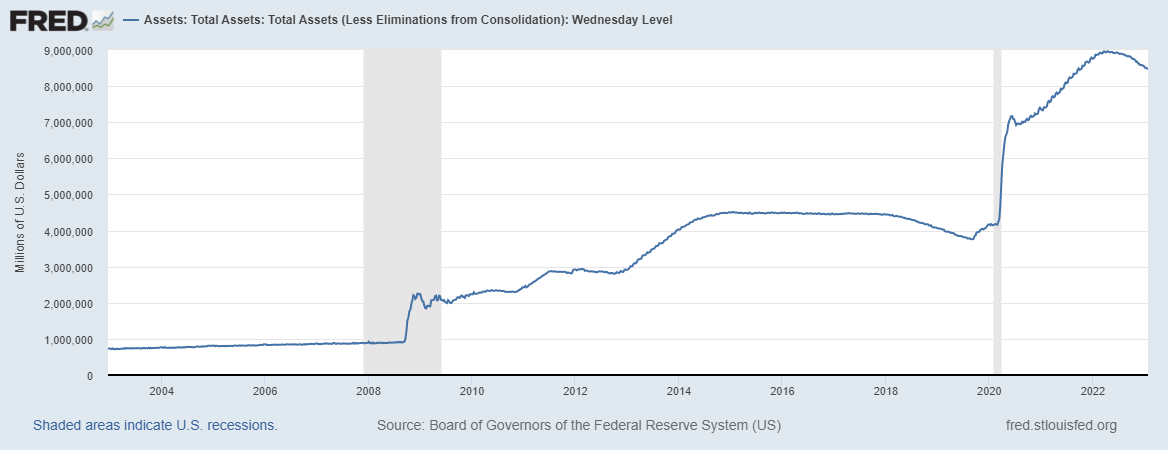

In 2022, the U.S. had real GDP growth of just 0.9 percent (Q4-over-Q4), the highest inflation in 40 years, the highest mortgage rates in 20 years, and the worst stock market in 14 years. Average real weekly earnings have now declined year-over-year for 22 straight months. Fortunately, history is a good guide for how to overcome this mess. The two of us have served as chief economists at the Office of Management and Budget (OMB), though 50 years apart. One of us (Arthur Laffer, originator of the “Laffer Curve”) was the first chief economist of the OMB in the Nixon White House. The other (Vance Ginn) was the last associate director for economic policy at the OMB in the Trump White House. While much has changed since the OMB was formed in 1970, the problems are basically the same today. There remains a lot of unjustifiable government spending, prosperity-killing taxes, unwarranted regulations, excessive liquidity, and harmful interference in international trade. But just because counterproductive economic policies have been around for a long time doesn’t mean we shouldn’t try for a better world. Each of the above areas is the subject of intense debate. In politics, these debates have their short-term winners and losers as judged by elections. But the principles of economics aren’t determined by votes. The remedy for economic malaise has been and is less government, not more. Free-market, pro-growth policies are the cure. The legacy of the 1970s is now called the era of stagflation, and the 2020s are shaping up to be known for the same, or worse. Even with 50 years of experience, many people still haven’t learned a lesson. During the Nixon and Ford administrations, the economy was stifled at every turn. The dollar was taken off gold and devalued, resulting in higher inflation. Then there was the imposition of wage and price controls, which did nothing to stop inflation but instead ravaged the economy. Government spending was out of control. Taxes were raised, and tariffs imposed, including a 10 percent import tax surcharge; such was the wisdom of the D.C. crowd. The consequences were rising inflation, stock market collapse, impeachment, and a weak economy. Then, President Jimmy Carter tried to do more of the same with the same consequences. There followed a true renaissance, led by President Ronald Reagan’s tax and regulatory cuts and Federal Reserve Chairman Paul Volcker’s sound monetary policy. Inflation crashed, the stock market soared, new jobs surged, and Reagan won re-election in a landslide, winning 49 states. And then there was the sad interlude of George H.W. Bush, who broke his promise by raising taxes, leading to a one-term presidency. President Bill Clinton, partnering as he did with House Speaker Newt Gingrich, cut government spending by 3 percentage points of GDP, cut capital gains tax rates while exempting owner-occupied homes from this tax altogether, and finally, he and the Republicans pushed the North American Free Trade Agreement (NAFTA) through Congress. On the bad side, he raised the top two tax rates. But the spending restraint contributed to a budget surplus for four straight years. President George W. Bush, with a penchant for spending more and for temporary tax cuts, was followed by President Barack Obama, with a desire on steroids to spend even more, plus he nationalized health care. Stagnation took hold, and prosperity faded. In his first two years, President Trump reversed some of the prior 16 years of bad policy with substantial tax cuts, historic deregulation, and other measures that helped get government out of the way, contributing to the lowest poverty rate and the highest real median household income on record. But with the onset of the pandemic, prosperity was cut short by the ill-advised massive spending increases and lockdowns. Today, we’re once again mired in a sea of bad policies and bad consequences despite President Joe Biden’s self-serving narrative. With tax hikes, massive spending, oppressive energy regulations, soaring debt levels, trade protectionism, and a bloated Fed balance sheet, stagflation was given a brand-new lease on life. We should follow the proven, pro-growth path (not currently taken) of sound money, minimal regulations, free trade, flat taxes, and most of all, spending restraint for the sake of the economy and human flourishing. It’s also great politics. With this elixir in hand, it would be springtime again in America. And that is something Americans can believe in. Vance Ginn, Ph.D., is an economist and senior fellow at Young Americans for Liberty and previously served as the associate director for economic policy of the White House’s Office of Management and Budget from 2019 to 2020. Arthur Laffer, Ph.D., is an economist from Nashville, Tennessee, and was the first chief economist of the White House’s Office of Management and Budget. Originally published at The Federalist. Key Point: The U.S. economy in 2022 had the slowest Q4-over-Q4 growth during a recovery since at least 2009 and average weekly earnings are now down for 22 straight months as inflation keeps roaring. But there’s hope if we just give free-market capitalism a chance to let people prosper. Overview: Although President Biden recently tried to claim that the state of the union is strong, facts tell a different story. The government failures that drove the “shutdown recession,” high inflation, and weak economic growth over the last three years continue to plague Americans. This includes excessive federal spending leading to massive deficit spending adding up to $7 trillion since January 2020 to reach nearly $31.5 trillion in national debt—about $250,000 owed per taxpayer. This has created a fight between the Biden administration and House Republicans over the debt ceiling, as raising it must come with spending restraint to avoid some of the fiscal insanity that will lead to insolvency if nothing is changed. And more inflation could be on the horizon if the Federal Reserve chooses to monetize more more of the new debt, which past excess has already contributed to 40-year-high inflation rates. These government failures with little relief from pro-growth policies in sight mean that things will get worse before they get better. Labor Market: The Bureau of Labor Statistic recently released its U.S. jobs report for January 2022. This report came with substantial revisions to seasonal adjustments and population estimates which could bias the data for a while given that the revised estimates include the much of the last three years of data that are highly volatile. And recall the recent report by the Philadelphia Fed finds that if you add up the jobs added in states in Q2:2022 there were just 10,500 net new jobs rather than more than 1 million reported. The establishment survey shows there were +517,000 (+3.3%) net nonfarm jobs added in January to 155.1 million employees, with +443,000 (+3.6%) added in the private sector and +74,000 (+1.4%) jobs added in the government sector. Most of the private sector jobs were added in the sectors of leisure and hospitality (+128,000), private education and health services (+105,000), and professional and business services (+82,000), which these three sectors led over the last 12 months as well; information (-5,000) and utilities (-700) were the only net job declines over the last month and no sector had net job losses over the last year. Average hourly earnings for all employees was up by 10 cents last month to $33.03, or up by +4.4% over the last year. And average weekly earnings in the private sector increased by $13.35 last month to $1,146, or up by +4.7% over the 12 months. The household survey had another large increase of +894,000 jobs added to 160.1 million employed There have been declines in net jobs in four of the last 10 months for a total increase of +1.8 million since March 2022, which is about half of the +3.6 million of the net jobs added per the establishment survey. The official U3 unemployment rate declined slightly to 3.4% which is the lowest since 1969. But challenges remains as inflation-adjusted average weekly earnings were down -1.5% over the last year for the 22nd straight month, weighing on Americans budgets to make ends meet. And since February 2020 before the shutdown recession, the prime age (25-54 years old) employment-population ratio was 0.3-percentage point lower, prime-age labor force participation rate was 0.3-percentage point lower, and the total labor-force participation rate was 0.9-percentage-point lower with millions of people out of the labor force thereby holding the U3 unemployment rate much lower than otherwise. Economic Growth: The U.S. Bureau of Economic Analysis’ recently released the 2nd estimate for economic output for Q4:2022. The following table provides data over time for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. And most of the estimates for Q4:2022 and growth in 2022 were revised lower, providing more evidence that 2022 was a very weak year if not a recession. The shutdown recession in 2020 had GDP contract at historic annualized rates because of individual responses and government-imposed shutdowns related to the COVID-19 pandemic. Economic activity has had booms and busts thereafter because of inappropriately imposed government COVID-related restrictions in response to the pandemic and poor fiscal policies that severely hurt people’s ability to exchange and work. Since 2021, the growth in nominal total GDP, measured in current dollars, was dominated by inflation, which distorts economic activity. The GDP implicit price deflator was +6.1% for Q4-over-Q4 2021, representing half of the +12.2% increase in nominal total GDP. This inflation measure was +9.1% in Q2:2022—the highest since Q1:1981—for a +8.5% increase in nominal total GDP that quarter. This made two consecutive declines in real total (and private) GDP, providing a criterion to date recessions every time since at least 1950. In Q3:2022, nominal total GDP was +7.6% and GDP inflation was +4.4% for the +3.2% increase in real total GDP. But if inflation had been as high as it was in the prior two quarters or had the contribution of net exports of goods and services (driven by natural gas exports to Europe) not been 2.9%, real total GDP would have either declined or been essentially flat for a third straight quarter. In Q4:2022, there was a similar story of weakness as nominal total GDP was +6.6% and GDP inflation was +3.9% for the +2.7% increase in real total GDP. But if you consider the +2.7% real total GDP growth was driven by contributions of volatile inventories (+1.5pp), government spending (+0.6pp), and next exports (+0.5pp) which total +2.6pp, the actual growth is quite tepid like it was in Q3:2022. For all of 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.9%, which was the slowest Q4-over-Q4 growth for a year since 2009 (last part of Great Recession). The Atlanta Fed’s early GDPNow projection on February 24, 2023 for real total GDP growth in Q1:2023 was +2.7% based on the latest data available. The table above also shows the last expansion from June 2009 to February 2020. A reason for slower real private GDP growth in the latter period is due to higher deficit-spending, contributing to crowding-out of the productive private sector. Congress’ excessive spending thereafter led to a massive increase in the national debt by more than +$7 trillion that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in the following figure with federal spending and tax receipts as a share of GDP no matter if there are higher or lower tax rates. But the Fed monetized much of the new debt to keep rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 6.5% since the record high in April 2022. The Fed will need to cut its balance sheet (see first figure below with total assets over time) more aggressively if it is to stop manipulating so many markets (see second figure with types of assets on its balance sheet) and persistently tame inflation, which there’s likely a need for deflation for a while given the rampant inflation over the last two years. The resulting inflation measured by the consumer price index (CPI) has cooled some from the peak of +9.1% in June 2022 but remains hot at +6.4% in January 2023 over the last year, which remains at a 40-year high (highest since July 1982) along with other key measures of inflation (see figure below). After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only +2.2% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, deficits and taxes are always and everywhere a spending problem. The figure below (h/t David Boaz at Cato Institute) shows how this problem is from both Republicans and Democrats. As the federal debt far exceeds U.S. GDP, and President Biden proposed an irresponsible FY23 budget and Congress never passed one until the ridiculous $1.7 trillion omnibus in December, America needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on population growth plus inflation. If Congress had followed this approach from 2003 to 2022, the figure below shows tax receipts, spending, and spending adjusted for only population growth plus chained-CPI inflation. Instead of an (updated) $19.0 trillion national debt increase, there could have been only a $500 billion debt increase for a $18.5 trillion swing in a positive direction that would have substantially reduced the cost of this debt to Americans. Of course, part of this includes the Great Recession and the Shutdown Recession, so these periods would have likely been good reason to exceed the limit, but regardless we would be in a much better fiscal and economic situation with this fiscal rule. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And to top this off, the Federal Reserve should follow a monetary rule so that the costly discretion stops creating booms and busts. Bottom Line: While there appears to be a strengthening labor market in January, let’s see if this continues as my guess is that these were biased from the data adjustments, and we will see a weaker labor market in the months to come. My expectation is that stagflation will continue along with the a deeper recession this year given the “zombie economy” with “zombie labor” of many workers sitting on the sidelines and others are “quiet quitting” along with the failures of many “zombie firms” that live on debt. Ultimately, Americans are struggling from bad policies out of D.C.. Instead of passing massive spending bills, the path forward should include pro-growth policies. These policies ought to be similar to those that supported historic prosperity from 2017 to 2019 that get government out of the way rather than the progressive policies of more spending, regulating, and taxing. The time is now for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty.

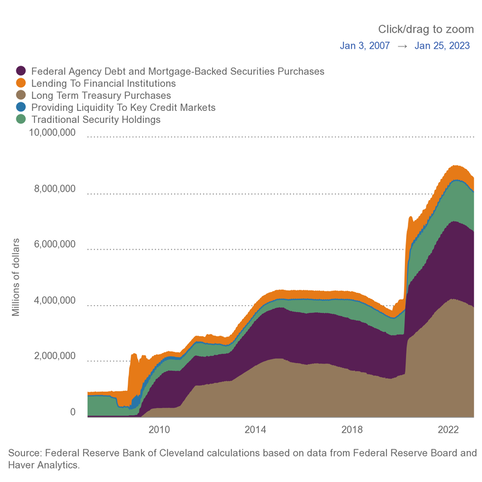

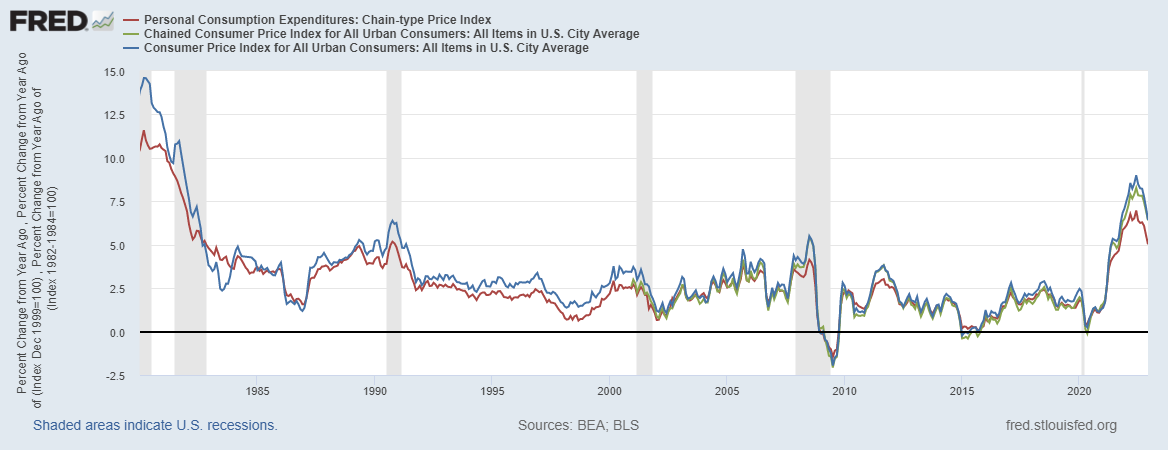

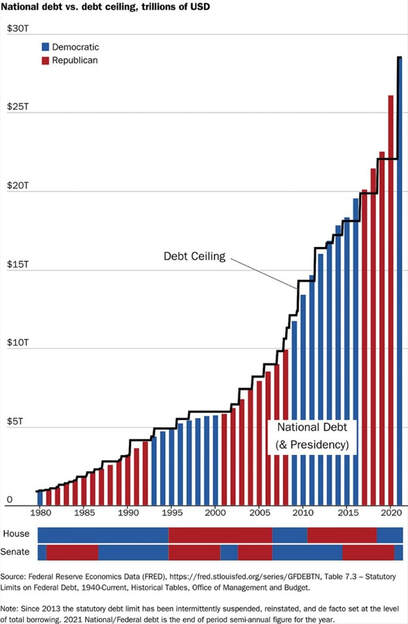

Recommendations:

Key Point: Americans are suffering under big-government policies as average weekly earnings adjusted for inflation are down for 21 straight months. It's time for pro-growth policies to unleash economic potential to let people prosper. Overview: The irresponsible “shutdown recession” and subsequent government failures have led to a longer, deeper recession with high inflation that are having persistent consequences for many Americans’ livelihoods. This includes excessive federal spending redistributing scarce private sector resources with deficit spending of more than $7 trillion since January 2020 to reach the new high of $31.4 trillion in national debt—about $95,000 owed per American or $250,000 owed per taxpayer. This new debt has hit its limit and needs to be addressed with spending restraint as the Federal Reserve monetized most of the new debt, leading to a 40-year-high inflation rates. The failed policies of the Biden administration, Congress, and the Fed must be replaced with a liberty-preserving, free-market, pro-growth approach by the new majority by House Republicans so there are more opportunities to let people prosper. Labor Market: The U.S. Bureau of Labor Statistics recently released the U.S. jobs report for December 2022. The BLS’s establishment report shows there were 223,000 net nonfarm jobs added last month, with 220,000 added in the private sector. Interestingly, while there have appeared to be a relatively robust number of jobs created, a recent report by the Philadelphia Fed find that if you add up the jobs added in states in Q2:2022 there were just 10,500 net new jobs rather than more than 1 million initially estimated. This further indicates that the recession started in (likely) March 2022 (more on this below). That expected revision to the establishment report supports the weak data in the BLS’s household survey, which employment increased by 717,000 jobs last month but had declined in four of the last nine months for a total increase of 916,000 jobs since March 2022. This number of net jobs added since then is much lower than the report 2.9 million payroll jobs in the establishment. The official U3 unemployment rate declined slightly to 3.5%, but challenges remain, including: 3.1% decline in average weekly earnings (inflation-adjusted) over the last year, 0.4-percentage point lower prime-age (25–54 years old) employment-population ratio than in February 2020, 0.6-percentage point below prime-age labor force participation rate, and 1.0-percentage-point lower total labor-force participation rate with millions of people out of the labor force. These data support my warnings for months of stagflation, recession, and a “zombie economy.” This includes “zombie labor” as many workers are sitting on the sidelines and others are “quiet quitting” while there’s a declining number of unfilled jobs than unemployed people to 4.5 million And that demand for labor is likely inflated from many “zombie firms,” which run on debt and could make up at least 20% of the stock market and will likely lay off workers with rising debt costs. Economic Growth: The U.S. Bureau of Economic Analysis’ released economic output data for Q4:2022. The following provides data for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. The shutdown recession in 2020 had GDP contract at historic annualized rates because of individual responses and government-imposed shutdowns related to the COVID-19 pandemic. Economic activity has had booms and busts thereafter because of inappropriately imposed government COVID-related restrictions in response to the pandemic and poor fiscal policies that severely hurt people’s ability to exchange and work. Since 2021, the growth in nominal total GDP, measured in current dollars, was dominated by inflation, which distorts economic activity. The GDP implicit price deflator was +6.1% for Q4-over-Q4 2021, representing half of the +12.2% increase in nominal total GDP. This inflation measure was +9.1% in Q2:2022—the highest since Q1:1981—for a +8.5% increase in nominal total GDP that quarter. This made two consecutive declines in real total (and private) GDP, providing a criterion to date recessions every time since at least 1950. In Q3:2022, nominal total GDP was +7.6% and GDP inflation was +4.4% for the +3.2% increase in real total GDP. But if inflation had been as high as it was in the prior two quarters or had the contribution of net exports of goods and services (driven by natural gas exports to Europe) not been 2.9%, real total GDP would have either declined or been essentially flat for a third straight quarter. In Q4:2022, there was a similar story of weaknesses as nominal total GDP was +6.4% and GDP inflation was +3.5% for the +2.9% increase in real total GDP. But if you consider the +2.9% real total GDP growth was driven by contributions of volatile inventories (+1.5pp), government spending (+0.6pp), and next exports (+0.6pp) which total +2.7pp, the actual growth is quite tepid. For all of 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.96%, which was the slowest Q4-over-Q4 growth for a year since 2009 (last part of Great Recession). The Atlanta Fed’s early GDPNow projection on January 27, 2023 for real total GDP growth in Q1:2023 was +0.7% based on the latest data available. The table above also shows the last expansion from June 2009 to February 2020. The earlier part of the expansion had slower real total GDP growth but had faster real private GDP growth. A reason for this difference is higher deficit-spending in the latter period, contributing to crowding-out of the productive private sector. Congress’ excessive spending thereafter led to a massive increase in the national debt that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in the following figure with federal spending and tax receipts as a share of GDP. But the Fed monetized much of it to keep rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 6% since the record high in April 2022. The Fed will need to cut its balance sheet (see first figure below with total assets over time) more aggressively if it is to stop manipulating so many markets (see second figure with types of assets on its balance sheet) and persistently tame inflation. The resulting inflation measured by the consumer price index (CPI) has cooled some from the peak of 9.1% in June 2022 but remains hot at 6.5% in December 2022 over the last year, which remains at a 40-year high (highest since June 1982) along with other key measures of inflation (see figure below). After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only 1.1% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, high deficits and taxes are always and everywhere a spending problem. The figure below (h/t David Boaz at Cato Institute) shows how this problem is from both Republicans and Democrats. As the federal debt far exceeds U.S. GDP, and President Biden proposed an irresponsible FY23 budget and Congress never passed one until the ridiculous $1.7 trillion omnibus in December, America needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on population growth plus inflation. If Congress had followed this approach from 2002 to 2021, the (updated) $17.7 trillion national debt increase would instead have been a $1.1 trillion decrease (i.e., surplus) for a $18.8 trillion swing to the positive that would have reduced the cost to Americans. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And the Federal Reserve should follow a monetary rule.

Bottom Line: Americans are struggling from bad policies out of D.C., which have resulted in a recession with high inflation. Instead of passing massive spending bills, like passage of the “Inflation Reduction Act” that will result in higher taxes, more inflation, and deeper recession, the path forward should include pro-growth policies. These policies ought to be similar to those that supported historic prosperity from 2017 to 2019 that get government out of the way rather than the progressive policies of more spending, regulating, and taxing. The time is now for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty. Recommendations:

With U.S. prices higher than expected in all areas including food, shelter, and gas, the Biden administration’s student debt relief plan is really a “redistribution scheme” that will further fuel inflation, according to Vance Ginn, economist and founder of Ginn Economic Consulting.