|

David is joined by former Trump-era OMB economist, Dr. Vance Ginn, to discuss the history of economic thought; the strengths and weaknesses of the classical, Chicago, and Austrian schools of thought; whether or not we need a Fed; and what to do about excess debt and economic growth. Yes, it is a busy hour, but one you will not want to miss!

0 Comments

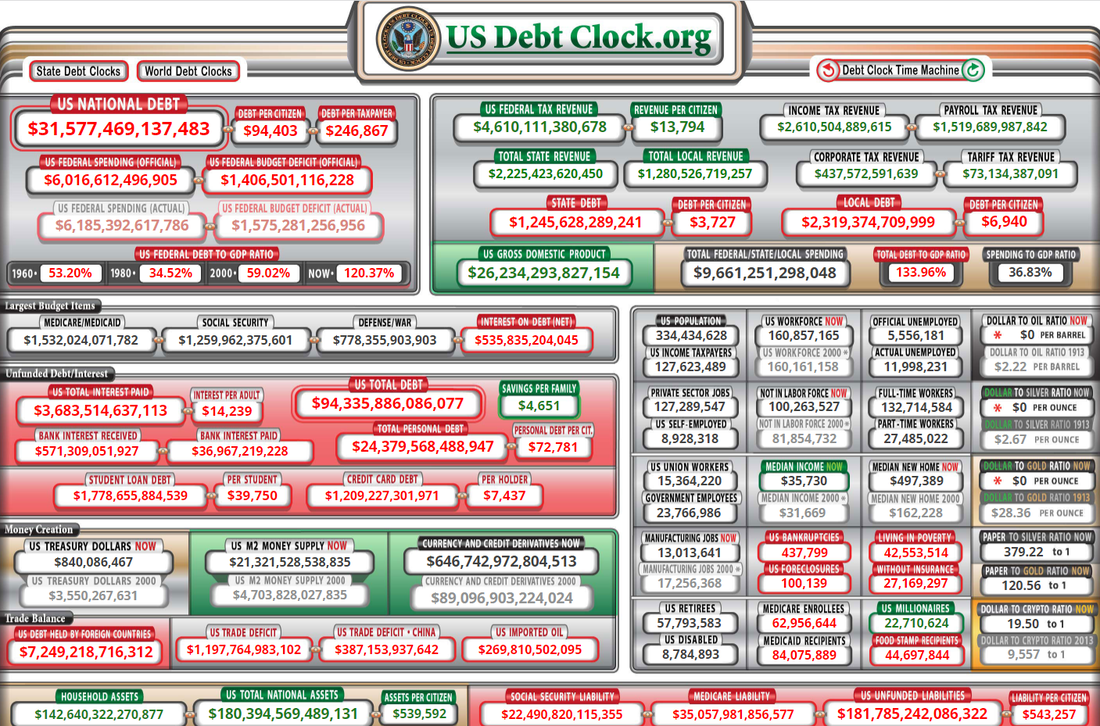

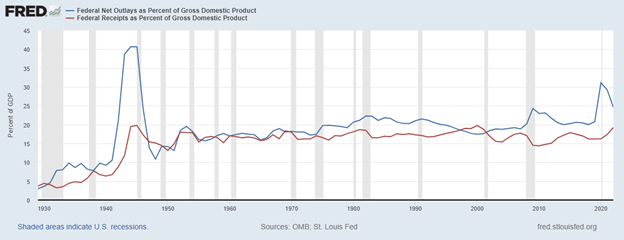

Both Republicans and Democrats at the national level have put us down a path of slow growth, massive deficits, and high inflation. With a new Republican majority in the U.S. House and the daunting debt ceiling fight over the bloated $31.4 trillion national debt almost exclusively due to excessive spending, there’s a proven pro-growth, pro-liberty path.

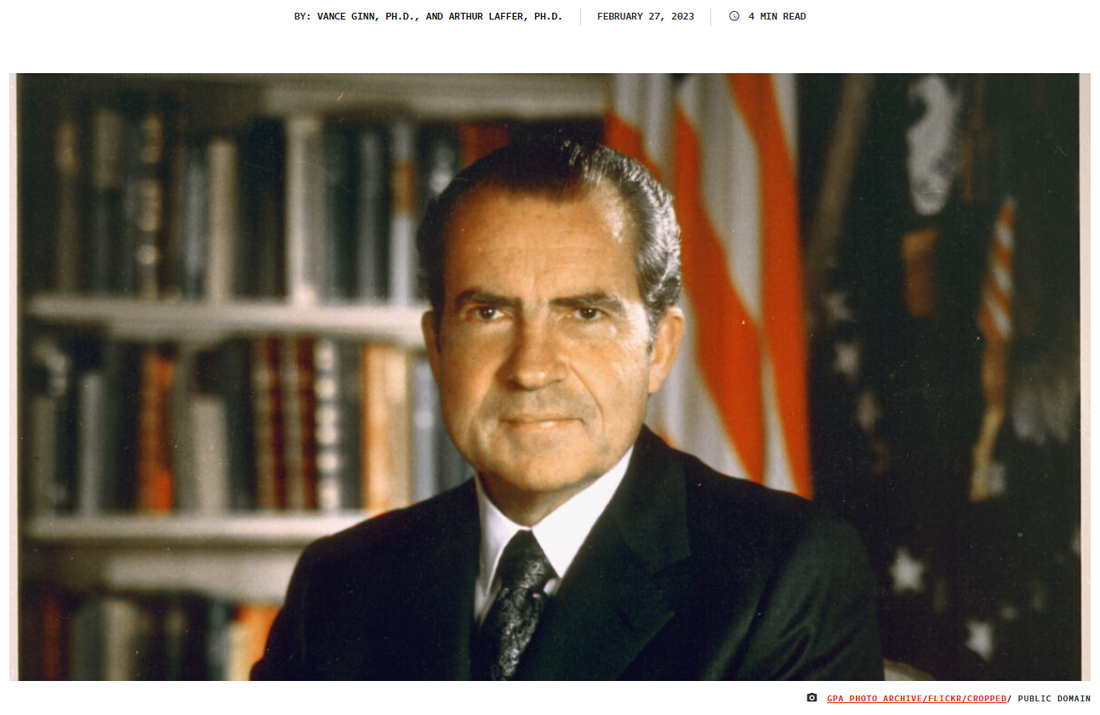

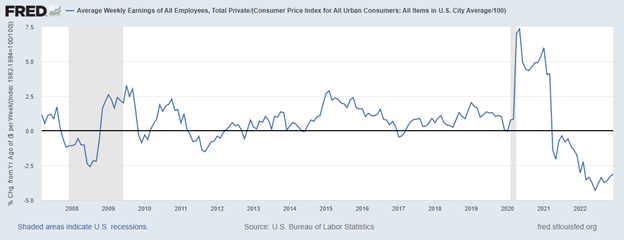

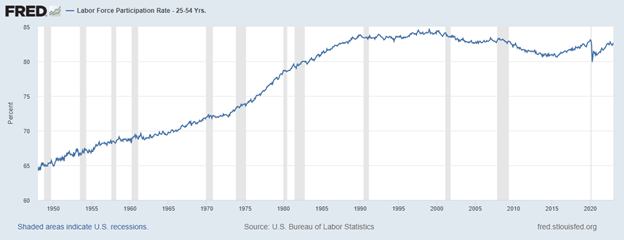

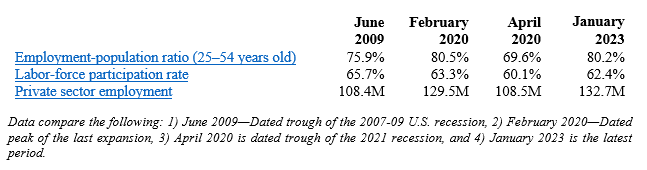

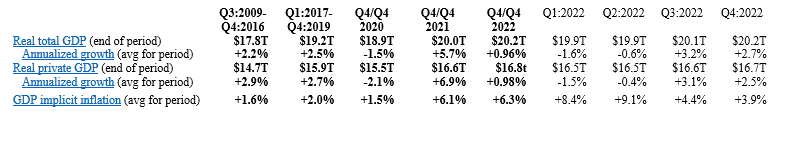

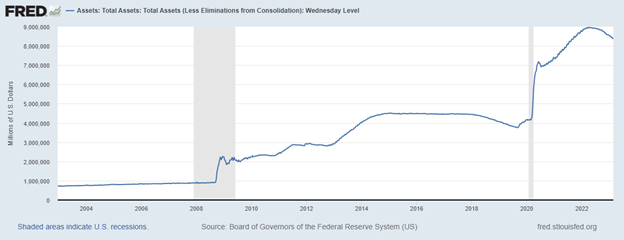

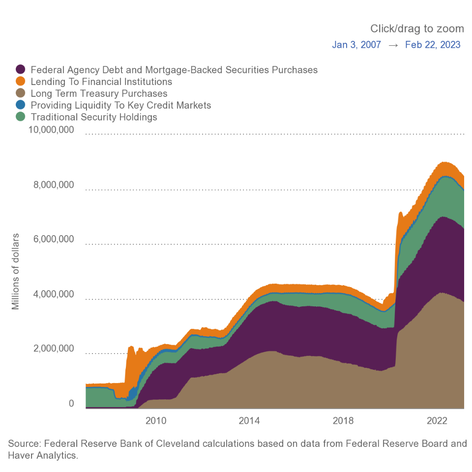

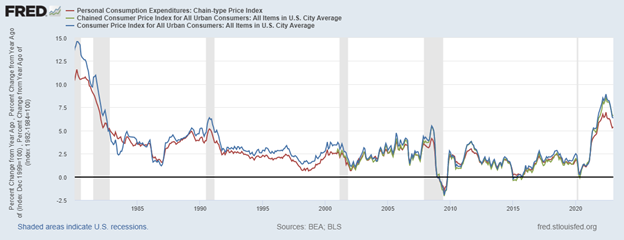

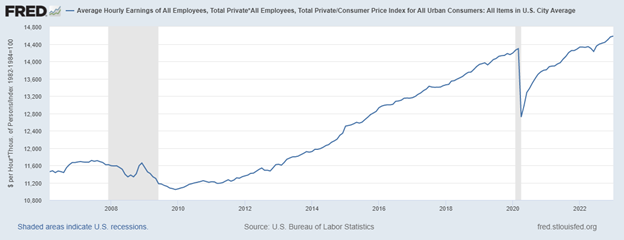

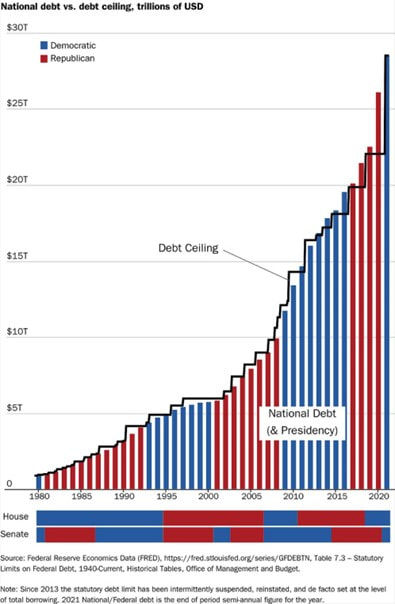

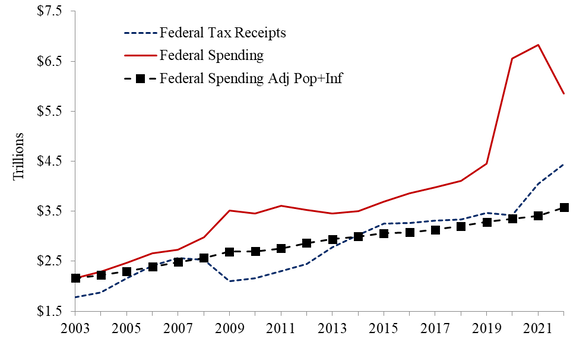

In 2022, the U.S. had real GDP growth of just 0.9 percent (Q4-over-Q4), the highest inflation in 40 years, the highest mortgage rates in 20 years, and the worst stock market in 14 years. Average real weekly earnings have now declined year-over-year for 22 straight months. Fortunately, history is a good guide for how to overcome this mess. The two of us have served as chief economists at the Office of Management and Budget (OMB), though 50 years apart. One of us (Arthur Laffer, originator of the “Laffer Curve”) was the first chief economist of the OMB in the Nixon White House. The other (Vance Ginn) was the last associate director for economic policy at the OMB in the Trump White House. While much has changed since the OMB was formed in 1970, the problems are basically the same today. There remains a lot of unjustifiable government spending, prosperity-killing taxes, unwarranted regulations, excessive liquidity, and harmful interference in international trade. But just because counterproductive economic policies have been around for a long time doesn’t mean we shouldn’t try for a better world. Each of the above areas is the subject of intense debate. In politics, these debates have their short-term winners and losers as judged by elections. But the principles of economics aren’t determined by votes. The remedy for economic malaise has been and is less government, not more. Free-market, pro-growth policies are the cure. The legacy of the 1970s is now called the era of stagflation, and the 2020s are shaping up to be known for the same, or worse. Even with 50 years of experience, many people still haven’t learned a lesson. During the Nixon and Ford administrations, the economy was stifled at every turn. The dollar was taken off gold and devalued, resulting in higher inflation. Then there was the imposition of wage and price controls, which did nothing to stop inflation but instead ravaged the economy. Government spending was out of control. Taxes were raised, and tariffs imposed, including a 10 percent import tax surcharge; such was the wisdom of the D.C. crowd. The consequences were rising inflation, stock market collapse, impeachment, and a weak economy. Then, President Jimmy Carter tried to do more of the same with the same consequences. There followed a true renaissance, led by President Ronald Reagan’s tax and regulatory cuts and Federal Reserve Chairman Paul Volcker’s sound monetary policy. Inflation crashed, the stock market soared, new jobs surged, and Reagan won re-election in a landslide, winning 49 states. And then there was the sad interlude of George H.W. Bush, who broke his promise by raising taxes, leading to a one-term presidency. President Bill Clinton, partnering as he did with House Speaker Newt Gingrich, cut government spending by 3 percentage points of GDP, cut capital gains tax rates while exempting owner-occupied homes from this tax altogether, and finally, he and the Republicans pushed the North American Free Trade Agreement (NAFTA) through Congress. On the bad side, he raised the top two tax rates. But the spending restraint contributed to a budget surplus for four straight years. President George W. Bush, with a penchant for spending more and for temporary tax cuts, was followed by President Barack Obama, with a desire on steroids to spend even more, plus he nationalized health care. Stagnation took hold, and prosperity faded. In his first two years, President Trump reversed some of the prior 16 years of bad policy with substantial tax cuts, historic deregulation, and other measures that helped get government out of the way, contributing to the lowest poverty rate and the highest real median household income on record. But with the onset of the pandemic, prosperity was cut short by the ill-advised massive spending increases and lockdowns. Today, we’re once again mired in a sea of bad policies and bad consequences despite President Joe Biden’s self-serving narrative. With tax hikes, massive spending, oppressive energy regulations, soaring debt levels, trade protectionism, and a bloated Fed balance sheet, stagflation was given a brand-new lease on life. We should follow the proven, pro-growth path (not currently taken) of sound money, minimal regulations, free trade, flat taxes, and most of all, spending restraint for the sake of the economy and human flourishing. It’s also great politics. With this elixir in hand, it would be springtime again in America. And that is something Americans can believe in. Vance Ginn, Ph.D., is an economist and senior fellow at Young Americans for Liberty and previously served as the associate director for economic policy of the White House’s Office of Management and Budget from 2019 to 2020. Arthur Laffer, Ph.D., is an economist from Nashville, Tennessee, and was the first chief economist of the White House’s Office of Management and Budget. Originally published at The Federalist. Key Point: The U.S. economy in 2022 had the slowest Q4-over-Q4 growth during a recovery since at least 2009 and average weekly earnings are now down for 22 straight months as inflation keeps roaring. But there’s hope if we just give free-market capitalism a chance to let people prosper. Overview: Although President Biden recently tried to claim that the state of the union is strong, facts tell a different story. The government failures that drove the “shutdown recession,” high inflation, and weak economic growth over the last three years continue to plague Americans. This includes excessive federal spending leading to massive deficit spending adding up to $7 trillion since January 2020 to reach nearly $31.5 trillion in national debt—about $250,000 owed per taxpayer. This has created a fight between the Biden administration and House Republicans over the debt ceiling, as raising it must come with spending restraint to avoid some of the fiscal insanity that will lead to insolvency if nothing is changed. And more inflation could be on the horizon if the Federal Reserve chooses to monetize more more of the new debt, which past excess has already contributed to 40-year-high inflation rates. These government failures with little relief from pro-growth policies in sight mean that things will get worse before they get better. Labor Market: The Bureau of Labor Statistic recently released its U.S. jobs report for January 2022. This report came with substantial revisions to seasonal adjustments and population estimates which could bias the data for a while given that the revised estimates include the much of the last three years of data that are highly volatile. And recall the recent report by the Philadelphia Fed finds that if you add up the jobs added in states in Q2:2022 there were just 10,500 net new jobs rather than more than 1 million reported. The establishment survey shows there were +517,000 (+3.3%) net nonfarm jobs added in January to 155.1 million employees, with +443,000 (+3.6%) added in the private sector and +74,000 (+1.4%) jobs added in the government sector. Most of the private sector jobs were added in the sectors of leisure and hospitality (+128,000), private education and health services (+105,000), and professional and business services (+82,000), which these three sectors led over the last 12 months as well; information (-5,000) and utilities (-700) were the only net job declines over the last month and no sector had net job losses over the last year. Average hourly earnings for all employees was up by 10 cents last month to $33.03, or up by +4.4% over the last year. And average weekly earnings in the private sector increased by $13.35 last month to $1,146, or up by +4.7% over the 12 months. The household survey had another large increase of +894,000 jobs added to 160.1 million employed There have been declines in net jobs in four of the last 10 months for a total increase of +1.8 million since March 2022, which is about half of the +3.6 million of the net jobs added per the establishment survey. The official U3 unemployment rate declined slightly to 3.4% which is the lowest since 1969. But challenges remains as inflation-adjusted average weekly earnings were down -1.5% over the last year for the 22nd straight month, weighing on Americans budgets to make ends meet. And since February 2020 before the shutdown recession, the prime age (25-54 years old) employment-population ratio was 0.3-percentage point lower, prime-age labor force participation rate was 0.3-percentage point lower, and the total labor-force participation rate was 0.9-percentage-point lower with millions of people out of the labor force thereby holding the U3 unemployment rate much lower than otherwise. Economic Growth: The U.S. Bureau of Economic Analysis’ recently released the 2nd estimate for economic output for Q4:2022. The following table provides data over time for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. And most of the estimates for Q4:2022 and growth in 2022 were revised lower, providing more evidence that 2022 was a very weak year if not a recession. The shutdown recession in 2020 had GDP contract at historic annualized rates because of individual responses and government-imposed shutdowns related to the COVID-19 pandemic. Economic activity has had booms and busts thereafter because of inappropriately imposed government COVID-related restrictions in response to the pandemic and poor fiscal policies that severely hurt people’s ability to exchange and work. Since 2021, the growth in nominal total GDP, measured in current dollars, was dominated by inflation, which distorts economic activity. The GDP implicit price deflator was +6.1% for Q4-over-Q4 2021, representing half of the +12.2% increase in nominal total GDP. This inflation measure was +9.1% in Q2:2022—the highest since Q1:1981—for a +8.5% increase in nominal total GDP that quarter. This made two consecutive declines in real total (and private) GDP, providing a criterion to date recessions every time since at least 1950. In Q3:2022, nominal total GDP was +7.6% and GDP inflation was +4.4% for the +3.2% increase in real total GDP. But if inflation had been as high as it was in the prior two quarters or had the contribution of net exports of goods and services (driven by natural gas exports to Europe) not been 2.9%, real total GDP would have either declined or been essentially flat for a third straight quarter. In Q4:2022, there was a similar story of weakness as nominal total GDP was +6.6% and GDP inflation was +3.9% for the +2.7% increase in real total GDP. But if you consider the +2.7% real total GDP growth was driven by contributions of volatile inventories (+1.5pp), government spending (+0.6pp), and next exports (+0.5pp) which total +2.6pp, the actual growth is quite tepid like it was in Q3:2022. For all of 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.9%, which was the slowest Q4-over-Q4 growth for a year since 2009 (last part of Great Recession). The Atlanta Fed’s early GDPNow projection on February 24, 2023 for real total GDP growth in Q1:2023 was +2.7% based on the latest data available. The table above also shows the last expansion from June 2009 to February 2020. A reason for slower real private GDP growth in the latter period is due to higher deficit-spending, contributing to crowding-out of the productive private sector. Congress’ excessive spending thereafter led to a massive increase in the national debt by more than +$7 trillion that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in the following figure with federal spending and tax receipts as a share of GDP no matter if there are higher or lower tax rates. But the Fed monetized much of the new debt to keep rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 6.5% since the record high in April 2022. The Fed will need to cut its balance sheet (see first figure below with total assets over time) more aggressively if it is to stop manipulating so many markets (see second figure with types of assets on its balance sheet) and persistently tame inflation, which there’s likely a need for deflation for a while given the rampant inflation over the last two years. The resulting inflation measured by the consumer price index (CPI) has cooled some from the peak of +9.1% in June 2022 but remains hot at +6.4% in January 2023 over the last year, which remains at a 40-year high (highest since July 1982) along with other key measures of inflation (see figure below). After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only +2.2% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, deficits and taxes are always and everywhere a spending problem. The figure below (h/t David Boaz at Cato Institute) shows how this problem is from both Republicans and Democrats. As the federal debt far exceeds U.S. GDP, and President Biden proposed an irresponsible FY23 budget and Congress never passed one until the ridiculous $1.7 trillion omnibus in December, America needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on population growth plus inflation. If Congress had followed this approach from 2003 to 2022, the figure below shows tax receipts, spending, and spending adjusted for only population growth plus chained-CPI inflation. Instead of an (updated) $19.0 trillion national debt increase, there could have been only a $500 billion debt increase for a $18.5 trillion swing in a positive direction that would have substantially reduced the cost of this debt to Americans. Of course, part of this includes the Great Recession and the Shutdown Recession, so these periods would have likely been good reason to exceed the limit, but regardless we would be in a much better fiscal and economic situation with this fiscal rule. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And to top this off, the Federal Reserve should follow a monetary rule so that the costly discretion stops creating booms and busts. Bottom Line: While there appears to be a strengthening labor market in January, let’s see if this continues as my guess is that these were biased from the data adjustments, and we will see a weaker labor market in the months to come. My expectation is that stagflation will continue along with the a deeper recession this year given the “zombie economy” with “zombie labor” of many workers sitting on the sidelines and others are “quiet quitting” along with the failures of many “zombie firms” that live on debt. Ultimately, Americans are struggling from bad policies out of D.C.. Instead of passing massive spending bills, the path forward should include pro-growth policies. These policies ought to be similar to those that supported historic prosperity from 2017 to 2019 that get government out of the way rather than the progressive policies of more spending, regulating, and taxing. The time is now for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty.

Recommendations:

“We’ve had two quarters: 1.5% decline in GDP, that’s actually done the first quarter, and this quarter now is estimated by the Atlanta Fed as being very, very close to zero,” economist Art Laffer told Fox Business. “If it comes in negative, that will be the two quarters in a row—that would be the definition of recession.”

With the economy stagnating and inflation soaring, stagflation is here for the first time since the Great Inflation of the 1970s because of bad policies out of Washington. A recession is inevitable as the government-inflated “boom” busts—and we could already be in one. But pro-growth policies would help ease the pain. The pandemic prompted irresponsible and record-breaking deficit spending by Congress, pumping in massive “stimulus” funds that raised the national debt by $6 trillion to $30 trillion, or about $90,000 owed by every American. And President Biden has also been on a regulatory spree. His administration has finalized 360 rules through June 17 with a cost of about $215 billion, according to the American Action Forum. Compared to the same time since its inauguration, the Trump administration completed 367 rules at an economic cost of $1.2 billion. Those bad policies by Congress and the Biden administration have been a major reason why the economy is stagnating, with negative growth in the first quarter of 2022 and likely little to no growth in the second quarter. And the Fed purchasing that debt and printing too much money to chase too few goods resulted in a 40-year high in inflation. This stagflation affects employers and workers. Firms now can hold less inventory for the same amount they paid previously, which reduces their profitability and causes them to increase prices, cut costs, or reduce output to keep up with inflation. And consumers have less purchasing power. Workers and employers must then reduce their spending and investment, respectively. With workers producing less, productivity declined by at the fastest rate since 1947, contributing to why inflation-adjusted average hourly earnings are down substantially over the last year. Another issue is that safety-net programs were increased without work requirements during and since the pandemic. Those programs included expanding Medicaid, increasing child tax credits, and enhancing unemployment insurance payments. This has created even more dependency on government. And these expansions of government contributed to soaring deficit-spending with a 25% increase in the national debt in just the last two years. These handouts also encouraged people not to work because they would lose more in payments than they would receive from working. There are now 5.5 million more unfilled jobs than unemployed workers. In order to reduce the pain of the inevitable recession, Congress ought to adopt pro-growth policies, similar to those between 2017-2019. These policies included a concerted effort to reduce onerous regulations and to pass the Tax Cuts and Jobs Act. They contributed to the U.S. records of the lowest poverty rate (across most demographics) and the highest inflation-adjusted median household income. But excessive spending was an important factor that was missed then because Congress spent too much. If Congress just reined in spending to no more than population growth plus inflation, as outlined in the Foundation’s Responsible American Budget (RAB), the $20 trillion increase in the national debt over the last 20 years would instead have been a nearly $3 trillion surplus. This would have meant more money in Americans’ pocket and more economic growth from lower interest rates and less debt for the Fed to purchase to create inflation. Which is why the Fed also needs a monetary rule, which would call for it to have a much smaller balance sheet to reduce the quantity of money and a much higher federal funds rate target. Historically, the federal funds rate target must be as high or higher than the rate of inflation. With the latest inflation rate being 8.6% and the federal funds rate target being in a range of only 1.5%-1.75%, the rate target should be much higher. While this would likely result in a quick and deep recession, this is necessary given the government-inflated boom that must now bust. Bad policies have driven this government failure that’s making the situation worse before it gets better. For the sake of Americans, let’s end them now, because more government isn’t the solution. https://www.texaspolicy.com/economic-stagflation-is-here-is-a-recession-next/ Top Stat: Average hourly earnings (inflation-adjusted) down by 2.6% over last year. Link Key Point: Total nonfarm employment down 1.2 million jobs since February 2020. Link Overview: The economic costs of the shutdown recession from February to April 2020 and subsequent policy errors have been persistent and substantial across the nation. The U.S. labor market has been improving, but this is not a “booming economy” as weaknesses remain. This is in spite of Congress adding $6 trillion in deficit spending since January 2020 to reach the new high of $30 trillion national debt. And the Federal Reserve has monetized much of the new debt, leading to 40-year high inflation. Given rampant inflation and a stagnating economy, stagflation is here for the first time since the 1970s. Specifically, the Biden administration, Congress, and the Fed should stop overregulating, overspending, and overprinting, respectively, and instead provide pro-growth policies that support productive activity so that Americans can improve their livelihoods. https://www.texaspolicy.com/the-ginn-economic-brief-u-s-economic-situation-may-2022/  The fact that our nation’s unemployment rate is approaching the low rate of 3.5% that was reached just prior to the pandemic should be a cause for celebration. But for a variety of reasons, the official unemployment number is misleading. The employment situation is not as rosy as it may seem. There is a wide disparity among the states that can be explained by how much economic freedom they allow, including how severely each state shut down its economy due to the COVID-19 pandemic. Consider that the U.S. remains 1.6 million jobs short of our February 2020 high, just before the pandemic came to our shores. Since then, our population has grown by 3.8 million people but the labor force shrank by 174,000 workers. The picture diverges for states. As demonstrated in our 2021 study, the states with the worst job recovery also imposed the harshest COVID-19 measures. For example, two states with the severest lockdowns — California and New York — are also experiencing two of the worst job recoveries, with unemployment rates at least a full percentage point above the national average of 3.6% based on the newly released March 2022 data. Conversely, Utah and Nebraska, who are among the states with the least severe lockdown policies, are tied with the lowest unemployment rate of 2.0%, well below the national average. In measuring how states have rebounded, a better metric than the unemployment rate is the recovery in private employment. Only 16 states have recovered all the private jobs lost due to the shutdowns compared to February 2020. But if we account for each state’s pre-pandemic job growth trajectory, our analysis shows that Montana and Utah stand above the rest for exceeding our forecast of their private employment. Idaho follows closely behind Montana and Utah, and then Wyoming, North Carolina, Mississippi, South Dakota, Arkansas, Maine, and Georgia to round out the top 10 performing states. Except for Maine and North Carolina, each one has a Republican trifecta (GOP controls both chambers of the legislature and the governor’s office). North Carolina leans Republican, and Maine is the anomaly having a Democrat trifecta. What about the bottom 10 states in private-sector jobs recovery? They are Hawaii, New York, North Dakota, California, Maryland, Vermont, Minnesota, Oregon, Massachusetts, and Louisiana. Four of those have Democrat trifectas and four lean Democrat. Louisiana, the last state to make the bottom 10, leans Republican. North Dakota — a Republican trifecta that had one of the least restrictive COVID policies — is a special case due to an unusual economic situation. Its pre-pandemic job growth numbers differed from all other states, and it also relies more heavily on mining and petroleum than any other state. Its petroleum industry went bust in 2014, causing private employment to peak in December 2014 that finally bottomed out in January 2017. Since then, its private job growth has been slow, less than 1% per year. President Biden’s anti-fossil fuels executive orders, including the cancellation of the Keystone XL Pipeline, have only made matters worse for North Dakota. Putting this outlier aside, what accounts for this dramatic difference in recoveries between red and blue states? As already indicated, Republican governors were less severe with their lockdown policies. For another, all Republican governors (with the exception of Louisiana) ended supplemental unemployment payments before they were set to expire last September. These payments contributed to some people receiving more than they would have had they been working. In fact, one study finds that those states that didn’t end these payments early contributed to 3 million fewer people in the labor force. Underlying the difference is likely the extent of economic freedom in each state. Using the Economic Freedom of North America 2021 report published by the Fraser Institute, which is based on 2019 data, the top 17 states allowing for the most economic freedom either lean Republican or have Republican trifectas. In fact, 14 of them are the trifectas. Eight of the bottom 10 have Democrat trifectas, with New York leading the pack, followed by California. The other two in the bottom 10 include Vermont that leans Democrat and West Virginia with a Republican trifecta. The best path to prosperity is a job. Work brings dignity, hope, and purpose to people by allowing them to earn a living, gain skills, and build social capital that endures. Advancing policies that connect people with work, along with reducing barriers for new jobs and opportunities, should be our goal, rather than making a government the first resort for help that disconnects people from what work brings. The red states are showing the way to achieve this sound policy. Other states should follow while things at the federal level look bleak. But as our founders desired, the system of federalism that breeds a laboratory of competition helps shed light on what works best to let people prosper. https://www.texaspolicy.com/economically-free-states-are-recovering-rapidly-high-control-states-not-so-much/ Fear and uncertainty over the pandemic are rising again as the first U.S. case of the Omicron variant of COVID-19 was found in a patient in California and has been spreading across the nation. But let’s not panic and jump to solutions. While this could contribute to the second consecutive winter wave, our new research shows why state governments shouldn’t overreact. Instead, we must steer clear of the devastation caused by mistaken shutdowns over the last two years.

Recently, Federal Reserve Chairman Jerome Powell told a U.S. Senate committee that this new variant poses “downside risks” to our country’s economic recovery and inflation headed into 2022. But if recent history is a guide, the economic consequences of Omicron—or future variants—would be mostly from bad policies out of Washington and state capitols. Congress is already running up massive deficits with excessive spending and misguided policies. The Fed has monetized much of that debt issuance, creating too much money that’s chasing too few goods, hence the highest inflation in 39 years. That inflation rate is challenging for the middle class, but it’s devastating to the impoverished who struggle to afford spiking prices of groceries, gasoline, and more. But what’s too often missed is the effect that states had on making what could have been a slowdown or minor recession in response to the pandemic into a severe downturn. Our new research, commissioned by the Georgia Center for Opportunity, finds that the overreaction by states to previous waves did substantial damage without much benefit in reducing the effects of the coronavirus. The research shows a statistical correlation between how severe state governmental actions were in shutting down their economies and negative impacts on employment more than a year after the pandemic began in America. This was the case even after controlling for a state’s dependence on tourism or agriculture, population density, and the prevalence of COVID-19 infections and hospitalizations. Our research found no correlations between the severity of shutdowns imposed by state governments and the rate of reported COVID-19 hospitalizations or deaths. What we do know is that nationally, there are 3.3 million fewer people employed in the private sector since February 2020, a month before the shutdowns in most states. But the job loss is not spread evenly across the country. Our study did not settle for simply comparing the job loss as measured from February 2020, the month before the pandemic hit. Instead, we ran more than 200 ARIMA model forecasts to capture pre-pandemic trajectories in an effort not to skew the results. Not all states had upward trajectories, and job growth rates varied from −0.8% to 2.9% for the 12 months prior to the pandemic. States like Hawaii, New York, California, and New Mexico that imposed harsher economic restrictions generally have greater job losses even today than those states that were less harsh, such as South Dakota, Iowa, Nebraska, Missouri, and Utah. For example, New York was 10.2% below its trajectory in October 2021 while Nebraska was just 2.4% below. Policies need to be implemented in a way that preserve jobs. Protecting the rights and opportunities of workers to earn a living is obvious. Equally important are the psychological benefits that come with the dignity of work. And there are socio-economic benefits from work that positively impact everyone, such as building social capital and gaining skills, which are especially important for those in marginalized communities who were most impacted by the pandemic. As the states prepare to deal with the Omicron variant (and we’re sure there are more to come), it is paramount that they consider the empirical evidence and not impose burdensome restrictions—such as business closures, stay-at-home orders, school closures, gathering restrictions, and capacity limits—on economic activity that will likely end up doing more harm than good. Instead, the policies need to be crafted more carefully to expand opportunities for the poor and preserve jobs in an open economy in which entrepreneurs can solve problems while taking measures when necessary to protect vulnerable populations. These are the policies that should have been done all along to avoid the severity of the shutdown recession and the effects on lives and livelihoods thereafter. Let’s not make another mistake when so many are already suffering. Mr. Randolph who authored the study, is the Director of Research for the Georgia Center for Opportunity. Mr. Ginn, who sat on the advisory panel for the study, is chief economist at the Texas Public Policy Foundation, served as associate director for economic policy at the White House Office of Management and Budget, 2019-20. https://www.texaspolicy.com/with-the-omicron-variant-here-states-must-avoid-past-mistakes/ www.texaspolicy.com/reconciliation-bill-is-an-assault-on-marriage-and-families/Marriage is already tough enough; fewer and fewer Americans are even attempting it, and while divorce rates are down slightly, that may only be a temporary side effect of the pandemic. Yet the evidence is clear—marriage is the not-so-secret ingredient for success in life, for men, women and especially for children.

But marriage is about to become even harder. Congress’ massive reconciliation bill, clocking in at more than $5 trillion, is riddled with provisions that undermine society’s most fundamental institution—the family. From multiple marriage penalties to taxes that will prevent parents from passing businesses and farms down to their children, to lower household incomes paired with higher prices (financial stress is still the primary cause of divorce), the bill makes marriage more expensive and even cost-prohibitive in some cases. We’ve long known that fiscal policies can have a big effect on marriage rates. Chief among these policies are welfare programs. “A safety net marginally reduces the costs of single parenthood, nonmarital childbearing, and divorce,” a U.S. Congress Joint Economic Committee report said in 2020. “It also can create a significant tax on marriage because the addition of a spouse with income typically reduces safety net benefits, and if he has only modest earnings or unsteady employment, the trade-off may not be worthwhile.” But Congress and the Biden administration are doubling down on such policies. If the reconciliation bill passes, marriage will be even less advantageous to couples and to children. Let’s look at a few examples of how. First, multiple marriage penalties are found in the bill. A marriage penalty occurs when tax liability for a couple increases after the wedding because of differences in tax bracket thresholds, deduction limitations, and other aspects of the tax code. Some couples could find nearly all of one spouse’s income now subject to a higher tax rate. Marriage penalties in the proposed structure can total $130,200 annually in higher taxes. Estate taxes are another way the reconciliation bill chips away at a family’s opportunities. Family businesses and family farms will be severely penalized upon the death of a parent. The federal estate tax, also known as the death tax, currently applies only to estates valued over $11.7 million, with the top marginal rate at 40%. Democrats would lower the exemption by $8.2 million and increase the top marginal rate to 65% while also introducing a tax on unrealized capital gains. The total tax rate on an estate can easily climb over 70%, even on relatively modest estates. One former Democratic senator says hiking the estate tax is a mistake. “I’m trying to sound the alarm, both economically and politically, for Democrats that this is not a path to walk,” says Heidi Heitcamp of North Dakota. “The disruption that it would create for small family business and farmers and family assets is not worth the pain.” The bill will also result in fewer jobs and lower household incomes. Our analysis shows that the “Build Back Better” plan (as the Democrats are now euphemistically calling it) will reduce employment by the equivalent of 5.3 million full-time jobs. And it will reduce incomes. Despite the Biden administration’s repeated promise to not raise taxes on those earning less than $400,000 a year, there are many implicit and even explicit tax increases on that group. Aside from the bottom quintile, those who earn under roughly $20,000 a year, all income groups will see their after-tax incomes decline as a result of the Democrats’ tax agenda, through a combination of direct and indirect taxation, as well as reduced income from lower economic growth. Combined with runaway inflation due to the Democrats’ love of modern monetary theory, the pressures on married couples and other families will only intensify. As historian Will Durant pointed out, “The family is the nucleus of civilization.” It’s our most basic institution. We can’t build back better on top of its ruins. Congress must reject the reconciliation bill. Commentary Many Americans have historically associated “socialism” with things like the Red Scare, Nazism, the Cold War, and McCarthyism. Today, that fear has largely faded—particularly among young people—and has instead become a love affair.

A recent Axios/Movement poll found that 51% of 18 to 34 year-olds view socialism positively, though the share is only 41% for all Americans. That poll also found that 49% of young adults viewed capitalism favorably—a decrease from 58% in 2019. However, across all Americans there is 57% support for capitalism with just 36% having a negative view of it, which is a slight decrease from the 61% to 36% split in 2019. Many reasons explain these trends, but the fact that capitalism has lifted more than one billion people worldwide out of poverty is irrefutable. Despite this reality, the alarming rise in support for socialism, particularly among young adults, begs the question: Do proponents of “socialism” really understand it, and will it ever invade America? In short, institutions matter and we should understand them, because when we do, we have a better appreciation for capitalism and will reject socialism, even as socialism metastasizes throughout many sectors of our economy. Socialism is an economic system in which government owns the means of production. Socialism is an extractive economic institution with redistribution of resources—not with market prices but rather by elite politicians who supposedly understand the collective desires of society. Capitalism, on the other hand, derives its success from an inclusive economic institution with private ownership of the means of production in a free enterprise system. This institutional framework has strong private property rights allowing for a well-functioning price system in markets that allow efficient allocation of resources to those who desire things most with a profit-loss calculation to increase prosperity. Many supporters of socialism believe society would be best served by a big government that oversees things like health care, food, employment, and transportation, with college and housing at no charge. Socialism’s enthusiasts also claim government-run societies would decrease income inequality and give workers a greater voice. However, socialists fail to recognize the truth that nothing is free. More precisely, scarcity means there are always costs, whether realized or unrealized. Free college and universal health care could be fantastic services if they were truly free, but the government doesn’t have its own money—it must extract resources from Peter to give to Paul, and “free” provisions like these have poor outcomes. Moreover, the ideas of “tax the rich” and “give to the poor” are fallacies that don’t support lower poverty or less income inequality, as they reduce opportunities for success in the productive private sector while contributing to greater dependency on costly government redistribution. This intervention stifles consumer power, eliminates competition, and oftentimes contributes to greater poverty and income inequality. History shows us that socialism has never worked and will never work well. Cuba—a socialist country located only 90 miles south of Florida—first embraced socialism over 60 years ago under Fidel Castro. Cubans yielded enormous liberties to Castro’s government in exchange for promises of a better life. As Cuba now grapples with shortages of COVID-19 vaccinations, food, and other critical supplies, even President Biden recently denounced Cuba and its economic system as a failure. Despite the growing disdain for capitalism in the United States, data from the Economic Freedom of the World report confirms that capitalist, free-market policies lead to the greatest prosperity. Greater economic freedom under capitalism provides for a more robust economy and a well-functioning price system that yields higher life expectancies, higher incomes, greater per-capita GDP, and less poverty. And capitalism is also morally superior to socialism as it empowers people to make decisions that meet their needs rather than being told what to do through subjective determinations from elite politicians. Furthermore, socialism requires the immoral violation of personal property rights and individual freedoms. Government is not intended to dictate the lives of each individual, nor it is it supposed to control a society’s factors of production. As former President Trump said, “America will never be a socialist county.” Socialism did not make America great, nor will it provide for a more perfect union. While we’ve moved further toward socialism in many sectors of our economy, which explains their poor outcomes, Americans should appreciate the many benefits of capitalism so that we can right the course toward more human flourishing. Commentary Overview: The COVID-19 pandemic and forced business closures by state and local governments over the last year left much economic destruction. Many Americans have been recovering as we near herd immunity and states reopen, but fiscal and monetary policies out of D.C. are distorting economic activity and the labor market. For example, the labor market has been improving at a slower pace in recent months, even as there has been at least $6 trillion in passed or proposed bills during the first 100 days of the Biden administration. The federal unemployment “bonuses” and even more in handouts have reduced incentives to work, resulting in a similar number of unemployed as the record high of 9.2 million job openings. Although the economy has withstood these headwinds for now, a pro-growth approach is necessary. The COVID-19 pandemic and forced business closures by state and local governments over the last year left much economic destruction. Many Americans have been recovering as we near herd immunity and states reopen, but fiscal and monetary policies out of D.C. are distorting economic activity and the labor market. For example, the labor market has been improving more slowly in recent months even as Congress recently passed the American Rescue Plan Act (ARPA), which led to fewer people wanting to work due to more unemployment “bonuses”—up to $1,200 per month—and even more in handouts. This has contributed to a record high of 9.3 million job openings with a similar number unemployed. Fortunately, the economy continues to withstand these headwinds for now, which is why a pro-growth approach is necessary. Full article Americans’ lives and livelihoods took a hit in spring 2020 when the COVID-19 pandemic disrupted their routines and how they earn a living as lockdowns by governments in response to the pandemic exacerbated the situation. Congress has since authorized about $4.5 trillion in aid, which has swelled an unsustainable national debt. Combined with the redistribution of resources from the private sector, the result is a crowding out effect that harms America’s future economic potential and disproportionately hurts those who cannot afford this government overreach. There is a need for sound policy by governments at every level to support a safe, expedited, and fiscally responsible rebound so Americans have more opportunities to thrive. https://www.texaspolicy.com/the-ginn-economic-brief/ The COVID-19-induced recession in Texas has strained the ability of many Texans to pay taxes to fund the state’s budget. The Legislature should consider prioritizing budget reductions to cover any potential budget shortfall. Key points:

https://www.texaspolicy.com/prioritizing-texas-budget-reductions-amid-deficits-due-to-the-covid-19-induced-recession/ In May, U.S. Senators Bennet (D-CO) and Young (R-IN) introduced the RESTART Act (S. 3814) to provide increased flexibility to the Paycheck Protection Program (PPP). It also would establish a new lending program for small and medium-sized businesses to cover up to six months of operating expenses for those hit hardest by the economic fallout due to COVID-19 and lockdowns by state and local governments. This bill is bipartisan with 56 cosponsors in the Senate and 163 cosponsors in the House (H.R. 7481) as of Sept. 27. TPPF proposes adding an amendment to include rehire grants to cover 120% of up to six months of the costs of rehiring employees terminated since the beginning of the COVID-19 crisis. While the economic damage continues from governments not ending lockdowns, congressional discussions are progressing towards moving the RESTART Act to the floor for a vote. In lieu of other congressional action, TPPF supports the passage of the RESTART Act and recommends adding the rehire grant amendment while reallocating CARES Act unspent dollars to fund it. Texas’s economy took a major blow in March from COVID-19 as it reduced Texans’ activity across the state. Then lockdowns by state and local governments in response to the novel coronavirus further exacerbated the economic fallout. The economic data are clear that the labor market, economic outlook, and social mobility remain well below where it was in February. These weaknesses tell the story of how many Texas families and employers are struggling in their lives and livelihoods during this trying time without hope until government reopens the economy. https://www.texaspolicy.com/overview-of-texass-economy/ Overview: The U.S. Bureau of Economic Analysis recently released the second estimate of real (inflation-adjusted) gross domestic product (GDP) in Q2:2020. The latest figures show GDP contracted by 5% (annualized) in Q1:2020 and 31.7% in Q2:2020 for a total GDP loss of $2 trillion this year. The Federal Reserve Bank of Atlanta’s GDPNow running estimate of real GDP indicates it could increase by 28.9% in Q3:2020 (as of August 28) depending on COVID-19 responses. The U.S. private economy has lost $2 trillion this year from COVID-19 and resulting lockdowns by state and local governments, but it will keep improving as states reopen. In this Let People Prosper show, we discuss the push by locally elected officials for total control of our lives instead of allowing control by local voters. We also discuss the reasoning for every dollar raised by increasing the state's sales tax rate to go to property tax relief of lower tax bills instead of growing government by just reducing recapture which stays with school districts and doesn't go to cutting your tax bills. That discussion included the House Ways & Means hearings of HJR 3 last week and SB 2 this week. Finally, we discussed major reforms to bail and ban the box that could improve the criminal justice system and help those that are involved. These are the ways we can help Texans and all Americans have more opportunities to prosper.

Please watch the full episode and share with your network. Thanks! #letpeopleprosper In this Let People Prosper episode, we discuss the key elements of real property tax cuts (slower growth rates and lasting tax reductions), movement afoot to eliminate civil asset forfeiture, and potential expansions in local liberty that are being discussed at the Texas Legislature. As we get closer to the end of session, these are critical aspects that you don't want to miss.

#letpeopleprosper In this Let People Prosper episode, we discuss the latest current events on the U.S. jobs report, efforts to increase liberty at the local level, reforming a broken bail system, and a path for the Texas Senate to make their version of the budget a Conservative Texas Budget.

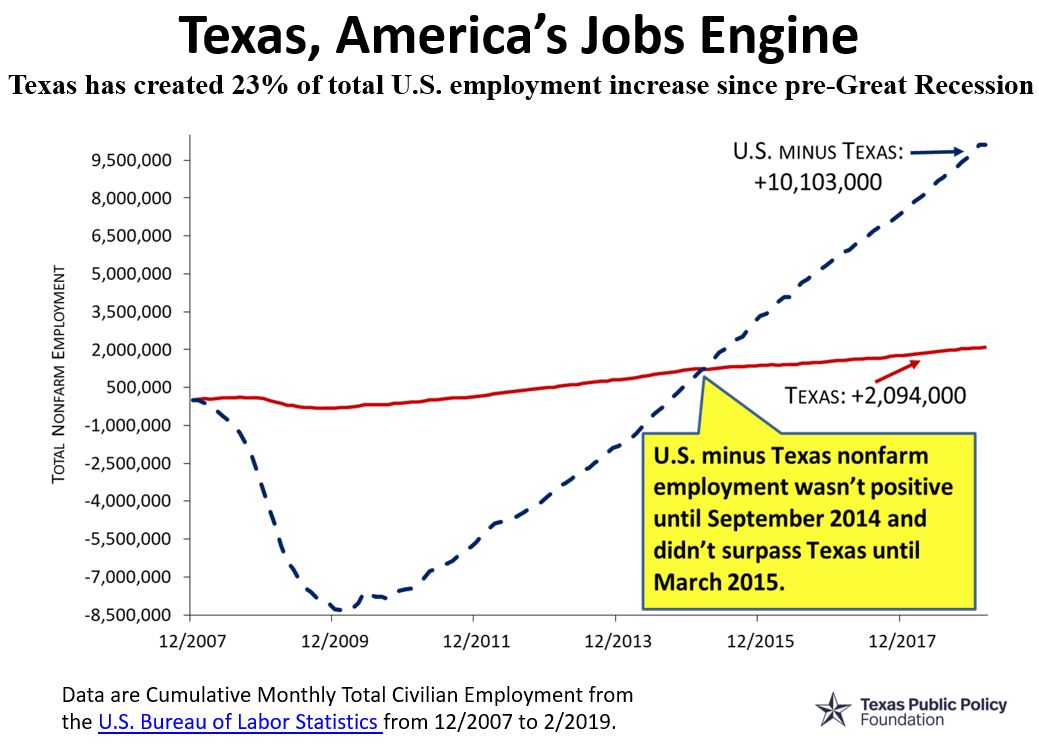

#letpeopleprosper Texas Model Helps to Let People Prosper - Presentation on Texas' Economic & Fiscal Situation4/1/2019 The latest BLS state-level jobs report for February shows that Texas continues to lead the way in job creation for the last 12 months and keeps the state's near record low unemployment rate of 3.8%. Here's the statement by the Texas Workforce Commission. The presentation below provides an overview of Texas’ economic, labor market, and fiscal situation while also comparing Texas with other large states. There are also policy recommendations to strengthen the Texas Model of limited government so that it can foster more individual liberty and economic prosperity. My prior research on how institutions matter takes a deeper dive into these figures. I recommend reading it along with watching my vlog on the subject. To summarize, Texas should increase economic freedom by eliminating unnecessary government barriers to competition to let people prosper. Watch my explanation of previous state-level labor reports and other videos at my YouTube channel: Vance Ginn Economics. https://www.texaspolicy.com/blog/detail/texas-economic-labor-market-and-fiscal-situation

In this Let People Prosper episode, we discuss local government transparency and efforts to rein in progressive policies like government-mandated paid sick leave, state reforms to the criminal justice system, and the failure of the Texas House to pass a Conservative Texas budget...but there was a good discussion about property tax relief!

#letpeopleprosper In this Let People Prosper episode, James Quintero, Chance Weldon and I discuss the Conservative Texas Budget related to SB 500; Teacher Retirement System (TRS) of Texas related to SB 12; superintendent pay reform in HB 880; local debt issues in HB 440, HB 477, and SB 30; and a legal case regarding child safety.

#letpeopleprosper TxLege Review on Sunshine Week, Bad Occ Licensing Bills, CJ Reforms: Let People Prosper Ep 803/11/2019 In this Let People Prosper episode, James Quintero, Derek Cohen, and I go over this week's key issues in the Texas Legislature.

These include issues related to the following:

#letpeopleprosper Current Events Friday includes Jobs Report, Annexation, & Criminal Justice Reforms: LPP Ep 793/8/2019 In this Let People Prosper episode, James Quintero, Dr. Derek Cohen, and I discuss today's release of reports on the U.S. and Texas jobs picture, movement on annexation reform (HB 347), and various issues related to criminal justice reforms (HB 63). Find more of TPPF's work at www.txlegehub.com.

#LetPeopleProsper In this Let People Prosper episode, James Quintero, Dr. Derek Cohen, and I discuss the following:

|

Vance Ginn, Ph.D.

|

||||||

RSS Feed

RSS Feed