|

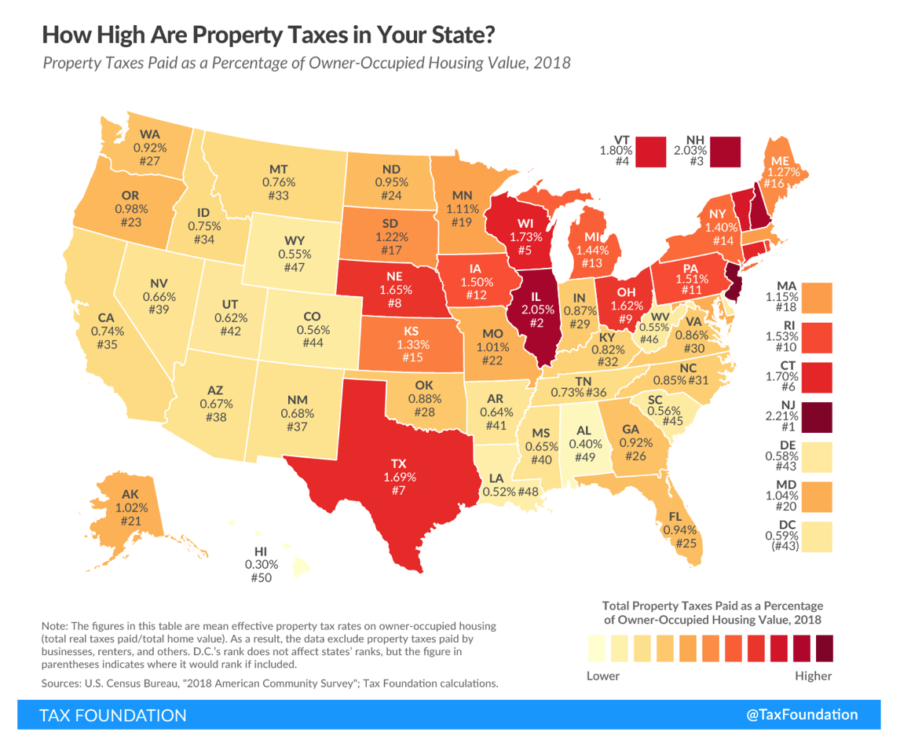

In May, U.S. Senators Bennet (D-CO) and Young (R-IN) introduced the RESTART Act (S. 3814) to provide increased flexibility to the Paycheck Protection Program (PPP). It also would establish a new lending program for small and medium-sized businesses to cover up to six months of operating expenses for those hit hardest by the economic fallout due to COVID-19 and lockdowns by state and local governments. This bill is bipartisan with 56 cosponsors in the Senate and 163 cosponsors in the House (H.R. 7481) as of Sept. 27. TPPF proposes adding an amendment to include rehire grants to cover 120% of up to six months of the costs of rehiring employees terminated since the beginning of the COVID-19 crisis. While the economic damage continues from governments not ending lockdowns, congressional discussions are progressing towards moving the RESTART Act to the floor for a vote. In lieu of other congressional action, TPPF supports the passage of the RESTART Act and recommends adding the rehire grant amendment while reallocating CARES Act unspent dollars to fund it. The Tax Foundation recently published a map of the country illustrating the property taxes paid in each state as a percentage of owner-occupied housing value in 2018. Of all 50 states, Texas had the seventh highest property tax burden in the country, with an effective rate of 1.69% of occupied housing value. This burden is something that Texans across the state know too well.

The article accompanying the map acknowledges that Texas to some extent relies on high property taxes in lieu of other tax categories – i.e., income taxes – though other states without an income tax do not necessarily have a high property tax burden (e.g., Florida). Regardless, in an economy hampered by COVID-19 and government lockdowns and with homeowners under substantial financial and mental stress, local governments have a responsibility to reduce the burden on taxpayers. The Texas Public Policy Foundation has put forward proposals to reduce burdensome property taxes by focusing on Texas embracing final sales taxes over property taxes and governments implementing sound budget practices. A final sales tax system is a more attractive alternative to a property tax. Property taxes are calculated on oftentimes subjective property values, which can rise without a change in homeowners’ ability to pay; Texans can adjust their spending habits to a sales tax, however. This results in a compounding effect of property taxes on holders of property every year that reduces their ability to pay them, forcing many to lose their property and to never truly own it. One way to ease the property tax burden across Texas is to buy down school districts’ maintenance and operations (M&O) property taxes, which is about half of the property tax burden. This could be done by limiting state spending and using any surplus funds to cut the local property tax until it is eliminated, which could take roughly a decade, moving Texas towards sales taxes as they are the state’s top revenue source. However, this could be difficult to maintain session after session with the limitations on state and local government spending to achieve this in a timely manner, if at all. Another way is for the state to immediately replace school M&O property taxes with higher sales taxes. An immediate swap would eliminate the risk that the switch to a final sales tax would be only temporary, a failure common to past property tax relief efforts. However, an immediate switch may be politically challenging to implement, so a way to mitigate this is to limit state spending and use surplus funds to cut the sales tax rate over time. Switching M&O costs to sales taxes is not the only measure local (or state) governments should adopt. The other, and possibly even more fundamental to reducing barriers for opportunities to let people prosper, is implementing sound budgetary practices. By reducing government spending through things like freezing new hires and pay raises and placing a moratorium on incurring any new taxpayer-funded debt, there are plenty of opportunities to cut taxes. Local governments should volunteer for third-party audits to determine where areas of waste can be eliminated along with expensive lobbying contracts and longevity pay. Ultimately, practicing zero-based-budgeting, whereby local governments must justify every expenditure, could help achieve setting budget priorities that support effective government programs. Any government approach to supporting an economic recovery in the wake of COVID-19 must begin with easing the burden on Texas taxpayers, and that approach must include reducing the burden of soaring property taxes and implementing sound budgeting at all levels of government. Today the Texas Public Policy Foundation released the threshold number for the 2022-23 Conservative Texas Budget in a live event and released a paper on the topic. The Conservative Texas Budget is an approach to the state budget limiting its growth so spending doesn’t outpace Texans’ ability to pay for it. Measured in terms of population growth plus inflation, the Conservative Texas Budget establishes a maximum threshold for growth in the state’s initial appropriations.

For the 2022-23 state budget that percentage is 5% for a total appropriation of $246.8 Billion. “The Conservative Texas Budget is an effective maximum threshold for prioritizing the taxpayer in the state budget process as every dollar spent comes out of the pocket of Texans,” said TPPF’s Chief Economist Vance Ginn, Ph.D. “Since this approach was implemented ahead of the 2015 legislative session, budgets have grown less than half the rate of the five prior state budgets. This trend should continue for the 2022-23 Texas budget especially as many families are recovering from the recession due to COVID-19 and government lockdowns.” The 2022-23 Conservative Texas Budget sets a maximum threshold for the state’s budget that will be passed during the 2021 Legislature so government grows by less than taxpayers’ ability to pay for it. Key points:

Production of crude oil and natural gas has historically fluctuated based on many market-driven and geopolitical factors. Because the Texas Legislature collects severance taxes from this volatile production to primarily fund the state’s rainy day fund, the purpose for and use of the ESF must be worthy. The U.S. Bureau of Labor Statistics recently released the U.S. jobs report for August 2020. The labor market has been improving but families continue to struggle compared with the robust situation at the peak in February 2020, which was before the COVID-19 pandemic and subsequent lockdowns of society by state and local governments. https://www.texaspolicy.com/the-ginn-economic-brief/ Texas’s economy took a major blow in March from COVID-19 as it reduced Texans’ activity across the state. Then lockdowns by state and local governments in response to the novel coronavirus further exacerbated the economic fallout. The economic data are clear that the labor market, economic outlook, and social mobility remain well below where it was in February. These weaknesses tell the story of how many Texas families and employers are struggling in their lives and livelihoods during this trying time without hope until government reopens the economy. https://www.texaspolicy.com/overview-of-texass-economy/ I provide options for how to substantially reduce the high property tax burden in Texas by limiting government spending with either a buydown of property taxes over time or a swap with sales taxes immediately so that Texans have more opportunities to prosper. https://www.texaspolicy.com/paths-to-reducing-the-excessive-property-tax-burden-in-texas/?fbclid=IwAR36wMUa0RfeKZPI3UwoS2Dm-SrFNK7uMf2iNJScV17QH6Z7Fxp2zsu3lX8 On May 19, 2020, President Trump signed the Executive Order on Regulatory Relief to Support Economic Recovery. In Section 6 of the EO, titled the “Fairness in Administrative Enforcement and Adjudication,” it includes ways to improve the institutional framework of how federal regulations are enforced. The EO should help empower people to be protected from undue, expensive, unclear regulatory overreach by the federal government that costs Americans trillions of dollars over time. https://www.texaspolicy.com/overview-of-the-presidents-executive-order-on-regulatory-relief-to-support-economic-recovery-path-forward/ Overview: The U.S. Bureau of Economic Analysis recently released the second estimate of real (inflation-adjusted) gross domestic product (GDP) in Q2:2020. The latest figures show GDP contracted by 5% (annualized) in Q1:2020 and 31.7% in Q2:2020 for a total GDP loss of $2 trillion this year. The Federal Reserve Bank of Atlanta’s GDPNow running estimate of real GDP indicates it could increase by 28.9% in Q3:2020 (as of August 28) depending on COVID-19 responses. The U.S. private economy has lost $2 trillion this year from COVID-19 and resulting lockdowns by state and local governments, but it will keep improving as states reopen. Overview: The Texas Workforce Commission recently released the Texas jobs report for July 2020. The report highlights improvements in the state’s labor market but there are challenges to get back to its peak in February 2020, which was before the COVID-19 pandemic and subsequent lockdowns of society by state and local governments. Texas’s private employment in July during the government-induced recession due to COVID-19 is at the lowest level since December 2016. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed