|

Today, I'm honored to be joined by Amity Shlaes, who has written four NYT bestsellers, chairs the board of the Calvin Coolidge Presidential Foundation, is winner of the Manhattan Institute's Hayek Book Prize, and serves as a scholar at the King's College. We discuss:

You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share on social media, subscribe to your favorite platform and my newsletter, like it and leave a 5-star rating.

0 Comments

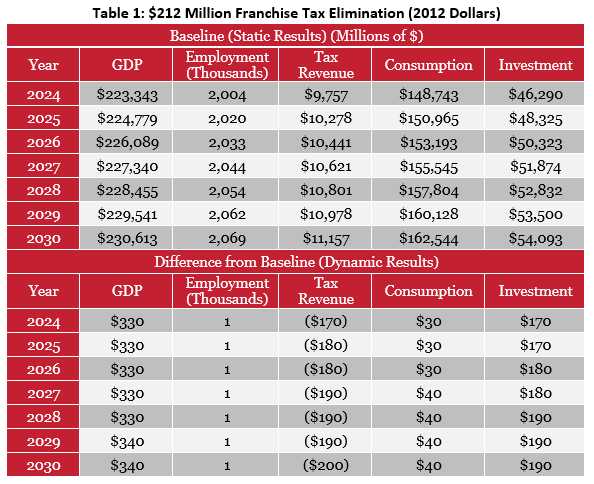

There’s much discussion in Baton Rouge about how to best allocate scarce taxpayer money that’s overflowing the state’s coffers. A problem with $3 billion in the state’s savings accounts is that everyone has their hands out to receive some of it. But the ones who should be remembered first are the taxpayers. In this discussion, one of the bright spots is tax reform, particularly eliminating the state’s corporate franchise tax. The corporate franchise tax is levied annually on the taxable capital of corporations, including capital stock, surplus, and undivided profits. Unlike corporate income taxes, which are levied on a company’s profits, these taxes are imposed on a company’s net worth. Therefore, the tax penalizes investment and requires companies to pay the tax regardless of whether they make a profit. While it’s just three percent of the state’s revenue, it’s a large burden on businesses as only 16 states have one and two of them (i.e., Connecticut and Mississippi) are phasing theirs out. Louisiana should eliminate its corporate franchise tax, too. There were improvements to the franchise tax in the state’s 2021 tax reforms that reduced the rate and increased the minimum amount needed to begin paying the tax. Those reforms also included revenue triggers which would reduce personal income taxes and corporate franchise taxes if three revenue targets are hit. This tax could be reduced substantially this session. The first two triggers are already hit so the Legislature simply needs to add about $55 million to the rainy day fund to hit the final one and there could be at least a 50 percent cut in the corporate franchise tax rate. And State Senator Bret Allain’s SB 1 could help make this phase out more certain. Eliminating this tax would result in increased productivity, faster economic growth, higher consumption, and greater investment. We’ve been working with the Economic Research Center to examine the economic effects of eliminating this tax. Their model estimates the dynamic effects of tax changes on economic variables. Table 1 includes the dollar values reported in millions of 2012 inflation-adjusted dollars and are based on the estimates in the Congressional Budget Office’s February 2023 economic projections. Employment is represented by full-time equivalent non-farm jobs, in thousands of jobs. Removing this tax on capital would support more investment and economic output over time with the largest effect in the first year. Their results show that eliminating the costly corporate franchise tax would result in gross domestic product (GDP) increasing by $330 million, with employment increasing by at least 1,000 jobs, consumer spending increasing by $30 million, and investment jumping by $170 million in 2024.

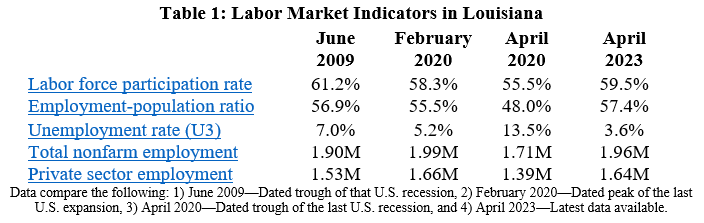

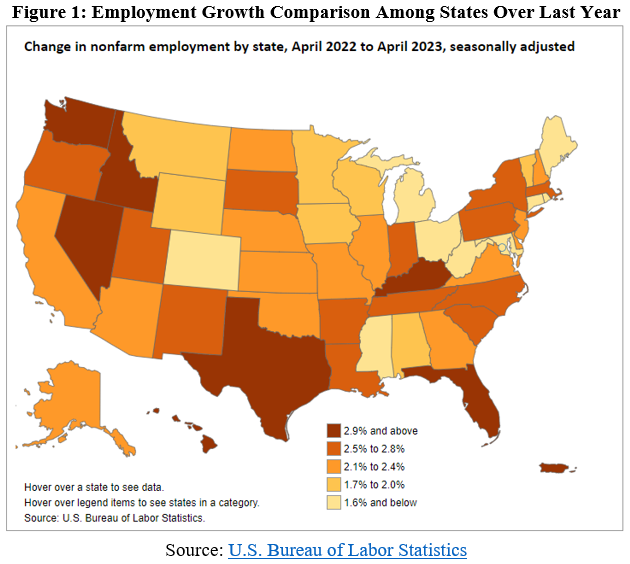

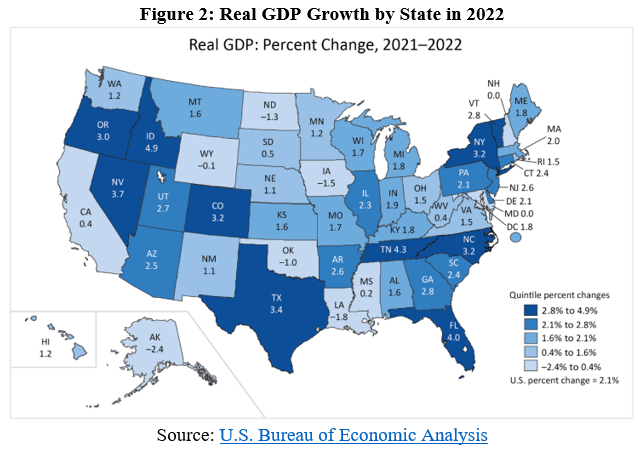

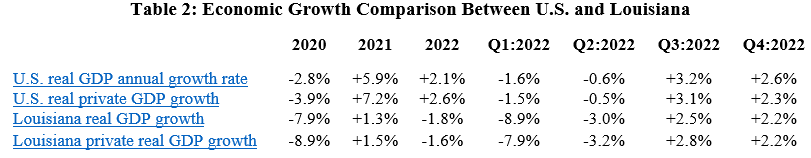

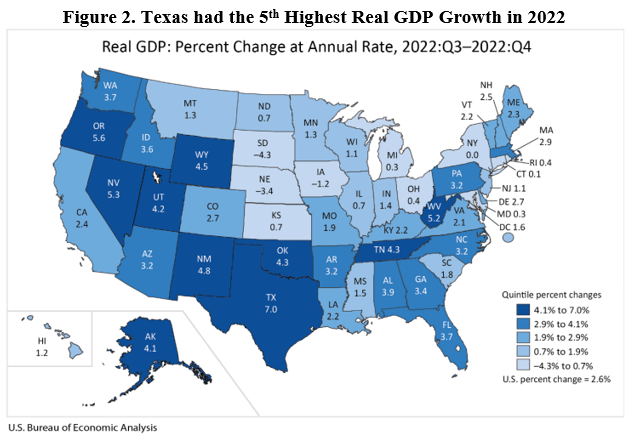

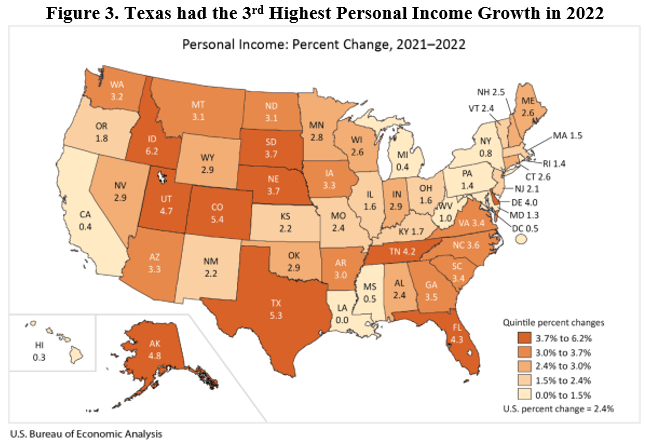

And the inflation-adjusted value of a $212 million franchise tax cut would result in just $170 million in reduced total tax revenue because the increased economic growth, employment, and investment contributes to higher collections in other taxes, such as the personal income tax because there are more people working. Of note, the temporary reduction in tax revenue won’t affect the state’s budget. Over the last three fiscal years, the state has seen a boom in corporate income and franchise tax revenues, such that, according to law, anything collected over $600 million in this category automatically goes into a savings account—the Revenue Stabilization Fund—to help offset future decreases in revenue. This money is not even in the state’s operating budget, so it won’t be missed. Louisiana is hemorrhaging people and businesses as they move to other nearby states with better tax systems. The Legislature has a chance to stop the bleeding so the state and Louisianans can heal and become more prosperous over time. There’s a great opportunity to do so now. Lawmakers can pass a responsible budget, activate revenue triggers for tax relief, and set the state on a path toward ending this punishing tax so our state can be competitive. Originally published by Pelican Institute. Key Point: Louisianans aren’t reaching their full potential primarily because of bad public policies but that can change with the Pelican Institute’s “Comeback Agenda.” Louisiana’s Labor Market: Table 1 shows Louisiana’s labor market over time until the latest data for April 2023 from the U.S. Bureau of Labor Statistics. The establishment survey shows that net total nonfarm jobs in the state increased by 8,200 jobs last month (+0.4%), bringing total jobs to 33,700 jobs below the pre-shutdown level in February 2020. Private sector employment was up by 5,900 jobs (+0.4%) and government employment increased by 2,300 jobs (+0.7%) last month. Compared with a year ago, total employment was up by 48,400 jobs (+2.5%), with the private sector adding 41,400 jobs (+2.6%) and the government adding 7,000 jobs (+2.3%). The household survey finds that the working-age population declined by another 920 people last month, down 11,077 people over the last year, and down 33,212 people since February 2020. But the civilian labor force rose by 6,260 people last month, 16,090 people over last year, and 24,592 people since February 2020. These figures result in a labor force participation rate of 59.5%, which is up from 58.9% from last year and up from 58.3% since pre-shutdown but well below the 61.2% rate in June 2009. While the unemployment rate of 3.6% is substantially lower than the 5.2% rate in February 2020, a broader look at Louisiana’s labor market shows that Louisianans still face challenges (see Figure 1). These challenges include the continued decline in the working-age population which weighs on the labor-market shortage and long-term economic growth and comparisons with neighboring states based on several measures indicate concerns. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) recently provided the real (inflation-adjusted) gross domestic product (GDP) and personal income for Louisiana and other states in Figure 2. Table 2 shows how U.S. and Louisiana economies performed since 2020. The steep declines were during the shutdowns in 2020 in response to the COVID-19 pandemic, which was when the labor market suffered most. The increase in real GDP of +2.2% in Q4:2022 ranked 26th in the country, resulting in an annual decline in economic output by -1.8% in 2022 which was the second worst in the country. The BEA also reported that personal income in Louisiana grew at an annualized pace of +6.0% (ranked 32nd) in Q4:2022 (below +7.4% U.S. average). This resulted in personal income growth of 0.0% in 2022, ranking 50th of the states, driven by the negative $10 billion (-4.0-percentage points) in transfer payments from a decline in safety net payments as the expanded child tax credit expired and more people found jobs, but increases in net earnings by $8.4 billion (+3.4-percentage points) and other income by $1.6 billion (+0.6-percentage point). Personal income per person in Louisiana increased by 0.08% to $54,622 last year, which ranked 42nd in the country but the increase was well below inflation.

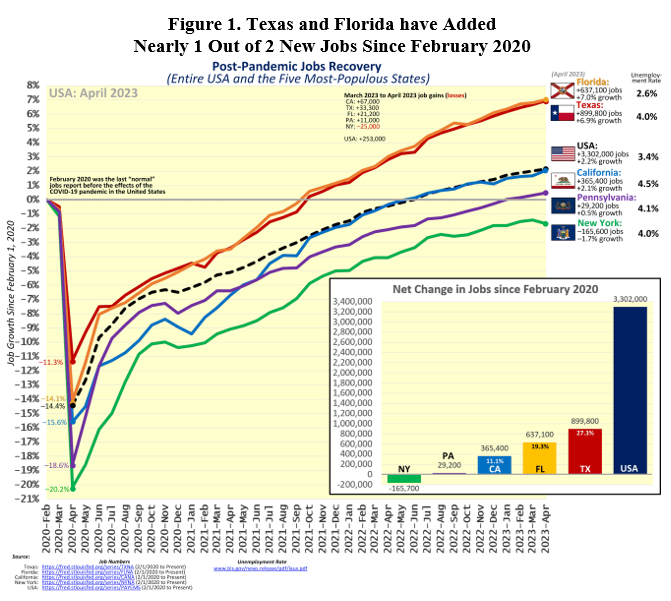

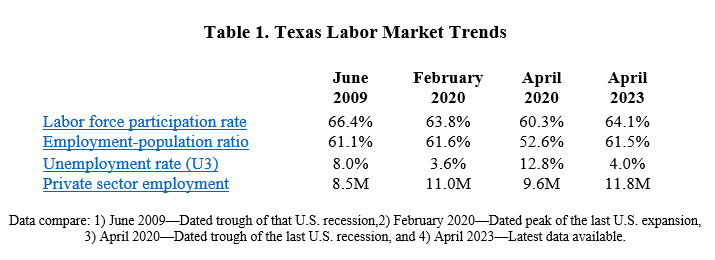

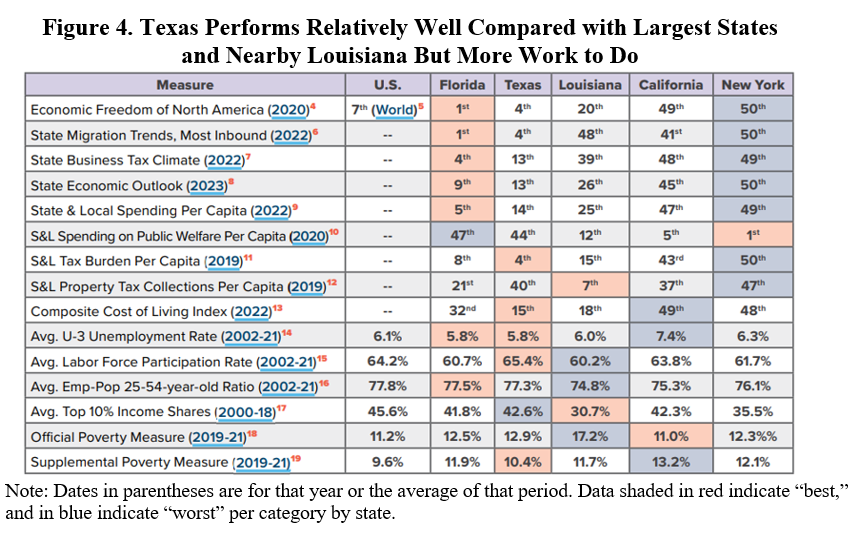

Bottom Line: More Louisianans gained jobs in April, but their pay hasn’t been keeping up with inflation in a stagnant economy. Economic freedom matters to human flourishing, but Louisiana ranks relatively low among the states in economic freedom and other measures. While the state improved its tax code in 2021, there’s a historic opportunity to ensure prosperity by doing more this session. The combination of spending restraint, not busting the spending caps, paying down debt, and putting money in the rainy day fund for tax relief now are essential. These steps would improve the state’s poor business tax climate, help curb the net outmigration of Louisianans, and help mitigate the 19.6% poverty rate that ranks second highest in the country. State and local policymakers should work to reverse this trend by passing pro-growth policies. Which pro-growth policies should be pursued? Refer to the Pelican Institute’s “Comeback Agenda” for policy recommendations related to the state’s budget and taxes, K-12 education, public safety, social safety nets and workforce development, technology and innovation, and reducing regulatory barriers. Originally published by Pelican Institute. Key Point: Texas is a leader in job creation over the last year and since February 2020 (Figure 1 by @SoquelCreek). But Texas will struggle to compete with other states or prosper more as the 88th Legislature passed the largest budget increase in the state’s history, passed the largest corporate welfare increases in the state’s history, passed the largest safety net increases in the state’s history, didn’t pass property tax relief, and didn’t pass school choice. Governor Greg Abbott called a special session to tackle property tax relief and border security with more special sessions likely to come. Overview: Texas has been a leader in the country’s economic recovery since the costly shutdown recession in Spring 2020. This includes reaching a new record high in total nonfarm employment for the 19th straight month. The current 88th Legislature ended the regular session on May 29 with a record surplus but chose to pass the largest spending and welfare increases in the state’s history without passing tax relief or school choice. This was a huge, missed opportunity for Texas that will set up a fiscal cliff with so much spending, less competition with fiscally conservative states, and less opportunity to let people prosper which combined will stop the Lone Star State from being a leader in the country. Fortunately, Governor Abbott called what is likely the first of multiple special sessions to tackle property tax relief (and border security). Labor Market: The best path to let people prosper is free-market capitalism as it is the best system that supports jobs and entrepreneurship for more people to earn a living, gain skills, and build social capital. Table 1 shows Texas’ labor market for April 2023. The establishment survey shows net nonfarm jobs in Texas increased by 33,300 last month, resulting in increases for 35 of the last 36 months, to bring record-high employment to 13.8 million. Compared with a year ago, total employment was up by 534,600 (+4.0%)--second fastest growth rate in the country to Nevada (+4.2%)—with the private sector adding 476,800 jobs (+4.2%) and the government adding 57,800 jobs (+2.9%). The household survey shows that the labor force participation rate is higher and employment-population rate is slightly lower than in February 2020, but the former is well below June 2009 at the trough of the Great Recession. The state’s unemployment rate of 4.0% is higher than the U.S. rate of 3.4% but this is weak indicator as it’s highly volatile based on changes in the labor force. There is also continued declining inflation-adjusted average earnings in Texas. Economic Growth: The U.S. Bureau of Economic Analysis (BEA) reported the real gross domestic product (GDP) by state for 2022. Figure 2 shows Texas had the fifth fastest real GDP growth of +3.4% to $1.9 trillion (above the U.S. average of +2.1% to $20.0 trillion). The BEA also reported that personal income in Texas grew by 5.3% to $1.9 trillion in 2022 which was the third highest in the country. This is behind Idaho (+6.2%) and Colorado (+5.4%) but well above the U.S. growth rate of 2.4% (to $21.8 trillion). Figure 3 shows personal income growth across the country. Bottom Line: As Texans struggle from high inflation and high property taxes and an uncertain future with the U.S. economy likely in a deepening recession, they need substantial relief to help make ends meet. Other states are cutting, flattening, and phasing out taxes, passing responsible budgets, and passing school choice, so Texas must make bold reforms to support more opportunities to let people prosper, mitigate the affordability crisis, and withstand destructive policies out of D.C. Figure 4 provides a comparison of the size of government, economic freedom, and economic outcomes among the four largest states and nearby Louisiana. While Texas does relatively well, there is much more to do for more liberty and prosperity. Unfortunately, the Texas Legislature failed to achieve these needed policy objectives in the regular session of 2023 so Governor Greg Abbott is calling them back where the Legislature should spend less, provide more in property tax relief, pass school choice, and reduce or eliminate corporate welfare and expansions of safety net programs. Free-Market Solutions: The Texas Legislature should improve the Texas Model by:

News: Property Taxes Primed for a Special Session After Appraisal Reform Dispute Stalls Out5/29/2023 State leaders promised “historic” property tax relief this session, but though it is near the finish line, it will not make it past the checkered tape before the body adjourns sine die on Monday.

Last summer, Gov. Greg Abbott called on the Legislature to appropriate “at least half” of the then-$27 billion projected budget surplus to provide “the largest property tax cut ever in the history of Texas.” The comptroller’s January Biennial Revenue Estimate increased that total to $32.7 billion in the state treasury and $27 billion in the Economic Stabilization Fund, also known as the state’s savings account. That’s a lot of tax dollars to disburse, and number one on Abbott’s list was property taxes — which was also high on the list of both chambers. But after a lengthy, attention-grabbing impeachment proceeding against Attorney General Ken Paxton on Saturday afternoon, the clock ticked on toward the midnight deadline to distribute the conference committee report for the last-remaining property tax proposal. And then, some Sunday evening scrambling on a last-minute deal turned out to be more smoke than fire — the House conferees announced the signing of a deal last night, and posted a picture of them waiting for the Senate’s conferees to come sign it, but that ultimately did not happen. Details of that blueprint have not been disclosed as both sides have kept their cards close to their chest. The Texan can confirm that plan included the $12 billion for rate compression, a $70,000 standard homestead exemption, a $100,000 elderly and disabled homestead exemption, and a 7.5 percent appraisal cap on all real property. After a hastily convened meeting with Lt. Gov. Dan Patrick and Abbott, Speaker Dade Phelan (R-Beaumont) made a beeline for the House dais and adjourned the body until Monday morning with no deal announced on marquee property tax relief. Discussions continued into Monday morning but no deal was struck — appraisal caps being the point of insurmountable disagreement. Abbott tacitly weighed into the debate, gesturing at putting rate compression above all else, but it did little to move the needle one way or the other. The Texas House passed a revamped version of Senate Bill (SB) 3 on May 19 — a plan that included $12 billion for new rate compression and the 5 percent appraisal cap on all property from its original plan. But it also included a $100,000 homestead exemption, double what the Senate included in its proposal. Ultimately, the two sides could not coalesce on a compromise; the House dug its heels in for an appraisal cap reduction and extension, while the Senate dug its heels in against it. The ramped-up homestead exemption was not enough to entice the upper chamber to swallow the appraisal cap pill. Lt. Gov. Dan Patrick has maintained it to be a total non-starter in the upper chamber. As passed by the House, SB 3 would have amounted to $16.3 billion in property tax curtailment, plus the $5.3 billion already in the budget to maintain previous levels of compression. Because of this stalemate, and the emphasis Abbott has placed on it, property tax relief is sure to be on the list of issues for the coming special session — expected, but not yet confirmed, to start Tuesday. Property tax relief was on the governor’s list of emergency items at the beginning of the session. Even with the appraisal reform stalemate, there is a starting point of common ground between the chambers. The 2024-2025 state budget, approved by both chambers over the weekend, earmarks $17.3 billion for rate compression — $5.3 billion to maintain previous levels and $12 billion to add to it. The budget has no line item for homestead exemption increases and the appraisal cap extension would not require any financial injection. When the two bodies reconvene, it’s unclear how this stalemate could be resolved other than both just throwing up their hands and moving forward only with the rate compression — the aspect they both agree on. The previous record for the largest property tax cut is $14 billion in the mid-2000s. Both chambers of the Legislature have said their plans surpass that line — including the $5.3 billion to maintain current levels. Critics of that claim — such as Vance Ginn, former chief economist for the Texas Public Policy Foundation — have set the line at $20 billion in today’s dollars accounting for inflation, and also say that the entire sum of dollars going toward property tax relief should be allocated to compression. On top of this, add in the fact that to maintain levels of compression next biennium, the state will have to allocate the same amount of money toward it. Otherwise, tax bills will jump. Before the House adjourned sine die, Lt. Gov. Dan Patrick issued a letter asking for Abbott to include the Senate’s property tax plan — a $70,000 standard homestead exemption, $30,000 elderly and disabled homestead exemption, a $25,000 business personal property tax exemption, and a business inventory tax credit — among a litany of other priorities. Despite the appraisal stalemate running out the clock on this session, the Legislature will quickly have another go at the issue and the chance to fulfill the promises made before and during the 88th regular session. Originally published by The Texan. This Week's Economy Ep 10 | Is U.S. in Recession? Will TX Pass Largest Spending Increase in HISTORY?5/26/2023 Today, I cover: 1) National: What's the latest on the debt ceiling deal, why I believe that the U.S. is in a recession based on the latest GDP report, and how inflation continues to indicate more aggressive monetary tightening by the Fed; 2) State-Level Jobs: I break down the latest state-level jobs report and share reasons for optimism and more with a focus on Texas and Louisiana. 3) Texas: What's going on with the current Texas legislative session, and why the proposed budget increase would be the largest spending increase in TX history while not passing the largest property tax relief in history. Plus, massive increases in corporate welfare, and large increases in social safety net spending, which would result in a disaster for Texans and the Texas economy. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating!).

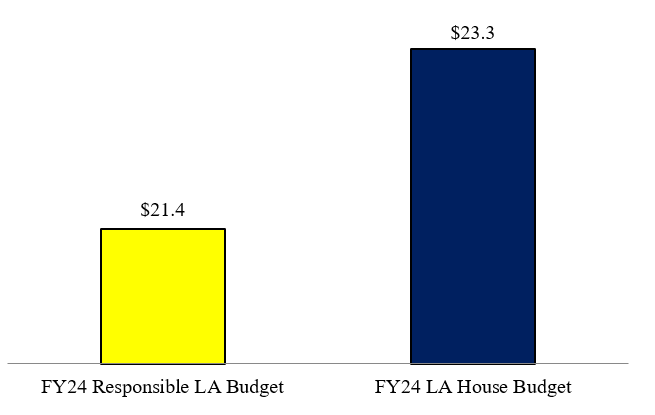

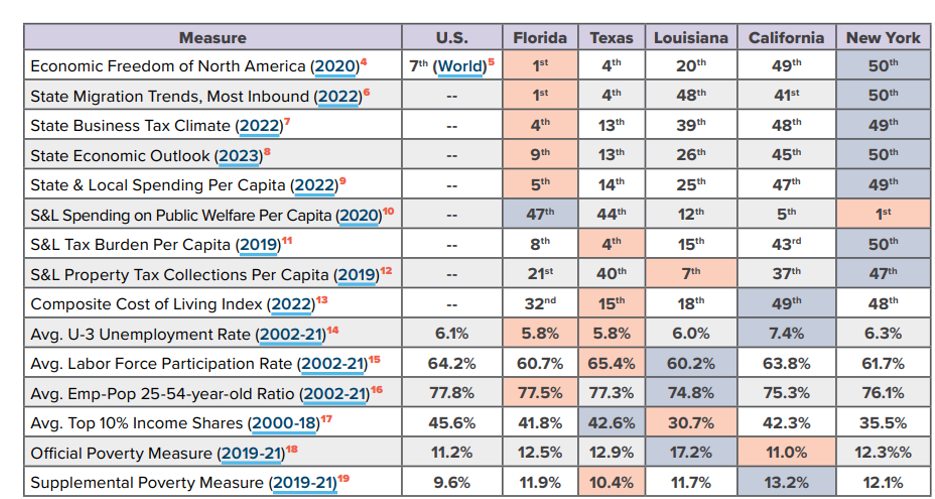

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter on Substack, share this post, and leave a comment. You may have heard that the state of Louisiana is facing a “fiscal cliff” and this is why the Legislature shouldn’t reduce the taxes Louisianans pay to fund the government. This claim is based on assumptions that the state’s tax collections will decline dramatically from the expiration of the “temporary” sales tax rate hike of 45 cents in fiscal year 2025 and the potential for less tax collections from slower economic growth. But this doesn’t appear to be true. Instead, the latest reports of growth of net earnings and tax revenues in Louisiana indicate these claims of a “fiscal cliff” are likely overblown. In fact, these assumptions support a historic opportunity to provide much needed tax relief by hitting the revenue triggers for more money in Louisianans’ pockets and the need for legislators to restrain government spending. Add in the $3 billion in taxpayer money in the state’s savings accounts and we can see that the claims of a “fiscal cliff” are likely overblown. There has been strong growth in net earnings that support more income for Louisianans, which has resulted in higher taxes collected, and there’s plenty of money on the sidelines in case there’s a downturn. Instead of worrying about how the bloated government will grow, we must consider struggling taxpayers across Louisiana and ensure the revenue triggers are hit for tax relief. According to the latest report from the Bureau of Economic Analysis, Louisiana’s personal income growth was stagnant at 0.0% to $250.7 billion in 2022, which declined when adjusting for inflation. But this was driven by the negative $10 billion (-4.0-percentage points) in transfer payments from a decline in safety net payments as the expanded child tax credit expired and more people found jobs. Just considering the factors that support increased economic growth and higher tax revenue, net earnings increased by $8.4 billion (+3.4-percentage points) and other income was up by $1.6 billion (+0.6-percentage point). And given that these gains in the productive part of the economy were in the industries that pay taxes such as manufacturing, wholesale trade, professional services, and health care, the trend of higher tax collections will likely continue thereby reducing the fear of a fiscal cliff. While there are economic headwinds with elevated inflation and rising interest rates from bad policies out of D.C., Louisiana must do more to help Louisianans withstand these headwinds. A pro-growth path forward includes passing a responsible budget, not busting the spending cap, paying down debt, and hitting the revenue triggers for tax relief. There have been strides to achieve these steps in the House’s budget. Table 1 shows that more spending restraint is necessary to pass a Responsible Louisiana Budget that holds spending growth to no more than the rate of population growth plus inflation, which is a good measure for the average taxpayer’s ability to pay for government spending. Table 1. Louisiana’s FY24 State Effort in House Budget Is Above Pelican’s Proposed Responsible Louisiana Budget But even if the maximum threshold of the proposed Responsible Louisiana Budget isn’t met, there’s a grand opportunity to put money into the rainy day fund to hit the triggers put in place in 2021 for substantial relief in personal income and corporate franchise taxes. The results of lower spending and lower taxes are clear from more fiscally conservative states like Florida and Texas compared with more spending and taxes like in fiscally profligate states like California and New York. Table 2 provides a comparison of these states with Louisiana in terms of economic freedom, burden government, economic prosperity, and poverty. Table 2. States with More Economic Freedom Have Better Economic Outcomes Notes: Dates in parentheses are for that year or the average of that period. Data shaded in red indicate “best,” and in blue indicate “worst” per category by state.

Economic prosperity happens when a robust private sector has a more competitive tax system, and this starts with spending restraint and limiting government. Louisiana has the keys to do this; now there needs to be political will to overcome the overblown fears of a “fiscal cliff.” If Louisiana doesn’t, there will be more losses of people and businesses. But if the Legislature achieves this pro-growth path, there will be more opportunity to let people prosper. Originally published at Pelican Institute. What REALLY Happens in the White House, Need Tax & Spending Reforms & More w Paul Winfree | Ep. 455/23/2023 Today, I'm honored to be joined by economist and trusted public policy adviser Paul Winfree, who has served in top management and policy roles in the White House, U.S. Senate, and think tanks. We discuss:

Paul Winfree is an economist and a trusted public policy advisor. He has served in top management and policy roles in the White House, the US Senate, and in think tanks.

This Week's Economy Ep 9 | New Debt Ceiling Bill, Importance of Reducing Taxes, Gov. Spending & More5/19/2023 Don't miss the 9th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Today I cover: 1) National: Breaking down the latest debt ceiling bill and the importance of restraining government spending for helping the economy to bounce back; 2) States: How states are setting an example of better spending habits with responsible budgeting and taxation in states like Florida and Iowa; and 3) Recession: Why I believe next year's data will show that we are in a recession that is set to deepen due to ongoing stagflation, and more. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating!).

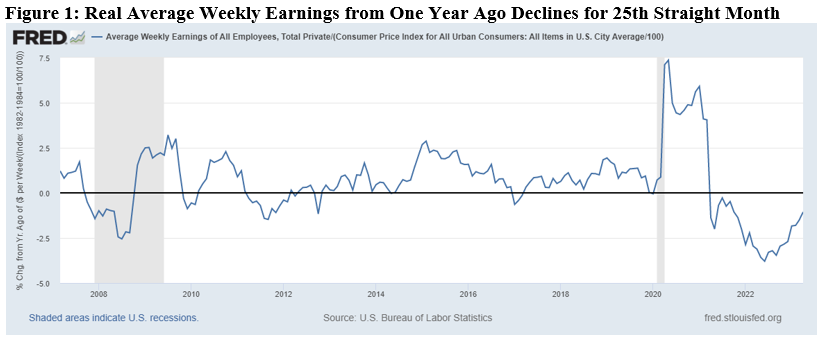

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (https://www.vanceginn.com/) and please subscribe to my newsletter on Substack (vanceginn.substack.com/). According to a recent CNBC survey, pessimism regarding the American economy is at an all-time high, with 69% of the public having a negative view. The leading reason is inflation in a weak economy. The latest report this week shows that inflation remains persistently high at near 5%, eroding slower-growing average weekly earnings year-over-year for 25 straight months.

The Federal Reserve recently raised its federal funds rate target for the 10th meeting in a row to 5.25%–the highest since August 2007. While these rate hikes were anticipated in light of ongoing inflation, they could have been avoided. But excessive government spending and money printing during the “boom” led to this government-failure bust, the effects of which we’ll feel for months and even years to come. The sluggish economic growth has been rough on Americans, but inflation has been a killer. The survey also noted, “Just 5% say their household income is growing faster than inflation, 26% say it’s keeping pace, and 67% report they are falling behind.” This is devastating lower-income households’ standard of living. The trend of declining real wages is particularly harmful to low-income Americans. But even the wealthy feel the effects, as more than half of higher-income Americans surveyed report spending less on eating out and entertainment. This has contributed to the anemic annualized economic growth of just 1.1% in the first quarter of 2023 after rising by only 0.9% from the fourth quarter of 2021 to the fourth quarter of 2022. As prices increase, businesses spend more on production, making it more difficult to raise workers’ wages while remaining profitable. Employees who can’t be paid enough to fund costly goods like childcare and groceries, which have risen by 7.1% over the last year, spend less on other things or fall behind on their bills. Businesses earning less revenue will invest less, and so goes the vicious downward cycle. Another hit on Americans has been the cost of shelter, which was up 8.1% over the last year even as there are signs that housing prices are cooling across the country. Still, housing prices have been “eclipsing the inflation rate by 150% since 1970.” This means many Americans can’t afford to own a home, and that’s getting further out of reach as mortgage rates have soared. What’s to be done about inflation threatening Americans’ livelihoods? Legendary economist Milton Friedman had some advice about addressing sky-rocketing inflation that is valuable today. There is one and only one basic cause of inflation: too high a rate of growth in the quantity of money—too much money chasing the available supply of goods and services,” he argues. “These days, that cause is produced in Washington, proximately, by the Federal Reserve System, which determines what happens to the quantity of money; ultimately, by the political and other pressures impinging on the System, of which the most important are the pressures to create money in order to pay for exploding Federal spending and in order to promote the goal of ‘full employment.’ Despite raising its target interest rate to fight inflation, the Fed has a bloated balance sheet of nearly $9 trillion, which is too high for disinflation to its target of an average 2% rate. When the Fed engages in excessive money printing compared with the supply of goods and services, inflation is the result, as Friedman described. While it was appropriate for the Fed to raise its target rate, the ongoing increase to its balance sheet is just continuing to distort productive economic activity. And Congress must restrain spending. The national debt is nearly $31.5 trillion, with net interest payments on the debt set to exceed $1 trillion soon. The government must borrow to finance the deficit when it spends more than it makes, driving up interest rates. Higher interest rates increase the cost of borrowing for businesses, leading to lower investment, which reduces the supply of goods and services. Add in the Fed buying the debt that increases the money supply with less supply of goods and services, resulting in more inflation. House Republicans passed a debt ceiling bill that would return spending to 2022 levels and limit spending to just 1% growth over the next decade while eliminating other bad policies. Negotiations between the two parties continue, while a June 1 deadline looms. If they don’t reach agreement, it will make the debt issue an ongoing concern as defaulting on the debt nears, further raising interest rates that weaken the economy. This means we can expect a deeper, longer recession. The Fed and Congress have a duty to stop flawed policies of excessive printing and spending, respectively. High inflation harms Americans, and the Fed and Congress must address this. If they don’t take action soon to address these government failures, the erosion of the American dream will continue. The future of America depends on sound, pro-growth, pro-liberty policies instead that will let people prosper. Originally published at Econlib. President Calvin Coolidge regarded “a good budget as among the most noblest monuments of virtue.” Government spending is at the heart of sound public policy. President Coolidge understood the importance of economy in government in order to achieve sound public policy. President Coolidge’s fiscal conservatism is being exemplified at the state level by Iowa Gov. Kim Reynolds, who is making fiscal conservatism a priority resulting in benefits to Iowans. Gov. Reynolds, just as with Coolidge, understands that prudent budgeting is a virtue.

Despite the national economic malaise from high inflation and stagnant growth, Iowa’s fiscal foundation was strong heading into the 2023 legislative session. Last year, Gov. Reynolds and the Iowa Legislature continued to place a priority on prudent budgeting. The general funds budget for fiscal year 2023 was $8.2 billion, increasing by just 1 percent from the prior year. This session the legislature enacted an $8.5 billion budget for fiscal year 2024, which is a 3.6 percent increase from the previous year’s budget. This holds the budget well below the Conservative Iowa Budget, which set a cap on the budget of $8.8 billion based on the maximum rate of population growth plus inflation of 7.4 percent. In other words, taxpayers benefit from the budget growing well below the growth of the economy, allowing more money in the productive private sector. In January, Gov. Reynolds proposed an $8.48 billion budget, which reflected her priorities including funding the Students First Act, which created a universal Education Savings Account program. After budget negotiations between the House and Senate, the Legislature passed a budget that was a slight increase from the governor’s original proposal. The $8.5 billion budget spends only 88.25 percent of projected tax collections. Since 2018, Gov. Reynolds and the Legislature have placed an emphasis on passing tax reforms and restraining the growth of spending. This approach has left more money in taxpayers’ pockets with a substantial tax relief package headed toward a low flat tax by 2026. What too many people overlook is that significant tax cuts like Iowa’s are only made possible by years of prudent and conservative budgeting. Without spending restraint, any tax relief, regardless of the tax, becomes impossible. The evidence is clear that prudent budgeting is paying off for Iowans. Iowa’s budget continues to be in surplus. The surplus for fiscal year 2023 is projected to be $1.7 billion and the current estimated surplus for fiscal year 2024 is projected to be $2 billion. In addition, Iowa’s reserve accounts (Cash Reserve Fund and the Economic Emergency Fund) will continue to be funded at their statutory limits with a combined balance of over $961 million. The Taxpayer Relief Fund will also continue to increase. The balance in the Taxpayer Relief Fund for fiscal year 2023 is $2.7 billion and this is estimated to increase to $3.5 billion in fiscal year 2024. Both Gov. Reynolds and legislative leaders have signaled that further income tax reform will be a priority for the 2024 legislative session. The Taxpayer Relief Fund, which was originally created for the purpose of income tax relief, will be instrumental in further income tax rate reductions. Iowa Senate Republicans introduced an income tax reform proposal this past session that if enacted would have sped up the income tax rate cuts and used the Taxpayer Relief Fund to phase-out the income tax altogether. In addition to restraining spending, Gov. Reynolds also made some important reforms that will impact future state spending. One of her major priorities was to reform state government. Gov. Reynold’s state government reform measure consolidates and makes government more efficient. Currently, Iowa has 37 executive branch cabinet agencies – more than all neighboring states. The governor’s proposal will reduce the number of executive-level agencies to 16, streamlining and cutting bloated bureaucracy while saving taxpayer dollars. It is estimated that this plan will save taxpayers over $214 million over four years. This was the first major reform of Iowa’s bureaucracy in nearly 40 years. Further, Reynolds issued an executive order at the beginning of the legislative session that requires an extensive review process of Iowa’s regulatory code. Both reforming Iowa’s bureaucracy and reducing burdensome regulations are essential in the path to sustaining limited spending. In its Fiscal Policy Report Card on America’s Governors 2022, the Cato Institute ranked Gov. Reynolds as the best governor. “Governor Reynolds has been a lean budgeter and dedicated tax reformer since entering into office in 2017,” wrote Chris Edwards and Ilana Blumsack, authors of the report. This year, Gov. Reynolds and the Legislature are continuing this trend. Iowa is at the forefront of conservative budgeting that other states and the federal government should follow. Originally published at The Center Square and co-authored with John Hendrickson at Iowans for Tax Relief Foundation. TRUTH On Inflation, Housing Market, Interest Rates, & Incentives w. Dr. Chuck Beauchamp | Ep. 445/16/2023 In today's new episode of the "Let People Prosper" podcast, I'm thankful to be joined by Dr. Chuck Beauchamp for a thought-provoking discussion on new inflation numbers and the current economy. We discuss: 1) The newest inflation numbers and how the rate is impacting various markets including food, housing, and energy; 2) Interest rates' impact on the housing market and the crisis of affordability; and 3) Why the U.S. dollar's status could continue to wane and more. You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating). Chuck’s bio:

Find show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more here at my website (https://www.vanceginn.com/) or Substack newsletter (https://vanceginn.substack.com). Please subscribe to the newsletter, share it with your friends and family, and leave me a comment. The U.S. dollar will likely soon lose its status as the global reserve currency. The dollar’s global reserve dominance has declined in recent years. As a result, international trade partners are hedging new connections. This will restructure the global economic order and create challenges ahead, especially for middle-class Americans.

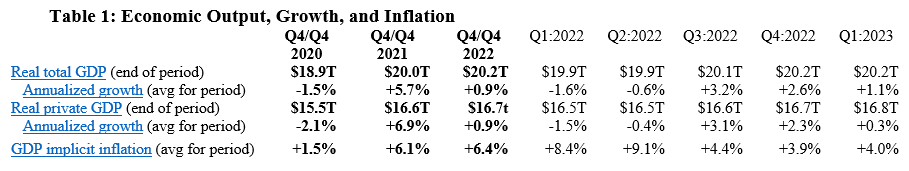

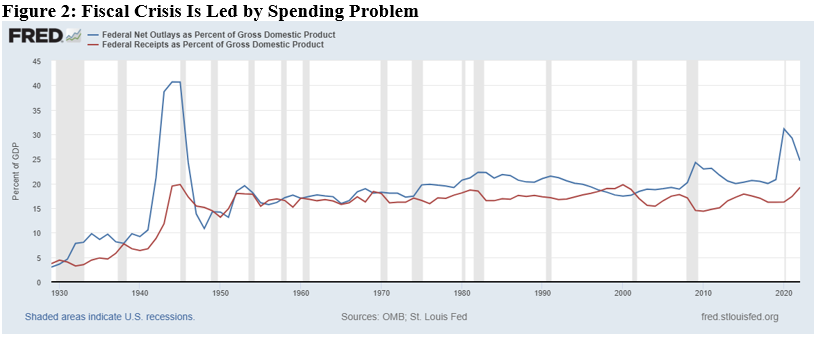

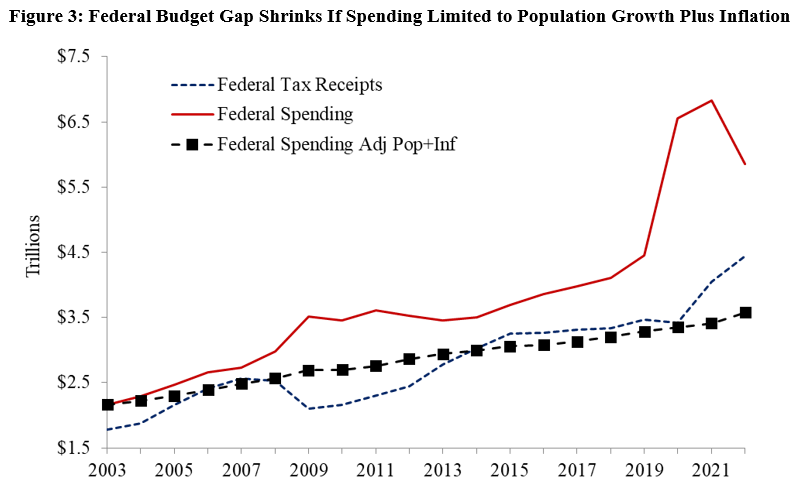

Americans should know what’s happening and how they can prepare for this possibility. But first, what does it mean to be the world’s global reserve currency, and why does it matter? The U.S. Dollar is the dominant global reserve currency. It’s widely accepted and is the preferred medium of exchange for international transactions. The dollar has enjoyed this status for the past 80 years due to its strong reputation acquired across a long history of America’s rising military prowess, fulfilling its financial obligations, and maintaining a strong economy. These institutional foundations of the dollar created high demand among foreign entities. One of the most important transactions utilizing the dollar is the purchase of oil. Oil is currently priced in dollars globally and other dollar-denominated assets. Losing or weakening the dollar’s position and value results in higher oil prices. The dollar’s elevated demand has helped keep its value high relative to other currencies. This prompted many countries to tie their currency directly to our dollar. The U.S. benefited by leveraging foreign demand for dollars into loans to the U.S. federal government. Foreign investors lend the U.S. high volumes of money because of the debt’s dollar denomination. The higher demand for U.S. Treasury securities pushes down domestic interest rates. This influences lower rates on mortgages and business loans, which help provide increased investment and economic growth. Losing or weakening the dollar’s reserve position will result in increased interest rates, decreased investment, and weak to negative economic growth. The dollar’s reserve status has also meant an increased volume of international trade. Ultimately, international trade helps keep interest rates and inflation moderately low. Losing or weakening the dollar’s reserve position will result in increased inflation. Trouble for the dollar is on the horizon. The once-givens about the dollar have come into question recently due prominently to excessive deficit spending. Foreign investors are reducing their demand for dollars as they diversify their portfolios. This combination contributed to the ballooning of the debt, depreciated the dollar, led to higher inflation and falling year-over-year real average weekly earnings for 25 straight months, and drove up interest rates, thereby slowing economic activity. Of course, this will have tradeoffs and many of them won’t be good. As mentioned, the major tradeoffs will be higher inflation and interest rates. The latter will trigger a move by the Federal Reserve to attempt to lower interest rates. But if its target rate is held below what markets dictate, the Fed will monetize the debt, increase the money supply, and drive inflation higher. The long-term result will be even higher interest rates to tame inflation. Unfortunately, the consequences of higher interest rates and inflation would be severe. People should expect higher mortgage rates than the already rising average rate of 6.4%. This is the highest in 15 years. Ultimately, higher interest rates would result in a steeper contraction in the housing market, exacerbate economic weakness, increase job losses, and worsen poverty. But maybe more importantly, it would likely crush middle-class Americans and the lifestyle that they’ve been accustomed to having for decades. The higher cost of shelter, food, gasoline, and energy as the dollar loses its reserve currency status would wreck havoc on their budgets and force major decisions about what’s best for their families. This could mean having to put off saving for college, going on vacations, and living in much smaller homes. All because our government couldn’t spend our money wisely. Therefore, the government should take serious steps to restore confidence in the dollar before a bad situation for Americans becomes worse or irreconcilable. To start, the federal government should reduce deficit spending. The long-term goal should be a balanced budget and an eventual start to paying down the debt. This will be pro-growth as the government stops redistributing taxpayer money from productive to unproductive activities. It will also strengthen the fiscal and economic situation of the U.S. The result will be an improvement in foreigners’ outlook on the dollar that would help preserve the dollar’s status. Dollar-focused policies should be tied to reducing the money in circulation. This should occur as the Federal Reserve reduces its balance sheet. Doing so tames inflationary pressures and could even result in some disinflation. This would allow the hard-earned dollars of Americans to go further than they do today. These policy improvements should be put into law with fiscal and monetary policy rules. The rules should remove the discretion of big-government spenders and printers. This would enable people’s livelihoods to get back on track and improve for generations. The potential loss of the dollar’s reserve currency status could have significant economic consequences, and there are even more than highlighted here. There is, however, reason for optimism: The U.S. economy is resilient and adapts well to challenges. But will those in D.C. allow for that to happen in the dynamic marketplace? Time will tell. But let’s hope so before it’s too late for middle-class Americans and everyone else to have the opportunity to fulfill their hopes and dreams. Originally published at The Daily Caller with Chuck Beauchamp, Ph.D. Key Point: The best way to let people prosper is free-market capitalism. Unfortunately, government has created a situation where inflation-adjusted average weekly earnings are down year-over-year for 25 straight months and economic growth is anemic. Overview: Government failures drove the “shutdown recession” and stagflationary period over the last three years that has plagued Americans, with more banking problems to come. This is fueled by the debt ceiling fight and elevated inflation that has also rocked the U.S. dollar. The answer are pro-growth policies of less spending by Congress, less regulation by the Biden administration, and less money printing by the Fed. Labor Market: The Bureau of Labor Statistic recently released its U.S. jobs report for April 2023, which was another mixed report with some strengths but many weaknesses. The establishment survey is the most reported shows there were +253,000 (+2.6%) net nonfarm jobs added in April to 155.7 million employees, which has increased by +4.0 million over the last year but just +3.3 million since February 2020. However, there were cumulative revisions in the prior two months of 149,000, so on net for that reduced the net increase to just +104,000 jobs indicating a weakening labor market. Over the last month, there were +230,000 jobs (+2.7%) added in the private sector and +23,000 jobs (+2.1%) added in the government sector. Most of the private sector jobs were added in the sectors of private education and health services (+77,000), professional and business services (+43,000), and leisure and hospitality (+31,000), which these three also led over the last 12 months. But wholesale trade lost -2,200 jobs last month while no industry had job losses over the last year. The household survey increased by +139,000 jobs to 161.0 million employed in April. There have been declines in net employment in four of the last 13 months for a total increase of +3 million since April 2022 and +2.3 million since February 2020, which both are 1 million below the jobs reported in the establishment survey. This could be because of reporting issues or the number of jobs each person has in the market. The official U3 unemployment rate ticked down to 3.4% and the broader U6 underutilization rate fell to 6.6%, which both are near or at historic lows. Since February 2020, the prime-age (25-54 years old) employment-population ratio is up by 0.3pp to 80.8%, prime-age labor force participation rate was 0.3-percentage point higher at 83.3%, and the total labor-force participation rate was 0.7-percentage-point lower at 62.6% with millions of people out of the labor force holding the U3 rate artificially low. Given some improvements, challenges remain for Americans as inflation-adjusted average weekly earnings were down (-1.1%) over the last year for the 25th straight month. Economic Growth: The U.S. Bureau of Economic Analysis’ recently released the 1st estimate for economic output for Q1:2023. Table 1 provides data over time for real total gross domestic product (GDP), measured in chained 2012 dollars, and real private GDP, which excludes government consumption expenditures and gross investment. Most of the estimates for Q4:2022 and growth in 2022 have been revised lower, providing more evidence that 2022 was a very weak economy if not a recession. Economic activity has had booms and busts since the government-imposed COVID-related restrictions in response to the pandemic and poor fiscal and monetary policies that severely hurt people’s ability to exchange and work. In 2022, the first two quarters had declines in real total (and private) GDP, providing a reason to date recessions every time since at least 1950. While the second half of 2022 looked better, those two quarters were influenced by net exports and inventories that would have made the economy much weaker. For 2022, real total GDP growth is reported +2.1% year-over-year but measured by Q4-over-Q4 the growth rate was only +0.9%, which was the slowest Q4-over-Q4 growth during a recover on record. Then the anemic growth of just +1.1% in Q1:2023 provides more reason that this is an extended recession or at least stagflation. The Atlanta Fed’s early GDPNow projection on May 8, 2023 for real total GDP growth in Q2:2023 was +2.7% based on the latest data available, but this rate has been lowered in recent quarters. Considering the last expansion from June 2009 to February 2020, there was slower real private GDP growth in the latter part of that period due to higher deficit-spending, contributing to crowding-out of the productive private sector. Congress’ excessive spending since February 2020 led to a massive increase in the national debt by nearly +$7.6 trillion that would have led to higher market interest rates. This is yet another example of how there is always an excessive government spending problem as noted in Figure 2 with federal spending and tax receipts as a share of GDP no matter if there are higher or lower tax rates. But the Fed monetized much of the new debt to keep interest rates artificially lower thereby creating higher inflation as there has been too much money chasing too few goods and services as production has been overregulated and overtaxed and workers have been given too many handouts. The Fed’s balance sheet exploded from about $4 trillion, when it was already bloated after the Great Recession, to nearly $9 trillion and is down only about 5.2% to $8.5 trillion since the record high in April 2022 after rising nearly $400 billion in March 2023 then down $200 billion since then. The Fed will need to cut its balance sheet (total assets over time) more aggressively if it is to stop manipulating markets (see this for types of assets on its balance sheet) and persistently tame inflation, as we may need deflation which hasn’t happened since 2009 given the rampant inflation over the last two years. The current annual inflation rate of the consumer price index (CPI) has been cooling since a peak of +9.1% in June 2022 but remains elevated at +4.9% in April 2023, which remains the highest since 2008 as do other key measures of inflation. After adjusting total earnings in the private sector for CPI inflation, real total earnings are up by only +2.6% since February 2020 as the shutdown recession took a huge hit on total earnings and then higher inflation hindered increased purchasing power. Just as inflation is always and everywhere a monetary phenomenon, deficits and taxes are always and everywhere a spending problem. David Boaz at Cato Institute notes how this problem is from both Republicans and Democrats. In order to get control of this fiscal crisis which is contributing to a monetary crisis, the U.S. needs a fiscal rule like the Responsible American Budget (RAB) with a maximum spending limit based on the rate of population growth plus inflation. If Congress had followed this approach from 2003 to 2022, the figure below shows tax receipts, spending, and spending adjusted for only population growth plus chained-CPI inflation. Instead of an (updated) $19.0 trillion national debt increase, there could have been only a $500 billion debt increase for a $18.5 trillion swing in a positive direction that would have substantially reduced the cost of this debt to Americans. The Republican Study Committee recently noted the strength of this type of fiscal rule in its FY 2023 “Blueprint to Save America.” And to top this off, the Federal Reserve should follow a monetary rule so that the costly discretion stops creating booms and busts. Bottom Line: Stagflation will continue with the a deeper recession this year given the “zombie economy” and the unraveling of the banking sector which will hit main street hard. Instead of passing massive spending bills, the path forward should include pro-growth policies that shrink government rather than big-government, progressive policies. It’s time for limited government with sound fiscal and monetary policy that provides more opportunities for people to work and have more paths out of poverty. There is some optimism with the House Republicans debt ceiling bill package, but it’s got an uphill battle to become law with Democrats in the Senate and White House so more must be done.

Recommendations:

This Week's Economy Ep. 8 | TRUTH On Inflation, U.S. Dollar, Debt Ceiling, Texas & Louisiana Policy5/12/2023 Thank you for checking out the 8th episode of "This Week's Economy,” where I briefly share insights every Friday on key economic and policy news across the country. Subscribe to receive new posts and support my work. Today I cover:

1) National: Breaking down the latest report on CPI inflation and how it relates to real average weekly earnings, what’s going on with the debt ceiling debate, and why the Fed should continue to raise its interest rate target and cut its balance sheet; 2) States: ALEC's newest "Rich States, Poor States" report findings related to where Texas stands in comparison with Utah and Florida, what the legislatures are doing late in the sessions of Texas (here), Louisiana (LA jobs report and tax relief), and elsewhere; and 3) Other: New findings on the importance of work-life balance, the value of the U.S. dollar, and more. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating!). For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, continue to check out my website (https://www.vanceginn.com/) and please subscribe to my Substack newsletter (https://vanceginn.substack.com). In Texas, widely viewed as one of the reddest states in the nation, conservatives are working hard to get a large property tax relief package, an education savings account (ESA) program, and other landmark reforms to Governor Greg Abbott’s (R) desk before the state legislature adjourns its 88th regular session on May 30.

Governor Abbott has made school choice a top priority this year, barnstorming the state for months and speaking at numerous events in favor of providing Texas families with school choice, something that parents and children have in a growing number of states. Since the beginning of 2021, legislatures in ten states have enacted or expanded ESA programs. When Governor Ron DeSantis (R) signed legislation in March to provide universal access to ESAs in Florida, it was the fourth state to enact legislation in 2023 making ESAs available to children. Recent polling continues to show strong public support for ESAs in Texas. Anew University of Texas-Austin Texas Politics Project poll, like many previous polls, found strong bipartisan backing for ESAs among Texas voters. That poll, which was conducted in April, found 60% of Texas voters overall support the creation of an ESA program, including 75% of Republicans surveyed and 46% of Democrats. The UT-Austin poll also found majorities of black (64%) and hispanic (56%) voters support the enactment of an ESA program in Texas. Since Lt. Governor Dan Patrick (R) passed an ESA bill, Senate Bill 8, out of the Texas Senate on April 6, those pushing for school choice in Texas have been focused on the House. Legislators know they likely face a special session this summer if significant property tax relief and a bill that expands school choice in a meaningful way is not enacted before the regular session ends. Bills Conservatives Want To Fail While school choice is one of the top reforms that conservatives would like to see Texas lawmakers send to Governor Abbott this month, there are other pending bills that many conservatives and free market oriented legislators would like to see voted down or allowed to die. One such proposal that is viewed as a legislative threat by conservatives is House Bill 4602/Senate Bill 1498, legislation that would raise taxes on Texans who lend their personal vehicle out through a car sharing platform. Such platforms are relatively new, but they’ve proven popular because they expand consumer options while providing people with a new source of income. These platforms have been described by some as “AirBnB, but for personal vehicles instead of personal homes.” HB 4602/SB 1498 is part of a multi-state campaign by rental car company lobbyists who are seeking to impose higher taxes on a competitor. Rental car company representatives claim that they are at a disadvantage since they must collect and remit rental car excises taxes, while car sharing hosts do not. Yet car sharing platforms, car sharing hosts, and other opponents of HB 4602/SB 1498 point out that the playing field is already uneven, with rental car companies currently possessing their own tax advantage relative to car sharing platforms. That’s because rental car companies do not pay sales tax on the vehicles that they rent out, whereas Texans who rent out their cars through an online platform have paid sales tax on their vehicle. Critics of HB 4602/SB 1498 contend that it would further exacerbate an unlevel tax framework in favor of rental car companies at the expense of Texans. Unlike rental car companies, Texans who earn income through peer-to-peer car sharing services pay a motor vehicle sales tax. Rental car companies, meanwhile, collect gross rental receipts tax from their customers instead of paying the motor vehicle sales tax. HB 4602/SB 1498 would force Texans to remit three taxes (the motor vehicle sales tax, gross rental receipts tax, and a local stadium tax). Rental car companies, meanwhile, only have to remit two of those taxes. Opponents of HB 4602/SB 1498 point out that the majority of peer-to-peer car sharing customers (or guests) in the state are Texas residents in need of a vehicle for in-state trips. Texas residents who would be adversely affected by HB 4602/SB 1498 already help pay for local stadiums through property taxes and general sales tax payments. Rental car company lobbyists insist they’re seeking tax parity with car sharing platforms, but critics view this proposal as bad policy that would further tilt the playing field in favor of rental car companies to the detriment of many Texans. Another bill still pending in Austin that conservatives would like to see go down this month is House Bill 3395, legislation that would prohibit credit card interchange fees from applying to the tax portion of a transaction. In April, a coalition of conservative organizations sent a joint letter to Texas legislators urging opposition to HB 3395, stating that if this bill is enacted, state government “would be interfering in the free market in an attempt to control who bears the burden of collecting and remitting sales tax – risking higher costs for Texans in a time of out-of-control inflation.” “Like every government attempt to control the market, there will be unintended consequences,” the April joint letter added. “By drastically increasing the amount of transactions processed, forcing processors to create new systems, software, and even new equipment, costs for small businesses and consumers in Texas would rise.” California-Style Committee Proposed In TexasWhile heavy handed regulations like plastic bag bans and taxes are typically associated with blue states like California, they can still pop up in red states. Take House Bill 3210, legislation now pending in the Texas House of Representatives that aims to “address the proliferation of carryout bags” and “reduce a source of litter on the landscape.” HB 3210 seeks to accomplish this mission through the creation of a new committee that will “develop and implement a statewide litter program to comprehensively address litter prevention and reduction.” The committee created by HB 3210 will also “evaluate existing state laws, and any administrative rules related to those laws, that address litter.” Concerns that the committee created by HB 3210 could have negative unintended consequences were voiced at the April 20 hearing on the bill. “This committee, as proposed, should be given the ability to assist recyclers collect and process the targeted items in a cost effective manner,” said Bryan Wallace, an Alvin resident, in testimony presented to the April committee hearing on HB 3210. “However,” Wallace added, “If the goal of this committee becomes that of an enforcement agency with a punitive culture toward businesses, then I would be very opposed to using public funds to build such an organization.” The Manhattan Institute’s Brian Riedl has written about how “leading progressive bills make utopian promises of huge new benefits and then assign a commission or agency to figure out how to make it all work.” Enactment of HB 3210 would have Texas taking a similar approach. In addition to these bills that Texas conservatives would like to see defeated, there are many who believe that Republicans in both the state House and Senate are proposing to spend too much. One of those is Vance Ginn, Ph.D., an economist who has worked on public policy in Texas for a decade where he helped create the Conservative Texas Budget approach and is now a senior fellow at Americans for Tax Reform. Ginn says the current spending levels that have been proposed by both the House and Senate are too high. “The Senate and House passed two-year budgets that substantially increase from what was appropriated last session to totals of more than $300 billion,” says Ginn. “These irresponsible budgets spend too much and provide too little in new property tax relief.” “The amount of new property tax relief should be about $20 billion to be the ‘record relief’ desired by state leadership to account for inflation since the $14.2 billion in property tax relief in 2008-09,” Ginn adds. “Texas must remain competitive and not sit back on its laurels as other states are passing responsible budgets, providing substantial tax relief, and creating universal ESAs. But time is running out quickly.” While Texas conservatives are playing offense in trying to enact property tax relief and expand school choice, it’s clear they still see many legislative threats looming in the final weeks of session in Austin. If House and Senate leaders are unable to get top priorities to Governor Abbott’s desk this month, however, there is a good chance they’ll have to return to Austin this summer to address unfinished business in a special session. Originally posted at Forbes. On today's episode of the "Let People Prosper" show, I'm thankful to be joined by Dr. Larry White, Professor of Theory and History of Banking and Money at George Mason University and author of the new book "Better Money: Gold, Fiat, or Bitcoin?" We discuss:

You can watch this interview on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor (please share, subscribe, like, and leave a 5-star rating). Dr. White’s bio:

For show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more, check out my personal website and subscribe to my Substack newsletter where you can get every episode in your inbox. House Republicans have proposed a bill that would increase the debt ceiling but cut government spending. Biden has refused to negotiate the terms of the bill because of these cuts. Now U.S. Treasury Secretary Janet Yellen says the 14th Amendment could be invoked to declare the debt ceiling unconstitutional. This would enable the United States to avoid default but would lead to what Yellen calls a “constitutional crisis.” NTD spoke with Vance Ginn, senior fellow at Americans for Tax Reform, to learn more about the issue.

Watch interview with NTD News here. Our new jobs report highlights Louisiana’s economic situation based on the most recent data. The report is based on several key factors that indicate how the economy, labor market, and public policy influence the lives of everyday Louisianans. While some of these data indicate a relatively strong labor market–such as the historically low unemployment rate–there are underlying factors showing Louisiana’s economic struggle. Louisiana’s comeback story will happen through reforms that remove government barriers, bring jobs and opportunity back to Louisiana, and let people prosper. We must decide: Will we continue to hold on to the status quo (which hasn’t done us any favors), or will we embrace the significant reforms necessary to bring jobs and opportunity to Louisiana? We need the latter. Read the full two-pager originally posted by Pelican Institute. In our system of federalism, competition matters among the states. This reality has been on full display the past few years as people fled big-government states like California and New York to more limited government states like Texas and Florida. But what works best?

The American Legislative Exchange Council’s (ALEC) “Rich States, Poor States” report is a recent comparison of states. Utah, a politically red state, ranks second best in economic performance and first in economic outlook for 2023. Texas, the largest red state, ranks seventh in performance and 13th in outlook. On the surface, this looks pretty straightforward, but a closer look shows that Texas is a leader but needs much improvement. The report measures performance based on the growth of state gross domestic product, absolute domestic migration, and non-farm payroll from 2011 to 2021. The economic outlook is based on 15 state policy variables, including tax burden, debt and other factors. Utah beats Texas for state GDP and nonfarm payroll growth rates, while Texas wins for absolute domestic migration. This is thanks to people leaving states like California and New York, which rank 45th and 50th, respectively, in outlook, and coming to Texas in search of more economic freedom. Should Utah be a model for Texas? Not necessarily. Note that Utah’s population is about 3.4 million. Texas has more than 30 million people or nearly nine times more people than Utah. Utah is also less diverse, with 77.2% of its population being white, 14.8% Hispanic, and 1.5% black, compared with Texas’ population being 40.3% white, 40.2% Hispanic, and 13.2% Black. Texas also has twice the share of foreign-born residents, with 17.0%, whereas Utah has just 8.5%. Utah has a much lower poverty rate at 8.6% compared with 14.2% in Texas. Clearly, there are significant differences between these two red states. And what works well in Utah likely may not fit well in Texas, given their substantially different demographics and economies. While the ALEC report is insightful, a cursory glance at the two ranks is just that. Considering all the metrics it provides along with state population and diversity, there’s a more holistic picture of which states are thriving. A more reasonable comparison for Texas based on economic and population sizes and diversity is the second largest red state of Florida. Florida has a population of about 22 million, with 52.7% white, 26.8% Hispanic, and 17.0% Black, while 21.0% is foreign-born, and the poverty rate is 13.1%. According to ALEC’s report, Florida ranks first for performance, better than Utah and Texas, and 9th for outlook, better than Texas. Texas and Florida boast business-friendly policy climates, typically spend responsibly, have no state income tax, and are right-to-work states. And the performances of their economies are robust based on multiple indicators. But two of the biggest factors that put Florida above Texas are the same ones that help put Utah above Texas now and for the foreseeable future: lower property tax burden and universal school choice. According to the Tax Foundation, individuals have the 6th highest property tax burden in Texas, 26th in Florida, and 43rd in Utah. Texas’ outrageous property taxes, which are high in large part due to too much local spending, is causing an affordability crisis as home and property values have risen faster than wages for too long. If businesses perceive the cost of doing business as too high due to high property taxes, they may choose to locate elsewhere, which results in less investment, economic growth, and job creation. This is why Texas should spend responsibly and use the at least $33 billion surplus to compress the school district maintenance and operations property taxes that are essentially controlled by the state’s school finance formulas. Combine this with spending restraint at the state and local levels and Texas could put property taxes on a path to elimination within a decade so that Texans can finally fulfill their right to own property while ending a bad wealth tax. Finally, when it comes to school choice, Utah and Florida joined the universal school choice revolution this year, while Texas is still fighting for it. Universal school choice is critical for improved state economies as it’s linked to improved student outcomes and increased teacher pay, both essential to becoming more competitive and producing a population with less criminal activity and higher economic earnings, to name just a few benefits. In short, competition matters! While it’s misleading to declare that Utah or Florida economically outperform Texas overall based on the differences outlined here, they do put pressure on Texas to improve or risk falling behind. Decreased property taxes and universal school choice mean more freedom, which empowers people to prosper. Time is running out this session so the Texas Legislature must act promptly. Originally published at The Center Square. If a state doesn’t provide tax relief, then it falls behind those that do. That’s simple competitiveness as taxes have consequences and influence families and employers’ decisions to move where they pay less in taxes. While true, it’s more pertinent now than ever given the extent of tax relief happening across the states during the flat tax revolution.

Patrick Gleason, vice president of state affairs at Americans for Tax Reform, recently said at a press conference, “We’ve gone from nine to 14 states with flat taxes. When you look at the states with a flat tax of zero — no income tax — or a flat tax above zero, we’re now at almost half the country that either has a zero income tax or a flat tax rate. This is really significant progress in just a few years.” Louisiana ranks 25th in the country for its individual income taxes according to the Tax Foundation’s state business tax climate. It’s time for Louisiana to join the flat tax revolution or lose more people and businesses to other states. This is a pressing concern today as nearby states of Texas, Tennessee, and Florida have no personal income taxes and are leading the way in providing opportunities for people to flourish. Income taxes reduce the incentive to work, save, and invest as each dollar of income is taken from checks before workers receive it. Progressive income taxes, like that in Louisiana with higher tax rates as incomes increase, disincentivize work and productivity even more as you lose more of your earned income as you earn more. Clearly, progressive income taxes or just income taxes in general aren’t helpful to a family, business, or an economy and should ultimately be flattened then eliminated. These tax reforms must be accompanied with spending restraint to avoid running budget deficits, which are prohibited with the balanced budget requirement in the state, so the legislature may choose to cut spending or raise taxes. Economic data comparisons show that the nine states without personal income taxes outperform, on average, the nine states with flat income taxes in economic growth, domestic migration, and non-farm payroll employment over the last decade. This is also true when comparing Louisiana with no income tax states, Texas and Florida, and the highest income taxes, California and New York. There’s a once-in-a-generation opportunity this legislative session in Louisiana for lawmakers to increase the competitiveness of the state and fulfill the promise to taxpayers made in 2021 that they will provide tax relief when there’s enough revenue. There’s plenty of money available now. Lawmakers should pass a Responsible Louisiana Budget that limits state appropriations to less than the rate of population growth plus inflation, pay down debt, and put extra money in the rainy day fund to hit the trigger for individual income and corporate franchise tax cuts. This would result in sizable tax cuts that Louisianans would feel in their daily lives through more money in their pocket, more jobs available, and more paths out of poverty. There’s good progress in this direction so far this session but as the session is winding down there will need to be a focus on these priorities, especially hitting the revenue trigger for tax relief. If not, Louisiana will continue to fall behind nearby states which will mean more people and employers will move elsewhere. This is unacceptable and must be changed now to turn the tide of less opportunity and flourishing in the Pelican State. Originally posted at Pelican Institute. Re: “Protecting kids on social media — Texas House’s proposed age limit is a step forward,” Thursday editorial.

While some connect social media use with teen depression and suicides, evidence is unclear. The Economist noted, “If social media were the sole or main cause of rising levels of suicide or self-harm — rather than just one part of a complex problem — country-level data would probably show signs of their effect.” They don’t. Underlying causes of depression and suicide are often much deeper for teens, best addressed by parents, yet some want to give it to government bureaucrats. The latest attempt is Texas House Bill 18, supported by your editorial board. The bill would essentially ban teens from social media and force all to register online. It excludes YouTube by picking it as a winner with an educational provision. Though well-intended, the bill would have many costly unintended consequences. Teens could lose benefits from connecting with family and friends and learning new things, have less information in a growing digital world and possibly choose less-desired activities. Everyone registering for digital services reduces privacy and security. Texas should empower parents to decide for their kids — many of us may choose to keep our kids offline — not government bureaucrats. Vance Ginn, Round Rock Originally published at the Dallas Morning News. This Week's Economy Ep. 7 | New Jobs Report NOT What It Seems, TRUTH on Fed’s Rate Hike & More5/5/2023 Thank you for listening to the 7th episode of "This Week's Economy,” where I briefly share my insights every Friday morning on key economic and policy news at the U.S. and state levels. Today, I cover: 1) National: Breaking down today's new U.S. Jobs Report and what the findings actually reflect about the current economy, plus my thoughts on real weekly average earnings and the Fed’s hike in its federal funds rate target; 2) States: Texas and Louisiana employment reports, fact and fiction, and Texas House passes corporate welfare bill in HB 5, and; 3) Other: Bills circulating on restricting social media, the value of the U.S. dollar under threat, and more. Please share this episode on social media, like, and subscribe if you enjoyed it! Find show notes, thoughtful economic insights, media interviews, speeches, blog posts, research, and more at my website (https://www.vanceginn.com/) or Substack newsletter (https://vanceginn.substack.com/). The mental health of preteens and teenagers across America has been a growing concern as suicide remains the third highest cause of their deaths. The causes of suicide are largely unknown and complex.