Will the Federal Government SHUT DOWN? + Student Loan Payments & TX School Choice | TWE 289/29/2023 Today, I cover:

1) National: Whether or not the U.S. federal government will shut down, will student loan payments start soon, and how legal immigrants are helping combat the U.S. labor shortage;

2) States: North Carolina adopts Universal School Choice, why Texas should do the same along with addressing property taxes, and why Louisiana desperately needs tax reform; and 3) Other: My latest podcast episode with Taylor Barkley discussing abundance and digital parenting laws, and a sneak peek of next Monday's episode with Naomi Lopez on health care policy. You can watch this TWE episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple, Spotify, Google, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment.

0 Comments

This commentary was originally published at The Center Square here.

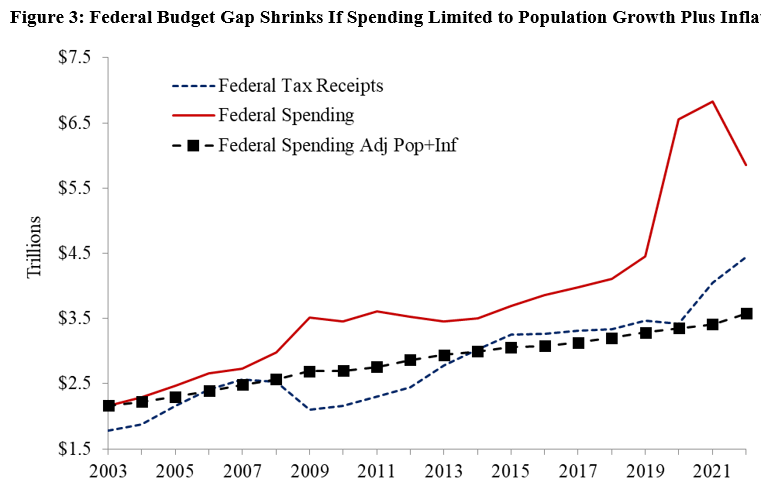

If you live in Texas, then your property taxes are skyrocketing. This has made housing less affordable, especially for the neediest among us. The Texas Legislature passed what some are calling the “largest property tax cut in Texas history,” but it’s the second largest. Regardless, the amount of lower tax bills will likely be underwhelming and leave voters with a bad taste in their mouths come election time next November. There have been some bright spots, but they’re dimming quickly. Dallas was one place that showed promise. Its city council passed the largest budget in city history, going against Mayor Eric Johnson’s (a Democrat who recently stated he will switch to be a Republican) wishes. He aptly voiced what most Texans are thinking in Dallas and beyond about the perils of big budget increases: “In an environment of such economic uncertainty for our residents and businesses, with inflation and interest rates being where they are, I simply could not vote for a budget that is the largest in the history of the city and that is paid for by raising taxes on our residents and businesses.” This increase will completely override the city passing a one-cent tax rate decrease, making people’s property bills 8 percent higher due to rising property values. Dallas is exhibiting on a smaller scale what occurred at the state level a few months ago. Despite the Texas Legislature passing the state’s second-largest property tax cut of $12.7 billion to reduce school district maintenance and operations (M&O) property taxes earlier this year, half of the property tax burden is imposed by other local governments. Because many localities, like in Dallas, are poised to raise property taxes, there are very few places where taxpayers will see a lower property tax bill despite the statewide tax cut. Or, like in Dallas, many local governments pursuing “cuts” will render it irrelevant with excessive spending. Certainly not what should be expected from such a large state tax relief package. And this is likely to hurt Republicans in the next election as they (wrongly) sell this as the “largest property tax cut in Texas history.” Mayor Johnson has it right that reining in spending is crucial to providing tax relief. When spending outpaces a responsible budget, and Dallas’ has for decades, higher taxes and less economic growth have resulted. This is why the biggest governmental burden is always spending, not taxes. Excessive government spending by primarily blue localities in a sea of red helps explain why Texas has some of the most burdensome property taxes nationwide. But Texas is also running up massive debts for even more spending to get around the requirement to pass a balanced budget. The Lone Star state’s total outstanding local government debt is $280 billion, making its local debt per person third most among the top 10 largest states. Regarding local debt, Texas looks much more like New York and California (largest debts per capita) than its southern counterparts, like Florida, where the debt per person is about half of that in Texas. To get spending, and therefore taxes, under control, Texas needs to adopt a responsible budget at the state and local levels. This responsible budget provides a limit that does not exceed what the average taxpayer can afford to fund, restricting the budget to the maximum rate of population growth plus inflation. Ideally, spending should always be below this fiscal rule, but even meeting that cap could save taxpayers billions of dollars. For instance, had Dallas followed this responsible budget model yearly since 2013, the city would have saved $3.4 billion by 2022. This results in substantially higher property taxes in these localities, with similar results in other localities across the state than otherwise. Implementing this budget rule would also result in substantial surpluses because tax revenues generated from sales taxes, fines, and fees typically increase faster than this rule. Through these surpluses, property taxes could be reduced until they are zero. Cities that do this would create so much competition that other cities would be compelled to use their other current revenue sources to reduce their property taxes, leading to the state having much more competitive property taxes overall. With the most competitive rate being zero. That’s one step. The second step to take Texas to the top is to do the same at the state level. The state legislature recently took two steps back and one step forward by passing its largest budget increase in the state’s history in tandem with its hefty property tax cut. But if they stick to the same fiscal rule or, even better, a “Frozen Budget,” they can use surplus funds generated to buy down school district M&O property tax rates each period until they’re eliminated. This process would also take about a decade for the state to fund 100% of the state’s school finance formulas as intended by the Texas Constitution. While Texas boasts many freedoms, including no personal income tax and a business-friendly climate, its burdensome spending and property taxes reduce opportunities for people to flourish. Immediate fiscal restraint at the state and local levels is required for the Lone Star State to continue thriving by seeking to eliminate property taxes. Texans deserve to stop renting from the government and start owning property. Limiting spending is the catalyst to take us there. And localities passing the no-new-revenue rate that would cover all property taxes collected would be a great path eventually eliminating property taxes to better let people prosper. In 2023, Americans for Tax Reform launched The Sustainable Budget Project, a new venture that monitors state government spending and tracks which states have or have not enacted sustainable budgets.

The Sustainable Budget Project defines a sustainable budget as one that limits the pace of state government spending to lower than the rate of population growth plus inflation, which accounts for the average taxpayer’s ability to pay for government spending.

From 2013 to 2022, the following happened:

There four states that held growth in state funds and all funds below the rate of population growth plus inflation over the last decade, thereby keeping taxes lower than the average taxpayer can afford:

Go to ATR's Sustainable Budget Project to find out the following information:

Originally posted at Americans for Tax Reform. Click below to watch the episode and read on for show notes:

Taylor and I discuss: 1) The critical roles of accessible energy and technology for abundant living among Americans; 2) How Americans feel about “big tech” companies and AI according to recent polls anTaylor’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (www.vanceginn.com) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. This commentary was originally published at EconLib here.

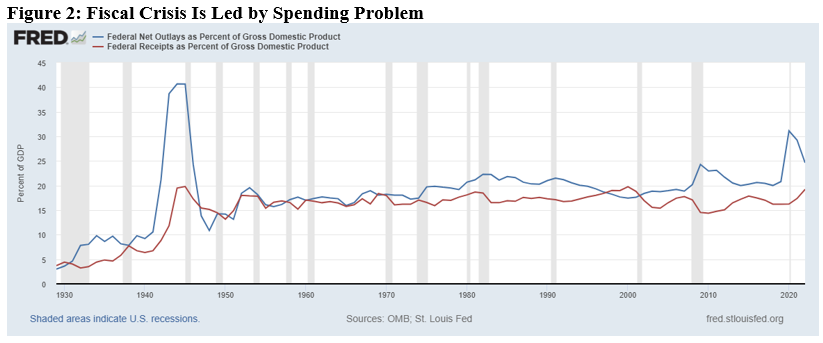

Americans say the economy is the most important problem facing the country. But major headlines covering the latest jobs report for August do their best to downplay this concern. The New York Times’ headline covering the news was, “August Jobs Report: U.S. Jobs Growth Forges On,” but the economic reality is far less cheerful. Sure, the jobs report beat the consensus estimate by economists. But that high-level look at the data fails to address underlying issues keenly felt by many Americans that are apparent with more scrutiny. And these problems won’t be over unless policies out of D.C. substantially and quickly improve. Last month, 187,000 jobs were added, according to the payroll survey, compared with the anticipated 170,000. But the jobs added in the prior two months were revised lower by a cumulative 110,000 jobs, bringing the net jobs added in August to just 77,000. This extends an ongoing trend of downward revisions over the last several months. According to the household survey, the unemployment rate, a weak indicator of the labor market’s strength, jumped substantially from 3.5% to 3.8%. Coupled with news of slow wage growth of just 0.2% last month, there is growing concern among Americans trying to make ends meet. We know the higher unemployment rate isn’t from too few jobs available. The number of job openings has been nearly double that of those unemployed for a long time, though decreasing quickly. Instead, the higher rate suggests a sluggish economy in which there are more unemployed or ghost job openings from companies that do not intend to hire but want to gauge interest and competition. There is some good news. The labor force increased by 736,000, which raised the participation rate to 62.8% in August. This is the highest rate since February 2020, just before the shutdowns in response to the COVID-19 pandemic. More people entering the labor force and higher participation rates appear promising. However, the increase in the labor force was a combination of 222,000 more people employed, with the other 514,000 people becoming unemployed. And diving deeper, 4.2 million more adults remain not in the labor force compared with February 2020. Many of these individuals have been unemployed for years, so obtaining employment could be difficult due to a lack of productivity signals in their resume on top of employers dealing with a stagnant economy. The rise in the unemployment rate, lackluster wage growth, and the possibility of unfilled job openings all point to a weak labor market. Add in ongoing stagflation, as too-high inflation continues, and Americans are rightly concerned about the future. Some blame the Federal Reserve for this weakness because of its fight to bring down inflation after creating it. However, Milton Friedman debunked this tradeoff between lower inflation and a higher unemployment rate decades ago. Specifically, there’s no long-run tradeoff between the two, so the Fed must focus on the single mandate of price stability instead. The Fed has been working to combat inflation by hiking its interest rate target to a multi-decade high of 5.5% and slowly reducing its bloated balance sheet. This is why you’ve seen car loan and mortgage rates soar to multi-decade highs. These higher rates significantly disrupt the new car and housing markets. But this is the resulting bust after the artificial post-pandemic “boom” as new money moves throughout the economy and manipulated interest rates create malinvestments. We felt the higher inflation rate last year from the Fed’s actions of close to 9%, and now it’s about one-third of that rate, but this remains about 50% higher than its 2% flexible average inflation target. The Fed has stated that it may raise interest rates further. And I believe that it will be forced to raise its target rate to about 6% before this hiking cycle is over. But just raising this rate won’t be enough to curb inflation for long if Congress’ deficit spending remains unchecked. This will force the Fed to monetize it to avoid putting more pressure on Congress to get their irresponsible fiscal house in order. President Biden and Democrats in Congress made this situation worse with the passage of the misnamed Inflation Reduction Act, which is likely to cost about four times the initial $300 billion estimate over a decade. Their wasteful spending, along with Republicans’ excessive spending before them, has led to a fiscal crisis, the most significant national threat. Congress will unlikely make the needed reforms to the primary drivers of the deficit of mandatory spending programs like Social Security and Medicare because of rent-seeking in politics. This will likely result in the Fed not sufficiently cutting its balance sheet to stop inflation. Rather, the Fed will probably choose to increase its balance sheet, putting more inflationary pressure on the economy when that’s the last thing it needs. A vital measure of the economy known as real gross domestic output, the real average of gross domestic product and gross domestic income, has declined in three of the last six quarters. While I don’t want there to be a hard landing, this is the situation that central planners by Congress spending and taxing too much, President Biden regulating too much, and the Fed printing too much have left us. There will be efforts by the government to correct these government failures, but we shouldn’t double down on past mistakes. Let’s learn from these failures and remember the most recent lesson in the 1980s: President Reagan cutting regulations, Congress passing tax cuts (but spending too much), and Fed Chairman Paul Volcker cutting the balance sheet. Initially, the cuts to the Fed’s balance sheet contributed to soaring double-digit interest rates, and the economy suffered a double-dip recession. However, afterward, the economy was able to heal from the prior hindrances of past presidents, congressional members, and the Fed, resulting in a long period of economic prosperity, which is often called the Great Moderation. What we have today is an economy where the government is growing, and markets aren’t as much. This must be reversed. When workers, entrepreneurs, and employers are free to engage in voluntary transactions, competition thrives, innovation flourishes, and resources are allocated efficiently. Moreover, free markets promote consumer choice and personal freedom. When government interventions, such as wasteful spending, excessive regulations, and high taxes, are removed, markets can function more efficiently and respond dynamically to changing economic conditions. Striking the right balance between constitutionally limited government functions and preserving the freedom of markets is crucial for achieving a vibrant and prosperous economy. Rising unemployment, stagnant wages, and the specter of inflation require a multifaceted approach. Raising interest rates hasn’t been enough. The government must focus on responsible fiscal and monetary policies, including reducing government spending, addressing burdensome regulations and taxes, and substantially cutting the Fed’s balance sheet. Americans are still suffering, and there is no time to waste in aggressively assessing these measures that cause economic strain so that people can get back to flourishing instead of merely “making it.” Click below to watch the episode and read on for show notes: Today, I cover:

1) National: Shocking findings from the Fraser Institute's newest "Economic Freedom of the World Report," especially as it relates to the U.S. and Hong Kong, the Fed not raising interest rates, and the average 30-year mortgage rate reaching its highest since Nov. 2000; 2) States: My new co-authored report published by the Pelican Institute highlighting how Louisiana could become "the next big thing” with tax reform and responsible budgeting, and why Colorado's Taxpayer's Bill of Rights (TABOR) is under attack; and 3) Other: My recent articles on the DOJ's antitrust lawsuit against Google and Constitution Day. You can watch this TWE episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Interview: Could The Biden Admin’s Antitrust Crusade Against Big Tech End Up Hurting Consumers?9/21/2023 President Joe Biden’s administration has targeted Big Tech with several antitrust enforcement actions that could significantly impact consumers, but while many conservatives support the efforts, others fear they may stifle innovation.

Under Biden, the Department of Justice (DOJ) is presently engaged in a lawsuit against Google, the Federal Trade Commission (FTC) took Meta to court, and there is a possibility of a forthcoming lawsuit against Amazon, all over alleged antitrust violations stemming from industry monopolies. Some conservatives say this enforcement will increase competition, but others say the increase in government intervention in business will harm consumers while also reducing innovation. “Generally, antitrust enforcement is intended to help consumers by deterring anticompetitive conduct that would lead to higher prices, lower quality service, and fewer choices for consumers,” Hudson Institute Senior Fellow and former FCC Commissioner Harold Furchtgott-Roth told the DCNF. “DOJ must explain to the judge how Google’s contracts for search engines harm consumers. Based on public information, I am not sure how DOJ makes that case.” The DOJ originally filed an antitrust lawsuit against Google under the Trump administration, in October 2020, alleging the company used unlawful practices to maintain a monopoly in the search and search advertising markets. In particular, the lawsuit alleges that Google has abused its dominant market position to force its search engine as the default on web browsers. “Google’s contracts ensure that rivals cannot match the search quality ad monetisation, especially on phones,” the DOJ alleges. “Through this feedback loop, this wheel has been turning for more than 12 years. It always turns to Google’s advantage.” Though the Biden administration did not initiate antitrust cases against Facebook and Google, since Biden took office his administration has expanded antitrust enforcement against tech companies, with the FTC under Biden appointee Lina Khan suing Microsoft over its Activision acquisition and refiling a lawsuit against Facebook. Biden has also made antitrust reform a key part of his economic platform, calling for passing “bipartisan legislation to strengthen antitrust enforcement and prevent big online platforms from giving their own products an unfair advantage” in his February State of the Union address. Some economists argue, however, that this strategy disincentivizes innovation by creating greater regulatory friction for companies looking to expand. Moreover, experts question whether large tech companies’ market positions actually hurts consumers, as many of their products, such as Facebook and Google search, are free to use and provide numerous benefits. There are also many other search engines that are available to use. “This administration has used [antitrust] to go after businesses based on subjective grounds,” Pelican Institute for Public Policy chief economist Vance Ginn told the DCNF. “The consequences … are a growing reliance on lawyers instead of expanding their businesses that people are choosing to use even with competitors in the search engine market. Doing so, the administration is making it more costly for new businesses to enter the market because of legal liability and dealing with a radical antitrust policy environment.” Google referred the DCNF to a blog post titled, “People use Google because it’s helpful,” highlighting the quality of its product and the fact that it is free of charge. (RELATED: DAVIS: Why Conservatives Must Support The DOJ Against Google). Despite these concerns, many Republicans and conservatives have joined with Biden in advocating for stronger antitrust enforcement and legislation targeting tech companies’ market dominance. Prominent GOP lawmakers including Iowa Sen. Chuck Grassley, Arkansas Sen. Tom Cotton and Colorado Rep. Ken Buck all backed legislation intended to target major tech companies. Many conservatives also argue that stricter antitrust enforcement could ameliorate the problem of online censorship. “Big Tech has had a stranglehold on the online marketplace of ideas for far too long,” founder and President of the Internet Accountability Project Mike Davis told the DCNF. “Consumers, especially those on the right, have had their opinions and voices silenced by the speech censors of Big Tech. Breaking up those behemoths will not only allow for more freedom of expression online, but it would allow a new era of discourse to flourish. Competition is important for all Americans, not just conservatives. Antitrust should be a nonpartisan issue as American as apple pie.” Jake Denton, a research associate at the Heritage Foundation’s Tech Policy Center, asserts that government intervention is necessary to prevent this. “The unchecked growth of Big Tech monopolies has gone on for too long,” Denton told the DCNF. “Silicon Valley giants like Google, Amazon, Facebook and Apple have been steadily acquiring emerging startups and growing competitors, consolidating their control over the tech sector … It is no longer tenable for regulators or our lawmakers to remain on the sidelines.” The Biden administration has recently signaled its willingness to expand its crackdown on tech companies, with the FTC charging Amazon in June for allegedly having “duped millions of consumers into unknowingly enrolling in Amazon Prime,” according to its complaint. It also claims it takes at least six clicks to cancel a Prime membership. “Consumers could lose out on popular features like Google Maps being at the top of search results, Amazon’s Prime program, or iPhones that come ready to use with basic apps out of the box,” Cato Institute Technology Policy Research Fellow Jennifer Huddleston told the DCNF. “The shift towards a ‘big is bad’ mentality could penalize companies for developing features that make them more popular than competitors or otherwise improve their product” Huddleston told the DCNF. The White House referred the DCNF to speeches and studies conducted by the administration asserting that antitrust enforcement boosts economic activity and competition. The DOJ did not respond to the Daily Caller News Foundation’s request for comment. The FTC declined to comment. Originally posted at Daily Caller. PMorgan Chase CEO Jamie Dimon says Americans would be making a “huge mistake” if they believe narratives saying the U.S. economy is booming.

NTD spoke to Vance Ginn, the president of Ginn Economic Consulting and former Chief economist at the Office of Management and Budget, on some ideas to kickstart the economy. Ginn says he agrees with Dimon’s statement, citing increasing inflationary pressures and inflation-adjusted spending being basically flat. Watch my full interview on NTD News here. Click below to watch the episode and read on for show notes: We discuss:

1) The potential comeback of COVID shutdows and mask mandates, and why that would be fruitless for communities and public health; 2) How to reform the broken U.S. safety net system with the implementation of Empowerment Accounts, and how these differ from Universal Basic Income; and 3) How high property taxes in Texas are making home ownership unattainable for many or are driving seniors out of their homes, and how Texas could reasonably reduce property taxes until they are eliminated. Be sure to check out and subscribe to the "This Week in Bitcoin" podcast. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (www.vanceginn.com) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Read the full paper here. Here's the original post by the Pelican Institute. Pelican Institute reform plan would flatten personal and corporate taxes, boost jobs in first year. Baton Rouge — As candidates for Louisiana governor debate the future of the state, a new poll shows Louisiana voters strongly support phasing out the state’s income tax while ushering in fiscal responsibility. Today, the Pelican Institute has released a new tax reform plan that would do just that—transform the state, make it more competitive, pave the way for more and better jobs, and launch Louisiana’s comeback. By a wide margin, 58% of Louisiana voters support phasing out the state income tax (only 20% oppose), and 66% want leaders to prioritize responsible budgeting and limiting the growth of state spending to bring fiscal stability to state government (only 9% oppose). Voters also strongly back education freedom; 62% support giving Louisiana parents the ability to use state funds to select the school of their choice for their child’s education (only 25% oppose). The poll, which was conducted by Cor Strategies in partnership with the Pelican Institute, can be seen here. In Louisiana’s Comeback: A Tax Reform for Our Brighter Future, the Pelican Institute identifies the state’s significant tax problems and proposes a path to set the state in a brighter direction, including flattening the personal and corporate income taxes to 3.5% rates, reducing the number of tax preferences, eliminating the corporate franchise tax and the inventory tax, and reforming the budget to limit the growth of spending, among other changes. “If we are to write Louisiana’s comeback story, we first have to get our fiscal house in order and fix our broken tax code that has, for far too long, landed Louisiana at the bottom of every good list and the top of every bad list,” said Daniel Erspamer, Chief Executive Officer of the Pelican Institute. “Louisiana families are suffering, and too many of our best and brightest are leaving the state to find opportunity elsewhere. It’s time to embrace a bold vision for tax reform proven to bring jobs and opportunity – not to mention our kids and grandkids – back to our state.” Louisiana suffers under a tax system that is brutally punishing for families and businesses. It is painfully progressive, thereby increasing tax rates as more income is earned—and that disincentivizes greater earnings, reduces productivity, and slows economic growth. Meanwhile, tax preferences create exemptions and deductions that make compliance costly, pick winners and losers, and narrow the tax base. That, in turn, requires an even higher tax rate to collect needed revenue for funding limited government. On top of that, Louisiana’s taxes on businesses are particularly burdensome, including a triple taxation on profit, investment, and inventory, that together stifle economic growth. The Pelican Institute’s tax plan solves these problems with a proposal that will kickstart the economy into immediate growth and increase the number of available jobs in the state in the first year. The plan is the latest part of the Pelican Institute’s Comeback Agenda released in March of this year, which lays out a series of policies critical to the state’s future, including tax and budget reform, guaranteeing universal education freedom, enhancing public safety, and reducing regulatory barriers to work. A two-page guide to the reform can be read below and a one-pager below that. Click below to watch the episode and read on for show notes: We discuss:

1) Why he believes an economic bust is coming based on lending activities and economic indicators, and where there's corruption in the banking industry; 2) How high home mortgage rates after low rates during the pandemic are restricting supply, and how this affects the housing market; and 3) How the U.S. can rebuild its waning creditworthiness by Congress balancing the budget and putting taxpayer dollars to better use, and his thoughts on the Teacher Retirement System of Texas. Dory’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Originally published at Freemen Newsletter.

236 years ago today, our nation's forefathers signed one of the most crucial documents in human history: the U.S. Constitution. This monumental event in 1787 marked the birth of a government built on principles aimed to secure liberty in America. But it’s hard to reflect on this momentous anniversary without noting how the principles outlined therein are not currently upheld as faithfully as they should be. Our founding fathers were visionaries who drew from the lessons of history to create a blueprint for a virtuous and prosperous society. They understood the perils of unchecked government power and sought to protect individual liberties and secure private property rights. If only the governing activity in recent decades reflected the same sobriety when it comes to not repeating historical mistakes. Instead, the departure from many of the Constitutional principles established 236 years ago has landed America in economic turmoil today. The Constitution was designed to limit the federal government's powers, intending to prevent reckless spending and unsustainable debt. In modern times, we have witnessed an alarming trend of government spending beyond its means, racking up massive deficits and debt, thereby jeopardizing our nation's economic stability. Our creditworthiness is waning, our dollar is devaluing, and Americans are pessimistic about the economy. Much of this is thanks to excessive deficit-spending in recent years under both major politicial parties that has reduced our reliability to make good on our debts. What won’t be felt by today’s Americans will be the burden of future generations. By Congress not balancing its budget and the Federal Reserve monetizing much of the debt with a bloated balance sheet, the government is expanding its scope by spending more, often on wasteful programs, contrary to the contained government our founders foresaw. Furthermore, excessive money creation by the Fed has become a troubling issue, diverting us from the pillars that made America the wealthiest and most generous country in human history. Our Constitution, inspired by principles of capitalism and private property rights, aimed to foster an environment where individuals could pursue their dreams, innovate, and create prosperity for themselves and their communities. However, the fiscal policies of Congress, the regulatory policies of the Executive Branch, and the monetary policy of the Federal Reserve have led to an unprecedented situation in recent years. While a supposed goal has been to “stimulate” economic growth, it has come at a huge cost. The excessive spending, regulations, and taxes have distorted prices, leading to asset bubbles. It has also created an environment where wages aren’t keeping pace with inflation, home ownership is a far-off dream for many, and individual debt remains high, notwithstanding the national debt. On this Constitution Day, our nation’s leaders would do well to reflect on our founding fathers' wisdom and the principles enshrined in this historic document to restore America to its intended limited government. One major step to restoring constitutional principles would be pursuing responsible fiscal policy that prioritizes the long-term financial health of our nation. This means making the difficult decisions to curb wasteful government programs and live within our means. One promising approach to addressing deficit spending is implementing a spending limit like most states have across the country. This would require Congress to pass a budget that does not exceed a maximum rate of population growth plus inflation, thereby growing government by less than the economy. This fiscal rule represents what the average taxpayer can afford to pay for spending and would be more than enough to fund limited gvoernment. We must also embrace the spirit of capitalism and protect private property rights, which the founding fathers recognized as an essential component of freedom. Addressing government spending and reducing taxes would help give people across the income spectrum more opportunities to own more things that will help them prosper. This should also be combined with a monetary rule that gets the Fed back to only stabilizing prices rather than the discretionary policies that have led to terrible outcomes. The Constitution is not a historical artifact but a testament to the enduring values and principles that can guide our nation toward a brighter future. It's time to rekindle the spirit of the Constitution for the sake of our prosperity, liberty, and people. Restoring the principles of the Constitution is not a partisan issue; it's an American imperative. It requires a commitment to fiscal responsibility, economic freedom, and individual liberty. It requires us to hold our elected officials accountable and demand that they prioritize the principles that have made America exceptional. The Biden Administration’s Justice Department took Google to a civil trial on Tuesday, beginning the department’s first major monopoly lawsuit since it took on Microsoft in 1998. What’s the allegation? Google supposedly violated U.S. antitrust laws. But it seems the main “violations” are that Google is good at what they do, consumers love their product and Microsoft is mad.

Jonathan Kantor at the Justice Department (and Lina Khan at the Federal Trade Commission) have pushed an endlessly fruitless crusade against “Big Tech.” Now, it has taken issue with Google’s methods of becoming the default browser on popular devices, which they’ve done through legal means that more savvy people might just call “marketing.” Products like iPhones and MacBooks make it easy for consumers to change their default browser to whatever they prefer. Most of them favor Google because they believe it’s a better search engine. Herein lies the real crux of the lawsuit. Antitrust laws were created to preserve competition. The original laws were rightly deemed too broad and vague, so a new guiding principle of the consumer welfare standard for enforcing these laws was implemented to consider whether consumers are better or worse off from the actions of businesses. In economics, consumer welfare is defined as the “value consumers get from a product less the price they paid.” That value varies from person to person, which is what makes free markets work. Consumers have the ability and the sovereignty to decide which product or service is best for them. To violate the consumer welfare standard would mean moving toward a monopoly. This is when a business has a large market share, or even the market share, such that they can raise prices of their goods or services regardless of quality. The outcome would reduce consumer welfare and, therefore, contribute to potential antitrust law violations. Found guilty, a business could be broken up into smaller parts, forced to sell off part of it or face penalties. In other words, it’s another hindrance to productive activities as targeted employers are forced to beef up on lawyers to deal with federal pushback instead of allocating those resources toward productive means that would help their employees and customers prosper. Despite what the DOJ claims, antitrust laws are rarely enforced to protect consumer welfare, and this case is no exception. Google is not only Americans’ preferred browser, but the company is consistently rated one of the best places to work. So, it seems most of its consumers find value in the product. If they don’t, they can use Bing, Firefox, DuckDuckGo or any other search engine that competes with Google and is readily accessible. So, if this case isn’t centered around consumer welfare or targeting monopolies, what is it really about? If the DOJ wins, which is highly unlikely, American competition and innovation will be stifled. This rent-seeking behavior may win votes with folks on the Left concerned with restricted competition and those on the right concerned about censoring on popular platforms like Google and Meta, but at what cost? Inhibiting free markets with increased regulations is far more likely to drive up prices and decrease consumer welfare than any part of “Big Tech.” This pursuit wastes taxpayers’ dollars that would be better spent elsewhere or, better yet, for the federal government to spend less so people have more money in their pockets to improve their own welfare. At a time when inflation remains too high, the labor market is cooling and Americans are suffering from a bleak economy, this lawsuit is a frustrating misuse of government resources. Moreover, government attempts like this to manipulate markets will always fail due to what economist Friedrich Hayek identified as the knowledge problem. He argued that information (knowledge) is decentralized, dispersed across society and not contained within departments of power. Central planners, in this case the DOJ (and FTC), do not have all the knowledge necessary to designate market competition, and they never will. Free market capitalism cannot be manipulated but must be allowed to work through spontaneous order. This lawsuit attacks free markets and, thereby, free people. Not monopolies or consumer welfare violations, and it’s abundantly clear that neither of those are real problems regarding Google. It’s time for the DOJ to accept defeat and focus on things that actually matter. Ganging up on Google amid all the problems Americans face today, while understanding legitimate concerns with some of Google’s actions, is out-of-touch, to say the least. Originally published at Daily Caller. Today, I cover: 1) National:

3) Other: My thoughts on the DOJ lawsuit against Google for violating antitrust laws and why I believe it's an attack on consumers and capitalism. You can watch this TWE episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Americans say the economy is the most important problem facing the country. But major headlines covering the latest jobs report for August do their best to downplay this concern. The New York Times’ headline covering the news was, “August Jobs Report: U.S. Jobs Growth Forges On,” but the economic reality is far less cheerful.

Sure, the jobs report beat the consensus estimate by economists. But that high-level look at the data fails to address underlying issues keenly felt by many Americans that are apparent with more scrutiny. And these problems won’t be over unless policies out of D.C. substantially and quickly improve. Last month, 187,000 jobs were added, according to the payroll survey, compared with the anticipated 170,000. But the jobs added in the prior two months were revised lower by a cumulative 110,000 jobs, bringing the net jobs added in August to just 77,000. This extends an ongoing trend of downward revisions over the last several months. According to the household survey, the unemployment rate, a weak indicator of the labor market’s strength, jumped substantially from 3.5% to 3.8%. Coupled with news of slow wage growth of just 0.2% last month, there is growing concern among Americans trying to make ends meet. We know the higher unemployment rate isn’t from too few jobs available. The number of job openings has been nearly double that of those unemployed for a long time, though decreasing quickly. Instead, the higher rate suggests a sluggish economy in which there are more unemployed or ghost job openings from companies that do not intend to hire but want to gauge interest and competition. There is some good news. The labor force increased by 736,000, which raised the participation rate to 62.8% in August. This is the highest rate since February 2020, just before the shutdowns in response to the COVID-19 pandemic. More people entering the labor force and higher participation rates appear promising. However, the increase in the labor force was a combination of 222,000 more people employed, with the other 514,000 people becoming unemployed. And diving deeper, 4.2 million more adults remain not in the labor force compared with February 2020. Many of these individuals have been unemployed for years, so obtaining employment could be difficult due to a lack of productivity signals in their resume on top of employers dealing with a stagnant economy. The rise in the unemployment rate, lackluster wage growth, and the possibility of unfilled job openings all point to a weak labor market. Add in ongoing stagflation, as too-high inflation continues, and Americans are rightly concerned about the future. Some blame the Federal Reserve for this weakness because of its fight to bring down inflation after creating it. However, Milton Friedman debunked this tradeoff between lower inflation and a higher unemployment rate decades ago. Specifically, there’s no long-run tradeoff between the two, so the Fed must focus on the single mandate of price stability instead. The Fed has been working to combat inflation by hiking its interest rate target to a multi-decade high of 5.5% and slowly reducing its bloated balance sheet. This is why you’ve seen car loan and mortgage rates soar to multi-decade highs. These higher rates significantly disrupt the new car and housing markets. But this is the resulting bust after the artificial post-pandemic “boom” as new money moves throughout the economy and manipulated interest rates create malinvestments. We felt the higher inflation rate last year from the Fed’s actions of close to 9%, and now it’s about one-third of that rate, but this remains about 50% higher than its 2% flexible average inflation target. The Fed has stated that it may raise interest rates further. And I believe that it will be forced to raise its target rate to about 6% before this hiking cycle is over. But just raising this rate won’t be enough to curb inflation for long if Congress’ deficit spending remains unchecked. This will force the Fed to monetize it to avoid putting more pressure on Congress to get their irresponsible fiscal house in order. President Biden and Democrats in Congress made this situation worse with the passage of the misnamed Inflation Reduction Act, which is likely to cost about four times the initial $300 billion estimate over a decade. Their wasteful spending, along with Republicans’ excessive spending before them, has led to a fiscal crisis, the most significant national threat. Congress will unlikely make the needed reforms to the primary drivers of the deficit of mandatory spending programs like Social Security and Medicare because of rent-seeking in politics. This will likely result in the Fed not sufficiently cutting its balance sheet to stop inflation. Rather, the Fed will probably choose to increase its balance sheet, putting more inflationary pressure on the economy when that’s the last thing it needs. A vital measure of the economy known as real gross domestic output, the real average of gross domestic product and gross domestic income, has declined in three of the last six quarters. While I don’t want there to be a hard landing, this is the situation that central planners by Congress spending and taxing too much, President Biden regulating too much, and the Fed printing too much have left us. There will be efforts by the government to correct these government failures, but we shouldn’t double down on past mistakes. Let’s learn from these failures and remember the most recent lesson in the 1980s: President Reagan cutting regulations, Congress passing tax cuts (but spending too much), and Fed Chairman Paul Volcker cutting the balance sheet. Initially, the cuts to the Fed’s balance sheet contributed to soaring double-digit interest rates, and the economy suffered a double-dip recession. However, afterward, the economy was able to heal from the prior hindrances of past presidents, congressional members, and the Fed, resulting in a long period of economic prosperity, which is often called the Great Moderation. What we have today is an economy where the government is growing, and markets aren’t as much. This must be reversed. When workers, entrepreneurs, and employers are free to engage in voluntary transactions, competition thrives, innovation flourishes, and resources are allocated efficiently. Moreover, free markets promote consumer choice and personal freedom. When government interventions, such as wasteful spending, excessive regulations, and high taxes, are removed, markets can function more efficiently and respond dynamically to changing economic conditions. Striking the right balance between constitutionally limited government functions and preserving the freedom of markets is crucial for achieving a vibrant and prosperous economy. Rising unemployment, stagnant wages, and the specter of inflation require a multifaceted approach. Raising interest rates hasn’t been enough. The government must focus on responsible fiscal and monetary policies, including reducing government spending, addressing burdensome regulations and taxes, and substantially cutting the Fed’s balance sheet. Americans are still suffering, and there is no time to waste in aggressively assessing these measures that cause economic strain so that people can get back to flourishing instead of merely “making it.” Originally published at Econlib. Thank you for listening to the Let People Prosper Show podcast and for reading the newsletter for show notes and key economic insights. Click below to watch the episode and read on for show notes: We discuss:

1) How Medicaid evolved from its origins and throughout the pandemic, and need for reform; 2) How Obamacare continues to affect the health care industry, distort prices, and influence how employers provide health care coverage; and 3) How government intervention in health care alters the flow of supply and demand and what changes should be made to improve the system. Brian’s bio:

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. LPP Bonus Episode | Why Tariffs, Immigration & Antitrust Laws can be HARMFUL w "The Immigration Guy"9/6/2023 In this bonus episode, we discuss: 1) How immigration helps the U.S. economy and the truth behind common immigration myths, such as fear that immigrants "steal jobs," 2) Why the tariffs against China didn't work, and the tyranny of excessive government spending; and 3) Dangers of antitrust laws, and the importance of letting markets work. Be sure to check out and subscribe to “The Immigration Guy” podcast.

You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, check out my website (www.vanceginn.com) and please subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. As the U.S. commemorates Labor Day, we should consider how many Americans aren’t actively participating in the workforce and what to do about it.

The labor force participation rate was 66% in 2007, declining to 63.3% in February 2020. Today, it’s even lower at 62.8%. Although there are many reasons for this trend, including Baby Boomers retiring, one glaring cause that will continue to exacerbate it with time is the flawed safety-net system. Labor Day was created to commemorate the many contributions of American workers, and rightly so. There’s an inspiring symbiotic relationship between the dignity individuals derive from working and the flourishing that the country experiences as a result. This is why it’s so concerning that the current structure of the many safety-net programs can disincentivize work-capable individuals from seeking, finding and keeping employment. Too often, these recipients become trapped in a cycle of government dependence. Programs like Temporary Assistance for Needy Families (TANF) and Supplemental Nutrition Assistance Program (SNAP) have minimal work requirements. This can discourage users from seeking better-paying employment opportunities, especially if the increase in income reduces the payments from these programs, which is called a benefits cliff. With purchasing power decreased from ongoing inflation, dependence on these programs is growing. There’s a high cost of these programs on recipients and taxpayers funding it, with little to show for it. Anti-poverty efforts have cost taxpayers about $25 trillion (adjusted for inflation) since 1965 and more than $1 trillion annually. While the official poverty rate in America has barely changed since 1970, only six years after President Lyndon B. Johnson declared the “war on poverty,” other measures show substantial improvements in people’s livelihoods. But much of that is because of safety-net programs that boost people’s income at the expense of other taxpayers. Ideally, a flourishing civil society with strong families, communities, nonprofits, churches and other institutions in civil society would render government assistance irrelevant. But we’re a long way from that vision being attainable. Until then, these programs need key reforms, and implementing empowerment accounts (EAs) would help. EAs are designed to consolidate state-administered safety-net programs into a single account accessible through a debit card. While they initially focus on streamlining existing programs, their potential lies in gradually replacing most, if not all, other safety-net programs over time. EAs incorporate a work requirement for work-capable adults, complemented by skills training and education. Recipients would also have access to financial literacy education, community-based case management and opportunities to build savings while enrolled in the program, helping reduce the benefits cliff. An essential aspect of EAs is their adaptability. The account’s government contribution would depend on current income, assets and dependents. Unlike current safety-net programs with income thresholds that create benefit cliffs, empowerment accounts would use a time limit while offering more flexible income limits for up to a year. This approach ensures recipients are motivated to achieve self-sufficiency within a defined period. Community-based case management, provided by established non-profit organizations, would connect recipients with crucial resources and foster connections within local communities. EA’s structure of requiring participation from safety-net recipients would go beyond merely providing financial assistance to equipping them to sustain fiscal and employment stability. The result would not only mean taxpayer funds are more efficiently spent, but struggling individuals are equipped for independence, leading to a decreased poverty rate, higher labor force participation rate and a flourishing economy. Too often, the government promotes mediocrity by quickly “rescuing” people from their situation without showing them how to maintain stability. But all individuals deserve to experience the irreplaceable satisfaction that comes from earned self-sufficiency. While celebrating Labor Day, Americans should emphasize not lack of work but meaningful work that aligns with individual callings. By empowering individuals to regain their financial independence through encouraging labor force participation, we pave the way for holistic human flourishing. Implementing empowerment accounts would mark a pivotal step towards promoting prosperity and reducing dependency on government safety nets. Originally published by The Daily Caller. We discuss: 1) How antitrust laws harm capitalism, why free markets work better with less government interference, and how people misunderstand antitrust laws; 2) What people, especially younger generations, misunderstand about capitalism, what it is and isn't, and how most of us on either side of the political aisle have more in common than not; and 3) How Hannah believes the country could change for the better, and her fascinating background from being a singer/songwriter and interning for Taylor Swift's team to becoming a liberty warrior. Hannah’s bio:

You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating! For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. Highlights

Overview

Labor Market The Bureau of Labor Statistics recently released its U.S. jobs report for April 2023, which was another mixed report with some strengths but many weaknesses.

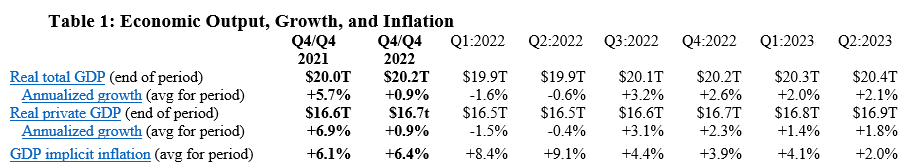

Economic Growth The U.S. Bureau of Economic Analysis recently released the second estimate for economic output for Q2:2023.

Bottom Line

Recommendations:

Today, I cover: 1) National: What the new revised GDP rate reveals about ongoing economic weakness, how the labor market continues to cool, and why there are more job openings than there are unemployed individuals; 2) Texas: My latest report published by Texans for Fiscal Responsibility highlights why Texas' state and local governments must spend less and eventually eliminate property taxes; and 3) Other: A sneak peek of next week's LPP podcast episode with Hannah Cox of BASEDPolitics, one of my recent articles on Townhall about new antitrust threats, and my experience at the State Policy Annual Network Meeting in Chicago. You can watch this episode and others along with my Let People Prosper Show on YouTube or listen to it on Apple Podcast, Spotify, Google Podcast, or Anchor. Please share, subscribe, like, and leave a 5-star rating!

For show notes, thoughtful insights, media interviews, speeches, blog posts, research, and more, please check out my website (www.vanceginn.com) and subscribe to my newsletter (www.vanceginn.substack.com), share this post, and leave a comment. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed