|

Your browser does not support viewing this document. Click here to download the document. Originally published at American Energy Institute.

0 Comments

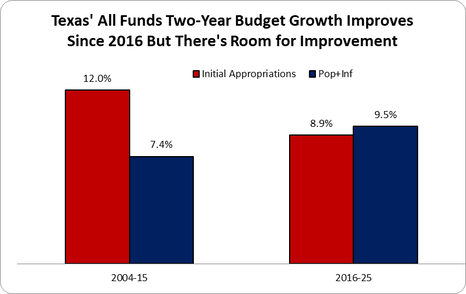

Government Spending Is The Problem The late, great economist Milton Friedman said, "The real problem is government spending." This is true as spending comes before taxes or regulations. In fact, if people didn't form a government or politicians didn’t create new programs, then there would be no need for government spending and no need for taxes. And if there was no government spending nor taxes to fund spending then there would be no one to create or enforce regulations. While this might sound like a utopian paradise, which I agree, there are essential limited roles for governments outlined in constitutions and laws. Of course, most governments are doing much more than providing limited roles that preserve life, liberty, and property. This is why I have long been working diligently for more than a decade to get a strong fiscal rule of a spending limit enacted by federal, state, and local governments promptly under my calling to "let people prosper," as effectively limiting government supports more liberty and therefore more opportunities to flourish. Fortunately, there have been multiple state think tanks that have championed this sound budgeting approach through what they've called either the Responsible, Conservative, or Sustainable State Budget. I recently worked with Americans for Tax Reform to publish the Sustainable Budget Project, which provides spending comparisons and other valuable information for every state. This groundbreaking approach was outlined recently in my co-authored op-ed with Grover Norquest of ATR in the Wall Street Journal. When Did This Budget Approach Begin? I started this approach in 2013 with my former colleagues at the Texas Public Policy Foundation with work on the Conservative Texas Budget. The approach is a fiscal rule based on an appropriations limit that covers as much of the budget as possible, ideally the entire budget, with a maximum amount based on the rate of population growth plus inflation and a supermajority (two-thirds) vote to exceed it. A version of this approach was started in Colorado in 1992 with their taxpayer's bill of rights (TABOR), which was championed by key folks like Dr. Barry Poulson and others. (picture below is from a road sign in Texas) Why Population Growth Plus Inflation? While there are many measures to use for a spending growth limit, the rate of population growth plus inflation provides the best reasonable measure of the average taxpayer's ability to pay for government spending without excessively crowding out their productive activities. It is important to look at this from the taxpayer’s perspective rather than the appropriator’s view given taxpayers fund every dollar that appropriators redistribute from the private sector. Population growth plus inflation is also a stable metric reducing uncertainty for taxpayers (and appropriators) and essentially freezes inflation-adjusted per capita government spending over time. The research in this space is clear that the best fiscal rule is a spending limit using the rate of population growth plus inflation, not gross state product, personal income, or other growth rates. In fact, population growth plus inflation typically grows slower than these other rates so that more money stays in the productive private sector where it belongs. To get technical for a moment, personal income growth and gross state product growth are essentially population growth plus inflation plus productivity growth. There's no reasonable consideration that government is more productive over time, so that term would be zero leaving population growth plus inflation. And if you consider the productivity growth in the private sector, then more money should be in that sector at the margin for the greatest rate of return, leaving just population growth plus inflation. Population growth plus inflation becomes the best measure to use no matter how you look at it. Given the high inflation rate more recently, it is wise to use the average growth rate of population growth plus inflation over a number of years to smooth out the increased volatility (ATR's Sustainable Budget Project uses the average rate over the three years prior to a session year). And this rate of population growth plus inflation should be a ceiling and not a target as governments should be appropriating less than this limit. Ideally, governments should freeze or cut government spending at all levels of government to provide more room for tax relief, less regulation, and more money in taxpayers' pockets. Overview of Conservative Texas Budget Approach Figure 1 shows how the growth in Texas’ biennial budget was cut by one-fourth after the creation of the Conservative Texas Budget in 2014 that first influenced the 2015 Legislature when crafting the 2016-17 budget along with changes in the state’s governor (Gov. Greg Abbott), lieutenant governor (Lt. Gov. Dan Patrick), and some legislators. The 8.9% average growth rate of appropriations since then was below the 9.5% biennial average rate of population growth plus inflation since then, which this was drive substantially higher after the latest 2024-25 budget that is well above this key metric (before this biennial budget the growth rate was 5.2% compared with 9.4% in the rate of population growth plus inflation). This approach was mostly put into state law in Texas in 2021 with Senate Bill 1336, as the state already has a spending limit in the constitution. The bill improved the limit to cover all general revenue ("consolidated general revenue") or 55% of the total budget rather than just 45% previously, base the growth limit on the rate of population growth times inflation instead of personal income growth, and raise the vote from a simple majority to three-fifths of both chambers to exceed it instead of a simple majority. There are improvements that should be made to this recent statutory spending limit change in Texas, such as adding it to the constitution and improving the growth rate to population growth plus inflation instead of population growth times inflation calculated by (1+pop)*(1+inf). But this limit is now one of the strongest in the nation as historically the gold standard for a spending limit of the Colorado's Taxpayer Bill of Rights (TABOR) has been watered down over the years by their courts and legislators, as it currently covers just 43% of the budget instead of the original 67%. My Work On The Federal Budget In The White House From June 2019 to May 2020, I took a hiatus from state policy work to serve Americans as the associate director for economic policy ("chief economist") at the White House's Office of Management and Budget. There I learned much about the federal budget, the appropriations process, and the economic assumptions which are used to provide the upcoming 10-year budget projections. In the President's FY 2021 budget, we found $4.6 trillion in fiscal savings and I was able to include the need for a fiscal rule which rarely happens (pic of President Trump's last budget). Sustainable Budget Work With Other States and ATR When I returned to the Texas Public Policy Foundation in May 2020, as I wanted to get back to a place with some sense of freedom during the COVID-19 pandemic and to be closer to family, I started an effort to work on this sound budgeting approach with other state think tanks. This contributed to me working with many fantastic people who are trying to restrain government spending in their states and the federal levels. Here are the latest data on the federal and state budgets as part of ATR's Sustainable Budget Project. From 2014 to 2023, the following happened: Federal spending increased by 81.7%, nearly four times faster than the 23.1% increase in the rate of population growth plus inflation.

Result: American taxpayers could have been spared more than $2.5 trillion in taxes and debt just in 2023 if federal and state governments had grown no faster than the rate of population growth plus inflation during the previous decade. And this would be even more if we considered the cumulative savings over the period. My hope is that if we can get enough state think tanks to promote this budgeting approach, get this approach put into constitutions and statutes, and use it to limit local government spending as well, there will be plenty of momentum to provide sustainable, substantial tax relief and eventually impose a fiscal rule of a spending limit on the federal budget. This is an uphill battle but I believe it is necessary to preserve liberty and provide more opportunities to let people prosper. Sustainable State Budget Revolution Across The Country Below are the states and think tanks which I'm working with and this revolution is going, which you can find an overview of this budgeting approach in Louisiana and should be applied elsewhere. I update these periodically, successful versus not successful budgeting attempts being 20-7 so far.

If you're interested in doing this in your state, please reach out to me. For more details, check out these write-ups on this issue by Grover Norquist and I at WSJ, Dan Mitchell at International Liberty, and The Economist. It's a pleasure to speak with the Texas Aggregates and Concrete Association again and enjoy the great resort here with my wife and three young kids. While aggregates and concrete may not always be in the spotlight, they are the bedrock of our infrastructure, forming the foundation upon which we build our homes, businesses, and communities.

Reflecting on my journey, I realize how essential the right direction and strong institutions are in shaping our paths. Much like the solid foundation of concrete, institutions give us the stability to build and grow. Like the economy, my life has been a series of peaks and troughs. In my younger years, I grew up in a low-income, single-mother household in South Houston as my dad had epilepsy, and they divorced when I was five years old. I went to private school from K-2 grades, public school from 3-6 grades, and home school from 7-12. Unlike many of you, I took many risks during my teenage years and began playing drums in a band called "Sindrome," living the rockstar life. But a near-fatal car accident in 2002 was my wake-up call, one of several but the one that turned me toward a brighter path. Through this experience, a month in bed with many bumps and bruises, and a lot of prayer, I found my purpose: to help others through my calling to let people prosper. We find ourselves at a pivotal point in our country and in Texas. The recent elections tell us that there is a clear call for change in the Lone Star State. The upcoming November elections will be another opportunity for the country to steer towards a path of prosperity or continue down a troubling road. As an optimist, I believe in our potential, but I also recognize our country and state's many economic, political, and cultural issues. Policy Uncertainty and Economic Volatility At the national level, we face several economic challenges. The Biden administration has been keen on infrastructure spending, which includes the $1.2 trillion Infrastructure Investment and Jobs Act. While this aims to rejuvenate our infrastructure, it also raises concerns about efficiency and the role of government in these projects, and the fact that we are running deficits higher than that per year with the national debt at nearly $35 trillion and net interest payments of $1 trillion exceeding national defense expenditures of about $860 billion. Excessive government spending, increased regulation, and interventionist policies often lead to inefficiencies and distortions in the market. Milton Friedman, my favorite economist, warned about the dangers of heavy government involvement, advocating instead for free-market solutions that empower individuals and businesses. Election years heighten policy uncertainty, which can drive economic volatility. Businesses and investors become cautious, waiting to see which policies will prevail. This hesitation can slow economic activity, affecting everything from job creation to investment in new projects. For the aggregates and concrete industry, this means potential delays in infrastructure projects and fluctuations in demand. Milton Friedman once said, "If you put the federal government in charge of the Sahara Desert, in five years, there’d be a shortage of sand." This sharp but insightful remark underscores the inefficiency that often accompanies government intervention. In his view, infrastructure projects should be managed by private entities with a direct stake in the outcome and can respond more agilely to changes and needs. Here in Texas, we are not immune to these challenges. Our state is known for its robust economy and low taxes, but we're grappling with excessive government spending and high property taxes. The Texas Comptroller's report highlights how our spending on transportation is around $10 billion annually. While infrastructure is crucial, we must be mindful of how these funds are used to ensure they generate real value for taxpayers. Weak Labor Market Amid Headlines of Strength Despite headlines showing strength, the U.S. labor market reveals underlying weaknesses. Nearly half of Americans think we are in a recession, reflecting a disconnect between reported statistics and personal experiences. Real average weekly earnings have declined by nearly 4% since January 2021, squeezing household budgets and diminishing purchasing power. The labor force participation rate remains low at 62.5%, significantly below the February 2020 level. If participation were the same as it was then, the unemployment rate would be closer to 6% rather than the reported 4% today. Texas, however, leads in job gains, which is a testament to our state's resilient economy. Yet, we must acknowledge that the 25% increase in the two-year state budget last year was excessive. This surge in spending did not provide sufficient property tax relief, which is critical for maintaining economic vitality and keeping Texas attractive for businesses and residents alike. Moreover, we must prioritize universal school choice next year to ensure educational opportunities that meet diverse needs and drive future economic growth. Election Year Volatility During election years, the stakes are even higher. Uncertainty about future policies can cause volatility in markets and economic performance. For instance, debates over infrastructure funding, environmental regulations, and tax policies can create an unstable business environment. Companies may delay or cancel projects, affecting the demand for aggregates and concrete. This uncertainty trickles down, impacting jobs, investments, and overall economic health. Aggregates and concrete are essential for the development and maintenance of our infrastructure. These materials for things like highways and homes are our physical landscape's backbone. However, it's crucial to approach their use smartly. We don't need to resort to industrial policies with high costs and trade-offs, burdening taxpayers. Instead of a top-down approach, which often fails due to bureaucratic inefficiencies, we should consider a bottom-up approach to transportation projects. This includes government projects, public-private partnerships, and private projects. A significant portion of infrastructure could be managed through private toll roads. While my ideal vision leans heavily on privatization and tax cuts, I recognize that a balanced approach is more realistic in the current environment. Public-private partnerships can bring innovation and efficiency, reducing the burden on taxpayers while still delivering essential infrastructure. Let me share an example from my work. My research finds that private toll roads can often be built faster and cheaper than public projects. Private companies are directly incentivized to minimize costs and maximize efficiency. For instance, the LBJ Express project in Dallas, a public-private partnership, was completed ahead of schedule and under budget, demonstrating the potential benefits of such collaborations. There is also a need to move to design-build for projects in Texas rather than today's more costly and time-consuming design-bid-build approach. Additionally, Texas is experiencing significant population growth, with more people moving to the state, increasing the demand for our infrastructure. The Texas Department of Transportation (TxDOT) is investing in expanding highways and improving ports to accommodate this growth. Projects like the $7.5 billion North Houston Highway Improvement Project aim to address these demands. However, we must ensure that these investments are managed efficiently and effectively. Role of Institutions and Central Planning Another key aspect is the role of institutions. Friedrich Hayek, in his book "The Road to Serfdom," cautioned against the overreach of central planning. He emphasized that central planning often leads to inefficiencies and a loss of individual freedoms. His insights are particularly relevant today as we navigate the complexities of modern infrastructure development. To truly flourish, Texas needs to embrace more free-market capitalism and resist the creeping influence of socialism in our economy. This applies to transportation and beyond. By focusing on the efficient use of resources, reducing regulatory burdens, and fostering competition, we can build a more prosperous future. The bottom-up approach not only ensures better utilization of resources but also empowers local communities to take charge of their development, aligning projects more closely with the actual needs and priorities of the people. Consider the example of toll roads in other states. Using private toll roads in Virginia has significantly improved traffic flow and reduced congestion in previously bottleneck areas. This model can be replicated in Texas, where traffic congestion is growing, especially in urban areas. By allowing private companies to manage and maintain these roads, we can ensure they are kept in optimal condition without continuously draining public funds. Furthermore, private toll roads can be a source of innovation. Companies can introduce advanced technologies for traffic management and toll collection, making the entire system more efficient. For example, using electronic toll collection systems in Florida has greatly reduced vehicles' time at toll booths, enhancing the overall travel experience. However, this doesn't mean we should eliminate public involvement in infrastructure projects. There are instances where government intervention is necessary, especially in projects that may not be immediately profitable but are crucial for public access and economic activity. This is where public-private partnerships come into play, allowing us to leverage the strengths of both sectors. The government should act as a facilitator rather than a direct manager of projects. By setting clear regulations and standards, it can ensure that private companies operate fairly and efficiently while also protecting the interests of the public. This approach can help us avoid the pitfalls of excessive government control while still reaping the benefits of private sector efficiency. Paul Krugman and other progressives might argue that significant government intervention is necessary to address market failures and ensure equitable outcomes. They believe that without government oversight, critical infrastructure could suffer from underinvestment, and social inequalities could worsen. While these points are worth considering, history has shown us that excessive government control often leads to inefficiencies, higher costs, and reduced innovation. Learning from Failures and Future Outlook My journey from poverty to rockstar to entrepreneurial economist taught me the value of strong institutions and the importance of aligning personal purpose with societal needs. This principle applies to our infrastructure as well. Just as a solid foundation is critical for a stable building, a robust institutional framework is essential for a thriving economy. We must ensure that our policies and investments in infrastructure reflect this understanding. As we look toward the future, we must remain vigilant against the encroachment of socialist policies that threaten to undermine the free-market principles that have made Texas a beacon of prosperity. Instead, we should champion policies that promote individual liberty, economic freedom, and responsible stewardship of resources. Failure provides us with valuable lessons, and too often, people want to mitigate this by expanding government intervention, which can be detrimental to our learning and growth. We are at a critical juncture in our state's history. The recent elections have shown us that Texans are ready for a change. The upcoming November elections present another opportunity to reaffirm our commitment to the principles that have made Texas great. While I am optimistic about our future, we must address the economic, political, and cultural challenges that threaten our way of life. Election Year Volatility and Policy Uncertainty One of the most pressing issues is the rise of big government. Across the political spectrum, there is a growing tendency to rely on government intervention to solve problems. This trend is particularly concerning in Texas, where we have traditionally prided ourselves on independence and self-reliance. Many of you might be demanding the government give you handouts or reap the benefits of federal, state, or local spending, but all this comes from taxpayers' pockets. We must try a different approach. Election year volatility adds another layer of complexity. Businesses and investors are left guessing about the future as policies swing with the political tide. This uncertainty can stall projects, delay investments, and increase costs. The aggregates and concrete industry, heavily reliant on long-term planning and stability, feels these effects acutely. Conclusion In conclusion, aggregates and concrete are vital for Texas's growth, but their smart use is paramount. Let's leverage the strengths of the free market, prioritize efficiency, and ensure that our infrastructure investments truly benefit Texans. As we progress, I am eager to collaborate with any of you on projects aligning with these principles. Together, we can build a stronger, more prosperous Texas. For those interested in further discussions on economic policy and free-market solutions, I invite you to check out my podcast, the Let People Prosper Show on all major platforms, and my Substack newsletter at vanceginn.substack.com, where I delve into these topics in greater detail. You can also visit my website, VanceGinn.com, for more information and resources. Thank you for your time and attention. Let's work together to build a future where smart infrastructure investment and strong institutions pave the way for a prosperous Texas. Originally published at TFR.

Texas at the Forefront: Leading the Charge but Facing New Challenges Texas continues to blaze trails in the labor market, with recent data from the Texas Workforce Commission showing a robust addition of over 42,000 jobs and an unemployment rate of 4% in April. This included 41,000 jobs in the productive private sector and 1,100 in the government sector. Coupled with an impressive gain of 306,000 jobs (+2.2%)since last April, these figures underscore Texas’ economic vitality and its role as a leader in the national economy. However, as other states ramp up their economic policies, especially in red states, and the burdens of federal missteps weigh heavily on Americans, Texas must renew its commitment to pro-growth, limited government principles to maintain its leadership position. In April, the Lone Star State’s labor force expanded and demonstrated resilience in several key sectors, contributing significantly to the state’s economic dynamism. Employment grew the most in percentage terms over the last year in other services (+6%) and professional and business services (+3.3%), but government (+3.3%) grew too much. This private sector growth is a testament to Texas’ business-friendly environment and its ability to attract and retain top-tier talent and enterprises. Despite these achievements, there is an emerging need for vigilance as other states begin to adopt reforms that could rival Texas’ appeal. Nationally, the labor market shows varying degrees of recovery, with some states quickly catching up by implementing aggressive tax cuts and regulatory reforms to support economic growth. Red states like South Carolina (+3.4%), Florida (+2.5%), and Missouri (+2.5%) are thriving, with job growth rates that challenge Texas’ dominance. Texas has long been a bastion of economic freedom, which has fostered an environment where businesses and individuals can thrive. However, the state now faces the dual challenge of maintaining its competitive edge while also addressing the economic pressures exerted by federal policies and economic management—or mismanagement—by the Biden administration, Congress, and the Federal Reserve. These challenges include inflationary pressures, federal spending levels, and monetary policies that have left many Texans feeling the pinch. Policy adjustments are essential to address these challenges and keep Texas at the forefront of job creation. First, Texas must return to limited government. Reinforcing and expanding upon policies that have proven successful, such as reducing regulatory burdens and further limiting state and local government spending, should be a priority. As other states enhance their economic policies, Texas must not rest on its laurels but should strive for even bolder reforms to sustain its economic leadership. This includes strengthening the state’s constitutional and statutory spending limits consistent with the average taxpayer’s ability to pay for government spending. The best path would be to limit the entire budget or at least all state funds, excluding federal funds, with a maximum rate of population growth plus inflation and a two-thirds vote to exceed it. This limitation should also cover local governments, which has helped keep Colorado’s state and local spending in check, even in a blue state, with its Taxpayer’s Bill of Rights. Additionally, the state’s approach to taxation needs a radical rethink. The overwhelming support for eliminating property taxes reflects a broader dissatisfaction with traditional tax structures that penalize success and deter investment. A bold approach would be to transition from property taxes to a more equitable tax system by limiting state and local government spending and using surpluses to lower property taxes until they are eliminated in about a decade. The state would use its surpluses to buy down the school district M&O property tax rates, and local governments would use their surpluses to reduce their property tax rates. This approach would support substantial economic growth and a path for people to finally own their home instead of renting from the government forever by being forced to pay these taxes whether the mortgage is paid off. Moreover, as Texas navigates these fiscal reforms, there should be key reforms and reductions where necessary to wasteful government programs and agencies. Given the excessive spending by the state legislature during the last session, with more than a 20% increase in appropriations–the largest in Texas history- there is a need to cut government spending in the next session rather than just limit the growth. This should include providing universal school choice with education savings accounts that should replace the state’s school finance formulas. Doing so would help to empower parents to do what’s best for their kids’ education while reducing the burden on taxpayers because this could dramatically reduce spending. While Texas continues to lead in job growth and reach record highs, the path forward requires adherence to tried-and-tested economic principles and a willingness to innovate and adapt to changing economic landscapes. Texas can maintain and strengthen its position as an economic powerhouse by fostering a more favorable business climate, eliminating corporate welfare, reducing unnecessary governmental interference, and revamping its tax system. As other states accelerate their economic reforms, Texas must lead by example, championing policies that ensure prosperity and freedom. The call to action is clear: Texas must stop passing progressive fiscal policies and ensure its policies promote growth and provide a bulwark against the economic challenges of our times. Texas stands as one of the most vibrant and attractive states in the United States, celebrated not only for its robust job market but also as a top destination for new residents. Its economic success and allure are largely due to the free-market model, which has fueled growth and innovation. However, even in such a thriving environment, the electricity market presents significant challenges that must be addressed to ensure continued prosperity. To keep up with its growth, Texas must refine its energy strategies, emphasizing market-driven solutions rather than increased government intervention.

Texas is rich in natural resources, capable of meeting the energy demands of its growing population if managed wisely. Among these, natural gas stands out as a particularly reliable source. In contrast to the intermittent nature of wind and solar power, natural gas provides consistent and robust energy supply, rain or shine, making it a cornerstone of Texas’ energy infrastructure. Despite these natural advantages, there has been a worrying shift towards greater government involvement in the energy sector, potentially undermining the very free-market principles that have driven Texas’ growth. This trend was exemplified by the recent legislative decision to pass SB 2627, establishing the Texas Energy Fund. While intended to support the state’s energy infrastructure, this initiative opens the door for problematic state interventions in the market. Approved by voters last November, the fund is slated to allocate $10 billion, with a substantial portion earmarked for state-controlled power projects and infrastructure developments outside the purview of the Energy Reliability Council of Texas (ERCOT). Such strategies risk taxpayer dollars and discourage the private sector investment crucial for spurring innovation and efficiency in the energy sector. Further compounding the issue is the engagement of large investment firms like BlackRock, which has expressed interest in exploiting the Texas Energy Fund. Historically detached from Texas’ core energy industries, these firms stand to benefit from state-directed initiatives at taxpayer expense. This involvement will centralize power, stifle competition, and suppress the innovation that is vital for a healthy market economy. Instead of continuing down this path, Texas needs a light-touch regulatory framework that promotes competition and fosters innovation through market forces. State policies should remove obstacles for private investment in energy production and distribution, ensuring a competitive market that drives down costs, improves service quality, and encourages technological advancements. The limitations of unreliable energy sources have been made starkly apparent each time Texans receive a conservation notice from ERCOT, with more likely coming this summer. A free-market approach, which minimizes government intervention and allows energy prices to reflect supply and demand, offers the best solution for managing Texas' energy resources efficiently. This strategy is about more than just maintaining an efficient energy grid; it’s about preserving the entrepreneurial spirit that defines Texas. By reducing government overreach and enhancing market dynamics, Texas can ensure that its energy sector remains as dynamic and resilient as its economy. Looking forward, Texas policymakers face a clear choice. They can embrace the principles of free-market capitalism and minimal government intervention across all sectors, not just energy. This path will secure Texas' leadership in economic growth and innovation, ensuring a reliable and affordable energy supply for future generations, which ought to include nuclear energy. By championing policies that reduce government involvement and promote market functionality, Texas can strengthen its infrastructure to support its growing population and sustain its status as a beacon of prosperity and freedom. Emphasizing market-driven solutions will enable Texas to meet the challenges of today and tomorrow, ensuring that the state remains a fantastic place to live, work, and raise a family. Texas has always been a leader, not a follower. By adhering to the principles that have shaped its past successes, Texas can ensure a bright and prosperous future, powered by innovation, competition, and the indomitable Texan spirit. Originally published at Texans for Fiscal Responsibility.

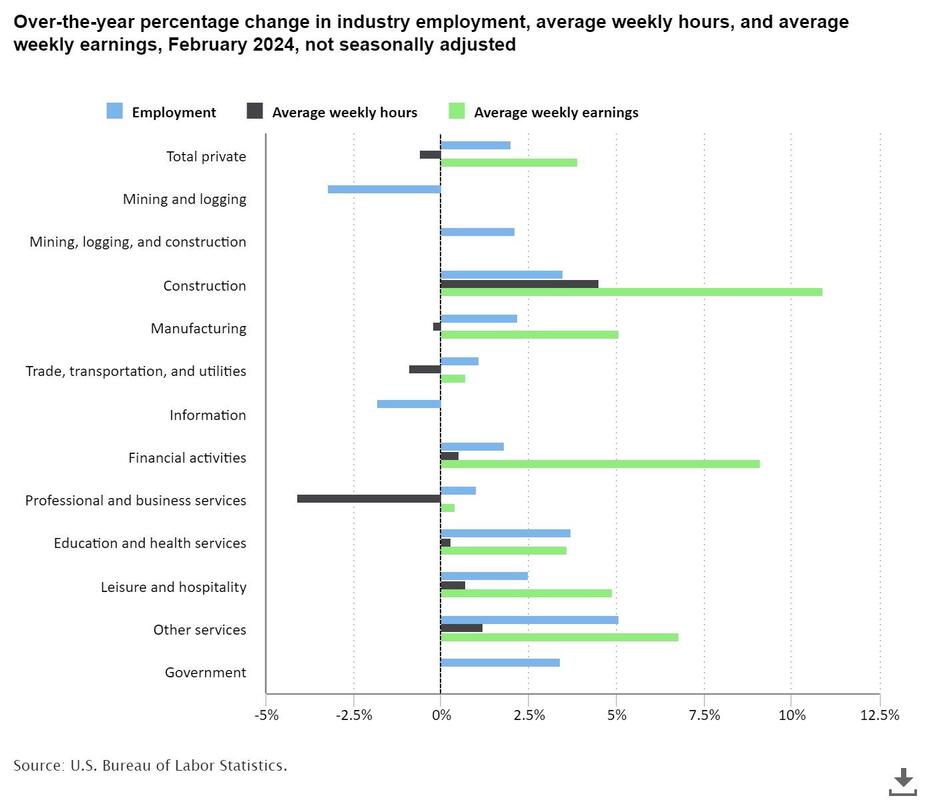

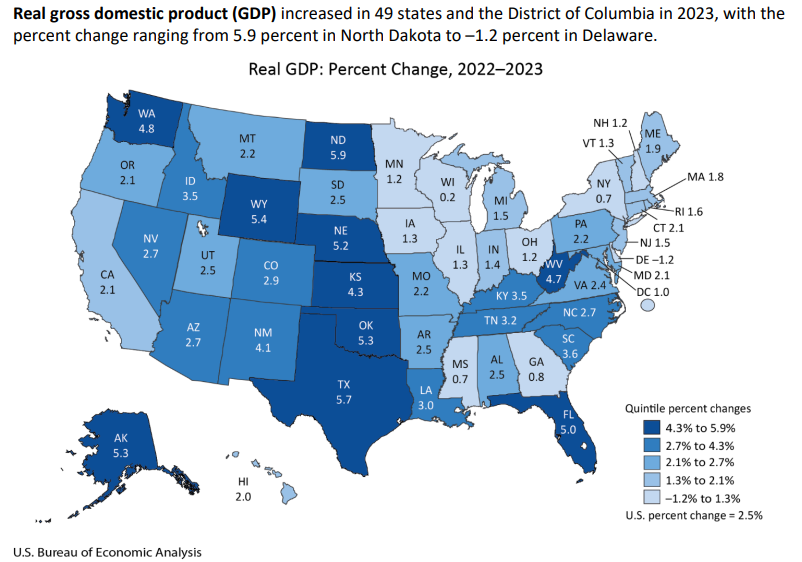

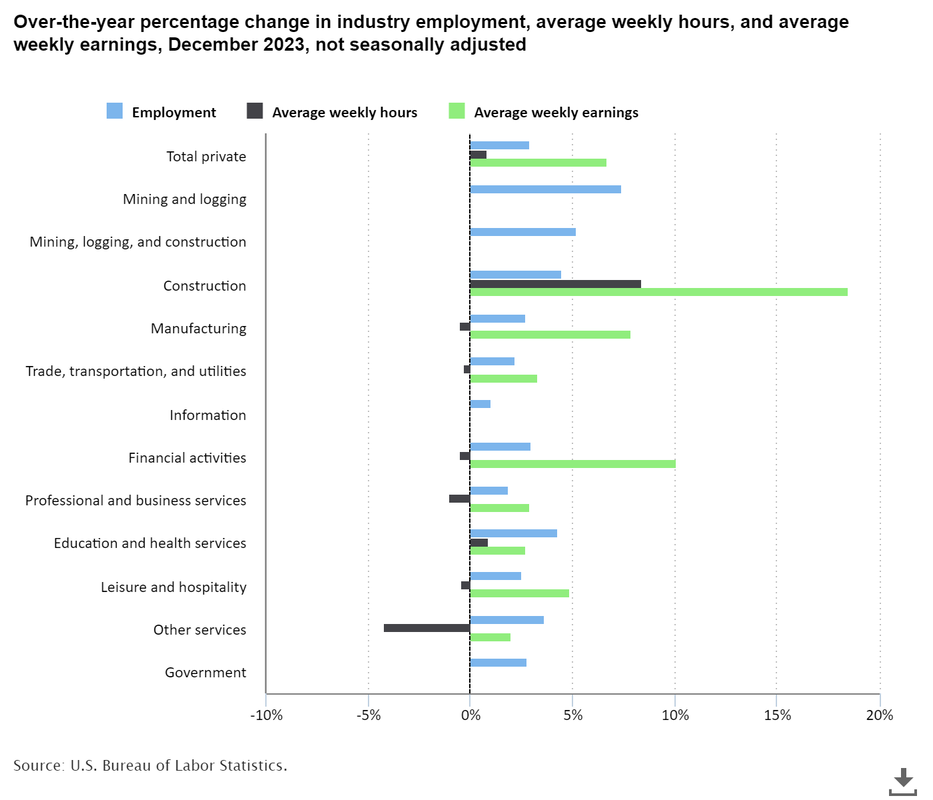

Texas on the Brink: A Call for Free-Market Revival Overview Texas stands at a crossroads. Renowned for its robust economy and job creation, the Lone Star State now confronts economic challenges that could define its future. Excessive government spending, burdensome property taxes, and federal missteps threaten the prosperity Texans have come to expect. Despite recent property tax relief efforts, runaway state and local spending stifles true fiscal reform. It’s time for Texas to double down on its free-market roots, slash government overreach, and set a course for sustained economic liberty and prosperity. Current Economic Landscape For the latest data in March 2024, Texas’ economy shows resilience, yet not without signs of stress. Labor market data from the U.S. Bureau of Labor Statistics points to a continued recovery, with nonfarm employment adding 270,700 jobs over the last year (most in the country). There were 19,100 jobs added to 14.1 million employed in March for a new record high and the 36th straight month of job creation and in 45 of the last 47 months. Household employment has been up 195,997 since last March, along with a similar increase in the labor force, with an unemployment rate of 3.9%. However, this annual job growth has slowed to 2.0%, ranking it 8th best in the country but below Florida’s 2.2% rate and Idaho’s top rate of 3.5%. Moreover, a major factor in this job growth has been the increase in costly government jobs by 3.5% since March 2023, the fastest rate next to the growth in other services of 5.2%. The sectors of mining and logging and information had job losses over the last year, and average weekly earnings were up in most sectors except mining and logging, information, and professional and business services. Texas has had the fourth most jobs created since February 2020 joining many other red states that have led the way since the lockdown recession. The Bureau of Economic Analysis reports a 5.7% GDP growth for 2023—ranking second-best nationally. This economic snapshot highlights the many benefits of the Texas model but leaves room for improvement from more disciplined, growth-oriented policies. Historical Context and Policy Shifts Texas has always been a beacon of opportunity, partly thanks to its commitment to limited spending, lower taxes, and sensible regulation. Recent trends, however, signal a departure from this successful formula. As detailed in my analysis of educational freedom and fiscal responsibility, it’s evident that the state’s current trajectory could hinder long-term prosperity. Furthermore, the much-discussed property tax relief has fallen short of its promised impact, highlighting the need for genuine and transparent fiscal reforms. Policy Recommendations To reclaim its position as a leader in key economic and fiscal issues, Texas must implement free-market reforms:

Conclusion Free-market principles are not just theoretical ideals but practical necessities that can elevate and sustain Texas’ economic vitality, strengthen families, and boost opportunities to flourish. Texas is uniquely positioned to lead by example with a robust economic foundation and a reputation for fostering opportunity. Reducing government intervention and promoting individual freedom are not merely beneficial; they are imperative for the future prosperity of every Texan. Now is the time to act decisively, ensuring that Texas survives and thrives in the face of national challenges. Let’s champion these changes to secure a free and flourishing Texas for generations. Originally published at Texans for Fiscal Responsibility. Overview

Texas’ employment has been up for 44 of the last 46 months since May 2020.

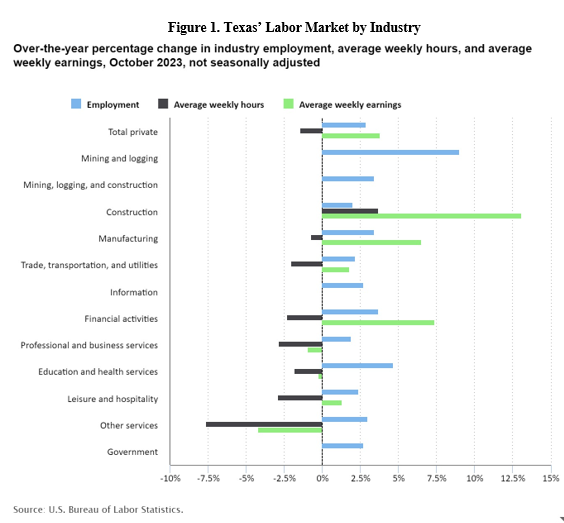

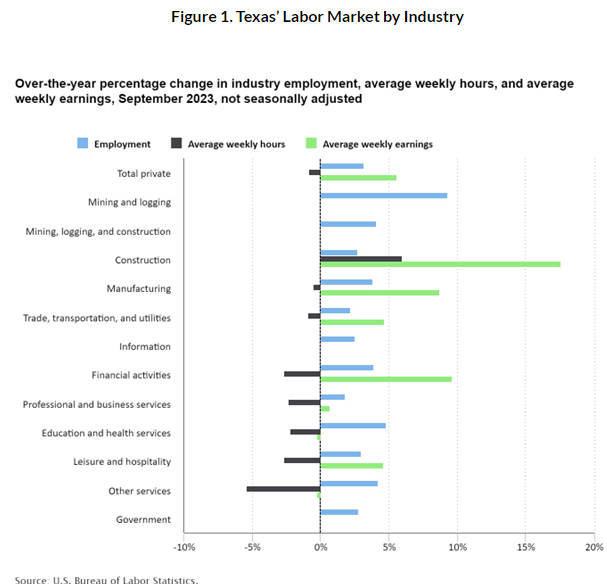

Figure 1. Texas Labor Market by Industry Source: U.S. Bureau of Labor Statistics Economic growth has picked up, but personal income lags the U.S. average.

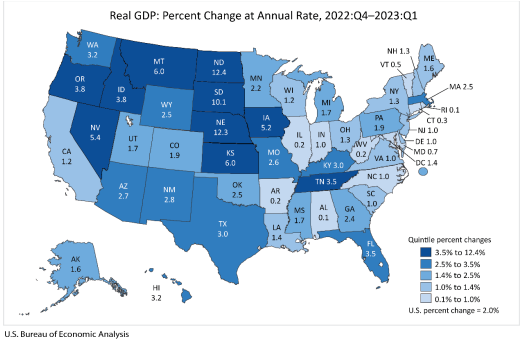

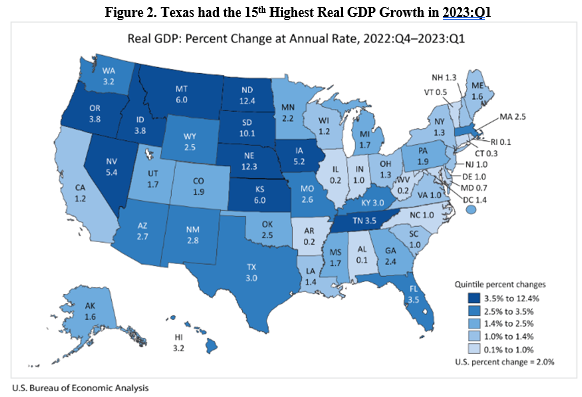

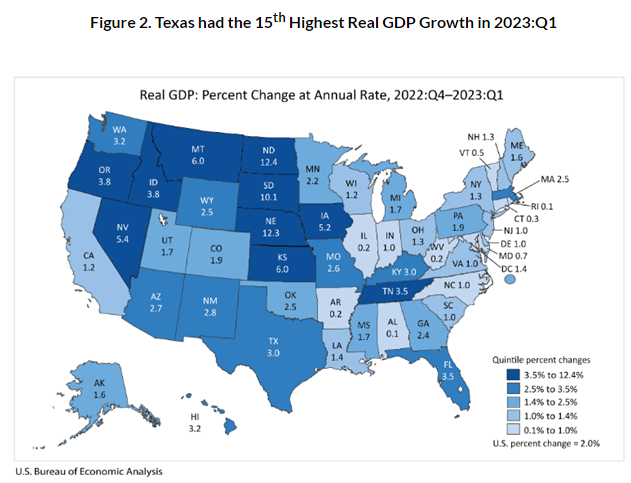

Figure 2: Real Gross Domestic Product by State in 2023 Improve the Texas Model with pro-growth policies that limit government by:

Originally published at Texas Scorecard.

Texas can pass bold school choice legislation when the next legislative session starts in January 2025. This could finally happen because of the recent election wins in the House primaries, efforts led by Gov. Greg Abbott. The election wins include pro-school choice candidates beating anti-school choice incumbents or filling seats of retiring anti-school choice members. More incumbents, including House Speaker Dade Phelan, were forced to a runoff in May. Moreover, 80 percent of Republicans voted for Proposition 11 on the primary ballot to support school choice, which matters in a dominantly red state. In the evolving educational reform landscape, universal education savings accounts (ESAs) provide the best path to empower parents to decide their children’s education. They are also a practical, fiscally responsible strategy for reimagining the future of education. At least 10 states have passed universal school choice, and more are likely to do so soon. But these states haven’t reached the pinnacle of what a competitive education system should look like. The optimal school choice approach should liberate education from the constraints of the monopoly government school system, draw upon successful market-driven solutions, and offer a simplified education finance system. The Texas Legislature essentially controls the current school finance system with funding from taxpayers through taxes collected by the state, school district, and federal governments. The inefficiency and ineffectiveness of the status quo are stark, including questionable but relevant declining test scores. This highlights a critical need for an approach that better serves students’ and families’ unique needs and aspirations. The state’s school finance system is based on many factors to the school system, but the Texas Education Agency recently reported that the average funding per student was $14,928 in the 2021-22 school year. Total funding was $80.6 billion for 5.5 million students. Of course, this is how much is spent, but the actual cost of the monopoly government school system is hidden and driven higher by politics rather than market outcomes. ESAs provide flexibility in covering many educational services, including various schooling options, tutoring, testing, and other related expenses. This empowers parents to customize their children’s education to suit individual learning styles and interests. This adaptability is vital for fostering environments where children excel academically, socially, and emotionally. Implementing a universal ESA program demands a framework that balances simplicity with accountability, ensuring the focus remains on expanding educational opportunities and improving student outcomes. While many current ESA programs run alongside the government school system, this doesn’t provide the most competitive framework. Running them in tandem, whereby the funding remains the same or even increases for government schools while creating a new system to fund ESAs, is costly and lacks the incentives for optimal outcomes. Instead, we should pursue a simplified education finance approach that maximizes competition, reduces costs, and lowers taxes by funding students, instead of a system. A bold proposal would provide parents with an ESA of $10,000 per child for the school year but paid monthly or the preferred frequency to choose any approved schooling, including government, private, charter, home, co-op, tutoring, or other types of schooling. With about 6.3 million school-age children in Texas, the annual total expenditure would be $63 billion, or $17.6 billion less than what’s being spent today on government schools. Parents could receive an ESA of as much as $12,800 per student to keep the same expenditures as today. However, given the bloated bureaucracy and misguided direction of government schools, the $10,000 amount would help force efficiencies while reducing taxpayers’ costs and incentivizing new education providers. The lower cost of $17.6 billion would provide an opportunity for substantial school property tax relief. Combining ESAs and property tax relief would further accentuate the proposal’s appeal, addressing the lack of school choice and burdensome property taxes. The bold approach eliminates most, if not all, of the current antiquated government school finance system with one that gives parents a way to meet their children’s unique learning needs best. It would help alleviate the hardship for many families that can choose alternatives for financial reasons, pay lower property taxes, or have money remaining to invest in their children’s quality of life and educational pursuits. As states across the nation begin to recognize the transformative potential of this bold universal school choice approach, the momentum is undeniable. This trend underscores a growing consensus on the need for educational systems that prioritize choice, flexibility, and parental empowerment. By breaking free from the monopoly government school finance system and embracing a bold ESA finance approach that empowers parents, we can pave the way for a future where every child can achieve their full potential. Originally published at The City Journal.

In November 2023, Texas voters approved a constitutional amendment, HJR 2, which Governor Greg Abbott said would “ensure more than $18 billion in property tax cuts—the largest property tax cut in Texas history.” Texas homeowners’ hopes were dashed at the start of 2024, however, when they got their property tax bills. The promised $18 billion reduction amounted to only $12.7 billion in new property tax relief, a fraction of the state’s record $32.7 billion budget surplus, while the other $5.3 billion merely maintained property tax relief from years past. While Texas doesn’t have a state income tax, it does have the nation’s sixth-most burdensome property taxes. These taxes obstruct peoples’ ability to buy homes and price others out of the homes they’re in. Texans expect and deserve clarity about their property tax bills, but state policymakers’ failed promises and lack of transparency have eroded public trust. Despite the governor’s claim, the 2023 tax relief package, spread over two years, isn’t even the state’s largest historic property tax cut. In 2006, the Texas legislature apportioned $14.2 billion to reducing residents’ property taxes, cutting school district maintenance and operations (M&O) property tax rates by a third for 2008–09 biennium, and making up the difference with a revised franchise tax, a higher cigarette tax, and a higher motor vehicle sales tax. Adjusted for inflation, 2023’s cut would have had to exceed $21 billion to surpass the 2006 cut. The new package's biggest achievement was saving taxpayers $5 billion in 2023 by reducing the maximum school district M&O property tax rate by 10.7 cents per $100 valuation; it also raised the homestead exemption of taxable value for school district M&O property taxes to $100,000 and limited appraisal-value increases to 20 percent for other property. And yet, Texans’ total property taxes paid in 2023 nevertheless rose by $165.2 million over 2022, an overall increase of 0.4 percent. That net increase came from school district tax hikes to fund more debt ($890.2 million); municipal governments ($1.3 billion); county governments ($1.5 billion); and special purpose districts ($1.5 billion). These hikes effectively washed away state-level reductions. While this result is ultimately the fault of local governments, the state should have done more to provide relief and restrict localities’ spending and taxes. This growth in local property tax collections is part of a larger trend. From 1998 to 2023, Texas’s total property taxes collected rose 338 percent while the rate of population growth plus inflation was just 136 percent. No wonder so many Texans feel as though they are being crushed by housing unaffordability. How can Texas fix its spending problem? Rather than resort to temporary fixes, the state needs a robust spending cap in its constitution like Colorado’s Taxpayer’s Bill of Rights (TABOR), which limits state and local government spending increases to no more than the rate of population growth plus inflation. Though Colorado’s TABOR has been the gold standard for a state spending limit since its enactment in 1992, it can be improved. At this time, TABOR applies to Colorado’s general revenue, less than half of its total funds; it should be expanded to apply to all state funds, which would account for about two-thirds of its budget, as originally intended. Texas, or Colorado itself, could also improve the model by replacing the latter’s policy of refunding excess tax revenue to taxpayers with up-front income-tax-rate cuts. Texas enacted a statutory spending limit in 2021, but it lacks teeth, as an overriding constitutional spending limit covers just 45 percent of the budget and can be exceeded by a simple majority. In conjunction with a stronger constitutional spending limit, the Texas legislature should implement strategic budget cuts. These efforts combined with the stricter constitutional spending limit would create opportunities for surpluses at the state and local levels, which would pave the way for the state to reduce school M&O property taxes annually until they are fully eliminated. This alone would shave off nearly half of the property tax burden in Texas. Viewed from the coasts, Texas is a beacon of economic freedom. But as its spending and property tax data show, it isn’t perfect. The Texas legislature should acknowledge its failed promises and deliver real property tax relief for its citizens. Originally published at Dallas Express.

National School Choice Week was last month, a time when all states should be celebrating the educational freedom they provide to teachers, parents, and, most of all, students. Sadly, only about 20% of states have embraced universal school choice, with Texas being among the 80% failing to partake in the school choice revolution. Texas leads the nation in many respects, but our educational landscape continues to lag behind. Without universal school choice, we will continue regressing, compelling families to seek superior educational options elsewhere. The consequences of this regression are already evident, making it imperative for Texas to act. School choice through education savings accounts (ESAs) would allow families to direct their money for their children’s education to approved schooling providers. These include traditional public schools, charter schools, private schools, virtual learning, co-ops, and homeschooling. ESAs are the gold standard for school choice, and 13 states have already adopted them. ESAs put the power in the hands of parents, where it should be, by giving them the funds for education to choose which schooling best meets their kids’ unique needs. It’s essential to distinguish ESAs from controversial “vouchers,” as ESAs offer a more comprehensive range of educational choices. Rather than funding following the child from a government school to a private school with vouchers, the funding goes to the parents, who decide how to use it with ESAs. This also helps break the connection between dollars going directly to an institution where politicians and bureaucrats can regulate. Instead, ESAs give freedom for different types of schooling to compete in a market without the many rules that hamper government schools today. While there was a glimmer of hope in late 2023 for Texas to pass ESAs, the legislation, which had many problems, failed due to insufficient support from Democrats and rural Republicans. This setback carries considerable weight, particularly when other states embrace the competition and innovation accompanying universal school choice. Texas can’t afford to be left in the shadows. The consequences of our state’s hesitancy in progressing toward educational freedom are evident. According to The Heritage Foundation, between 2007 and 2022, rural Texans, a group purportedly opposed to school choice, witnessed a 20-point decline in 8th-grade math scores and a 12-point decrease in 8th-grade reading. Regarding 8th-grade reading scores across the state, we are four points below the national average. The subpar results are disturbing, with Texas spending an average of nearly $15,000 per student. Moreover, the pandemic has underscored the need for flexible and diverse learning options. Families faced unprecedented challenges during school closures, revealing the shortcomings of a one-size-fits-all educational approach that left substantial learning loss. Universal school choice can serve as a crucial buffer, ensuring students have access to adequate and adaptable learning environments, whether in-person, virtual, or a combination. The heart of the matter lies in the freedom of educational options. School choice makes diverse educational opportunities accessible to families, dismantling the notion that quality education is a privilege reserved for the affluent. Every parent deserves the freedom to choose the best path for their child’s education. As it stands, taxpayers fund schools that may not benefit their children. Redirecting these dollars back into the hands of parents creates a system where informed choices determine the efficacy of schools. This fosters competition, improving the educational landscape for teachers and students. And entrepreneurs will have many more opportunities to open new schools not available today in a market dominated by government schools and destructive regulations. Texas must also consider the long-term economic impact of educational choices. The state is cultivating a skilled and adaptable workforce by fostering an environment where students can access tailored educational experiences. This, in turn, attracts businesses and ensures the state remains competitive in an ever-evolving global economy. The Lone Star State stands at a crucial crossroads. Embracing universal school choice is not just a necessity: it is an investment in the future, unlocking the potential of our students and helping every child receive the education they deserve. The time for choice is now. Texas must lead the charge in providing its citizens with the educational freedom they need to thrive in the 21st century or risk getting left behind. Originally published at Dallas Express.

Home “owners” in Dallas and surrounding cities find themselves grappling with the weight of unaffordability as property taxes soar, increasing by $120 million despite the touted cuts at the end of 2023. A recent study reveals the burden on renters in Texas and nationwide, with many paying over 30% of their monthly income on housing. A factor contributing to this rising cost of renting, and housing in general, is soaring property taxes. The predicament stems from excessive state and local spending and purported property tax “cuts” that too often merely shift the burden through exemptions. Renters, technically anyone with a monthly payment or a mortgage since homeowners are just renting from the government, bear the brunt of this financial strain, emphasizing the urgent need for fiscal reform. Late last year, Dallas residents witnessed a modest one-cent property tax reduction rate, with surrounding cities experiencing varying degrees of reduction. Fort Worth saw a 4-cent reduction, and McKinney a 3-cent reduction. Despite these adjustments, most cities, including Dallas, faced increased property taxes eclipsed by rising spending and housing appraisals. Even in Plano, recognized for its low property taxes in the DFW area, homeowners will endure higher monthly property tax amounts due to home valuation hikes. The incongruity between property tax decreases and housing cost increases is alarming, prompting a closer look at the numbers. According to Axios, the average taxable value of homes in Denton County rose from approximately $402,000 in 2022 to around $449,000 in 2023. Similarly, the average market value of Collin County homes increased from about $513,000 in 2022 to roughly $584,000 in 2023. One doesn’t need to be a mathematician to recognize how a property tax decrease of even a few cents doesn’t begin to keep pace with skyrocketing home valuations and rent. No wonder 20% of Dallas homebuyers looked to get out of the city last year. The crux of the issue lies in reining in local spending. The axiom holds: the burden of government is not how much it taxes but how much it spends. Dallas, with its escalating budget that reached a historic high last year, renders proposed property tax cuts inconsequential. My new research released by Texans for Fiscal Responsibility highlights how property taxes continued to go up last year by $165 million, even with the Texas Legislature passing $12.7 billion in new property tax relief. This ended up being the second largest property tax relief in Texas history, not the largest as many politicians have been claiming since last July, which is what I wrote then. The best path for Texans is to finally have their right to own their prosperity instead of renting from the government by paying property taxes forever. This can be done by restraining state and local government spending and using resulting state surpluses to reduce school property tax rates until they’re zero. And by local governments, including Dallas, using their resulting surpluses to reduce their property tax rates until they’re zero. Dallas must adopt a spending limit, one that does not permit the budget to exceed the rate of population growth rate plus inflation – a measure aligned with what the average taxpayer can afford. Performance-based budgeting and independent efficiency audits, preferably conducted by private auditors, should identify opportunities for improvements and reductions in ineffective programs, helping provide more opportunities for property tax relief. Dallas leaders can empower their constituents by redirecting taxpayer money to them while funding limited government. The adoption of these strategic measures not only benefits homeowners but extends its positive impact to renters and business owners, providing tangible rewards for their hard work and fostering a more economically vibrant community. Dallas leaders are responsible for ushering in a new era of fiscal responsibility that ensures affordability for all residents and supports sustained economic growth. The path to long-lasting property tax relief is clear: let’s seize this opportunity for positive change and secure a brighter, more prosperous future for Dallas. Thank you for listening to the 45th episode of "This Week's Economy."

Today, I cover: 1) National: -DeSantis drops out of the race, and New Hampshire primary results put Trump and Haley fairly close, so what happens next? -Real GDP for Q4 2023 was up 3.3%, but the contribution of costly, unproductive government spending makes the real private GDP rate lower. -The stock market has been better under Trump than Biden through three years of their terms, but Trump can’t necessarily take the credit. Will he try? -Grocery prices have moderated but have still outpaced earnings since 2019; what does it mean to you? -Why the tax code shouldn’t serve as social engineering, but why does Congress try? 2) States: -National School Choice Week highlights which states need to provide universal education freedom. Is your state next? -My new paper with Sal Nuzzo of the James Madison Institute notes how Florida can reduce its sales tax burden, but will they do it? -State-level jobs report reveals that job growth is slow across most states, but Texas leads in job creation. How does your state do? 3) My Media Hits & Other: -My recent commentary reveals what’s really going on in the labor market. -My latest bonus LPP episode with Brad Swail of Texas Talks shares my thoughts on the economy, Texas, property taxes, immigration, and more. -Last week’s LPP episode with Matt Mitchell reveals how Estonia is freer than the U.S. -Set your alarms for Monday so you don’t miss my upcoming episode with Dr. Bruce Caldwell on Friedrich Hayek and much more. Please like this video, subscribe to the channel, share it on social media, and provide a rating and review. Also, subscribe and see show notes for this episode on Substack (www.vanceginn.substack.com) and visit my website for economic insights (www.vanceginn.com). Podcast: Is Texas Becoming Like California? TRUTH On State Spending, Property Taxes & More1/24/2024 This BONUS episode of the Let People Prosper show is with Bradley Swail, host of the Texas Talks podcast.

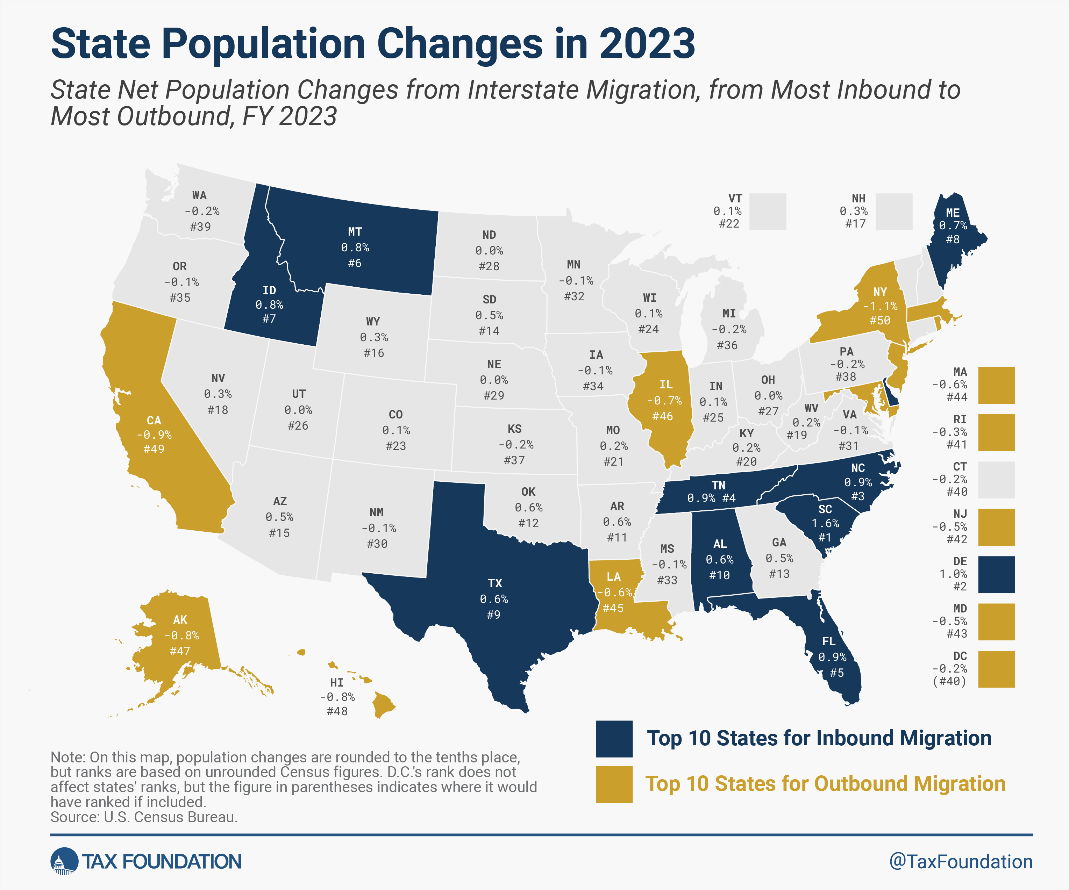

Today, we discuss: 1) Why "largest property tax relief in Texas history” became the second biggest due to excessive state spending and how the Lone Star State can eliminate the property tax for good; 2) The problem with a mandated minimum wage and reckless spending at the state and federal levels and; 3) Policies Texas leaders and lawmakers should adopt to strengthen the Texas model. Please like this video, subscribe to the channel, share it on social media, and provide a rating and review. Also, subscribe and see show notes for this episode on Substack (www.vanceginn.substack.com) and visit my website for economic insights (www.vanceginn.com). Originally published at Texans for Fiscal Responsibility. While the Texas economy continues to be one of the best in the country, the state must not rest on its laurels. This is because other states are becoming more competitive, and recent efforts by the Texas Legislature have headed Texas in a more progressive, California-style direction. But let’s see what the data tell us about the Lone Star State. 1) Texas had the 9th largest in-migration from other states in 2023.

Figure 1: Texas had the Ninth Best Percent Increase in Net Domestic Migration in 2023 Source: Tax Foundation

2) Texas’ labor market continues to improve but remains well below where it was in 1999.

3) Texas’ employment has been up for 43 of the last 44 months.

4) Texas’ workers gain jobs in most industries but some have lost purchasing power.

Figure 2. Texas’ Labor Market by Industry Source: U.S. Bureau of Labor Statistics 5) Economic growth has picked up, but personal income lags the U.S. average.

Figure 3: Real Gross Domestic Product by State in Q3:2023 Source: U.S. Bureau of Economic Analysis

Bottom Line:

These Pro-Growth Opportunities Include:

Strengthening the Texas Model will help Texans better resist D.C.’s overreach, be more competitive with other states, and, more importantly, flourish more for generations to come. Let’s start today! I cover the following in less than 12 minutes:

1) National:

In 2023, Texas led the U.S. on many fronts: job growth, economic expansion, energy production, and a record surplus of $33 billion. This was when many other states, especially California, were reporting economic challenges and deficits.

Despite Comptroller Glenn Hegar's warning to spend wisely, the 88th Texas Legislature chose out-of-control, record spending. This isn’t a record Texans wanted because it means less available money for property tax relief. Texas can reverse course to lead the U.S. in fiscal responsibility by passing sustainable budgets that result in more surplus to return to taxpayers by reducing school property tax rates until they are zero. In 2023, the Texas Legislature passed the largest spending increase in state history. The fiscal 2024-25 budget increased appropriations by 21.3% to $321 billion, or, excluding federal funds, by 31.7% in state funds to a staggering $219 billion. Even more disturbing is that currently reported amounts may increase further as some legislation passed in the special sessions increases spending. Either way, the budget growth far eclipsed the rate of population growth plus inflation, which increased by 16% over the prior two years. This rate is a good comparison because it represents the average taxpayer’s ability to pay for government spending. This record spending, along with records of over $10 billion in new corporate welfare payments even to multi-billion-dollar companies and more than $13 billion in constitutional amendments that move money outside of the state’s spending limit, sets a challenging path forward. The bloated fiscal 2024-25 budget now looms as the new baseline for lawmakers, expanding government to the chagrin of many Texans. The excessive budget increase overshadowed Gov. Greg Abbott’s historic tax relief compromise signed into law during the Legislature’s second special session. While hailed as the largest property tax cut in Texas history, it fell short. The total for new school property tax relief was $12.7 billion. It falls short of the $14.2 billion appropriated for reducing school property taxes in fiscal 2008-09 due to a Supreme Court of Texas ruling that the school finance system was unconstitutional. But when the amount is adjusted for inflation since then, the $14.2 billion would be about $21 billion. Even when factoring in the state’s contribution of $5.3 billion to maintain reductions in school property taxes in prior sessions, the $18.3 billion in combined relief remains well below the $21 billion needed to be the largest in Texas history. It should be noted that the $14.2 billion for property tax relief for fiscal 2008-09 helped cut school property taxes by just $2 billion in 2007. But then school property taxes increased by $2.3 billion in 2008, surpassing 2006 before the relief by $300 million. Total property taxes decreased by just $450 million in 2007 and then increased by $3.8 billion in 2008. While those with property received some relief in their property tax bill in 2023, especially those with a homestead exemption, the amount will not be nearly as much as some lawmakers claimed. Worse still, these savings won’t likely last as local governments continue to push to pass bonds and increase spending and taxes. The Legislature should focus this interim on doing efficiency audits across the government, much like it started with safety net programs. Finding savings across the government with so much excessive spending recently will help maintain the property tax relief passed last year; spending excesses will not lead to calls for tax increases, and resulting surpluses can put school property taxes on a fast path to zero next session. There will also be an opportunity to put the new, stronger statutory spending limit in the constitution and have this limit cover spending by local governments. There should also be a requirement that at least 90% of resulting surpluses by the state go toward reducing school property tax rates and by local governments to reduce their own property tax rates. Doing so will achieve fiscal sustainability and put all property taxes on a path to elimination. In the meantime, Texans have opportunities in the March primary and November general election to consider many candidates' policy proposals. Do candidates on the ballot support eliminating property taxes, reducing government spending, and increasing prosperity? We need more politicians pushing for these things because they benefit Texas families and entrepreneurs. Let’s not have big-government socialism creep more into Texas but turn back toward free-market capitalism that has contributed to abundance. Originally published at The Center Square. This commentary was originally published at The Center Square here.

A record number of states have passed universal school choice so far this year, but it seems Texas won’t be among them. Given the lack of universal school choice in multiple bills this year, I’m relieved it hasn’t passed in Texas yet. I’ve long been a researcher and staunch supporter of universal school choice. The way to do this is by making the eligibility and funding for education savings accounts (ESAs) available for all 6.3 million school-age students. ESAs put the power of choosing kids’ schooling in parents’ hands by picking public, private, home, co-op, micro, or other types of schooling. ESAs would be funded through the current school finance system and other general funds or new tax credits as necessary. After the Texas Legislature failed to pass a school choice bill in the regular legislative session earlier this year, Texas Gov. Greg Abbott added school choice to the third and fourth special sessions. The first two special sessions focused on property tax relief and border security. The latest $7.6 billion K-12 education-related bill supported by Gov. Abbott in the fourth special session was killed in the House. The massive education bill died after Rep. John Raney, R-College Station, introduced an amendment to remove Texas’ first ESA program from the bill. The amendment passed with 21 Republicans joining all Democrats, essentially killing the bill as it likely is stuck until the special session ends Dec. 7. Gov. Abbott asserts that he will keep fighting for school choice, with the possibility of calling more special sessions. But trying to pass universal school choice before the next regular session in 2025 would be a mistake. This progress was historic as it was the first time since 2005 that a school choice bill had passed out of the House Public Education Committee and made it to the House floor. The Senate has passed school choice bills out of its chamber many times since then, including several times this year. The latest House bill allocated $7.1 billion for additional public school funding and only $486 million for ESAs. Put another way, that’s more than $14 for public schools for every $1 for school choice, which amounts to providing an ESA of $10,700 to only 45,400 students, or just 0.7% of the 6.3 million school-age kids. Texas is long overdue to join the growing number of states that have passed it. But there’s no path to real school choice for every student in Texas now because of politics, not from a lack of support among Texans. A recent University of Houston survey found that 47% of Texans support school choice “for all parents, regardless of income,” and only 28% oppose it. The support exceeds opposition to it across all demographics, including rural areas. The politics of this is a strange bedfellows of some Republicans and all Democrats spreading fear based on teacher union claims that public schools won’t survive. But doesn’t that fear concede that those schools in a monopoly government school system can’t compete and aren’t serving families well? The best chance to pass true universal school choice, not the minimal and problematic school choice in the House’s and the Senate’s bills, is to vote out representatives who prioritize teacher unions over Texans. Then, come back to the regular session in 2025 and pass a bill that won’t let Texans continue to fall behind. This is how to help students, parents, and teachers–who would see better pay and benefits through school choice. Gov. Abbott is leading the way. He recently endorsed 58 House Republicans who voted against Raney’s amendment and made his first endorsement of a candidate running against an incumbent who voted for the amendment. Some argue that more Texas public school funding is the answer instead of school choice. But as Texas continues to increase funding for public education to record levels, a recent public school ranking shows that Texas public schools rank 13th worst of all 50 states. In another ranking, only 23% of 8th graders performed at or above the National Assessment for Educational Progress (NAEP) proficiency level on its nationally recognized exam. This means that 77% of 8th graders in Texas scored below proficiency on this national exam. Clearly, the monopoly government school system is failing students in Texas. More funds will not fix this monopoly government school system problem; only more parental freedom will. Although history was made this year, these efforts aren’t enough. Universal school choice with ESAs for every parent to choose the type of schooling for their kids must be the outcome for better student outcomes, higher teacher pay, more parental opportunities, and greater taxpayer benefits. Gov. Abbott has been pushing the correct path of universal school choice for more than a year. But given the current makeup of the Legislature, especially in the House, he should give passage of school choice a rest for now. Texans can only hope that the 2024 election will yield a new wave of politicians who reflect what they want: putting kids first. www.chronicle-tribune.com/opinion/could-social-media-regulation-stifle-our-future/article_1dd66cd8-5e61-5e04-ac82-e9c56b12d166.htmlOriginally published at the Tribune.

This is the season of controversial big-government actions by Republicans and Democrats. They too often want to direct people’s actions toward how politicians see fit, through policies dealing with industrial support, climate change, and labor markets. One concern is regulating social media. From the Supreme Court’s scrutiny of Texas and Florida’s social media laws to Utah and other states unveiling social media rules for the digital world, parental rights and capitalism are at a pivotal moment. The policy choices we are making now on these issues will impact the brightest spot in the American economy. As economist Thomas Sowell correctly noted, there are no solutions, only trade-offs. This is a reason why it is crucial for Americans to grasp the trade-offs of social media regulation before politicians and bureaucrats take action. Utah’s ”Social Media Regulation Act” serves as a cautionary tale of government overreach with severe trade-offs. While the road to online safety is paved with good intentions, as we all want the best for minors (and everyone), we must evaluate policies by their real-world results. Utah’s law mandates minors under 18 must obtain a guardian’s permission to create social media accounts. If they proceed, the guardian gains full access to the minor’s account, with default curfew settings between 10:30 p.m. and 6:30 a.m. Additionally, minors cannot receive unapproved direct messages, and their accounts are blocked from appearing in search results. While there is mixed evidence suggesting a relationship between excessive social media usage and declining mental health, a recent study from Gallup reveals that parents have an even more prominent role than social media when it comes to well-being: “The strength of the relationship between an adolescent and their parent is much more closely related to their mental health than their social media habits. When teens report having a strong, loving relationship with their parents or caretakers, their level of social media use no longer predicts mental health problems.” Even if the mental health studies are correct, Utah’s law may not help teens most in need. Implementing government regulations always comes with a cost, and in this case, the very thing this policy intends to help could be harmed as a result. Parenting could be taken from parents and given to social media companies and government bureaucrats. Another trade-off looms: Will children growing up with restricted access to social media be disadvantaged compared to their counterparts in states and countries without such restrictions? Social media plays a key role, not just socially, but also professionally. The effect of limited exposure to these platforms remains uncertain. Beyond concerns about parental rights and career challenges, bills like these can seriously disrupt free markets and the prosperity we’ve seen them bring. Instead of restrictions, states and the federal government should focus on education. Indeed, many states are considering such digital literacy laws, following in Florida’s footsteps. On the free speech side of social media regulations, the bills in Texas and Florida aimed to prevent social media companies from selectively influencing digital expression. The Texas law was challenged in court and upheld; the Florida law was challenged and struck down. Now, these laws will be considered by the Supreme Court, and the outcome will have a big impact on the social media ecosystem. Although it’s frustrating for social media companies to potentially influence users by removing, promoting, or de-ranking specific content besides pornography, they are within their rights to do so. Content moderation practices, whether strict or open, bring a great opportunity for competition. For example, platforms like Rumble emerged in response to concerns that the big social media companies were unfairly moderating their content and attracting millions of users. This exemplifies the essence of free enterprise — problems inspire innovation, and competition drives improvement, allowing for diversification. But if social media companies in these states are compelled to adhere to the restrictive regulations, it will deter new startups and stifle growth. The social media landscape is evolving rapidly, and regulations like these demand careful consideration. While the safety of minors online is paramount, for our kids and yours, it’s crucial to strike a balance that preserves parental rights, encourages innovation, protects free speech, and safeguards individual freedoms. As we navigate this digital age, let’s remember that effective solutions should empower parents, consumers, and promote competition, not hinder progress with more government. These are the things that have provided the greatest human flourishing in free-market capitalism. Today, I cover the following:

Check out the short from the episode below if you want a quick recap before watching the full episode. Texas lost jobs in October and faces major headwinds with a weak U.S. economy and a poor performance by this year’s 88th Legislature. There is a better way.

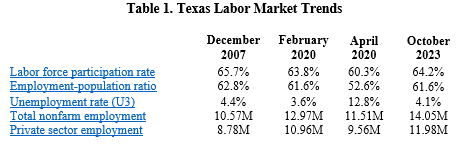

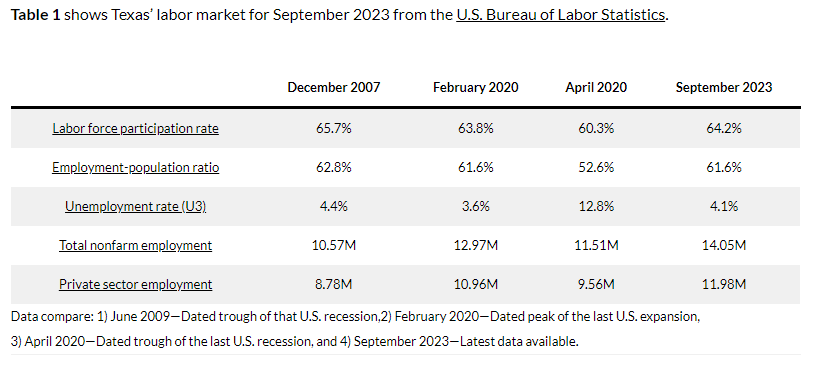

Free-market capitalism is the best path to let people prosper, as it is the best economic institution that supports jobs and entrepreneurship for more people to earn a living, gain skills, and build social capital. Table 1 shows Texas’ labor market for October 2023 from the U.S. Bureau of Labor Statistics. These data compare the following important dates: 1) June 2009—Dated trough of that U.S. recession, 2) February 2020—Dated peak of the last U.S. expansion before the COVID-19 shutdowns, 3) April 2020—Dated trough of the last U.S. recession, and 4) October 2023—Latest data available. The labor market declined last month continuing a weakening trend in Texas.

The economy continues to expand in Texas though there are headwinds.

As Texans face an affordability crisis from high inflation and high property taxes and an uncertain future with the U.S. economy likely in a deepening recession, the Legislature provided some tax relief but not nearly enough because of excessive spending.

Strengthening the Texas Model will help Texans better resist D.C.’s overreach, be more competitive with other states, and, more importantly, flourish more for generations to come. The Texas Legislature just found out it has a huge opportunity to correct its profligate spending failures made earlier this year. But instead, they’re gearing up to spend more at the expense of strapped taxpayers. This would be a fatal error for the Lone Star State.