|

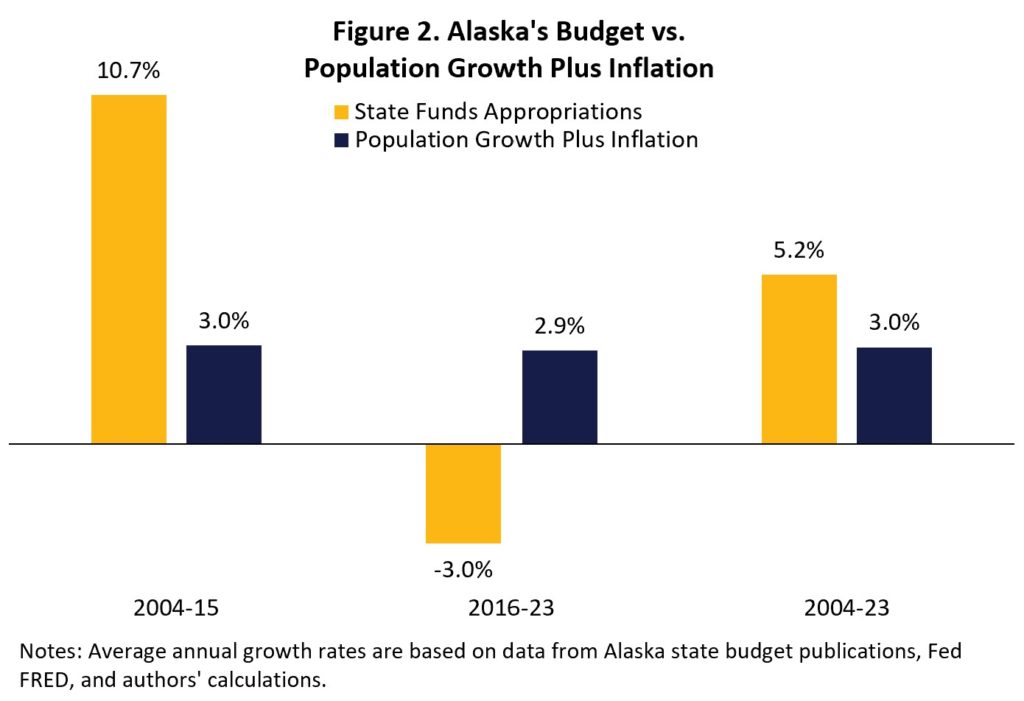

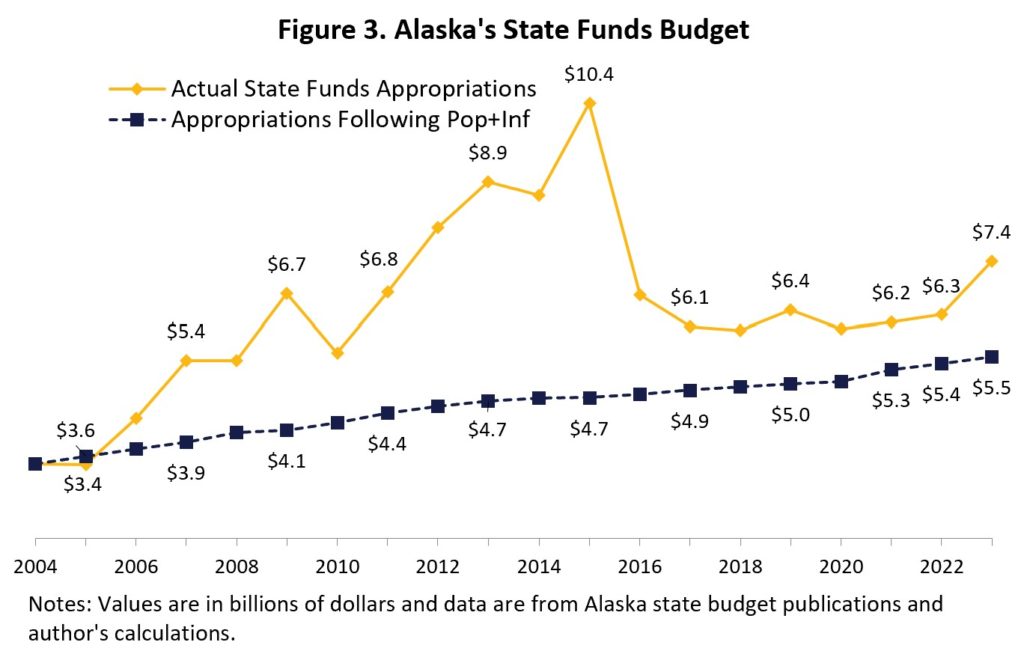

By Vance Ginn and Quinn Townsend Introduction While revenue estimates for the state of Alaska hit a record high last fiscal year, this upcoming fiscal year 2024 (July 2023 – June 2024) is another story. The Fall 2022 revenue forecast is much lower than it has been in previous years. Now more than ever, Alaskans need policymakers to show fiscal responsibility and restraint as they congregate in Juneau to discuss the next state budget. To that end, a responsible budget should not exceed $7.71 billion in state funds. Alaska Policy Forum is releasing its third annual Responsible Alaska Budget (RAB), now for FY 2024, to help effectively limit state spending and restrain the growth of government. The RAB represents a strong fiscal rule in the form of a spending limit which should be passed and added to the state’s constitution as a meaningful appropriation limit. Fiscal restraint allows the state to prioritize the needs of Alaskans without excessively growing the size of government, thus limiting the burden on the private sector where productivity advances improve opportunities for Alaskans to prosper today and for generations to come. There is a need to overcome the economic challenges the state is experiencing and the extravagant spending from 2004 to 2015 in Alaska. The RAB is an essential maximum limit for policymakers this session, and the actual budget should be well below it to help Alaskans deal with economic challenges and to correct past budgeting excesses. Responsible Alaska Budget Calculation The FY 2024 RAB sets a maximum threshold on the upcoming state appropriations based on the summed rate of the state’s resident population growth and inflation, as measured by the U.S. chained-consumer price index (CPI), over the year before the legislative session. This threshold is an upper limit for the enacted budget for all state funds, excluding federal funds, the Permanent Fund Dividend (PFD), and fund transfers. The calculation is found using the growth rate of Alaska’s resident population and adding it to the growth rate of the U.S. chained-CPI. In 2022, the U.S. chained-CPI inflation increased by 4.97%, and Alaska’s population growth declined 0.10%. The sum of these values, an increase of 4.87%, serves as the maximum growth rate for state funds appropriations in FY 2024. With a base approved state funds budget of $7.35 billion in FY 2023, Figure 1 shows that the FY 2024 RAB is a maximum of $7.71 billion. It should be noted that due to reporting consistencies, APF is now using the official budget numbers from the Office of Management and Budget rather than the Legislative Finance Division, resulting in a slightly different calculated FY 2023 RAB than what we published in 2022. And we are using chained-CPI inflation now to account for the substitution effects by consumers who choose different goods and services when there are changes in prices, which are not accounted for with just CPI inflation. The FY 2023 enacted budget was $7.35 billion — $800 million more than the published FY 2023 RAB threshold of $6.55 billion, meaning it was an irresponsible budget. This should be corrected in the FY 2024 budget. Due to higher price inflation over the past year across the country and a decrease in the state’s resident population, the FY 2024 RAB accounts for these with a ceiling growth rate of 4.87% which essentially freezes inflation-adjusted state funds appropriations per capita. In addition to high inflation, Alaskan policymakers will also be struggling with a low revenue forecast, due in part to decreased oil prices and oil production. Alaska’s Department of Revenue estimates an FY 2024 revenue of $10 billion (excluding federal funds), which does include revenue for the Permanent Fund Dividend, an appropriation we do not include in our maximum threshold calculation, as well as state restricted funds. A responsible budget passed by policymakers will take this into consideration, while not relying on the state’s savings accounts. Instead, limiting the growth of government spending to keep more money in the productive private sector will support increased opportunities for Alaskans to achieve their hopes and dreams while helping those struggling to gain the dignity of work by earning a living. Historical Budget Trends Figure 2 shows Alaska’s budget trends since FY 2004. During the period from 2004 to 2015, the average annual budget increased by almost 11%, which was nearly four times faster than the key metric of the rate of population growth plus inflation. Since then, the budget has declined annually by 3%, on average, while the rate of population growth plus inflation increased by about 3% from 2016 to 2023. This means that policymakers have done a better job budgeting in the last several years but there is more room for improvement. Additionally, these budget numbers are only the enacted budgets, not total state spending. Unfortunately, Alaska has a history of relying heavily on supplemental spending, which is above and beyond the enacted budget. From FY 2004 to FY 2023, the budget grew on an average annual basis by 5.2%, which was substantially higher than the average 3% rate of population growth plus inflation. Figure 3 illustrates state funds appropriations over this period and the appropriations that would have happened if they had followed the rate of population growth plus inflation each period. The budget growth excesses in the earlier period (2004-15) have compounded over time even with the improved budgeting since 2016 to lead a much larger budget over time. This results in state funds budgeted for FY 2023 $1.8 billion more than what would have been spent, which translates to the state spending an additional $2,500 per Alaskan. Or, if you take the cumulative differences between the actual budget and those if policymakers followed the rate of population growth plus inflation, the cumulative difference is $37.3 billion in overspending over time, which translates to excessive government spending of $50,000 per Alaskan. This excessive spending has resulted in a bloated state government that reduces private sector economic activity and opportunities for people to prosper.

Conclusion Alaska Policy Forum’s FY 2024 RAB sets a maximum budget threshold that will help bring the state budget in check with state appropriations of less than $7.71 billion, representing a 4.87% increase based on the rate of population growth plus inflation in 2022. Working to enact a budget less than this maximum amount, particularly considering the low revenue forecast, past budget excesses, and economic headwinds, will help immensely in reducing the cost of funding limited government. Policymakers should pass an FY 2024 budget that is less than the Responsible Alaska Budget and put this spending limit in the constitution. Doing so will move the Last Frontier into the future, with a strong, steady economy and a vibrant population with opportunities for all Alaskans to flourish. Originally published at Alaska Policy Forum.

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed