|

In this Let People Prosper episode, James Quintero, Chance Weldon and I discuss the Conservative Texas Budget related to SB 500; Teacher Retirement System (TRS) of Texas related to SB 12; superintendent pay reform in HB 880; local debt issues in HB 440, HB 477, and SB 30; and a legal case regarding child safety.

#letpeopleprosper

0 Comments

In this Let People Prosper episode, James Quintero, Dr. Derek Cohen, and I discuss key bills regarding local liberty issues related to debt transparency (HB 440 & HB 477), criminal justice reform efforts, property taxes (HB 2, HB 705, HB 648), and teacher pay/retirement (SB 3/SB 393).

#LetPeopleProsper In this Let People Prosper episode, James Quintero, Dr. Derek Cohen, and I discuss the following:

In this Let People Prosper episode, I am interviewed by Liz Wheeler on her show the Tipping Point on One America News.

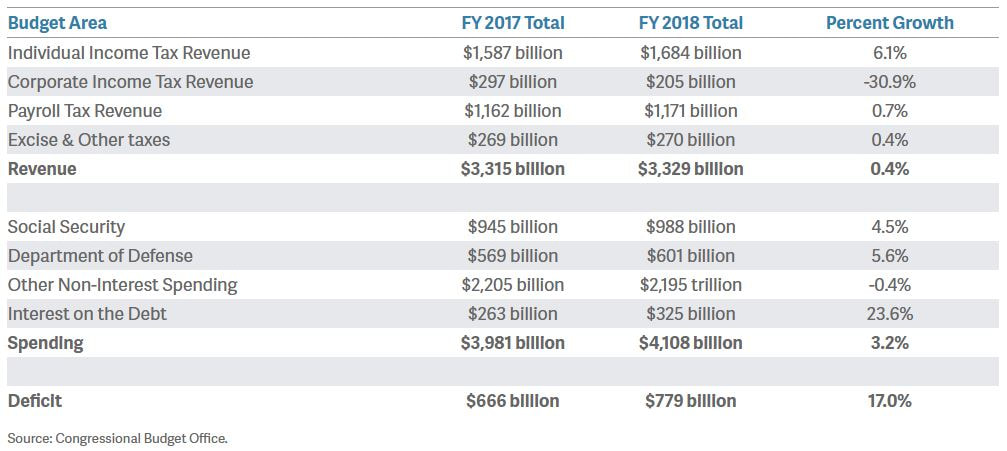

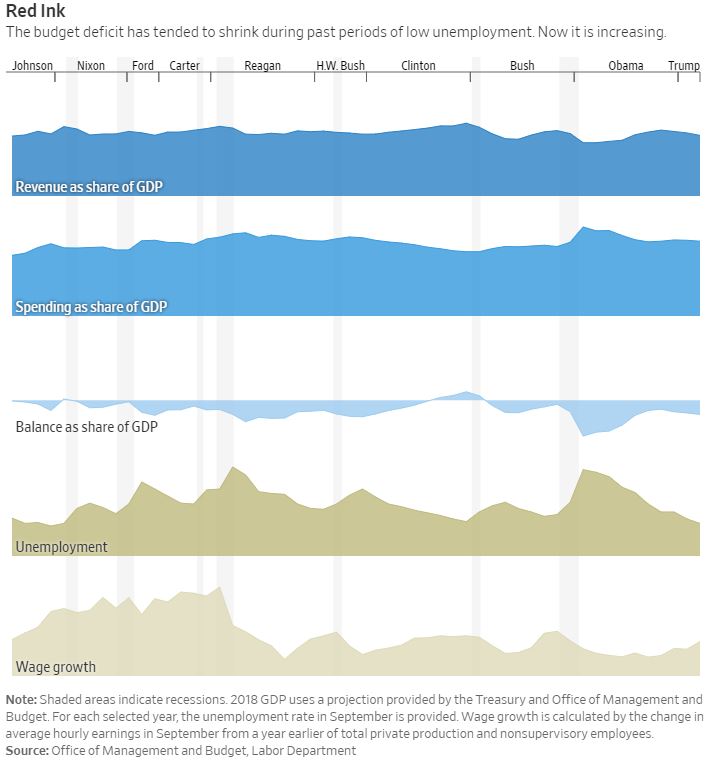

We discuss the high cost of deficits and debt and the need for government spending relief along with the latest farm bill which continues the expansion of welfare. In this Let People Prosper episode, let's discuss the report released by the U.S. Treasury today that notes the federal budget deficit was $779 billion, an increase of 17%, in fiscal year 2018. Again, the evidence shows that government doesn't have a revenue problem but rather a spending problem.

The largest increase in expenditures was in interest paid on the debt that increased by 23.6% to $325 billion, which is about half of what our taxpayer dollars are used to fund national defense, about one-third of what we pay for Social Security, and about 8% of total federal expenditures. A problem is that interest on the debt will continue to increase at a rapid pace because the national debt looks to continue to grow and the Federal Reserve is expected to raise their targeted federal funds rate, which is currently 2-2.25%. Each dollar spent by the government is funded by either taxes, debt, or inflation. Each of these drain resources from the productive private sector. In other words, each dollar crowds out our ability to satisfy our desires and prosper. So, we must be able to prove without doubt that each dollar is spent more effectively by politicians than by individuals in the private sector. Sure, there are roles for government, but, in my view, the federal government should have three main functions: national defense, justice system, and very few public goods. The total of national defense is just above $600 billion per year, so assuming the rest may run $400 billion per year, that $1 trillion federal budget would be only 25% of the $4.1 trillion spent today. Given a $1 trillion federal budget, the budget surplus would be $2.3 trillion, allowing for substantially lower taxes at every level--preferably one flat rate on final consumption. You'll also notice that tax collections did increase even after the large Trump tax cuts indicating that the robust growth of a dynamic economy supported more revenue, even if it was less than what it could have been otherwise. Moreover, higher tax revenue negates some of the noise by the Congressional Budget Office of a $1.5 trillion deficit over a decade based on a static economic model, but we don't live in a static world and the data today are another revelation of that fact. When we consider these details, the crowd out effect of government spending and interest on the $21.5 trillion debt, which is greater than our country's entire economic output of $20 trillion, is a huge cost to the prosperity of our nation that we must get control over before it's too late. But the cost is even greater than that because the $20 trillion GDP includes government spending, which is about 20% of GDP. If you exclude government spending, which there is good reason because it's a transfer of funds from the private sector, then the national debt would be $21.5 trillion/$16 trillion, or 134%! That's what we are looking at trying to pay back over time and is currently more than $65,000 per American. As Reinhart and Rogoff wrote in their book This Time Is Different, there's likely a threshold when the debt-to-GDP ratio gets too high such that it hinders economic growth. I don't think that threshold is very high and that we are far above it, and moving further above it quickly unless things change. We are seeing the benefits of the tax and regulatory reforms along with the benefits of a long--though relatively weak before recently--expansion, but these benefits will quickly expire if government spending is not restrained, trade barriers continue to be imposed, and the national debt continues to rise. The best path to let people prosper is by getting rid of government barriers to opportunity, so we must reduce government spending. President Trump’s Council of Economic Advisors recently released a reportshowing that there is a large portion of non-disabled, working-age adults (16 to 64 years old) who are receiving government non-cash welfare payments funded by taxpayers but aren’t working. For example, of those on Medicaid, 53 percent of non-disabled, working-age adults don’t have a job.

These perverse incentives created by relaxed work requirements for able-bodied workers who receive welfare payments not only hurts their financial prospects today and over time, but is an extractive institution hurting civil society. Institutions are the framework that makes up society. They are the rules of the game. Institutions can include formal laws and rules, but also more informal social norms, families, and churches. Institutions can be considered inclusive, like capitalism, or extractive, like socialism, as noted by Acemoglu and Robinson. Economist Douglass North remarked in his 1993 Nobel Prize in Economics lecture that “if the institutional framework rewards productive activities then organizations—firms—will come into existence to engage in productive activities.” On the opposite side, if institutions reward unproductive behavior, the result will be more unproductive behavior and increased poverty. Unfortunately, the institutional framework in the U.S. has many extractive programs in our welfare system that have incentivized unproductive behavior and made many people poor in the process. As another example of a costly welfare program, the Supplemental Nutrition Assistance Program (SNAP) provides assistance to more than 10 million non-working, non-disabled working-age adults. Of all the childless adult recipients on SNAP, 63 percent do not work, which is higher than the rate of recipients with infants (57 percent)—often the most difficult age to raise a child. Clearly, the incentives to work while getting welfare are little to none, even when you are able to work and don’t have a child. Welfare should be based on need, and with the unemployment rate at record lows and more job openings than people unemployed, there are few excuses to not work. Work ethic, personal responsibility, and independence are all informal institutions. They are the rules of our game. These institutions are inclusive, because they allow individuals to be self-sufficient, and become productive members of civil society. When these incentives and social norms are eroded, our institutions become extractive, redistributing resources from productive workers to welfare recipients. This process is done by government bureaucrats subjectively determining who gets what and when. Moreover, these institutions create a situation that crowds out inclusive social institutions, such as families and private charities and churches, which have been the backbone of civil society for centuries. Our current welfare system, specifically the Temporary Assistance for Needy Families (TANF), has been reformed before, making it more inclusive. This includes putting the recipients on a path to individual responsibility and prosperity by increasing work requirements to receive welfare, thereby increasing recipients’ productivity that helps them actually get off government welfare. Chicago economist Casey Mulligan has explained that the income cliff when someone earns more income and is dropped from government welfare programs acts like an implicit marginal income tax that reduces their incentive to work. It’s time to stop this sort of welfare for non-disabled working age adults. This would not only improve the relatively low but improving employment-to-population ratio for the prime age working group(25 to 54 years old) but also help to reduce welfare and the taxes paid by workers to fund these programs. The Trump administration’s recent report highlighting these issues and calling for an increase in work requirements of welfare programs for able-bodied people is a step in the right direction to let people prosper. www.texaspolicy.com/blog/detail/government-welfare-keeps-people-from-flourishing BY VANCE GINN AND DREW WHITE, OPINION CONTRIBUTORS

Original can be found at The Hill The good news keeps coming. Since the passage of the Tax Cuts and Jobs Act, announcements about increased investment in the U.S. and various companies offering employees bonuses haven’t stopped. The vast majority of Americans will prosper from the Tax Cuts and Jobs Act. As an economist and policy analyst, we’ve been skeptical of the Trump administration’s direction on some issues, like NAFTA renegotiations, but we’re encouraged by the results of regulatory and tax reforms because they let people prosper, the flipside of what’s been stifling us. This first major rewrite of the federal tax code in a generation is a historic moment for our republic. The institutional framework that stifled Americans can again work for We the People instead of for bloated governments. We admit that the bill isn’t perfect and encourage Congress to follow this massive $5.5 trillion gross tax cut with spending restraint. That’s especially important because without spending reductions roughly $500 billion could be added to the national debt in the next decade. Also, doing so will help keep the roughly $112 trillion in federal IOUs from requiring government to further infiltrate our lives. We’ve experienced government’s overreach during the worst recovery since WWII of about two percent annual growth while the national debt almost doubled under the Obama administration’s high tax and spend policies. This reshaping of institutions increased barriers to prosperity through excessive regulations, like ObamaCare, and higher taxes that redistributed resources among people. America voted for a new institutional direction in 2016. Regarding regulations, the Trump administration has already repealed 67 of them while creating only three. Entrepreneurs can now budget lower costs longer which contributes to more investments in workers and capital. The result is faster economic growth with a three percent average annualized growth the last three quarters of 2017 matching GDP’s long-term average, which has lifted consumer sentiment. The tax bill’s most sweeping changes include cutting the corporate tax rate and individual income tax rates for most Americans. Sixty percent of the gross tax cuts go to families while the rest goes to businesses. As expected, critics claim these changes benefit the rich. Interestingly, the corporate tax rate cut once had bipartisan support, as President Obama proposed cutting it to 28 percent, and progressives passed and extended much of President Bush’s personal income tax cuts. Regardless, permanently cutting the corporate tax rate from 35 percent, the highest in the developed world, to 21 percent, slightly below the worldwide average, drastically improves employment prospects. Often missed in the discussion is that corporations simply submit taxes to the government because people pay them through higher prices, lower wages, and fewer jobs available. Cutting the corporate tax rate means corporations can pass those savings along to people. Businesses are reporting they will pay bonuses and higher wages, immediate pay increases to let people freely prosper. On the individual income tax side, most taxpayers will pay less tax until at least 2026. According to good tax policy, the tax bill doesn’t flatten as it leaves seven income tax brackets, but it broadens the base by eliminating many exemptions and deductions and simplifies the code by doubling the standard deduction. Critics claim that these changes could increase income inequality. But history shows that the tax code is not the place to deal with supposed income inequality as it fluctuates whether taxes are high or low. By changing the institutional incentives through this tax bill, more people can move up the income ladder. But, do only the rich get a tax cut? No. The Tax Foundation calculated the changes in tax liability for multiple households and found that each of them would pay less tax. An individual earning $30,000 with no kids could pay $379 less in taxes. An individual earning $50,000 with two kids could pay $1,892 less in taxes. A married couple filing jointly earning $165,000 with two kids could pay $2,224 less in taxes. And a married couple filing jointly earning $2 million could pay $18,904 less in taxes. All income groups receive a tax cut. Higher income people pay fewer dollars than those with lower income, but that’s because they pay more in income taxes. For example, the top 10 percent of income earners pay 70 percent of federal income taxes collected. However, the share of income taxes paid could become more progressive under these tax changes. It’s not just more money in people’s pocket, but doubling the standard deduction lets many people spend less time on their taxes and more time with their families. This is great news for working Americans. Icing on the cake would be for Congress to restrain government spending, the ultimate burden of government. Bipartisan welfare reform in the 1990s helped cut spending but more importantly improved the lives of many Americans as they returned to work or received better assistance. The amount of waste, fraud, and abuse in these programs along with too many dollars to bureaucracy and not to people make welfare a good place to start. Reforms to the major drivers of Medicaid, Medicare, and Social Security must be on the table to restrain spending growth while improving them for the truly needy. Until then, let’s celebrate the Trump administration’s new institutional direction that has long supported prosperity. Skepticism is healthy to provide proper checks and balances on government. But when pro-growth policies like regulatory and tax reforms improve human flourishing, we’re much more optimistic about the future. Vance Ginn, Ph.D., is director of the Center for Economic Prosperity and senior economist and Drew White is senior federal policy analyst, both at the nonprofit Texas Public Policy Foundation. This commentary was originally featured in The Hill on August 24, 2017.

The discussion of raising the debt ceiling before the federal government potentially defaults on September 29 is an excellent opportunity for Congress to demand tax cuts and restraining government spending for pro-growth budget neutrality. Budget neutrality would allow increased economic activity from restraining government while allocating more tax revenue from that growth to pay down expected ballooning deficits. This would help move the country past President Obama’s government-centered policies such as the ironically named “stimulus” plan, ObamaCare, Dodd-Frank, and the numerous lesser known regulations and programs. The result of this approach, along with unconventional monetary policy, was the slowest economic recovery since WWII and a doubling of the national debt to a level exceeding annual U.S. economic output. Instead, Congress can and should pursue a limited government approach that’s repeatedly helped achieve more economic prosperity in Texas and other places that have practiced it. A good start was Congress recently putting to rest the misguided border adjustment tax (BAT). While advocated as a way to maintain tax revenue neutrality when lowering the industrialized world’s highest corporate income tax, the argument assumed an economically questionable strengthening of the dollar value to mitigate higher costs of goods and services paid by Americans. For example, the Texas Public Policy Foundation and R Street Institute published a study highlighting how the BAT could substantially raise property-casualty insurance premiums from the effects on the international reinsurance market. With mounting opposition to the BAT, Congress rightfully dismissed this bad idea that would have grown government. There are, however, some very good ideas available that depend on restraining government spending to provide relief from onerous regulations and burdensome taxes. On the regulatory front, the Heritage Foundation noted that from 2009 to 2015 more than 20,000 new rules resulted in a net burden on businesses and individuals of approximately $108 billion. Fortunately, the Trump administration has begun dismantling onerous regulations by a pace of 16 regulation rollbacks for each new regulation. With many costly regulations and mounting expenditures with ObamaCare, Congress should fully repeal it. This would not only set the stage for a market-based, patient-centered healthcare system that would provide better care, but it would also help bend the cost-curve of a major driver of excessive government spending. Until Congress demonstrates the fortitude to overcome the obstacles to accomplish this, it should move to restraining government by providing tax relief and cutting spending elsewhere. The Texas model of low taxes, relatively less government spending, and sensible regulations provides a good guide. During the last two legislative sessions, there’s been a push to pass a “Conservative Texas Budget,” whereby spending growth increases by no more than state population growth plus general price inflation. Fortunately, the state legislature has taken steps to passing two such budgets in a row. These allowed for $4 billion in tax and fee relief in the 2015 session and budget growth of less than 4.5 percent during the upcoming 2018-19 period. Texans are rewarded for this fiscal conservatism. Texas has created almost 30 percent of the increase in U.S. employment since the start of the Great Recession, stayed below a five percent unemployment rate for three straight years, and had lower supplemental poverty and less economic inequality than comparable states — California, New York, and Florida. Moreover, Texas was the top state for net domestic migration from 2010 to 2016 and has led the nation in exports for 15 straight years. The Texas model of limited government has been tried and tested, and similar pro-growth fiscal policies should be implemented at the federal level. As a first step, Congress should work toward budget neutrality, whereby a dollar of a tax cut will be much more effective if it’s met with a dollar cut to spending. This approach helps to minimize any influence a tax cut might have in contributing to the growth of projected deficits and likely reduce current deficits over time due to continued spending restraint. As the all too familiar practice of raising the debt ceiling nears, Congress has the opportunity to look to the Texas model as it focuses on reforming the institutional framework of the federal government. By fully repealing ObamaCare, simplifying the tax code, broadening the tax base, lowering tax rates, and continuing to cut excessive regulations, America can again be the beacon of fast-growing prosperity for the world. https://www.texaspolicy.com/blog/detail/congress-should-follow-the-texas-model-when-it-comes-to-government-spending Here are my thoughts on the border adjustment and federal tax reform in general as they could influence the U.S. economy, especially Texas.

I disagree with some of the analysis and findings by Kotlikoff (see full article below), whom is a highly respected economist regarding life cycle economic modeling and analysis, but he tends to be Keynesian in his approach, as you can see throughout his piece. Much of what he states about the border adjustment, also known as the border adjustment tax (BAT) though it is not technically a tax, is reflected in the Tax Foundation’s (TF) talking points. TF claims that the border adjustment will be more efficient than our current corporate income tax system by leveling the playing field for goods that are consumed in the U.S. Moreover, TF argues that it is not a tax but rather a “border adjustment” of the current corporate income tax such that corporations report consumption of their imported goods as income since it is consumed here instead of exports that are consumed elsewhere. TF and Kotlikoff also put a lot of emphasis on the far-reaching assumption that the dollar value will adjust accordingly to not make the border adjustment cause increases in consumer and producer prices. While theoretically TF is correct on several points, the BAT argument fails on at least the following levels:

Tax revenue neutrality is a failed argument that has been tried multiple times (e.g., Kennedy-Johnson tax cuts, Reagan tax cuts, Bush tax cuts); tax reform should focus on budget neutrality such that the economic drain of a rising $20 trillion in federal debt is plugged as soon as possible. The vision, like in Texas, should be to not tax businesses that simply submit taxes to the government while people pay the actual cost through the form of higher prices, lower wages, and fewer jobs available. In economic terms, the tax incidence is ultimately on people. Ending the corporate income tax would eliminate whether we are taxing income based on imports or exports, removing the concern over the border adjustment. Considering we are unlikely to eliminate federal taxes on businesses today, reducing the corporate tax rate to as low as possible while not changing the tax base, thereby distorting the marketplace more than it should, balancing the budget should be based on economic growth and slowing and cutting government spending so budget neutrality is achieved. There’s no need to add a “new tax,” though it’s not technically a new tax, in the form of the border adjustment. The Texas Public Policy Foundation (TPPF) recently commissioned a study with the R Street Institute that highlights the cost increase of $3.4 billion in Texas' property-casualty insurance premiums over the next decade from the border adjustment, which is just a small portion of the potential costs to Texas and other states. TPPF's research also shows that taxes on income and higher taxes in general are detrimental to economic activity among states; therefore, shrinking the size and scope of government by cutting government spending is the best path toward prosperity, not providing revenue neutrality with a new border adjustment. Fortunately, President Trump’s announced tax plan does not include the BAT. While I have concerns about the contribution of Trump’s tax plan to the already estimated increases in the national debt from current policy, economic growth will reduce some of the static analysis revenue losses. Considering that neither President Trump's nor the GOP tax plan will pay for itself, as some economists suggest, the focus must be on budget neutrality as Congress cuts and restrains government spending. At this point, I prefer the Trump tax plan and think it would best reduce tax burdens to allow more incentives by entrepreneurs to produce—the driver of economic activity. However, this is an opportunity to highlight that there shouldn’t be taxes on businesses, like TPPF argues to eliminate Texas' business franchise tax, and that the federal government should continue to simplify the tax code to provide more efficiency in the code by moving to a flat tax, which I prefer a flat consumption tax, and subsequent increased economic activity. This is also an opportunity for the U.S. to increase its economic competitiveness through tax reform to counter the unfortunate protectionist arguments in D.C. that could lead to potentially worse negotiated trade deals and fewer beneficial trade agreements, which is very disconcerting. Below are two recent WSJ articles that provides different views on this issue. I hope the debate will continue so that the appropriate institutional framework for fiscal policy will prevail. In general, this framework should be based on the core principles of taxation, which includes simplicity, efficiency, and competitiveness. By following these principles and focusing on budget neutrality without shifting to a new tax base, the U.S. can be more prosperous and Texans will benefit in the process. __________________________________ On Tax Reform, Ryan Knows Better The House proposal beats Trump’s plan, which is more regressive and would induce huge tax avoidance. By Laurence Kotlikoff May 11, 2017 6:58 p.m. ET 172 COMMENTS As Republicans push toward a major rewrite of the U.S. tax code, they must evaluate two competing proposals: the House GOP’s “Better Way” plan and President Trump’s framework, introduced last month. Either would greatly simplify personal and business taxation, but pro-growth reformers should hope that the final package looks more like the House’s proposal. Let’s begin the analysis with personal taxes. Both plans eliminate the alternative minimum tax, deductions for state and local taxes, and the estate tax. The House plan eliminates exemptions, while Mr. Trump’s outline is unclear. Both raise the standard deduction, reduce the number of income-tax brackets, lower the top marginal tax rate, and provide a big break to those with pass-through business income. On this last point the Trump plan is particularly generous. It taxes pass-through income at 15%—far below its proposed top rate of 35% for regular income. The large gap between these rates would induce massive tax avoidance by the rich. The Better Way’s proposed rates are much closer: 25% and 33%, respectively. Another criterion to judge tax reform is its effect on the budget. Absent any economic response, the Better Way proposal would lower federal tax revenue by $212 billion a year, according to a recent study I conducted with Alan Auerbach, an economist at Berkeley. But some economic response is likely. The House plan would cut the U.S. corporate tax rate from one of the highest among developed countries to one of the lowest. Computer simulations—which will be included in a forthcoming journal article I am writing with Seth Benzell and Guillermo Lagarda —suggest that increased dynamism could raise U.S. wages and output by up to 8%. Under this optimistic scenario, federal tax revenue would rise by $38 billion a year. We are in the process of simulating the Trump plan, and it is too early to say whether it produces less revenue. The plan’s potential for tax avoidance, however, is a major red flag. Which plan is more regressive? Both personal tax reforms appear to help the rich. But the Better Way’s business tax reform actually appears highly progressive. Despite the popular perception that the corporate income tax is paid by the rich, my research suggests it represents a hidden levy on workers. This causes American companies and capital to flee the country, reducing demand for U.S. workers, whose wages consequently shrink. The Better Way plan transforms the corporate income tax into something different: a business cash-flow tax with a border adjustment. Notwithstanding innumerable mischaracterizations by the press, politicians and business leaders, the cash-flow tax implements a standard value-added tax, plus a subsidy to wages. Every developed country has a VAT, which is an indirect way to tax consumption. All of these levies have border adjustments, which ensure that domestic consumption by domestic residents is taxed whether the goods in question are produced at home or imported. Unlike the Better Way, Mr. Trump’s plan does not include a border adjustment, which means it effectively taxes exports and subsidizes imports. This undermines his goal of reducing the U.S. trade deficit. Where is the progressive element to the cash-flow tax? It’s in the subsidy to wages, which insulates workers from the brunt of the VAT. They will pay VAT consumption taxes when they spend their paychecks, but they also will have higher wages thanks to the subsidy. The folks who truly pay the cash-flow tax are the rich, because they pay the VAT when they spend wealth that was earned years or decades ago. As my study with Mr. Auerbach shows, this quiet but large wealth tax makes the overall House plan almost as “fair” as the current system. Our analysis—in contrast with studies done by congressional agencies and D.C. think tanks—assesses progressivity based on what people of given ages and economic means get to spend over the rest of their lives. Consider the present value of remaining lifetime spending for 40-year-olds. The richest quintile of this cohort accounts for 51% of the group’s spending, and the poorest quintile for 6.3%. Under the House tax plan, those figures move only modestly, to 51.6% and 6.2%. And the Trump plan? Hard to say, given how easily the rich could transform otherwise high-tax wage income into low-taxed pass-through business income. The Trump tax plan strikes out on all counts. Whoever knew tax reform could be this complicated? We specialists in public finance did. The bottom line is that the U.S. needs more revenue and less spending to close the long-term fiscal gap. The nation’s true debt—the present value of all projected spending, including the cost of servicing the $20 trillion in official debt, minus the present value of all current taxes—has been estimated by Alan Auerbach and Brookings’s William Gale to be as high as $206 trillion. The Better Way plan moves in the right direction, but if the economy doesn’t respond as hoped, there’s a risk of larger deficits. One way to prevent that would be to eliminate the ceiling on earnings subject to the Social Security payroll tax. That could add $300 billion to the Treasury each year, according to our calculations. But even without that adjustment, the House plan seems far superior to both the current system and the Trump plan. The press, politicians, and business leaders should get things straight, including this key point: The Better Way tax plan is indeed a better way. Mr. Kotlikoff, an economist at Boston University, is director of the Fiscal Analysis Center. ______________________________ Economists Say President Donald Trump’s Agenda Would Boost Growth — a Little The WSJ’s monthly survey of economists gauges the impact of a fully implemented Trump plan By Josh Zumbrun Updated May 11, 2017 10:34 a.m. ET 17 COMMENTS One of the most-watched economic forecasts in Washington will come later this month when the White House releases its budget. Here is what it would look like if done by economists surveyed by The Wall Street Journal. Over the course of the next decade, the estimated cost of many items on President Donald Trump’s wish list will depend critically on his own team’s projections for economic growth, unemployment and interest rates. Per the longstanding custom, however, the White House budget differs from most economic forecasts in one crucial way. Most forecasters estimate the path for the economy they believe is most likely, taking into account that many political promises will never come to fruition. But White House forecasts are an estimate of what the economy would be like if the president’s full agenda were implemented. To establish a baseline of what a reasonable forecast might look like under Mr. Trump, respondents to The Wall Street Journal’s monthly survey of forecasters provided their own estimates of the economy if all of Mr. Trump’s initiatives were enacted. If the president’s agenda were enacted, forecasters on average think long-run gross domestic product growth could rise to 2.3%, an 0.3 percentage point increase from their 2% baseline. Unemployment would average 4.4% under this scenario, instead of 4.5%. Interest rates set by the Federal Reserve would be about a quarter-point higher. Short-term rates would be about 3.1%. So an improvement, but a modest one. Early on, White House officials have reportedly considered penciling in growth rates as high as 3.2% a year. But the respondents to the Journal’s survey—a mix of academic, financial and business economists who regularly produce professional forecasts—say numbers so high will be hard to attain, because the policies under consideration just might not pack that punch. Key Trump initiatives, which face a challenging road through Congress, include overhauling the health-care system, simplifying the corporate tax code, cutting income taxes, rewriting regulation and investing in the nation’s infrastructure. “If you were to assume that such initiatives get passed later this year, there should be positive economic benefits, especially for 2018,” said Chad Moutray, chief economist of the National Association of Manufacturers. Over the course of a decade, 3.2% growth would leave the economy nearly $2 trillion larger than 2.3% growth. So the lower estimates of economists are significant. “Fewer regulations may raise long-term growth 0.1% to 0.2% by stimulating productivity growth,” said Nariman Behravesh of IHS Markit Economics. “It should have hardly any effect on the long-term unemployment rate and inflation rates.” It is “hard to quantify, but measures would not boost long-term productivity,” said Ian Shepherdson of Pantheon Macroeconomics. “But they probably would push up both short and long-term interest rates.” The White House always has some incentive to put forth overly optimistic numbers. For one thing, the White House staff generally believe in the wisdom and benefits of the president’s agenda. And if growth rates are boosted and unemployment comes down, it does wonders for budget projections. Tax revenue climbs and spending on programs such as unemployment or Medicaid may dwindle. In recent months, economists’ forecasts for the coming year haven’t changed much. They expect growth for this year of 2.2%, down from 2.4% in the March survey. They place the odds of recession in the next year at just 15%, compared with 20% at this time a year ago. For now, many are waiting to see more detail in Mr. Trump’s agenda and retain doubts about how much he will be able to accomplish. “Infrastructure spending is great, but it has to be paid for and that creates drag at some point,” said Amy Crews Cutts, the chief economist of Equifax. “The proposed tax breaks won’t stimulate the economy nearly enough to pay for themselves let alone fund other new initiatives, which leads to deep cuts in the long run." The survey of 59 economists was conducted from May 5 to May 9. Not every economist answered every question. Texas performs relatively well in measures of financial stability by ranking 16th nationwide in fiscal health and 2nd lowest in state debt per capita among the top 10 most populous states. These rankings along with historically high growth rates in economic output and population (see Chart 1) indicate that Texas has remained steadfast in having sound fiscal management.

However, a recent TPPF paper shows that there are increasingly troubling signs of fragility in the state’s fiscal position. These signs of a rising burden of state liabilities (i.e., state debt and public pensions) could cost taxpayers billions of dollars without key reforms. State debt outstanding, which is just the principal, amounted to $49.8 billion at the end of fiscal year (FY) 2016. While this amount is small compared with the $1.7 trillion economy, it has increased by 52.7 percent per capita since FY 2006 and is up to $1,790 owed per every man, woman, and child in Texas. Debt outstanding tells only part of the story because the interest owed on this debt is also a taxpayer expense. Total debt service outstanding, which includes the principal and interest owed, is $80.8 billion, meaning every Texan owes roughly $3,000! If these trends continue, they could jeopardize Texas’ AAA credit ratings by all three major credit rating agencies and raise the debt burden on taxpayers. To reduce this concern, we recommend increasing debt transparency by requiring the following information on ballot propositions for voter approval of issuances of GO state debt: total debt service required to pay the proposed debt on time and in full and an estimate of the proposed debt’s influence on the average taxpayer’s taxes, as recommended for local debt. Although state debt is a problem that must be addressed, the elephant in the room is state pensions. Chart 2 shows the two largest state pension systems, Employees Retirement System (ERS) and Teachers Retirement System (TRS), with their estimated 8 percent annual return and the eight state debts with the highest computed compounded annual growth rates. Volatile annual rates of return and fewer contributors paying for more beneficiaries are exhausting these defined-benefit (DB) plans. Assuming a less risky average 15-year Treasury rate of 2.3 percent compared with today’s 8 percent assumed return rate, Williams et al. estimate that unfunded liabilities for all of Texas’ state pensions of $360 billion ranks 3rd highest nationwide and of $13,120 per person ranks 14th lowest. To alleviate this mounting state pension issue, we recommend changing these pension systems from DB plans to defined-contribution (DC) plans, whereby payments would be based on employee contributions and a defined government match with little to no transaction cost and the benefit of sustainability without higher taxes. Finally, given the low computed compounded growth rates of state debt in Chart 2, we recommend that surpluses of state revenue be used to cut taxes before paying down state liabilities. This could be done by creating a budget-cutting tool called the Sales Tax Reduction (STaR) Fund or eliminating the state’s business margins tax. These tax cuts would help avoid leaving revenue unchanged for future spending. Implementing ballot box transparency for state debt, converting public pensions to defined-contribution plans, and prioritizing state surpluses to cut taxes will help lower the burden of state liabilities on taxpayers. www.texaspolicy.com/blog/detail/fragility-of-texas-state-debt-and-public-pensions Overview: Texas has a proven record of financial stability. Ranking 16th nationwide in fiscal health, 7th in lowest state debt per capita, and with historically high population growth rates accompanied by economic growth, these factors have kept Texas steadfast even during times of economic uncertainty. Relatively sound fiscal management has provided Texans a certain level of comfort, but increasingly evident signs of vulnerability are raising concerns about the state’s financial health.

http://www.texaspolicy.com/content/detail/reducing-the-burden-of-texas-state-liabilities-on-current-and-future-generations  This commentary originally appeared in Forbes on May 2, 2016. Are American governments making promises that American taxpayers can’t keep? The answer may well be “yes” when it comes to public pensions. Unfunded pension liabilities, or the difference between what’s been promised to future retirees and what’s actually on hand to provide for those benefits, have grown to absolutely epic proportions. This raises serious concerns about the sustainability of America’s retirement systems and its ability to make good on the promises made. Last month, Moody’s Investor Services, one of the nation’s top credit rating agencies, estimated that federal unfunded pension liabilities (including civilian and military obligations) had risen to $3.5 trillion, or about 20% of GDP. In addition, Moody’s pegged state and local governments’ unfunded liabilities at roughly the same amount, bringing the total U.S. pension shortfall to 40% of GDP. Making matters even worse, total U.S. unfunded liabilities that includes Social Security, Medicare and other debts top $100 trillion, according to the website usdebtclock.org. Regardless, there’s an ocean of retirement-related red ink that, at some point, will have to be mopped up either through massive future tax increases, a substantial reduction in benefits, or some costly combination of the two. Part of the reason that things have gotten so far out of hand is government’s penchant for hiding the ball. U.S. Congressman Devin Nunes echoed this frustration when he said: “It has been clear for years that many cities and states are critically underfunding their pension programmes and hiding the fiscal holes with accounting tricks.” Nunes filed legislation recently to help get a handle on the issue. In Texas, the problems with public pensions are less pronounced but still serious. The latest figures from the Pension Review Board (PRB), the state agency charged with overseeing Texas’ state and local retirement systems, show that among the 93 systems monitored by the agency, unfunded liabilities topped $60 billion as of February 2016. That’s a spike in pension debt of $2.7 billion since June 2015 and an increase of $7.7 billion compared with two years ago. Digging further into the data reveals that the funded ratio—a measure of a plan’s current assets as a share of its liabilities—averaged 80% across all plans. It’s generally held that a funded ratio of 80% or more signifies a firm financial footing, something that Texas’ systems are right on the brink of surpassing. Looking at these plans’ amortization periods also hints at trouble. The PRB’s guidelines for actuarial soundness recommend that a plan’s amortization period ideally range between 15 and 25 years. However, 56 of the 93 plans exceeded that target as of February 2016. Over a longer time horizon, it’s evident that fewer plans are able to achieve the recommended amortization period. A 2014 PRB report compares the financials of Texas’ 93 monitored plans in 2000 and 2013. The report finds that in 2000 roughly 46%, or 43 of the 93 plans, had amortization periods at or above 25 years. By 2013, however, that figure had grown to 65%, or 60 of the 93 plans. On a more local level, the city of Houston—which is the largest city in Texas and the fourth biggest in the nation—is seeing its finances wrecked because of public pension problems. Its three major municipal systems, including the Houston Municipal Employees Pension System ($1.8 billion owed), the Houston Police Officers Pension System ($1.2 billion owed) and the Houston Firefighter’s Relief and Retirement Fund ($532 million owed), have unfunded liabilities totaling $3.5 billion. And thanks to a sweetheart setup, the city is limited on what it can do to bring down the swell of debt. Recognizing Houston’s pension problems, Moody’s downgraded the city’s credit rating in March, citing “large unfunded pension liabilities (among the highest in the nation)” as one of core concerns. Shortly thereafter, Standard & Poor’s followed suit and dinged Houston’s credit rating citing: “the city’s large unfunded pension liability that has been exacerbated by what we consider optimistic rate of return assumptions and a history of lower-than-actuarially determined contributions…” Be it from a statewide perspective or more locally, Texas’ public pension systems are clearly not headed in the appropriate direction. A course correction is needed before the problem metastasizes into something much, much worse. At the core of the pension problem, both nationally and in Texas, is a fundamentally flawed system—the defined benefit (DB) system. DB-style pension plans promise current and future retirees a lifetime of monthly income, but do so without knowing whether the money will be in the fund. These types of pension plans suffer from two major deficiencies: generational accounting and excessive expected rates of return. The first is the issue of fewer people contributing to the pot of retirement benefits compared with the rapid pace of baby boomers receiving benefits that’s often more than what they contributed. Put another way, there are fewer dollars available for retirees. This is a huge burden on DB-style plans. Another issue is the fact that many plans assume unrealistically high rates of return—like an 8.5% return expected annually by the Houston firefighters fund or an 8% yield assumed by Houston’s other two major pension plans. Houston is certainly not the only U.S. city guilty of being too bullish on future returns. This is a nationwide problem that’s leaving a wider gap in financial solvency over time. Moreover, many plan managers have invested in risky assets to achieve these returns that could come to bite them later. For taxpayers and retirees, it’s imperative that substantive reforms are put in place. This starts with eliminating DB-style plans and transitioning to a more secure retirement option like defined contribution (DC) plans. DC-style plans resemble 401(k)s in the private sector and the optional retirement programs (ORP) available for higher education employees in Texas. These DC-style plans put the power of an individual’s future in their own hands instead of depending on the good fortune of government-directed DB-style plans. DC-style plans are portable and sustainable over the long term as they are based on the contributions of retirees and a defined government match. With DC-style plans, retirees will finally have the opportunity to determine how much risk they are willing to take. They also reduce the risk that the government will default on their retirement or fund those losses with dollars from taxpayers who never intended to use these pensions. By giving retirees more freedom on how to best provide for their family, they will be in a much better position to prosper. Because of their efficiency, simplicity and fully funded nature, the private sector moved primarily to DC-style plans long ago. For the sake of taxpayers and retirees dependent on government pensions, it’s time for all governments to move to these types of plans as well. With trillions of dollars in pension problems at the federal level and tens of billions of dollars in Texas, lawmakers at the federal, state and local levels must make changes now. Specifically, they should transition all new employees and those interested into DC-style plans.If not, our kids and grandkids will be saddled with pension debt and forced into a future of higher taxes and broken promises that could have been avoided. This commentary originally appeared in the print edition of the Midland Reporter-Telegram on April 17, 2016.

Low and falling oil prices are starting to take their toll on some Texas towns. Moody’s Investor Services recently placed Midland city and ten other local governments that have been hit hard by the recent energy turmoil on watch for a possible credit downgrade. That comes on the heels of Houston’s actual downgrade by two credit rating agencies, both Moody’s and Standard and Poor’s, because of “high fixed costs” that includes outsized debts. Oil’s collapse, while not welcome, is helping to shine a light on an emerging public policy threat facing Texas—too much debt propping up too much government. This is a problem that was made clear at a recent Senate Finance hearing in Austin. Last month, staff with the Legislative Budget Board (LBB), the state’s chief fiscal advisors, informed members of the Senate Finance Committee that state and local debt outstanding, which refers to only the principal amount owed, had grown to a whopping $260 billion in fiscal year 2015. Include the interest component and Texas’ total debt soars to an unthinkable $415 billion, or roughly $15,000 owed by each and every Texan. This rising red ink must be stopped before stressing families and wrecking the economy with higher taxes, especially at a time of potential bond credit downgrades and an uncertain economic future. By slowing spending, prioritizing debt payments, and providing increased ballot box transparency, those in Midland and all Texans can rest a little easier. Dissecting state and local debt outstanding shows that there is $41 billion in state debt, $6 billion in revenue conduit that’s not technically a legal liability of the state, and $213 in local debt. Clearly, the major debt problem is at the local level where 82 percent of the total originates. Evidence shows that while Texas has one of the nation’s lowest levels (45th) of state debt per capita. On the other hand, local debt ranks as the second highest next to California and the second highest in debt per capita next to New York among the top ten most populous states. However, these amounts tell only part of the story. They don’t include interest owed that’s captured by debt service outstanding. Instead of the $47.1 billion reported in debt outstanding for the state and revenue conduit, state debt service outstanding is $77 billion, or about $2,800 per person. Local debt service outstanding has reached a whopping $338 billion, or $12,250 per Texan. Collectively, the total is $415 billion, or more than $15,000 owed by every man, woman, and child in the Lone Star State. This must be resolved before we are all burdened with even higher taxes, resulting in fewer opportunities to reach our full potential. One way to get control of this costly problem is by scrutinizing all budget areas because excessive government spending results in more debt. This should be paired with zero-based budgeting such that every program starts at zero and every dollar spent must be reasonably explained as effective and efficient. Another valuable option is to prioritize debt to consider which order they should be paid if given the opportunity. This would help determine the useful life of projects paid with debt, the interest rate, and other variables to best use taxpayer dollars. Last, but certainly not least, Texans must urge governments to do better regarding debt transparency. This could be done by publishing on a local ballot for bond proposals how tax bills will be affected, how much the bond will cost in principal and interest, and current debt service outstanding per capita. We’ve called this ballot box transparency. By controlling spending, prioritizing debt payments, increasing debt transparency, Texans can have a better sense of whether state and local lawmakers are being good stewards of their tax dollars. Vance Ginn, Ph.D., is an Economist in the Center for Fiscal Policy at the Texas Public Policy Foundation, a non-profit, free-market research institute based in Austin. He may be reached at [email protected]. James Quintero leads the Think Local Liberty Project at the Texas Public Policy Foundation. He may be reached at [email protected]. http://www.texaspolicy.com/blog/detail/midlanders-texans-face-mounting-state-local-debt By Dr. Vance Ginn & Kiara Pillay

The Legislative Budget Board (LBB) recently presented updated information about state and local debt in Texas for fiscal year 2015. These data show that state and local outstanding debt is $259.5 billion with $41 billion in state debt and $6.1 billion in revenue conduit (“issued by state entities on behalf of third parties and is not a legal liability of the state”) (see Chart 1), and $212.4 billion in local debt (see Chart 2). While this is valuable information, “debt outstanding” refers to just the amount of upaid principal on a debt that will continue to generate interest until paid off.” A more accurate representation of Texas’ full obligation, or what their tax dollars could ultimately pay, is “debt service outstanding” which is defined as “the amount that is required to cover the repayment of principal and interest on a debt,” according to the Texas Bond Review Board(pg. 119). When you consider debt service outstanding, the data by the Texas Bond Review Board paint a much more costly picture. Instead of the $47.1 billion, or roughly $1,700 per Texan, reported in debt outstanding for the state and revenue conduit, the amount of state debt service outstanding is $77 billion, or about $2,800 per person. This means that the true debt that Texans are on the hook for is 63 percent higher than the reported debt outstanding. While it’s true that Texas ranks relatively well as having one of the lowest levels (45th) of state debt per capita nationwide, that’s not to say that something shouldn’t be done about state debt. Senate Finance Chair Jane Nelson made a valuable recommendation at a recent committee meeting to prioritize state debt to consider which order debts should be paid off if given the opportunity. The 100-pound gorilla in the room is not state debt but rather local debt. The principal owed on local debt ranks as second highest next to California and local debt per person ranks second highest to New York among the top ten most populous states. Adding to this red ink is local debt service outstanding that has reached an exorbitant amount of $338.4 billion, which is up $30 billion in just five years, bringing local debt per person up to around $12,250 per Texan. Combining state and local debt service outstanding, the total is $415.4 billion, or more than $15,000 owed by every man, woman, and child in the Lone Star State. That substantial amount must be resolved in some fashion before we are all burdened with even higher taxes and fees, resulting in fewer opportunities to prosper. To combat a greater financial burden, Texans must urge the government to do better regarding debt transparency. One way would be for lawmakers at the state and local level to publish more details about their debt amount, particularly the debt service outstanding and what that means for taxpayers. This idea has been advocated by the Foundation through what’s called ballot box transparency, as noted in the Forbes piece above. Specifically, this would include providing more information about a local bond proposal on a local ballot such as (1) how their tax bills will be affected, (2) how much the bond will cost in principal and interest, and (3) local debt service outstanding per capita. By increasing debt transparency and prioritizing which should be paid first, Texans can have a better sense of whether state and local lawmakers are being good stewards of their tax dollars. http://www.texaspolicy.com/blog/detail/15000-owed-by-every-texan-for-state-and-local-debt |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed