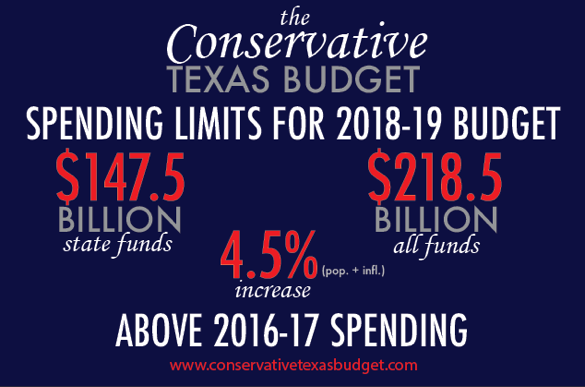

Last session, the Texas Legislature passed a generally conservative budget, defined as a budget that increases above previous appropriations by no more than the rate of state population growth plus inflation. This key spending metric accounts for changes in government spending from changes in the state’s population and the general cost of providing goods and services. Past legislatures have also passed conservative budgets; however, favorable budgets have consistently been followed by unfavorable ones with massive spending hikes. To prevent such costly cycles, the Texas Public Policy Foundation has joined with the Conservative Texas Budget Coalition to propose the 2018-19 Conservative Texas Budget (see Figure 1) as a guideline for the 85th Texas Legislature and government agencies (watch the recent press conference here and read the paper here). Figure 1: Spending Limits for a Conservative 2018-19 Texas Budget The Conservative Texas Budget sets a spending growth limit of 4.5 percent for the upcoming 2018-19 budget, ensuring that total appropriations will not exceed the estimated increase in population growth plus inflation over the two previous fiscal years (FY 2015 and FY 2016). Specifically, the Conservative Texas Budget sets spending limits that:

State government spending in Texas has increased 68.5 percent since 2004, or 11.8 percent faster than increases in compounded population growth plus inflation. Given this, the Legislature should control state spending by consistently passing a conservative budget. The Texas economy once benefited from high oil prices and a steady global economy; however, lower oil prices, a stronger U.S. dollar, and global economic weakness are detriments to economic growth. Therefore, it’s essential to pass a conservative budget that funds basic government-provided goods and services while reducing the tax burden on Texans. The Conservative Texas Budget will best equip Texas as it moves into a future that is forcibly less dependent on oil and gas. By using the past two fiscal years as a base rather than arbitrary predictions of the future, this budget is superior in both predictability and stability. Ultimately, holding government spending growth below population growth plus inflation will get spending back on track to funding basic goods and services so the excessive tax burden can be cut. By passing the second consecutive conservative budget, the 85th Texas Legislature will provide Texans the freedom needed to reach their full potential while upholding the Texas model of growth and prosperity as one for the nation to follow. www.texaspolicy.com/blog/detail/the-conservative-texas-budget-ending-an-unfavorable-budget-cycle

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed