|

We previously discussed the problems with Texas’ skyrocketing property tax burden. Let’s now consider past failed property tax relief attempts signaling a need for options that will provide permanent relief.

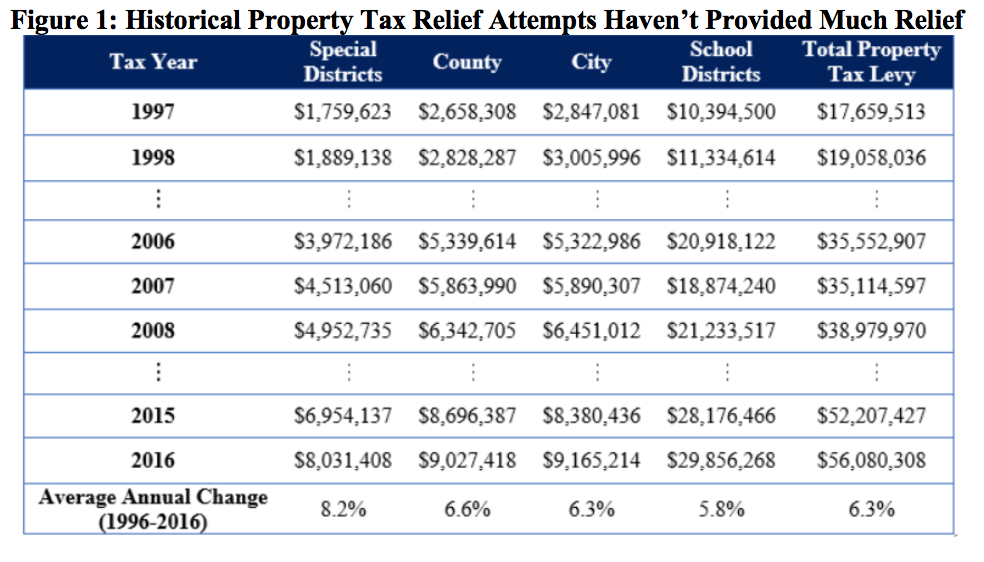

Since Texas’ modern property tax system took shape in 1979 with the passage of the “Peveto bill,” there have been three major attempts by the Texas Legislature to provide relief for taxpayers. Unfortunately, none of the attempted solutions created lasting reductions in property taxes as the attempts failed to address increased spending—the cause of increasing taxes—and instead simply shifted around the burden. 1997 Reform Attempt: Homestead Exemption Increase by $10,000 The 75th Texas Legislature attempted to reduce the rising property tax in 1997 by increasing the homestead exemption for school district property taxes by $10,000. Instead of allowing only $5,000 to be deducted from the taxable value of an individual’s property, the taxpayer could now deduct up to $15,000. The increased exemption was accompanied with homeowners who were 65 and over receiving a freeze on their school district property taxes. The total tax relief package was estimated at $1 billion. However, it resulted in little to no effect as school district property taxes increased by nearly $1 billion and total property taxes increased $1.4 billion the year after implementation and continued rising thereafter. 2006 Reform Attempt: Property Tax-Franchise Tax Swap After the Texas Supreme Court determined the school finance system was unconstitutional in 2005 from an essentially statewide property tax, the Legislature in a 2006 special session aimed to bring property tax relief. The solution was a reformed business franchise tax to what’s known as the margins tax today and increase the motor vehicle sales tax and tobacco tax while also changing the school finance formulas. While the outcome was an initial reduction in school district and total property taxes, the declines were marginal the first year with taxes being substantially higher than 2006 in 2008. As a result, instead of sustained property tax reduction, Texans experienced an increase in both local property taxes and state taxes. Moreover, the swap exchanged an already poor property tax system with an arguably worse margins tax that should be eliminated. 2015 Reform Attempt: Homestead Exemption Increase by $10,000 Similar to the 1997 reform, the 84th Texas Legislature looked to raise the homestead exemption for school districts property taxes another $10,000 to $25,000. Again, lower local property tax collections were replaced with state funds so as to not decrease school district budgets. Yet, much like 1997, there was no improvement in the tax burden as school property taxes increased by $1.7 billion and all property taxes increased by almost $4 billion the next year. Conclusion With past property tax relief failures of increasing the homestead exemption and the franchise tax swap, the time has come for a strategy that employs reducing the growth of government spending at the state and local levels while using state dollars to eliminate property taxes.

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed