|

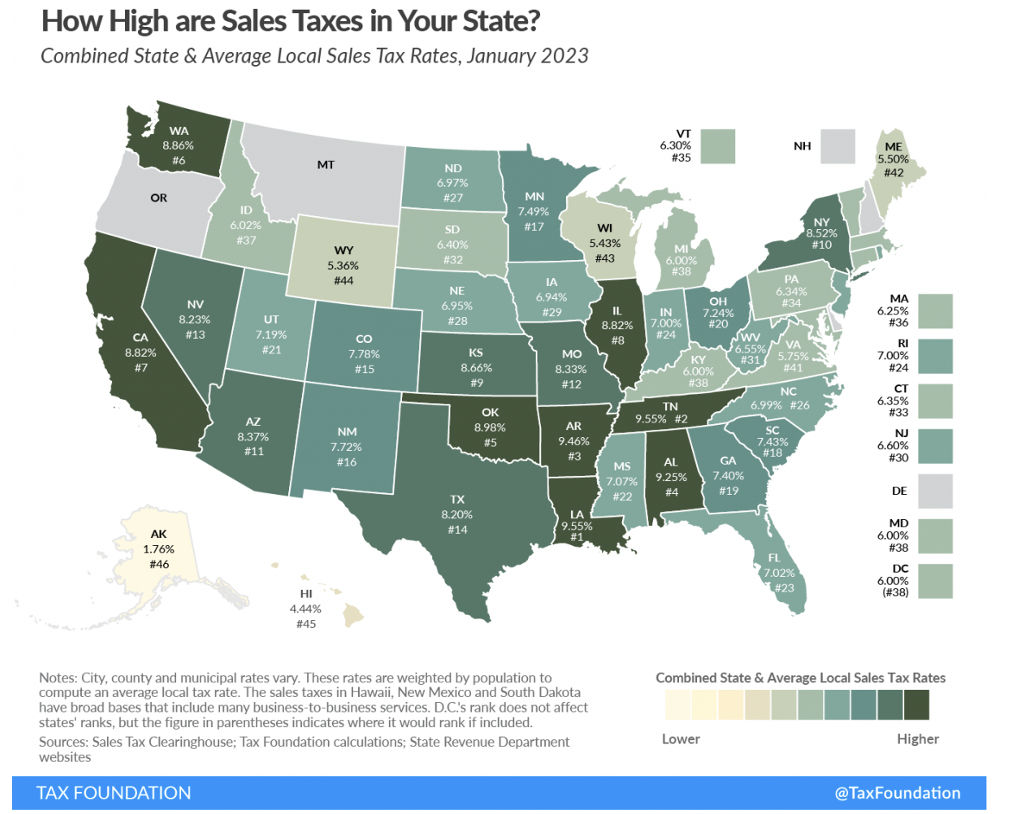

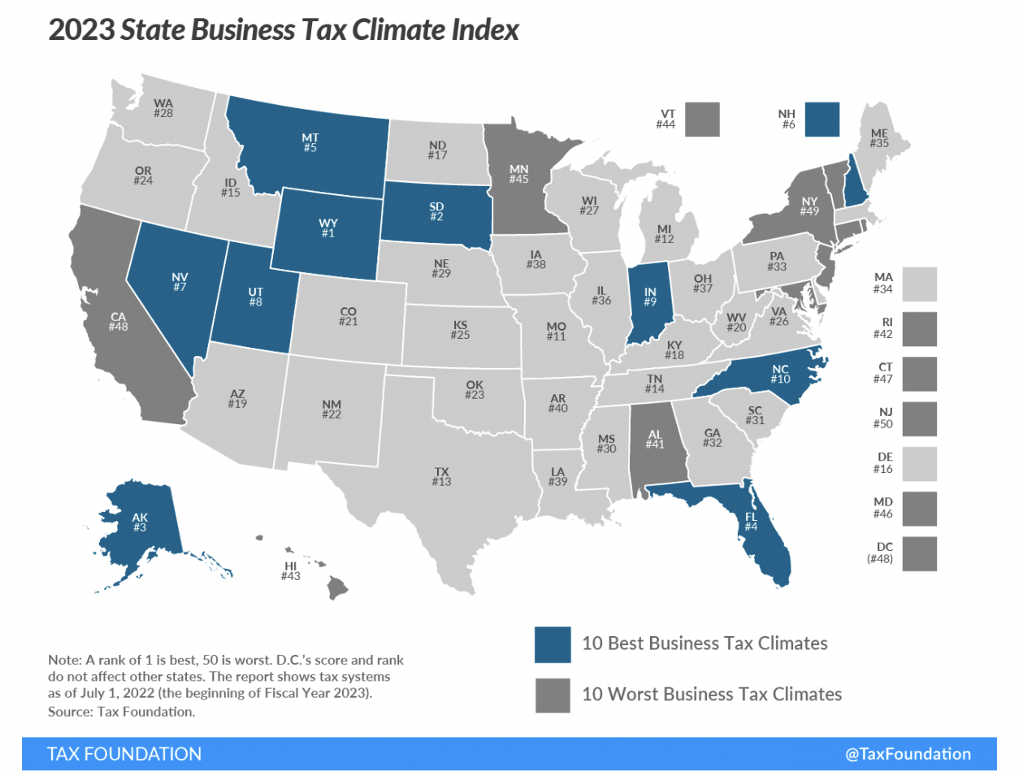

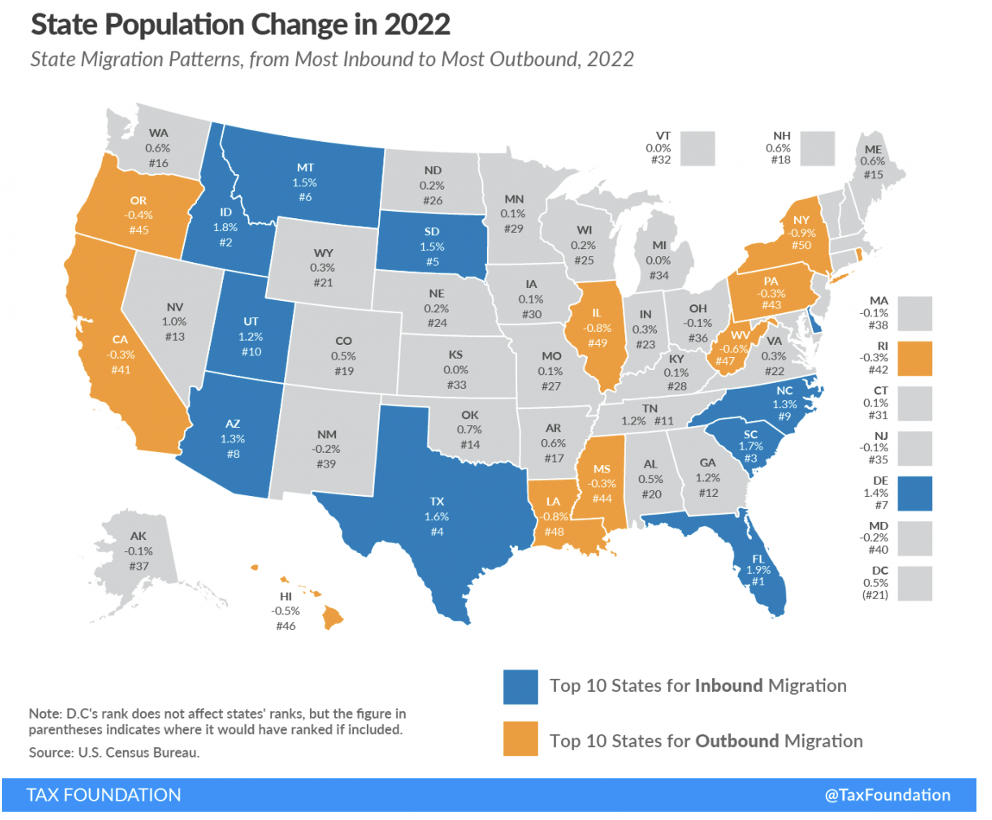

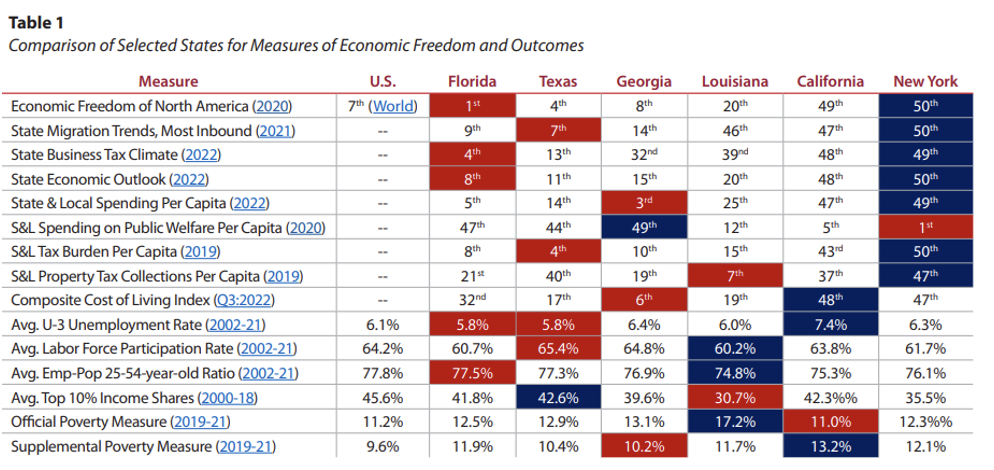

Recent data from the Tax Foundation reveals that Louisiana has the highest average combined state and local sales tax rate of all the states. The bulk of this burden comes from its local taxes, the second highest in the nation. Pair these findings with Louisiana’s progressive income taxes of a graduated personal income tax rate of up to 4.25% and a corporate income tax rate max of 7.50%, and there’s no wonder why the Pelican State has a net out-migration problem. According to the Tax Foundation’s business tax climate index, the state ranks 12th worst in the country. Personal income taxes disincentivize work, and sales taxes can lead consumers to shop elsewhere and businesses to relocate. Employers and consumers want to be where they can keep more of what they earn, which helps explain why Florida, a state with no personal income taxes and a combined sales and local tax rate that’s more than 2.5-percentage points lower than Louisiana’s, had the highest net in-migration last year. Clearly, Louisiana’s tax code needs an overhaul if the growth and flourishing of Louisianans are priorities. But so does the state’s spending. To start, the Pelican State could consider joining the 14 states in the flat-income tax revolution. As more states flatten or remove their personal income taxes, Louisiana’s costly progressive income taxes will become much less appealing. Moving to flat personal and corporate income taxes would be a pro-growth step forward toward the eventual greater goal of eliminating these costly taxes, helping to compete with places like Florida and Texas, both of which don’t have personal income or corporate income taxes. Considering that the ultimate burden of government is how much it spends, reforming the tax code is just one piece of the puzzle. The excessive government spending at the state and local levels, compared with reasonable metrics like the rate of population growth plus inflation which helps measure the average taxpayer’s ability to pay for government spending, burdens Louisianans. Furthermore, Louisiana’s state and local debt is estimated to be about $7,600 per person owed by 2027, plus another nearly $28,000 per person owed in unfunded liabilities over time, so there are clearly massive barriers in the way for Louisianans to flourish. This is an issue because heavy spending leads to heavy burdens on state residents and decreased economic freedom, which Louisiana can’t afford to lose more of, considering how far it falls behind other states. Not surprisingly, Georgia, Florida, and Texas all boast lower spending than Louisiana, with improved economic freedom and poverty rates. Meanwhile, Louisiana has the highest official poverty rate in the country. The rankings for the Pelican State aren’t quite as bad as the highly progressive states of New York and California, which are hemorrhaging population to other states. Incentives matter, so people are voting with their feet to flee high cost, low freedom states.

Louisiana should start its comeback story by adopting a stronger spending limit, similar to the one recently passed in Texas. Spending caps help governments stay limited, which is imperative for states to thrive as it forces them to narrow their scope. In turn, the private sector has more elbow room to grow and people have greater ability to prosper. This would also help provide more surplus funds to put toward cutting, flattening, and eventually eliminating personal and corporate income taxes. Louisiana has too great of a culture and too much potential for it to be squandered by burdensome spending and taxes. It’s time for serious spending restraint and major tax reforms to provide the best path forward. Originally published at Pelican Institute.

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed