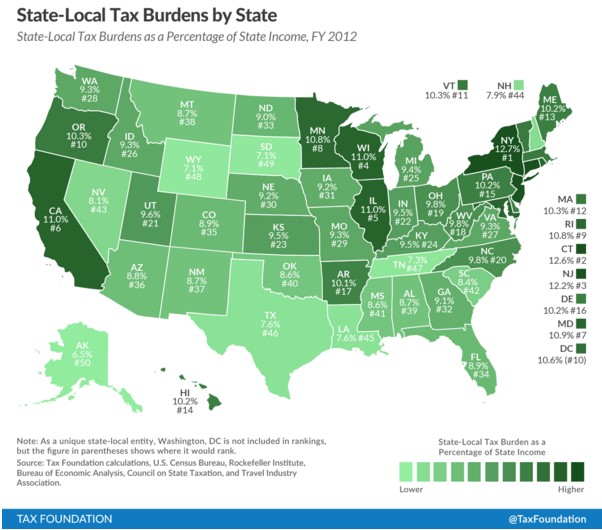

By: Vance Ginn and Kiara Pillay Texas’ relatively low tax burden has helped create an economic environment that brings people worldwide and from other states here for the opportunity to prosper. This is evident by the state’s 4.7 percent unemployment rate that has now been at or below the U.S. average for 108 consecutive months. There is ample evidence that the Texas model works and must be advanced by passing conservative budgets and eliminating the costly business margin tax. As an indication of Texas’ competitive standing with other states, the Tax Foundation’s recently released State-Local Tax Burden Rankings FY 2012 report compares this burden for all 50 states. To calculate state-local tax burdens, the authors gather Census Bureau data for state and local governments in 26 categories and then subdivide these into groups and account for tax exporting. Tax exporting is “the shifting of tax burdens from state residents to nonresidents” such as taxing restaurant meals and hotels. After accounting for tax exporting, the authors compute the total state and local tax burden as a share of total state income. While these measures of a state’s tax burden have limitations, they provide valuable information about the aggregate level of state-local tax burden in a state. The U.S. average burden as a share of state income is 9.9 percent. Texas’ burden is 7.6 percent, which ranks 46th with 1st being the highest burden and 50th being the lowest, indicating the Lone Star State has the fifth lowest state-local tax burden. However, this was a decline from 47th lowest for FY 2011. Figure 1 provides a comprehensive map comparing the tax burdens for all states in FY 2012. Figure 1: Texas Ranks as the 46th Lowest State-Local Tax Burden Source: Tax Foundation Many of the least burdensome states, including Alaska (50th), Wyoming (48th), Nevada (43rd), and Texas (46th), unsurprisingly do not have an income tax and instead rely on other less burdensome forms of taxation to generate government revenue. Comparatively, California has similar resources and population sizes and demographics as Texas but vastly different governing philosophies that shows up in this report as California’s state-local tax burden ranks 6th worst. Bottom line: The Texas model of low taxes and no personal income tax works well to keep a low overall burden on Texans, but as another Tax Foundation report recently noted the state ranks 41st worst for the corporate income tax from the burdensome business margin tax that must be eliminated. To do that, the principles of limited government and free market principles must be enhanced for a more prosperous future. http://www.texaspolicy.com/blog/detail/texas-has-46th-lowest-state-local-tax-burden

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed