|

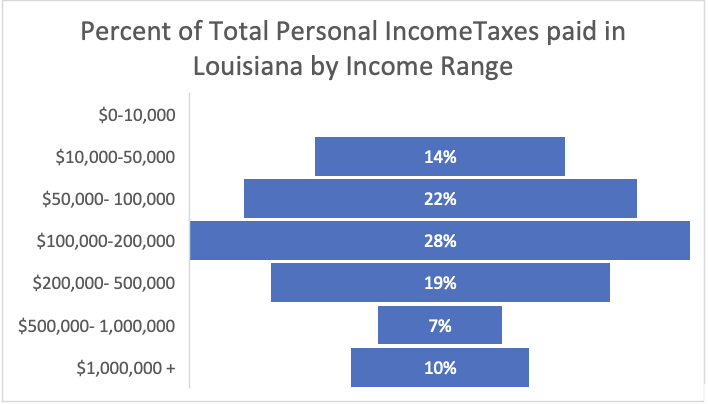

Fairness, like beauty, is in the eye of the beholder. This popular sentiment is certainly true in a free market where buyers and sellers determine prices instead of a third party picking winners and losers. Unfortunately, taxes in Louisiana and other states get caught up in this subjective determination when the questions that really matter are what will help more Louisianans stay in the state, and what will bring them well-paying jobs along the way? A recent presentation by Together Baton Rouge before Louisiana’s House Ways & Means Committee made the case that the state’s tax code is unfair. They pointed to research by the left-leaning Institute on Taxation and Economic Policy (ITEP), which considers the distributional effects of tax systems in each of the 50 states. And as you’d expect, ITEP considers those states without a personal income tax as the most regressive because low-income earners tend to pay a larger share of income to taxes than upper-income earners. The fact, however, is that the majority of Louisiana’s individual income tax revenue is paid by middle and higher-income earners, as reported by the Louisiana Department of Revenue in its annual report. ITEP’s analysis finds that “Louisiana has the 14th most unfair state and local tax system in the country.” And while that’s true in many respects, it’s not necessarily because of rising income inequality as some suggest.

Recent Census data show that people are continuing to leave Louisiana. This is a drain on innovation and job opportunities, so there’s less incentive for businesses to stay. Why would the state resort to trying to smooth the distribution of income, which would inevitably mean raising taxes on entrepreneurs who start businesses and hire workers? Instead, lawmakers’ next steps should be to restrain spending and flatten income taxes until they can be eliminated. This process was started in 2021 by lowering all the personal income tax rates, further stipulating that future increased revenue should “trigger” even lower income tax rates, which could potentially go into effect beginning next year. The state is currently seeing record levels of revenue. In fact, Louisiana is set to have an additional $1.6 billion to use in this fiscal year alone, and there is already an increase of $600 million above current revenue expected for the next fiscal year. But there is a lot of uncertainty surrounding whether the state will hit its revenue targets in future years due to economic downturns and record spending increases. If it does, the state would benefit from the lower tax rates by fueling economic growth. More should be considered in the 2023 legislative session beyond just cutting existing rates. Lawmakers should consider flattening income taxes to just one bracket with a single, low rate for everyone. This is what research has proven effective to incentivize people to work and take risks, much more so than continually taxing their innovative prosperity. Given these factors, a flat income tax would help everyone who pays taxes have skin in the game instead of trying to pick winners and losers. Higher-income earners would still pay much more in taxes with a flat tax rate because their income is higher. Fairness can be a factor, but it shouldn’t be the overarching factor when deciding tax law. The best taxes are those that are broad-based with the lowest flat rate possible, and ultimately without income taxes. This would be fair to workers and the flourishing of Louisianans for many years to come. Originally published at Pelican Institute.

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed