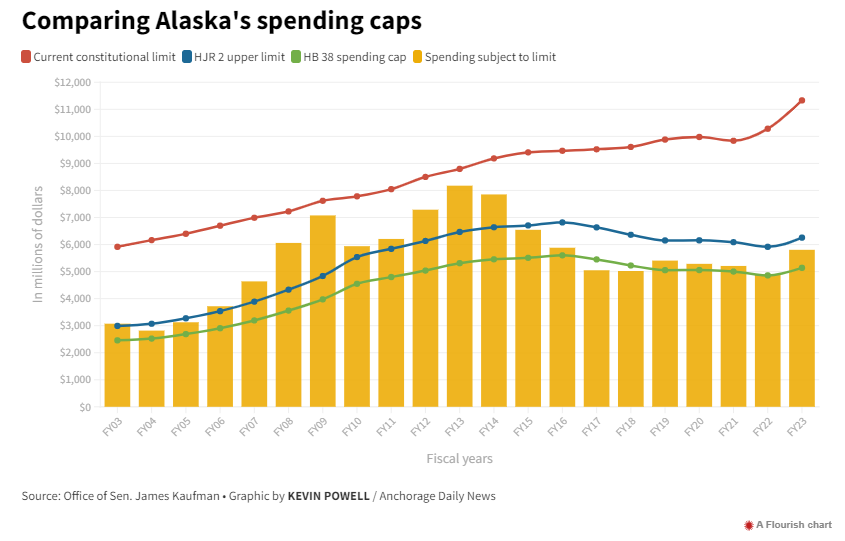

News: Lawmakers say a new fiscal cap could stabilize Alaska’s economy. It could also tank it.2/25/2023 A tighter limit on state spending is a top priority for Republicans in the state House of Representatives this year, but a proposal to tie spending to gross domestic product is raising questions about whether a tighter limit will hamstring the state’s ability to fund critical services and weather future economic downturns. Alaska already has a spending cap, enacted in 1982, based on the state’s population and inflation. But lawmakers have called it “the perfect law,” because it is so difficult -- essentially impossible -- to break. The state simply does not spend nearly as much as that limit allows for. Now, House Republicans are indicating they favor a pair of bills that would force lawmakers to tighten the belt on the state budget even as they are considering hefty spending increases to shore up ailing services. The House Judiciary committee could advance the measures as early as Monday. Proponents of a tighter spending cap say it will help prevent the boom-and-bust cycles that have dominated Alaska’s oil-based economy for decades. Gone will be the days, they say, when years of high oil prices are accompanied with fat budgets, and oil price crashes put the state in austerity. A spending cap will reign in the appropriators when the revenue fortunes are good, the argument goes, leaving money for years when revenue shrinks. A new limit on state spending was part of a proposed framework for a new fiscal plan put forward by a bipartisan working group in 2021 which also listed new revenue sources and a new Permanent Fund dividend formula in its final report. Lawmakers from both parties agree that a new spending cap should be part of a fiscal plan, but they disagree on the order of business. Some think resolving the Permanent Fund dividend calculation should take precedence. Others say that new revenue streams for the state are most important. House Republicans, who dominate the chamber’s majority caucus this year, have cited a tighter spending cap as the first item they’d like to tackle. The odds are stacked against the policy in a divided Legislature. And according to some policy analysts, that’s a good thing. Spending caps, opponents say, leave states with unwieldy budgets that cannot respond adequately to the state’s changing needs. Still, proponents are charging ahead. Chief among them is Sen. James Kaufman. An Anchorage Republican and retired oil and gas quality manager, he devised a new idea in 2021 to limit Alaska’s spending to a percentage of the state’s gross domestic product, excluding the public sector. GDP measures the value of the goods and services produced in-state. While more than 20 states have some form of spending cap, none have tied their budgets to gross domestic product, a complex figure calculated by federal financial institutions. In 2021, Alaska’s GDP was $57.3 billion, the smallest of all states except Wyoming’s and Vermont’s — two states with smaller populations than Alaska’s. Kaufman says that the metric, rather than the more commonly used consumer price index or personal income, “is an accurate measurement of the state’s economic performance.” Excluding the public sector, which has accounted for roughly 20% of Alaska’s GDP in recent years according to data from the Federal Reserve Bank of St. Louis, puts the focus on Alaska’s private sector, dominated by resource development. “Sometimes we have an embarrassment of riches where we have a lot of revenue come in, and the next year it can be radically different,” said Kaufman in an interview. “To try and break the boom-and-bust cycle, I started considering caps that would help that, and which caps would be the most helpful.” Tying the state’s spending to the private sector “ensures that government does not outgrow the private sector that it is meant to support” and that the state avoids becoming overly dependent on revenue from the Permanent Fund, according to a statement accompanying the bill. Kaufman’s policy would be based on an average of the preceding five years’ GDP. He is proposing a statutory limit set at 11.5% of that average, while a companion constitutional amendment would set the upper limit at 14%. That way, lawmakers could agree to exceed the 11.5% limit with a two-thirds majority, but would not be able to exceed the 14% ceiling. Under the proposal, both the statutory limit and the constitutional limit would have to pass to be effective. It’s a tall order — constitutional amendments must be adopted by a two-thirds vote by both chambers of the Legislature. It’s a tall order also for the state’s economy — of the last 20 budgets, all but three would have exceeded the proposed statutory limit. Half would have exceeded the proposed constitutional limit. Over the course of two decades, such a spending cap would have prevented the state from spending $5 billion, roughly the equivalent of an entire year’s budget.

Gov. Mike Dunleavy’s proposed spending plan for the coming fiscal year would exceed the proposed statutory limit, but remain below the proposed constitutional limit. Dunleavy has favored a tighter cap on state spending and has proposed legislation to that effect during his first term in office, but he has yet to put forward such a bill this year. Dunleavy spokesman Jeff Turner did not respond when asked if the governor intends to advocate for his own plan or for Kaufman’s. Instead, Turner said in an email that the governor’s office “does not comment on bills until they have passed the Legislature” because they can be substantially changed before that, and that “Dunleavy has always advocated for a plan to limit the growth of the state budget.” Kaufman’s proposal has many exceptions: the limit would not apply to the Permanent Fund dividend, disaster relief or federal dollars, among other exceptions. But it would apply to all general fund spending on capital projects and operating expenses, which covers building and road maintenance, schools, public safety, and other programs that have seen effective cuts in recent years. Kaufman said he settled on the 11.5% limit for the statutory proposal to match the exact level of spending in the 2022 fiscal year budget, which was shaped by low oil prices and lingering pandemic-era federal funding. Even amid these complexities, Kaufman calls it “kitchen table economics.” ‘Everybody would be worse off’ Comparing a state budget to household expenses is part of the problem, according to Bernie Gallagher, a policy analyst with the Center on Budget and Policy Priorities. Gallagher said spending caps are inherently arbitrary and pinned to a particular moment in time. Just as Alaska’s previous spending cap proved too generous, a new spending cap could prove too onerous. “It makes it very difficult to override that limitation when the capped amount is inadequate to meet the needs of state families or communities,” said Gallagher. Kaufman’s efforts to design a more resilient limit to reign in Alaska’s fluctuating economy could prove to be insufficient, because GDP “is just as volatile as personal income,” Gallagher said. “In fact, it has a slower rebound effect than personal income,” he added. “Many other states and conservative groups that do advocate for spending limits don’t use state GDP for that reason — because it’s just capturing too much.” University of Alaska Anchorage economist Kevin Berry raised similar concerns about gross domestic product, saying it is a flawed mechanism for capping state spending, because it could exacerbate longer economic downturns, just like the one the state is currently facing. In Alaska, where the oil industry makes up a large part of the private sector, a long-term downturn in oil prices could bring down the state’s GDP even if the population and its needs remain unchanged. The bigger issue, Berry said, is that tying state spending to the GDP could prevent the state from responding to recessions with increased spending, as governments often do. “What happens when the government ramps up spending, is it helps support households and support businesses and make the recession less bad,” said Berry, citing unemployment insurance as an example. “That money supports household incomes and that also leads to more revenue for businesses and prevents businesses from suffering and people going out of business. We stop the whole negative cycle that way.” Tying spending to GDP, he said, would mean that during prolonged economic recessions, “at the same time the private sector would be struggling, the public sector would have to struggle too, so everybody would be worse off.” Berry said that would be exacerbated by the fact that Alaska’s economy is what he called “counter-cyclical,” meaning it tends to do better when the Lower 48 economy is doing worse. Federal fiscal policy, in turn, is designed to meet the needs in the Lower 48, and sometimes works against Alaska’s interests. “That means that federal policy is doing the opposite of what we want it to do in any given period, potentially, exacerbating our business cycle,” Berry said. During a recession, economic principles dictate that the state government might need to spend more money “to counter the cycle and smooth things out. But if you’ve got a spending cap that’s tied to GDP, we can’t do that.” The bill makes an effort to overcome the potential problem by tying spending to a five-year average, rather than a single year. That isn’t necessarily enough, Berry said. “The problem is, we’ve had a prolonged downturn. It’s very likely in the future at some point, we’ll have another prolonged downturn, and then we can get stuck in this trap,” he said. ‘Different things to different people’ Kaufman is a member of the Senate’s bipartisan majority, which has named improving the state’s long-term fiscal outlook as one of its priorities. But at a press conference, leaders of the caucus shrugged off Kaufman’s proposal. “A long-term fiscal plan means different things to different people,” said Sen. Donny Olson, a Golovin Democrat who co-chairs the finance committee. Discussing a spending cap “highlights the fact that if you’re going to deal with a long-term fiscal plan, you’ve got to figure in where your new revenues are going to be coming from.” Some Senate members appear interested in handling other elements of the state’s fiscal plan before they reconsider the spending cap. “Before we can really, really focus on a long-term fiscal plan, we need to figure out the Permanent Fund dividend issue. That’s what we really need to do first,” said Sen. Elvi Gray-Jackson, an Anchorage Democrat. Other senators said that a cap on spending from Alaska’s Permanent Fund revenue already in practice limits the money at the state’s disposal, thus limiting state spending. In 2018, lawmakers passed a law capping the amount that can be withdrawn from the earnings of the Permanent Fund based on the performance of the fund’s investments — or percent of market value (POMV) — to ensure that the Legislature does not overspend and deplete it over time. “The revenue cap — the POMV law — actually provides us with a spending cap today, because it limits the revenue as long as we hold the line on that law. We still have to figure out where we spend the money but it means there’s a cap in place,” said Sen. Matt Claman, an Anchorage Democrat who chairs the Senate Judiciary committee, which is assigned to handle Kaufman’s proposal. The proposed policy has seen more support from conservative House members who sit on the House Judiciary Committee, which is scheduled to take action on both the statutory limit and the constitutional limit on Monday. They could vote to advance the bill as is, amend it, or table it for further consideration. If the judiciary committee approves the measure, it still must pass scrutiny in the Ways and Means Committee, then the Finance Committee, before reaching the House floor. “It’s very challenging for private enterprise to make long term decisions when there’s so much instability in policy, especially spending at the state level,” said Rep. Will Stapp, a freshman Republican from Fairbanks who is the primary sponsor for the measure in the House. “I like the fact that we are creating a link between state spending and Alaska’s private sector.” If anything, Stapp said, his conservative colleagues wonder if the percentage limits proposed in the bill should be set even lower. The new spending cap has backing from the right-wing Alaska Policy Forum. Vance Ginn, a Texas-based economist and fellow with the forum, told the House Judiciary committee that the measure would incentivize private sector economic growth while limiting the public sector. But Ginn appeared unfamiliar with the particulars of Alaska’s economy, including its reliance on the oil industry for revenue and the lack of broad taxes like an income tax. Another prominent advocate for a tighter spending cap is the Alaska Chamber of Commerce, which has for several years listed the cap as the business group’s top priority. Kati Capozzi, chamber president, said that the group’s advocacy for a new spending limit came in response to the crash in oil prices that occurred a decade ago, leading to what she called “the yoyo budget cycle,” and a perpetual fear among business owners that new taxes are on the way. “The business community is constantly under pressure and frankly threatened that there’s going to be a tax increase every time we are unable to pay our bills. This would provide some security for the business community,” said Capozzi. A spending cap is the “most important thing that needs to be addressed” in the state’s long-term fiscal plan, according to Capozzi, because it would provide “side rails” that would attract more investment in Alaska, by signaling to investors that a crash in oil prices would not lead to “a knee jerk reaction to go get more revenue from the business community.” But Rep. Cliff Groh, an Anchorage Democrat who sits on the House Judiciary committee, wonders if limiting the state’s spending could hamper the business community in the long run. “Given that corporate executives and people in charge of companies stress how much a highly qualified workforce is so important for setting up, for expanding or bringing their companies at all to a state — if the schools become crummy, the roads become crummy, and the public services are at such a low level it’s unattractive to employees — you can imagine that that can occur, that a certain improperly designed spending limit could lead to a smaller population and a smaller economy,” said Groh at a recent House Judiciary committee hearing on the measure. Ginn responded that a review of spending caps in other states indicated that such limits force states to “really prioritize those dollars — wherever they should go — within that spending limit.” “We need to have the least burdensome form of taxation on individuals … And a good big way to do that is to ensure that spending doesn’t go out of control so that we don’t need as many taxes,” said Ginn. “Additional spending doesn’t necessarily equal better outcomes.” ‘A red herring’Berry, the Alaska economist, said that while the GDP could be a flawed foundation for a spending cap, that doesn’t necessarily mean the idea of a stricter spending limit is bad. “This is not to say that I’m for a spending cap or against a spending cap. I think that’s a policy choice the state needs to make. I think there’s just better ways to do it,” Berry said. An alternative to the new mechanism would be adapting the existing spending limit to match existing revenue levels. Lawmakers are not currently considering such a proposal. “The general idea of tying the size of government service to the demand for those services makes a lot of sense. So tying it to CPI (consumer price index) and tying it to population,” Berry said, referring to the 1982 limit. “Maybe we did set it too high, but it doesn’t require complex mechanisms to bring it down.” Still, some economists argue that binding spending caps that tie the hands of lawmakers are never a good idea. Gallagher, with the Center on Budget and Policy Proposals, said that experience in other states has shown that spending limits “do little or nothing to make government run any more efficiently or ensure that tax dollars are well spent. It shifts costs from states to cities and towns, which only moves the burden over to property taxes and fees.” Gallagher said a better solution to Alaska’s spending volatility could be a progressive tax, like an income tax, that is more dependable year-after-year and ensures the burden of paying for state services does not fall disproportionately on a single group. Gallagher called that “a much more sustainable model” than Alaska’s current dependence on revenue sources that can fluctuate wildly. “It’s a state that has massive, massive revenue volatility. Addressing that is really being lost. Addressing the spending side is actually a red herring. The real focus should be over on — are we collecting a sufficient amount for the needs of our state?” Gallagher said. Yet more than a month into the legislative session, state lawmakers are not considering any new broad taxes. Dunleavy, a conservative Republican, has proposed shoring up state revenue by monetizing carbon through keeping trees standing and injecting carbon into the ground, in an effort to meet state needs without imposing new taxes on businesses or individuals. But skeptics say that even if that plan pans out, revenue is still years away and will hardly be enough to make up for falling oil returns in the future. As lawmakers have debated the spending cap proposal, they have largely sidestepped questions on what would be required to meet a lower limit. Amid falling oil prices, state budgets over the past decades have translated to cuts to virtually every state service. And Alaskans are beginning to notice; private and public sector leaders have reported it is increasingly difficult to stem the tide of out-migration because state services like education, public safety and transportation infrastructure are not meeting expectations. “One of the things that people don’t mention is a spending cap that’s binding, that requires cuts, requires identifying those cuts. So the question is, what are people talking about cutting?” Berry said. Originally published at Anchorage Daily News.

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed