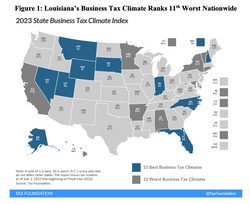

Today, the Tax Foundation released the 2023 State Business Tax Climate Index. The report ranks all fifty states based on the collective burdens of each state’s corporate income tax, individual income tax, sales tax, unemployment insurance, and property tax. The results show that spending restraint funded with low rate, broad-based taxes provide the best climate for business activity, which supports more jobs; and we all know that work helps provide people with dignity, purpose, and hope, along with the long-term self-sufficiency that is essential for families to flourish. The Tax Foundation’s report notes what many entrepreneurs in Louisiana already know: the state’s business tax climate needs improving. Figure 1 shows that this year the state ranks as the 12th worst among the 50 states, which is an improvement from the 8th worst ranking in the prior year, but still well below where it needs to be to support more in-migration, economic growth, and well-paying jobs. This year’s ranking is influenced by the corporate tax rank of 32nd, individual income tax rank of 25th, sales tax rank of 48th, property tax rank of 23rd, and unemployment insurance tax rank of 6th in the nation. Compared with nearby states, Louisiana ranked ahead of Arkansas (40th), behind Mississippi (30th), and remained well-below neighboring Texas which improved from the previous report to 13th best in the nation. The Texas model of relatively less government spending, no personal income tax, relatively low tax burden, and a sensible regulatory system have propelled it to substantial prosperity over time. This helped Texas diversify its economy from being as dependent on oil and gas activity as it was in the 1970’s and 1980’s. Still, Texas ranked behind the more fiscally conservative Florida (4th), who can provide an even better direction for where Louisiana should head if it wants more businesses to thrive in Louisiana. The Tax Foundation’s report also provides caution of what not to do: don’t be like California (48th), New York (49th), or New Jersey (50th). These states have high government spending, high personal income taxes combined with other tax burdens, and a costly regulatory climate. Given the upcoming 2023 session in Louisiana, the state legislature has an extraordinary opportunity to learn from the Tax Foundation’s report on how to improve. For Louisiana to provide greater opportunity for entrepreneurs and families to prosper, the business tax climate must improve by limiting spending, reforming and cutting taxes, and reducing regulatory burdens. Doing so will help more Louisianans live the American Dream. Originally posted at Pelican Institute Comments are closed.

|

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed