|

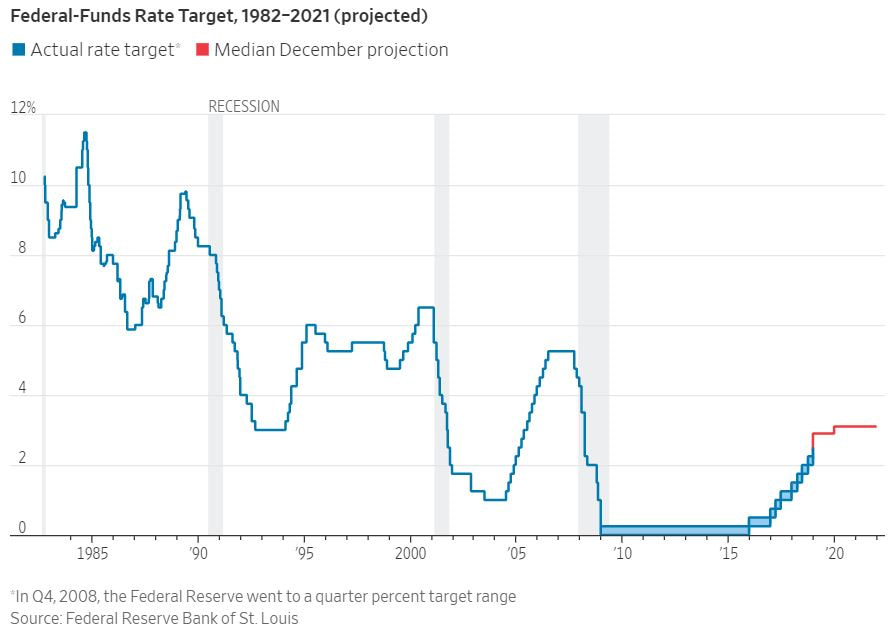

In this Let People Prosper episode 61, let's discuss the U.S. Senate's passage (and soon will be in the House) of a landmark criminal justice reform bill called the First Step Act, the unanimous vote by the Texas Commission on Public School Finance of recommended changes to the system, and the ninth increase by the Federal Reserve of the federal funds rate target to a range of 2.25-2.5%. These are all key issues. But I'm particularly proud of the work that TPPF's Right on Crime team did to make criminal justice reform a priority for years and ultimately by the Trump administration. The First Step Act "provides reentry programming to help reduce recidivism, includes modest sentencing reforms, increases public safety, and gives those incarcerated a second chance once they have paid their debt to society." This is truly a step in the right direction as far too many are locked up for far too long and then return to a life of crime after because of the lack of a job and social normalcy. The Texas Commission on Public School Finance provided a number of recommendations on how to improve student outcomes, how to increase teacher pay, how to more efficiently spend taxpayer money, and ultimately how to provide tax reform. Fortunately, the final version included language similar to TPPF's property tax plan that could provide lower property tax payments for Texans across the state. This is what Texans need and deserve to assure that they have every chance possible without unnecessary government barriers keeping them from reaching their hopes and dreams. Finally, the Federal Reserve raised their overnight lending rate between banks, known as the federal funds rate, to 2.25-2.5%. This is the 9th increase since December 2015 after the Fed had left this rate in a range of 0-0.25% for seven years. The new rate remains near historic lows, as noted in the chart below. While the stock market tanked after this report, the fundamentals of the economy remain relatively strong. One reason for the decline in the stock market today was because the price of credit increased today. This raise reduces the net present value of longer term capital investments and profitability along with the expectation of at least two more raises next year.

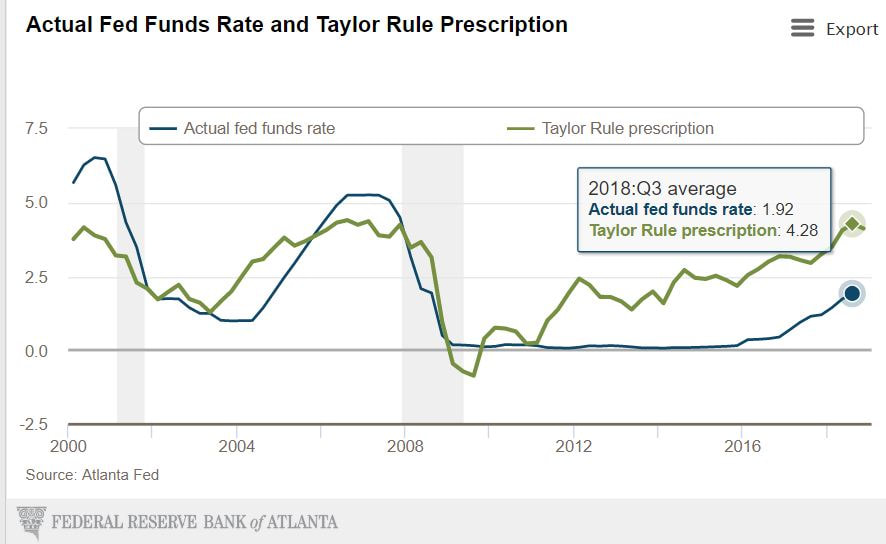

My take is that the Fed left rates too low for too long when you compare it with an indicator of a more market-driven, "neutral" rate derived by the Taylor rule. As you'll notice in the figure below, the Taylor rule suggests a neutral rate above 4%, which is almost twice as high as the federal funds rate. By the Fed's distortion of the markets with imposing an ultra-low interest rate policy and multiple rounds of quantitative easing, there are many assets that are bound to be highly inflated and we should expect corrections in these markets as the rate is raised to a more normal level. This isn't necessarily a bad thing as letting the air out of these inflated markets will help steady the markets and ultimately the economy for a firmer foundation for the long run. Interestingly, stocks remain much higher than they were when President Trump took office, which are positive signs of a growing economy as the economic institutions were strengthened from regulatory and tax relief even as burdens were imposed by excessive government spending and trade protectionism. More to do to #letpeopleprosper.

0 Comments

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed