|

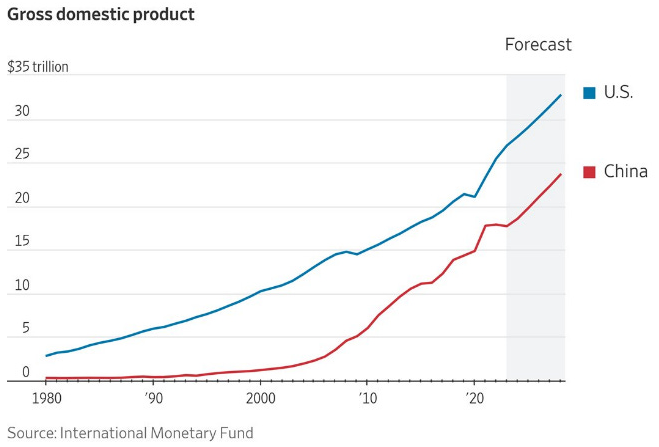

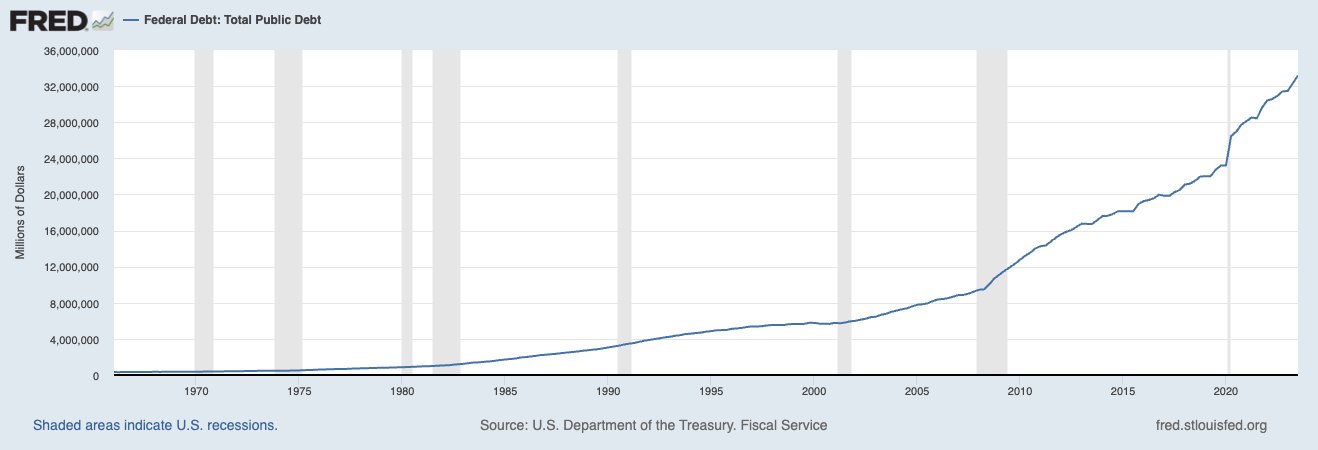

Originally published at American Institute for Economic Research. Rating agency Moody’s just downgraded China’s credit outlook from stable to negative after doing the same to the US about a month ago. Does this mean that China is on equal footing with us? Worse? Better off? An economic analysis suggests that China is not our biggest threat, nor are we theirs. In fact, the biggest problem we face is completely self-inflicted and found on our home soil. Apprehensions about China’s military actions and trade strategies maintain resonance, especially among middle-aged and older Americans. While caution is warranted, especially concerning their censorship and the treatment of Hong Kong and Taiwan, an economic comparison settles many doubts. Regarding economic might, the US outshines China with a GDP of $27 trillion compared to China’s $18 trillion. The contrast is stark on a per-capita basis. Americans enjoy an average income of $79,000, six times more than their Chinese counterparts. One alarming similarity stands out though: Both nations have weathered credit downgrades mainly due to escalating budget deficits and national debts. The United States’ national debt is shaping up to be this decade’s hallmark. Now nearly $34 trillion, the deficit spiked in 2020, with trillions of dollars more added since. Net interest payments on the debt climbed by 39 percent and recently surpassed $1 trillion annually. The repercussions of the national debt crisis are not merely theoretical – they are tangible, affecting the everyday lives of citizens.

In 2023, the dollar has significantly depreciated. Fitch (and now Moody’s) downgraded our creditworthiness. Home sales hit their slowest pace since 2010. Average 30-year fixed mortgage rates reached their highest point since 2000. And real median household income dipped to its lowest level since 2018, to name just a few of our recent economic woes. These findings shed new light on our competition with China. They should prompt America’s leaders to reevaluate our priorities and consider whether the enemy across the Pacific is as pressing as the ones we face at home. While some argue the government spending that drove the deficits was necessary, especially during the pandemic’s peak, it underscores the broader problem – a lack of fiscal discipline and a predisposition to rely on debt as a quick fix. It is high time the US adopted a spending-limit rule. Without one, we’ve only made things worse and failed to reach budget agreements. A reasonable spending limit of no more than the rate of population growth plus inflation has worked at the state level, and it would work at the federal level. While the US points the finger at China, we have three other fingers pointing back at us. Excessive government spending and a burgeoning national debt are eroding the foundation of our economic stability. Now is not the time to allocate excessive resources to confront external foes, but to address the fundamental issue plaguing us: a government that refuses to rein in spending of taxpayer money. America should also correct the errors in recent years of trade protectionism. There is reason to counter those countries who don’t play by the same rules, like China, but that should be done by joining free trade agreements with allies. This would be a more effective and affordable approach for Americans instead of raising taxes on them through tariffs, appreciating the dollar thereby increasing the trade deficit and contributing to trade wars that often lead to military wars. Let’s refocus our efforts, fortify our economic foundation, and confront the genuine threat within our borders. If not, governments will not be able to do their job of preserving liberty. This is of utmost importance.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Vance Ginn, Ph.D.

|

RSS Feed

RSS Feed